13 September 2023: ThaiBev (THBEV SP), Samsonite International S.A. (1910 HK), DraftKings Inc (DKNG US)

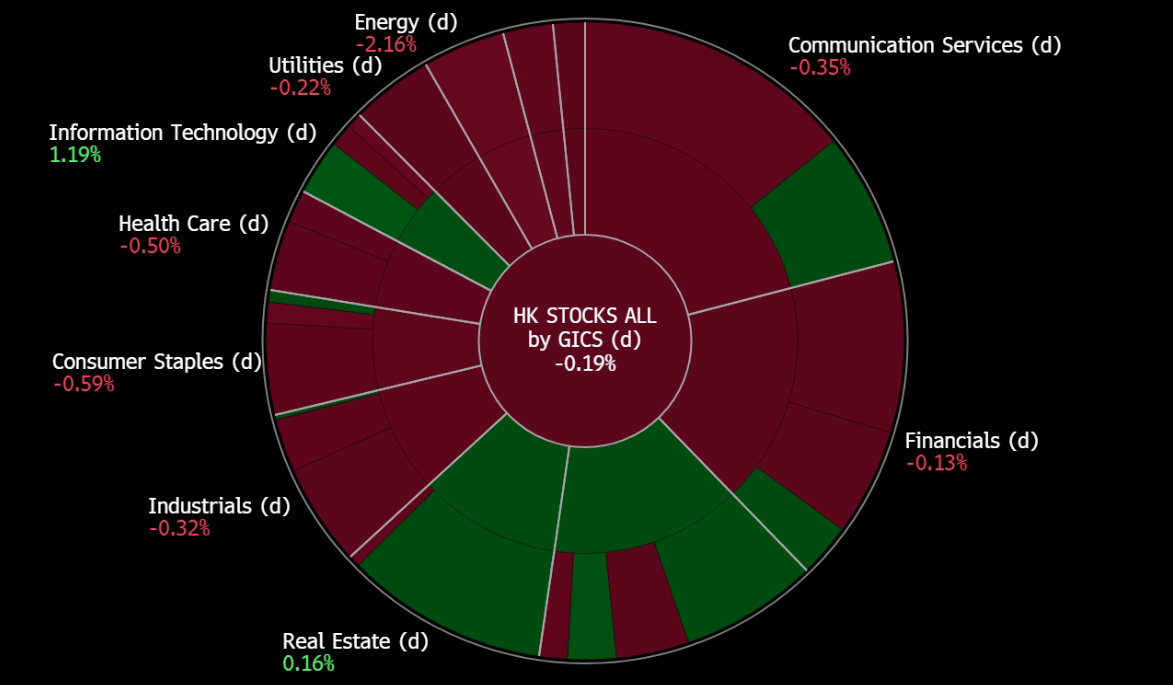

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

ThaiBev (THBEV SP): Expecting a tourism boost in Thailand during China’s upcoming golden week

- RE-ITERATE BUY Entry 0.58 – Target – 0.62 Stop Loss – 0.56

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

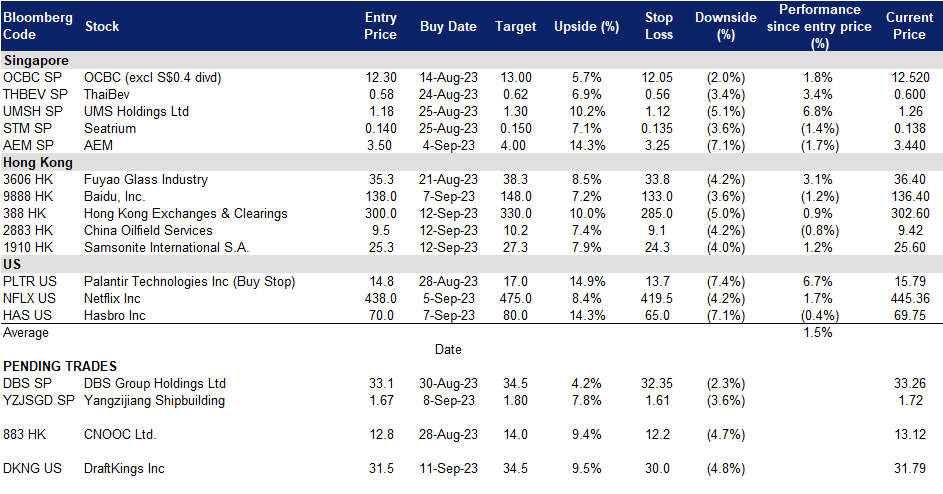

- Consumer confidence remains strong. According to the latest consumer confidence survey, the index recovered to the highest level since the COVID outbreak, reaching 51.2 in June before declining slightly to 50.3 in July. This promising recovery was driven by the growth in tourism and the demand for industrial and agricultural goods.

Thailand Consumer Confidence Economic Index

(Source: Bloomberg)

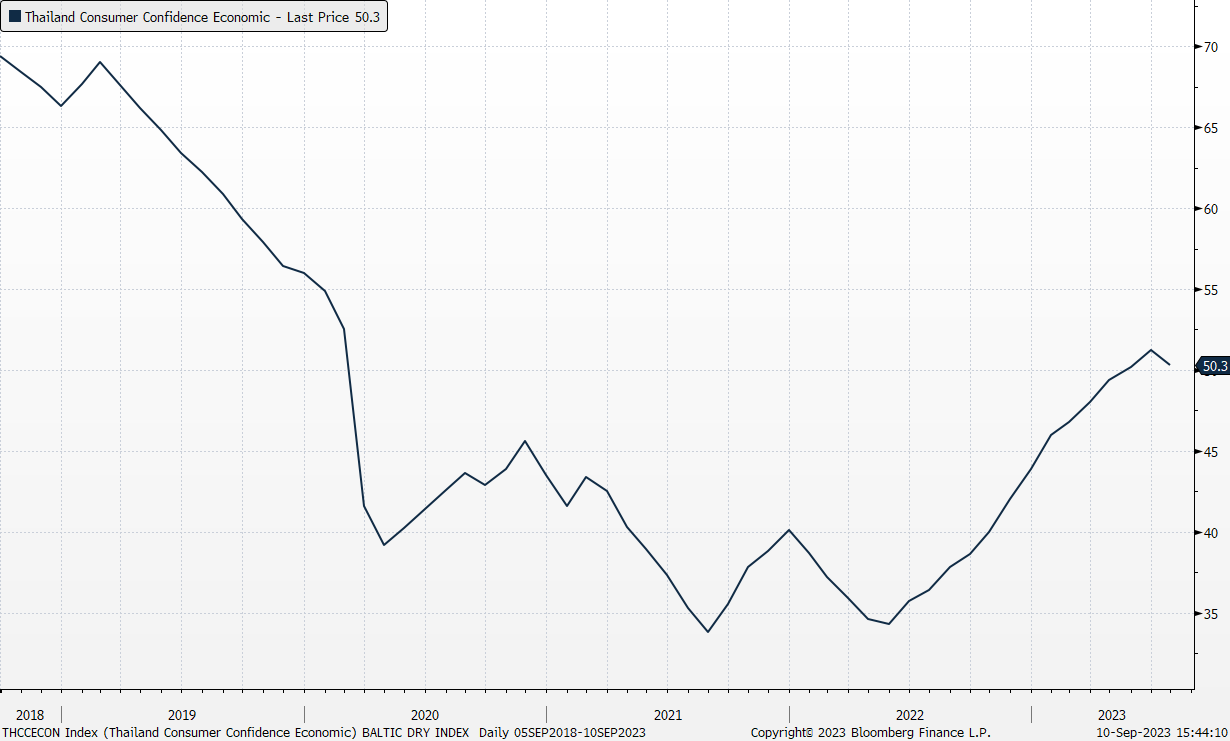

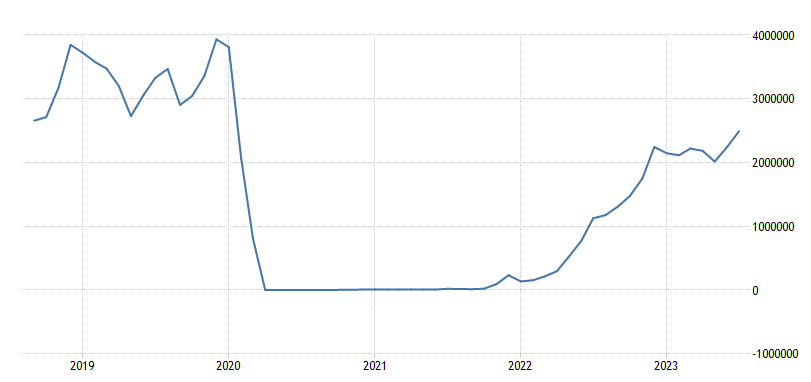

- Tourism to drive alcohol consumption. Thailand’s economy is expected to have grown by 3.1% in 2Q23, up from 2.7% in 1Q23. The growth was driven by increased foreign tourist arrivals, which have been recovering since the country reopened its borders in late 2022. However, exports, a key driver of growth, have contracted since October 2022, indicating weak global demand. Despite the challenges, the Thai economy is still expected to grow by an average of 3.7% in 2023, in line with the Bank of Thailand’s estimate. With alcohol being readily available in Thailand and as more foreign tourists visit Thailand, it is anticipated that the amount of alcohol consumed will increase alongside tourism arrivals. Thailand is expected to see another peak in tourism during the upcoming golden week in China (China’s National Day holiday) as the Chinese still favour Thailand as an overseas travelling destination.

Thailand Tourists Arrivals

(Source: Trading Economics)

- 3Q23 earnings review. Revenue grew mildly by 3.8% YoY to 215.9bn THB. EBITDA was down 3.4% YoY to 37.8bn THB. Its largest revenue contributor, the spirits business revenue was 93.7bn THB a 3.3% rise YoY.

- Market consensus.

(Source: Bloomberg)

Yangzijiang Shipbuilding (YZJSGD SP): Double bonanzas-record order book and weak RMB

- RE-ITERATE BUY Entry 1.67 – Target 1.80– Stop Loss – 1.61

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against weakening RMB. Recent macro figures released from China showed a gloomy outlook as soft domestic, exports and property crisis continues to weaken confidence. USD/RMB broke 7.3 again. The authority has released multiple stimuli, but all are ineffective. The US Fed remains hawkish towards fighting against inflation, and hence, the US will keep rates high for the rest of 2023. There is downside room for RMB if China’s economy further slows down in 3Q23.

Share price and USD/RMB price trend comparison

(Source: Bloomberg)

- Shipbuilding outshines other sectors. According to the China Association of the National Shipbuilding Industry, new contracts secured by Chinese shipyards surged by 67.7% YoY in 1H23 with 123.77m dwt orders on hand as of June. Containerships and LNG carriers dominate the new orders. The newly-received orders and orders on hand in deadweight tonnage accounted for 49.6%, 72.6% and 53.2% of the global market share; the amount in gross tonnage accounted for 47.3%, 67.2% and 46.8% of the world volume, both ranking as number one in the global market.

- 1H23 orderbook exceeded the full-year target. As of June, the company has obtained orders for 72 vessels, amounting to a value of US$5.76 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.7 billion for 181 vessels. Among all ordered vessels, 91 are containerships, 29 are oil tankers, 53 are bulk carriers, and 8 are LNG/LPG/LEG.

- 1H23 results review. Revenue for 1H23 increased by 16% YoY to RMB11.3bn. Gross profit increased by 48% YoY to RMB2.1bn. GPM increased by 4ppts to 19%. PATMI increased by 26% YoY to RMB1.7bn.

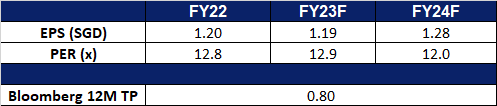

- Market Consensus.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): Flying with style

- RE-ITERATE BUY Entry – 25.30 Target – 27.30 Stop Loss – 24.30

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- New partnership with Indian Olympic Association. Samsonite recently announced that the company has entered into a partnership with Indian Olympic Association for the upcoming Asian Games, which will be taking place in Hang Zhou, from 23rd September 2023 to 8th October 2023. Gifting each member of the Indian team a high-quality suitcase specially crafted for the official kit of the Asian Games 2023 symbolizes the support and confidence that both the entire nation and renowned brands like Samsonite bestow upon their champions. This partnership helps to promote Samsonite’s brand name indirectly, as well as showcasing the premium quality that Samsonite’s luggage is able to provide to their consumers.

- Rising air travel demand. According to the latest report by International Air Transport Association (IATA), the global air travel demand recovery persisted in July, with revenue passenger kilometers increasing by 26.2% compared to the previous year. This figure represents 95.6% of the air traffic recorded in July 2019, marking the second-highest monthly result of 2023. Planes were seen to be full during July as people continue to travel in ever greater numbers. The further re-opening of borders also brought in a higher demand for international travel. Several tourism companies such as Trip.com also reported stronger-than-expected results, highlighting the recovery of travel demand.

- Plans for expansion. The brand is extending its sales locations in the country using an innovative format already successful in Asia and Europe. This fresh brand concept arrives in Peru, situated within Mall de Salaverry. This year, the company aims to remodel its flagship store at Jockey Plaza, which houses multiple brands. Plans also include launching new stores in Lima and provinces next year, with a target of achieving 25% growth compared to the prior year and 30% growth relative to pre-pandemic 2019. Furthermore, the company also has a plan to expand its warehouse in an attempt to enhance market reach as well as to ramp up its production capacity.

- 1H23 results. Net sales improved to US$1.78bn, up 39.8% YoY, compared to US$1.27bn in 1H22. Net profit rose to US$170.9mn in 1H23, up 104.9% YoY, compared to US$83.3mn in 1H22. Basic EPS was US$0.106 cents in 1H23, compared to US$0.039 in 1H22.

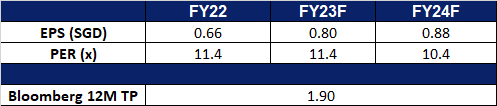

- Market Consensus.

(Source: Bloomberg)

China Oilfield Services (2883 HK): Capturing Oil Demand

- RE-ITERATE BUY Entry – 9.50 Target – 10.20 Stop Loss – 9.10

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- New Drilling Rig Service Contracts. China Oilfield Services recently announced that its wholly owned subsidiary, COSL Drilling Europe, has entered into multiple drilling rig service agreements with two multinational oil firms in Norway, each with a set term and an option to extend for up to five years. The total value of the contracts with fixed terms is around 4.7 billion RMB.

- Demand for oil to outgrow supply. World oil demand is surging to record levels, with growth being driven by a number of factors, including a rebound in air travel, increased oil use in power generation, and strong demand from China’s petrochemical industry. Demand is expected to rise by 2.2 mb/d in 2023, reaching 102.2 mb/d. China is expected to account for more than 70% of this growth. Additionally, major oil-producing countries, including Saudi Arabia, also recently announced that they would be extending the voluntary oil cuts to year-end, putting more constraints on oil supply, and driving up oil prices in the near term. Saudi Arabia will be extending its voluntary oil cut of 1mn barrels per day to the end of 2023, and Moscos will be extending its voluntary oil cut of 300,000 barrels per day to end of 2023, with both countries to still review the cuts monthly. Consequently, the cost of oil is anticipated to increase within the market.

- 1H23 earnings. Revenue rose by 24.1% YoY to RMB18.9bn, compared to RMB15.2bn in 1H22. Net profit rose 31.0% YoY to RMB1.46bn, compared to RMB1.11bn in 1H22. Basic EPS rose by 21.1% YoY to RMB28.06, compared to RMB23.17 in 1H22.

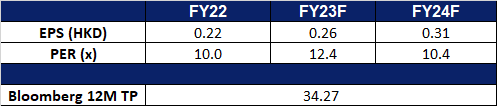

- Market Consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

DraftKings Inc (DKNG US): Super Bowl Season

- RE-ITERATE BUY Entry – 31.5 Target – 34.5 Stop Loss – 30.0

- DraftKings Inc. operates as a daily fantasy sports contest and sports betting company. The Company allows users to enter daily and weekly fantasy sports-related contests and win money based on individual player performances in American sports. DraftKings serves customers in the United States.

- NFL season. The NFL season, which commenced last Thursday and will culminate in the Super Bowl in Las Vegas on 11 February 2024, holds a prominent position in the sports betting industry. A survey conducted by the American Gaming Association anticipates a substantial surge in adults participating in NFL betting this year, projecting 73.5 million participants compared to 27 million in 2022. Currently, FanDuel and DraftKings dominate the sports betting market share, while competitors such as BetMGM, Caesars Entertainment, and Bet365 vie for their share. The entry of ESPN Bet, facilitated by a partnership with Penn Entertainment, introduces an element of uncertainty to the landscape. DraftKings stands to benefit from the increase in anticipated participants and promotional activities in the sector.

- Possible game changer. Disney’s ESPN Bet is gearing up to play a significant role in the upcoming NFL season, in partnership with Penn Entertainment. Although ESPN Bet will only launch in the middle of the season, it will benefit from ESPN’s extensive football coverage across various platforms. Recent survey data from Jefferies highlights a growing interest in online sports betting, with 44% of respondents having placed bets in the past year, up from 37% in January. Moreover, 89% of respondents are likely to continue betting with their current accounts, compared to 83% in January. Notably, more bettors are considering maintaining multiple sportsbook accounts, with 33% planning to stick with just one account (down from 40%), 39% intending to have two accounts (up from 37%), and those looking to keep three accounts increasing to 20% from 15% in the previous survey. However, it’s worth noting that previous ESPN marketing partnerships with companies like Caesars Entertainment and DraftKings had mixed success, and media partnerships with Bally’s, Fox Bet, and PointsBet-NBC didn’t live up to the initial hype. Therefore, ESPN Bet’s impact on DraftKings’ revenue during this Super Bowl season remains uncertain.

- Promotions to entice users. DraftKings presents an enticing “Bet $5, Get $200” welcome bonus for newcomers. To qualify, simply click the provided link, place a $5 bet on any market, and enjoy a cash payout if their bet wins. Win or lose, DraftKings sweetens the deal with eight $25 bonus bets, each requiring just a 1x playthrough. Beyond this, DraftKings boasts an array of promotions, including free-to-play pools, enhanced parlays, a referral program, and a rewards initiative. The platform is accessible in multiple states and offers user-friendly web and mobile interfaces for betting. Nonetheless, it falls short in customer support, is limited to email, and could enhance withdrawal processing times. Overall, DraftKings distinguishes itself with a generous welcome bonus and a user-friendly interface, making it an excellent choice for sports betting enthusiasts.

- 2Q23 earnings review. Revenue rose 87.8% year-over-year to US$875mn, beating estimates by US$112.16mn. Non-GAAP EPS of $0.14 beat expectations by $0.28. DraftKings’ Q2 revenue increase was driven by the acquisition of new customers and higher bets on lucrative products. The number of monthly unique players grew by 44% to 2.1mn. The company raised its FY23 revenue guidance to a range of $3.46bn to $3.54bn.

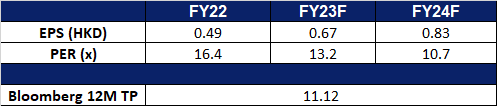

- Market consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): Generative new AI high

Advanced Micro Devices Inc (AMD US): Generative new AI high

- RE-ITERATE BUY Entry – 108 Target – 116 Stop Loss – 104

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- Improvement in interests. AMD CEO said that demand for AI semiconductors remains strong, with the company seeing continued acceleration of engagements for AI in the data center over the past 30 days. She also added that the market for AI semiconductors is skyrocketing and that AMD is one of the few companies that offers a complete AI technology portfolio across chips and software. The company expects the market for AI accelerators in data centers to reach $150 billion by 2027, and its upcoming MI300 AI accelerator is on track to launch during the fourth quarter. The company’s AI roadmap and customer interest in the MI300X processor indicates the potential for continued growth in the data center, with the product line expected to bolster margins. Although AMD is a laggard in the chip market, we believe funds will soon rotate into AMD shares. This is due to the company’s strong growth prospects in the AI market, as well as its competitive position in the server CPU market.

- US AI chip export restictions. The US government has expanded export restrictions on AI chips made by Nvidia and AMD beyond China to some countries in the Middle East. It is unclear what risks are posed by exports to the Middle East. However, the restrictions to China are likely to have a significant impact on China’s AI capabilities, as the country will need help accessing American chips necessary for carrying out advanced computing tasks. This could have a knock-on effect on China’s military capabilities. The US government’s decision to expand export restrictions on AI chips is a sign that it is willing to take more aggressive measures to counter China’s technological advances. However, it was noted that these restrictions imposed will have no material impact on AMD’s revenue.

- Latest GPUs. AMD has released two new mid-range GPUs, the RX 7700 XT and RX 7800 XT. Both cards are aimed at 1440p gaming and offer more VRAM than their Nvidia counterparts. The RX 7700 XT is priced at $449 and offers 12GB of VRAM, while the RX 7800 XT is priced at $499 and offers 16GB of VRAM. Both cards perform well at 1440p, beating Nvidia’s RTX 4060 Ti and RTX 4070 respectively. However, the RX 7800 XT does not offer a significant generational leap over the RX 6800 XT, which is still a good option for 1440p gaming. The RX 7700 XT and RX 7800 XT both use eight-pin power connectors, but the RX 7800 XT is more power-efficient than the RX 6800 XT.

- 2Q23 earnings review. Revenue fell 18.2% year-over-year to US$5.36bn, beating estimates by US$40mn. Non-GAAP EPS of $0.58 beat expectations by $0.01. It reported an increase in AI engagement by over 7 times, as the company saw more customers initiate or expand programs supporting future deployments of Instinct accelerators.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Amazon (AMZN US) at US$142 and Uber Technologies Inc (UBER US) at US$48. Add Hong Kong Exchanges & Clearings (388 HK) at HK$300, China Oilfield Services (2883 HK) at HK$9.5 and Samsonite International S.A. (1910 HK) at HK$25.3. Cut loss on Advanced Micro Devices (AMD US) at US$104.