28 November 2024: Wealth Product Ideas

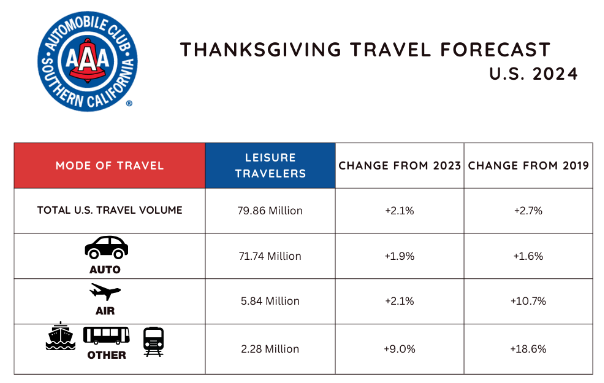

- The start of winter travel season. Global air travel demand is expected to surge during the upcoming winter holiday season, particularly as the festive period approaches. In the United States, the Thanksgiving travel window—traditionally the busiest time of the year for airlines—will span from November 26 to December 2. During this period, the Transportation Security Administration (TSA) anticipates screening over 18mn passengers, marking a 6% YoY increase. Additionally, data from the American Automobile Association (AAA) shows international travel bookings haven risen by 23% compared to last year. Booking platforms such as Expedia, Airbnb and Booking issued upbeat forecasts for the current holiday quarter, driven by stronger-than-expected demand. This growing demand is poised to benefit airlines and travel-related companies significantly.

- Heightened passenger travel indicating strong travel demand. Airlines are preparing for a significant increase in passenger travel as the holiday season begins. Major airline company United Airlines anticipates its busiest holiday travel season ever, spanning Thanksgiving, Christmas, and New Year, with an estimated 25mn passengers expected to fly. Similarly, American Airlines projects an additional 500,000 passengers during the Thanksgiving holiday period alone, bringing its total to 8.3mn passengers across 77,000 flights during that timeframe. This high expectation indicates a potentially strong season for airlines and travel-related companies.

- Expectations of better profit margins by airlines. The U.S. Bureau of Labor Statistics reports that airfares have risen by approximately 4.1% year-over-year. Despite higher prices, travel demand remains robust, with booking platforms reporting strong activity during the winter travel season. Additionally, jet fuel prices are lower compared to the same period last year, a factor that is likely to boost airline profitability.

Source: Automobile Club of Southern California

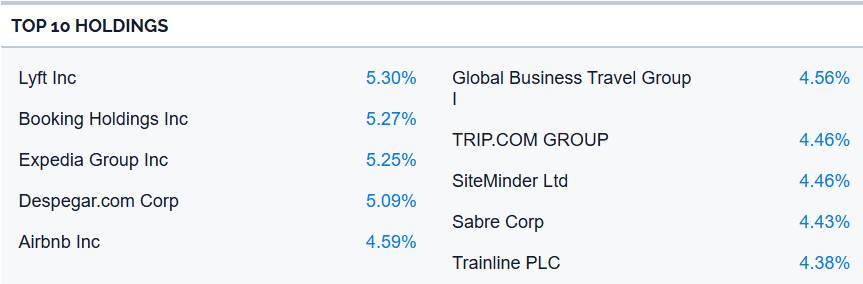

Fund Name (Ticker) | Amplify Travel Tech ETF (AWAY US) |

Description | AWAY seeks investment results that generally correlate (before fees and expenses) to the total return performance of the Prime Travel Technology Index NTR. AWAY tracks a portfolio of companies in the “Travel Technology Business” that use internet technology to enable travel-related services such as bookings, ride sharing, price comparison, and travel advice. |

Asset Class | Equity |

30-Day Average Volume (as of 26 Nov) | 11,622 |

Net Assets of Fund (as of 26 Nov) | $64,799,355 |

12-Month Yield (as of 26 Nov) | 0.28% |

P/E Ratio (as of 26 Nov) | 68.47 |

P/B Ratio (as of 26 Nov) | 5.462 |

Expense Ratio (Annual) | 0.75% |

Top Holdings

(as of 27 November 2024)

(Source: Bloomberg)

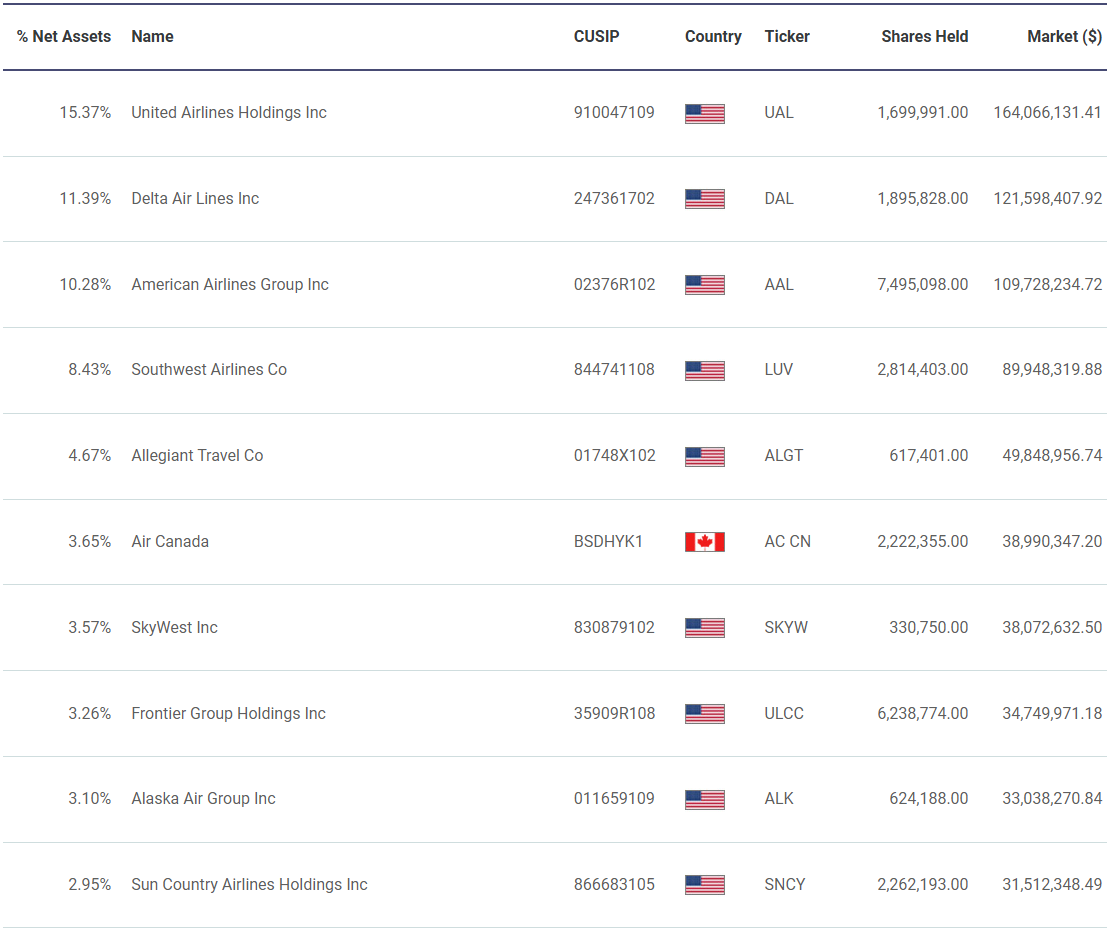

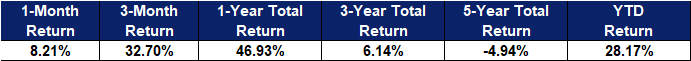

Fund Name (Ticker) | U.S. Global Jets ETF (JETS US) |

Description | The U.S. Global Jets ETF (JETS) provides investors access to the global airline industry, including airline operators and manufacturers from all over the world. |

Asset Class | Equity |

30-Day Average Volume (as of 26 Nov) | 2,840,032 |

Net Assets of Fund (as of 25 Nov) | $1,079,551,241 |

12-Month Yield | NA |

P/E Ratio (as of 26 Nov) | 19.721 |

P/B Ratio (as of 26 Nov) | 2.818 |

Expense Ratio (Annual) | 0.60% |

Top 10 Holdings

(as of 26 November 2024)

(Source: Bloomberg)