11 April 2024: Wealth Product Ideas

Power Sector

- The U.S. may see a shortage in power as the demand for power increases alongside the demand for AI. Power infrastructure is expected to expand even further to cater to this heightened demand. I.E. More data centers are required to cater to the demand of AI; Large language models are also very energy-intensive because they require a lot of computational power.

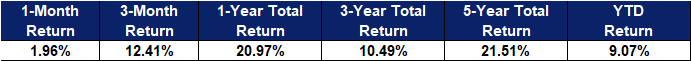

Fund Name (Ticker) | First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID US) |

Description | The First Trust NASDAQ® Clean Edge® Smart Grid Infrastructure Index Fund is an exchange-traded fund. The Fund seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an equity index called the Nasdaq Clean Edge Smart Grid Infrastructure™ Index. |

Asset Class | Equity |

30-Day Average Volume (as of 8 Apr) | 55,589 |

Net Assets of Fund (as of 8 Apr) | USD996,351,702 |

12-Month Yield (as of 28 Mar) | 1.15% |

P/E Ratio (as of 28 Mar) | 20.61 |

P/B Ratio (as of 28 Mar) | 3.14 |

Management Fees (Annual) | 0.57% |

Top 10 Holdings

(as of 8 April 2024)

(Source: Bloomberg)

Food & Beverage Sector

- During the COVID period, inflationary pressure led to selling price hikes. However, the Fed managed to curb inflation, resulting in a fall in raw material prices. However, F&B companies maintain higher selling prices, and accordingly, they benefit from high margins.

- Fast food companies deliver the sharpest return and quickest profitability recovery. Diet habit is hard to change once it is formed. The consumption of fast food was reinforced during a lockdown. Also, it is the cheapest compared to other food alternatives.

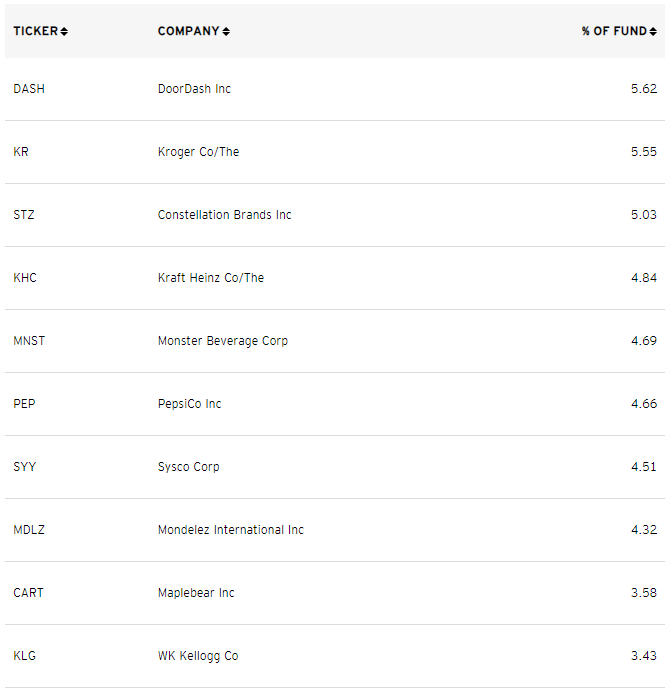

Fund Name (Ticker) | Invesco Food & Beverage ETF (PBJ US) |

Description | The Invesco Food & Beverage ETF (Fund) is based on the Dynamic Food & Beverage Intellidex℠ Index (Index). The Index is comprised of securities of 30 US food and beverage companies. These are companies that are principally engaged in the manufacture, sale or distribution of food and beverage products, agricultural products and products related to the development of new food technologies. |

Asset Class | Equity |

30-Day Average Volume (as of 08 Apr) | 13,263 |

Net Assets of Fund (as of 08 Apr) | US$129,980,800 |

12-Month Trailing Yield (as of 08 Apr) | 6.32% |

P/E Ratio (as of 08 Apr) | 36.074 |

P/B Ratio (as of 08 Apr) | 2.238 |

Management Fees (Annual) | 0.50% |

Top 10 Holdings

(as of 5 April 2024)

(Source: Bloomberg)