30 September 2024: CapitaLand Investment Ltd (CLI SP), Meituan (3690 HK), Uber Technologies Inc (UBER US)

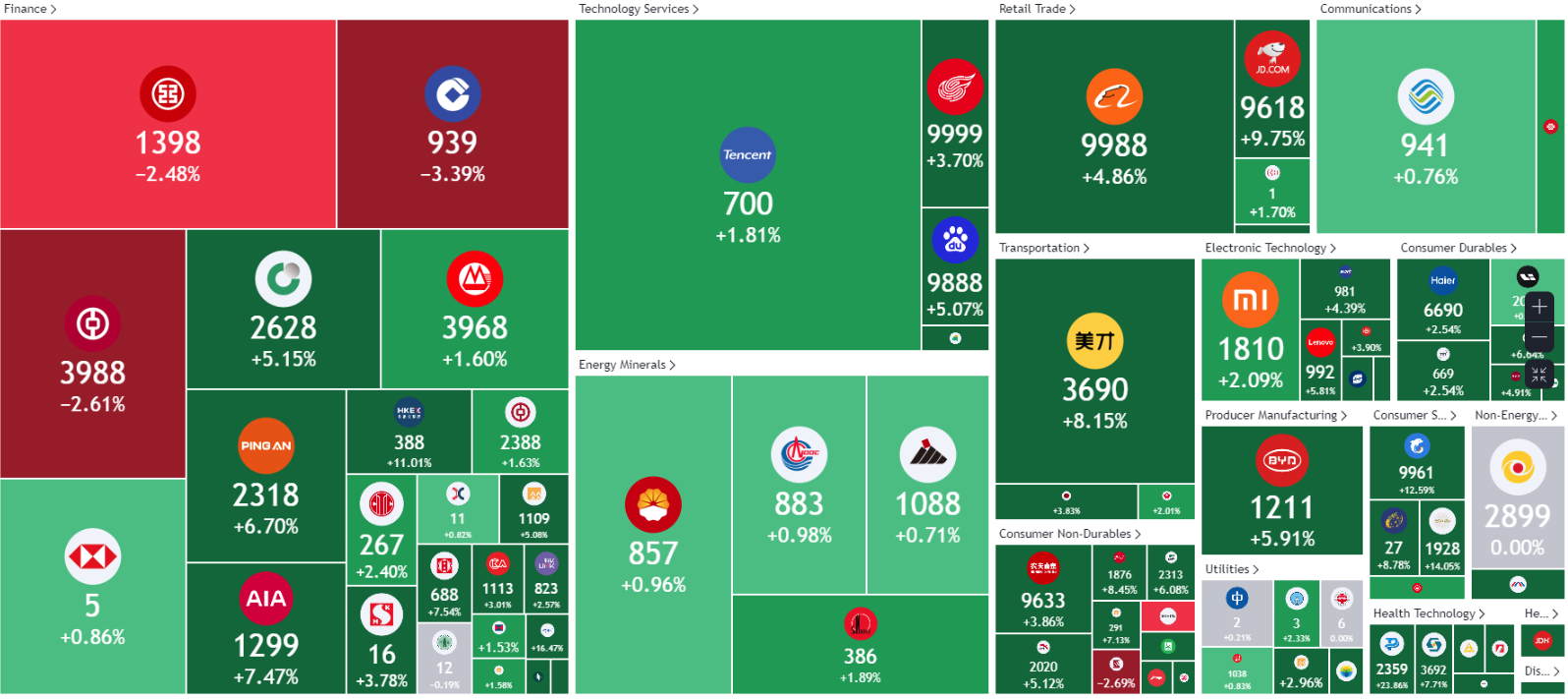

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

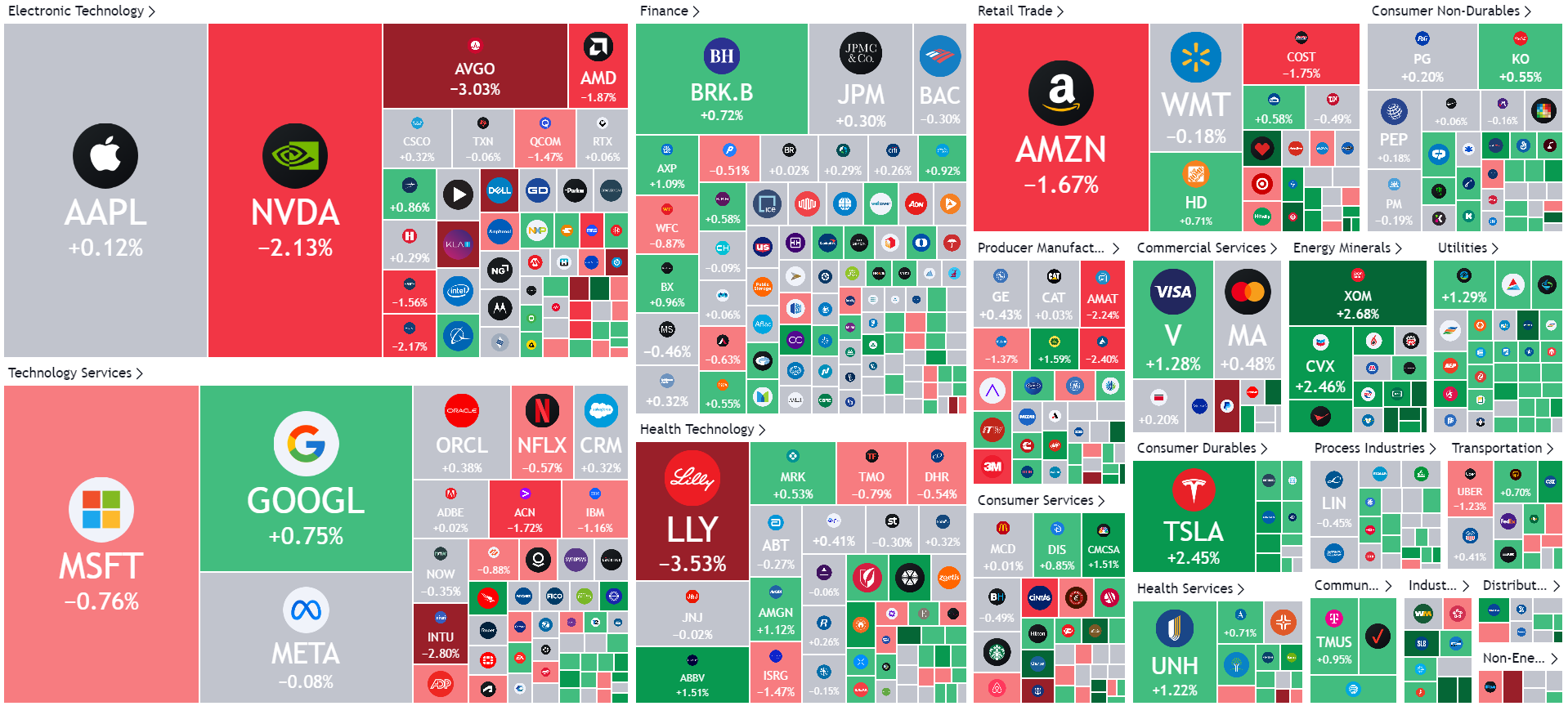

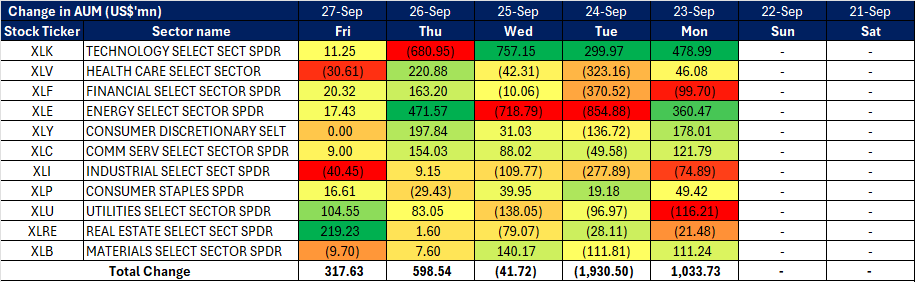

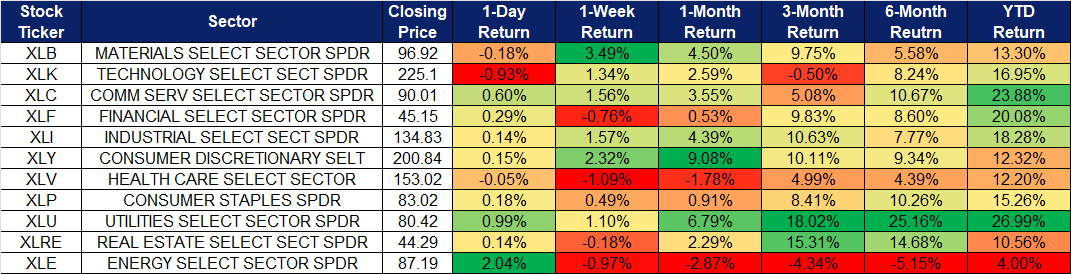

United States

Hong Kong

CapitaLand Investment Ltd (CLI SP): Benefiting from China’s economic stimulus

- BUY Entry – 3.05 Target– 3.35 Stop Loss – 2.90

- CapitaLand Investment Limited (CLI) is a global real estate investment manager with the aim to scale its FUM and fee-related earnings through its full stack of investment management and operating capabilities. The Company’s portfolio of integrated developments, retail, office, lodging and new economy assets are either owned/managed directly or through its fund management platform.

- China’s stimulus package improving investor confidence. China recently unveiled its largest package to date to support its struggling property market, reducing borrowing costs on up to US$5.3tn in mortgages and lowering the down-payment requirement for second homes to 15% from 25%. The People’s Bank of China (PBOC) will cut mortgage rates for existing loans by an average of 0.5 percentage points, aiming to alleviate a housing-led slowdown in the economy. These measures are expected to ease the mortgage burden for an estimated 150mn people, reducing annual interest expenses by about 150bn yuan. Additionally, the PBOC also introduced 800bn yuan (US$114bn) worth of new funding tools for buying stocks and pledged more monetary easing. These measures have resulted in the strengthening of the yuan and has increased investor interest and positive sentiment over China’s economy. This imrpovemenr in economic sentiment would prove beneficial for CapitaLand Investment as it has invested in properties in China and could potentially lead to higher property values and rental demand, boosting the company’s returns. With China’s renewed focus on stimulating its property market and economy, CapitaLand Investment stands to benefit from the increased liquidity and consumer spending, enhancing its portfolio performance in the region. These policy changes may also attract more foreign investments, further stabilizing the market and providing long-term growth opportunities for real estate investors like CapitaLand.

- Potential acquisition. CapitaLand Investment is in advanced discussions to acquire a 20% to 30% minority stake in French luxury resort chain Club Med SAS from its Chinese owner, Fosun International, for several hundred million euros. CapitaLand has emerged as the likeliest buyer after outbidding other rivals, including private equity firms, though final decisions have yet to be made. Fosun International, which owns Club Med through Fosun Tourism Group, has been actively reducing its debt through asset disposals and reduced borrowing. Club Med operates over 60 all-inclusive resorts worldwide.

- 1H24 results review. Revenue for 1H24 increased by 1% YoY to S$1,365mn, compared to S$1,345mn in 1H23. PATMI declined by 6% YoY from S$351mn to S$331mn, due to weaker real estate investment business, which was impacted by higher interest expenses and unfavourable foreign exchange rates.

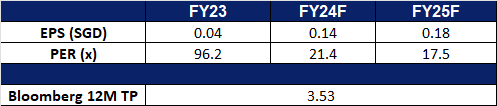

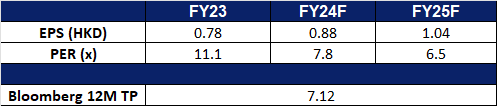

- Market Consensus.

(Source: Bloomberg)

Centurion Corp Ltd (CENT SP): Strong revenue growth and strategic expansion

- RE-ITERATE BUY Entry – 0.780 Target– 0.850 Stop Loss – 0.745

- Centurion Corporation Limited specialises in owning and operating worker and student accommodation assets. It ranks among Singapore’s largest owner-operators of high-quality worker accommodations in Singapore and Malaysia. Additionally, the company manages student accommodation properties across Singapore, Australia, the United Kingdom, and the United States.

- Stronger than anticipated revenue growth. Centurion Corporation reported a 27% YoY growth in total revenue for 1H24, increasing from S$97.9mn to S$124.4mn. This robust performance was driven by high financial occupancy in key markets like Singapore, the UK, and Australia, along with positive rental revisions across all regions. The total asset under management reached S$2.1bn with 66,495 operational beds across 32 properties in 14 cities globally.

- Inorganic growth through geographical expansion. Centurion entered China’s Purpose-Built Student Accommodation (PBSA) market with two master-leased properties in Kowloon, Hong Kong. These properties will be refurbished to cater to students, with operations expected by September 2024. Additionally, Centurion has secured a third master lease for a larger Purpose-Built Workers Accommodation (PBWA) in the New Territories, expected to open in November 2024.

- Continued organic growth of portfolio. Centurion is positioned for continued revenue growth through its strategic expansion into high-growth regions and its solid portfolio of existing properties. The planned addition of 3,275 new beds in 2H24 and the additional 17,095 beds in the potential future will further bolster financial performance. The company is well-prepared to meet regulatory requirements while maintaining high occupancy rates. Anticipated interest rate reductions will further enhance profitability. Centurion is pursuing scalable growth through partnerships, investment funds, and fee-based management services, which include selective acquisitions, optimizing assets, and expanding revenue streams through specialized management services.

- 1H24 results review. Revenue for 1H24 increased by 27% YoY to S$124.4mn, compared to S$97.9mn in 1H23, which reached 95% for PBWA and 98% for PBSA, compared to 96% and 89%, respectively, in 1H23. Although there was a slight decline in PBWA occupancy due to capacity expansions in Malaysia, this was offset by improved rental rates across all regions. Interim dividend per ordinary share rose to 1.5 Scents, from 1.0 Scents in 1H23.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.85. Please read the full report here.

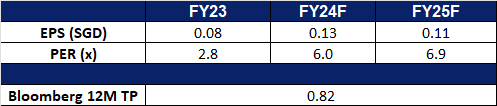

- Market Consensus.

(Source: Bloomberg)

Meituan (3690 HK): Boost domestic consumption

- Entry – 160 Target 180 Stop Loss – 150

- Meituan, formerly Meituan Dianping, is a China-based e-commerce platform providing life services. The Company connects consumers and businesses to provide services satisfying people’s daily eating needs. The Company owns an instant food ordering and delivery brand, Meituan, as well as provides services through its mobile application, Meituan. The Company is also engaged in the operation of a bike-sharing brand, Mobike.

- Issuance of special sovereign bonds focused on increasing consumption level. China recently announced plans to issue special sovereign bonds worth approximately 2.0tn yuan ($284.43bn) this year as part of a new fiscal stimulus package, with 1.0tn yuan specifically aimed at boosting consumption. According to sources, the Ministry of Finance will use the proceeds from these bonds, which are floated for specific purposes, to increase subsidies for the trade-in and renewal of consumer goods, as well as for upgrading large-scale business equipment. According to Reuters, the funds will be used to provide a monthly allowance of about 800 yuan ($114) per child to families with two or more children, excluding the first child. This increases the income of middle and low-income group and improves the consumption structure in China. China also plans to raise another 1.0tn yuan through a separate sovereign debt issuance to assist local governments in addressing their debt challenges. These policies are expected to drive higher consumption across the country, potentially benefiting companies like Meituan.

- Lower rates to drive growth. China has unveiled a series of rate cuts aimed at stimulating economic growth, with a focus on boosting both consumption and investment. As part of these measures, the People’s Bank of China lowered interest rates on existing mortgages by 0.5 percentage points and reduced banks’ reserve requirements to encourage more lending. The stimulus package also includes easing borrowing restrictions for stock market investments and lowering the minimum down payment for second homes from 25% to 15%. These steps are expected to enhance business confidence and drive consumer spending, benefiting companies like Meituan. Additionally, the National Development and Reform Commission (NDRC) reaffirmed plans to introduce a private-sector promotion law, designed to create a favourable environment for private-sector growth, further boosting consumption levels.

- Expansion into Saudi Arabia. Meituan recently announced the expansion of its international service, Keeta, into Saudi Arabia as the company seeks growth opportunities abroad amidst a slowing domestic economy and increased competition. The food ordering and delivery service has launched in Al-Kharj, a central city in Saudi Arabia, with plans to expand soon into the capital, Riyadh. Despite strong competition in the region, Saudi Arabia’s online food delivery market is projected to reach US$11.74bn this year and grow at a 5.2% annual rate, hitting US$15.13bn by 2029, according to Statista. This presents significant growth potential for Meituan. While the company is still in the early stages of its international expansion, management emphasized that pursuing overseas markets aligns with Meituan’s long-term growth strategy.

- 1H24 earnings. Total revenue rose by 22.9% YoY to RMB155.5 bn in 1H24, compared to RMB126.6bn in 1H23. Net profit rose by 107.8% YoY to RMB16.7bn in 1H24, compared to RMB8.05bn in 1H23. Basic earnings per share was RMB2.70 in 1H24, compared to RMB1.30 in 1H23.

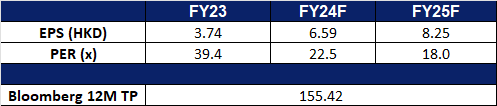

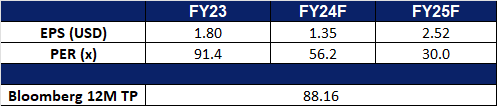

- Market consensus.

(Source: Bloomberg)

CSC Financial Co Ltd (6066 HK): Resuscitating the economy

- Entry – 7.40 Target 8.20 Stop Loss – 7.00

- China Securities Co., Ltd. is mainly engaged in securities brokerage, securities investment consulting, financial advisers related to securities trading and securities investment activities, securities underwriting and sponsor, securities self-management, securities asset management, securities investment fund agent distribution, providing futures companies with medium introduction services, margin financing, financial products agent distribution, insurances facultative agent, stock options market making, securities investment fund trusteeship and precious metal products sales businesses.

- Unveiling stimulus to boost economy. China has announced a series of rate cuts aimed at stimulating economic growth, with a commitment to enhancing both consumption and investment. As part of these efforts, the People’s Bank of China reduced interest rates on existing mortgages by 0.5 percentage points and lowered the reserve requirements for banks, enabling increased lending. The stimulus package also includes relaxed restrictions on borrowing for stock market investments and a reduction in the minimum down payment for second homes from 25% to 15%. These actions represent some of the most significant economic measures China has introduced in recent years to revive its sluggish economy.

- More liquidity injected into the stock market. China has also announced a reduction in the reserve requirement ratio (RRR), which determines the amount of cash banks must hold in reserve. This move is expected to inject approximately one trillion yuan of “long-term liquidity” into the financial market. Additionally, the government will introduce a “swap program,” allowing companies to obtain liquidity directly from the central bank. This initiative, with an initial scale of 500 billion yuan and potential future expansions, is expected to significantly improve firms’ access to capital for stock purchases. The anticipated increase in market liquidity is likely to boost investor sentiment, benefiting firms like CSC Financials.

- Benefitting from a lower interest rates. The lowering of Hong Kong’s interest rate by 50 basis points to 5.25% recently, mirroring the U.S. Federal Reserve’s move. This rate cut is expected to boost business confidence and stimulate consumer spending in Hong Kong. Lower rates are also likely to encourage a shift of funds from safe assets into the stock market, enhancing market liquidity and trading volumes. The recent recovery of the Hang Seng Index, which is now trading at a 52-week high, around the 20,000 level is bound to improve investor sentiments, further driving fund flows in the Hong Kong stock market. CSC Financial is well-positioned to benefit from the increased liquidity and volume of the stock market.

- 1H24 earnings. Total revenue fell by 20.5% YoY to RMB14.8bn in 1H24, compared to RMB18.7bn in 1H23. Net profit fell by 33.6% YoY to RMB2.86bn in 1H24, compared to RMB4.32bn in 1H23. Basic earnings per share was RMB0.30 in 1H24, compared to RMB0.49 in 1H23.

- Market consensus.

(Source: Bloomberg)

Uber Technologies Inc (UBER US): Rolling out Robotaxi

- BUY Entry – 75 Target – 83 Stop Loss – 71

- Uber Technologies Inc provides ride hailing services. The Company develops applications for road transportation, navigation, ride sharing, and payment processing solutions. Uber Technologies serves customers worldwide.

- Actively promote the robot taxi business. Uber Technologies, which has been making a lot of moves in the self-driving and robo-taxi space recently, recently announced a partnership with WeRide to bring the Chinese self-driving technology company’s vehicles to the sharing platform, starting with the United Arab Emirates. In addition, the company expanded its cooperation with Waymo to introduce robot taxis to Austin and Atlanta in the United States. The company is also working with Cruise, GM’s robo-taxi unit, which will offer self-driving cars on the platform starting next year.

- Funds are rotated into cyclical and growth sectors. Entering the fourth quarter, institutions’ asset portfolios will be adjusted. The market still maintains expectations that the Federal Reserve will cut interest rates by 200 basis points in the next year. Loose monetary policies will continue to benefit platform stocks in obtaining capital inflows.

- 2Q24 earnings review. Revenue increased by 15.9% YoY to US$10.7bn, exceeding expectations by US$120mn. GAAP earnings per share were US$0.47, beating expectations by US$0.16. The company’s third-quarter gross bookings guidance is US$40.25bn to US$41.75bnn (an annual increase of 18% to 23% at constant exchange rates).

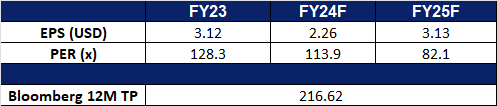

- Market consensus.

(Source: Bloomberg)

Tesla Inc (TSLA US): Robocars unite

Tesla Inc (TSLA US): Robocars unite

- RE-ITERATE BUY Entry – 255 Target – 280 Stop Loss – 242

- Tesla Inc. operates as a multinational automotive and clean energy company. The Company designs and manufactures electric vehicles, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla owns its sales and service network and sells electric power train components to other automobile manufacturers.

- High expectations for Q3 deliveries. On 2 October, Tesla is expected to announce its third-quarter delivery numbers. The company is expected to have a strong third quarter in China, potentially marking its best quarter ever there, prompting analysts to raise their delivery forecasts for the electric vehicle maker. Wall Street now anticipates Tesla delivering around 462,000 to 480,000 vehicles in Q3, with the average estimate at 462,000. This surge in China sales comes at a critical time, helping to offset weaker demand in the US and Europe. While Tesla’s core business is facing competitive pressures and high borrowing costs, the recent cut in interest rate and stimulus support from governments would help strengthen the demand for big-ticket purchases like cars, which would further improve sales. Furthermore, the upcoming “Robotaxi Day” event, where Tesla will unveil its self-driving technology, could further boost investor confidence.

- “We, Robot”, robotaxi event. Invitations for the Tesla Robotaxi reveal event have been sent out and is set to happen on 10 October this year. Anticipation has risen due to speculation that the Robotaxi will have reached full autonomy alongside the rollout of full self-driving (FSD) 13, which is an improved version of its current supervised automated driving suite. The FSD 13 release is expected to introduce automated reverse parking and reduce the number of interventions per mile driven on FSD. Furthermore, the CEO of Tesla, Elon Musk, had announced on social media that once its unsupervised full-self-driving robotaxi service begins operations, busses would no longer be needed, and it would be similarly priced to a bus ticket. Additionally, he also mentioned that the robotaxis would function like a combination of Airbnb and Uber, with a certain portion of the fleet being owned by Tesla alongside individual Tesla customers for additional income, and the rides can be called via the mobile app. This initiative to develop fully autonomous vehicles using FSD technology will give it an edge over its EV competitors while positing it in the AI race.

- 2Q24 earnings review. Revenue increased by 2.3% YoY to US$25.5bn, exceeding expectations by US$760mn. Non-GAAP earnings per share were US$0.52, missing expectations by US$0.10.

- Market consensus.

(Source: Bloomberg)

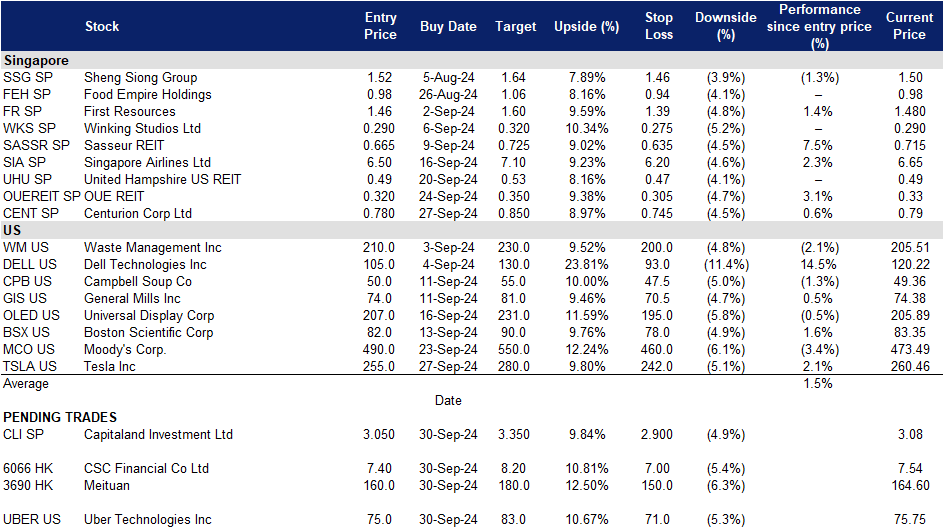

Trading Dashboard Update: Add Tesla Inc (TSLA US) at US$255.