KGI DAILY TRADING IDEAS – 26 March 2021

IPO Watch

Bilibili (9626 HK): Priced at HK$808; Public offer 170x oversubscribed

- The HK$808 offer price is 18% lower than the maximum offer price of HK$988m, even while the public offer was 170x oversubscribed, making it the most oversubscribed second-listing for a Chinese company in Hong Kong.

- HKEX will offer investors Futures and Options on Bilibili shares after its debut on 29 March.

- Read our previous write-up on Bilibili here.

- Bilibili starts trading on Monday, 29 March 2021.

Zhihu (ZH US): A unique social media play hits the market; IPO priced at US$9.5, bottom of range

- ZH is the largest Chinese question-and-answer website similar to Quora.

- ZH has priced at the bottom of their indicated IPO range, which translates to an initial market cap of US$5.4bn.

- IPOs for this week have largely underperformed with negative price gains for first-day pops. We think sentiment could be weak for ZH as well, which also suffers from rising US-China tensions.

- ZH is expected to trade tomorrow, 26 March.

US Trading Ideas

Korn Ferry (KFY US): Get staffed

- Entry – 58.9 Target – 64.9 Stop Loss – 56

- KFY operates as a consulting firm offering talent acquisition, leadership development, organisational strategy, and other human resource management services.

- KFY and other employment service stocks have seen strong momentum since 4Q20 as unemployment rates in the US continue to fall. However, shares of most employment service stocks have range traded in March alongside overall market volatility.

- Despite almost doubling in share price since November 2020, KFY trades around 20x pre-COVID and forward P/E, as the company achieved US$3.21 and US$2.93 EPS in FY19 and FY20 respectively. We think the valuation is fair relative to S&P 500’s forward PE of ~25, and expect share prices to bounce off the nearest Fibonacci support at US$58.80.

Warner Music Group (WMG US): Own the means of production

- RE-ITERATE BUY Entry – 32.8 Target – 38.5 Stop Loss – 31.25

- We pitched WMG last Friday, and WMG remains in a downtrend despite signing a new deal with Tencent Music (TME US).

- We maintain conviction in our thesis, as volume activity appears healthy for WMG, with strong volume on uptrend days and weak volume on downtrend days. The lows of recent trading activity have not breached US$31.6, which is close to the 200 Moving Average line. Maintain stop loss at US$31.25 as a move towards US$31 would indicate strong bearish sentiment with further downside.

HK Trading Ideas

ANTA Sports Products Limited (2020 HK): No joke! Patriot’s choice!

- BUY Entry – 116 Target – 140 Stop Loss – 105

- ANTA Sports Products Limited is principally engaged in the manufacture and trading of sporting goods, including footwear, apparel and accessories in Mainland China. The company focuses on the sportswear market in China with a brand portfolio, including ANTA, ANTA KIDS, FILA, FILA KIDS and NBA. Through its subsidiaries, the company is also engaged in the manufacture of shoe soles. The company’s subsidiaries include Anta Enterprise Group Limited, Motive Force Sports Products Limited and REEDO Sports Products Limited.

- The company recently announced FY20 full year results. Revenue grew by 4.7% YoY to RMB35.5bn. Gross profit grew by 10.7% YoY to RMB20.7bn. Net profit slightly dipped by 1% YoY to RMB5.6bn.

- Number of stores breakdown by brands as of FY20 and FY21F:

| 2020 | 2021F | YoY growth | |

| KOLON SPORT | 157 | 160 to 170 | 1.9% to 8.2% |

| DESCENTE | 175 | 210 to 220 | 20% to 25.7% |

| ANTA and ANTA KIDS | 9,922 | 9,800 to 9,900 | -1.2% to -0.2% |

| FILA, FILA KIDS, and FILA FUSION | 2,006 | 2,050 to 2,150 | 2.2% to 7.2% |

- Near-term catalyst is the boycott movement of counter-Xinjiang cotton ban. Domestic consumers will likely switch to domestic sportswear brands like Anta. Medium-term catalyst is the upcoming summer Olympic games as Anta is one of the few domestic sponsors of Chinese athletes. The double bonanzas are believed to boost the sales for the company and attract more investors’ interests in the stock.

- Market consensus of net profit growth in FY21 and FY22 are 56% YoY and 28% YoY, which implies forward PERs of 35.8x and 28x. Current PER is 55.3x. Bloomberg consensus average 12-month target price is HK$145.23.

COSCO Shipping Holdings (1919 HK): Ride on the roller coaster again

- RE-ITERATE Buy Entry – 7.8 Target – 10.2 Stop Loss – 7

- COSCO Shipping Holdings is an investment holding company principally engaged in container shipping and related businesses. The Company is engaged in container shipping, dry bulk shipping, the management and operation of container terminals, container leasing and the provision of logistics services. The Company operates its business through two segments. The Container Shipping segment is engaged in the transportation of goods across the Pacific, Asia and Europe, and other international routes. The Terminal Operation and Investment segment is engaged in the operation and management of ports. The Company is also involved in the management and leasing of containers.

- Global container freight index is currently maintaining at above US$4,000. As of 19th March, the index was reported at US$4,045. Sub-index of the route from China/East Asia to North America and North Europe also remained at highs of US$5,729 and US$7,665 respectively. The seaborne trade from China to the western hemisphere remains buoyant.

- Market consensus of net profit growth in FY21 is 52.11%YoY which implies forward PER of 6.8x. Current PER is 10.3x. The consensus of the average 12-month target price is HK$11.21.

- The company will announce FY20 full year results on 30 March.

SG Trading Ideas

CapitaLand (CAPL SP): Still some meat left; reopening play #1

- BUY Entry – 3.75 Target – 4.10 Stop Loss – 3.60

- CapitaLand has proposed privatising its property development business while listing its asset management business and assets in a newly listed entity to be called CapitaLand Investment Management (CLIM).

- Shareholders of CAPL will receive S$0.951 in cash, one CLIM share that is valued at S$2.823 and dividend-in-specie of 0.155 CapitaLand Integrated Commercial Trust (CICT SP) units worth S$0.323. In addition, CAPL will be paying out the proposed FY2020 dividend of S$0.09.

- The new CLIM entity will hold its listed REITs and business trusts, unlisted funds and its lodging business. The Lodging business is of particular interest as this could be an earnings driver over the next 12-16 months as countries reopen.

- The company has over 122,000 lodging units with a target of 160,000 by 2023. CAPL believes that the business becomes capital efficient when reaching 130-140k units.

- Taken together, CAPL still offers a decent upside potential despite the recent rally, especially going into the second half of 2021 when countries reopen their borders and there is significant pent-up travel demand.

ComfortDelGro (CD SP): Back to work; reopening play #2

- BUY Entry – 1.68 Target – 1.85 Stop Loss – 1.60

- CD is a reopening play #2 as workers return to offices from 5 April. Singapore’s government raised the proportion of employees allowed back in the workplace to 75% from 50% currently, starting from 5 April.

- CD is one of the largest land transport companies in the world, operating in seven countries and with a global network of over 40,000 vehicles. The company’s businesses include bus, taxi, rail, car rental and leasing, automotive engineering, inspection and testing services, drive centres and outdoor advertising.

- Singapore is the largest contributor of operating profits, making up 66% in FY2019, followed by Australia (19% of operating profits), UK/Ireland (10%) and China (5%).

- Net profit for FY2020 declined 77% YoY to S$62mn as ridership across all its business and regions were affected by the various lockdowns. It had to recognise impairments of almost S$50mn for the year.

- However, the worst may finally be over. Management says that they are seeing a steady uptick in business activity especially in 4Q20, and the group has been doubling down on its digitalisation efforts to better prepare and take advantage of recovery opportunities.

- Valuations are currently attractive at 1.2x P/B, which is significantly below historical averages. CD has a very strong balance sheet (near net cash as at end 2020), a rarity for a transport company, thereby giving it flexibility to fund dividend payouts going forward. Dividend yields are expected to recover to 3.9% in FY2021E, and stabilize at around 5-6% thereafter, based on street estimates.

Market Movers – What’s Hot

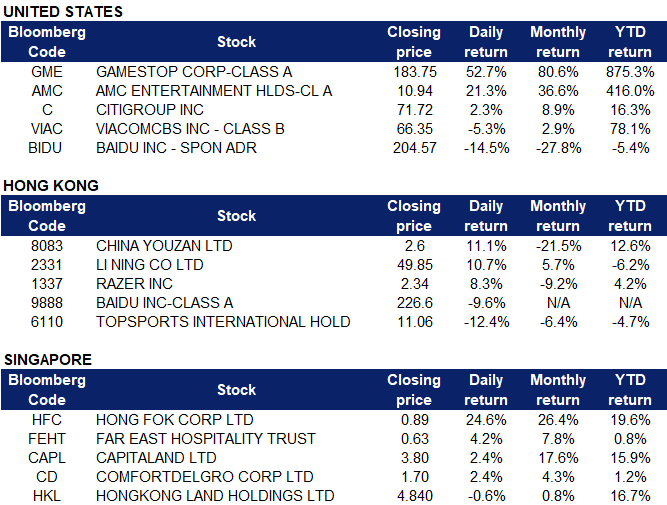

United States

- GameStop (GME US) shares roared back 53% in overnight trading, the largest gain since 24 Feb when it jumped 104%. The closing gain ranks among the sixth-largest percentage gain for the stock on record. Buyers stepped in at the US$125 level which was well-supported by the 50-day moving average. Other popular Reddit trades also surged with Koss (KOSS US) gaining 57% and AMC Entertainment (AMC US) rising 21%.

- Citi (C US) rose alongside other US banks including Wells Fargo (WFC US) and Bank of America (BAC US). The Fed will allow banks to resume normal levels of dividend payouts and share repurchases as of 30 June 2021 as long as they pass this year’s stress test.

- ViacomCBS (VIAC US) and Discovery Inc (DISCA US) led the decliners in the S&P 500 index, dropping further after a day when they declined more than 13% following analysts’ downgrades. VIAC will be raising US$3bn in a stock offering that will close 26 March.

- BIDU (BIDU US) shares closed 14.47% lower in overnight trading and 40% from its all-time high of US$254.82. The recent sell-off also follows the muted secondary listing of its shares in Hong Kong.

- Trading Dashboard: Take profit on Target at US$192.5. Include Citibank at US$70.

- Earnings Watch: Cloopen Group, Up Fintech, RLX Technology (26 Mar)

Hong Kong

- China Youzan Ltd (8083 HK). Investors were likely front running the FY20 results which will be announced on 26 March. The stock has dropped by more than 50% from the peak of HK$4.52 in mid-February.

- Li Ning Co Ltd (2331 HK). Chinese domestic sportswear sector jumped as foreign apparel companies announced they would remove Xinjiang cotton out of their supply chains. H&M is the first company to be targeted, and Nike, Uniqlo, and Adidas are the subsequent targets. The nationalistic rhetoric lifted the sector from the current weak market sentiment.

- Razer Inc (1337 HK). The company announced the FY20 full year results. Revenue grew by 48% YoY to US$1.21bn. Gross profit grew by 61.3% YoY to US$271mn. Net profit arrived at US$5.63mn compared to net losses of US$84.18mn.

- Baidu Inc (9888 HK). Following the sell-off of Chinese ADRs in the US market. The Chinese big tech companies were under selling pressure on the potential delisting from US stock exchanges. Meanwhile, China is reportedly proposing a joint venture to oversee data collection from e-commerce and digital payment companies.

- Topsports International Holdings Ltd (6110 HK). Being a distributor of foreign sportswear brands such as Nike, Adidas, and Puma, the company is an indirect target of the boycott movement of counter-Xinjiang cotton ban.

Singapore

- Hong Fok (HFC SP) shares gained as much as 26% on media reports of its deep value. HFC’s net asset value per share was S$2.95 or more than three times its current share price. HFC’s assets include the 41-storey commercial tower The Concourse on Beach Road; the 13-storey International Building and 30-the storey Yotel Singapore, both on Orchard Road; and several apartments and commercial units at the newly developed Concourse Skyline.

- Far East Hospitality Trust (FEHT SP) gained after CGS-CIMB reiterated its “ADD” recommendation and higher target price of S$0.745, factoring in an accelerated recovery from FY2023. The new TP implies 0.95x P/B.

- CapitaLand (CAPL SP) closed higher as investors digested news of the restructuring plan to privatise its development business while listing the asset management arm. Analysts have also upgraded CAPL’s target price to an average of S$4.02, with Goldman Sachs issuing the highest 12-month TP of S$4.56.

- ComfortDelGro (CD SP). Shares reacted positively to the Singapore Government’s announcement that more can return to the workplace. From 5 April, the proportion of employees allowed back in office will increase to 75% from 50% currently.

- Hongkong Land (HKL SP) as the stock went ex-dividend. HKL will be paying out 16 US cents final dividend, payable on 12 May 2021. HKL offers among the highest dividend yield for a SG-listed property developer at 4.6%/4.7%/4.8% forecasted yield for FY2021/22/23F and trades at only 0.3x P/B.

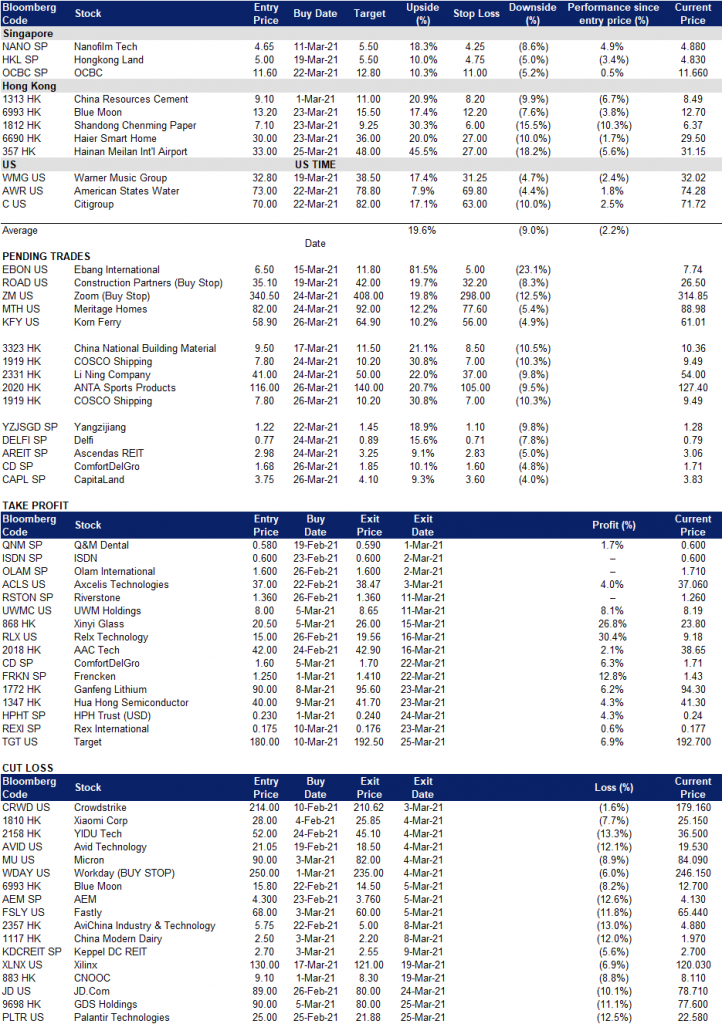

Trading Dashboard