28 June 2024: Singapore Telecommunications Ltd (ST SP), Trip.com Group Ltd. (9961 HK), Airbnb Inc (ABNB US)

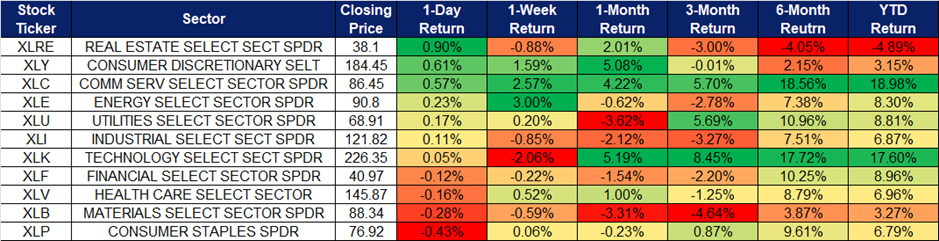

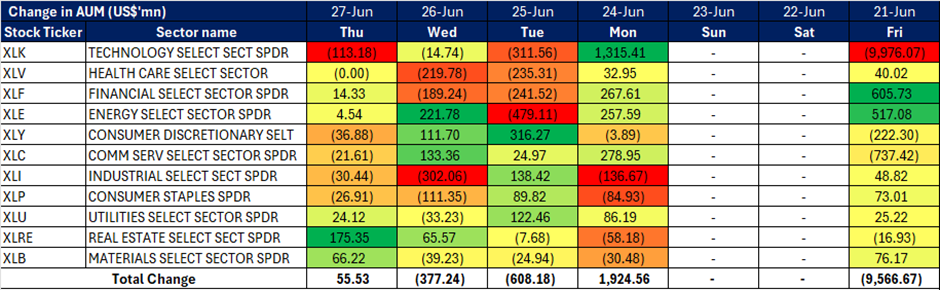

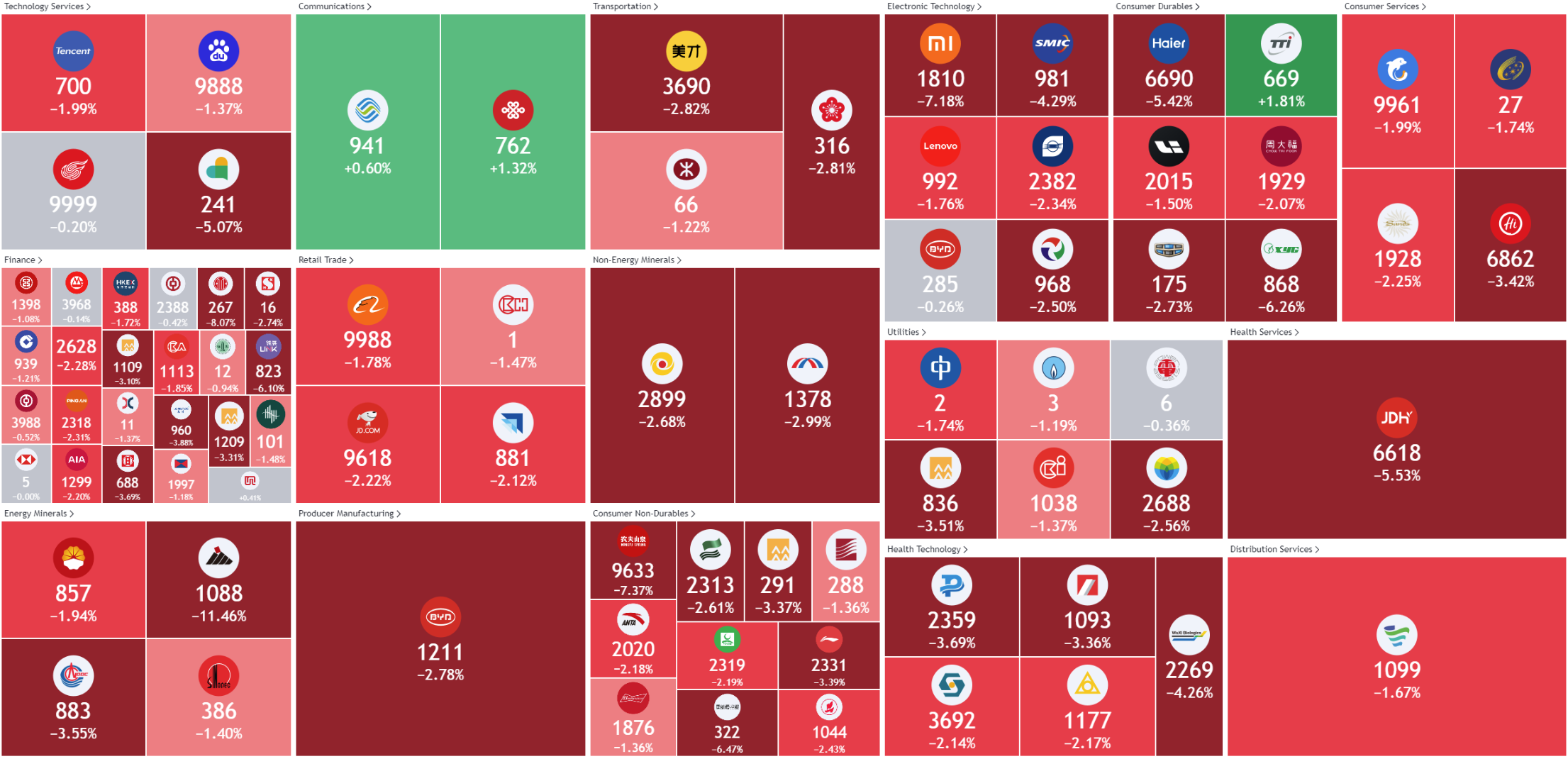

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

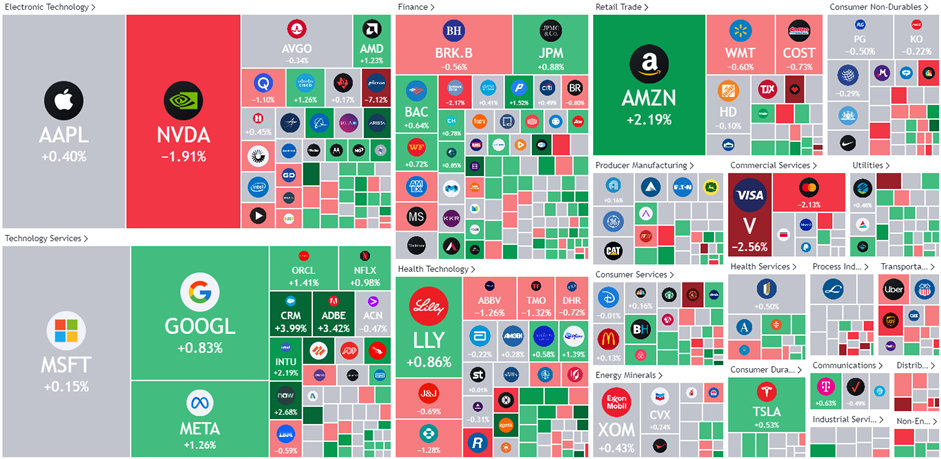

United States

Hong Kong

Singapore Telecommunications Ltd (ST SP): Investing in AI and Data Centres for future prospects

- BUY Entry – 2.74 Target– 2.88 Stop Loss – 2.67

- Singapore Telecommunications Limited wireless telecommunication services. The Company offers diverse range of services including fixed, mobile, data, internet, TV, and digital solutions. Singapore Telecommunications serves customers worldwide.

- Partnership to research industrial AI solutions. Hitachi Digital, a subsidiary of Hitachi, is set to incorporate Singtel’s Paragon platform at its US facilities to speed up the deployment of 5G, edge computing, and AI. The initial deployment will occur at Hitachi Americas’ Santa Clara R&D Labs and later at a US factory for Industry 4.0. The collaboration aims to test Hitachi AI applications in various areas such as quality assurance, workplace safety, training, and maintenance on Paragon. This partnership will allow the smooth integration of Paragon with Hitachi’s industry cloud applications, enhancing connectivity and productivity. Hitachi Digital Services will provide Paragon-integrated solutions, targeting enterprise clients who require robust industrial AI and network capabilities, which will benefit both companies. Additionally, with AI bringing a new level of complexity, the partnership is expected to accelerate AI adoption for corporations. This collaboration with Hitachi will allow Singtel to expand its Paragon platform’s reach and demonstrate its capabilities, fostering growth and innovation for Singtel in the global market.

- Exploring multilingual large language models. Singtel, Deutsche Telekom, e&, SK Telecom, and SoftBank Corp., founding members of the Global Telco AI Alliance (GTAA), recently signed a Joint Venture (JV) agreement at TM Forum’s DTW24-Ignite. This JV aims to co-develop and launch multilingual Large Language Models (Telco LLM) tailored for telecommunications companies. The JV will receive equal investments from the parties to develop AI solutions enhancing customer interactions and operational efficiencies. These models, available in languages like Korean, English, German, Arabic, and Bahasa, will cater to a global customer base of approximately 1.3 billion across 50 countries. The launch is pending regulatory approvals.

- Launch of Singtel28. Singtel launched Singtel28 (ST28), a new growth plan aimed at enhancing customer experiences and delivering sustained value for shareholders following a successful strategic reset initiated in 2021. This reset focused on transforming the company amidst accelerated digitalisation driven by COVID-19. ST28 builds on this foundation by emphasising business performance improvement and smart capital management. It includes integrating Singtel Singapore and Optus to drive synergies, expanding into growth areas like ICT and data centers with NCS and Nxera, and scaling up Paragon for 5G and edge cloud computing. The plan also prioritises sustainability, divesting non-core assets, and enhancing shareholder returns through a revised dividend policy and capital recycling initiatives. Hence, signaling confidence in Singtel’s future growth and profitability.

- FY24 results review. FY24 net profit dropped 64% YoY to S$795mn due to exceptional loss of S$1.47bn, from impairment charges on goodwill and Optus Enterprise’s fixed network assets. However, excluding these charges, underlying net profit was up 10% YoY to S$2.26bn, showing an increase in regional associate contributions and higher interest income. Singtel also revised its dividend policy and declared a higher total ordinary dividend payout of 15.0Scents for FY24, a 52% YoY increase.

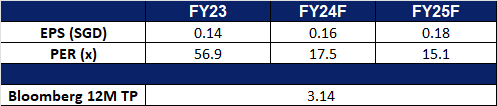

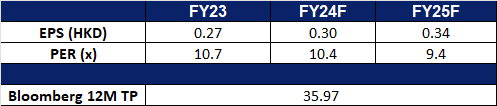

- Market Consensus.

(Source: Bloomberg)

TSH Resources Bhd (TSHRES SP): Palm oil demand to rise

- RE-ITERATE BUY Entry – 0.33 Target– 0.35 Stop Loss – 0.32

- TSH Resources Berhad operates as a holding company. The Company, through its subsidiaries, engages in cultivating, processing, and refining oil palm. TSH Resources serves customers in Malaysia, Singapore, and Spain.

- Palm oil usage in Mala. Malaysia is aiming to boost its palm oil exports by promoting its use in China’s popular mala hotpot, especially during Chinese Premier Li Qiang’s visit to Malaysia. As the world’s second-largest palm oil producer, Malaysia seeks to diversify its market amidst potential EU sanctions over deforestation concerns. China, the second-largest importer of Malaysian palm oil, could significantly increase its demand with nearly 400,000 hotpot restaurants. Malaysia has partnered with Chinese enterprises to integrate palm oil into the hotpot industry, emphasizing its suitability for high-heat cooking. This initiative aligns with Malaysia’s ongoing efforts to promote sustainable palm oil through its Malaysian Sustainable Palm Oil (MSPO) certification, aiming to counter the deforestation narrative and enhance market acceptance in China. The increase in palm oil exports will be beneficial to TSH Resources, boosting its top lines.

Malaysian Crude Palm Oil Spot Price Chart

(Source: Bloomberg)

- Palm oil price. Malaysian palm oil futures rose for the second session in a row despite lower export estimates for June 1-20. The benchmark contract for September delivery increased by MYR37, or 0.94%, closing at MYR3,957 per metric ton. Trading ranged between MYR3,901 and MYR3,966 per metric ton. Estimated exports dropped between 8.1% to 12.9% MoM, according to Intertek Testing Services and AmSpec Agri Malaysia. However, Societe Generale de Surveillance estimated higher exports of 737,717 metric tons for June 1-20, up from 647,353 metric tons in the previous period. In related markets, soyoil prices on the Dalian Commodity Exchange and the Chicago Board of Trade (CBoT) also saw gains. Palm oil prices are influenced by movements in related oils due to their competition in the global market. The continued rise in palm oil prices will also lead to an increase in TSH Resources sales for the year.

- 1Q24 results review. 1Q24 Revenue for the year fell by 3.2% YoY to MYR242.4mn from the previous MYR250.3mn in 1Q23. Net profit fell by 33.6% to MYR25.2mn from MYR37.9mn. Basic EPS fell to 1.45 sen in 1Q24, compared to 2.13 sen in 1Q23.

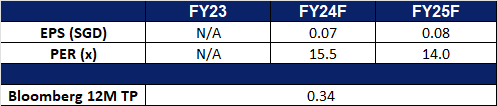

- Market Consensus.

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): Kickstarting the summer holidays

- BUY Entry – 370 Target 410 Stop Loss – 350

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Incoming summer holidays. Tourism levels in China are expected to rise during the upcoming summer holidays. Many airlines, including Air China, plan to increase the number of international flights to meet passenger demand and support China’s global civil aviation market. Sporting events like UEFA Euro 2024 and the Paris 2024 Olympic Games have also sparked interest in summer travel to Europe. YoY growth in flight and hotel booking volumes has been significant in these popular destinations. According to Tongcheng Travel, flight bookings from major Chinese cities to Paris for July have increased by more than 70% YoY, while hotel bookings in Paris for the same period have surged by 150% YoY, highlighting the strong tourism trend for the summer season.

- Heightened interest from visa-free travel. China recently added Australia to its visa-free list, sparking increased interest among Australian tourists in visiting China. Just thirty minutes after the announcement on Monday, Trip.com, China’s largest online travel agency, saw a more than 80% surge in search volumes for China-related keywords from Australian tourists compared to the previous day. With new flights and increased frequencies between China and Australia since the start of the year, travel between the two countries has been on the rise. Trip.com is poised to benefit from the expected increase in travel volume due to the visa-free policy.

- Furthering expansion efforts into APAC. Trip.com Group recently signed a three-year Memorandum of Collaboration with the Malaysia Tourism Board during the ITB China trade show. This agreement aims to extend their existing partnership beyond China into the broader Asia Pacific region. The collaboration will focus on attracting more Chinese and international visitors to Malaysia, emphasizing marketing efforts and promoting key products such as hotels and attractions. This initiative is expected to positively impact Trip.com Group’s revenue.

- 1Q24 results review. Revenue increased 29% YoY to RMB11.9bn in 1Q24, compared with RMB9.2bn in 1Q23. Adjusted net income rose by 26% to RMB4.3bn in 1Q24, compared to RMB3.4bn in 1Q23. Diluted basic earnings per share was RMB6.38 in 1Q24, compared to RMB5.02 in 1Q23.

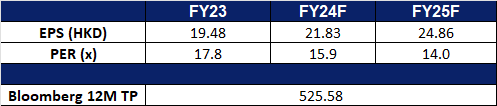

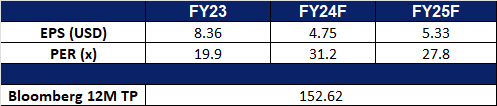

- Market consensus.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): Riding on Summer Seasonality

- RE-ITERATE BUY Entry – 24.4 Target 27.4 Stop Loss – 22.9

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Expectations of a good summer season. Historically, Samsonite’s share price performance has performed well over the summer seasons, especially over the months of July and August, except for 2019 to 2021, which saw the onset of the COVID-19 pandemic. We expect Samsonite’s share price to follow the summer seasonality trend in 2024 as the tourism level has already shown signs of picking up.

Samsonite Seasonal Performance

(Source: Bloomberg)

- Expanding brand presence. Samsonite recently announced a partnership with Lagardère Travel Retail to open a standalone boutique in the new terminal of Zayed International Airport, Abu Dhabi. This boutique is the only dedicated luggage outlet in the airport’s duty-free zone and represents Samsonite’s 13th location in the Middle East. Positioned near the entrance to Pier B in Departures, the store offers a wide range of Samsonite products and provides complimentary personalization services for customers to customize their purchases. This expansion underscores Samsonite’s commitment to enhancing its global brand presence.

- Ramping up sales efforts. Samsonite has recently intensified its sales efforts to boost volume as the summer season begins. This includes offering discounts of up to 30% during the Memorial Day holidays in the U.S. and running significant promotions on e-commerce platforms like Amazon. These sales are designed to attract consumers planning to travel overseas during the summer, and are expected to increase Samsonite’s sales volume for the next quarter.

- 1Q24 results review. Revenue increased 0.9% YoY to US$859.6mn in 1Q24, compared with US$852.1mn in 1Q23. Adjusted Net profit rose by 7.2% to US$87.1mn in 1Q24, compared to US$81.2mn in 1Q23. Adjust basic earnings per share was 6.0 US cents in 1Q24, compared to 5.6 US cents in 1Q23.

- Market consensus.

(Source: Bloomberg)

Airbnb Inc (ABNB US): Tailwinds from the Paris Olympic Games

- RE-ITERATE BUY Entry – 147 Target –165 Stop Loss – 141

- Airbnb, Inc. operates an online marketplace for travel information and booking services. The Company offers lodging, home-stay, and tourism services via websites and mobile applications. Airbnb serves clients worldwide.

- Benefit from the Paris Olympics and the European Cup. The quadrennial Olympic Games will be held in Paris from July to August, with an estimated 3 million visitors expected to arrive in the city. This will boost demand for accommodation and dining in Paris and surrounding cities. Airbnb bookings in Paris have surged by 400%, and bookings in other nearby cities such as Saint-Denis and Chartres have also skyrocketed. The company has previously reached an agreement with the International Olympic Committee to operate short-term rentals in Paris. However, Paris has a cap on the number of short-term rental nights per year at 120. In addition to the upcoming Olympics, the ongoing European Championship is also driving up Airbnb bookings in Europe.

- Summer tourist season. Airbnb’s revenue exhibits pronounced seasonal fluctuations, with peak booking volumes concentrated in July and August. The company’s stock price also demonstrates a similar seasonal pattern.

Share Price Seasonality Chart

(Source: Bloomberg)

- 1Q24 earnings review. Revenue grew by 18% YoY to US$2.14bn, beating estimates by US$80mn. GAAP EPS was US$0.41 beating estimates by US$0.18. 2Q24 revenue is expected to range between US$2.68bn to US$2.74bn vs consensus of US$2.74bn.

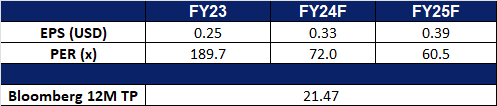

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): Buy the dip opportunity

- RE-ITERATE BUY STOP Entry – 24.0 Target –27.0 Stop Loss – 22.5

- Palantir Technologies Inc. develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Accelerate health outcomes. Palantir Technologies recently announced that it has been awarded a US$19mn, two-year contract by the Advanced Research Projects Agency for Health (ARPA-H) to support the agency’s mission of accelerating better health outcomes. Palantir’s AIP and Foundry software will provide a robust data strategy and infrastructure to enhance ARPA-H’s business operations and enable continuous improvement. The partnership aims to advance high-impact biomedical and health research, leveraging data and AI to drive efficiency and productivity. This contract not only boosts Palantir’s revenue but also enhances its expertise in public health data infrastructure and AI tools.

- New military contract secured. Palantir has secured a US$480mn contract from the U.S. Department of Defense to develop the Maven Smart System, a prototype designed to enhance military data analytics. The contract is expected to be completed by May 2029 and was awarded through a sole bid solicitation. Maven integrates data from various sources to identify military targets and expedite intelligence analysis.

- 1Q24 earnings review. Revenue grew by 20.7% YoY to US$634.33mn, beating estimates by US$16.72mn. GAAP EPS was US$0.08 in-line with estimates. 2Q24 revenue is expected to range between US$649mn to US$653mn vs consensus of US$643.39mn and adjusted income from operations US$209mn to US$213mn. FY24 revenue is expected to be between US$2,677mn to US$2,689mn vs consensus of US$2,680mn.

- Market consensus.

(Source: Bloomberg)

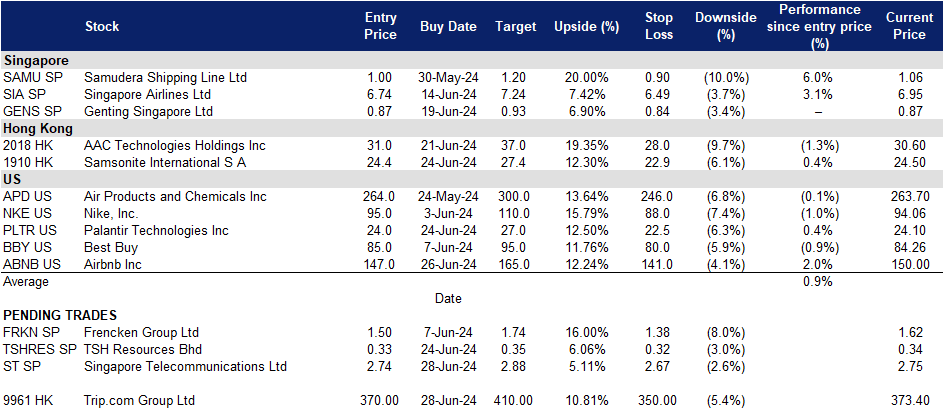

Trading Dashboard Update: Add Airbnb Inc (ABNB US) at US$147 and Best Buy (BBY US) at US$85. Cut loss on Dongfang Electric Corp Ltd (1072 HK) at HK$12.7 and COSCO Shipping Holdings Co Ltd. (1919 HK) at HK$13.6.