HONG KONG IPO: Chifeng Jilong Gold Mining Co., Ltd. (6693 HK)

IPO Watch

Chifeng Jilong Gold Mining Co., Ltd. (6693 HK)

Basic Information | |

Market | HK main board |

Industry | Mining |

Board Lots | 200 |

Listing Type | Primary listing |

Global Offering | |

Offer Price Range | HK$13.72-HK$15.83 |

Initial Market Cap Range | HK$38,435mn-HK$38,869mn |

Total Number of Offer Shares | 205,652,000 |

Number of International Offer Shares | 185,086,800 |

Number of HK Offer Share | 20,565,200 |

Sponsors | CITIC Securities |

Company Background | |

| |

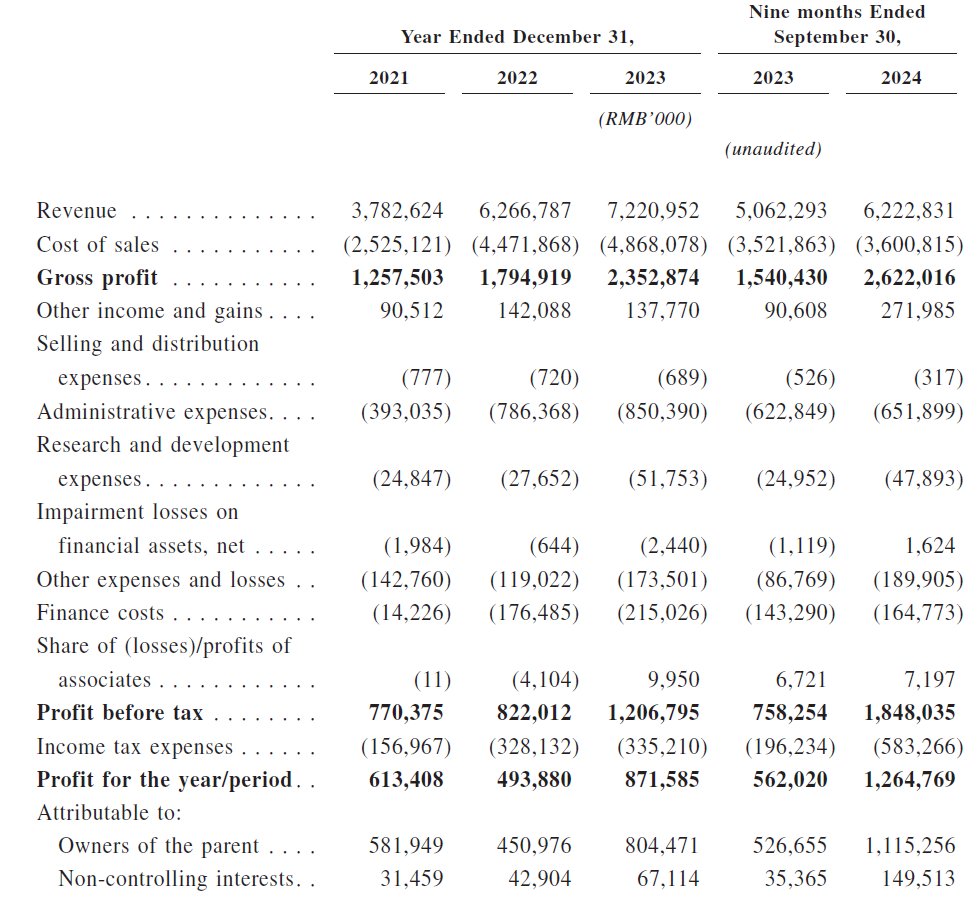

Financials | |

| |

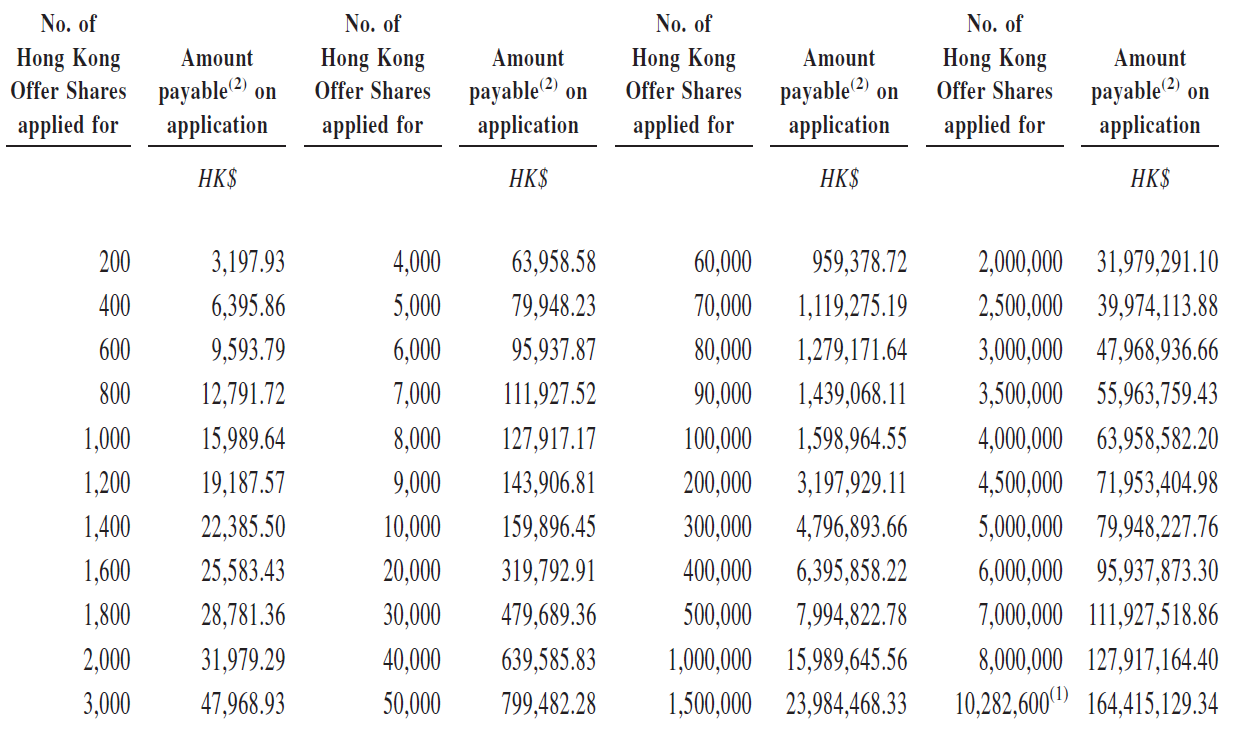

Subscription Table | |

| |

Time Table | |

IPO deadline: 05-Mar-2025 Results allotment date: 07-Mar-2025 Check refund date: 10-Mar-2025 Listing date: 10-Mar-2025 | |

新股上市

赤峰吉隆黃金矿业股份有限公司 (6693)

基本信息 | |

市场 | 香港主板 |

行业 | 矿业 |

每手股数 | 200股 |

上市类型 | 主上市 |

全球发行 | |

招股价范围 | HK$13.72-HK$15.83 |

初始市值范围 | HK$38,435mn-HK$38,869mn |

总发行股数 | 205,652,000 |

国际发行股数 | 185,086,800 |

香港发行股数 | 20,565,200 |

保荐人 | 中信证券 |

公司背景 | |

| |

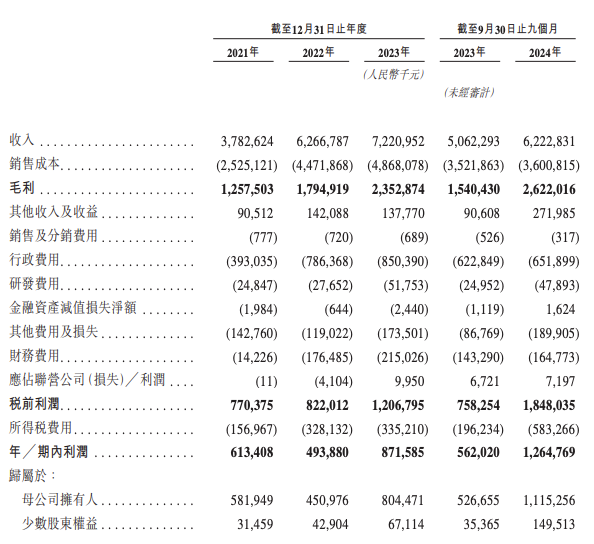

财务状况 | |

| |

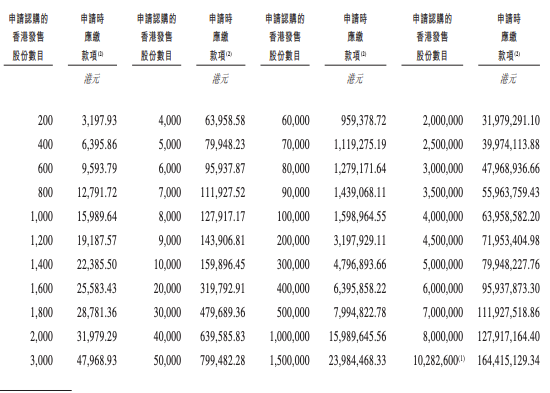

申购表 | |

| |

时间表 | |

申购截止日: 2025年3月5日 发行分配日: 2025年3月7日 支票退款日: 2025年3月10日 上市日期: 2025年3月10日 | |