31 January 2025 : Singapore Telecommunications Ltd. (ST SP), NuScale Power Corp (SMR US)

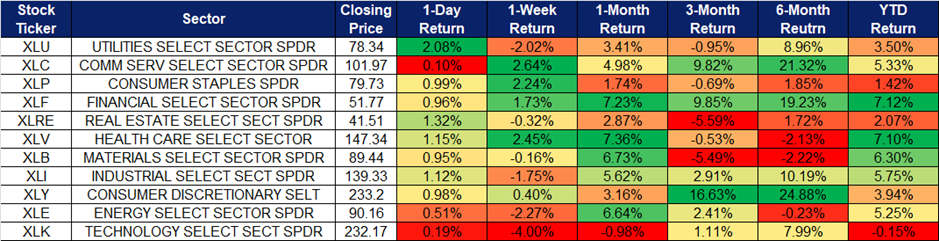

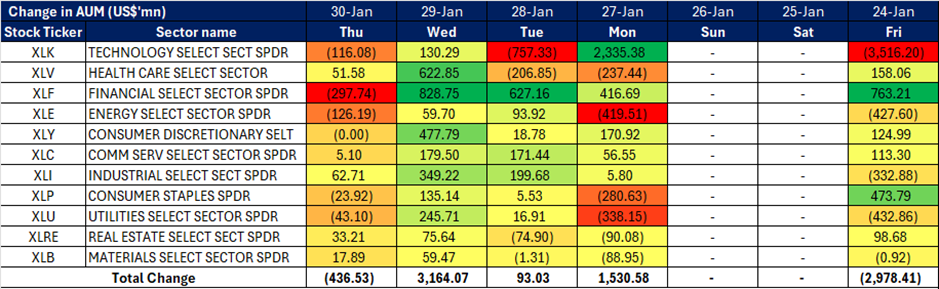

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

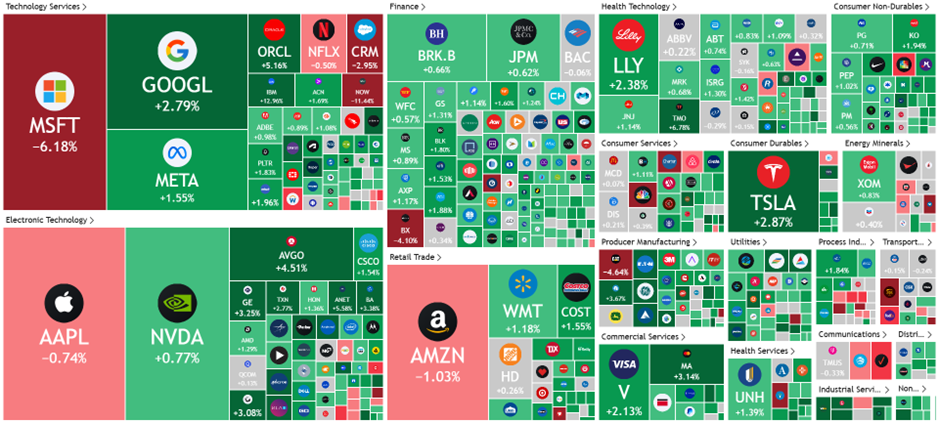

United States

Singapore Telecommunications Ltd. (ST SP): Further integration of AI

- BUY Entry – 3.24 Target– 3.50 Stop Loss – 3.11

- Singapore Telecommunications Limited wireless telecommunication services. The Company offers diverse range of services including fixed, mobile, data, internet, TV, and digital solutions. Singapore Telecommunications serves customers worldwide.

- Expanding AI Integration. Singtel has introduced free access to Perplexity Pro as part of a strategic initiative to democratize AI tools and enhance customer engagement. The year-long subscription, typically valued at SGD 270, is available to all Singtel broadband, mobile, and TV subscribers. This move positions Singtel as a gateway for mainstream AI adoption, particularly targeting users curious about generative AI but hesitant to integrate it into their daily lives. While early adopters may already use ChatGPT or Claude, many remain reluctant to try standalone AI applications. By bundling Perplexity Pro, Singtel eliminates barriers and provides a risk-free opportunity for users to explore AI’s potential. This partnership underscores Singtel’s focus on leveraging AI as a unique value proposition to deepen customer loyalty and enhance its service offering.

- Strengthening Local Connections Through Marketing. Singtel has released a new film celebrating the evolution of technology and its role in enriching lives, highlighting the power of its 10Gbps broadband service. Titled The Corridor, the 90-second film takes viewers on a nostalgic journey from the era of dial-up modems and pagers to today’s ultra-fast broadband. It showcases how Singtel has consistently bridged distances and strengthened bonds among families and communities. Featuring relatable personalities, the film emphasizes how technology empowers everyone—from small business owners to vulnerable groups—while aligning with Singtel’s festive Chinese New Year campaign. The campaign also promotes special deals on its 10Gbps plans, Singapore’s fastest home broadband service, reinforcing Singtel’s position as a trusted technology partner in everyday life.

- Partnership with DSTA and HTX. Singtel has announced a collaboration with Singapore’s Defence Science and Technology Agency (DSTA) and the Home Team Science and Technology Agency (HTX) to implement 5G network slicing technology, aimed at enhancing the nation’s defence and security capabilities. This customised solution leverages Singtel’s 5G network to deliver high-speed connectivity, low latency, and dedicated bandwidth, enabling the deployment of autonomous vehicles, robotics, and artificial intelligence (AI). It also supports the secure and efficient analysis of large data volumes, empowering first responders to make faster, more informed decisions and respond swiftly. This partnership builds on the successful trial conducted in July 2024 on Sentosa Island, where 5G was used for video-intensive transmissions and the autonomous control of unmanned vehicles and drones.

- 1H24 results review. Revenue fell by 0.5% YoY to S$6.99bn in 1H25, compared with S$7.03bn in 1H24. Net profit fell by 42.4% to S$1.23bn in 1H25, compared to S$2.14bn in 1H24, due to an exceptional gain from the issuance of Telkomsel shares to integrate IndiHome in the corresponding period last year. EBIT excluding associates contribution rose by 27.3% to S$738mn in 1H25, compared to S$580mn in 1H24, mainly driven by Optus and NCS.

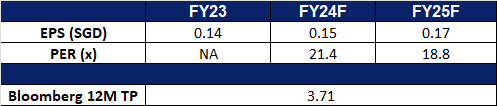

- Market Consensus.

(Source: Bloomberg)

Wee Hur Holdings Ltd (WHUR SP): Strategic repositioning

- RE-ITERATE BUY Entry – 0.47 Target– 0.53 Stop Loss – 0.44

- Wee Hur Holdings Ltd provides building construction services and acts as the management or main contractor in construction projects for both private and public sectors. The Company’s clients from the private sector include property owners and developers, and those from the public sector comprise government bodies and statutory boards.

- Increased construction demand in Singapore. Wee Hur Holdings showcased robust performance in the first half of 2024, underpinned by its strong dormitory segment and increased contributions from investments in associates and joint ventures. A key strength lies in its Tuas View Dormitory, which saw higher revenue as rising construction demand in Singapore drove the need for worker accommodation. As a BCA-registered A1-grade contractor, Wee Hur is well-positioned to tender for public projects of unlimited value, spanning residential, commercial, industrial, and conservation projects, further solidifying its expertise in the construction sector. The recent sale of its Australian PBSA portfolio has provided the company with additional capital flexibility, enabling it to focus on core segments like construction and dormitories. With Singapore’s construction demand projected to reach S$47bn to S$53bn in 2025, fuelled by major projects such as Changi Airport Terminal 5 and public housing developments, Wee Hur is poised to capitalize on these opportunities. Its diversified capabilities, including expertise in new constructions, refurbishments, and heritage restoration, further enhance its versatility and competitive edge in the market. These strengths position Wee Hur to thrive amid Singapore’s growing infrastructure and construction needs.

- Capitalising on sale of assets. Wee Hur Holdings sold its Australian student accommodation assets for A$1.6bn to Greystar, generating S$320mn in cash and retaining a 13% stake worth A$200mn in the new venture. The portfolio, comprising over 5,500 beds, has benefited from high occupancy rates and rising rental income. Wee Hur intends to allocate the proceeds toward expanding its construction and engineering business and exploring alternative investment opportunities. The sale also enabled the company to clear associated debt, strengthening its financial position. Additionally, Wee Hur continues to advance other key projects, including the development of new worker dormitories and student accommodations. Looking ahead, investors are optimistic about the potential for special dividends once the company receives the net proceeds from the transaction, further enhancing shareholder value.

- 1H24 results review. Total revenue for 1H24 increased by 10% YoY to S$109.12mn from S$99.21mn driven by higher contributions from Tuas View Dormitory, the Group’s first Purpose-Built Dormitory in Singapore, which operated at nearly full occupancy throughout 1H24. Gross profit for 1H24 surged to S$44.73mn, an increase of 144% YoY from S$18.30mn in 1H23. Profit from continuing operations for 1H24 was S$75.07mn, an increase of 488% from S$12.77mn the year before, this was mainly attributable to improved performance at Tuas View Dormitory and higher profits from investments in associates and joint ventures.

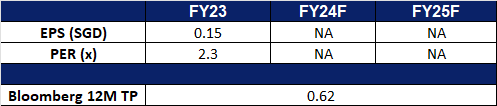

- Market Consensus.

(Source: Bloomberg)

NuScale Power Corp (SMR US): Meeting energy demands

- BUY Entry – 21 Target – 25 Stop Loss – 19

- NuScale Power Corporation operates as a small modular reactor (SMR) technology company. The Company provides scalable advanced nuclear technology for the production of electricity, heat, and clean water. NuScale Power serves customers worldwide.

- Surging electricity demand. The International Energy Agency (IEA) expects a significant rise in electricity demand driven by advancements such as electric vehicles, data centers, and artificial intelligence (AI). To meet this demand it necessitates a shift toward low-emission energy sources, with nuclear power taking center stage. NuScale Power Corporation is well-positioned to meet this growing need. Its VOYGR™ SMR power plants, with modular configurations generating up to 924 MWe, provide scalable solutions for diverse energy requirements. Factory-based construction of these reactors enables faster deployment and reduced costs compared to traditional large-scale reactors, aligning with the IEA’s call for cost-effective nuclear expansion. NuScale’s global presence is expanding, evidenced by its agreement to build a VOYGR-12 SMR in Ghana. This project highlights the growing demand for innovative nuclear technology to support both rising energy needs and decarbonization efforts worldwide. With governments and industries seeking reliable, sustainable energy sources, NuScale’s cutting-edge SMR systems are poised to play a pivotal role in reshaping the energy landscape.

- AI-infrastructure plans. The global demand for energy is surging, driven by advancements in artificial intelligence (AI) and other power-intensive technologies. Massive investments, such as the US$500 billion Stargate AI initiative supported by OpenAI, SoftBank, Oracle, and President Trump, highlight the immense power needed to sustain AI-driven data centers and applications across industries like healthcare, transportation, and finance. These data centers rank among the most energy-intensive infrastructures globally, with consumption expected to rise significantly as AI continues to proliferate. Traditional energy sources alone are insufficient to support this unprecedented growth, sparking renewed interest in nuclear energy as a reliable, low-emission alternative. South Carolina’s decision to revive its massive nuclear project further underscores the growing recognition of nuclear power as essential for meeting rising energy demands fuelled by AI and other emerging technologies. Beyond AI, sectors such as electric vehicles, cryptocurrency mining, and cloud computing also contribute to the escalating energy requirements, making NuScale Power Corporation’s solutions increasingly relevant. As industries and governments seek dependable power sources to fuel technological advancements and achieve sustainability goals, NuScale’s SMR systems emerge as a vital component in addressing the energy challenges of the future.

- 3Q24 results. NuScale Power Corporation’s revenue declined by 93.1% YoY to US$0.5mn in 3Q24 from US$7.0mn in 3Q23, below estimates by US$10.2mn. It delivered GAAP EPS of -US$0.18, below estimates by US$0.03. The company delivered a net loss of US$45.5mn in Q3 compared to a net loss of US$58.3mn in the prior year.

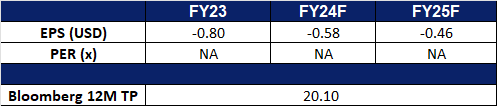

- Market consensus

(Source: Bloomberg)

Ciena Corporation (CIEN US): Dominating the optical networking space

- BUY Entry – 80 Target – 90 Stop Loss – 75

- Ciena Corporation develops and markets communications network platforms, software, and offers professional services. The Company’s broadband access, data and optical networking platforms, software tools, and global network services support worldwide telecom and cable/MSO services providers, and enterprise, and government networks.

- Cloud and AI driven traffic. The company’s fourth-quarter earnings exceeded Wall Street expectations, with robust revenue and strong order flow highlighting the growing demand for cloud and AI-driven bandwidth across networks. As AI remains a central focus in the coming year, Ciena Corp. is well-positioned to capitalize on this trend, driving accelerated revenue growth and market share expansion. As a leading provider of networking systems and software services, Ciena stands to benefit significantly from the anticipated surge in AI-related traffic. Its expertise in optical networking, enabling high-speed data transmission over long distances, will be a key differentiator in modern telecommunications, where speed and reliability are critical. Additionally, Ciena’s advanced 1.6 Tb/s and 800G coherent Coherent-Lite pluggable solutions are designed to help cloud and data center providers manage the exponential growth in cloud, machine learning, and AI traffic. With major projects like the Stargate AI data center and other large-scale data center initiatives underway, Ciena is poised to see increased demand for its optical networking equipment and inventory management solutions, streamlining operations for its customers. Supported by substantial investments from cloud customers and telecom operators, Ciena’s growth prospects remain strong, solidifying its position as a key player in the AI and cloud infrastructure landscape.

- Secured new term loan. Ciena Corporation refinanced its existing senior secured term loan with a US$1.16bn loan maturing in October 2030. Proceeds from the new loan, along with cash, were used to fully repay the previous loan. The loan features quarterly amortization payments, a SOFR-based interest rate, and early repayment options. This refinancing aims to optimize Ciena’s capital structure and enhance financial flexibility while maintaining consistent terms with the prior agreement.

- Connectivity milestone achieved. Southern Cross Cable Limited has achieved a significant milestone by implementing the world’s first 1 Tb/s single-carrier wavelength across its 13,500 km transpacific network, utilizing Ciena’s cutting-edge WaveLogic 6 Extreme (WL6e) coherent optics. This groundbreaking achievement underscores the exceptional performance and scalability of Ciena’s technology in meeting the surging demands of today’s digital world. By leveraging WL6e, Southern Cross enhances its network capacity and efficiency, enabling it to deliver high-bandwidth services critical for AI, cloud computing, and video applications. This deployment demonstrates the power of Ciena’s technology to support the growing bandwidth needs of global connectivity.

- 4Q24 results. Ciena Corporation’s revenue declined slightly by 0.9% YoY to US$1.12bn in 4Q24 from US$1.13bn in 4Q23, above estimates by US$20mn. It delivered non-GAAP EPS of US$0.54, below estimates by US$0.11. The company repurchased approximately 2.1mn shares of common stock for the aggregate price of US$132mn during the quarter. The company maintains a long-term revenue growth target of 6-8% CAGR, driven by webscale and cloud provider market growth.

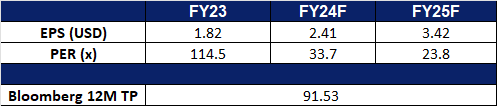

- Market consensus

(Source: Bloomberg)

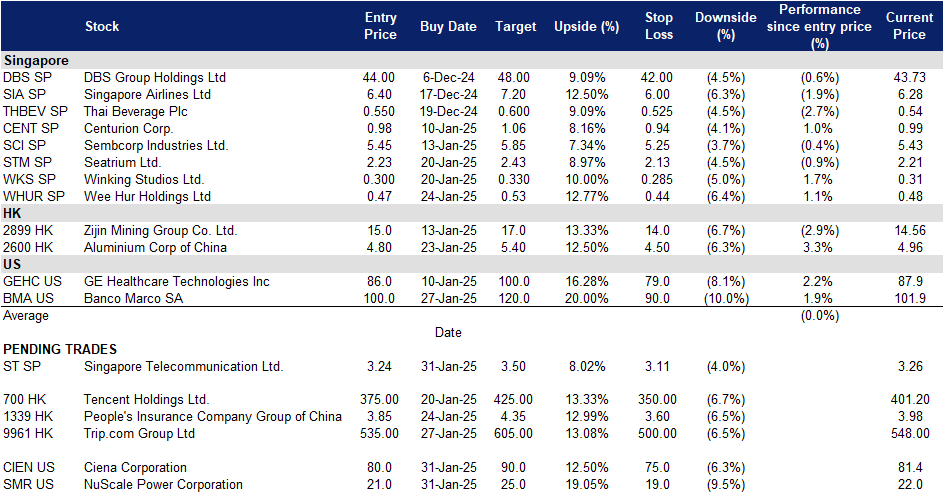

Trading Dashboard Update: Take profit on KKR & Co Inc (KKR US) at US$168. Add Broadcom Inc (AVGO US) at US$224. Cut loss on Broadcom Inc (AVGO US) at US$211 and CGN Mining Co Ltd (1164 HK) at HK$1.60.