KGI Daily Market Movers – 23 February 2021

Cryptocurrency – Bitcoin Futures

Bitcoin (XBTUSD/BTC): US$50,000 is the new US$30,000

- BTC experienced a mini flash crash in overnight trading, dropping to almost US$48,000 after almost touching a high of around US$58,000 in the futures market.

- We think BTC prices have formed a new range of between US$50,000 and US$60,00 in the short term, after trading in the range of US$30,000 to US$40,000 in January 2021.

- BTC’s market capitalisation has dropped to just slightly below US$1 trillion. In comparison, Ethereum now has a market capitalisation of US$202 billion.

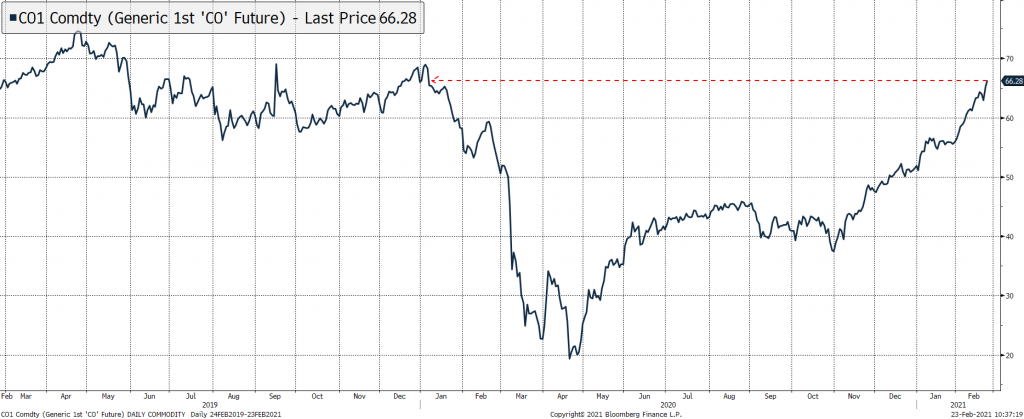

Commodity Movers – Oil Futures

Oil prices surged more than 4% on Monday, as Texas may need several weeks to resume normal operations after last week’s freezing weather. The Texas freeze has removed as much as 4mn barrels of production per day in the US, according to IHS Markit.

Brent shot up to US$65.59 and WTI is at US$61.91 in early morning trade today. Analysts are calling for further upside, with Goldman Sachs the latest to offer its view that oil prices will continue to climb into the US$70s over the next few months.

Market Movers – What’s Hot

United States

- First Majestic Silver Corp (AG US) +12.2% to US$19.64. Silver price has managed to climb back above US$28/oz since the silver short squeeze started in late January and early February.

- United States Steel Corporation (X US) + 5.42% to US$18.87. Iron ore price surged above US$170/tonne as investors bet a global economic recovery would boost steel demand.

- Walt Disney (DIS US) +4.4% to US$191.80, closing at a new all-time high. DIS was the best performing stock in the Dow Jones Industrial index as the jump in interest rates caused a rotation away from high-valuation growth stocks.

- Tesla (TSLA US) -8.6% to US$714.50, and a decline of 21% from its 52-week high of US$900.40 reached last month. TSLA’s stock has now dropped through its 50-day moving average, a key support level. The decline in TSLA’s share price pulled down the entire EV sector, including Chinese EV makers like LI (-6.7% to US$27.84), NIO (-7.9% to US$50.68) and XPEV (-7.0% to US$38.00).

- Trading Dashboard: Added Palantir (PLTR SP) at US$28.0.

- Earnings watch: Square (23 Feb), Home Depot (23 Feb), NVIDIA (24 Feb), Salesforce (25 Feb), Airbnb (25 Feb)

Hong Kong

- Jiangxi Copper Co Ltd (358 HK) +15.32%, closing at HK$21.75. The big jump was due mainly to the record high of international copper price (LME copper topped more than US$9,000/MT. CitiGroup forecasts copper prices to reach US$11,000/MT in 3Q21 and US$12,000/MT in 3Q22.

- Aluminum Corporation of China Limited (2600 HK) +15.13%, closing at HK$3.88. Non-ferrous metal sector continues to be strong on rising inflation expectations. LME aluminium reached a three-year high of US$2,166/MT.

- China Evergrande New Energy Vehicle Group Ltd (708 HK) -10.94%, closing at HK$61.45. Auto sector was sold off due to profit-taking movements. The stock has gained 104.8% YTD.

- Fuyao Glass Industry Group Co Ltd (3606 HK) -11.9%, closing at HK$51.1. Dragged by the sell-off in the auto sector, the share is trading lower as the correction from the high of HK$68.9 continues. The stock gained has 19.7% YTD.

- HengTen Networks Group Ltd (136 HK) -12.43%, closing at HK$12.12. The hype due to phenomenal tick sales of “Hi, Mom” during the lunar holiday is over. The stock has gained 357.4% YTD.

- Trading Dashboard: Added Blue Moon (6993 HK) at HK$15.8 and AviChina Industry & Technology (2357 HK) at HK$5.75, replacing China Modern Dairy (1117 HK) and Xinyi Glass (868 HK).

Singapore

- Sri Trang Agro (STA SP) +9.0% to S$2.06 as it reported an earnings beat last week and a higher-than-expected dividend of 1.75 baht per share, equivalent to 7.658 Sing cents. Net profit in 4Q FY2020 surged to 5.5 billion baht, from just 74mn baht in the prior-year period.

- Thomson Medical (TMG SP) +8.9% to S$0.11 as it continues to be a favourite momentum play among traders, riding on the positive sentiment in the local healthcare sector. The stock is among Singapore’s best performing stock year-to-date, having gained 125% over the last two weeks and now sports a market cap of S$2.9 bn. TMG’s warrants (W220424) with an exercise price of S$0.11 surged 180% on higher-than-average trading volumes.

- Raffles Medical Group (RFMD SP) +3.6% to S$1.02 after it reported that FY2020 net profit rose by 9% YoY to S$66mn, helped by various Covid-related projects. The group will now shift its focus from Covid testing to vaccine rollout, and expects operations across its network to return to normal this year.

- Avarga (AVARGA SP) +1.5% to S$0.335 as lumber prices rose above US$1,000 for the first time, bringing year-to-date gains to around 40%. Prices of lumber have climbed due to strong demand in the US amid a boom in home remodelling and construction. Avarga’s Canadian-listed subsidiary, Taiga Building Products (TBL CN), is a prime beneficiary of strong demand for building materials.

- Trading Dashboard: Added ISDN (ISDN SP) at S$0.60 and AEM (AEM SP) at S$4.30, replacing Nanofilm (NANO SP) and Sembcorp Marine (SMM SP).

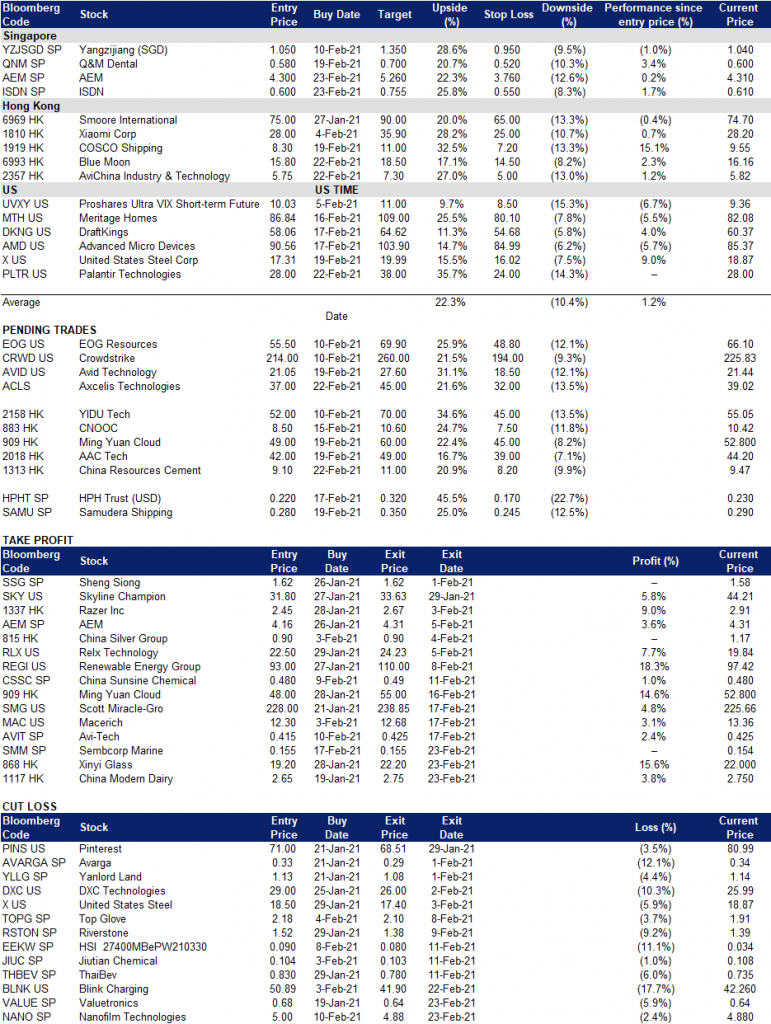

Trading Dashboard