30 October 2024: Yanlord Land Group Ltd (YLLG SP), Goldwind Science & Technology Co Ltd. (2208 HK), Trump-themed Trades

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

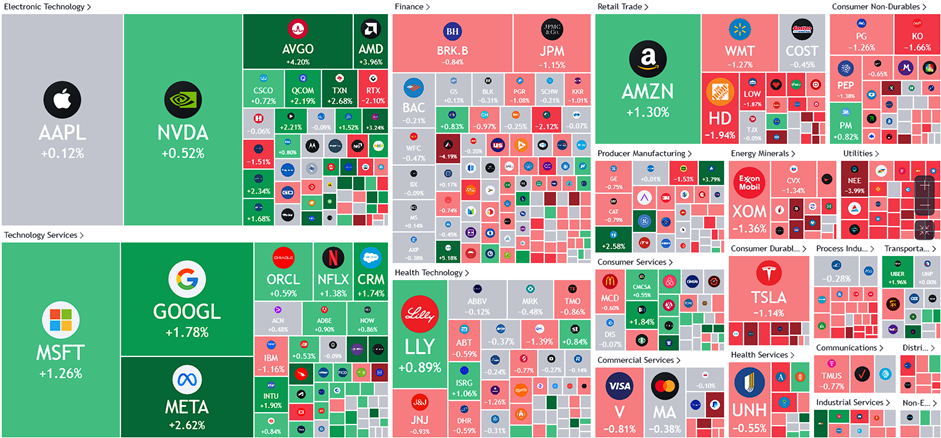

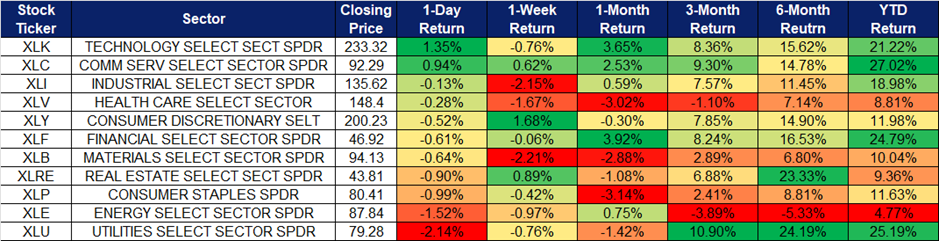

United States

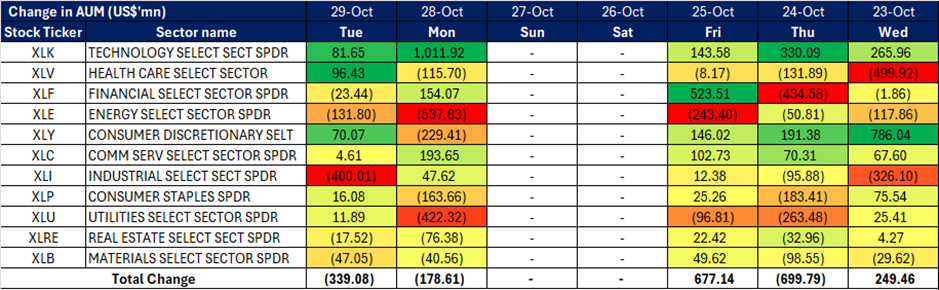

Hong Kong

Yanlord Land Group Ltd (YLLG SP): China’s stimulus to boost value

- BUY Entry – 0.680 Target– 0.760 Stop Loss – 0.640

- Yanlord Land Group Ltd is a real estate development company. The Company develops high-end residential property projects in the Peoples Republic of China.

- Signs of recovery in the property market. China’s property market is showing signs of recovery, with transaction volumes in major cities surging due to recent measures aimed at boosting demand and restoring confidence. In October, Shanghai’s secondary market recorded over 20,000 transactions—a month-on-month increase of 52.3%, according to data from the Shanghai Real Estate Trading Centre. Similarly, Beijing saw 11,699 pre-owned home sales from October 1 to 24. This uptick in transactions across top cities suggests a broader rebound in China’s property market. The recovery is supported by various government measures, including lower down payment and mortgage rates, an expanded “white list” to provide liquidity support for developers, and relaxed home purchase restrictions in key cities. This renewed momentum in China’s property market stands to benefit companies like Yanlord Land Group, which is well-positioned to capitalize on the improving market dynamics.

- Liquidity buffers for developers. The Ministry of Finance reiterated recently that the central government has room to increase fiscal deficit. The key policies shown are expected to ease property and construction companies’ liquidity issues.

- Allocate 400 billion yuan (US$56.57 billion) from the local government debt balance limit to expand local financial resources.

- Tap funding from an unused bond quota of 2.3 trillion yuan (US$325.3 billion) for local governments.

- Introduce a one-time, large-scale debt ceiling increase for local governments to swap their hidden debts.

- Allow local governments to use special bonds to purchase idle land from troubled developers.

- Use special bonds to purchase existing commercial homes. Earmark more for offering government-subsidised homes, and less on building new homes.

- Optimise tax policies and study the abolition of value-added tax on ordinary residential buildings.

- Allocate 400 billion yuan (US$56.57 billion) from the local government debt balance limit to expand local financial resources.

- Monetary policy tool to support capital market. China’s central bank announced the establishment of the Securities, Funds, and Insurance Companies Swap Facility (SFISF), with an initial scale of 500 billion yuan, aimed at promoting the healthy and stable development of the capital market. This marks China’s first monetary policy tool designed to support the capital market. The SFISF will allow eligible securities, funds, and insurance companies to use their assets, such as bonds, stock ETFs, and holdings in CSI 300 Index constituents, as collateral to obtain highly liquid assets like treasury bonds and central bank bills, according to a statement by the People’s Bank of China. The facility’s scale could be expanded based on market conditions. For China State Construction International Holdings (CSCIH), this provides access to highly liquid assets, strengthening its liquidity position and enhancing its ability to manage cash flow and finance operations. Additionally, the SFISF is expected to mitigate herd behavior and other pro-cyclical actions in the capital market, fostering a more stable and predictable environment for CSCIH to operate in.

- 1H24 results review. Total revenue for 1H24 increased by 34.8% YoY to RMB19.953bn from RMB14.805bn in 1H23. Income from property development, property investment and hotel operations, and property management for 1H24 increased by 42.4%, 1.9% and 0.4% to RMB17.488bn, RMB894mn and RMB591mn, respectively, while income from other segment decreased by 7.2% to RMB980mn, compared to 1H23. The Group reported a loss for the period of RMB421mn and a loss attributable to the owners of the Company of RMB486mn in 1H24, mainly due to write-down of completed properties for sale and properties under development for sale and net impairment losses on financial assets.

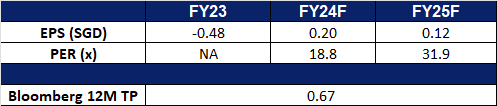

- Market Consensus.

(Source: Bloomberg)

Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP): Enhancing the world’s second-largest pharmaceutical market

- RE-ITERATE BUY Entry – 2.4 Target– 2.6 Stop Loss – 2.3

- Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited produces and sells traditional Chinese medicine, western medicine, health products, and healthcare instruments. The Company also manufactures gene-related biopharmaceutical products. Tianjin Pharmaceutical Da Ren Tang Group markets its products under the Great Wall, Cypress, and Health brand names.

- Policy support. China’s government is accelerating the development of its pharmaceutical market by implementing policies that emphasize innovation and R&D. The Government Work Report, passed in 2024, outlines measures to modernize the country’s industrial system, including financial incentives, subsidies, and the creation of high-tech science parks. These initiatives aim to boost the domestic biotech industry, enhance innovation, and support the development of new drugs. Additionally, China has introduced national reimbursement for innovative therapies and seen a rise in FDA-approved drugs and out-licensing deals, particularly in oncology, further demonstrating the government’s commitment to advancing the pharmaceutical sector. These will help to support Tianjin Pharmaceutical’s research and development of more products and instruments.

- New joint venture. Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited (formerly known as Tianjin Zhong Xin Pharmaceutical Group) is entering into an amended equity joint venture agreement regarding Tianjin TSKF Pharmaceutical Co., Ltd., alongside Haleon UK Services Limited and Haleon China Co., Ltd. This initiative includes extending the JV company’s operating period to 30 June 2025 and disposing of a 13% equity interest in the JV to Haleon China. Post-disposal, the equity structure will be adjusted, with Haleon UK holding 55%, Haleon China 33%, and Tianjin Da Ren Tang 12%.

- 1H24 results review. Revenue for 1H24 decreased by 3% YoY to RMB 3,965mn, a decrease of approximately RMB 124mn, driven mainly due to a YoY decrease in sale of goods. The profit attributable to equity holders in 1H24 was approximately RMB 658mn, a decrease of approximately RMB 65mn, or 9% from RMB 722mn of the corresponding period in 1H23. Earnings per share for 1H24 was RMB 0.85, lower than the RMB 0.94 in 1H23.

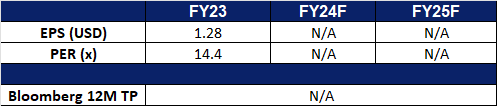

- Market Consensus.

(Source: Bloomberg)

Goldwind Science & Technology Co Ltd. (2208 HK): Spurring investments into renewable energy

- RE-ITERATE BUY Entry – 6.60 Target 7.50 Stop Loss – 6.15

- Goldwind Science & Technology Co Ltd, formerly Xinjiang Goldwind Science & Technology Co Ltd, is a China-based company that provides overall solutions for wind turbines, wind power services and wind farm development. The Company operates its businesses through four segments. The Wind Turbine Manufacturing and Sales segment is mainly engaged in the research and development, manufacturing and sales of wind turbines and their parts. The Wind Power Service segment mainly provides wind power-related consultants, wind farm construction and maintenance and transportation services. The Wind Farm Development segment is mainly engaged in the development and operation of wind farms. Other segment is mainly engaged in financial leasing and water treatment development and operation business. The Company conducts its businesses both in the domestic market and overseas markets.

- New Renewable Energy Consumption Benchmarks. China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) have jointly released updated requirements for the percentage of energy that provinces must source from renewable generators in 2024 and 2025. These requirements are part of China’s renewable energy consumption guarantee mechanism, mandating a significant increase in the share of renewable energy in several provinces. The document also outlines tentative renewable energy consumption targets for 2025. Current data reveals that six provinces experienced increases exceeding 6 percentage points in their renewable energy consumption mandate between 2023 and 2024. China remains on track to achieve its renewable energy goals, aiming for renewable energy, including hydropower, to account for 40 percent of total national energy consumption by 2030. This benchmarks are likely to spur on more investment into renewable energy as well.

- Increasing use of renewable energy in China. China’s renewable energy utilization has reached or exceeded advanced international levels, demonstrating rapid progress in sustainable energy. The country has maintained strong momentum in renewable energy adoption, with a utilization rate of 97.6%, surpassing 95% for six consecutive years since 2018. Last year, newly installed renewable energy capacity rose to 290 million kW, 2.4 times that of 2022, accounting for 79% of the total new power generation capacity nationwide, making it the primary source of new power generation. This surge in capacity has spurred significant investments in solar, wind, and hydropower projects across the country. These efforts are part of China’s broader strategy to peak carbon emissions before 2030 and achieve carbon neutrality before 2060. Furthermore, China’s National Energy Administration also recently reported that 486 million Green Electricity Certificates (GECs) were issued during the first half of 2024– a 13-fold increase compared to the same period last year, further signalling progress towards the decarbonisation and reform of the power sector. Goldwind is likely to benefit from the increased investment and spending in renewable energy.

- Expanding presence. Goldwind Science & Technology has officially opened its first overseas wind turbine manufacturing plant in Brazil. The facility has begun production with a capacity to produce up to 150 turbines annually. Valued at approximately $18.2 million, this investment aims to strengthen local supply chains and leverage the region’s rich wind resources. While the plant will primarily serve the Brazilian market, it is also positioned to export equipment across South America via the port of Bahia. With this new facility, Goldwind is expected to secure a 24% to 30% share of the Brazilian wind turbine market.

- 1H24 earnings. The company’s revenue rose to RMB20.1bn in 1H24, +6.53% YoY, compared to RMB18.9bn in 1H23. The company’s net profit rose by 6.74% YoY to RMB1.44bn in 1H24, compared to RMB1.35bn in 1H23. Basic earnings per share rose to RMB0.32 in 1H24, compared to RMB0.28 in 1H23.

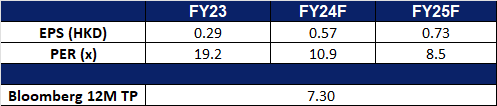

- Market consensus.

(Source: Bloomberg)

Lenovo Group Ltd (992 HK): PC shipment recovery on track

- RE-ITERATE BUY Entry – 10.7 Target 12.1 Stop Loss – 10.0

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Global PC recovery to continue through 1H25. Worldwide PC shipments reached 62.9 million units in the third quarter of 2024, reflecting a 1.3% decline compared to the same period in 2023, according to preliminary data from Gartner, Inc. This marks the first decline after three consecutive quarters of year-over-year growth in the PC market. Despite this dip, the market remains on a recovery trajectory. Global demand for PCs is expected to accelerate toward the end of 2024, with stronger growth anticipated in 2025 as the PC refresh cycle peaks. Lenovo maintained its position as the global market leader, holding a 26.3% share in Q3 2024 and posting a 2.5% year-over-year increase in shipments. The company’s strong financial performance in the first quarter of 2025, supported by rising global AI investments, reinforces optimism for a steady recovery in the computing industry. This resurgence is fueled by growing demand for servers, which are essential for AI development, helping to revitalize the hardware sector following the post-pandemic slowdown. As the industry approaches the four-year anniversary of the COVID-19 pandemic, the PC commercial refresh cycle is expected to gain momentum. With inventory levels stabilizing, average selling prices are projected to rise, driven by more advanced configurations and a reduction in discounting.

- Ramping up global AI spending. Major technology companies, including Microsoft, Alphabet, Meta, and Amazon, are projected to invest over $1tn in AI over the coming years, according to sources. In their recent earnings reports, these companies informed investors that they anticipate increased spending on AI infrastructure, particularly data centres, to secure their long-term positions in the AI sector and meet the growing computational demands. By investing in AI infrastructure now, these tech giants aim to ensure they have the necessary computing technology as AI continues to evolve. Lenovo’s AI PCs is likely to benefit from these AI investments.

- Expanding AI product portfolio. Lenovo continues to expand its AI product portfolio following the launch of its AI-enabled PCs earlier this year. The company recently introduced the Lenovo ThinkSmart Core Gen 2, one of the first AI-optimized devices specifically designed to power video conferencing room systems. Additionally, Lenovo announced that its Indian manufacturing facility has begun producing AI-powered servers. This news was further bolstered by the company’s plans to establish a new research and development lab in Bengaluru, its fourth globally. Looking ahead, Lenovo aims to integrate AI capabilities into all of its PCs by 2027. These advancements position the company to capitalize on the growing adoption of AI across industries as more businesses embrace AI-driven solutions in their operations.

- 1Q25 earnings. The company’s revenue rose by 19.7% YoY to US$15.4bn in 1Q25, compared to US$12.9bn in 1Q24. The company’s net profit rose by 38.3% YoY to US$253mn in 1Q25, compared to US$183mn in 1Q24. Basic earnings per share rose to US1.99 cents in 1Q25, compared to US1.48 cents in 1Q24.

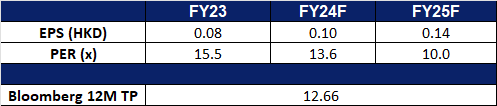

- Market consensus.

(Source: Bloomberg)

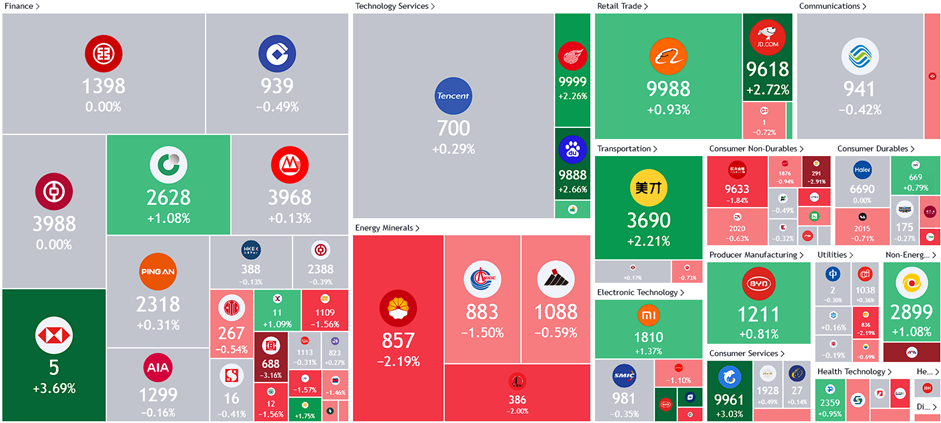

Trump-themed Trades

With less than a week until the 2024 U.S. election, the latest polls show Trump maintaining a lead over Harris, increasing the likelihood of his comeback to the presidency. His well-known slogan, “Make America Great Again,” reflects the core of his platform, often described as advocating for isolationist policies. Should Trump assume office once again, his administration’s impact on global economics and geopolitics could be profound and unpredictable. While there are both pros and cons, here are several Trump-themed ideas worth considering:

- Economic Reshoring – Trump has consistently pushed for bringing manufacturing jobs back to the U.S., aiming to reduce dependency on foreign markets. This could boost domestic employment and economic resilience, though it may strain trade relationships.

- Trade Policy – Known for prioritizing “America First,” Trump may increase tariffs and negotiate stricter trade agreements, potentially reshaping international commerce but also risking retaliatory measures from other countries.

- Immigration and Border Security – Trump has pledged to complete the U.S.-Mexico border wall, strengthening border security to curb illegal immigration and what he describes as the flow of drugs and crime across borders. Policies under a Trump administration would likely include stricter visa restrictions, aggressive deportation of undocumented immigrants, and limits on asylum, positioning immigration as a key national security issue.

- Military and Security – Trump’s approach could see increased defense spending and a reassessment of U.S. involvement in foreign conflicts. While this may bolster national security, it could create tensions with allied countries that rely on U.S. support.

- Energy Independence – Advocating for domestic energy production, Trump’s policies might drive a renewed focus on fossil fuels and reduced regulation on U.S. energy sectors. This could benefit local economies but raise concerns around environmental impact and climate commitments.

- Social Policy and Education – Advocating for free speech on campuses and in public institutions, Trump is likely to target what he sees as “cancel culture” and censorship, especially in social media and mainstream media. Trump’s education policy includes promoting school choice, cutting federal control over education, and banning critical race theory from public education.

- Cryptocurrencies – Trump used to be sceptical about cryptocurrencies, however, he repositioned himself as a pro-crypto presidential candidate in June this year. He declared that he wanted the U.S. to become the “crypto capital of the planet” and the Bitcoin “superpower of the world”. Trump’s crypto venture, World Liberty Financial, has launched its native token in October, and it plans to launch its own stablecoin, which is designed to peg 1 to 1 to the value of the USD.

- Healthcare – Rather than supporting expanded government-funded healthcare, Trump advocates for market-driven healthcare reforms, which may include expanding health savings accounts, lowering prescription drug costs, and promoting private healthcare options.

Sector | Stock | ETF |

| Curtiss-Wright Corp (CW) General dynamics corporation (GD) Northrop Grumman Corp (NOC) Palantir (PLTR) Lockheed martin corporation (LMT)

Rtx Corp (RTX)

| iShares Global Aerospace & Defence UCITS ETF (DFND) iShares U.S. Aerospace & Defense ETF (ITA) Invesco Aerospace & Defense ETF (PPA) |

| CleanSpark Inc (CLSK) Coinbase Global Inc (COIN) MicroStrategy Inc (MSTR) MARA Holdings Inc (MARA) Riot Platforms Inc (RIOT) | ProShares Bitcoin ETF (BITO) iShares Bitcoin Trust ETF (IBIT) |

| Peabody energy corp (BTU) Dominion Energy Inc (D) Energy transfer (ET) Cheniere energy Inc (LNG) Targa Resources Corp (TRGP) Exxon Mobile Corp (XOM) | iShares US Energy ETF (IYE) Global X MLP & Energy Infrastructure ETF (MLPX) |

| BlackRock Inc (BLK) Blackstone Inc (BX)

Capital One Financial Corp (COF)

Goldman Sachs Group Inc (GS) JPMorgan Chase & Co (JPM) | Invesco KBW Bank ETF (KBWB) SPDR S&P Regional Banking ETF (KRE) iShares U.S. Financials ETF (ITF) |

| Caterpillar Inc (CAT) Corning Inc (GLW) Dover Corporation (DOV) Ingersoll Rand Inc (IR) 3M Company (MMM) | iShares U.S. Manufacturing ETF (MADE) Tema American Reshoring ETF (RSHO) |

| Boston Scientific Corporation (BSX) Ensign Group Inc (ENSG) Intuitive Surgical Inc (ISRG) | iShares US Medical Devices ETF (IHI) |

| Reddit Inc (RDDT) SoundHound AI Inc (SOUN) Hims & Hers Health Inc (HIMS) | iShares Russell 2000 ETF (IWM) iShares Russell 3000 ETF (IWV) |

| Trump Media & Technology Group Corp (DJT) Rumble Inc (RUM) Tesla (TSLA) |

Coinbase (COIN US): Expect the rally to continue

- RE-ITERATE BUY Entry – 190 Target – 220 Stop Loss – 175

- Coinbase Global Inc provides financial infrastructure and technology for the crypto economy in the United States and internationally. The company offers consumers a primary financial account in the crypto economy; and a marketplace that provides institutional investors with a liquidity pool for trading crypto assets. It also provides technology and services that enable developers to build crypto products and securely accept crypto assets as payment.

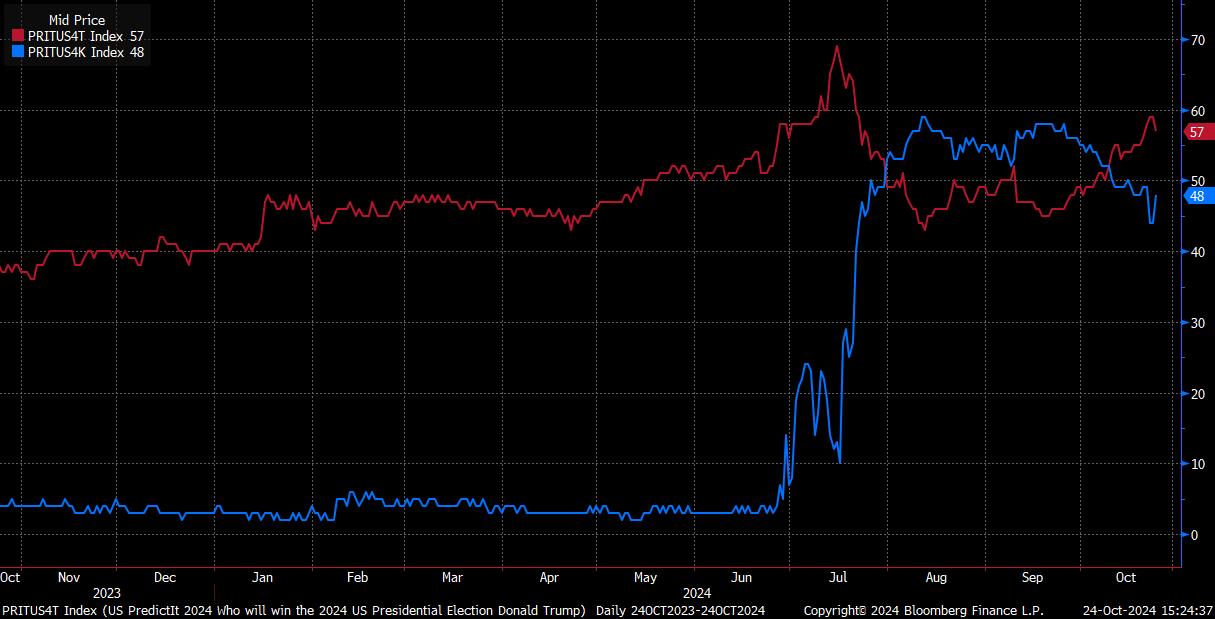

- Rising Trump-themed trades. The 2024 US election is less than two weeks. According to Bloomberg, Trump maintains the leading advantage against Harris by 9 pts. Funds have been betting on Trump-themed trade since early October. Cryptocurrencies are one of the asset classes that will benefit from Trump’s administration as he vowed to turn the US into the crypto capital of the planet and the Bitcoin superpower of the world. The recent upswing of Bitcoin reflects the strong expectations of Trump’s winning. However, the uncertainties of the Fed rate decision and the US election ahead still lead to a bumpy recovery of Bitcoin. We believe Bitcoin will retest the March all-time high and probably will create new highs after the election.

2024 US presidential election prediction

(Source: Bloomberg)

- Bitcoin ETF options approved. The Securities and Exchange Commission (SEC) has granted approval for the NYSE and CBOE to list options on spot Bitcoin ETFs. This will enhance capital inflows, and meanwhile, volatilities will enlarge. The trading volumes of Bitcoin ETFs and Bitcoin will increase accordingly.

- 4Q24 earnings review. Revenue increased 104.8% YoY to US$1.45bn, exceeding expectations by US$90mn. GAAP EPS was US$0.14, missing expectations by US$0.78.

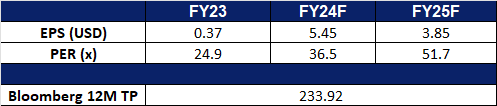

- Market consensus.

Trading Dashboard Update: Add and take profit on Xinyi Solar Holdings Ltd. (968 HK) at HK$4.0 and HK$4.6 respectively. Add Lenovo Group Ltd. (992 HK) at HK$10.70.