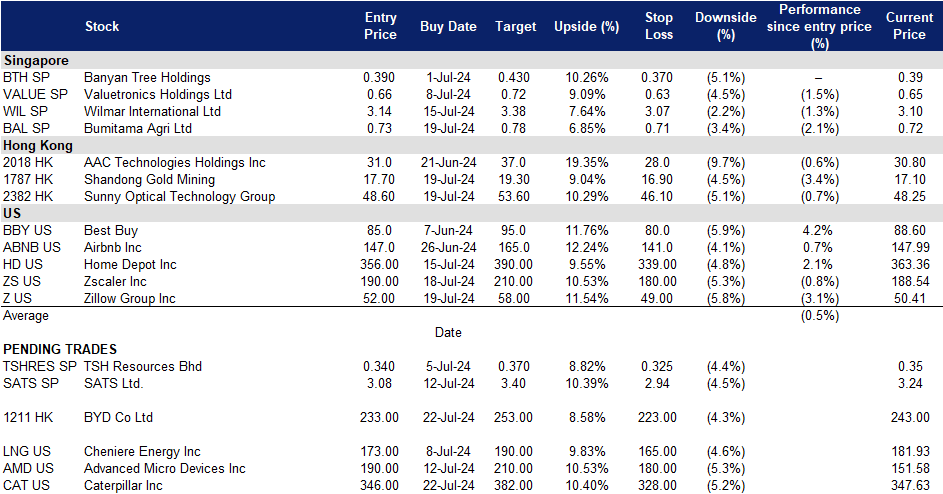

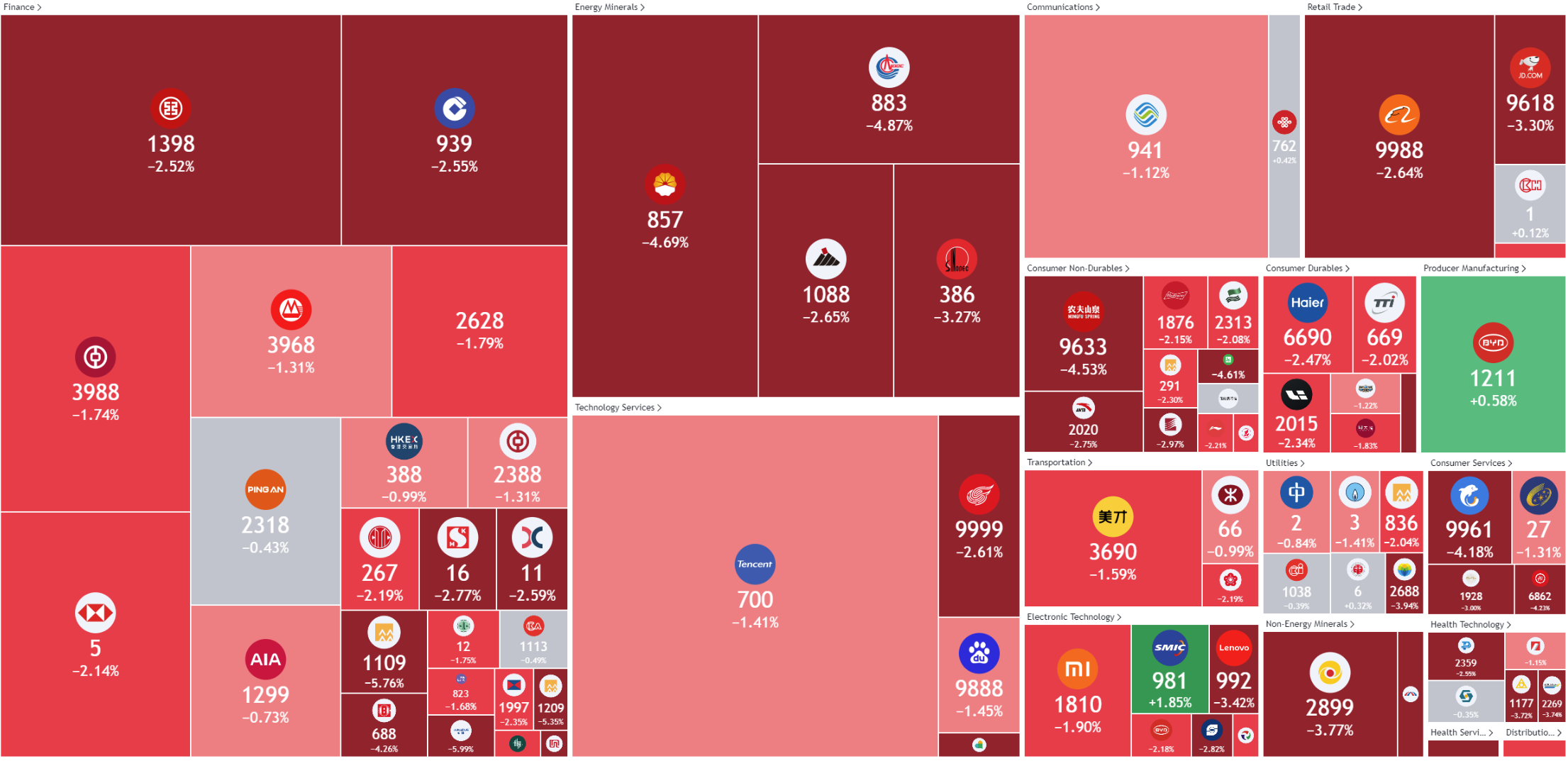

22 July 2024: Bumitama Agri Ltd (BAL SP), BYD Co Ltd. (1211 HK), Caterpillar Inc (CAT US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

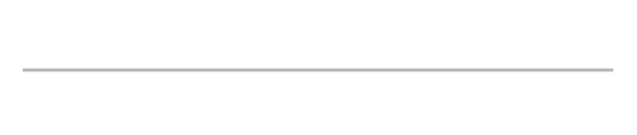

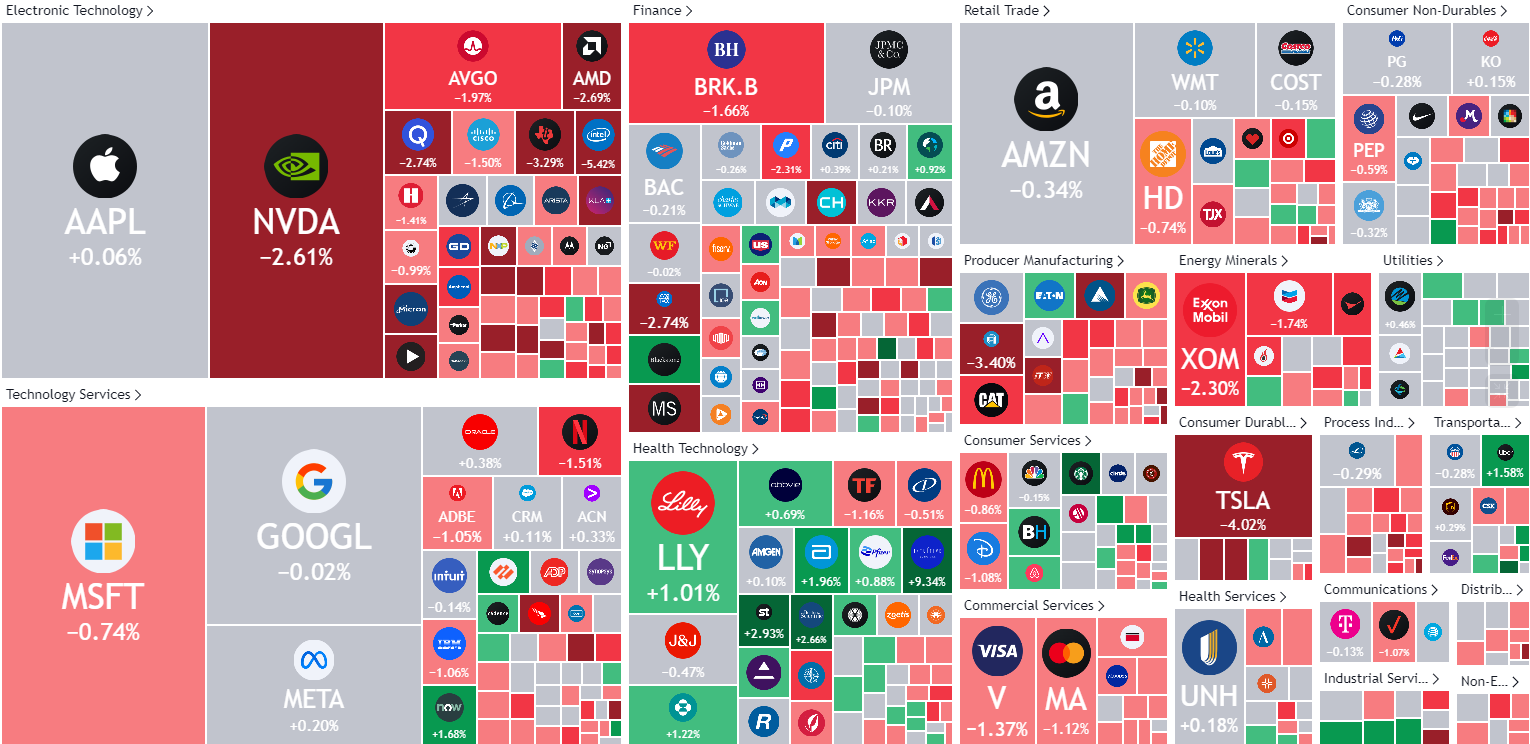

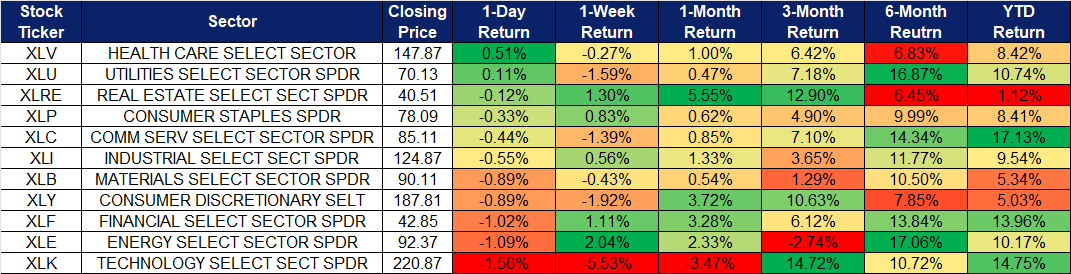

United States

Hong Kong

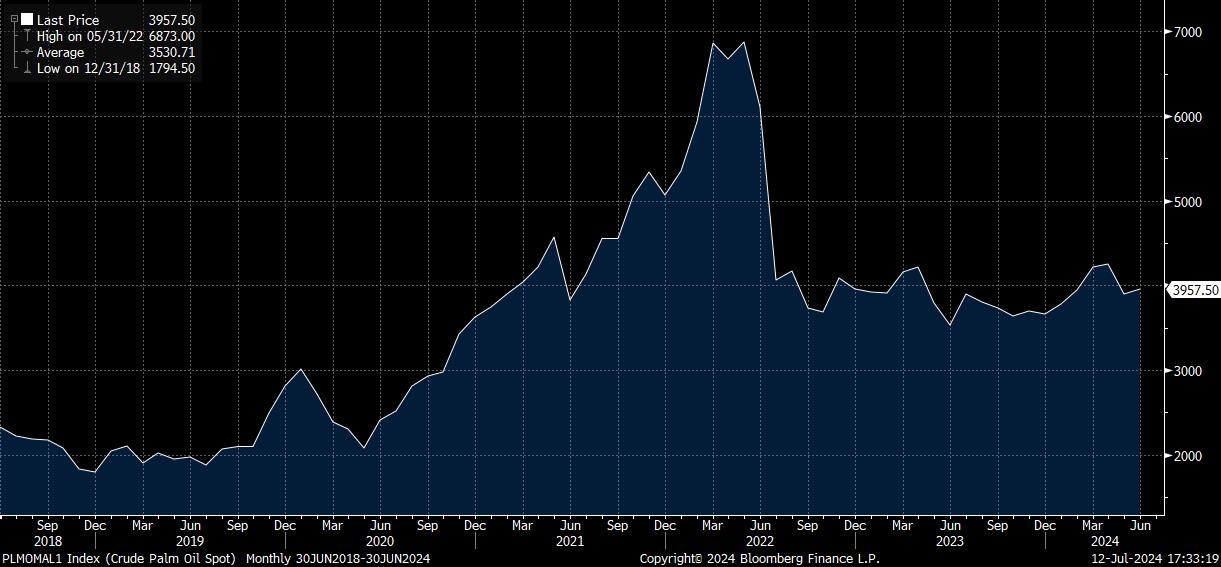

Bumitama Agri Ltd (BAL SP): Potential upside of palm oil prices

- RE-ITERATE BUY Entry – 0.730 Target– 0.780 Stop Loss – 0.705

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK and selling CPO and PK in Indonesia.

- Palm oil prices to remain elevated. Crude palm oil prices are anticipated to stay strong due to tighter production and high demand from India and China, according to the Malaysian Palm Oil Council (MPOC). Malaysia’s benchmark prices are expected to range between 3,800 ringgit to 4,200 ringgit per metric ton in 2H24. MPOC chief executive noted that Malaysia’s palm oil production growth will likely slow due to a high base effect from 2023’s peak output since 2018. Combined production from Indonesia and Malaysia shows a supply deficit of 200,000t. Despite Malaysia’s production increase of 440,000t from January to April 2024, Indonesia’s production decreased by 640,000t. Stable demand from India and China, along with slowing production, will maintain robust palm oil prices. Global supplies could further tighten if Indonesia raises its biodiesel blending rate to 40% next year. Malaysia’s palm oil production is forecast to rise by 2.4% to 19mt in 2024, with exports expected to increase by 3.1% to 15.6mt. The country’s palm oil inventory is projected to be around two million tons by December. This deficit in palm oil production alongside strong demand will continue to support the robust palm oil prices, benefiting company’s palm oil business.

Crude Palm Oil Price

(Source: Bloomberg)

- Strong demand for palm oil. India’s import of vegetable oils, including both edible and non-edible oils, increased by 18% in June to 15.5 lakh tonnes, driven by higher imports of crude palm oil and crude sunflower oil, according to trade data. In June 2024, vegetable oil imports reached 1,550,659 tonnes, up from 1,314,476 tonnes a year earlier. The robust import figures indicate sustained strong demand for palm oil in India, who is also the largest importer of palm oil globally. Bumitama Agri is likely to continue benefiting from this high demand for palm oil.

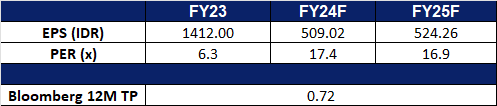

- FY23 results review. Revenue fell by 2.4% YoY to IDR15.4tn in FY23, compared to IDR15.8tn in FY22. Net profit fell by 13.8% to IDR2.93tn in FY23, compared to IDR3.40tn in FY22. Basic and Diluted EPS per shares is 1,412IDR in FY23, compared to 1,618IDR in FY22.

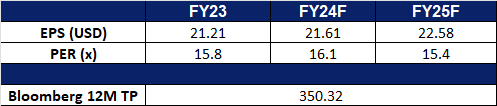

- Market Consensus.

(Source: Bloomberg)

SATS Ltd (SATS SP): Service improvement amidst air travel recovery

- RE-ITERATE BUY Entry – 3.08 Target– 3.40 Stop Loss – 2.94

- SATS Ltd. provides gateway services and food solutions. The Company specializes in airfreight, ramp and baggage handling; passenger services; aviation security services; aircraft cleaning; and cruise centre management. It also provides airline catering; institutional catering; aviation laundry; and food distribution and logistics. SATS has presence across Asia and the Middle East.

- Air passenger traffic not slowing. According to the International Air Transport Association, in 2024, the airline industry has recovered from the COVID-19 crisis, with total traffic surpassing 2019 levels in February. Domestic travel returned to pre-COVID levels in spring 2023, while international routes have also recently recovered. Most regions are expected to exceed 2019 levels in 2024, with Asia Pacific leading growth at 17.2% YoY. Over the next 20 years, global passenger journeys are expected to increase by an average of 3.8% annually, resulting in over 4 billion additional journeys by 2043 compared to 2023. This yearly rise in global travel will contribute to SATS revenue growth in the coming years.

- Business restructuring. SATS recently announced the division of its airport ground handling services into separate units for Singapore and the Asia-Pacific region to stimulate company growth. The restructuring of its Gateway Services business resulted in the creation of two new units: the Singapore Hub and Gateway Services Asia-Pacific. The Singapore Hub will focus on enhancing aviation hub competitiveness in Singapore, while Gateway Services Asia-Pacific will aim to expand the group’s market share by managing operations in overseas airports.

- Lounge improvements. SATS unveiled its upgraded Premier Lounge at Changi Airport Terminal 3 recently, featuring Singaporean dishes like laksa, chicken rice, and prawn noodles, along with interior designs by local artists and students. The lounge includes a new Executive space with private pods, dining service, and travel-friendly amenities. SATS plans to extend similar refurbishments to its other lounges in Terminals 1 and 2 over the next few years. The lounge also offers pasta made by robot chefs, products from SATS Gourmet Solutions, and collaborations with six renowned local food and beverage brands. SATS CEO highlighted the aim to enrich travellers’ experiences with a blend of food, culture, and hospitality. Refurbishments to the lounges in different terminals will offer more comfort and incentive for travellers at Singapore Changi Airport to visit the lounges.

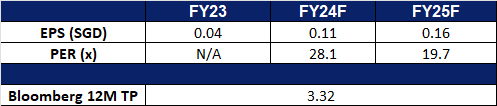

- FY24 results review. Total revenue rose by 192.9% YoY to S$5.15bn in FY24, compared to S$1.76bn in FY23. Core PATMI rose by 331.3% to S$78.5mn in FY24, compared to S$18.2mn in FY23. Basic EPS was 3.8 Scents in FY24, compared to -2.2 Scents in FY23.

- Market Consensus.

(Source: Bloomberg)

BYD Co Ltd. (1211 HK): Aggressive expansion

- BUY Entry – 233 Target 253 Stop Loss – 223

- BYD Co Ltd. is a China-based company principally engaged in the manufacture and sales of transportation equipment. The Company is also engaged in the manufacture and sales of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and automobiles and related products. The Company mainly conducts its businesses in China, the United States and Europe.

- Expansion in Vietnam. BYD recently unveiled its plans to aggressively expand its dealership network in Vietnam, posing a formidable challenge to local rival VinFast. Last week, the company opened its first 13 dealerships in the country and aims to increase this number to around 100 by 2026. Currently offering three models, BYD plans to expand its lineup to six models by October.

- More manufacturing plants. Earlier this month, BYD opened an electric vehicle plant in Thailand, marking its first factory in Southeast Asia, a rapidly growing EV market where the company has become a dominant player. The $490mn facility will have an annual production capacity of 150,000 vehicles, including plug-in hybrids. It will also assemble batteries and other critical components for BYD’s vehicles. BYD recently signed a $1 billion deal to establish a manufacturing plant in Turkey as part of its ongoing international expansion. The new plant will have an annual production capacity of up to 150,000 vehicles and is expected to begin operations by the end of 2026. This expansion aims to reduce the company’s future expenses by minimizing tariffs and import duties incurred when shipping vehicles from China to the EU.

- Record Sales in 2Q24. BYD sold a record number of electric and hybrid cars in the second quarter, according to sales data compiled by Bloomberg News. Nearly one million vehicles were sold during this period, marking a strong rebound after a slow start to the year. The surge in sales was driven by price cuts and new technology, which spurred consumer purchases. BYD’s strategy of reducing prices across most models, sacrificing profitability, aimed to compete with petrol models from foreign brands.

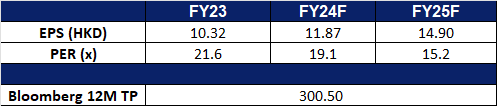

- 1Q24 earnings. The company operating revenue rose to RMB124.9bn, +3.97% YoY, compared to RMB120.2bn in 1Q23. The company’s net profit rose to RMB4.57bn, +10.62% YoY, compared to RMB4.13bn in 1Q23. Basic earnings per share were RMB1.57 in 1Q24, compared to RMB1.42 in 1Q23.

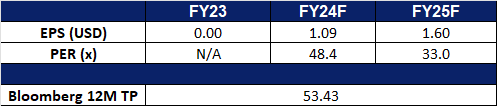

- Market consensus.

(Source: Bloomberg)

Shandong Gold (1787 HK): Record Gold Prices

- RE-ITERATE BUY Entry – 17.70 Target 19.30 Stop Loss – 16.90

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

- Better rate cut outlook driving Gold prices. Gold rose towards $2,470 per ounce on Thursday, nearing record highs amid growing optimism that the Federal Reserve will reduce rates as early as September. More Fed officials have expressed growing confidence that the pace of price increases is aligning more closely with policymakers’ goals. Powell also noted recently that June’s lower-than-expected inflation boosted confidence in achieving the price growth target, and emphasized the central bank’s readiness to cut rates before inflation reaches 2%. According to the CME’s Fed Watch Tool, markets now indicate a 98% chance of a rate cut at the Fed’s September meeting, with traders favoring three 25-basis-point rate cuts this year instead of two.

Gold Price

(Source: Bloomberg)

- New mining license. Shandong Gold Mining has successfully acquired the mining license for the Yanshan Mine Area from Shandong Gold Group Penglai Mining Co., Ltd., expanding its asset portfolio. The acquisition includes a total of five mineral rights, which promises to enhance the company’s mining capabilities and asset base. This strategic move is part of Shandong Gold Mining’s ongoing efforts to solidify its position in the mining industry.

- Continued global geopolitical tension and economic uncertainties. The ongoing Israel-Hamas conflict is likely to further escalate regional tensions. Red Sea attacks by the Houthis have continued to disrupt maritime networks, increasing uncertainty in the global economy. The recent assassination attempt on former President Donald Trump has also heightened political instability. These rising geopolitical tensions and economic uncertainties have led to a heightened demand for safe-haven assets such as gold.

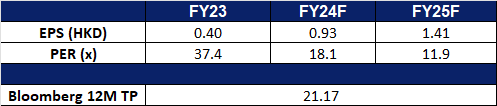

- 1Q24 earnings. The company revenue rose to RMB19.0bn, +44.7% YoY, compared to RMB13.1bn in 1Q23. The company’s profit rose to RMB699.9mn, +59.5% YoY, compared to RMB438.9mn in 1Q23. Basic earnings per share were RMB0.13 in 1Q24, compared to RMB0.07 in 1Q23.

- Market consensus.

(Source: Bloomberg)

Caterpillar Inc (CAT US): Rotation to infrastructure

- BUY Entry – 346 Target – 382 Stop Loss – 328

- Caterpillar Inc. designs, manufactures, and markets construction, mining, and forestry machinery. The Company also manufactures engines and other related parts for its equipment, and offers financing and insurance. Caterpillar distributes its products through a worldwide organization of dealers.

- Interest rate cut cycle to benefit mining activities and real estate development. Stimulated by expectations of interest rate cuts, major base metals and precious metals have performed well this year. Copper prices once hit a record high, and aluminium prices also hit a two-year high; they are currently experiencing a correction, but they still maintain positive returns year-to-date. Gold prices recently broke through a record high of US$2,450 per ounce, while silver prices maintained a high of US$30 per ounce. It is expected that precious metals will continue to maintain an upward trend after the interest rate cut cycle starts, thus stimulating mining companies to increase mining activities, thereby driving demand for related construction machinery. In addition, real estate development is expected to recover under the interest rate cut cycle, thereby stimulating construction activities, which will in turn benefit the construction machinery sector.

- Sector rotation. The recent US election has had a greater impact on the stock market, and funds have begun to deploy Trump-themed transactions. Trump advocates the return of manufacturing to the United States, and the infrastructure industry is one of the profit sectors. In addition, Trump also advocates expanding US infrastructure. Looking back at Caterpillar’s performance during Trump’s administration, it hit a record high in the year after he entered the White House, with a return of more than 90% in the same year.

- 1Q24 earnings review. Revenue fell by 0.6% YoY to US$15.8bn, missing estimates by US$190mn. Non-GAAP earnings per shares was US$5.60 beating expectations by US$0.47.

- Market consensus.

(Source: Bloomberg)

Zillow Group Inc (Z US): Double bonanza

Zillow Group Inc (Z US): Double bonanza

- RE-ITERATE BUY Entry – 52 Target – 58 Stop Loss – 49

- Zillow Group, Inc. is a tech real-estate marketplace company. The Company provides information about homes, real estate listings, and mortgages through websites and mobile applications. Zillow Group serves homeowners, buyers, sellers, renters, and real estate professionals in the United States.

- Small-mid caps in focus. In the first half of the year, investors were mainly interested in large-cap and AI-related stocks, which boosted the performance of the S&P and Nasdaq. However, as the highly anticipated rate cut cycle is set to begin this quarter, funds and investors are now shifting their attention to sectors that have been underperforming, like small and mid-cap stocks and Dow component-related stocks. This change in investment focus will be advantageous for Zillow.

- All-time high home sales prices. In May, existing home sales fell 0.7% to an annual rate of 4.11mn, down 2.8% from the previous year, while the median home price in the US rose 5.8% YoY to a record US$419,300. Single-family home prices reached an all-time high of US$419,300 in May 2024. Inventory increased by 6.7% to 1.28mn units, a 3.7-month supply. Homes typically stayed on the market for 24 days, first-time buyers made up 31% of sales, and all-cash sales accounted for 28%. Mortgage rates averaged 6.87% as of 20 June. The housing market has been under pressure for the past two years due to the high-interest-rate environment. The Federal Reserve is anticipated to cut interest rates in the third quarter, leading to a decline in mortgage rates. This is expected to result in increased funds flowing into the real estate industry, potentially leading to a recovery in the real estate market and higher real estate sales.

- Housing showing early signs of recovery. US single-family homebuilding fell to an eight-month low in June due to higher mortgage rates, likely impacting economic growth in the second quarter. Permits for future single-family home construction also dropped to a one-year low, despite a shortage of previously owned houses keeping prices high. Single-family housing starts declined 2.2% to a rate of 980,000 units, with decreases in the Northeast and West but increases in the South and Midwest. The average rate for a 30-year fixed mortgage was 6.89% last week, down from a six-month high. Homebuilder confidence dipped in July, though sales expectations for the next six months improved. Residential investment likely detracted from GDP in Q2, with permits for single-family homes falling 2.3% to 934,000 units, while multi-family starts surged 22% to 360,000 units. Overall housing starts rose 3% to 1.353mn units, and completions reached the highest level since January 2007. It is expected that mortgage rates will decrease in line with the anticipated rate-cut cycle in the current quarter, which is likely to stimulate further activity in the housing market.

- 1Q24 earnings review. Revenue rose by 12.8% YoY to US$529mn, beating estimates by US$21.25mn. Net loss was US$23mn. Zillow reduced its Q2 sales estimate to between US$525mn and US$540mn short of analysts’ estimates of US$559mn.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Bumitama Agri Ltd (BAL SP) at S$0.73, Shandong Gold Mining (1787 HK) at HK$17.70, Sunny Optical Technology Group (2382 HK) at HK$48.60, Zscaler Inc (ZS US) at US$190 and Zillow Group Inc (Z US) at US$52. Cut loss on Trip.com Group Ltd (9961 HK) at HK$350.