KGI DAILY TRADING IDEAS – 24 March 2021

IPO Watch

Bilibili (9626 HK): Priced at HK$808; Public offer 170x oversubscribed

- The HK$808 offer price is 18% lower than the maximum offer price of HK$988m, even while the public offer was 170x oversubscribed, making it the most oversubscribed second-listing for a Chinese company in Hong Kong.

- We have a write-up on it last Friday. Read it here.

- Bilibili starts trading on Monday, 29 March 2021.

IPO Performance

Baidu (9888 HK): Muted performance

- Baidu’s HK’s shares gained as much as 1.8% on its first day of trading, before closing flat at HK$252.

US Trading Ideas

Zoom (ZM US): Stick with the pandemic winner

- BUY Entry – 340.5 (BUY STOP) Target – 408 Stop Loss – 298

- ZM is the fastest growing modern enterprise video communications software, growing more than 4x in 2020 as it became a household name amidst COVID-19.

- ZM’s shares have faced selling pressure since late October as the pandemic subsides and the investment narrative focuses on its lofty valuations.

- We expect ZM to remain relevant in a post-COVID world as corporations seek to maintain reduced administrative expenses and adopt more flexible working arrangements. ZM’s latest product, Zoom Phone, is also experiencing good growth and can tap on ZM’s large existing user base.

- ZM currently trades near its 200 EMA after the March sell-off. We recommend buying on confirmation of recovery.

Meritage Homes (MTH US): Housing optics look poor but fundamentals still strong

- BUY Entry – 82 Target – 92 Stop Loss – 77.6

- We pitched MTH last month which hit our stop loss and has rebounded since, due to strong homebuilding figures from Lennar (LEN US) that signalled continued strong demand in the homebuilding sector.

- We attribute the recent sell-down to be due to poor New Home Sales results released on Tuesday. However, February sales were already expected to be poor due to record cold weather conditions.

- We expect a re-test of the support near the US$80-82 region, while MTH’s earnings call in late April can catalyse a rebound to the recent high near US$92.

HK Trading Ideas

COSCO Shipping Holdings (1919 HK): Ride on the roller coaster again

- Buy Entry – 7.8 Target – 10 Stop Loss – 7

- COSCO Shipping Holdings is an investment holding company principally engaged in container shipping and related businesses. The Company is engaged in container shipping, dry bulk shipping, the management and operation of container terminals, container leasing and the provision of logistics services. The Company operates its business through two segments. The Container Shipping segment is engaged in the transportation of goods across the Pacific, Asia and Europe, and other international routes. The Terminal Operation and Investment segment is engaged in the operation and management of ports. The Company is also involved in the management and leasing of containers.

- Global container freight index is currently maintaining at above US$4,000. As of 19th March, the index was reported at US$4,045. Sub-index of the route from China/East Asia to North America and North Europe also remained at highs of US$5,729 and US$7,665 respectively. The seaborne trade from China to the western hemisphere remains buoyant.

- Market consensus of net profit growth in FY21 is 52.11%YoY which implies forward PER of 6.8x. Current PER is 10.3x. The consensus of the average 12-month target price is HK$11.21.

- The company will announce FY20 full year results on 30 March.

Li Ning Company Limited (2331 HK): An Olympic Games play

- RE-ITERATE BUY Entry – 41 Target – 50 Stop Loss – 37

- Li Ning Company Limited is principally engaged in brand development, design, manufacture and sale of sport-related footwear, apparel, equipment and accessories in the People’s Republic of China (the PRC). The Company is also engaged in the manufacture, development, marketing, distribution and sales of sports products under several other brands, including Double Happiness (table tennis), AIGLE (outdoor sports) and Lotto (sports fashion). Through its subsidiaries, the Company is also engaged in the provision of information technology service.

- China’s sportswears consumption has been growing steadily. Due to COVID-19, most brick and mortar stores were forced to shut. However, the online sales, especially live-streaming sales helped sportswear companies to thrive during the pandemic period. Therefore, Li Ning 1H20 earnings dipped slightly YoY. But the recovery of consumption in 2H20 due to pent-up demand was expected to boost the sales.

- The upcoming catalyst is the summer Olympic Games in July and August 2021. This is the first international sports event after COVID-19. We believe that this Olympic Games will indirectly stimulate sportswear sales, especially Chinese brands. Li Ning is one of the top domestic brands that sponsors Chinese athletes.

- Market consensus of net profit growth in FY21 and FY22 are 38.5% YoY and 29.4% YoY, which implies forward PERs of 42.7x and 33.0x. Current PER is 59.1x. Bloomberg consensus average 12-month target price is HK$56.5.

SG Trading Ideas

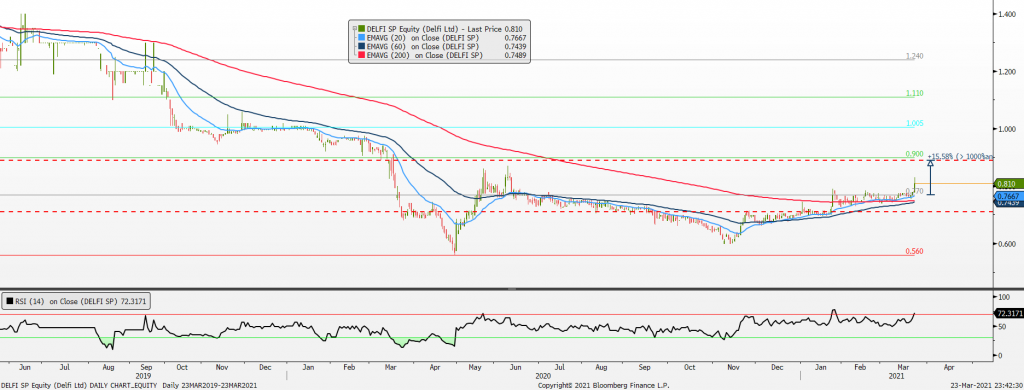

Delfi (DELFI SP): Never underestimate the power of chocolate

- BUY Entry – 0.77 Target – 0.89 Stop Loss – 0.71

- “Chocolate comes from cocoa, which is a tree. That makes it a plant. Therefore, chocolate is a salad”

- Delfi manufactures and distributes many of Indonesia’s favourite chocolate confectionary products, holding a strong and unwavering market share of close to 50%. Even global chocolatiers such as Cadbury (owned by Mondelez International Inc), Ferrero and Nestlé combined hold less than 20% of the Indonesian confectionery market.

- Despite the impact of Covid-19 on Indonesia’s economy, the country has consistently recovered more quickly than developed markets. Indonesia’s GDP is forecasted to grow 4.8% in 2021 and 5.0% in 2022, according to Bloomberg consensus forecast, after a mild contraction of -2.0% in 2020.

- Delfi’s latest earnings results showed that the recovery momentum is picking up. In 4Q20, while revenues were lower by 3.7% YoY, it was a significant 25.0% QoQ improvement. The group has laid out strategic initiatives for the year ahead, including rejuvenating its brands via refreshed packaging and strengthening its distribution network in the Modern Trade Channels (particularly Minimarts and Modern Trade Independents).

- Delfi trades at attractive valuations of 15x/13x/10x FY2021/22/23F P/E while EPS is forecasted to grow at 24-35% per annum in the next three years. We currently have a fundamental OUTPERFORM recommendation and target price of S$0.89, based on a conservaive 15x forward P/E, compared to its Indonesian confectionary peers trading at 20-30x P/E.

Ascendas REIT (AREIT SP): Insatiable cloud demand across the world

- BUY Entry – 2.98 Target – 3.25 Stop Loss – 2.83

- AREIT is Singapore’s largest industrial REIT with investments in business parks and industrial facilities. Its assets include 93 properties in Singapore, 30 in the US, 36 in Australia and 38 in the UK. As at end 2020, the REIT had S$15bn in assets. It completed S$973mn of acquisitions in FY2020 and plans an additional S$535mn worth of investments over the next two years.

- It recently entered Europe’s data centre market with the acquisition of 11 data centres for S$960mn. This included 4 data centres in the UK, 3 in the Netherlands, 3 in France and 1 in Switzerland.

- The acquisition increases AREIT’s data centre exposure to 10% of total portfolio value, and will be DPU accretive. The group remains positive and sees potential for more such acquisitions given its strong balance sheet and conservative leverage ratio (37% post-purchase vs the 50% regulatory limit).

- AREIT offers a dividend yield of 5.3%/5.6%/5.8% for FY2021/22/23F, according to Bloomberg consensus forecasts. Consensus has a target price of S$3.41 compared to its current unit price of S$2.97.

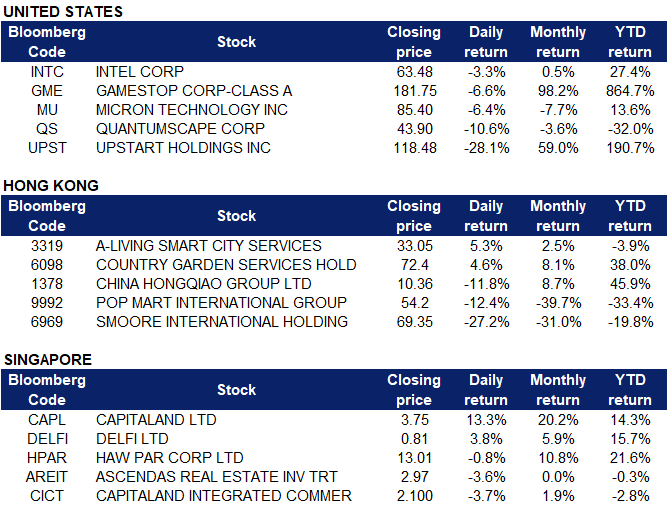

Market Movers – What’s Hot

United States

- Intel (INTC US) saw after hour gains of 6.6% after announcing a US$20bn investment into 2 new fabs in Arizona and a Capex guidance of US$19bn for 2021, ahead from consensus estimates of US$14.6bn.

- Gamestop (GME US) fell 15% after hours upon reporting lower than expected earnings and contemplation of offering more shares to the market.

- Micron (MU US) shares fell more than its semiconductor peers on a news report out from Korea that indicated some weakness in sales of Apple products. According to the Korea Herald and citing industry insiders, Samsung Display, the sole supplier of a 5.4-inch display for the iPhone 12 mini, is expected to receive compensation from Apple over a shortfall in panel orders.

- Quantumscape (QS US) dropped after announcing 13mn of new share offerings.

- Upstart (UPST US) fell back near the US$120 level as positive momentum for the shares came to a halt, after almost tripling since their earnings call last Wednesday.

- Earnings Watch: General Mills, GrowGeneration, KB Home, Guess, Energy Fuels (24 Mar); CNOOC (25 Mar); Cloopen Group, Up Fintech, RLX Technology (26 Mar)

Hong Kong

- A Living Smart City Services Co Ltd (3319 HK). Previously, the company announced FY20 full-year results. Revenue grew by 95.54% YoY to RMB10.26bn. Gross profit grew by 57.9% YoY RMB2.97bn. Net profit grew by 42.6% YoY to RMB1.75bn. EPS was RMB1.32, and DPS was proposed at RMB0.52.

- Country Garden Services Holdings Company Limited (6098 HK). Previously, the company announced FY20 full-year results. Revenue grew by 61.7% YoY to RMB15.6bn. Gross profit grew by 73% YoY RMB5.3bn. Net profit grew by 60.8% YoY to RMB2.69bn. EPS was RMB0.627, and DPS was proposed at RMB0.219.

- China Hongqiao Group Limited (1378 HK). Aluminium sector plunged as futures in Shanghai fell by 5% to RMB16.655/tonne, reaching the low since 24th February.

- Pop Mart International Group Ltd (9992 HK). The share price halved from the peak in mid-February. Investors are concerned with the high valuations as market sentiments of growth stocks are out of favour.

- Smoore International Holdings Ltd (6969 HK). China sent another warning shot to investors that its regulatory scrutiny on markets is hardening. New categories of cigarette products such as e-cigarettes will now be regulated like ordinary tobacco products, according to draft regulations posted by the Ministry of Industry and Information Technology on its website after the market closed on Monday.

- Trading Dashboard: Take profit on Ganfeng Lithium (1772 HK) and Hua Hong Semiconductor (1347 HK). Add Blue Moon (6993 HK), Shandong Chenming Paper (1812 HK) and Haier Smart Home (6690 HK).

Singapore

- Capitaland (CAPL SP) traded to a high of S$4.01 before giving in to selling pressure, closing at S$3.75 which was near the day’s low of S$3.72. The company announced on Monday that it will split itself into two businesses, where it will see the real estate development business privatised while the investment management platforms and lodging arm will be consolidated into a newly created entity called CapitaLand Investment Management (CLIM). CLIM will be listed on SGX and will hold all the group’s REITS, business trusts and selected unlisted funds currently managed by CapitaLand.

- Delfi (DELFI SP) rose on higher than average trading volumes. The chocolate maker’s shares have been on an uptrend since 4Q20, which we attribute to its cheap valuations and improving fundamentals. It currently trades at only 15x/13x/10x FY21/22/23E P/E, a significant discount to Indonesian-listed peers. We have a fundamental OUTPERFORM recommendation on DELFI and a target price of S$0.89.

- Haw Par Corporation (HPAR SP) saw the second largest institutional net buying last week, with S$31mn of net fund inflows. Together with Jardine Strategic (+S$35mn) and Venture Corp (+S$27mn), these three stocks topped the league for highest institutional fund inflows.

- CapitaLand Integrated Commercial Trust (CICT SP); Ascendas REIT (AREIT SP). Both REITs closed lower, likely due to profit taking as units of the two REITs had rallied prior to the announced corporate restructuring by parent company, CapitaLand.

- Trading Dashboard: Take profit on HPH Trust (HPHT SP) and Rex International (REXI SP).

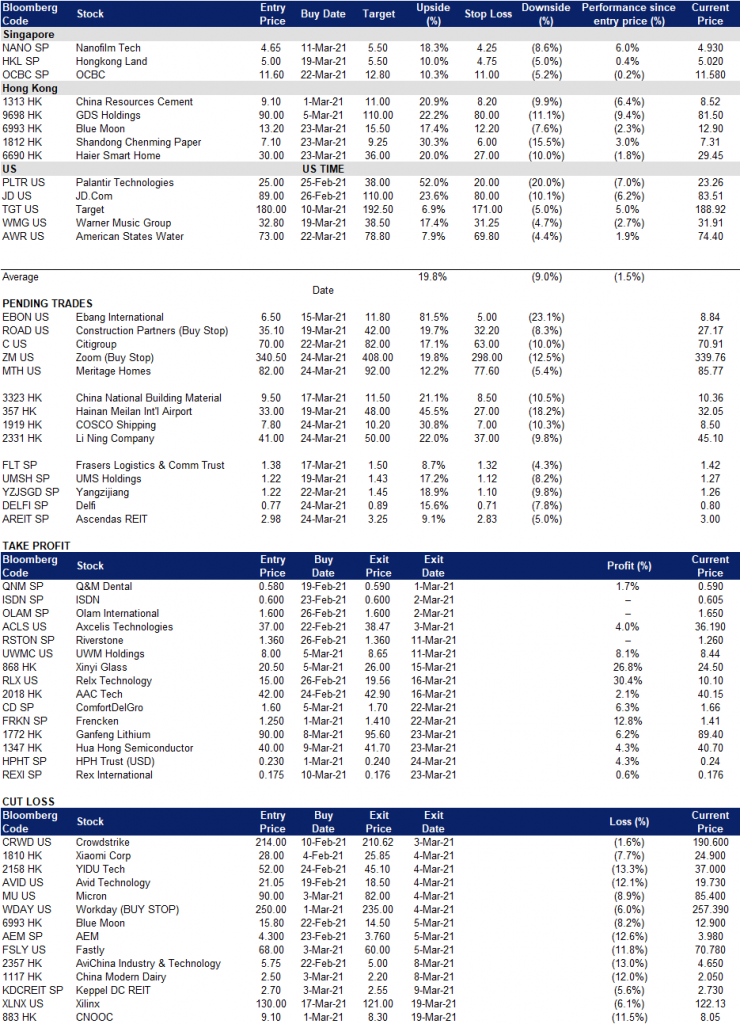

Trading Dashboard