24 July 2024: Singapore Technologies Engineering Ltd (STE SP), BYD Co Ltd. (1211 HK), Caterpillar Inc (CAT US)

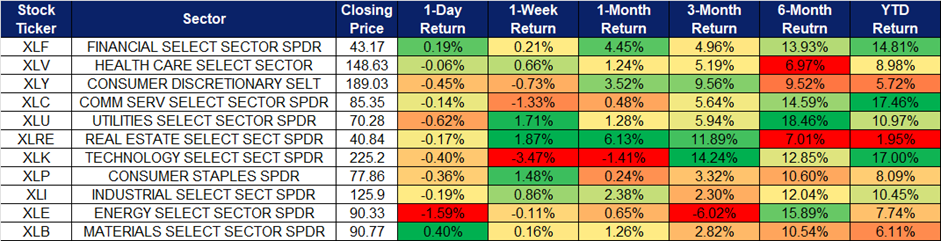

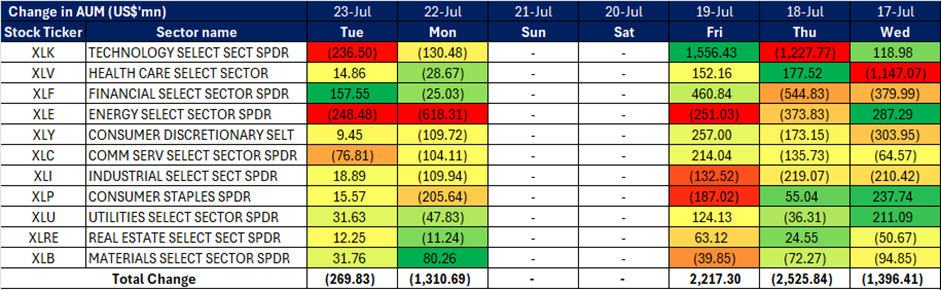

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

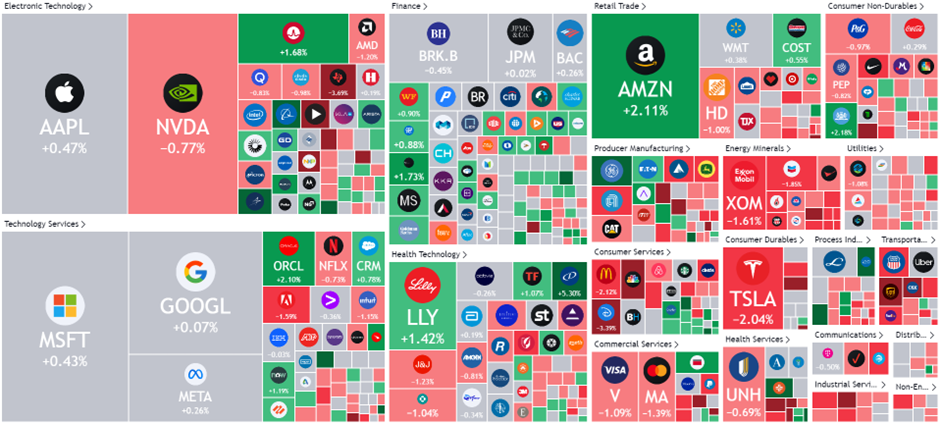

United States

Hong Kong

Singapore Technologies Engineering Ltd (STE SP): Deepening collaborations and partnerships

- BUY Entry – 4.38 Target– 4.70 Stop Loss – 4.22

- ST Engineering Ltd is a global technology, defence, and engineering group. The Company uses technology and innovation to solve problems and improve lives through its diverse portfolio of businesses across the aerospace, smart city, defence, and public security segments. ST Engineering serves clients worldwide.

- Collaboration to boost Cybersecurity. SPTel, a joint venture between ST Engineering and SP Group, has launched its Quantum-Safe Services, enhancing its National Quantum-Safe Network Plus (NQSN+) by integrating advanced quantum encryption products from ST Engineering, Nokia, and Fortinet. This initiative aims to provide comprehensive network protection against quantum threats. Appointed by Singapore’s Infocomm Media Development Authority, SPTel and SpeQtral are developing Southeast Asia’s first quantum-safe infrastructure, supporting the nation’s Digital Connectivity Blueprint. The services, designed for compatibility with existing IT infrastructures, secure data across physical, data link, and network layers using Nokia’s DWDM, ST Engineering’s encryptors, and Fortinet’s next-generation firewall. This initiative addresses the emerging “harvest now, decrypt later” threat and aims to fortify cyber defences in critical industries such as healthcare and finance. As cyber threats continue to rise globally, the demand for such services will increase, which would be beneficial for the adoption of ST Engineering’s encryptors.

- Strong order book. ST Engineering’s order book remains robust, valued at $27.7bn as of its first quarter 2024 business updates. The company anticipates delivering $6.5bn worth of orders for the remainder of the year. In the first quarter of 2024, ST Engineering secured additional contracts totaling $3.0bn. This includes $839 mn in the commercial aerospace sector, $1,645mn in the defense and public security market, and $542mn in the urban solutions and satcom industry. These new contract wins, along with a consistently strong order book, highlight the sustained high demand for ST Engineering’s services.

- Deepening LEAP engine support for Safra Aircraft Engines. ST Engineering recently announced that its Commercial Aerospace business has deepened its support for Safran Aircraft Engines1 by entering into a two-year agreement, with an option for extension, to provide module repair offload support for the CFM LEAP-1A and LEAP-1B engines. Under the agreement, Safran Aircraft Engines will offload module repair work on the high pressure turbine (HPT) rotor assembly and stage 2 HPT nozzle assembly of the LEAP-1A and LEAP-1B engines to ST Engineering. This collaboration addresses the growing MRO demand for LEAP engines as operators ramp up their flying operations. ST Engineering’s offload support augments Safran Aircraft Engines’ MRO capacity and optimises the turnaround time of engine shop visits for customers. This agreement strengthens the partnership with Safran Aircraft Engines and support for LEAP engines operators, and well positions the company to address the rising demand for quick-turn and performance restoration shop visits for LEAP engines.

- 1Q24 results review. Revenue rose by 18% YoY to S$2,703mn in 1Q24, compared to S$2,289mn in 1Q23, driven by double-digit YoY growth in its commercial aerospace and defence and public security segments. In the first quarter, its commercial aerospace revenue and defence and public security revenue grew 32% YoY to S$1.2bn and 14% YoY to S$1.1bn respectively.

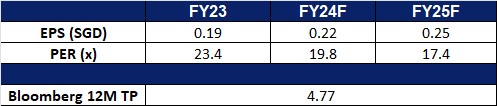

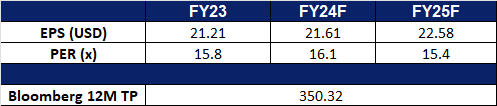

- Market Consensus.

(Source: Bloomberg)

SATS Ltd (SATS SP): Service improvement amidst air travel recovery

- RE-ITERATE BUY Entry – 3.08 Target– 3.40 Stop Loss – 2.94

- SATS Ltd. provides gateway services and food solutions. The Company specializes in airfreight, ramp and baggage handling; passenger services; aviation security services; aircraft cleaning; and cruise centre management. It also provides airline catering; institutional catering; aviation laundry; and food distribution and logistics. SATS has presence across Asia and the Middle East.

- Air passenger traffic not slowing. According to the International Air Transport Association, in 2024, the airline industry has recovered from the COVID-19 crisis, with total traffic surpassing 2019 levels in February. Domestic travel returned to pre-COVID levels in spring 2023, while international routes have also recently recovered. Most regions are expected to exceed 2019 levels in 2024, with Asia Pacific leading growth at 17.2% YoY. Over the next 20 years, global passenger journeys are expected to increase by an average of 3.8% annually, resulting in over 4 billion additional journeys by 2043 compared to 2023. This yearly rise in global travel will contribute to SATS revenue growth in the coming years.

- Business restructuring. SATS recently announced the division of its airport ground handling services into separate units for Singapore and the Asia-Pacific region to stimulate company growth. The restructuring of its Gateway Services business resulted in the creation of two new units: the Singapore Hub and Gateway Services Asia-Pacific. The Singapore Hub will focus on enhancing aviation hub competitiveness in Singapore, while Gateway Services Asia-Pacific will aim to expand the group’s market share by managing operations in overseas airports.

- Lounge improvements. SATS unveiled its upgraded Premier Lounge at Changi Airport Terminal 3 recently, featuring Singaporean dishes like laksa, chicken rice, and prawn noodles, along with interior designs by local artists and students. The lounge includes a new Executive space with private pods, dining service, and travel-friendly amenities. SATS plans to extend similar refurbishments to its other lounges in Terminals 1 and 2 over the next few years. The lounge also offers pasta made by robot chefs, products from SATS Gourmet Solutions, and collaborations with six renowned local food and beverage brands. SATS CEO highlighted the aim to enrich travellers’ experiences with a blend of food, culture, and hospitality. Refurbishments to the lounges in different terminals will offer more comfort and incentive for travellers at Singapore Changi Airport to visit the lounges.

- FY24 results review. Total revenue rose by 192.9% YoY to S$5.15bn in FY24, compared to S$1.76bn in FY23. Core PATMI rose by 331.3% to S$78.5mn in FY24, compared to S$18.2mn in FY23. Basic EPS was 3.8 Scents in FY24, compared to -2.2 Scents in FY23.

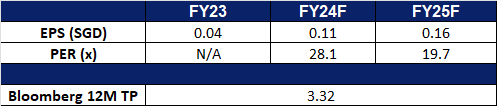

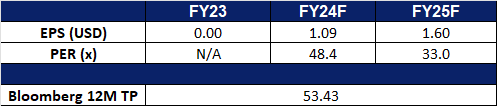

- Market Consensus.

(Source: Bloomberg)

BYD Co Ltd. (1211 HK): Aggressive expansion

- RE-ITERATE BUY Entry – 233 Target 253 Stop Loss – 223

- BYD Co Ltd. is a China-based company principally engaged in the manufacture and sales of transportation equipment. The Company is also engaged in the manufacture and sales of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and automobiles and related products. The Company mainly conducts its businesses in China, the United States and Europe.

- Expansion in Vietnam. BYD recently unveiled its plans to aggressively expand its dealership network in Vietnam, posing a formidable challenge to local rival VinFast. Last week, the company opened its first 13 dealerships in the country and aims to increase this number to around 100 by 2026. Currently offering three models, BYD plans to expand its lineup to six models by October.

- More manufacturing plants. Earlier this month, BYD opened an electric vehicle plant in Thailand, marking its first factory in Southeast Asia, a rapidly growing EV market where the company has become a dominant player. The $490mn facility will have an annual production capacity of 150,000 vehicles, including plug-in hybrids. It will also assemble batteries and other critical components for BYD’s vehicles. BYD recently signed a $1 billion deal to establish a manufacturing plant in Turkey as part of its ongoing international expansion. The new plant will have an annual production capacity of up to 150,000 vehicles and is expected to begin operations by the end of 2026. This expansion aims to reduce the company’s future expenses by minimizing tariffs and import duties incurred when shipping vehicles from China to the EU.

- Record Sales in 2Q24. BYD sold a record number of electric and hybrid cars in the second quarter, according to sales data compiled by Bloomberg News. Nearly one million vehicles were sold during this period, marking a strong rebound after a slow start to the year. The surge in sales was driven by price cuts and new technology, which spurred consumer purchases. BYD’s strategy of reducing prices across most models, sacrificing profitability, aimed to compete with petrol models from foreign brands.

- 1Q24 earnings. The company operating revenue rose to RMB124.9bn, +3.97% YoY, compared to RMB120.2bn in 1Q23. The company’s net profit rose to RMB4.57bn, +10.62% YoY, compared to RMB4.13bn in 1Q23. Basic earnings per share were RMB1.57 in 1Q24, compared to RMB1.42 in 1Q23.

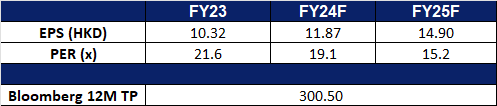

- Market consensus.

(Source: Bloomberg)

Sunny Optical Technology Group (2382 HK): Increasing supply chain presence

- RE-ITERATE BUY Entry – 48.6 Target 53.6 Stop Loss – 46.1

- Sunny Optical Technology Group Co Ltd is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components segment, Optoelectronic Products segment and Optical Instruments segment. The Company’s main products include mobile phone lenses, automotive lenses, high-pixel lens lights, camera modules and others. The Company’s products are sold in China and overseas markets.

- Entering Apple’s Supply chain. According to market news, Sunny Optical will be a Compact Camera Module (CCM) supplier for some iPhone 16 models and MacBooks by 2025, with mass production in Vietnam. As a first-tier CCM supplier, Sunny Opticals entry into Apple’s supply chain would significantly boost its revenue and support profit growth through vertical integration. Despite losing iPhone lens orders in 2023 due to production issues, Sunny Optical is set to regain these orders starting in the second half of 2024, aiming to restore its 2023 supply allocation by 2025, enhancing its business momentum.

- Expectations for AI integration in 2H. According to the International Data Corporation (IDC), global smartphone shipments increased by 6.5% year over year to 285.4 million units in 2Q24, marking the fourth consecutive quarter of growth. However, demand remained weak in many markets. Looking ahead, Chinese OEMs are increasing shipments in the low-end market, while there is excitement surrounding the growth of Gen AI smartphones, which are expected to capture 19% of the market this year. The 2H24 smartphone market is expected to be competitive and potentially driven by new-gen AI smartphone launches. With the release of new-gen AI smartphones, an increase in smartphone purchases is expected, leading to a surge in demand for Apple’s iPhone and a subsequent rise in revenue for Sunny Optical.

- PC shipments jump. Global shipments of personal computers (PCs) increased by 3% in 2Q24, reaching 64.9mn units, driven by demand for AI-capable devices, according to IDC. This marks the second consecutive quarter of growth after two years of decline. Apple saw the highest growth among PC makers with a 20.8% increase in shipments, followed by Acer Group with a 13.7% rise. The PC market is expected to rebound from a post-pandemic lull, with AI and a commercial refresh cycle contributing to this positive trend. Excluding China, global shipments grew over 5% YoY. This demand for PCs is expected to continue through 2H24 and FY25, with the release of more AI-capable devices, which will be beneficial for the sales of Sunny Opticals components needed in the new devices.

- FY23 earnings. Revenue fell by 4.6% YoY to RMB31.68bn in FY23, compared to RMB33.20bn in FY22. Net profit fell to RMB1.15bn in FY23, compared to RMB2.47bn in FY22. Basic EPS fell to RMB1.01 in FY23, compared to RMB2.20 in FY22.

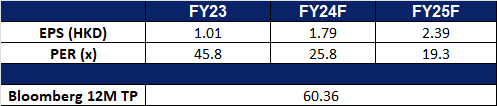

- Market consensus.

(Source: Bloomberg)

Caterpillar Inc (CAT US): Rotation to infrastructure

- RE-ITERATE BUY Entry – 346 Target – 382 Stop Loss – 328

- Caterpillar Inc. designs, manufactures, and markets construction, mining, and forestry machinery. The Company also manufactures engines and other related parts for its equipment, and offers financing and insurance. Caterpillar distributes its products through a worldwide organization of dealers.

- Interest rate cut cycle to benefit mining activities and real estate development. Stimulated by expectations of interest rate cuts, major base metals and precious metals have performed well this year. Copper prices once hit a record high, and aluminium prices also hit a two-year high; they are currently experiencing a correction, but they still maintain positive returns year-to-date. Gold prices recently broke through a record high of US$2,450 per ounce, while silver prices maintained a high of US$30 per ounce. It is expected that precious metals will continue to maintain an upward trend after the interest rate cut cycle starts, thus stimulating mining companies to increase mining activities, thereby driving demand for related construction machinery. In addition, real estate development is expected to recover under the interest rate cut cycle, thereby stimulating construction activities, which will in turn benefit the construction machinery sector.

- Sector rotation. The recent US election has had a greater impact on the stock market, and funds have begun to deploy Trump-themed transactions. Trump advocates the return of manufacturing to the United States, and the infrastructure industry is one of the profit sectors. In addition, Trump also advocates expanding US infrastructure. Looking back at Caterpillar’s performance during Trump’s administration, it hit a record high in the year after he entered the White House, with a return of more than 90% in the same year.

- 1Q24 earnings review. Revenue fell by 0.6% YoY to US$15.8bn, missing estimates by US$190mn. Non-GAAP earnings per shares was US$5.60 beating expectations by US$0.47.

- Market consensus.

(Source: Bloomberg)

Zillow Group Inc (Z US): Double bonanza

Zillow Group Inc (Z US): Double bonanza

- RE-ITERATE BUY Entry – 52 Target – 58 Stop Loss – 49

- Zillow Group, Inc. is a tech real-estate marketplace company. The Company provides information about homes, real estate listings, and mortgages through websites and mobile applications. Zillow Group serves homeowners, buyers, sellers, renters, and real estate professionals in the United States.

- Small-mid caps in focus. In the first half of the year, investors were mainly interested in large-cap and AI-related stocks, which boosted the performance of the S&P and Nasdaq. However, as the highly anticipated rate cut cycle is set to begin this quarter, funds and investors are now shifting their attention to sectors that have been underperforming, like small and mid-cap stocks and Dow component-related stocks. This change in investment focus will be advantageous for Zillow.

- All-time high home sales prices. In May, existing home sales fell 0.7% to an annual rate of 4.11mn, down 2.8% from the previous year, while the median home price in the US rose 5.8% YoY to a record US$419,300. Single-family home prices reached an all-time high of US$419,300 in May 2024. Inventory increased by 6.7% to 1.28mn units, a 3.7-month supply. Homes typically stayed on the market for 24 days, first-time buyers made up 31% of sales, and all-cash sales accounted for 28%. Mortgage rates averaged 6.87% as of 20 June. The housing market has been under pressure for the past two years due to the high-interest-rate environment. The Federal Reserve is anticipated to cut interest rates in the third quarter, leading to a decline in mortgage rates. This is expected to result in increased funds flowing into the real estate industry, potentially leading to a recovery in the real estate market and higher real estate sales.

- Housing showing early signs of recovery. US single-family homebuilding fell to an eight-month low in June due to higher mortgage rates, likely impacting economic growth in the second quarter. Permits for future single-family home construction also dropped to a one-year low, despite a shortage of previously owned houses keeping prices high. Single-family housing starts declined 2.2% to a rate of 980,000 units, with decreases in the Northeast and West but increases in the South and Midwest. The average rate for a 30-year fixed mortgage was 6.89% last week, down from a six-month high. Homebuilder confidence dipped in July, though sales expectations for the next six months improved. Residential investment likely detracted from GDP in Q2, with permits for single-family homes falling 2.3% to 934,000 units, while multi-family starts surged 22% to 360,000 units. Overall housing starts rose 3% to 1.353mn units, and completions reached the highest level since January 2007. It is expected that mortgage rates will decrease in line with the anticipated rate-cut cycle in the current quarter, which is likely to stimulate further activity in the housing market.

- 1Q24 earnings review. Revenue rose by 12.8% YoY to US$529mn, beating estimates by US$21.25mn. Net loss was US$23mn. Zillow reduced its Q2 sales estimate to between US$525mn and US$540mn short of analysts’ estimates of US$559mn.

- Market consensus.

(Source: Bloomberg)

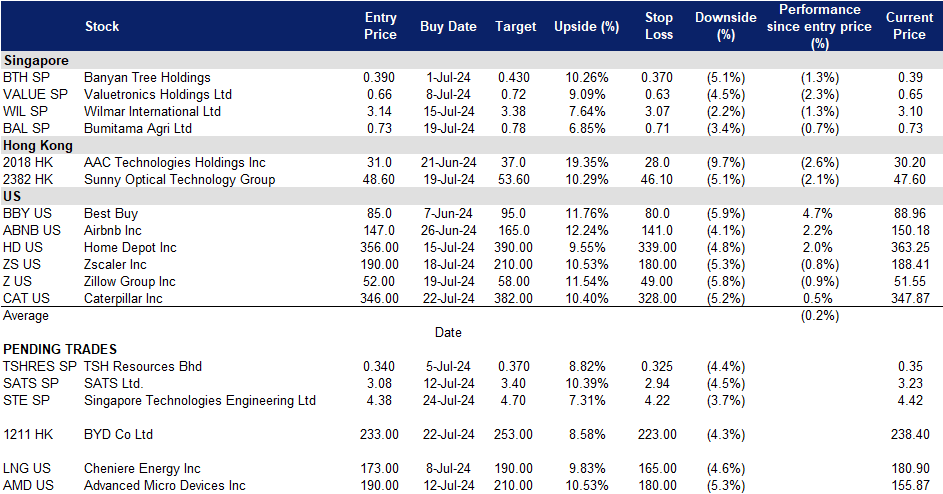

Trading Dashboard Update: Add Caterpillar Inc (CAT US) at US$346. Cut loss on Shandong Gold Mining (1787 HK) at HK$16.9.