COMEX Gold futures

Trade COMEX Gold futures contracts for a globally relevant, liquid financial instrument to help hedge against inflation.

A safe haven in times of financial uncertainty, CME Group’s suite of gold products includes full (100 oz.), E-mini (50 oz.), E-micro (10 oz.), and kilo size contracts to provide market users with flexibility, transparency, and choice in tailoring risk management programs.

Market Update: 3 March 2021

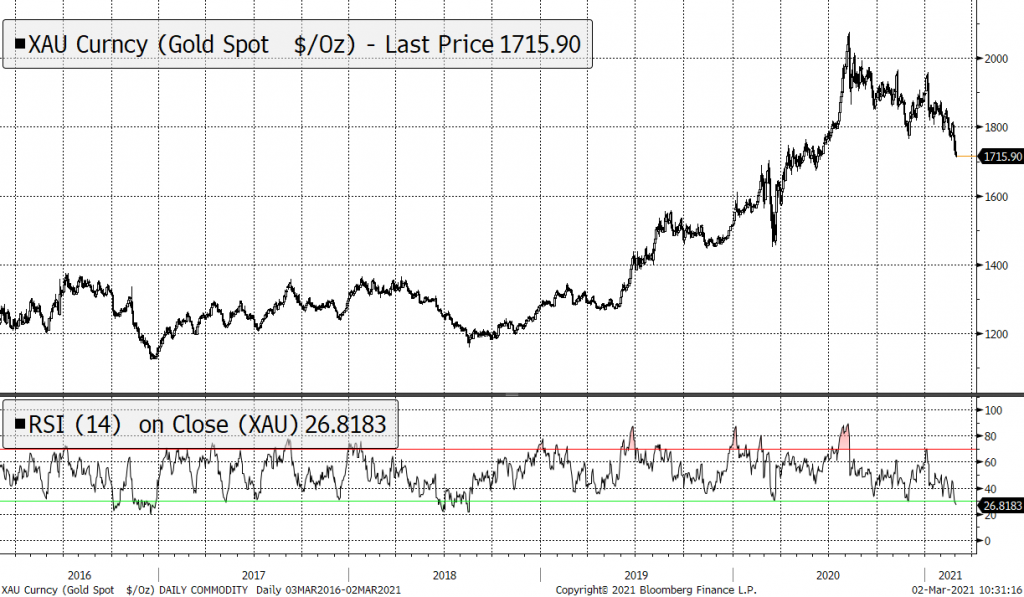

Gold prices have fallen for a sixth straight session on Tuesday, dropping to an eight-month low of US$1,715. It ended last week lower by 2.7%, following a drop of 2.5% in the prior week, and finishing February down by 6.6%. That would make last month the worst month since November 2016.

The technical picture has not been positive, with gold making lower highs and lower lows since hitting a high of US$2,063 in early August 2020. However, price momentum and relative strength indicators have declined from overbought conditions to oversold readings at the end of February 2021.

Why COMEX Gold Futures

- A central point of price discovery, price transparency, risk management, mitigation of counterparty credit risk, and CFTC oversight

- Price managed separately from physical supply

- Contracts are listed for 60-months forward, enabling the establishment of a forward price curve.

- Electronic futures trading available on CME Globex, facilitating risk management opportunities for market participants around the globe.

Source: CME Group