KGI Daily Market Movers – 25 February 2021

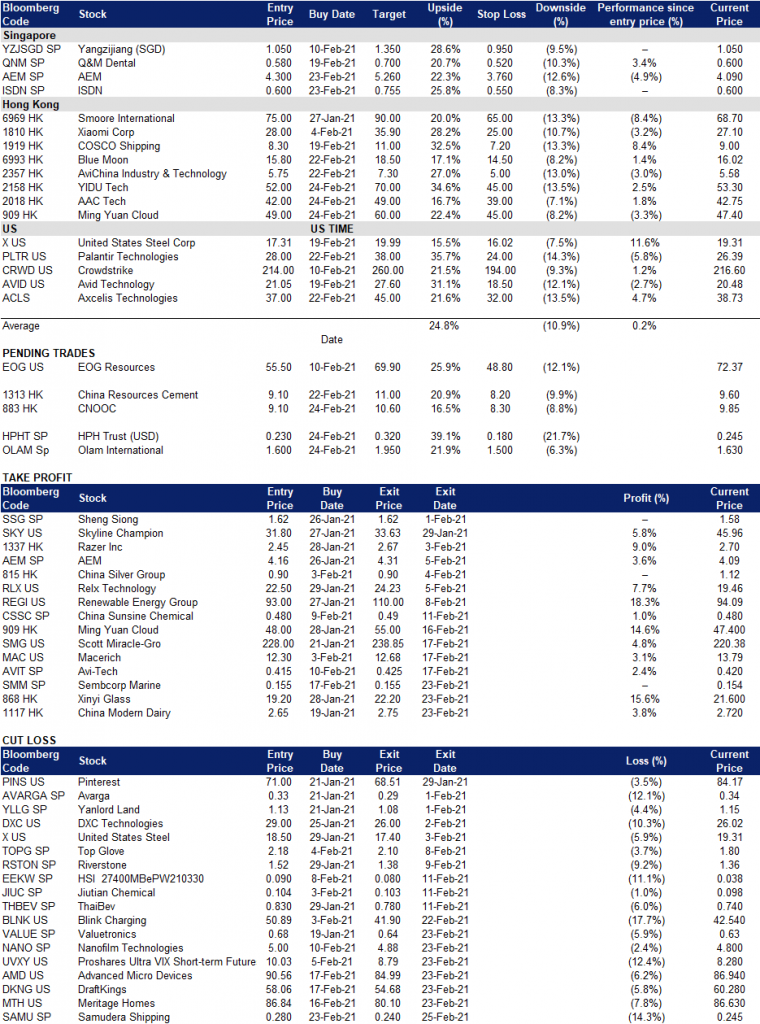

Commodity Movers – Oil Futures

WTI crude prices climbed above US$63 per barrel (Brent above US$67) supported by the slower-than-expected return of US crude production and a weaker dollar. Street consensus is calling for oil prices to continue rallying into the summer amid an increasingly tighter market. Bank of America forecasts Brent could hit US$70 in 2Q21 while Goldman Sachs expects Brent to trade at US$75 by 3Q21.

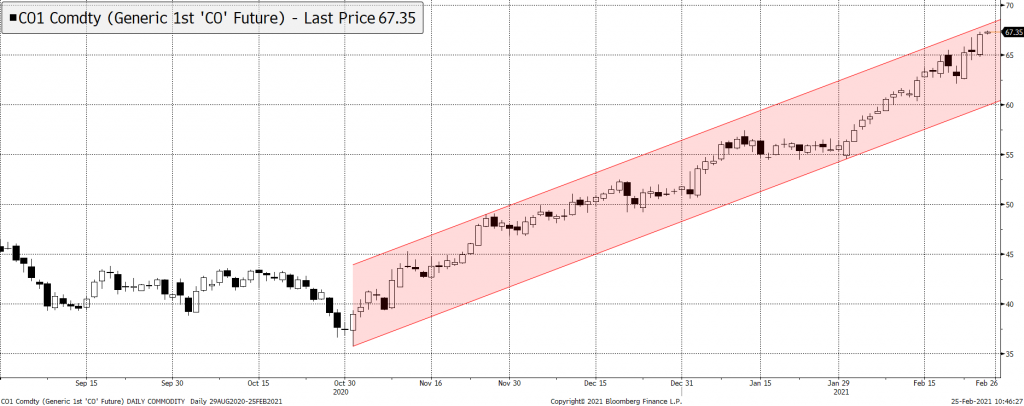

Commodity Movers – Iron Ore Futures

Steel rebar futures climbed to the highest in a decade as Tangshan city, one of the top steelmaking regions, was ordered to curb production after a heavy air pollution alert was issued by the authorities. This will likely cause upward pressure on steel prices.

Meanwhile, volumes for both Australia and Brazil iron ore exports to China continue to decline due to sufficient port inventories at the moment. In the near term, we expect iron ore futures to trade within the current levels.

Market Movers – What’s Hot

United States

- GameStop (GME US) +103.9% to US$91.71 amid an executive reshuffling. Shares further rose another 100% in after hours trading. Bloomberg reported that Gamestop’s board pushed out chief financial officer Jim Bell in order to execute its turnaround more quickly. Other hot stocks with Reddit traders also surged, including AMC (AMC US, +18% to US$9.09), KOSS (KOSS US, +55% to US$18.44) and Express Inc (EXPR US, +41% to US$3.25).

- AMC (AMC US) +18.1% to US$9.1, riding on GME’s surge and on positive news that New York cinemas will reopen on 5 March 2021. According to media reports, cinemas will reopen at only 25% capacity with no more than 50 people per screen.

- Occidental Petroleum Corp (OXY US) +8.1% to US$28.16 as WTI crude prices climbed above US$63 per barrel (Brent above US$67) supported by the slower-than-expected return of US crude production and a weaker dollar. Street consensus is calling for oil prices to continue rallying into the summer amid an increasingly tight market. Bank of America forecasts Brent could hit US$70 in 2Q21 while Goldman Sachs expects US$75 by 3Q21.

- United States Steel Corporation (X US) + 6.5% to US$19.31. Iron ore price surged above US$170/tonne, a level not seen since 2011, as investors increased their bets that the accelerating global economic recovery would boost steel demand.

- Earnings watch: Salesforce (25 Feb), Airbnb (25 Feb), Workday (25 Feb), Dell (25 Feb), DraftKings (26 Feb)

Hong Kong

- Jiangxi Copper Co Ltd (358 HK) -12.79%, closing at HK$19.84. Zijin Mining Group Company Limited (2899 HK) -9.84%, closing at HK$12.46. Though copper price remained at 9-year highs, both shares were sold off due to panic selling as the overall market sentiment turned bearish.

- Ming Yuan Cloud Group Holdings Limited (909 HK) -9.6%, closing at HK$47.1.

- Kingdee International Software Group Company Limited (268 HK) -8.93%, closing at HK$30.1. The whole SaaS sector slumped due to the overall bearish market sentiment in Hong Kong.

- Hong Kong Exchanges and Clearing Limited (388 HK) -8.78%, closing at HK$509. Hong Kong unveiled its first stamp-duty increase on stock trades since 1993. The plan calls for a trading-tax (stamp duty) hike to 0.13% from 0.10%.

- Kuaishou Technology (1024 HK) -8.6%, closing at HK$327.2. The tech sector was sold off due to the cooling measure caused by the stamp duty hike, given that the sector most actively traded in Hong Kong.

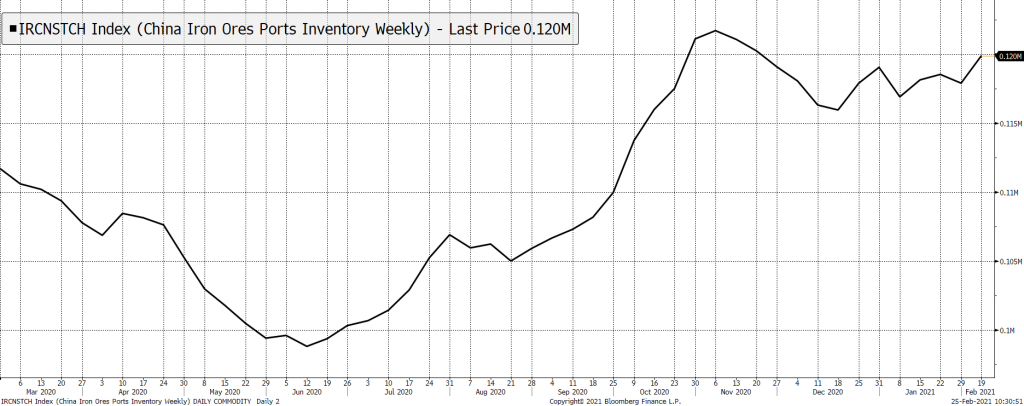

- Trading Dashboard: Added Blue Moon (6993 HK) at HK$15.8 and AviChina Industry & Technology (2357 HK) at HK$5.75, replacing China Modern Dairy (1117 HK) and Xinyi Glass (868 HK).

Singapore

- Thomson Medical (TMG SP) +2.8% to S$0.112 in early morning trade today as it continues to be a favourite momentum play among traders, riding on the positive sentiment in the local healthcare sector. TMG’s share price has gained 124% over the past month and now has a market cap of nearly S$3 bn. There has also been an increase in trading activity of TMG’s warrants (W220424) which have an exercise price of S$0.11.

- UOB (UOB SP) +2.1% to S$24.37 in early morning trade today as the US-10 year Treasury yield rose above 1.40%, the first time since February 2020. Long-term Treasury rates have been on an upward climb in anticipation of inflationary pressures, driven by the reopening of the global economy and pent-up up spending by consumers, as well as further fiscal stimulus in the US. The steepening of the yield curve should benefit the banks.

- SIA (SIA SP) +4.1% to S$4.88 and SATS (SATS SP) +2.8% to S$4.47 in trading this morning as travel-related stocks continue to be in play following positive re-opening news in Macao, the US and Singapore. On Tuesday, Macao Special Administrative Region lifted travel restrictions on all visitors from the mainland. Meanwhile, Singapore and Hong Kong are in close discussions on the air travel bubble which was suspended last November.

- Jiutian Chemical (JIUC SP) +2.1% to S$0.098 this morning after it plunged 10% yesterday (24 Feb) following 4Q20 earnings miss. The company reported a profit of RMB 86.2mn (S$17.6mn) for 4Q20 compared to a net loss of RMB 237.6mn in the prior year period. Despite the record-high earnings for the full-year 2020, JIUC did not declare a dividend as it remained loss-making at the firm level.

- Trading Dashboard: Remove Samudera (SAMU SP) at S$0.24

Trading Dashboard