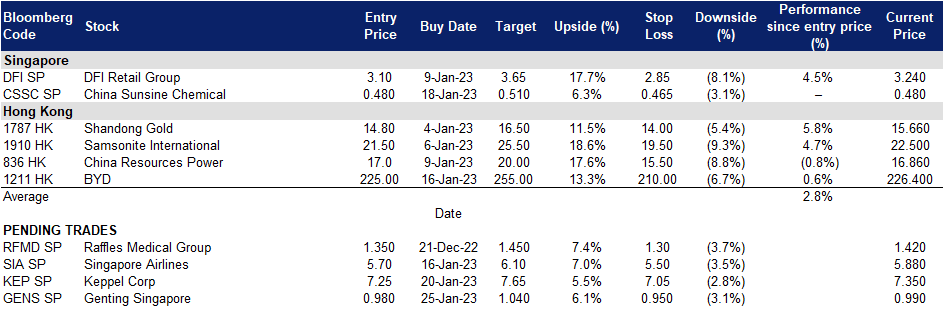

25 January 2023: Genting Singapore Ltd (GENS SP), Keppel Corp Ltd. (KEP SP)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

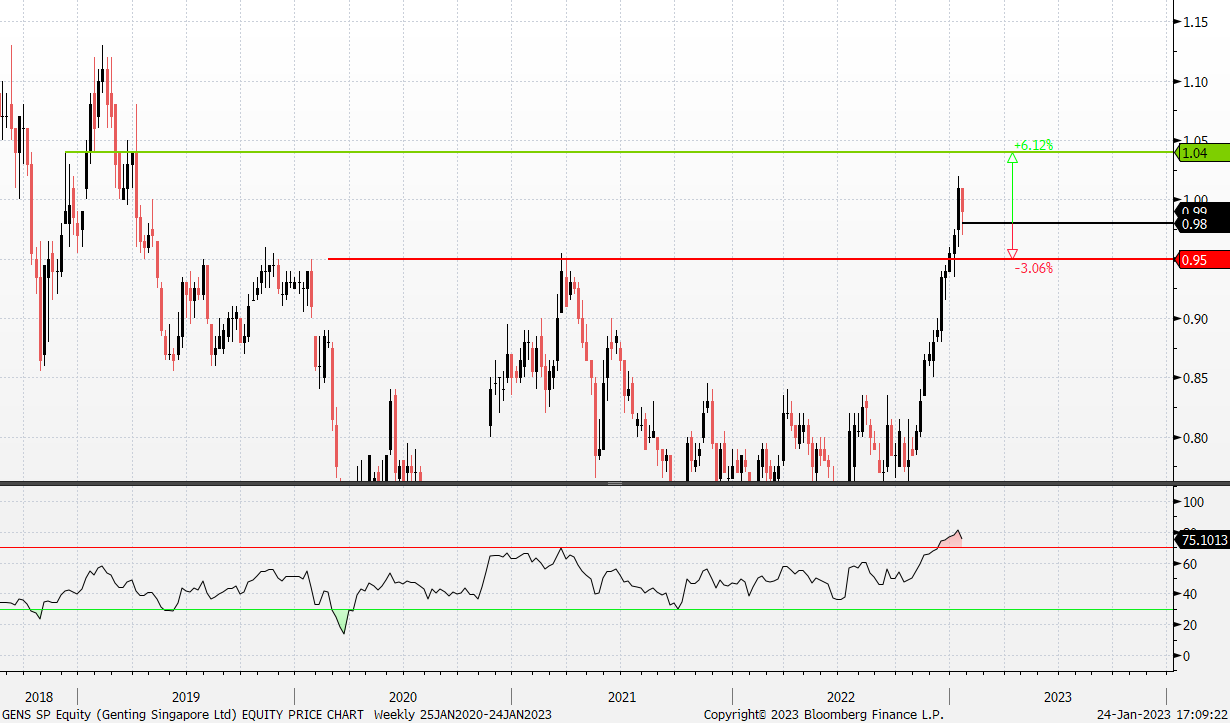

Genting Singapore Ltd (GENS SP): Tourism recovery

- Entry – 0.98 Target – 1.04 Stop Loss – 0.95

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index. The principal activities of Genting Singapore and its subsidiaries are in developing, managing and operating integrated resort destinations including gaming, hospitality, MICE, leisure and entertainment facilities.

- Arrivals to double. With Singapore’s tourism arrival figures expected to double from 6.3mn in 2022 to an estimated 13mn in 2023, mainly due to increasing travel demand from South-East Asia, Genting Singapore’s 2023 revenue is likely to see exponential growth in the new year. This revenue boost will likely translate to higher profits, which can then be used to continue fueling their expansion effort.

- RWS 2.0 expansion progress. RWS 2.0 project is on-going as planned, with both the construction of Minion Land at USS and, additions and upgrades to infrastructure facilities running smoothly. This expansion marks a shift in the company’s focus towards the affluent market. In 1Q23, it expects its remade Festive Hotel, turned boutique-style accomodation to reopen.

- Gross gaming revenue (GGR) recovery. Singapore’s GGR has been predicted to recover to more than 70% of pre-pandemic levels in 2023, boosted by China tourist arrivals. Pre-pandemic wise, GGR can usually be correlated to China tourist arrivals, with higher tourist arrivals leading to a higher GGR for Singapore. Therefore, with tourist arrival numbers from China recovering to near pre-pandemic levels, it is expected that GGR may make a similar recovery as well.

- Updated market consensus of the EPS growth in FY23/24 is 59.6%/10.1% YoY respectively, which translates to 20.5x/18.6x forward PE. Current PER is 64.5x. Bloomberg consensus average 12-month target price is S$0.98.

(Source: Bloomberg)

Keppel Corp Ltd. (KEP SP): Reviving infrastructure expansion in the post-COVID era

- RE-ITERATE Entry – 7.25 Target – 7.65 Stop Loss – 7.05

- Keppel Corporation is a Singaporean conglomerate headquartered in Keppel Bay Tower, HarbourFront. The company consists of several affiliated businesses that specialises in offshore & marine, property, infrastructure and asset management businesses. It is increasingly focused on transition energy and renewables, and is pivoting to renewables for a more sustainable future.

- Tracking China’s re-opening. With China being one of Keppel Land’s key markets, the reopening of China’s economy is bound to drive growth for the business. China’s growth is expected to bottom out in the first quarter of 2023 as the government fine- tunes its COVID policy and provides more supportive measures for the property sector.

- New Acquisitions driving expansion. Keppel Corp has acquired a freehold 15-storey office tower in Seoul for a purchase price of 220bn won (S$229mn) from Hana Alternative Assets Management, a fund of Hana Financial Group.The property arm of Keppel Corp, Keppel Land has entered into a forward purchase agreement to acquire a project in the western city of Pune for US$29mn, adding 1.1 million square feet to its India office portfolio, as well as a new senior living facility in Nanjing’s Qixia District. Keppel Capital, through its China logistics property fund, has partnered Chinese logistic park developer and operator BLOGIS to acquire the fund’s first asset, a grade-A high-standard warehouse, located in Dongxihu, Wuhan, China.

- New contract. Keppel Offshore & Marine Ltd (Keppel O&M), has secured a contract from an international renewable energy company for the construction of an offshore substation (OSS) worth approximately S$130 million.

- Updated market consensus of the EPS growth in FY22/23 is -5.4/-0.58% YoY respectively, which translates to 13.76x/13.84x forward PE. Current PER is 11.4x. Bloomberg consensus average 12-month target price is S$9.18.

The Hong Kong market is closed today in observance of a public holiday, Lunar New Year. The market will reopen on 26 January, Thursday.

United States

Top Sector Gainers

| Sector | Gain/ Loss | Related News |

| Trucks/Construction/Farm Machinery | +2.22% | Caterpillar (CAT) Earnings Expected to Grow: Should You Buy? Caterpillar Inc (CAT US) |

| Aerospace & Defence | +1.46% | Defense Stocks: Lockheed Martin, Raytheon Mixed, Despite Ukraine Boost; Northrop Grumman On Deck Raytheon Technologies Corp (RTX US) |

| Oil Refining/Marketing | +1.44% | U.S. oil refiners set for strong 4Q earnings as margins stay high Marathon Petroleum Corp (MPC US) |

Top Sector Losers

| Sector | Gain/ Loss | Related News |

| Medical Specialities | -1.72% | Danaher Hit After Cutting Covid-Related Revenue From Growth Reports Thermo Fisher Scientific Inc (TMO US) |

| Oil & Gas Production | -1.55% | Oil falls $2/barrel on economic jitters, U.S. crude stock build Conocophillips (COP US) |

| Internet Software/Services | -1.50% | S&P 500 ends lower after mixed earnings, opening glitch Alphabet Inc.(GOOG US) |

Hong Kong

Top Sector Gainers

Sector | Gain/ Loss | Related News |

Movies & Entertainment | +5.14% | In the fight against slowing growth, Netflix and its rivals are all in this together Alibaba Pictures Group Ltd. (1060 HK) |

Environmental Energy Material | +3.96% | Renewables Projected to Soon Be One-Fourth of US Electricity Generation. Really Soon Xinyi Solar Holdings (0968 HK) |

Petroleum & Gases Equipment Services | +3.84% | Chinese oil trader Unipec sweeps up cheap crude, eyes demand recovery China Oilfield Services Ltd (2883 HK) |

Top Sector Losers

Sector | Gain/ Loss | Related News |

Footwears | -0.32% | Xtep International Holdings Ltd. (1368 HK) |

Alcoholic Drinks & Tobacco | +0.14% | Bud Light and Budweiser are getting a makeovers at this year’s Super Bowl Budweiser APAC (1876 HK) |

Textile & Apparels | +0.15% | Sports Clothing Global Market To 2028 – Massive Demand From End-Users To Proliferate The Expansion Anta Sports Product Ltd. (2020 HK) |

Trading Dashboard Update: Take profit on Tianjin Pharma Da Ren Tang (TIAN SP) at S$1.09, Shanghai Fosun Pharmaceutical (2196 HK) at HK$27.0. Cut loss on Sinopharm (1099 HK) at HK$19.3.