27 November 2024: Banyan Tree Holdings Ltd (BTH SP), Xiaomi Corp. (1810 HK), Zillow Group Inc (Z US)

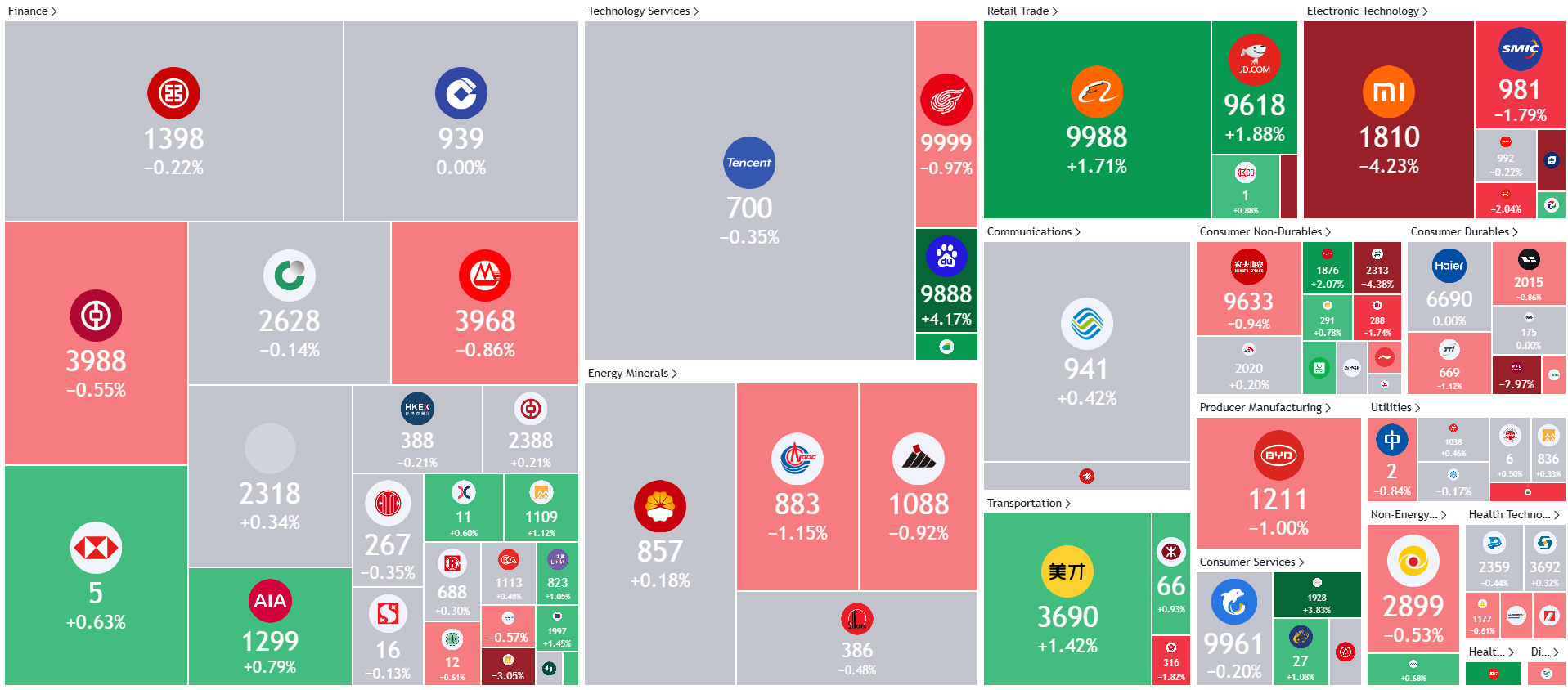

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

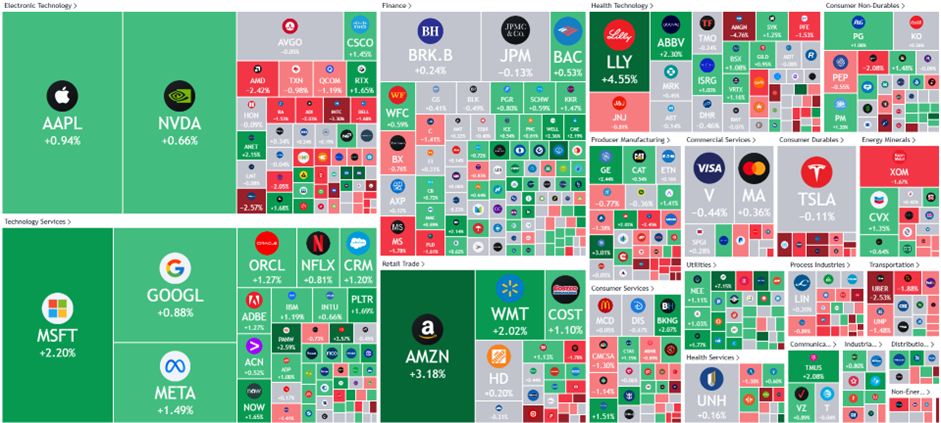

United States

Hong Kong

Banyan Tree Holdings Ltd (BTH SP): Year-end travel demand

- RE-ITERATEBUY Entry – 0.36 Target– 0.40 Stop Loss – 0.34

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Extension of visa-free policy. With a significant portion of Banyan Tree Holdings’ hotels, resorts, and spas located in China, the country’s recent expansion of its visa-free policy presents promising opportunities. Effective 30 November 2024 just in time for the year-end holiday season, through 31 December 2025, the policy now includes travelers from 38 countries, allowing visa-free stays of up to 30 days for business, tourism, family visits, exchanges, and transit. Combined with the 72/144-hour transit visa-free options, has significantly boosted inbound tourism and cultural exchanges. In 3Q24, foreign arrivals to China reached 8.186 million, up 48.8% YoY, with visa-free trips accounting for 4.885 million, a 78.6% increase. In the first three quarters of 2024, 58.8% of the 22.821 million inbound trips were facilitated by the visa-free policy. The announcement has sparked increased interest, as evidenced by sharp rises in travel searches and bookings on platforms like Trip.com. Additionally, China’s visa-free agreements with six countries, including Singapore and Thailand, have enhanced economic and trade cooperation. Travel agencies have been actively enriching tourism offerings and strengthening partnerships to meet growing demand. This expanded visa-free policy is expected to attract more international tourists to explore China, creating potential growth opportunities for Banyan Tree Holdings by driving increased revenue through its properties in the region.

- Expected growth in holiday travel. Holiday air travel in the US is poised to reach record highs this winter, with the Transportation Security Administration (TSA) projecting over 18 million passengers between 26 November and 2 December, marking a 6% increase from last year. Thanksgiving remains the busiest travel period, fueled by a significant rise in international bookings, particularly to European destinations. International reservations are up 23%, partly due to a 5% decline in flight costs. United Airlines expects its busiest holiday season ever, with 25 million passengers anticipated. Popular European destinations such as London, Paris, and Munich have seen bookings surge by 30% compared to pre-pandemic levels. Similarly, American Airlines forecasts flying 8.3 million passengers during Thanksgiving, with its peak day on 1 December. Regional carriers like GoJet Airlines are also experiencing growth, with a 40% YoY increase in scheduled flights driven by higher demand and fleet expansion. Despite the positive outlook, weather challenges loom, with a “bomb cyclone” predicted to bring heavy rain and snow across the US West Coast, Midwest, and Northeast during the early Thanksgiving travel period. Airlines in the US are proactively preparing with de-icing equipment and trained teams to mitigate potential disruptions. The surge in holiday travel is expected to provide a boost to the global tourism industry, underscoring the resilience of the travel sector amid operational challenges.

- 1H24 results review. Banyan Tree Holding’s revenue rose to S$179.7mn in 1H24, 25% YoY, compared to S$143.7mn in 1H23. The increase in revenue was primarily due to the robust growth from all business segments. Revenue per available room (RevPAR) for owned hotels increased 17% (on a same-store basis) vs 1H23. Residences segment sets a new record with S$198mn new sales. The group opened 10 new properties in 2024; expecting at least 12 more in the next 12 months.

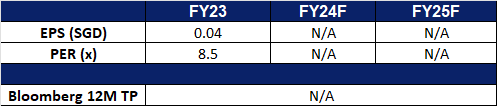

- Market Consensus.

(Source: Bloomberg)

Propnex Ltd (OYY SP): Surge in home sales

- RE-ITERATE BUY Entry – 0.92 Target– 1.02 Stop Loss – 0.87

- Propnex Limited operates as a real estate agency. The Company offers business strategies, consultation, training, marketing support, and technological innovations for real estate sector, as buying, selling, and renting of properties. Propnex serves customers in Singapore, Indonesia, and Malaysia.

- Rebounding private home sales. New private home sales soared to an 11-month high in October, driven by increased launches from developers to meet growing buyer demand. This marks a continued recovery in market activity following a rebound in September, which reversed a 16-year low recorded in August. According to the Urban Redevelopment Authority, developers sold 738 private homes in October (excluding executive condominium units), an 84% increase from the 401 units sold in September and more than 3.5 times the 204 units sold in October 2023. The surge in sales is attributed to improving consumer confidence amid a strengthening economy and recent interest rate cuts, which have made mortgages more affordable. Momentum has carried into November, with over 2,000 units already sold, including the highly successful launch of Emerald of Katong, which achieved a near sell-out with a 99% take-up rate on its first booking day. PropNex is well-positioned to benefit from this strong resurgence in private home sales as market activity continues to gain pace.

- Private housing prices expected to continue rising. Private residential property prices declined by 0.7% in Q3 2024, reversing the 0.9% increase recorded in the previous quarter. Despite this short-term dip, the property price index for private residential properties remains on an upward trajectory, reaching 204.7—its highest level since the index began rising steadily in 2020. The decline in interest rates and improved consumer confidence have fueled a resurgence in demand for private properties, as evidenced by the strong home sales in October and November. Factors such as the inflation-hedging appeal of property, robust household balance sheets, more affordable mortgages, and demand from public homeowners upgrading to private apartments are expected to sustain this demand. Looking ahead, heightened interest in private properties is likely to exert upward pressure on sale prices. Analysts anticipate that property prices in major Asian markets, including Singapore, will rise in 2025, with Singapore forecasted to record modest growth of around 3%.

Singapore Property Price Index of private residential properties

(Source: Urban Redevelopment Authority)

- 1H24 results review. Propnex’s revenue decline to S$345.6mn in 1H24, -5.1% YoY, compared to S$364.3mn in 1H23. The decline in revenue was primarily attributed to a 19.6% YoY decrease in commission income from project marketing services, which fell to S$91.3mn in 1H2024 from S$113.5mn a year ago. This drop reflected the reduced number of private new home sales amidst fewer launches in the primary market. In contrast, the secondary market showed strength, with the Group’s commission income from real estate agency services increasing by 1.3% to S$251.9mn in 1H2024, up from S$248.7mn in 1H2023. The company’s net attributable profit fell by 13.8% YoY to S$19.mn in 1H24, compared to S$22.1mn in 1H23. Basic earnings per share fell to 2.57 Scents in 1H24, compared to 2.98 Scents in 1H23.

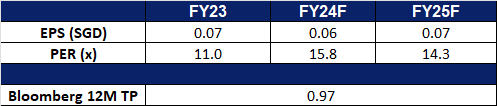

- Market Consensus.

(Source: Bloomberg)

Xiaomi Corp. (1810 HK): Higher EV delivery goals signify strong demand

- RE-ITERATE BUY Entry – 28.0 Target 32.0 Stop Loss – 26.0

- XIAOMI CORPORATION is a China-based investment holding company principally engaged in the research, development and sales of smartphones, Internet of things (IoTs) and lifestyle products, the provision of Internet services, and investment business. The Company mainly conducts its businesses through four segments. The Smartphone segment is engaged in the sales of smartphones. The IoT and Lifestyle product segment is engaged in the sales of other in-house products, including smart televisions (TVs), laptops, artificial intelligence (AI) speakers and smart routers; ecosystem products, including IoT and other smart hardware products, as well as certain lifestyle products. The Internet service segment is engaged in the provision of advertising services and Internet value-added services. The Others segment is engaged in the provision of repair services for its hardware products. The Company distributes its products in domestic market and to overseas markets.

- Expecting more EV deliveries in 4Q24. Xiaomi recently announced in its 3Q24 results that it raised its electric vehicle (EV) delivery target for the year to 130,000 units, marking the third upward revision as the company reported a 30.5% increase in third-quarter revenue. This surpasses its previous forecast of 120,000 units for its debut EV, the SU7 sedan, and significantly exceeds the initial goal of 76,000 units set at the SU7’s launch earlier this year, driven by surging demand. The company also celebrated a key milestone, achieving 100,000 deliveries of the SU7 in just 230 days. With its factory capable of producing 20,000 vehicles per month and room for further expansion, the revised target underscores strong and sustained demand for the SU7 sedan in China.

- Possible launch of 2nd EV model in 1Q25. Chinese media report that Xiaomi’s second EV model, an SUV currently code-named MX11, is set to launch in the first quarter of 2025. Additionally, the production version of the Xiaomi SU7 Ultra is slated for an official release in March 2025. Xiaomi is expected to adopt a similar pricing strategy for the new SUV as it did with the SU7 sedan.

- Global rollout of HyperOS 2. Xiaomi has unveiled the global rollout schedule for HyperOS 2, its latest operating system update. The new UI introduces three core features: HyperCore, HyperConnect, and HyperAI. Additional enhancements include dual-camera streaming between Xiaomi tablets and phones, improved performance, AI-generated dynamic wallpapers, and a redesigned home screen with richer widgets and smoother animations. The first wave of devices to receive the update in November includes the Xiaomi 14 and 14 Ultra, Xiaomi 13T Pro, Redmi Note 13 series, Poco C75, and more. A second batch, comprising a range of older devices, will follow in December. Xiaomi, alongside a few other Chinese smartphone manufacturers, remains at the forefront of AI innovation, consistently advancing hardware and AI applications ahead of U.S. competitors like Apple. Currently ranked second in the AI smartphone market with a 26.9% share, Xiaomi’s strong position continues to attract and retain a loyal customer base.

- 3Q24 earnings. The company’s revenue rose to RMB92.5bn in 3Q24, +30.5% YoY, compared to RMB70.9bn in 3Q23. The company’s net profit rose by 9.7% YoY to RMB5.34bn in 3Q24, compared to RMB4.87bn in 3Q23. Basic earnings per share rose to RMB0.22 in 3Q24, compared to RMB0.20 in 3Q23.

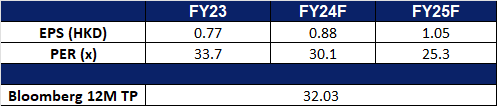

- Market consensus.

(Source: Bloomberg)

Pop Mart International Group Ltd. (9992 HK): Labubu Craze

- RE-ITERATE BUY Entry – 74.0 Target 90.0 Stop Loss – 65.0

- Pop Mart International Group Ltd is a China-based company mainly engaged in the provision of pop toy. intellectual property (IP) is at the core of its business. It has established an integrated platform covering the entire industry chain of pop toys, including artists development, IP operation, consumer access and pop toy culture promotion. The Company develops a broad array of pop toy products based on its IPs. Its Pop Mart brand products are primarily categorized into blind boxes, action figures, ball-jointed doll (BJDs) and accessories. The Company conducts its businesses within the China market and to overseas markets.

- In trendy series continue to rake in revenue. Pop Mart’s Labubu series recently went viral globally, thanks in part to a social media post by BLACKPINK’s Lisa. Combined with endorsements from several other celebrities, this surge in visibility has sparked overwhelming demand for Labubu toys, with products consistently selling out both in stores and online shortly after release. The Labubu series generated RMB 626.8 million in sales during the first half of 2024 and is on track to become Pop Mart’s top IP by revenue for the year. Other popular series, such as Molly and Skullpanda, have also performed exceptionally well, bringing in RMB 782.1 million and RMB 574.3 million in revenue, respectively, as of 1H24.

- Better than expected 3Q24 business updates. Pop Mart recently released its 3Q24 business update, projecting revenue to more than double YoY. The company expects overall revenue to grow by 120%-125% YoY. Revenue from operations in Mainland China increased by 55%-60% YoY, while revenue from Hong Kong, Macao, Taiwan, and overseas markets surged by 440%-445% YoY. This significant growth in overseas revenue highlights the success of Pop Mart’s expansion efforts and its strengthening market presence outside China. The company’s global growth strategy is clearly paying off, contributing substantially to its overall performance.

- Expanding presence locally and overseas. Pop Mart, the renowned high-end toy brand, has officially opened a store at Sun World Ba Na Hills in Da Nang, creating a highly artistic space. Situated in a prime location atop Ba Na Hills, the store features impressive interior architecture resembling a grand castle, inspired by the artistic and cultural charm of an old French village. This marks Pop Mart’s first store in a Southeast Asian theme park. Visitors can explore iconic characters like Molly, SkullPanda, Hirono, Dimoo, and The Monsters, making each visit a unique artistic experience. In addition, Pop Mart recently launched its first theme park in Beijing, transforming Chaoyang Park—the city’s largest park—into an immersive entertainment space filled with beloved characters like Molly, Labubu, and Dimoo. These expansions, coupled with the growing popularity of The Monsters and Molly series, are set to attract even more visitors and strengthen Pop Mart’s global presence.

- 1H24 earnings. The company’s revenue rose to RMB4.56bn in 1H24, +62.0% YoY, compared to RMB2.81bn in 1H23. The company’s net profit rose by 93.3% YoY to RMB964.1mn in 1H24, compared to RMB477.2mn in 1H23. Basic earnings per share rose to RMB69.49 in 1H24, compared to RMB35.46 in 1H23.

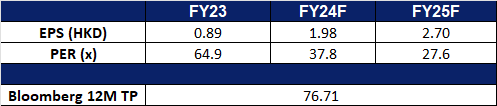

- Market consensus.

(Source: Bloomberg)

Zillow Group Inc (Z US): AI in the real estate

- RE-ITERATE BUY Entry – 80 Target – 90 Stop Loss – 75

- Zillow Group, Inc. is a tech real-estate marketplace company. The Company provides information about homes, real estate listings, and mortgages through websites and mobile applications. Zillow Group serves homeowners, buyers, sellers, renters, and real estate professionals in the United States.

- AI+ real estate. Zillow’s real estate information platform began using the company’s own machine learning model Zetimate to value real estate as early as 2022. There are currently approximately 200 million monthly active users using this model. In 2023, the company’s program will embed artificial intelligence natural language search capabilities, so users do not need to perform precise searches to find real estate listings that meet their requirements.

- Rebound in existing home sales. In October, existing home sales rose by 3.4% from the previous month to a seasonally adjusted annual rate of 3.96 million units, slightly surpassing market expectations of 3.95 million units. This recovery from a 14-year low was supported by sustained economic growth and robust employment levels, which continue to drive housing demand.

- Potential tax benefits. Trump’s proposed reduction of the corporate tax rate from 21% to 15%, applicable only to domestic companies, is expected to benefit the company significantly as its operations are based entirely in the United States.

- 3Q24 results. Revenue increased 17.1% YoY to US$581million, exceeding expectations by US$25.82 million. Net loss was US$20 million. In the third quarter, the group’s program views reached 2.4 billion times, and the average number of monthly active users reached 233 million.

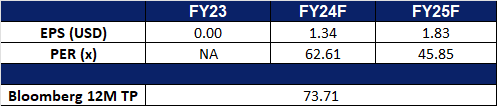

- Market consensus.

(Source: Bloomberg)

AppLovin Corporation (APP US): Excelling through AI

- RE-ITERATE BUY Entry – 320 Target – 360 Stop Loss – 300

- AppLovin Corporation develops technologies that help businesses of every size connect to their ideal customers. The company provides end-to-end software and AI solutions for businesses to reach, monetize, and grow their global audiences. AppLovin serves clients worldwide.

- Lower borrowing costs. AppLovin Corp has successfully transitioned from speculative-grade borrowing to the investment-grade bond market with a US$3.5 billion offering. The deal, divided into four parts, included a 30-year fixed note priced at 137.5 basis points over Treasuries, down from initial pricing of 175 basis points. This move to the high-grade market allows AppLovin to significantly reduce borrowing costs, saving tens of millions of dollars. Previously reliant on riskier loans, the company now holds a BBB- rating from S&P Global Ratings and Fitch Ratings, qualifying it as a “rising star” with access to a larger investor pool and lower pricing. The company’s strategic shift highlights its profitability, strong free cash flow, and potential for further credit rating upgrades, positioning it well for stock price appreciation.

- Exceptional Q3 performance. AppLovin recently joined the Nasdaq 100 index, highlighting its growing prominence. In Q3, the company reported exceptional results, with revenue increasing 39% YoY to US$1.2 billion, exceeding estimates of US$1.13 billion. Earnings per share of US$1.25 also outperformed expectations of US$0.92. AppLovin’s robust guidance for Q4, projecting revenue of US$1.24 to US$1.26 billion, above the US$1.18 billion consensus, reflects its confidence in continued growth. Furthermore, the company’s AI-powered advertising engine, AXON, has driven substantial growth, with software platform revenue rising 66% to US$835 million in Q3. AXON’s ability to enhance ad targeting has attracted advertisers, resulting in an impressive adjusted profit margin of 78% for the software platform. As it continues to expand its customer base, AXON will be able to deliver higher growth in revenue and profitability going forward.

- Emerging E-commerce opportunity. AppLovin’s pilot e-commerce project, which enables targeted ads within gaming environments, presents a promising growth avenue. Its CEO has emphasized its potential to drive financial impact beginning in 2025. As the project gains traction, it is expected to further boost the software segment, enhancing AppLovin’s revenue streams and market share in the broader digital advertising space. With the profitability and scalability of its software platform, AppLovin is poised for continued growth as it gains market share and expands its corporate client base. The combination of AI-driven ad solutions and emerging e-commerce capabilities positions the company as a future market leader in the AI advertising space.

- 3Q24 results. Revenue increased 38.8% YoY to US$1.20 billion, beating expectations by US$70 million. GAAP earnings per share were $1.25, beating estimates of $0.32. For the fourth quarter, Applovin projects US$1.24 billion to US$1.26 billion in revenue, above the US$1.17 billion analysts had expected. Its board also approved an additional US$2 billion in stock buybacks, as it had about US$300 million left in its previous buyback program after spending about US$437 million on buybacks in the third quarter.

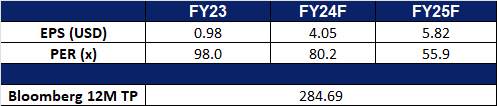

- Market consensus.

(Source: Bloomberg)

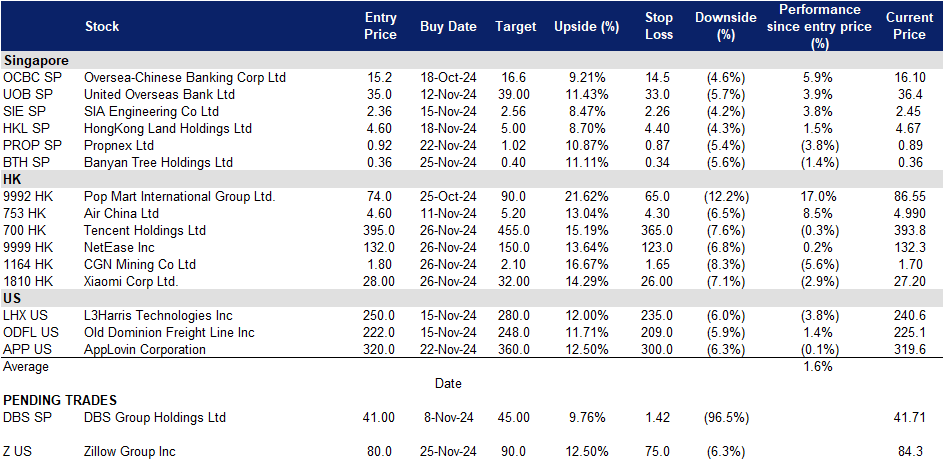

Trading Dashboard Update: Add Banyan Tree Holdings (BTH SP) at S$0.36, Tencent Holdings Inc (700 HK) at HK$395, NetEase Inc (9999 HK) at HK$132, CGN Mining Co Ltd (1164 HK) at HK$1.8 and Xiaomi Corp Ltd (1810 HK) at HK$28. Cut loss on Yanlord Land Group Ltd (YLLG SP) at S$0.64.