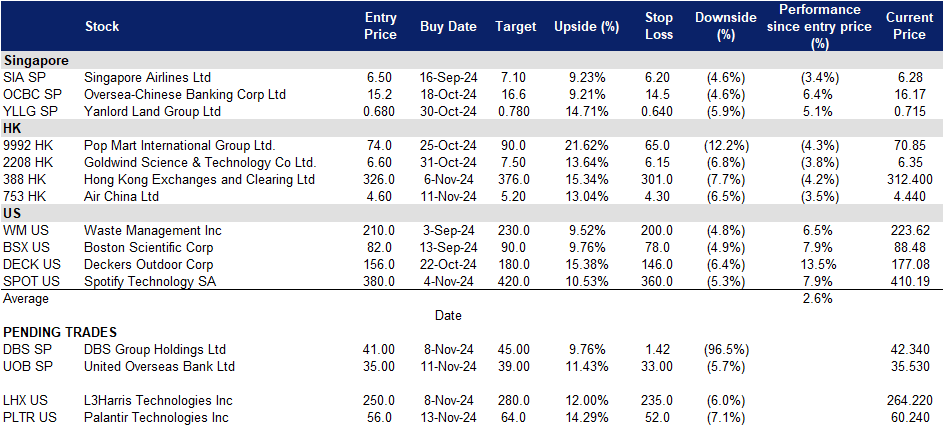

13 November 2024: United Overseas Bank Ltd (UOB SP), Air China Ltd. (753 HK), Palantir Technologies Inc (PLTR US)

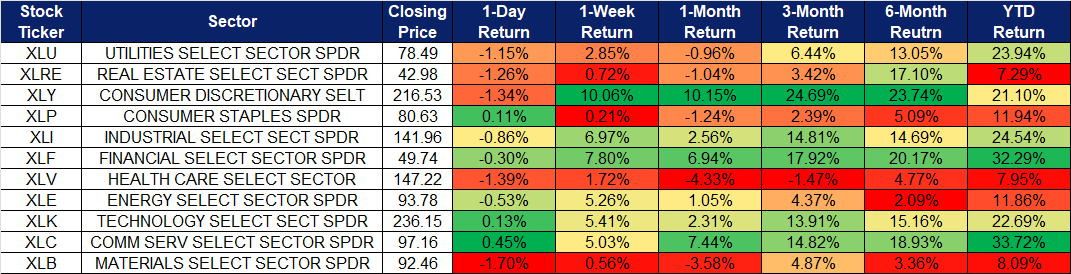

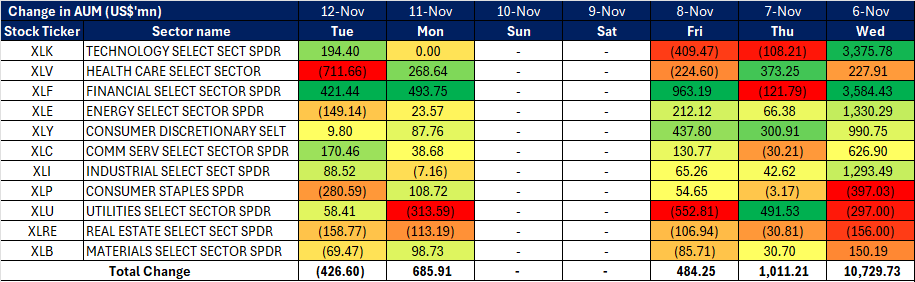

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

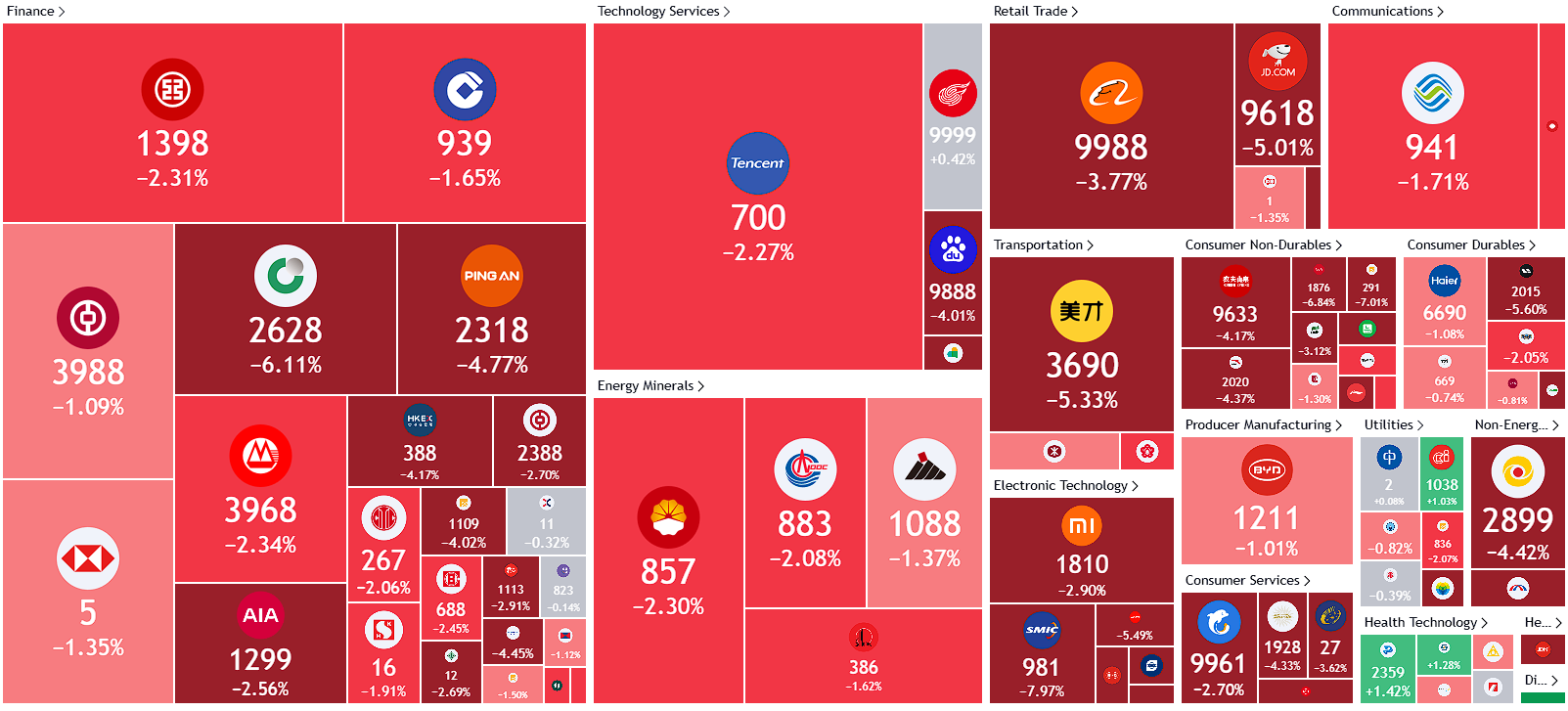

Hong Kong

United Overseas Bank Ltd (UOB SP): Continuation of Singapore’s Trump-themed trade

- RE-ITERATE BUY Entry – 35 Target– 39 Stop Loss – 33

- United Overseas Bank Limited provides a wide range of financial services including personal financial services, wealth management, private banking, commercial and corporate banking, transaction banking, investment banking, corporate finance, capital market activities, treasury services, futures broking, asset management, venture capital management and insurance.

- Record high price. In the third-quarter, UOB reported a 16% YoY increase in net profit, reaching S$1.61bn, beating the consensus forecast of S$1.51bn. The growth was attributed to record highs in net fee income and strong trading and investment income. Earnings per share rose to S$3.79, and total income increased by 11% to S$3.83bn. Core return on equity improved to 14.3%, excluding one-off acquisition expenses. Net interest income grew slightly by 1% to S$2.46bn, though the net interest margin decreased to 2.05%. Net fee income rose 7% to S$630mn, driven by wealth management and card fees. Trading and investment income surged 82% to S$709mn, contributing to a 70% increase in other non-interest income. Credit allowances increased by 29% to S$304mn, mainly due to integration issues with Citi’s Thai retail customers, which are expected to normalize soon. Asset quality remained stable with a non-performing loan ratio of 1.5%, and the cost-to-income ratio improved to 42.4%.

- Potential share buyback. UOB’s CFO noted that the company has excess capital of S$2 billion to S$2.5 billion and anticipates an uptick in loan growth for FY25. The bank is considering a potential share buyback to optimize capital management. For FY25, UOB expects high single-digit loan growth, double-digit fee growth, higher total income, a cost-to-income ratio between 41% and 42%, and credit costs within 25 to 30 basis points. This optimistic outlook is expected to drive further growth in its share price, bolstered by increased investor confidence.

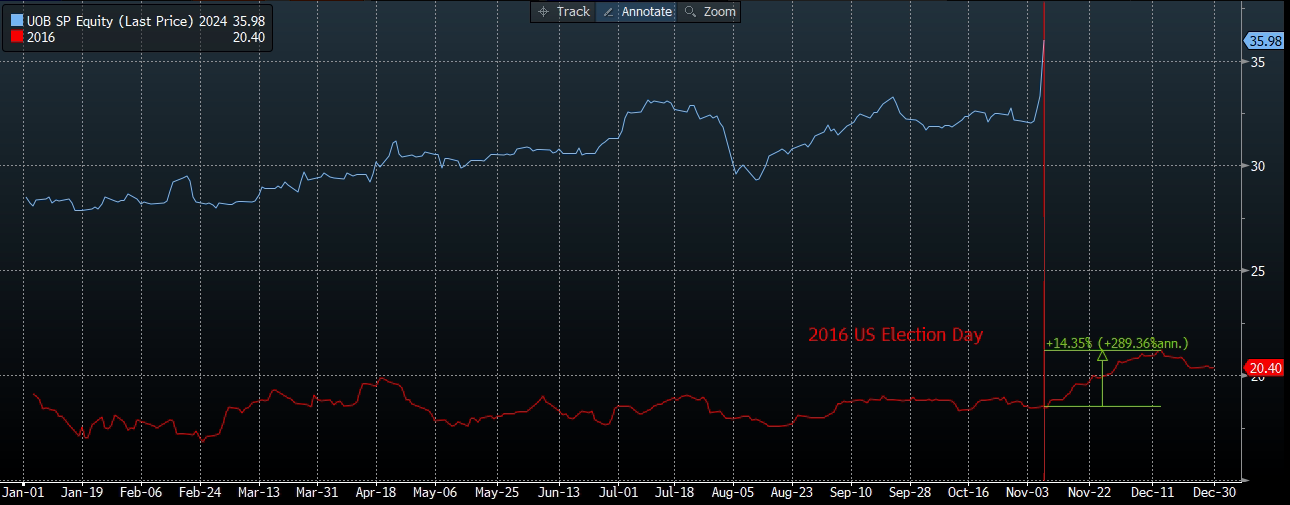

UOB price comparison (current vs Trump victory 2016)

(Source: Bloomberg)

- Benefitting from Trump’s victory. Singapore banks, such as UOB, are well-positioned to benefit from President-elect Donald Trump’s anticipated economic policies. His proposed measures, including tariff impositions and tax reductions, could lead to a larger fiscal deficit, potentially driving up inflation. In response, the Federal Reserve may adopt a tighter monetary stance, resulting in a higher interest rate environment. This scenario is advantageous for UOB, as elevated rates would enhance net interest margins (NIMs), allowing the bank to generate greater income from the difference between lending and deposit rates.

- 3Q24 results review. Total income for 3Q24 rose 11% to S$3.83bn and net profit rose 16% YoY to S$1.61bn from S$1.38bn the year before. Earnings per share was S$3.79 from S$3.23 in 3Q23.

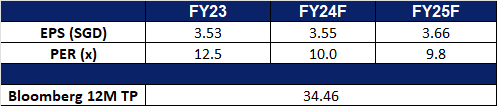

- Market Consensus.

(Source: Bloomberg)

DBS Group Holdings Ltd (DBS SP): Singapore’s Trump-themed trade

- RE-ITERATE BUY Entry – 41.0 Target– 45.0 Stop Loss – 39.0

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage. DBS Group also acts as the primary dealer in Singapore government securities.

- Record high quarterly profit. DBS reported a record quarterly net profit of S$3.03bn for 3Q24, driven by strong wealth management fees and trading income. The bank announced a S$3bn share buyback program, which will lead to an increase in its earnings per share and return on equity. Despite concerns about buying back shares at record highs, its CEO emphasized that the timing would be prudent and based on the bank’s fundamentals. DBS expects pre-tax profits for 2025 to remain around 2024 levels but sees potential upside if tighter monetary policies are maintained under Donald Trump’s administration. The incoming 15% global minimum corporate tax in Singapore is expected to impact net profit, while its non-interest income is projected to grow in high-single digits next year. Additionally, it announced a quarterly dividend of S$0.54 per share. We anticipate continued momentum in the current quarter from its wealth management and trading business segments to drive further growth in earnings and support the share buyback program.

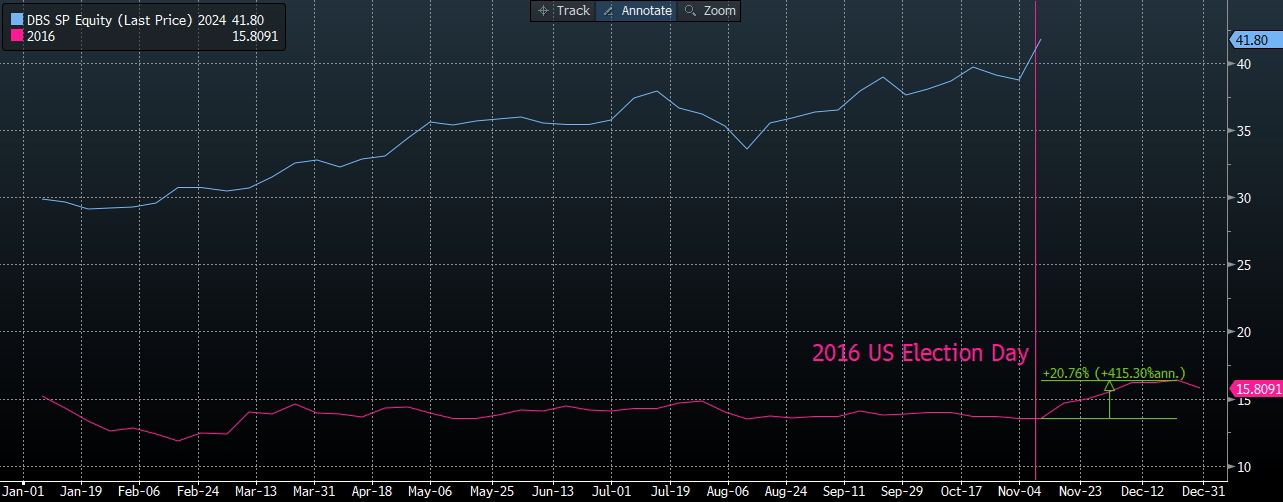

DBS price comparison (current vs Trump victory 2016)

(Source: Bloomberg)

- Benefitting from Trump’s victory. DBS anticipates potential benefits from President-elect Donald Trump’s return to office, as his inflationary policies, such as imposing tariffs and lowering tax rates, could lead to tighter monetary policy. This would help DBS by boosting its net interest margins (NIMs) and supporting the repricing of its fixed asset portfolio.

- 3Q24 results review. Total income for 3Q24 rose 11% to S$5.75bn and net profit rose 15% YoY to surpass S$3bn for the first time. DBS announced a new S$3bn share buyback programme and declared Q3 dividend at S$0.54 per share to be paid out on or about 25 November.

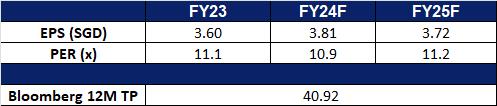

- Market Consensus.

(Source: Bloomberg)

Air China Ltd. (753 HK): More visa to support upcoming travel seasonality

- RE-ITERATE BUY Entry – 4.60 Target 5.20 Stop Loss – 4.30

- Air China Limited is a China-based company principally engaged in the provision of air passenger transportation, freight transportation, postal transportation and maintenance services in Mainland China, Hong Kong, Macau and foreign regions. The Company is also engaged in domestic and international business aviation businesses, plane business, aircraft maintenance, airlines business agents, ground and air express services related to main businesses, duty free on boards, retail business on boards and aviation accident insurance sales agents business.

- Visa-free policies extended to more countries. China recently announced an extension of its visa-free policy to include nine additional countries: Slovakia, Norway, Finland, Denmark, Iceland, Andorra, Monaco, Liechtenstein, and South Korea. This policy will take effect on November 8, 2024, and remain in place until December 31, 2025. The extension is expected to boost international tourism in China, particularly from South Korea, a key source of visitors. In 2019, prior to the pandemic, approximately 4.3mn South Koreans visited China, as reported by The Korea Times. However, South Korea’s Ministry of Foreign Affairs recorded fewer than 1.3mn South Korean visitors in 2023. These visa-free policies are designed to stimulate inbound tourism, which has yet to return to pre-pandemic levels, and the anticipated rise in international travelers is likely to benefit Air China.

- Upcoming winter activities and travel seasonality. Winter tourism in Harbin, the capital of Heilongjiang province in Northeast China, is gaining momentum. Since early October, searches and bookings for Harbin’s winter tourism offerings—such as skiing, ice fishing, snow hiking, and aurora and rime viewing—have seen a marked increase across various online travel, group-buying, and social media platforms, surpassing levels recorded during the same period last year, according to a recent report from Harbin Daily. Data from major online platform Meituan indicates a 72% rise in searches for winter activities in China. With the peak travel season approaching in November, travel demand is expected to surge as consumers plan year-end getaways, seek warmer destinations, or embrace the winter experience. Reflecting this demand, Chinese airlines have ramped up winter-spring flight schedules, with international flights projected to grow nearly 31% YoY in 2024, reaching new highs.

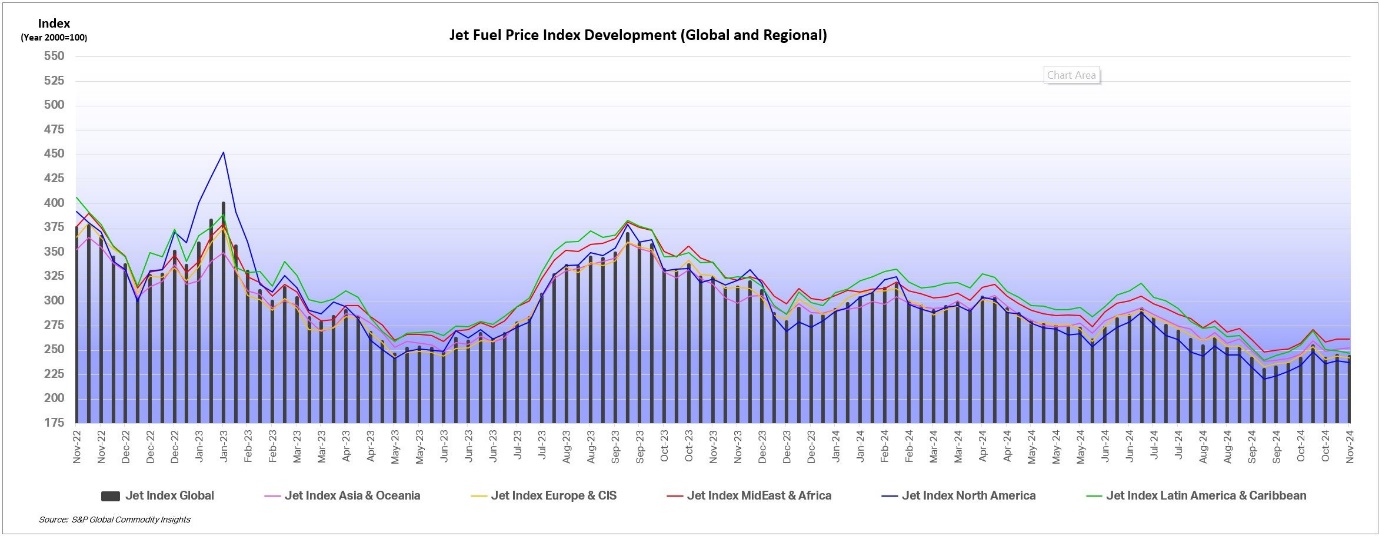

- Low Jet Fuel prices. Jet fuel prices remained low in November 2024, a positive development for airlines as it enables them to lower operating expenses. Jet fuel is a major cost factor for airlines, usually comprising 20-30% of their operating costs. Coupled with the upcoming peak winter travel season, airlines stand to benefit from reduced fuel costs, potentially enhancing their profit margins.

Jet Fuel Price

(Source: IATA)

- 3Q24 earnings. The company’s revenue rose to RMB48.6bn in 3Q24, +6.03% YoY, compared to RMB45.9bn in 3Q23. The company’s profit attributable to shareholders fell by 2.31% YoY to RMB4.14bn in 3Q24, compared to RMB4.24bn in 3Q23. Basic earnings per share rose to RMB0.26 in 3Q24, compared to RMB0.28 in 3Q23.

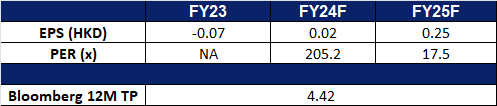

- Market consensus.

(Source: Bloomberg)

Pop Mart International Group Ltd. (9992 HK): Labubu Craze

- RE-ITERATE BUY Entry – 74.0 Target 90.0 Stop Loss – 65.0

- Pop Mart International Group Ltd is a China-based company mainly engaged in the provision of pop toy. intellectual property (IP) is at the core of its business. It has established an integrated platform covering the entire industry chain of pop toys, including artists development, IP operation, consumer access and pop toy culture promotion. The Company develops a broad array of pop toy products based on its IPs. Its Pop Mart brand products are primarily categorized into blind boxes, action figures, ball-jointed doll (BJDs) and accessories. The Company conducts its businesses within the China market and to overseas markets.

- In trendy series continue to rake in revenue. Pop Mart’s Labubu series recently went viral globally, thanks in part to a social media post by BLACKPINK’s Lisa. Combined with endorsements from several other celebrities, this surge in visibility has sparked overwhelming demand for Labubu toys, with products consistently selling out both in stores and online shortly after release. The Labubu series generated RMB 626.8 million in sales during the first half of 2024 and is on track to become Pop Mart’s top IP by revenue for the year. Other popular series, such as Molly and Skullpanda, have also performed exceptionally well, bringing in RMB 782.1 million and RMB 574.3 million in revenue, respectively, as of 1H24.

- Better than expected 3Q24 business updates. Pop Mart recently released its 3Q24 business update, projecting revenue to more than double YoY. The company expects overall revenue to grow by 120%-125% YoY. Revenue from operations in Mainland China increased by 55%-60% YoY, while revenue from Hong Kong, Macao, Taiwan, and overseas markets surged by 440%-445% YoY. This significant growth in overseas revenue highlights the success of Pop Mart’s expansion efforts and its strengthening market presence outside China. The company’s global growth strategy is clearly paying off, contributing substantially to its overall performance.

- Expanding presence locally and overseas. Pop Mart, the renowned high-end toy brand, has officially opened a store at Sun World Ba Na Hills in Da Nang, creating a highly artistic space. Situated in a prime location atop Ba Na Hills, the store features impressive interior architecture resembling a grand castle, inspired by the artistic and cultural charm of an old French village. This marks Pop Mart’s first store in a Southeast Asian theme park. Visitors can explore iconic characters like Molly, SkullPanda, Hirono, Dimoo, and The Monsters, making each visit a unique artistic experience. In addition, Pop Mart recently launched its first theme park in Beijing, transforming Chaoyang Park—the city’s largest park—into an immersive entertainment space filled with beloved characters like Molly, Labubu, and Dimoo. These expansions, coupled with the growing popularity of The Monsters and Molly series, are set to attract even more visitors and strengthen Pop Mart’s global presence.

- 1H24 earnings. The company’s revenue rose to RMB4.56bn in 1H24, +62.0% YoY, compared to RMB2.81bn in 1H23. The company’s net profit rose by 93.3% YoY to RMB964.1mn in 1H24, compared to RMB477.2mn in 1H23. Basic earnings per share rose to RMB69.49 in 1H24, compared to RMB35.46 in 1H23.

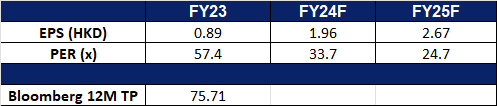

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): Growth in commercial revenue

- BUY Entry – 56 Target – 64 Stop Loss – 52

- Palantir Technologies Inc. develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Artificial intelligence application prospects are clear. The U.S. Department of Defense stands as the company’s largest public customer, leveraging its platform to deliver AI training to the U.S. Navy and Army. Given the sensitive and confidential nature of this data, the business has a strong competitive moat, ensuring stable and predictable growth in receivables. Additionally, the company’s commercial customer base is expanding rapidly. Its business model connects the AI platform with enterprise data to perform business analysis and provide tailored solutions. As customers become integrated, recurring revenue steadily increases. Overall, the company is in the early stages of significant growth.

- The performance of the last two quarters complies with the Rule of 40. The Rule of 40 is an indicator used to measure the comprehensive benefits of a Software as a Service (SaaS) company. This rule states that a combination of revenue growth rate and profit margin (EBITDA Margin) should equal or exceed 40% to indicate strong financial health. Palantir Technologies has exceeded this threshold in the last two quarters, demonstrating its robust fundamentals.

- 3Q24 results. Revenue increased by 30% YoY to US$725.5 million, exceeding expectations by US$21.83 million. GAAP earnings per share were US$0.1, beating expectations by US$0.01. Expected FY2024 revenue to be between US$767 million and US$771 million, lower than market expectations of US$774.05 million; raised U.S. commercial revenue forecast to at least US$687 million, with growth of at least 50%; revised adjusted operating income Guidance was raised to US$1.054 billion to US$1.058 billion; adjusted cash flow guidance was raised to more than US$1 billion; and it continues to expect positive GAAP operating income and net income in each quarter this year.

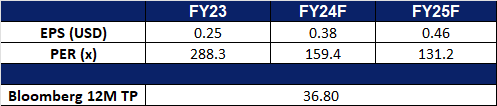

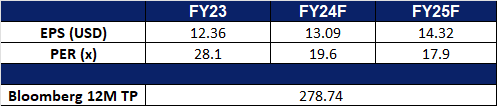

- Market consensus.

(Source: Bloomberg)

L3Harris Technologies Inc (LHX US): Defending the nation

- RE-ITERATE BUY Entry – 250 Target – 280 Stop Loss – 235

- L3Harris Technologies, Inc. is an aerospace and defense technology innovator. The Company designs, develops, and manufactures radio communications products and systems, including single channel ground and airborne radio systems. L3Harris Technologies provides advanced defense and commercial technologies across air, land, sea, space, and cyber domains.

- Sale of subsidiary. On November 4, L3Harris signed an agreement with BWX Technologies for the sale of its Aerojet Ordnance Tennessee, Inc. (A.O.T.) business for approximately US$100 million, with the transaction expected to close by year-end. This divestiture will streamline L3Harris’ operations, enabling greater focus and capital allocation toward its core business segments to drive revenue growth.

- Increased demand for defence products. Global demand for rocket motors has risen as militaries anticipate future conflicts requiring larger inventories of precision firepower. Acquired by L3Harris 15 months ago, Aerojet Rocketdyne is one of only two major solid-fuel rocket motor suppliers to the Pentagon and since its acquisition it has spurred substantial improvements in the rocket motor unit’s facilities and processes, addressing years of underinvestment and delayed deliveries. As countries such as the US seek to build a tactical missile inventory to deter potential threats, L3Harris’ business is well-positioned to capitalize on this growing demand.

- Strategic partnership with Palantir. L3Harris and Palantir have partnered to advance defence technology by combining Palantir’s Artificial Intelligence Platform (AIP) with L3Harris’ sensor and software systems. This collaboration supports US Army initiatives, including TITAN and the Unified Network Strategy, and facilitates L3Harris’ internal digital transformation. In a recent test, Palantir’s Sensor Inference Platform (SIP) integrated with L3Harris’ WESCAM MX-20 system, boosting target identification and situational awareness while reducing operator workload. This partnership enhances L3Harris’ capabilities with AI-driven solutions, strengthening its competitive position in defence and opening potential growth opportunities in the commercial sector.

- 3Q24 results. Revenue increased 7.7% YoY to US$5.3bn surpassing expectations by US$20mn. Non-GAAP earnings of US$3.34 per share, beat estimates by US$0.08.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take Profit on Paypal Holdings Inc. (PYPL US) at US$86.0 and DoorDash, Inc. (DASH) at US174. Cut loss on Meituan (3690 HK) at HK$185.0. Add Air China Ltd (753 HK) at HK$4.60.