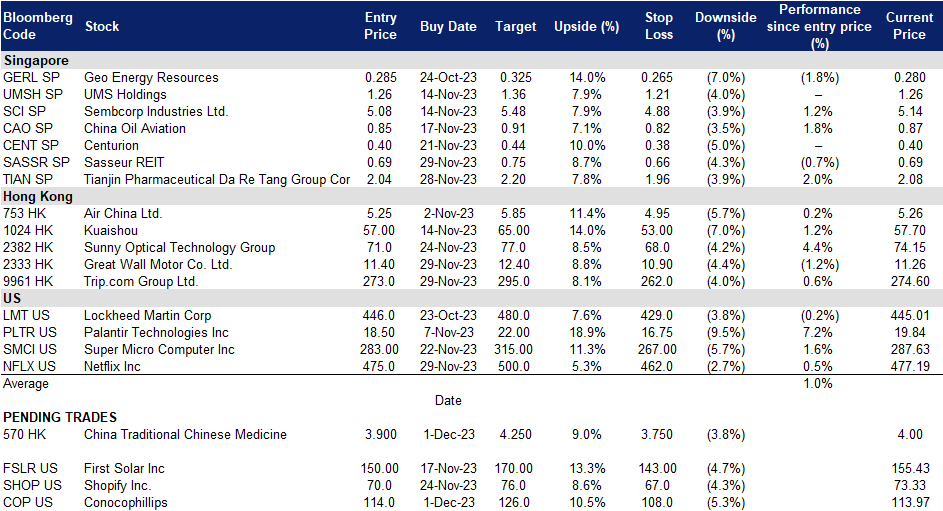

1 December 2023: Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP), China Traditional Chinese Medicine Holdings Co. Limited (570 HK), Conocophillips (COP US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

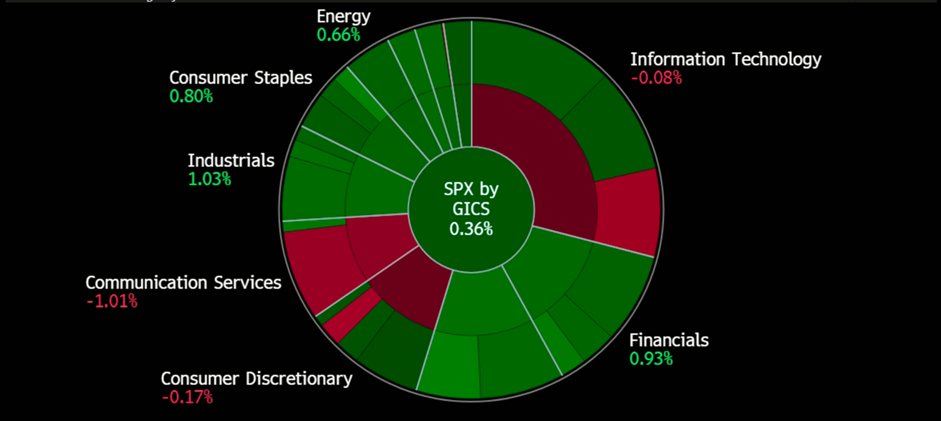

United States

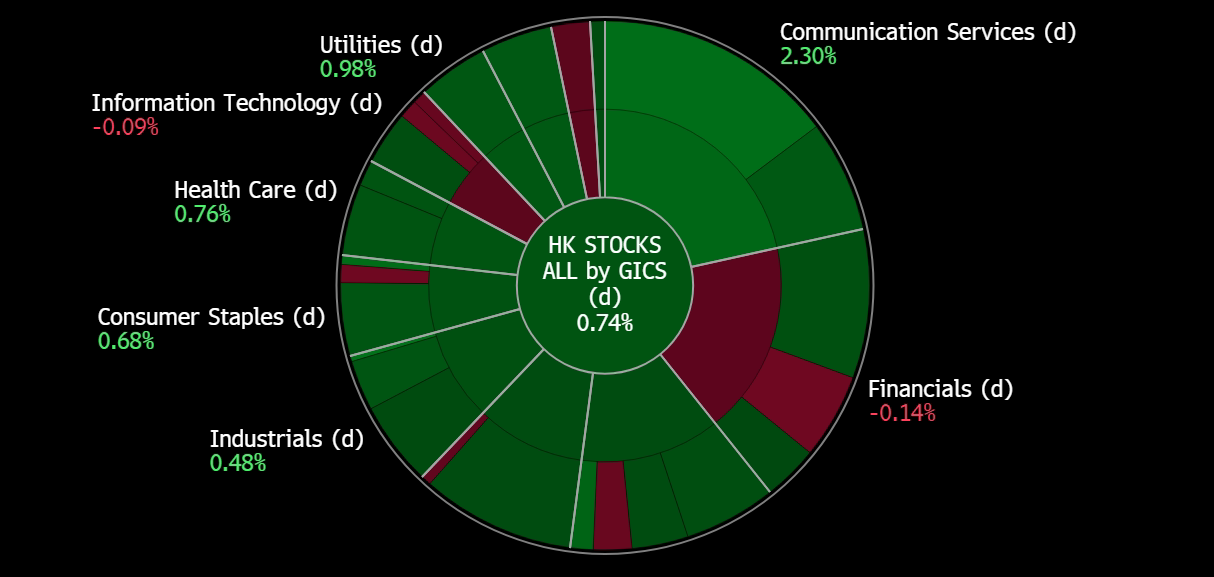

Hong Kong

News Feed |

4. Dalian Wanda wins consent from bondholders to restructure US$600 million bond, weaken debt covenants |

5. Public investors with $4.3 trln are down on China but in on net zero |

Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP): Respiratory illness strikes Northern China

- RE-ITERATE BUY Entry 2.04 – Target – 2.20 Stop Loss – 1.96

- Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited produces and sells traditional Chinese medicine, western medicine, health products, and healthcare instruments. The Company also manufactures gene-related biopharmaceutical products. Tianjin Pharmaceutical Da Ren Tang Group markets its products under the Great Wall, Cypress, and Health brand names.

- Respiratory symptoms spreading. China’s National Health Commission (NHC) responded to concerns about respiratory illness outbreaks, citing a surge in acute respiratory infections attributed to a combination of known pathogens, including influenza, rhinovirus, mycoplasma pneumoniae, and respiratory syncytial virus. Despite videos and social media showing crowded hospitals, the NHC assured the World Health Organisation (WHO) that no unusual or novel pathogens were detected, linking the rise to the easing of COVID-19 restrictions and the circulation of known pathogens. Influenza, respiratory syncytial virus, and adenovirus have been circulating since October. While China sees the surge as seasonal and linked to immunity debt, the WHO advises precautionary measures and stays in contact with Chinese authorities. The heightened concern may lead Chinese residents to stock up on medication and health supplements, benefiting companies like Tianjin Pharmaceutical, a producer of such health products.

- Resistance to antibiotics. Despite mycoplasma pneumonia showing resistance to a broad spectrum of antibiotics, it can be treated with other drugs like azithromycin, erythromycin, and clarithromycin. The State Council taskforce has ordered local governments to enhance preparedness for outbreaks of flu, COVID, and other infectious diseases, which may heighten the need for healthcare equipment and medications.

- 3Q23 business updates. Total revenue declined by 5% YoY to RMB$1,705mn. 9M23 revenue increased by 4% YoY to RMB$5,793mn. Issued cash dividend on 6 June 2023 amounting to RMB1.12 per ordinary share.

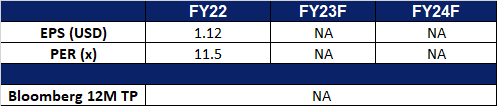

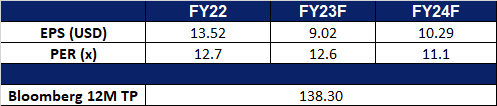

- Market Consensus.

(Source: Bloomberg)

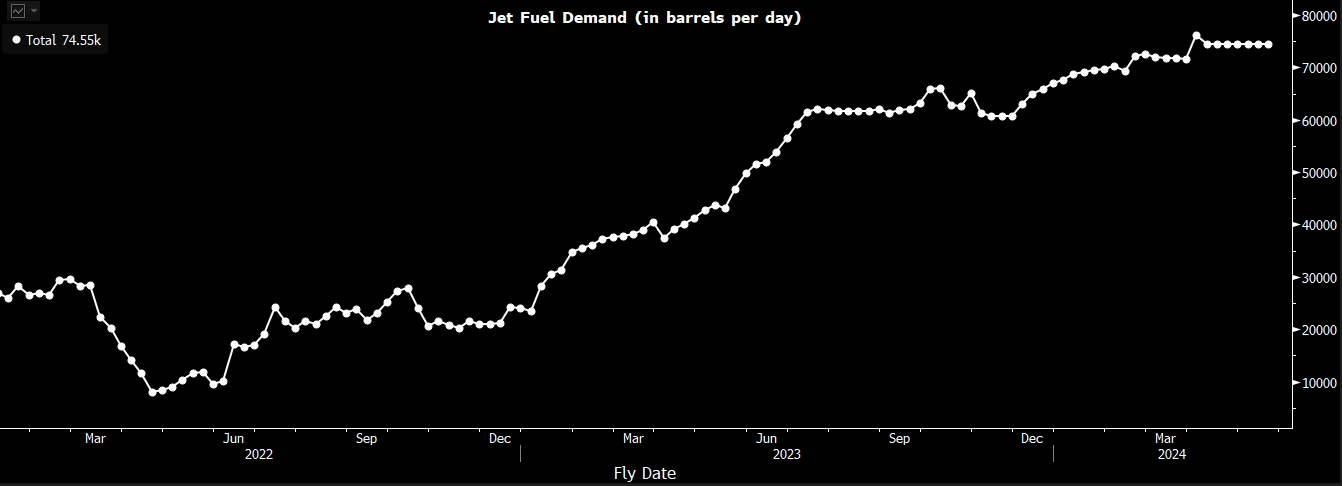

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Tailwinds from China-US summits

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Tailwinds from China-US summits

- RE-ITERATE BUY Entry 0.85 – Target – 0.91 Stop Loss – 0.82

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, and petrochemical products, including physical and paper swaps, and futures trading.

- Positives for air travel between China and the US. There were several achievements between China and the US after the two countries’ leaders met at the APEC forum. Among them, two items are favourable for the air transportation industry. Both countries agreed to further increase air travel in early 2024 and expand educational, student, youth, cultural, sports, and business exchanges. As the most open city in China, Shanghai shall see a further increase in direct flights to the US. Temporary moderation of China-US relations shall help recovery in foreign visits in Shanghai accordingly.

- Air traffic jumped in October. There were 41,559 takeoff and landing flights, an increase of 100.2% YoY in Shanghai Pudong Airport. The passenger traffic was 5.4 mn, an increase of 231.3% YoY. Freight turnover was 308,900 tonnes, an increase of 8.9% YoY.

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- 1H23 results review. 1H23 revenue plunged by 32.4% to US$6.3bn. Gross profit plunged by 50.6% YoY to US$10.6mn. Total supply and trading volume decreased by 16.1% YoY to 9.5mn tonnes. Net profit decreased by 1.07% YoY to US$19.4mn.

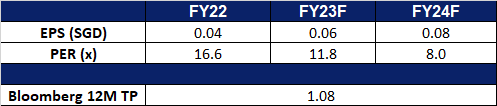

- Market consensus.

(Source: Bloomberg)

China Traditional Chinese Medicine Holdings Co. Limited (570 HK): Protection for winter flu

- BUY Entry – 3.90 Target – 4.25 Stop Loss – 3.75

- China Traditional Chinese Medicine Holdings Co. Limited is principally engaged in the manufacture and sales of traditional Chinese medicine (TCM). The Company operates through 12 subsidiaries, including Sinopharm Group Dezhong (Foshan) Pharmaceutical Co., Ltd., Sinopharm Group Feng Liao Xing (Foshan) Pharmaceutical Co., Ltd., Sinopharm Group Guangdong Medi-World Pharmaceutical Co., Ltd., Sinopharm Group Luya (Shandong) Pharmaceutical Co., Ltd., Sinopharm Group Feng Liao Xing (Foshan) Medicinal Material & Slices Co., Ltd., Foshan Winteam Pharmaceutical Sales Company Limited, Sinopharm Group Tongjitang (Guizhou) Pharmaceutical Co., Ltd., Sinopharm Group Jingfang (Anhui) Pharmaceutical Co., Ltd., Sinopharm Group Longlife (Guizhou) Pharmaceutical Co., Ltd., Qinghai Pulante Pharmaceutical Co., Ltd., Guizhou Zhongtai Biological Technology Company Limited and its subsidiaries and Jiangyin Tianjiang Pharmaceutical Co., Ltd. and its subsidiaries.

- China experiencing a respiratory illness outbreak. Seasonally, respiratory illness cases increase during winter season, especially in the norther part of China. However, a recent surge in flu and pneumonia cases in China raised concerns about whether COVID spread resumed. No new virus has been detected so far, and experts believe that the three-year lockdown policy protected most Chinese residents from COVID virus, and hence, a lack of antibodies contributes to people’s weakened immunity against COVID-like flu and pneumonia.

- Traditional Chinese medicines in demand. Thought traditional Chinese medicine is not the specialised drugs to treat flu or pneumonia, it is considered a supplementary treatment. Families are stocking up on traditional Chinese medicines and pills in case members have similar symptoms. The authorities have recently released the 2023 Winter Influenza Chinese Medicine Prevention and Treatment Plan for Beijing. Consequently, the demand for these medicines is likely to increase throughout the winter and early spring seasons.

- 1H23 results update. Revenue jumped by 57.4% YoY to RMB9.3bn. GPM was 51.1%, up 0.7ppts YoY. Net profit jumped by 40.0% YoY to RMB557.2mn. NPM was 6.2%, up 0.3 ppts.

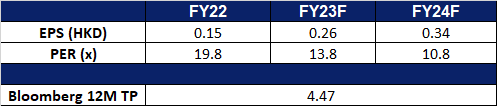

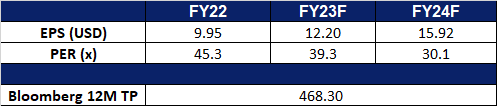

- Market consensus.

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): Favourable seasonality

- RE-ITERATE BUY Entry – 273 Target – 295 Stop Loss – 262

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travellers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Upcoming winter travel season. The upcoming winter and festive seasons are expected to provide a boost to travel demand. The winter holidays spanning early November through January are usually one of the busiest travelling periods. Consumers are likely to be clearing their work leaves, or finding time to escape the heat or cold in their countries. The upcoming winter holidays also mark the first winter season since China’s re-opening at the start of 2023. Trip.com would be able to ride on the rising demand for travelling over this peak period. Furthermore, a more relaxed visa-free transit policy is bound to encourage travel agencies from home and abroad to help more foreign visitors come to China. China’s 72-hour and 144-hour visa-free transit policies have been extended to visitors from 54 countries, with Norway being the latest addition.

- An increasing amount of flights showcasing strong travel demand. Several airlines globally have already announced plans to increase the number of flights globally across the incoming winter travel season. Chinese airlines have also seen a rise in scheduled flights for winter-spring, scheduling 96,651 domestic cargo and passenger flights each week for the upcoming winter-spring season, an increase of 33.95% from the same period in 2019-2020, according to the Civil Aviation Administration of China (CAAC). 516 new domestic routes will also be opened from Oct 29 to March 30 next year, providing 7,202 flights each week, according to the CAAC. In terms of international flights, 150 domestic and foreign airlines plan to arrange 16,680 flights per week, reaching 68 foreign countries. The US Department of Transportation announced that flights between China and the US will increase to 70 a week starting on 9 November, from the current 48 a week. The average flights between the two counties averaged 340 a week in the pre-COVID period.

- Promoting inbound tourism to China. Trip.com has signed a three-year agreement with the China International Culture Association (CICA) to boost inbound tourism through the Nihao! China campaign, which focuses on cultural exchange and fostering connections between China and international visitors. This year’s Hello! China event drew 892 representatives from 70 countries and regions around the world. To support China’s inbound tourism goals, the group will provide carefully chosen content highlighting specific products and services and will work with Chinese cultural centers, tourist boards, and other organizations.

- 3Q23 results. Net Revenue improved to RMB 13.7bn, up 99% YoY, compared to RMB 6.9bn in 3Q22. Net profit rose to RMB 4.6bn in 3Q23, compared to RMB 245mn in 3Q22. Diluted EPS was RMB 6.84 in 3Q23, compared to RMB0.41 in 3Q22.

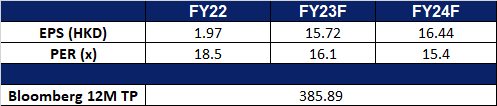

- Market Consensus.

(Source: Bloomberg)

Conocophillips (COP US): OPEC+ production cut expectations

- BUY Entry – 114 Target – 126 Stop Loss – 108

- ConocoPhillips explores for, produces, transports, and markets crude oil, natural gas, natural gas liquids, liquefied natural gas, and bitumen on a worldwide basis.

- OPEC+ meeting. OPEC+ is in discussions regarding a potential additional oil supply cut for the first quarter of 2024 to bolster the market, with the exact details yet to be finalised. The group, responsible for over 40% of global oil supply, is already implementing cuts of about 5mn barrels per day (bpd). Sources suggest the proposed cut could be as much as 1mn bpd, though uncertainties remain, and the meeting may retain the existing policy. The talks, initially delayed due to a dispute over output quotas for African producers, will proceed on Thursday. Brent crude oil is currently around $83 per barrel. With the possible output cut, oil prices will once again rise due to the reduction of supply in the market.

Brent price chart

(Source: Bloomberg)

- US oil production rose. US crude oil, gasoline, and distillate inventories increased as refiners raised output despite subdued fuel demand, according to the Energy Information Administration (EIA). Crude inventories rose by 1.6mn barrels, with East Coast stockpiles reaching their highest since January 2021. Refinery crude runs increased, and refinery utilisation rates rose to 89.8% of total capacity. The return of refinery capacity after maintenance, coupled with weak demand during the Thanksgiving holiday, contributed to the supply situation. Despite the inventory builds, Brent and West Texas Intermediate crude futures gained, showing that the increase in crude inventory did not affect the prices much and the focus remains on the OPEC+ meeting outcome.

- 3Q23 results. Production rose 3% YoY, to 1.81mn boe/day. Non-GAAP EPS beat estimates by US$0.07 at US$2.16. Expect Q4 revenue of US$8.69bn vs US$8.54bn consensus. Net income fell from US$4.5bn in 3Q22 to US$2.8bn in 3Q23. Forecast its 4Q23 production to be between 1.86mn to 1.9mn boe/day and raised its Fy23 forecast to be about 1.82mn boe/day. FY23 adjusted operating costs was also raised to US$8.6bn from the prior US$8.3bn.

- Market consensus.

(Source: Bloomberg)

Netflix Inc (NFLX US): Subscribers and profitability boost

- RE-ITERATE BUY Entry – 475 Target – 500 Stop Loss – 462

- Netflix, Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

- Increase in subscribers. Netflix exceeded expectations in its third-quarter results, reporting a substantial boost in subscriber growth with the addition of 8.76mn global subscribers. This surge was attributed to efforts to crack down on password-sharing and the introduction of a new ad-supported tier. The company’s earnings and revenue surpassed estimates. The total membership rose to 247.15mn, exceeding the expected 243.88mn. Notably, the ad plan membership experienced a nearly 70% QoQ growth. Netflix continues to dominate the streaming industry.

- Raising prices for profitability. In response to increased production costs and the pursuit of improved profitability, Netflix announced a price hike for its basic and premium plans in the US. The basic plan will now cost US$11.99 (up from US$9.99), while the premium plan will be US$22.99 a month (up from US$19.99). Despite this, Netflix is maintaining its ad tier pricing at US$6.99 a month. This strategic move in pricing aligns with the company’s commitment to maintaining its dominance in the streaming world. Additionally, Netflix provided a forecast for an 11% jump in revenue in the fourth quarter, reaching US$8.69bn, with expectations of net subscriber adds similar to the third quarter. Furthermore, the company also addressed shareholder concerns about executive compensation, promising substantial changes to a more conventional model in 2024 while retaining a performance-based structure.

- 3Q23 results. Revenue rose to US$8.54bn, up 7.7% YoY, in line with expectations. GAAP EPS beat estimates by US$0.23 at US$3.73. Expect Q4 revenue of US$8.69bn vs US$8.54bn consensus. Revised its full-year operating margin upwards to 20%. FY24 operating margin to be between 22% and 23%.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP) at S$2.04, Great Wall Motor Co. Ltd. (2333 HK) at HK$11.4, Trip.com Group Ltd (9961 HK) at HK$273 and Netflix Inc (NFLX US) at US$475. Cut loss on Samsonite International S.A. (1910 HK) at 23.