27 September 2024: Centurion Corp Ltd (CENT SP), CSC Financial Co Ltd (6066 HK), Tesla Inc (TSLA US)

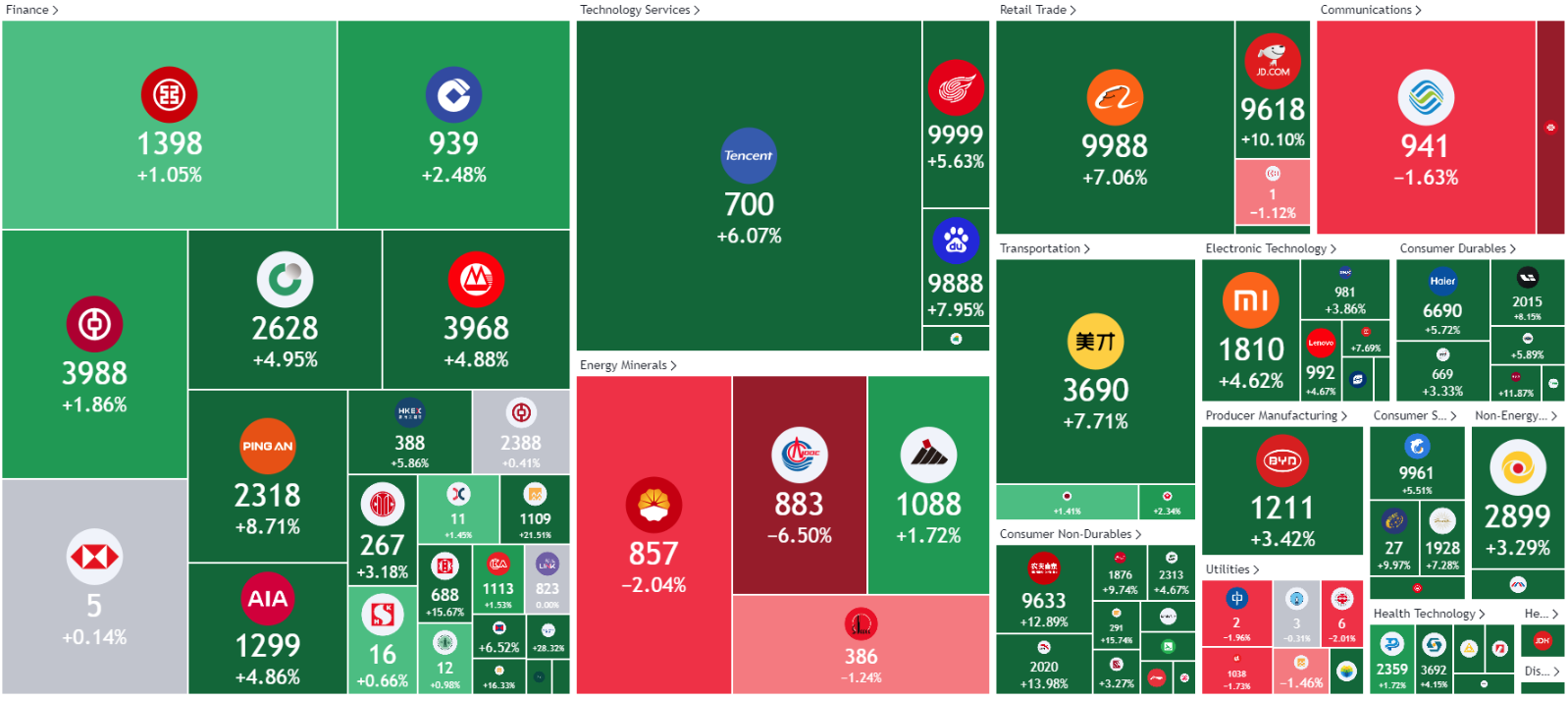

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Centurion Corp Ltd (CENT SP): Strong revenue growth and strategic expansion

- BUY Entry – 0.780 Target– 0.850 Stop Loss – 0.745

- Centurion Corporation Limited specialises in owning and operating worker and student accommodation assets. It ranks among Singapore’s largest owner-operators of high-quality worker accommodations in Singapore and Malaysia. Additionally, the company manages student accommodation properties across Singapore, Australia, the United Kingdom, and the United States.

- Stronger than anticipated revenue growth. Centurion Corporation reported a 27% YoY growth in total revenue for 1H24, increasing from S$97.9mn to S$124.4mn. This robust performance was driven by high financial occupancy in key markets like Singapore, the UK, and Australia, along with positive rental revisions across all regions. The total asset under management reached S$2.1bn with 66,495 operational beds across 32 properties in 14 cities globally.

- Inorganic growth through geographical expansion. Centurion entered China’s Purpose-Built Student Accommodation (PBSA) market with two master-leased properties in Kowloon, Hong Kong. These properties will be refurbished to cater to students, with operations expected by September 2024. Additionally, Centurion has secured a third master lease for a larger Purpose-Built Workers Accommodation (PBWA) in the New Territories, expected to open in November 2024.

- Continued organic growth of portfolio. Centurion is positioned for continued revenue growth through its strategic expansion into high-growth regions and its solid portfolio of existing properties. The planned addition of 3,275 new beds in 2H24 and the additional 17,095 beds in the potential future will further bolster financial performance. The company is well-prepared to meet regulatory requirements while maintaining high occupancy rates. Anticipated interest rate reductions will further enhance profitability. Centurion is pursuing scalable growth through partnerships, investment funds, and fee-based management services, which include selective acquisitions, optimizing assets, and expanding revenue streams through specialized management services.

- 1H24 results review. Revenue for 1H24 increased by 27% YoY to S$124.4mn, compared to S$97.9mn in 1H23, which reached 95% for PBWA and 98% for PBSA, compared to 96% and 89%, respectively, in 1H23. Although there was a slight decline in PBWA occupancy due to capacity expansions in Malaysia, this was offset by improved rental rates across all regions. Interim dividend per ordinary share rose to 1.5 Scents, from 1.0 Scents in 1H23.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.85. Please read the full report here.

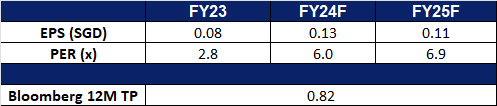

- Market Consensus.

(Source: Bloomberg)

OUE REIT (OUEREIT SP): 50bps rate cut not priced in yet

- RE-ITERATE BUY Entry – 0.320 Target– 0.350 Stop Loss – 0.305

- OUE Real Estate Investment Trust (OUE REIT) provides real estate investment services. The Company invests in income-producing real estate used primarily for retail, hospitality, and office purposes in financial and business hubs, as well as real estate-related assets. OUE REIT serves customers in Singapore and China.

- Beginning of US Federal Interest rate cuts. The recent US Federal Reserve cut interest rates by 0.5%, aimed at combating slowing inflation and maintaining labour market strength. Projections suggest further rate cuts through 2026, with the benchmark rate expected to fall to 2.75% to 3%. While inflation risks remain, the Fed is prepared to adjust policy as needed to maintain stable prices and maximum employment. The rate cuts are expected to benefit OUE REIT by reducing borrowing costs, enhancing financial flexibility, and aligning with the REIT’s growth strategy for increased profitability in the coming quarters.

- Refinancing at a lower rate. On 19 September, OUE REIT announced that it priced S$180mn in fixed-rate green notes, due in 2031, at an interest rate of 3.9%. The notes fall under OUE REIT’s S$2bn multicurrency debt issuance programme and are expected to be issued on 26 September 2024, with a maturity date of 26 September 2031. Rated “BBB-” by S&P Global Ratings, the net proceeds will be used to finance or refinance eligible green projects under the REIT’s green financing framework. OCBC serves as the sole global coordinator, with DBS and OCBC acting as joint lead managers and bookrunners. Despite the recent rate cuts by the US Federal Reserve, OUE REIT managed to secure a competitive rate of 3.9% for the loan, which is lower than current market rates. This favourable pricing reflects investor confidence in OUE REIT’s financial stability and strengthens its ability to drive profitability through lower financing costs while supporting its sustainability initiatives.

- Growth in rental reversion. Despite a market slowdown, OUE REIT’s management maintained a high committed occupancy rate of 95.2% for its Singapore office portfolio, with an average passing rent of S$10.57 per sq ft, marking a 0.7% QoQ increase. The REIT achieved rental reversion growth of 11.7%, supported by proactive lease renewal strategies that kept the weighted average lease expiry (WALE) at a comfortable 2.2 years by net lettable area (NLA) and 2.1 years by gross rental income (GRI). Enhancements to the tenant mix have further bolstered portfolio performance.

- 1H24 results review. Revenue for 1H24 increased by 5.7% YoY to S$146.7mn, compared to S$138.8mn in 1H23. Net property income rose by 1.6% YoY to S$117.1mn in 1H24, compared to S$115.3mn in 1H23, mainly driven by the recovery of Singapore’s tourism sector, benefiting the hospitality segment. However, due to the change in base management fees to be fully paid in cash, distribution per unit (DPU) declined by 11.4% YoY to 0.93 Scents, from 1.05 Scents in 1H23.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.309. Please read the full report here.

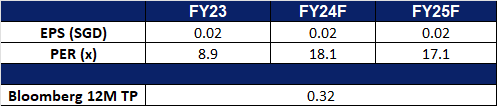

- Market Consensus.

(Source: Bloomberg)

CSC Financial Co Ltd (6066 HK): Resuscitating the economy

- Entry – 6.60 Target 7.40 Stop Loss – 6.20

- China Securities Co., Ltd. is mainly engaged in securities brokerage, securities investment consulting, financial advisers related to securities trading and securities investment activities, securities underwriting and sponsor, securities self-management, securities asset management, securities investment fund agent distribution, providing futures companies with medium introduction services, margin financing, financial products agent distribution, insurances facultative agent, stock options market making, securities investment fund trusteeship and precious metal products sales businesses.

- Unveiling stimulus to boost economy. China has announced a series of rate cuts aimed at stimulating economic growth, with a commitment to enhancing both consumption and investment. As part of these efforts, the People’s Bank of China reduced interest rates on existing mortgages by 0.5 percentage points and lowered the reserve requirements for banks, enabling increased lending. The stimulus package also includes relaxed restrictions on borrowing for stock market investments and a reduction in the minimum down payment for second homes from 25% to 15%. These actions represent some of the most significant economic measures China has introduced in recent years to revive its sluggish economy.

- More liquidity injected into the stock market. China has also announced a reduction in the reserve requirement ratio (RRR), which determines the amount of cash banks must hold in reserve. This move is expected to inject approximately one trillion yuan of “long-term liquidity” into the financial market. Additionally, the government will introduce a “swap program,” allowing companies to obtain liquidity directly from the central bank. This initiative, with an initial scale of 500 billion yuan and potential future expansions, is expected to significantly improve firms’ access to capital for stock purchases. The anticipated increase in market liquidity is likely to boost investor sentiment, benefiting firms like CSC Financials.

- Benefitting from a lower interest rates. The lowering of Hong Kong’s interest rate by 50 basis points to 5.25% recently, mirroring the U.S. Federal Reserve’s move. This rate cut is expected to boost business confidence and stimulate consumer spending in Hong Kong. Lower rates are also likely to encourage a shift of funds from safe assets into the stock market, enhancing market liquidity and trading volumes. The recent recovery of the Hang Seng Index, which is now trading at a 52-week high, around the 20,000 level is bound to improve investor sentiments, further driving fund flows in the Hong Kong stock market. CSC Financial is well-positioned to benefit from the increased liquidity and volume of the stock market.

- 1H24 earnings. Total revenue fell by 20.5% YoY to RMB14.8bn in 1H24, compared to RMB18.7bn in 1H23. Net profit fell by 33.6% YoY to RMB2.86bn in 1H24, compared to RMB4.32bn in 1H23. Basic earnings per share was RMB0.30 in 1H24, compared to RMB0.49 in 1H23.

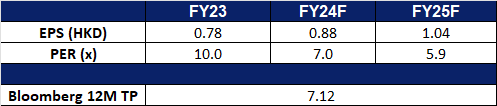

- Market consensus.

(Source: Bloomberg)

Hong Kong Exchanges and Clearing Ltd (388 HK): Expecting more fund inflows

- BUY Entry – 275 Target 305 Stop Loss – 260

- Hong Kong Exchanges and Clearing Limited (HKEX) is principally engaged in the operation of stock exchanges. The Company operates through five business segments. The Cash segment includes various equity products traded on the Cash Market platforms, the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Equity and Financial Derivatives segment includes derivatives products traded on Hong Kong Futures Exchange Limited (HKFE) and the Stock Exchange of Hong Kong Limited (SEHK) and other related activities. The Commodities segment includes the operations of the London Metal Exchange (LME). The Clearing segment includes the operations of various clearing houses, such as Hong Kong Securities Clearing Company Limited, the SEHK Options Clearing House Limited, HKFE Clearing Corporation Limited, over the counter (OTC) Clearing Hong Kong Limited and LME Clear Limited. The Platform and Infrastructure segment provides users with access to the platform and infrastructure of the Company.

- Lower interest rates to drive fund flow. Hong Kong’s central bank lowered its interest rate by 50 basis points to 5.25% yesterday, mirroring the U.S. Federal Reserve’s move. This rate cut is expected to boost business confidence and stimulate consumer spending in Hong Kong. Lower rates are also likely to encourage a shift of funds from safe assets into the stock market, enhancing market liquidity and trading volumes. As a result, HKEX is well-positioned to benefit from increased capital inflows into the stock market.

- To benefit from increasing IPO activities. Hong Kong’s IPO market is poised for growth, with positive signals suggesting more mega deals on the horizon. According to Chan, CEO of HKEX, the market expects increased IPO activity and sustained momentum. Medea’s recent IPO on the HKEX raised HK$31.01 billion, marking the city’s largest listing in over three years. So far this year, Hong Kong has raised approximately HK$51 billion through 45 IPOs and is expected to see continued robust activity through year-end. Alongside IPOs, the city’s secondary fundraising market is also gaining traction, with over US$20 billion raised through follow-on offerings to date. This surge in IPO and fundraising activity is set to significantly benefit HKEX.

- 1H24 earnings. Revenue rose marginally by 0.4% YoY to HK$10.6bn in 1H24, compared to HK$10.8bn in 1H23. Net profit fell by 3.0% YoY to HK$6.12bn in 1H24, from HK6.31bn in 1H23. Basic and diluted earnings per share was HK$4.84 in 1H24, compared to HK$4.99 in 1H23.

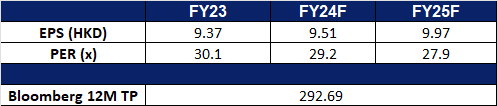

- Market consensus.

(Source: Bloomberg)

Tesla Inc (TSLA US): Robocars unite

- BUY Entry – 255 Target – 280 Stop Loss – 242

- Tesla Inc. operates as a multinational automotive and clean energy company. The Company designs and manufactures electric vehicles, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla owns its sales and service network and sells electric power train components to other automobile manufacturers.

- High expectations for Q3 deliveries. On 2 October, Tesla is expected to announce its third-quarter delivery numbers. The company is expected to have a strong third quarter in China, potentially marking its best quarter ever there, prompting analysts to raise their delivery forecasts for the electric vehicle maker. Wall Street now anticipates Tesla delivering around 462,000 to 480,000 vehicles in Q3, with the average estimate at 462,000. This surge in China sales comes at a critical time, helping to offset weaker demand in the US and Europe. While Tesla’s core business is facing competitive pressures and high borrowing costs, the recent cut in interest rate and stimulus support from governments would help strengthen the demand for big-ticket purchases like cars, which would further improve sales. Furthermore, the upcoming “Robotaxi Day” event, where Tesla will unveil its self-driving technology, could further boost investor confidence.

- “We, Robot”, robotaxi event. Invitations for the Tesla Robotaxi reveal event have been sent out and is set to happen on 10 October this year. Anticipation has risen due to speculation that the Robotaxi will have reached full autonomy alongside the rollout of full self-driving (FSD) 13, which is an improved version of its current supervised automated driving suite. The FSD 13 release is expected to introduce automated reverse parking and reduce the number of interventions per mile driven on FSD. Furthermore, the CEO of Tesla, Elon Musk, had announced on social media that once its unsupervised full-self-driving robotaxi service begins operations, busses would no longer be needed, and it would be similarly priced to a bus ticket. Additionally, he also mentioned that the robotaxis would function like a combination of Airbnb and Uber, with a certain portion of the fleet being owned by Tesla alongside individual Tesla customers for additional income, and the rides can be called via the mobile app. This initiative to develop fully autonomous vehicles using FSD technology will give it an edge over its EV competitors while positing it in the AI race.

- 2Q24 earnings review. Revenue increased by 2.3% YoY to US$25.5bn, exceeding expectations by US$760mn. Non-GAAP earnings per share were US$0.52, missing expectations by US$0.10.

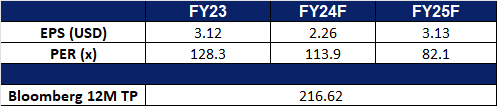

- Market consensus.

(Source: Bloomberg)

Moody’s Corp (MCO US): Bond market recovery

Moody’s Corp (MCO US): Bond market recovery

- RE-ITERATE BUY Entry – 490 Target – 550 Stop Loss – 460

- Moody’s Corporation is a credit rating, research, and risk analysis firm. The Company provides credit ratings and related research, data and analytical tools, quantitative credit risk measures, risk scoring software, and credit portfolio management solutions and securities pricing software and valuation models.

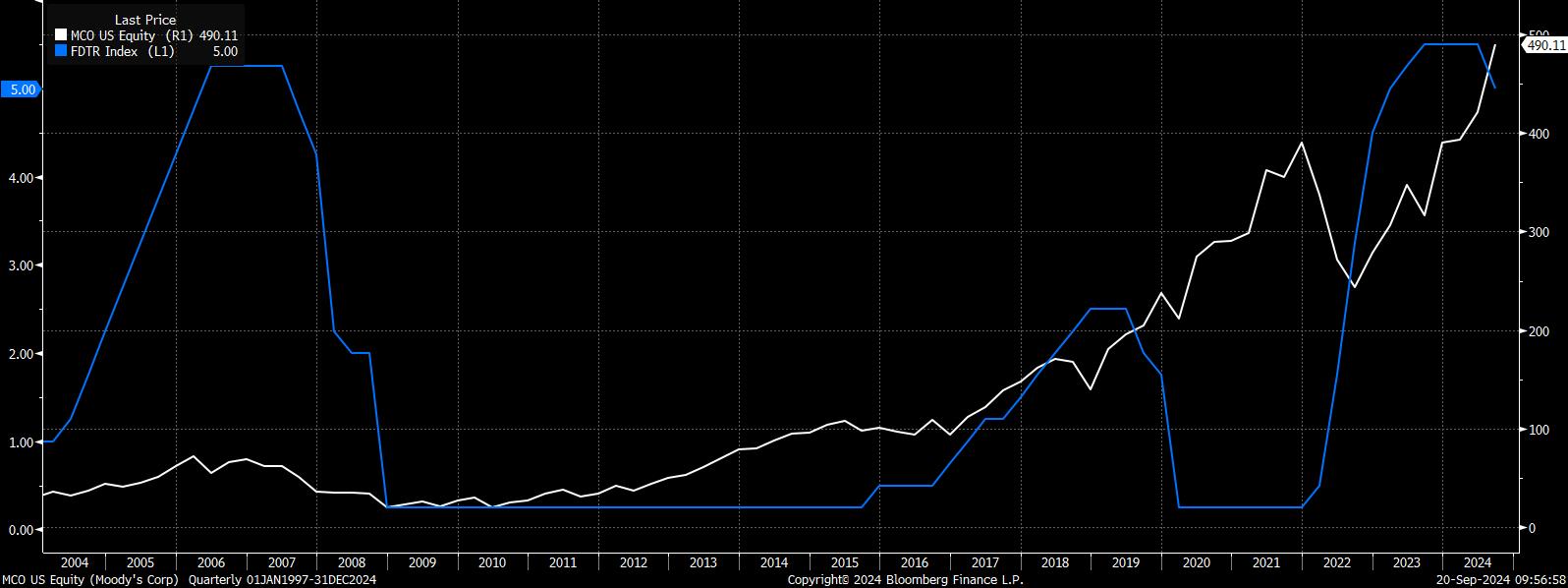

- During the interest rate cut cycle, the bond market recovers. The global bond market has experienced a bear market for more than two years due to the high-interest rate environment. As central banks around the world start their interest rate cut cycle, bond prices gradually recover. In the rising cycle, government and corporate bond issuance and market demand increase simultaneously, thereby increasing Moody’s ratings business revenue.

Company share price and Fed Fund rate cycle

(Source: Bloomberg)

- Funds rotated from defensive sectors to cyclical sectors. As the Federal Reserve begins to cut interest rates, the market expects interest rate cuts to reach 200 basis points in the next year. Some funds began to rotate from defensive stocks to cyclical stocks. Moody’s business has strong cyclical attributes, especially during periods of cyclical changes in interest rates

- 2Q24 earnings review. Revenue increased by 20.8% year-on-year to US$1.8 billion, exceeding expectations by US$80 million. Non-GAAP earnings per share were US$3.28, exceeding expectations by US$0.26.

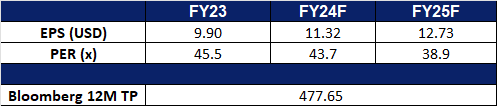

- Market consensus.

(Source: Bloomberg)

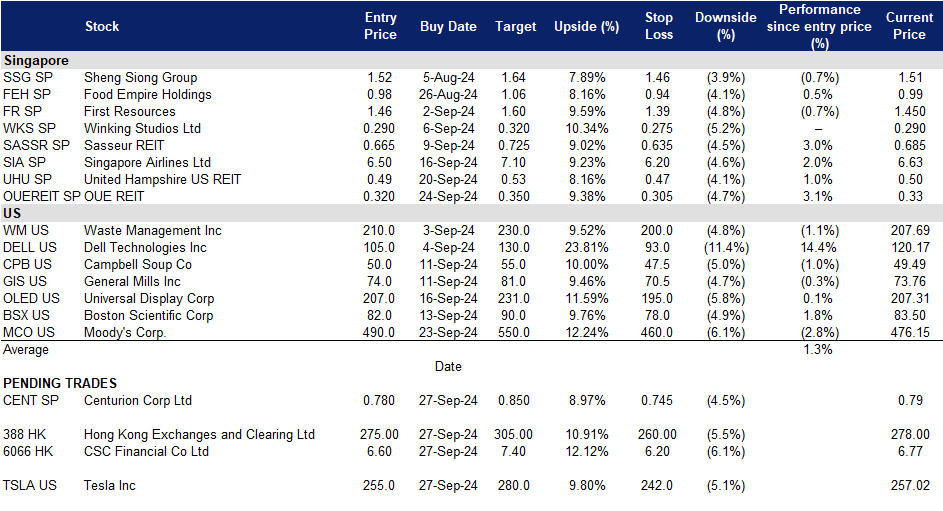

Trading Dashboard Update: Take profit on Trip.com Group Ltd (9961 HK) at HK$405 and CMOC Group Ltd (3993 HK) at HK$7.10.