13 January 2023: Singapore Airlines Ltd (SIA SP), Tianqi Lithium Corp (9696HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Singapore Airlines Ltd (SIA SP): Further recover in 2023

- BUY Entry 5.50 – Target – 5.75 Stop Loss – 5.37

- The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline related activities.

- Post-Covid boom. In 11M22, according to statistics collated by Singapore Tourism Board, there has been an exponential increase in visitor arrivals since the reopening of our borders to vaccinated travellers without quarantine in April. Between January and November last year, there were about 5.37 million visitors, a YoY increase of 2,164.9% compared to the same period in 2021. China lifted its overseas travelling restrictions in early January 2023, and Singapore is expected to see a spike in Chinese tourist influx this year. According to the recent market survey from travel agents in China, Southeast Asian countries are among the top cross-border travelling preferences after a three-year lockdown.

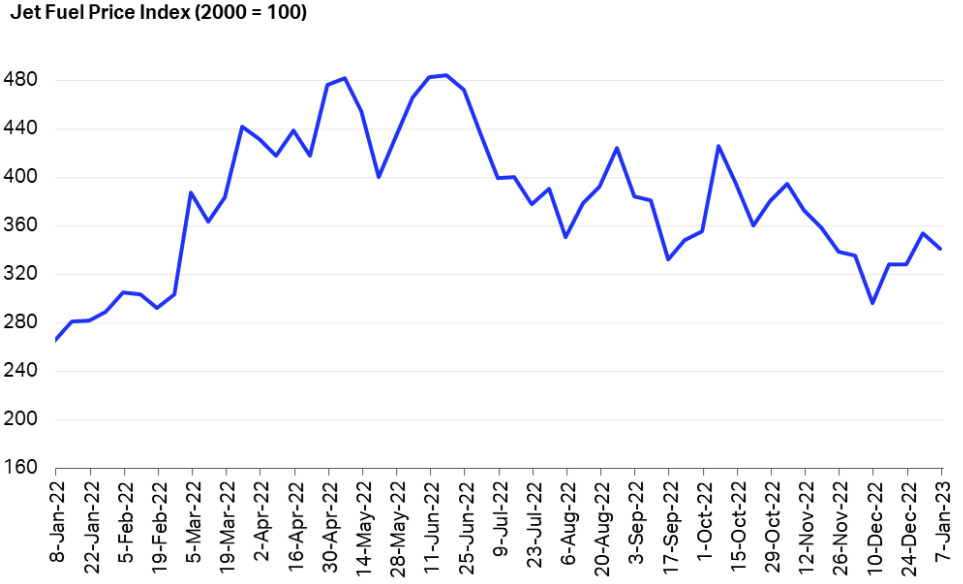

- Jet fuel prices fall. Due to concerns over a slowdown of global economic growth and recession, international oil prices have been trending downward since mid-2022. Accordingly, prices of crude oil derivatives fall, benefiting airline companies as part of operating costs drops.

Jet Fuel Price Index

(Source: IATA)

(Source: IATA)

- 1H23 results review. In1H23 (YE March), net profit arrived at S$927mn, recovering from an S$837mn loss during 1H22, resulting from the sharp revival in travel demand after economies reopened their borders. SIA and Scoot carried 11.4mn passengers during 1H23, a 13-fold jump from 1H22.

- Updated market consensus of the EPS in FY23/24 is S$0.584/S$0.390 respectively, which translates to 9.5x/14.3x forward PE. Bloomberg consensus average 12-month target price is S$5.62.

DFI Retail Group Holdings Ltd (DFI SP): Year of recovery

DFI Retail Group Holdings Ltd (DFI SP): Year of recovery

- RE-ITERATE BUY Entry – 3.10 Target – 3.65 Stop Loss – 2.85

- DFI Retail Group Holdings Limited operates as a retailer in Asia. The company operates through five segments: Food, Health and Beauty, Home Furnishings, Restaurants, and Other Retailing. It primarily operates supermarkets and hypermarkets under the Wellcome, Yonghui, CS Fresh, MarketPlace, Giant, Hero, Mercato, Oliver’s, 3hreesixty, San Miu, Jasons, and Lucky brands; and convenience stores under the 7-Eleven brand. The company also operates health and beauty stores under the Mannings, Guardian, and GNC brands; and home furnishings stores under the IKEA brand, as well as restaurants under the Maxim’s brand.

- Hong Kong-mainland China border reopens. The border reopened on 8th January after a three-year lockdown. The winter of Hong Kong’s retail sector is expected to be over. Tens of thousands of mainlanders will visit Hong Kong for vaccinations and medicines procurement. The influx of visitors will drive retail sales in Hong Kong, revitalising the sector which was badly hit by the pandemic over the past three years.

- Regional retail sector to recover further in 2023. As China reopened its borders, it is expected to see a sharp pent-up demand for overseas travelling. After three-year lockdowns in China, Chinese residents will favour Southeast countries as the destinations as the tour expenditures are relatively affordable. Hence, retail sales in Thailand, Malaysia, Singapore, and other popular tourist countries in the region are expected to further grow, boosted by Chinese tourist consumption.

- 1H22 results review. Total sales mildly edged up by 1% YoY to US$14bn. Loss attributable to shareholders was US$58mn compared to a net profit of US$17mn in 1H21.

- Updated market consensus of the EPS growth in FY23/24 is 523.3%/42.5% YoY respectively, which translates to 21.3x/15.0x forward PE. Current PER is 149.9x. Bloomberg consensus average 12-month target price is S$2.99.

China Resources Power Holdings Company Limited (836 HK): Power the economic revitalisation

- RE-ITERATE Buy Entry – 17.0 Target – 20.0 Stop Loss – 15.5

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Year of economic revitalisation. China has abandoned zero-covid policies by the end of 2022. Meanwhile, the authority released guidelines to expand domestic consumption in 2023, easing the crackdowns on several key sectors including real estate, technology, and education. On the other hand, China will continue to rely on infrastructure expansion to drive its economic growth, and one of the subsectors that are supported by policies is renewable energy. There are two tailwinds for the power sector, inorganic growth from clean energy (wind and solar) demand and margin improvement.

- Resumption of Australian coal import. In the first week of 2023, the National Development and Reform Commission is reported to hold talks with four state-owned importers over the partial lifting of the import ban on Australian thermal and coking coal. It is positive for the power sector as there will be more supply during the spring re-stocking period, and the seasonal increase in coal prices during the summer season will be mitigated accordingly. Therefore, the power sector will not see a sharp margin compression during the peak season in mid-year.

- November operation updates. Total net generation of subsidiary power plants in 11M22 increased by 3.9% YoY to 166,051,785MWh, among which, subsidiary wind farms increased by 10.5% YoY to 31,718,587MWh, subsidiary photovoltaic plants increased by 18.2% YoY to 1,243,941MWh.

- 1H22 earnings review. Turnover grew by 17.78% YoY to HK$50.4bn. The increase was mainly attributable to a YoY increase of 23.9% in the average on-grid tariffs (tax exclusive) of subsidiary coal-fired power plants and a YoY increase of 19.9% in the average sales price of heat supply of subsidiary coal-fired power plants. Net profit attributable to shareholders of the company dropped by 22.46% YoY to HK$4.4bn. The fall in net profit was due to the increase in operating expenses resulted from higher raw material costs.

- The updated market consensus of the EPS growth in FY23/24 is 37.8%/17.6% YoY, respectively, translating to 7.5×/6.4x forward PE. The current PER is 98.2x. FY23F/24F dividend yield is 5.4%/6.5% respectively. Bloomberg consensus average 12-month target price is HK$20.51.

Tianqi Lithium Corp (9696HK): Priced in correction in lithium prices ahead

- Buy Entry – 61.0 Target – 70.0 Stop Loss – 56.5

- Tianqi Lithium Corp, formerly Sichuan Tianqi Lithium Industries Inc, is a China-based company principally engaged in the research and development, manufacture and distribution of lithium products. The Company’s products include two categories, lithium concentrate products and lithium compounds and derivatives. Lithium concentrate products include chemical grade and technical grade lithium concentrate. Lithium compounds and derivatives include lithium carbonate, lithium hydroxide, lithium chloride and lithium metal. The Company’s products are used in a wide variety of end markets, primarily electric vehicles, energy storage systems, air transportation, ceramics and glass. The Company mainly operates its businesses in the domestic and overseas markets.

- Lithium price to correct with limited downside. In 4Q22, the capital expenditure from the EV sector amounted to more than US$13bn after the Biden administration passed the Inflation Reduction Act. In 2023, global EV sales are expected to grow by 20%YoY to 13mn units, driving demand for lithium batteries. However, the undersupply of lithium in 2022 will be changed as lithium miners expect ramp-ups in capacities this year. In 1Q23, EV manufacturers and battery companies will replenish inventories. Hence, lithium prices will have a short-term rebound after the Chinese New Year amidst its correction this year.

China Lithium Carbonate Price Index (RMB/tonne)

(Source: Bloomberg)

- Overseas expansion. On 8th January, Tianqi announced that its 51%-owned joint venture Tianqi Lithium Energy Australia enter a scheme implementation agreement to acquire 100% of Essential Metals Limited (ASX ESS) for A$0.5 with a total amount of A$136mn. ESS is a lithium exploration company which owns 100% of the Pioneer Dome Project in Western Australia with a total lithium resource of 11.2mn tonnes.

- 3Q22 results update. Operating income jumped by 580.2% YoY to RMB10.4bn. Net profit attributable to shareholders jumped by 1,173.4% YoY to RMB5.7bn. 9M22 operating income jumped by 536.4% YoY to RMB24.7bn. 9M22 Net profit attributable to shareholders jumped by 2,916.4% YoY to RMB16.0bn.

- The updated market consensus of the EPS growth in FY23/24 is -4.5%/23.5% YoY, respectively, translating to 4.1×/5.3x forward PE. The current PER is 21.8x. FY23F/24F dividend yield is 6.8%/5.0% respectively. Bloomberg consensus average 12-month target price is HK$95.71.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain/ Loss | Related News |

| Energy Minerals | +1.98% | Oil rises for a sixth day on optimism over demand, U.S. inflation ExxonMobil Corp. (XOM US) |

| Non-energy Minerals | +1.72% | Iron ore extends rally on China demand optimism BHP Group Ltd. (BHP US) |

| Communications | +1.38% | Ryan Reynolds-owned Mint Mobile eyed for acquisition by T-Mobile T-Mobile US, Inc. (TMUS US) |

Top Sector Losers

| Sector | Gain/ Loss | Related News |

| Consumer Non-Durables | -0.55% | Mielle Organics Co-Founders On Remaining True To Customers With Proctor & Gamble Acquisition Proctor & Gamble Company (PG US) |

| Utilities | -0.08% | Reliance on sustainable energy may cause electricity supply problems: Grid operator NextEra Energy (NEE US) |

| Retail Trade | -0.03% | FedEx, UPS and Amazon look to shore-up margins in a slower market Amazon.com, Inc. (AMZN US) |

Hong Kong

Top Sector Gainers

| Sector | Gain/ Loss | Related News |

| Chemical Products | +2.70% | ExxonMobil to sell interest in Esso Thailand Dongyue Group(0189 HK) |

| Papermaking | +2.42% | Nestlé Debuts Recyclable Paper Packaging for KitKat Bars Nine Dragons Paper Holdings Ltd.(2689 HK) |

| Environment Energy Material | +1.77% | White House touts biggest single investment in US solar energy by Korean company Xinyi Solar Holdings(0968 HK) |

Top Sector Losers

| Sector | Gain/ Loss | Related News |

| Travel & Tourism | -1.98% | Hong Kong will need to wait a little longer for influx of tourists from mainland China, industry leaders say Trip.com Group Ltd(9961 HK) |

| Electronic Component | -1.51% | Samsung Electronics Unveils High-Performance PC SSD That Raises Everyday Computing and Gaming to a New Level Sunny Optical Technology Company Ltd(2382 HK) |

| Property Management & Agency | -1.49% | Hong Kong to Return as a Top Property Investment Location BEKE-W(2423 HK) |

Trading Dashboard Update: Take profit on Genting Singapore (GENS SP) at S$1.00 and China Resources Medical (1515 HK) at HK$6.37.

(Source: Bloomberg)

(Source: Bloomberg) (Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)