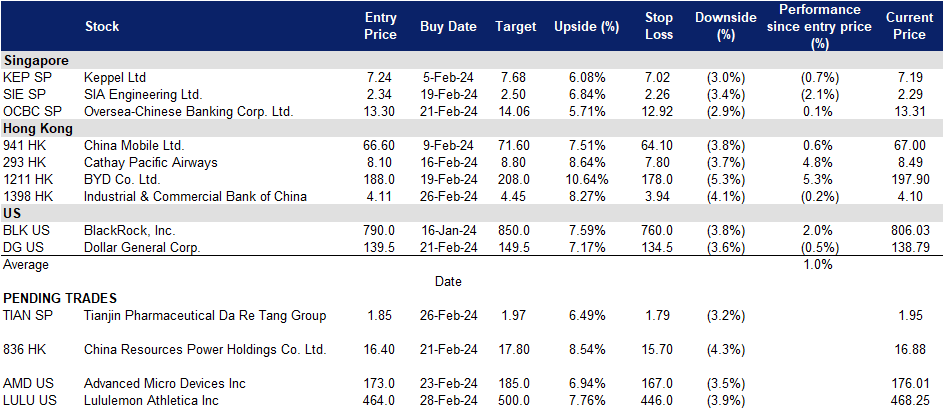

28 February 2024: Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP), Industrial & Commercial Bank of China (1398 HK), Lululemon Athletica Inc (LULU US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

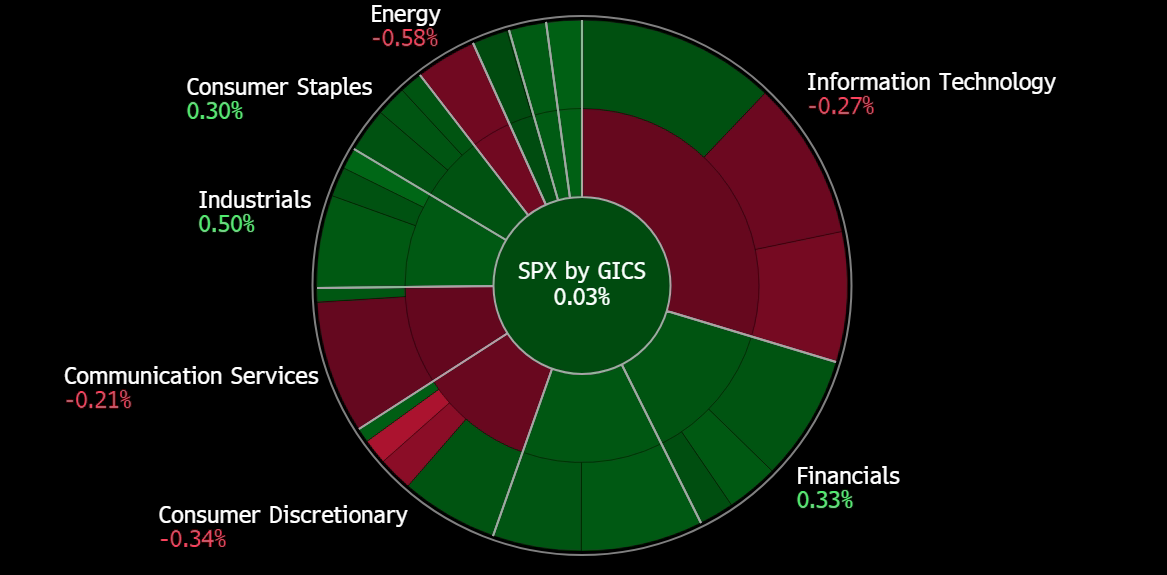

United States

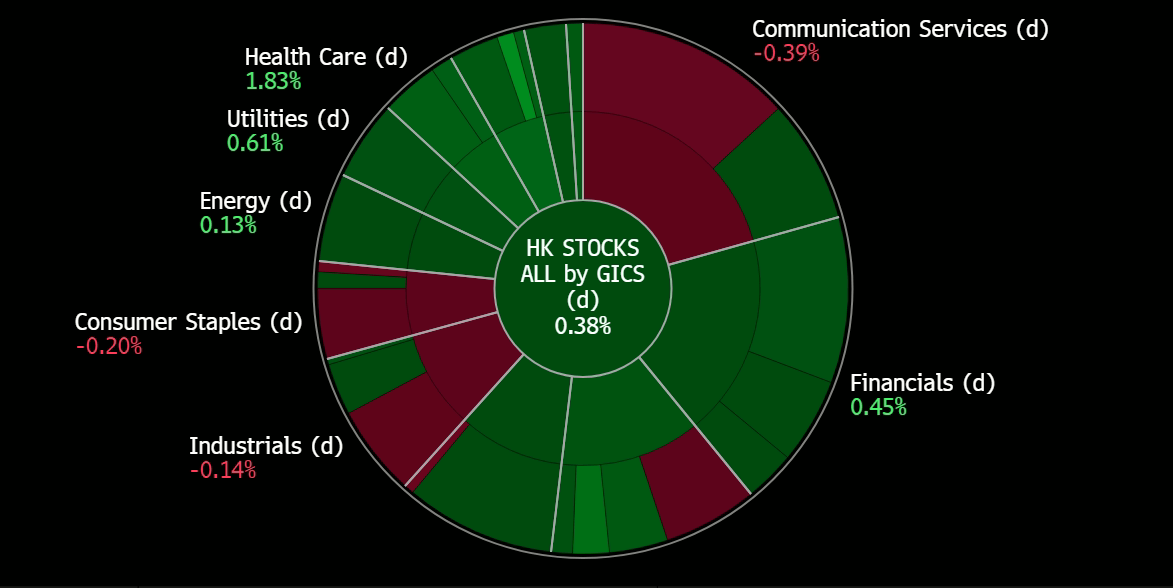

Hong Kong

Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP): Winter viruses on the rise

- RE-ITERATE Entry – 1.85 Target– 1.97 Stop Loss – 1.79

- Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited produces and sells traditional Chinese medicine, western medicine, health products, and healthcare instruments. The Company also manufactures gene-related biopharmaceutical products. Tianjin Pharmaceutical Da Ren Tang Group markets its products under the Great Wall, Cypress, and Health brand names.

- Increase in winter respiratory diseases. China’s National Healthcare Security Administration (NHSA) has urged drug suppliers to address shortages of imported medications used to treat respiratory diseases and influenza. The demand comes after doctors complained of a scarcity of drugs amid a surge in infectious diseases caused by various pathogens. Azithromycin, an antibiotic in high demand due to overuse and misuse, is among the medications facing shortages. The NHSA plans to intensify inspections to ensure timely distribution of these drugs and encourages healthcare institutions to report any shortages. Despite assurances that generic drugs are as effective as imported ones, consumers often prefer imported antibiotics, prompting China to conduct large-scale clinical trials to bolster confidence in generic medications. With Tianjin Pharmaceutical Da Re Tang Group offering a diverse range of over 800 medicinal products across more than 20 formulations, the increased demand for respiratory medications due to the surge in respiratory diseases could potentially bolster sales for similar products experiencing shortages domestically.

- Extreme cold temperatures. Severe weather warnings were issued across China as temperatures dropped sharply, with Beijing experiencing snowy conditions. An orange alert was renewed, indicating a significant temperature drop, particularly in the south, where temperatures could fall by up to 12 degrees Celsius. China has a three-tier, color-coded weather warning system for cold waves, with orange representing the most severe weather, followed by yellow and blue. The National Meteorological Centre (NMC) urged precautionary measures and protection of crops and aquatic products. The NMC has called on local governments to take precautions against the cold weather, advised the public to keep warm, and urged measures to protect crops and aquatic products. With winter intensifying and prolonged cold spells, typically associated with heightened respiratory virus cases, residents may increasingly seek medicines and health supplements to endure the harsh conditions.

- 3Q23 business updates. Total revenue declined by 5% YoY to RMB$1,705mn. 9M23 revenue increased by 4% YoY to RMB$5,793mn.

- Market Consensus.

(Source: Bloomberg)

Oversea-Chinese Banking Corp Ltd (OCBC SP): Seizing growth opportunities

Oversea-Chinese Banking Corp Ltd (OCBC SP): Seizing growth opportunities

- RE-ITEREATE Entry – 13.30 Target– 14.06 Stop Loss – 12.92

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Targeting regional growth. OCBC Bank plans to capitalise on China’s uncertain economic recovery by expanding its transaction banking business, particularly in Southeast Asia. The bank aims to increase its focus on Greater China and Asean markets, with Hong Kong and mainland China showing significant growth potential. To achieve this, OCBC plans to invest over S$50mn in its transaction banking capabilities in Greater China. Additionally, the bank aims to engage Chinese companies in Singapore and Hong Kong, facilitating their expansion into markets like Malaysia, Indonesia, Thailand, and Vietnam. OCBC also emphasized digital transformation, focusing on instant cross-border payments and exploring the use of digital currencies for payments and trade. The bank sees digitalization as crucial for capturing more business, as shown by the increasing adoption of digital solutions by trade finance customers and the growth of its OneCollect platform for QR code payments. OCBC has also been piloting the use of digital currencies, such as China’s central bank digital currency, and expanding its instant cross-border payment initiatives.

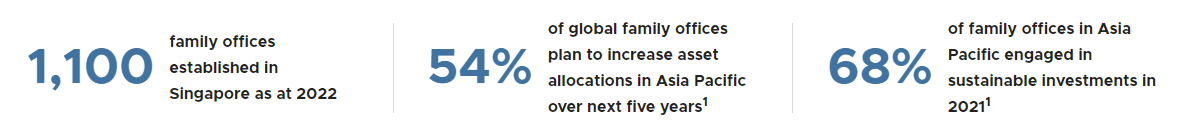

Singapore family office statistics

(Source: Singapore Economic Development Board)

- Attractive to multi-generational wealth. The Henley & Partners global ranking positions Singapore as the third most attractive destination for families seeking opportunities for the next generation, trailing only Switzerland and the United States. Singapore’s strong showing can be attributed to its robust economy, top-tier employment opportunities, and impressive economic mobility. The study emphasizes Singapore’s commitment to cutting-edge development across diverse sectors and its “skills-first” approach in the competitive job market, offering a significant advantage to recent graduates. While Switzerland takes the top spot due to its exceptional earning potential, career advancement opportunities, and low unemployment rate, the United States shines in terms of top-tier employment prospects and earning potential. Drawn by these advantages, affluent families have increasingly chosen Singapore as their new home, entrusting their wealth to established wealth management firms or setting up their own family offices here. This trend shows no signs of slowing down, and Singapore is well-positioned to continue attracting more affluent families seeking stability and growth for their futures. With more positive inflows of net new money in the country, OCBC will benefit from the continued influx of new clients under the group’s wealth management business unit.

- Doubled SME sustainable funding. OCBC Bank significantly increased its sustainable financing for small and medium-sized enterprises (SMEs) in 2023, doubling the amount from the previous year to over S$7bn provided to more than 1,200 companies across Southeast Asia. The bank’s SME Sustainable Finance Framework, initiated in 2020, aims to simplify and reduce the cost for SMEs to access sustainable financing. Over 80% of the SMEs that utilised the bank’s sustainable financing in 2023 were from sectors like built environment, clean transportation, energy efficiency, and renewable energy. OCBC also assisted larger and mid-sized corporates in manufacturing, logistics, and technology to become pioneers in sustainable transformation, hoping to inspire others. The motivation for SMEs to adopt sustainable financing is driven by the desire to future-proof their businesses and meet the increasing demand for sustainability from customers and stakeholders, rather than financial incentives. In 2024, OCBC aims to empower even more companies to become sustainability pioneers, offering them access to financing solutions while creating a positive impact on the environment. This approach benefits both borrowers through growth opportunities and the bank through sustainable practices and potential interest income.

OCBC share price and USD/SGD comparison

(Source: Bloomberg)

- Benefit from rates staying higher for longer. Singapore banks are poised to benefit from the extended period of higher interest rates. The recent rise in Singapore’s T-bill yield to 3.66%, reflecting strong global economic signals, indicates a potential delay in Federal Reserve rate cuts. While demand for T-bills dipped slightly, it remained substantial, suggesting sustained upward pressure on rates. Although future rate cuts are expected, the current high yields suggest a longer period of elevated rates. This could lead to wider interest margins and potentially boost profitability for OCBC.

- 3Q23 earnings. The company’s total income for the period was S$3.43bn rising 13% YoY driven by higher net interest income and growth in non-interest income. The company’s net profit rose to S$1.81bn, +21% YoY compared to S$1.49bn in 3Q22. EPS rose to S$1.58 on an annualised basis. The group’s wealth management income grew 16% YoY to S$1.12bn, making up 33% of the Group’s income in 3Q23. Its wealth management assets under management increased 8% YoY to S$270bn, driven by positive inflows of net new money.

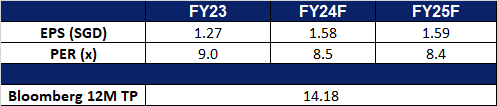

- Market Consensus.

(Source: Bloomberg)

Industrial & Commercial Bank of China (1398 HK): Increasing business confidence

- RE-ITERATE BUY Entry – 4.11 Target – 4.45 Stop Loss – 3.94

- Industrial and Commercial Bank of China Ltd is a China-based company principally engaged in the provision of banking and related financial services. The Bank mainly operates three segments, including Corporate Banking segment, Personal Banking segment and Treasury segment. The Corporate Banking segment provides loan, trade financing, deposit, corporate finance, custody and other related financial products and services to enterprises, government agencies and financial institutions. The Personal Banking segment provides loan, deposit, bank card, personal finance and other related financial products and services to individual customers. Treasury segment includes money markets business, securities investment business, self and valet foreign exchange trading and derivative financial instruments business. The Company conducts its businesses within domestic and overseas markets.

- Lowering loan prime rate. In an effort to stimulate economic growth in a sluggish consumption environment, the People’s Bank of China (PBoC) decreased China’s five-year loan prime rate (LPR) by 25 basis points, from 4.2% to 3.95%. This comes with the aim of reducing financial costs to shore up credit and property market. This move not only aims to improve the banks’ profitability but also paves the way for the People’s Bank of China to decrease other interest rates. As a result, China’s banks can stabilize their Net Interest Margins and sustain their lending capacity, thereby providing crucial support to the economy.

- Encouraging spending to stimulate growth. Reducing interest rates provides businesses with a stronger incentive to pursue loans, while a decline in deposit rates raises the expense for individuals holding savings in banks. This interplay fosters increased spending, consequently fueling economic growth. This ripple effect positively affects banks by generating more lending opportunities and broadening their customer base. A surge in loan demand could potentially elevate the volume of loans issued by banks, contributing to an overall income boost. Moreover, the enhanced consumption across China facilitates further economic recovery, particularly after a sluggish performance in the first half of 2023.

- Laws boosting business confidence. China has recently announced the initiation of drafting a law aimed at fostering the development of the private sector economy, with the goal of revitalizing confidence and promoting innovation. This legislation will address key issues concerning private companies, such as safeguarding property rights, ensuring entrepreneurs’ interests, and handling missed payments for small- and medium-sized enterprises. The primary objectives of the law include maintaining stable and consistent policy implementation, encouraging business innovation, and enforcing equitable treatment of state-owned and private companies. This initiative is poised to enhance the business confidence of private enterprises, potentially leading to an increased demand for loans as these companies seek to expand and grow their operations.

- 3Q23 earnings. Operating income fell 6.61% YoY to RMB194.6bn in 3Q23, compared with RMB208.4bn in 3Q22. Net profit rose 0.03% to RMB94.93bn in 3Q23, compared to RMB94.90bn in 3Q22. Basic earnings per share was RMB0.24 in 3Q23, same compared to in 3Q22.

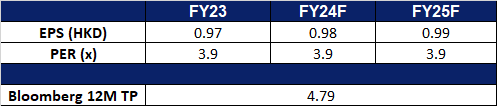

- Market consensus.

(Source: Bloomberg)

China Resources Power Holdings Co. Ltd. (836 HK): A freezing winter

- RE-ITEREATE BUY Entry – 16.40 Target – 17.80 Stop Loss – 15.70

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Incoming cold wave. China’s national observatory recently renewed an orange alert, the second-highest in the country’s four-tier weather warning system, for cold waves in various areas, forecasting plunging temperatures. The cold wave is set to bring a significant temperature decline to central and eastern China, progressing towards the east and south. Following the eight-day Spring Festival holiday, northern China witnessed strong winds, widespread sandstorms, dramatic temperature drops, and rainy and snowy conditions. Temperatures in the north plummeted, with certain areas experiencing declines exceeding 20 degrees Celsius. Throughout this week, central and eastern China can expect more widespread rainy, snowy, and freezing weather, coupled with noticeable temperature fluctuations. The imminent cold wave is likely to prompt increased electricity consumption as individuals opt to stay home, seeking warmth amid the freezing conditions.

- Long-Term green power purchase agreement with Merck. China Resources Power has revealed its intention to engage in a long-term power purchase agreement with Merck. Under this agreement, Merck China will substantially enhance its utilization of green electricity in production and operations, aiming to achieve a 60% usage and reduce Scope 2 carbon emissions by 185,000 tonnes. This initiative aligns with Merck’s broader objective of raising its global procurement of electricity from renewable sources to 80% by 2030 and achieving climate neutrality by 2040. The ten-year power purchase agreement with Merck guarantees life-cycle traceability of a total of 300 GWh of green power.

- Coal Prices. The decline in global coal prices is expected to have significant benefits for the company’s coal-fired power plants and gas-fired power plants. With prices at a 2-year low around $130 per tonne, lower fuel costs for coal-fired power plants translate into improved profitability and a competitive advantage in the market. While China Resources Powers does have its own coal production plants, energy consumption during the current winter period typically skyrockets for China, this means that the company will be required to buy coal from other suppliers to further supplement its energy production and will therefore benefit from the lower prices. The declining prices also create opportunities for the company’s gas-fired power plants, as natural gas becomes a more cost-effective alternative. This diversification and cost advantage contribute to improved financial performance, market competitiveness, and the ability to offer competitive electricity prices to consumers. Overall, the decline in coal prices presents favourable conditions for the company’s power generation operations, enhancing profitability and sustainability.

Thermal Coal Price

(Source: Bloomberg)

- 1H23 earnings. Revenue rose 2.13% YoY to HK$51.5bn in 1H23, compared with with HK$50.4bn in 1H22. Net profit rose 61.8% to HK$7,08bn in 1H23, compared to HK$4.37bn in 1H22. Basic earnings per share was HK$1.40 in 1H23, compared to HK$0.91 in 1H22.

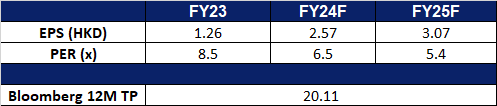

- Market consensus.

(Source: Bloomberg)

Lululemon Athletica Inc (LULU US): Working towards its sustainable targets

- BUY Entry – 464 Target – 500 Stop Loss – 446

- Lululemon Athletica Inc. designs and retails athletic clothing products. The Company produces fitness pants, shorts, tops and jackets for yoga, dance, running, and general fitness. Lululemon Athletica serves customers worldwide.

- Breakthrough in recycling. On 21 February, Lululemon and Samsara Eco, an Australian enviro-tech startup, introduced the world’s first enzymatically recycled nylon 6,6 product, showcasing a breakthrough in textile waste recycling. The samples, including Lululemon’s Swiftly Tech long-sleeve top, signify a milestone in creating a circular ecosystem in the fashion industry. Nylon 6,6, notoriously difficult to recycle, is now being extracted from end-of-life textiles, offering the potential for infinite clothing lifespans. Samsara Eco’s technology reduces emissions compared to virgin nylon production and has the potential to save millions of tonnes of CO2 annually. Over 90% of nylon in the samples is produced through Samsara’s recycling process, maintaining Lululemon’s quality standards. This collaboration aligns with Lululemon’s goal to make products with preferred materials and end-of-use solutions by 2030. Such partnerships not only drive Lululemon’s sustainability agenda forward through innovative practices but also mark a broader transition towards circular models across various industries.

- Footwear offerings expansion. Lululemon recently launched its inaugural men’s footwear line, including a casual sneaker named “cityverse” and will launch its new running shoe models, beyondfeel and beyondfeel trail in March and May respectively. This move aligns with the company’s strategy to double its men’s business and achieve US$12.5bn in revenue by 2026. While the footwear expansion marks a pivotal growth pillar, Lululemon remains primarily focused on its core apparel business. The launch comes amid a slower growth rate and heightened competition from established players like Nike and emerging brands like On Running. This will allow Lululemon to leverage innovation and its strong brand identity to differentiate itself in the increasingly competitive athletic apparel market.

- 3Q23 earnings review. Revenue rose by 18.3% YoY to US$2.2bn, beating estimates by US$10mn. Non-GAAP EPS was US$2.53 beat estimates by $0.25. For 4Q23, the company expects net revenue to be in the range of US$3.135bn to US$3.170bn. For FY23, it expects net revenue to be in the range of US$9.549bn to US$9.584bn.

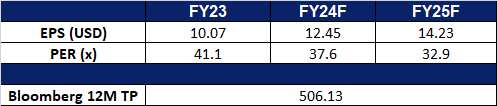

- Market consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): Riding the bull wave

- RE-ITEREATE BUY Entry – 173 Target – 185 Stop Loss – 167

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- AI and semiconductors play follow the leader. Following Nvidia’s earnings beat, there was a surge in artificial intelligence and semiconductor stocks. Nvidia’s supplier, Taiwan Semiconductor Manufacturing Company and Super Micro Computer, a server component supplier, experienced an increase in share prices. ASML, which supplies critical equipment to TSMC, also saw a surge. Rivals like Advanced Micro Devices and Arm Holdings also experienced significant gains. Nvidia’s success is attributed to its custom AI chip designs, which have driven demand from tech giants like Amazon and Microsoft. South Korean memory chipmakers Samsung Electronics and SK Hynix also saw gains. Additionally, Taiwanese semiconductor firms Orient Semiconductor Electronics and MediaTek rose in value. US chip makers Intel, Broadcom, and Qualcomm also saw increases in share prices. Nvidia’s CEO expressed optimism about continued growth, especially fuelled by demand for GPUs in AI and industry-wide shifts toward accelerators. Nvidia’s strong performance has also positively impacted the shares of large computing companies such as Amazon, Microsoft, and Alphabet.

- Expanded AI offering for machine learning. AMD has announced the expansion of its ML development offering with ROCm 6.0, which will support its Radeon PRO W7800 and Radeon RX 7900 GRE GPUs. This expansion aims to broaden access to desktop graphics cards for AI researchers. Additionally, AMD has introduced ONNX Runtime support, enabling inference on a wider range of source data. Mixed precision with FP32/FP16 is brought to ML training workflows with PyTorch framework support. These advancements aim to make AI development more accessible and affordable, demonstrating AMD’s commitment to broadening hardware support and enhancing the Machine Learning Development solution stack.

- Stronger support for ROCm. AMD unveiled a new blog platform dedicated to ROCm software, designed to showcase achievements, improvements, and ecosystem updates. The platform aims to offer a centralized space for ROCm-related content, delivering exciting news and developments in the future. The establishment of a dedicated community focused solely on the benefits of the ROCm system will help AMD strengthen brand loyalty, encourage collaboration, and gather valuable feedback for further improvements and innovations in their products and services. This initiative would enhance AMD’s customer satisfaction as well as maintain its competitive edge in the market.

- Delivered strong full-year results. In FY23, AMD saw strong performance, particularly in its Data Center and Client segments, driven by increased sales despite mixed demand. Record revenue was achieved, with notable growth in Q4 attributed to Instinct AI accelerators and EPYC server CPUs. Despite a 4% annual revenue decline to $22.7bn, Data Center and Embedded segments grew significantly, comprising over 50% of total revenue. Data Center revenue surged by 38% YoY, fuelled by EPYC CPUs and GPUs. Cloud sales increased, while Enterprise sector sales accelerated. AMD’s upcoming Turin EPYC Processors are highly anticipated. Data Center GPU revenue surpassed expectations, driven by MI300X. Partnerships with cloud providers and server vendors are progressing well. In the PC market, Ryzen 8000 series processors and AI-driven G-series processors were launched. Gaming segment revenue declined, but Gaming Graphics revenue grew. The Embedded segment saw a revenue decrease due to inventory reductions. Looking ahead, AMD expects strong growth in Data Center and Client segments, with continued focus on expanding its AI capabilities.

- 4Q23 earnings review. Revenue rose by 10.7% YoY to US$6.2bn, beating estimates by US$60.0mn. Non-GAAP EPS was US$0.77 in-line with estimates. For 1Q24, AMD expects revenue to be approximately US$5.4bn vs consensus of US$5.7bn, plus or minus US$300mn. Non-GAAP gross margin expected to be approximately 52%.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Industrial & Commercial Bank of China (1398 HK) at HK$4.11.