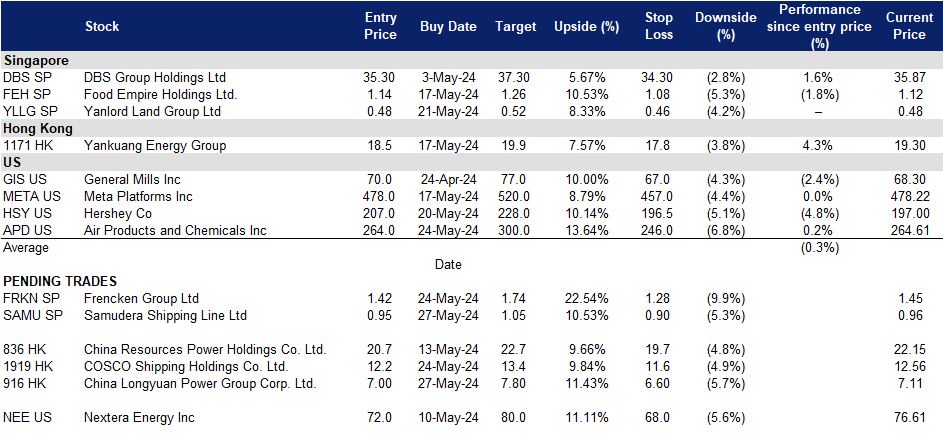

27 May 2024: Samudera Shipping Line Ltd (SAMU SP), China Longyuan Power Group Corp. Ltd. (916 HK), Air Products and Chemicals Inc (APD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Samudera Shipping Line Ltd (SAMU SP): Freight rates going back upwards

- BUY Entry – 0.95 Target– 1.05 Stop Loss – 0.90

- Samudera Shipping Line Limited owns and operates ocean-going ships and provides containerized feeder shipping services. Through its subsidiaries, the Company also owns and charters vessels, provides sea and air freight forwarding, and operates shipping agency and container freight station services.

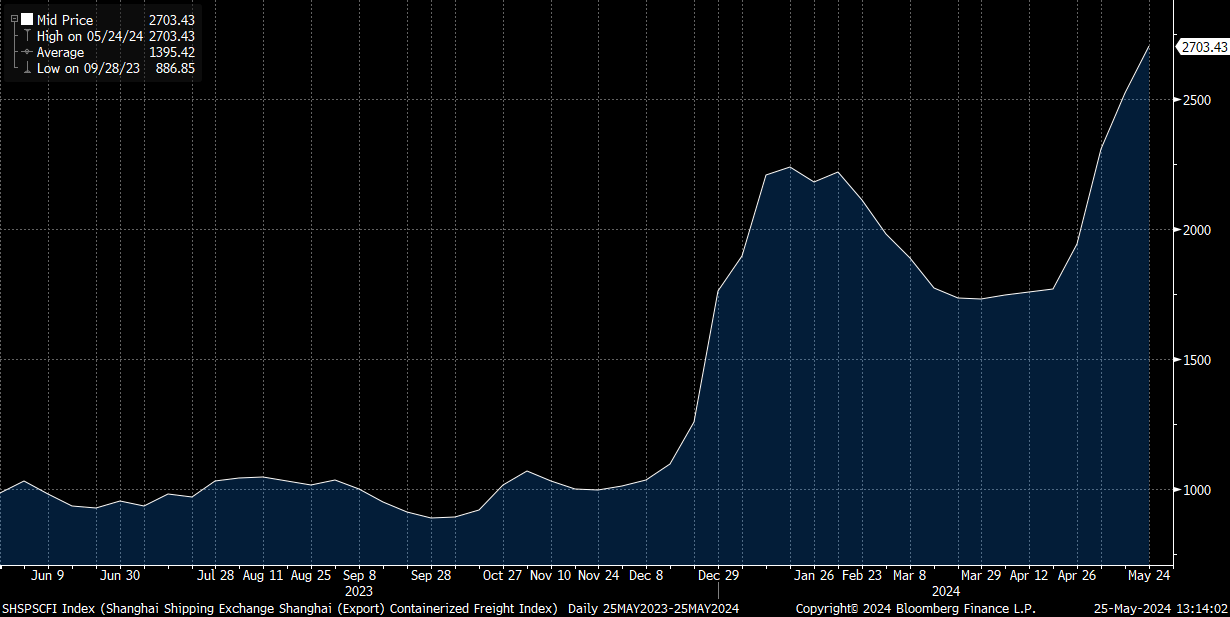

- Intra-Asia freight rates at 30-month high. Port congestion in Asia, diversions in the Red Sea, and increasing exports from Southeast Asia are driving intra-Asia freight rates to 30-month highs on some routes from China. Carriers and forwarders report rising intra-Asia volumes as long-haul ocean carriers redeploy vessels and skip regional trades to support mainline east-west services. High charter rates and a shortage of feeder vessels are preventing carriers from leasing additional ships to address the capacity shortfall.

Shanghai Shipping Exchange (Export) Containerized Freight Index

(Source: Bloomberg)

- Global shipping rates surge. A sudden container capacity crunch is causing global ocean freight rates to soar, with rates increasing by about 30% recently and expected to rise further, impacting consumer prices. This surge is driven by the peak shipping season, longer transit routes to avoid the Red Sea, and bad weather in Asia, leading carriers to skip ports and reduce time at ports, exacerbating supply chain issues. Spot rates have spiked by as much as US$1,500 on US routes, with container shortages severe due to high demand and delayed returns of empty containers. This situation is reminiscent of the Covid-19 pandemic, with logistics experts now facing shortages in trade lanes from Asia to Latin America, Europe, and the US West Coast. The ongoing congestion and higher rates are expected to persist, especially with an early start to the peak shipping season to avoid potential labour disruptions at East Coast and Gulf ports in the fall. Shipping companies are increasing rates and adding surcharges, with MSC announcing rates of US$8,000 to US$10,000 for 40-foot containers to the US West Coast. The higher rates are expected to benefit Samudera, enabling it to boost its revenue in response to the increased demand despite the higher prices.

- Reaping the benefits of its new additions. On 27 December, Samudera Shipping announced that it signed a memorandum of understanding to acquire two ethylene gas vessels for US$12.6mn, to be renamed Sinar Ternate and Sinar Tidore. Built in 2009 and 2010 and flagged in the Bahamas, the acquisition will be funded through bank borrowings and internal resources. This purchase aims to expand Samudera’s fleet and secure more charter contracts, capitalizing on the growing ethylene market in Indonesia, where ethylene is extensively used as a feedstock in petrochemical plants. It announced that the second vessel, Sinar Tidore was delivered on 24 April 2024. This will enable it to take on more charter contracts contributing to an increase in its revenue.

- FY23 results review. FY23 revenue fell by 41.2% to US$582.9mn and net profit decreased 68.6% YoY to USS$101.2mn. The decline was attributed to lower freight rates in the container shipping segment, despite a slight increase in container volume. In 1Q24, its container volume remained relatively stable, whereas freight rates declined to US$244 from US$371 per TEU. Its fleet size increased to 7 vessels. Additionally, both storage capacity and volume handled rose YoY, attributed to securing more management contracts and higher demand for storage capacity.

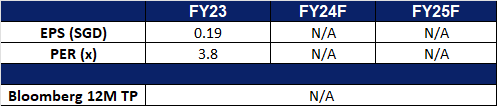

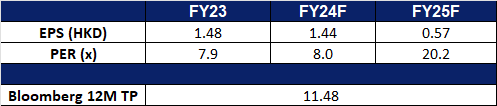

- Market Consensus

(Source: Bloomberg)

Frencken Group Ltd (FRKN SP): Semicon recovery on-track

- RE-ITERATE BUY Entry – 1.42 Target– 1.74 Stop Loss – 1.28

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment, and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial, and semiconductor industries.

- Nvidia delivering better than anticipated results again. Nvidia recently reported Q1 results which surpassed estimates, its revenue tripled YoY to US$26bn and it delivered profits that significantly exceeded expectations. The company projected higher-than-expected Q2 revenue of about US$28bn, surpassing analysts’ predictions of US$26.8bn. This positive outlook is driven by the strong demand for AI chips. Its CEO heralded this as the start of a new industrial revolution. Nvidia is currently bolstered by AI accelerators used by major tech firms like Amazon and Google. Despite high demand outpacing supply, Nvidia aims to diversify its market beyond hyperscalers to sectors like healthcare and automotive. This positive demand is expected to extend to Frencken’s semiconductor segment, which represents approximately 41% of its FY revenue.

- Good performance. Frencken Group’s revenue rose 12.2%YoY to S$193.6mn, with the mechatronics division seeing a 14.4% increase to S$170.1mn, primarily from the semiconductor, medical, and analytical life sciences segments. It reported a net profit of S$9mn for 1Q23, up 73% from S$5.2mn the previous year, driven by higher gross profit margins and revenue growth. The IMS division’s revenue remained stable at S$22.8mn, with a decline in the automotive segment offset by a significant increase in the consumer and industrial electronics segment. Gross profit margin improved to 13.7%. The company remains cautious due to global economic uncertainties and expects 1H24 revenue to be comparable to 2H23, with growth in semiconductor, medical, and analytical life sciences segments but softer automotive and industrial automation revenues. Frencken is anticipated to recover alongside the rest of the Semiconductor industry.

- 1Q24 results review. 1Q24 revenue rose by 12.2% to S$193.6mn, compared to S$172.5mn in 1Q23. Net profit increased 73% YoY to S$9mn from S$5.2mn in the previous year due to higher revenue growth and gross profit margins. Gross profit margin improved to 13.7% in 1Q24 from 12.3% in 1Q23, attributing it to better operating leverage. In 1H24, Frencken expects to deliver revenue comparable to 2H23 revenue. The semiconductor, medical, and analytical life sciences segments are expected to improve, while the industrial automation and automotive segments are expected to soften.

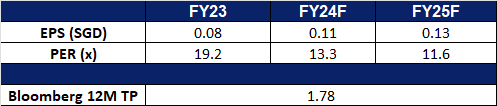

- Market Consensus

(Source: Bloomberg)

China Longyuan Power Group Corp. Ltd. (916 HK): Seasonal uptrend

- BUY Entry – 7.00 Target 7.80 Stop Loss – 6.60

- China Longyuan Power Group Corp Ltd is a China-based company mainly engaged in power sales business. The company operates three segments. Wind Power segment constructs, manages and operates wind power plants and produces electricity and sells it to grid companies. Coal Power segment constructs, manages and operates coal-fired power plants and produces electricity and sells it to power grid companies. All Others segment is mainly engaged in manufacturing and selling power generation equipment, providing consulting services, providing maintenance and training services to wind power enterprises and other renewable energy power generation and sales.

- Increasing electricity demand and upcoming summer season. In 2024, China is projected to generate 9.96tn kilowatt hours (kWh) of power, as per the National Energy Administration, reflecting a growth rate of 5.3%. The International Energy Agency predicts a 5.1% rise in electricity demand, while the China Electricity Council anticipates a 6% increase, surpassing GDP forecasts. Additionally, the upcoming summer season is expected to further boost electricity demand as consumers turn to air conditioning to escape the rising temperatures.

- Transition to green energy. China’s power storage capacity is poised for significant growth, driven by rapid advancements in renewable energy, innovative technologies, and ambitious government policies promoting sustainable development. In the first quarter of 2024, the nation’s energy storage capacity expanded substantially, with installed new-type energy storage reaching 35.3 gigawatts by the end of March, a 2.1-fold increase year-over-year. China has become a leader in renewable energy adoption, particularly focusing on enhancing its energy storage capabilities. The surging demand for energy storage solutions, essential for integrating intermittent renewable sources like wind and solar into the power grid, has spurred extensive investments in storage projects nationwide. This momentum is expected to continue, positioning China to dominate the global energy storage market in the coming years.

- Raising Capital. China Longyuan Power Group successfully issued RMB 2.0 billion in ultra short-term debentures with a 113-day term and a 1.77% coupon rate on May 22, 2024. Underwritten by Industrial Bank Co., Ltd., this issuance is intended to enhance the company’s working capital and repay debt, thereby strengthening its liquidity position.

- 1Q24 results review. Revenue increased marginally by 0.1% YoY to RMB9.88bn in 1Q24, compared with RMB9.87bn in 1Q23. Net profit rose by 1.34% to RMB2.76bn in 1Q24, compared to RMB2.72bn in 1Q23.

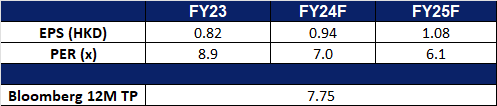

- Market consensus.

(Source: Bloomberg)

COSCO Shipping Holdings Co. Ltd. (1919 HK): Rebounding freight rates

- RE-ITERATE BUY Entry – 12.20 Target 13.40 Stop Loss – 11.60

- COSCO SHIPPING Holdings Co., Ltd., formerly China COSCO Holdings Company Limited, is an investment holding company principally engaged in container shipping and related businesses. The Company is engaged in container shipping, dry bulk shipping, the management and operation of container terminals, container leasing and the provision of logistics services. The Company operates its business through two segments. The Container Shipping segment is engaged in the transportation of goods across the Pacific, Asia and Europe, and other international routes. The Terminal Operation and Investment segment is engaged in the operation and management of ports. The Company is also involved in the management and leasing of containers.

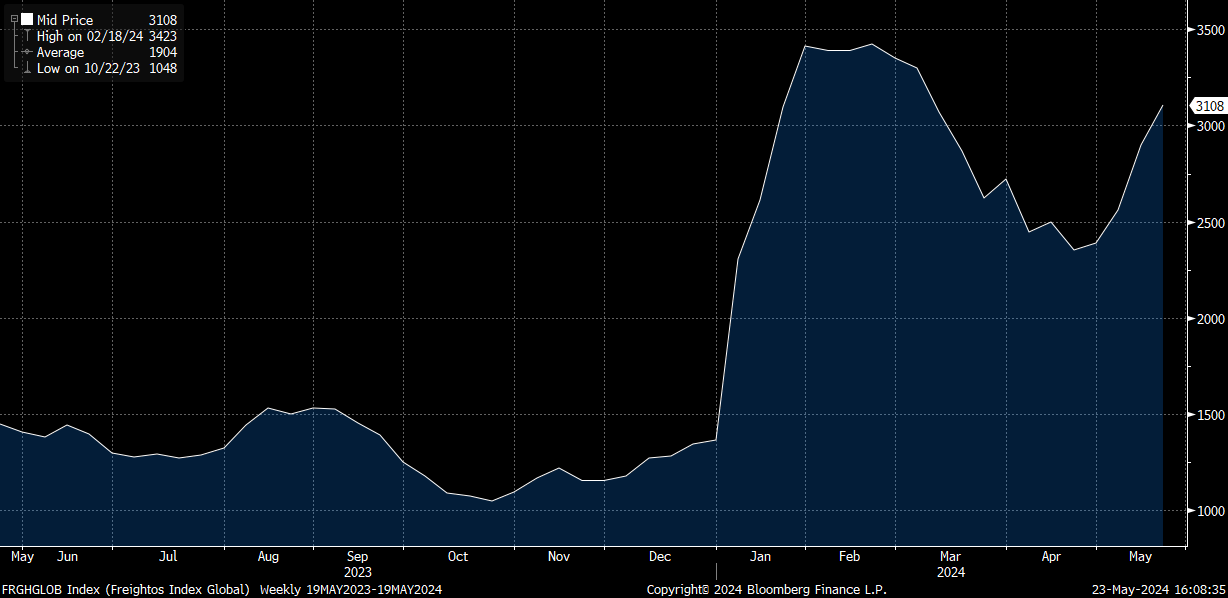

- Rebounding freight rates. The Freightos Baltic Index has rebounded since the end of April 2024, reaching its highest point since September 2022. This reflects a broader trend in the container shipping industry, marked by robust demand and supply chain disruptions. The increased demand for sea freight is primarily due to shifting consumer behaviors and a growing reliance on e-commerce platforms. Additionally, ocean carriers are being forced to divert routes away from the Red Sea, opting instead to navigate around Africa’s Cape of Good Hope due to ongoing vessel attacks, further straining the supply chain by extending shipping times. This rebound in freight rates is expected to positively impact COSCO Shipping.

Freightos Baltic Index

(Source: Bloomberg)

- More shipping routes. Cosco Shipping recently launched a new container service connecting Tianjin Port in China to the East Coast of South America. The service began operations last week, facilitating trade between China and countries in the region by reducing sailing time from 54 to 40 days and increasing reefer shipping capacity. The company will deploy 12 vessels, each with a capacity of 14,000 TEU, offering weekly sailings. Given that China has been Brazil’s largest trading partner for 15 consecutive years, this additional container service is poised to drive long-term revenue growth for the company.

- Launch of a self-operated warehouse in the US. Cosco Shipping has recently launched its self-operated fulfilment warehouse in the U.S., marking a significant step in enhancing its capacity to meet the growing logistics demands of cross-border businesses. The warehouse is designed to cater to medium and large-goods sellers, offering both standardized and customized logistics solutions for a variety of products, including home appliances and furniture. This strategic move not only adapts to the expanding needs of logistics services but also supports the growth of the global cross-border e-commerce industry.

- 1Q24 results review. Revenue increased 1.94% YoY to RMB48.3bn in 1Q24, compared with RMB47.4bn in 1Q23. Net profit fell 5.23% to RMB6.76bn in 1Q24, compared to RMB7.13bn in 1Q23. Basic earnings per share was RMB0.42 in 1Q24, compared to RMB0.44 in 1Q23.

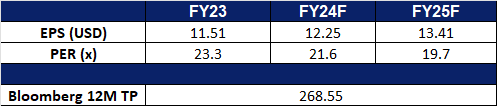

- Market consensus.

(Source: Bloomberg)

Air Products and Chemicals Inc (APD US): Natural gas demand to surge

- RE-ITERATE Entry – 264 Target –300 Stop Loss – 246

- Air Products and Chemicals, Inc. produces industrial atmospheric and specialty gases and performance materials and equipment. The Company’s products include oxygen, nitrogen, argon, helium, specialty surfactants and amines, polyurethane, epoxy curatives, and resins. Air Products and Chemicals products are used in the beverage, health, and semiconductor fields.

- Short squeeze spreads to the futures market. Short squeezes have once again emerged in the US market last week, similar to the short squeeze battle in early 2021, with investors looking for products with high short interest and buying them in large quantities. US natural gas futures soared 15.98% last week, and among the many futures, natural gas was the most heavily shorted, having fallen to a 30-year low in February. Upstream companies have gradually reduced capacity and exported large quantities in the past year to reduce inventory. The Middle East situation has changed natural gas trade routes, so oil and gas companies have begun to restore upstream production capacity. The bottom of the natural gas cycle has emerged. Air Products and Chemicals is highly correlated with natural gas prices.

- Electricity demand will drive natural gas demand. The future energy landscape is changing, leading to increased demand for natural gas in the medium to long term. Natural gas is the primary raw material for power generation in Western countries. China has already established market leadership in the photovoltaic and electric vehicle industries, and hydrogen energy is seen as the next vital area for all countries to focus on. Over the past two years, hydrogen energy and energy storage have been the fastest growing segments within the new energy industry segment.

APD stock vs Natural gas price trend

(Source: Bloomberg)

- 2Q24 earnings review. Revenue fell by 8.4% YoY to US$29.3bn, below estimates by US$130mn. Non-GAAP EPS was US$2.85, beating estimates by US$0.15. For FY24, adjusted EPS is expected to be between US$12.20 and $12.50, compared to the consensus estimate of US$12.31.

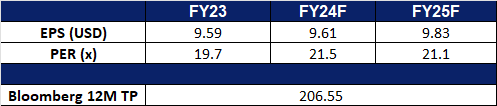

- Market consensus.

(Source: Bloomberg)

Hershey Co (HSY US): Decline in cocoa prices

- RE-ITERATE Entry – 207.0 Target –228.0 Stop Loss – 196.5

- The Hershey Company manufactures chocolate and sugar confectionery products. The Company’s principal products includes chocolate and sugar confectionery products, gum and mint refreshment products, and pantry items, such as baking ingredients, toppings, and beverages.

- Recent cocoa price decline. Cocoa prices have surged to nearly $10,000 per metric ton in March 2024, driven by a global shortage caused by climate change-induced droughts in West Africa, structural issues like underinvestment in cocoa farms, and increased investor speculation. This has led to higher costs for chocolate brands, many of which are passing these costs onto consumers, resulting in reduced demand and a shift towards other snacks. Some manufacturers are reducing product sizes or using less cocoa to cope. Cocoa prices dropped significantly to around US$7,277 per metric ton from record high of US$11,722 per metric ton earlier in the year, driven by a shortage of cocoa beans due to heavy rains and disease. This price decline was due to favourable climate changes which is expected to improve cocoa supply. Even though Hershey’s is largely covered on cocoa for the year, the decline in cocoa prices is beneficial for the company as will result in increased profit margins.

- New product varieties. Hershey recently showcased new products and retail strategies at the 2024 Sweets & Snacks Expo in Indianapolis, held from 14 May to 16 May, highlighting its expanding sweet and salty portfolio. New offerings include Reese’s Caramel Big Cup, Kit Kat Pink Lemonade, and Hershey’s Crunchy Waffle Cone Bars, among others. The company is also introducing Reese’s Medals for the Olympic Games. Hershey utilized augmented reality and image recognition to optimize merchandise placement and sales. With increasing foodservice demand, Hershey advises retailers to implement mobile ordering and foodservice features to enhance customer engagement. Effective merchandising at both assisted and self-checkout terminals is emphasized to maximize unplanned purchases and improve the shopping experience. Its new offerings cater to customer preferences, and the new flavours are likely to attract more customers to purchase these snacks.

- Delivered good results. Hershey exceeded Wall Street expectations for first-quarter sales and profit, driven by higher prices and steady consumer demand for its chocolates and candy. Despite raising prices to offset commodity costs, Hershey faced minimal resistance from customers, especially during holidays like Easter and Thanksgiving. Net sales rose 8.9% YoY to US$3.25bn, surpassing the expected US$3.11bn. Confectionary sales in North America, which makes up 80% of revenue, increased to US$2.70bn. Excluding items, earnings were US$3.07 per share, above the US$2.76 estimate. The company’s gross margin fell by 170 basis points to 44.9%.

- 1Q24 earnings review. Revenue rose by 8.7% YoY to US$3.25bn, beatings estimates by US$140mn. EPS was US$3.07, beating estimates by US$0.31. For 2Q24, it expects to deliver revenue between US$36.5bn to US$39.0bn. For FY24, Hershey expects net sales to increase by 2% to 3% versus estimated growth of 3.43% and adjusted earnings per share are expected to remain unchanged.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Stop loss on China State Construction International Holding (3311 HK) at HK$9.7. Add Air Products and Chemicals (APD) at US$264.