18 April 2024: Wealth Product Ideas

Gold: A Safe Haven Amidst Economic Storms

- Strong Long-Term Fundamentals: Despite the US March CPI exceeding expectations and the short-term strengthening of the US dollar and Treasury yields, gold prices remain resilient, mainly supported by long-term factors such as “de-dollarization” and safe-haven demand.

- Rate Cut Expectations: Although the probability of a June rate cut has decreased, the market generally expects the Federal Reserve to start cutting rates later this year, which will benefit gold prices.

- Geopolitical Risks: The current geopolitical situation remains tense, and gold’s safe-haven attributes will continue to attract attention.

- Central Bank Gold Purchases: Major central banks such as China continue to increase their gold reserves, providing support for gold prices.

- Inflation Hedge: Although US inflation has slowed, it remains at a relatively high level, and gold’s inflation-hedging properties are still attractive.

- For investors seeking to diversify their portfolios and manage the risks associated with high gold prices, principal-protected gold notes can be considered as a way to express a bullish view on gold.

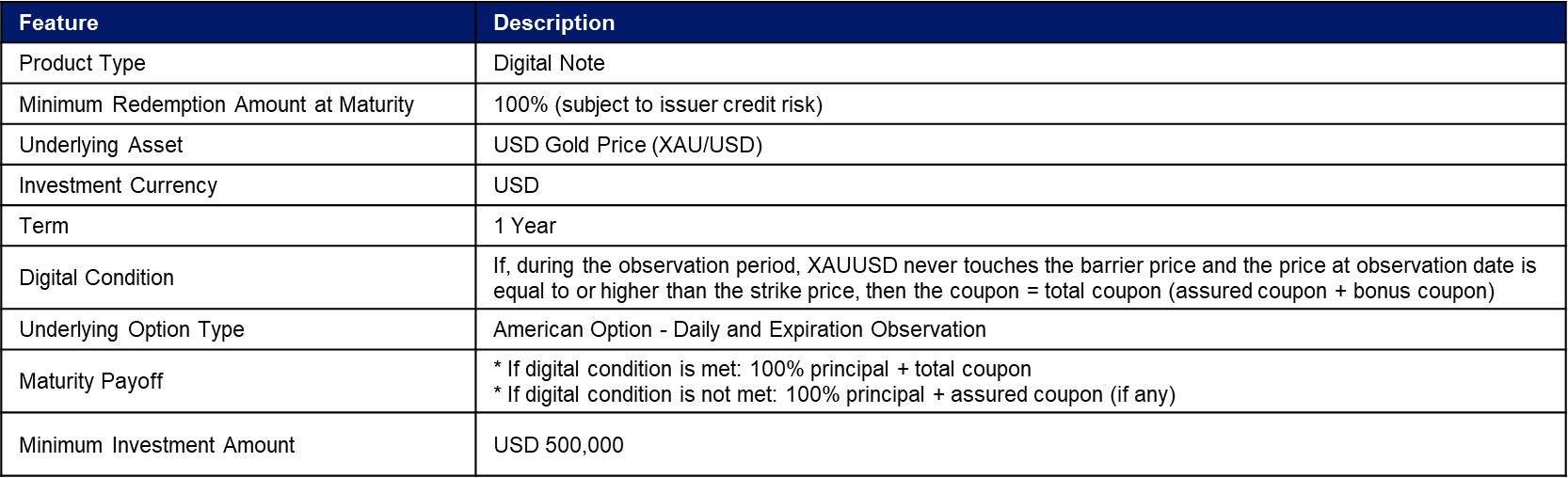

Trade Idea: XAU/USD Digital Note

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

XAU/USD Digital Note: Key Features and Risks

Investment Overview:

- Potential for Enhanced Returns: The return at expiry depends on whether the gold price is equal to or higher than the strike price and has not touched the barrier price during the observation period. If the gold price increases without exceeding the upper limit, investors enjoy a greater overall return.

- Bullish on Gold: This investment strategy is based on the expectation that the price of gold will increase or at least stay within a defined range above the strike price.

- Limited Downside Risk: Your maximum loss is limited to the initial investment amount, providing downside protection. Even if the price of gold falls, you will still receive your principal back, and potentially an assured coupon payment.

Main Risks:

- Gold Price Risk: The performance of this investment is directly linked to the fluctuations in the price of gold. If the price of gold falls or touches the barrier price, your return will be limited to the principal (and any assured coupon).

- Issuer Risk: You will be exposed to the credit risk of the issuer. If the issuer defaults, you may lose your principal.

- Liquidity Risk: This investment may have limited liquidity in the secondary market, making it difficult to sell before maturity.

- Opportunity Cost: Investing in this product may limit your ability to participate in other potentially more profitable opportunities.

- Complexity Risk: The structured payoff mechanism of this investment can be complex and may be difficult to fully understand.