15 May 2025: Investment Product Ideas

iShares 0-3 Month U.S. Treasury Bond ETF (SGOV US)

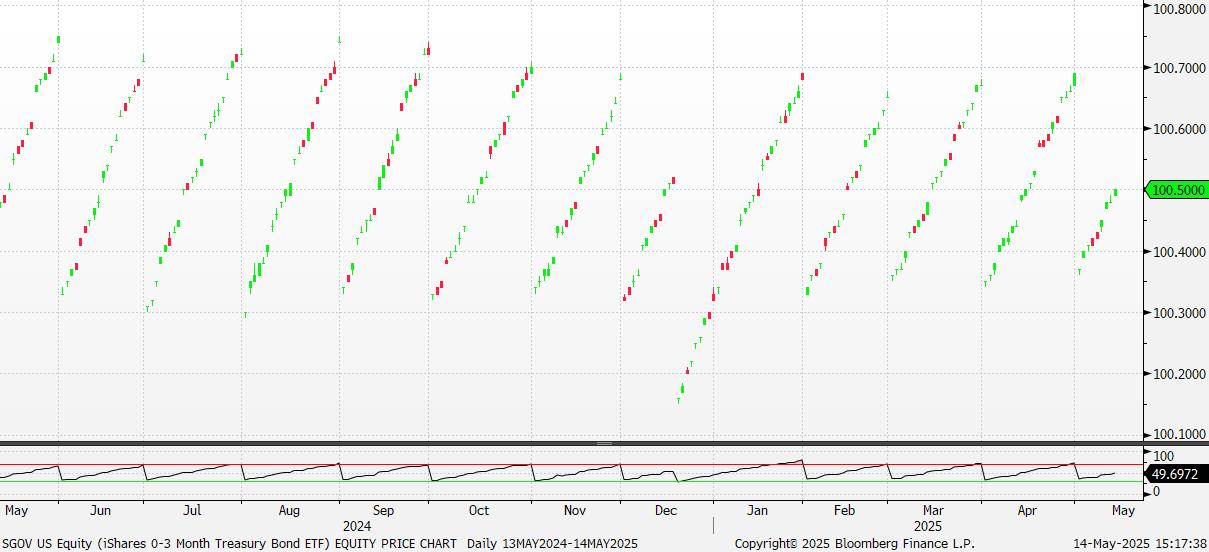

- Buffer Against Market Volatility. The index measures the performance of U.S. Treasury bills with remaining maturities of three months or less. With extremely low sensitivity to interest rate movements, the ETF exhibits very low volatility.

- Low Duration. The ETF has an effective duration of just 0.11 years, helping to mitigate interest rate risk. It serves as a defensive allocation tool during market turbulence, suitable for investors seeking exposure to U.S. Treasury securities or a temporary parking place for short-term capital.

- Low Expense Ratio. This ETF has an expense ratio of 0.09% which is considered low relative to peers. Its cost efficiency helps investors reduce overall investment expenses.

Fund Name (Ticker) | iShares 0-3 Month U.S. Treasury Bond ETF (SGOV US) |

Description | The iShares 0-3 Month Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities less than or equal to three months. This ETF tracks the ICE 0-3 Month US Treasury Securities Index (aiming to replicate the performance of the index constituents and deliver returns in-line with the benchmark. |

Asset Class | Fixed Income. |

30-Day Average Volume (as of 12 May) | 12,196,157 |

Net Assets of Fund (as of 13 May) | $46,497,998,623 |

12-Month Yield (as of 12 May) | 4.70% |

Average Yield to Maturity (as of 12 May) | 4.31% |

Effective Duration (as of 12 May) | 0.12years |

Expense Ratio (Annual) | 0.09% |

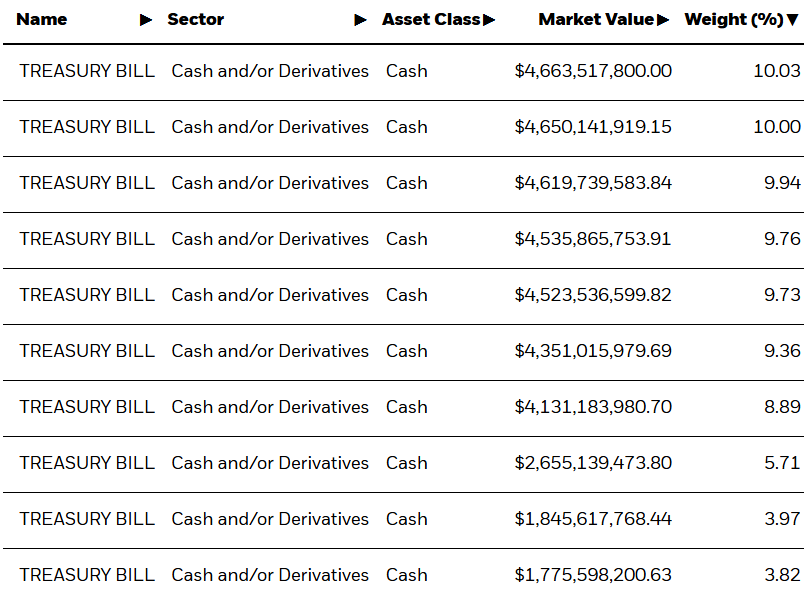

Top Holdings

(as of 12 May 2025)

(Source: Bloomberg)

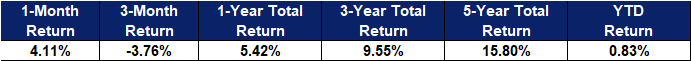

Vanguard Value ETF (VTV US)

- Value-Oriented Investment Approach. The index comprises primarily leading U.S. value stocks, which are selected based on factors such as dividend yield and financial stability. This ETF is well-suited for investors seeking to benefit from the long-term growth potential of large-cap U S value equities.

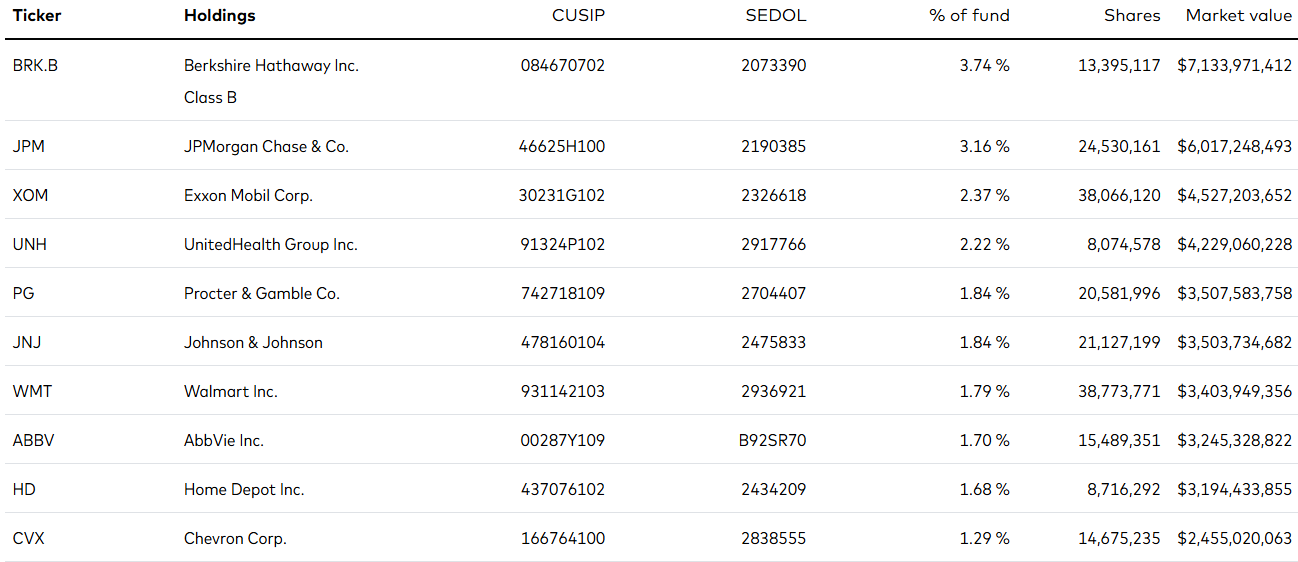

- Diversified Investment. This ETF holds approximately 331 stocks, offering broad diversification. The top 10 holdings account for about 21.71% of the portfolio, with the largest holding: Berkshire Hathaway, representing approximately 3.76%, indicating limited exposure to any single stock.

- Low Expense Ratio. The ETF has an expense ratio of 0.04%, which is considered low within its category. Its cost-efficiency helps investors reduce overall investment costs

Fund Name (Ticker) | Vanguard Value ETF (VTV US) |

Description | The Vanguard Value ETF seeks to track the performance of the CRSP US Large Cap Value Index, which measures the investment return of large-capitalization value stocks. The ETF provides a convenient way to match the performance of many of the nation’s largest value stocks, and follows a passively managed, full-replication approach. |

Asset Class | Equity |

30-Day Average Volume (as of 5 May) | 3,725,247 |

Net Assets of Fund (as of 6 May) | $170.72bn |

12-Month Yield (as of 13 May) | 2.30% |

P/E Ratio (as of 13 May) | 20.195x |

P/B Ratio (as of 13 May) | 2.941x |

Expense Ratio (Annual) | 0.04% |

Top Holdings

(as of 31 March 2025)

(Source: Bloomberg)