21 June 2024: Genting Singapore Ltd (GENS SP), Singapore Airlines Ltd (SIA SP), COSCO Shipping Holdings Co. Ltd. (1919 HK)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

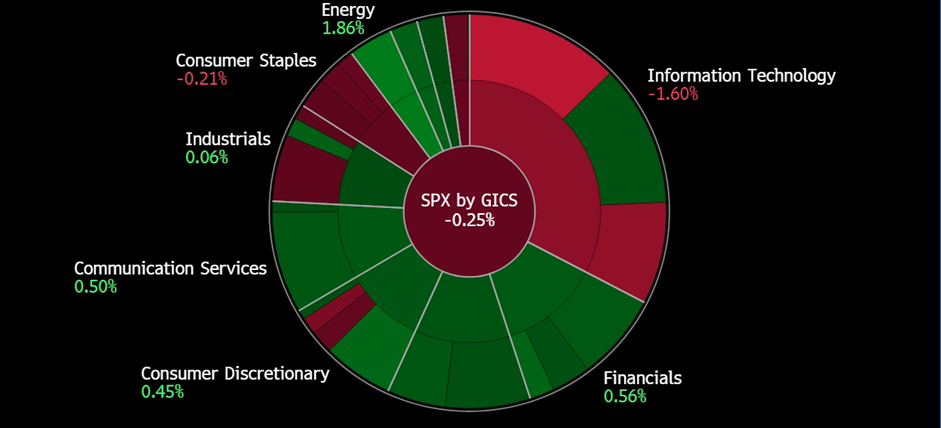

United States

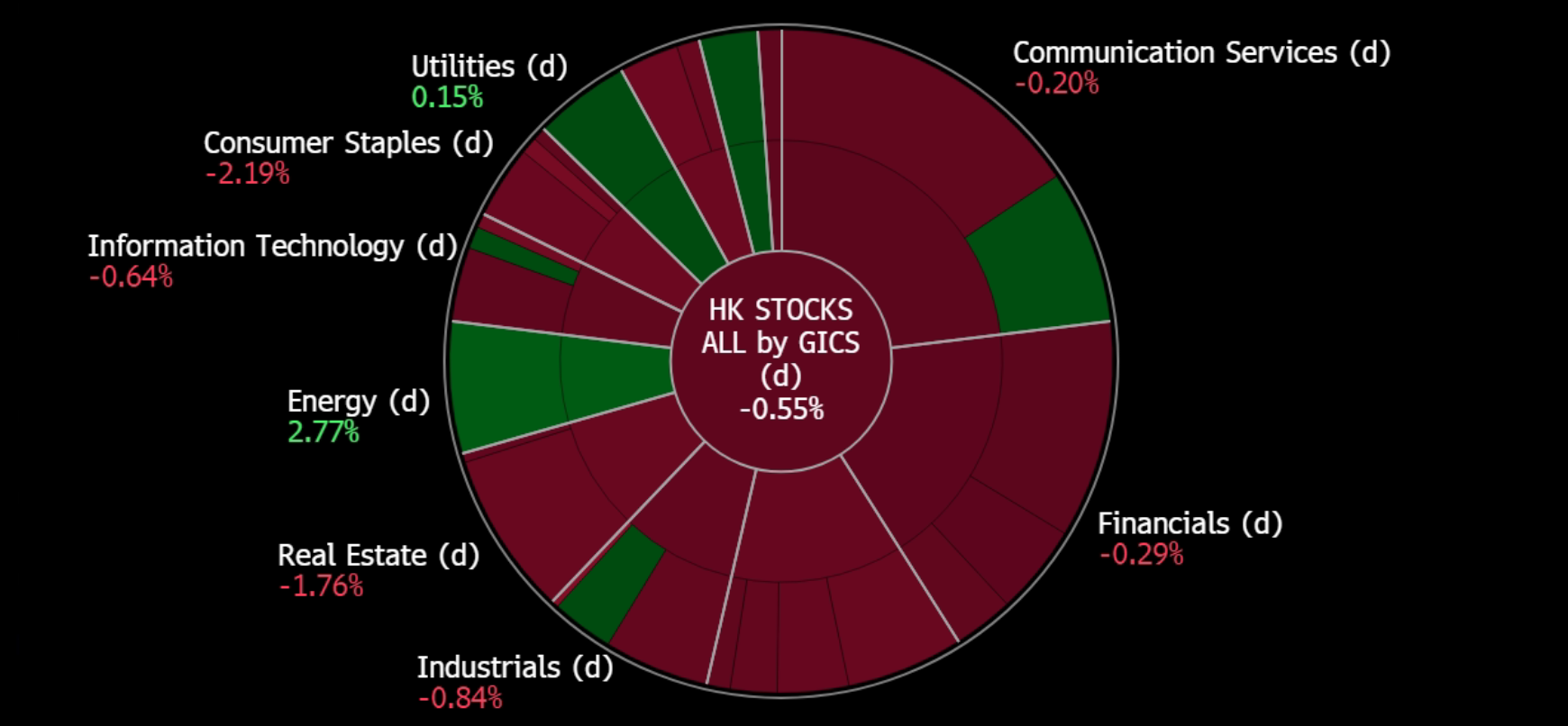

Hong Kong

Genting Singapore Ltd (GENS SP): Summer vacation season

- RE-ITERATE BUY Entry – 0.87 Target– 0.93 Stop Loss – 0.84

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

- Summer vacation preference. Agoda has identified the top international summer vacation spots for Indian travellers, with Bali, Singapore, Bangkok, Dubai, and Kuala Lumpur leading the list for May and June. The data shows a strong preference for Southeast Asian destinations, with Thailand, Indonesia, Singapore, and Malaysia being the most searched, followed by the UAE. This trend highlights Indian tourists’ interest in diverse cultural experiences, urban landscapes, and beaches. With Singapore being one of the top destinations, Resorts World Sentosa will be sure to attract more tourists during this busy summer season.

Genting Singapore Stock Seasonal Performance

(Source: Bloomberg)

- Momentum to continue. Genting Singapore reported a 91.5% increase in net profit for 1Q24, reaching S$247.4mn, up from S$129.2mn the previous year. Revenue rose by 61.9% to S$784.4 million. The boost is attributed to higher visitor numbers and tourism spending during the Chinese New Year and relaxed visa regulations between China and Singapore. Resorts World Sentosa plans to host more lifestyle events, such as Harry Potter: Visions of Magic, in 2H24 and is on track with new projects like Minion Land and Singapore Oceanarium, set to open in early 2025. Additionally, a new Waterfront development is expected to be awarded in 3Q24, and a new luxury hotel will launch in early 2025. RWS also signed an MoU with Sentosa Development Corporation and other partners to enhance RWS’s appeal as part of broader. government efforts to boost tourism, which saw receipts exceed S$27.2bn in 2023.

- 1Q24 results review. Total revenue for the year rose 62% YoY to S$784.4mn from the previous S$484.5mn in 1Q23. Net profit increased 92.0% to S$247.4mn from S$129.2mn. Its gaming segment revenue increased significantly by 69% YoY to S$576mn and its non-gaming segment revenue also rose 44% YoY to S$208.3mn.

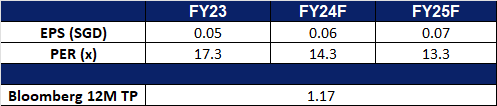

- Market Consensus.

(Source: Bloomberg)

Singapore Airlines Ltd (SIA SP): Seasonally peak coming

- RE-ITERATE BUY Entry – 6.74 Target– 7.24 Stop Loss – 6.49

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

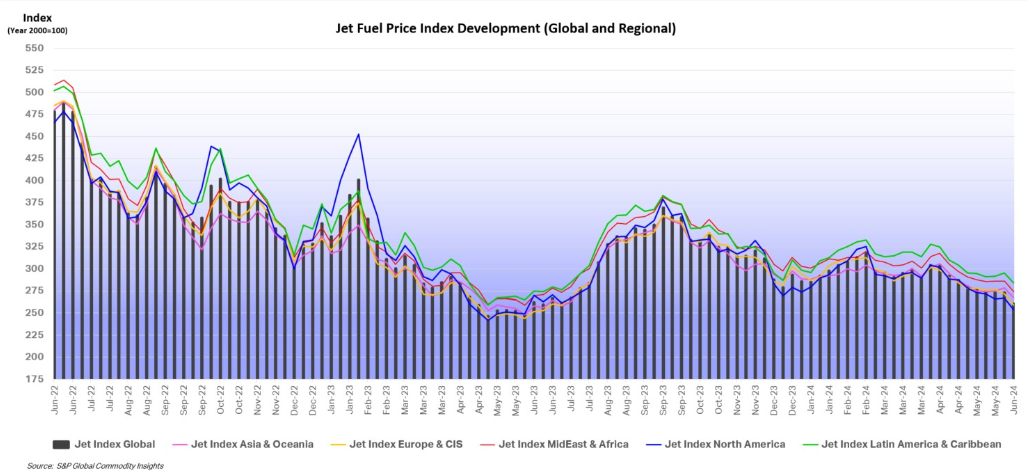

- Summer vacation demand. Despite the high-ticket prices, there has been a significant rise in travel demand due to the start of the summer holidays and the lifting of travel restrictions. This trend is evident in the large summer schedules and new destinations offered by airlines, as well as the increased capacity by some airlines to meet the growing demand. The decrease in jet fuel prices, coupled with higher ticket prices resulting from increased demand, is set to bolster Singapore Airlines’ profit margins.

Jet Fuel Price Trend

(Source: International Air Transport Association)

- Raised FY24 profit expectations. The International Air Transport Association (IATA) has raised its 2024 profit forecast for airlines to US$30.5bn, up from US$27.4bn in 2023. Revenue is projected to grow 9.7% to nearly US$1tn, with a record 4.96bn passengers expected to fly this year. However, supply chain issues and high fuel costs may impact profitability, with a forecasted profit margin of just 3.1% for the year. The Asia-Pacific region is expected to see the most significant profit increase.

- Striving towards sustainability goals. Cathay Pacific and Singapore Airlines have teamed up to promote the use of sustainable aviation fuel (SAF) in the region. They signed a memorandum of understanding to work on sustainability initiatives, including joint procurement of SAF, advocating for supportive policies, and creating a standard global accounting and reporting framework for emissions reductions. They also agreed to exchange best practices for reducing single-use plastic, minimizing waste, and improving energy efficiency. This collaboration aims to accelerate and support the development of the SAF supply chain in the region. The collaboration will assist the airlines in advancing their environmental initiatives, aligning with the decarbonisation theme in the aviation industry.

SIA seasonal performance

(Source: Bloomberg)

- Established a commercial partnership. On 4 June, it was announced that Singapore Airlines and Riyadh Air, a new airline set to start flying in 2025, inked a memorandum of understanding for a partnership. The partnership will explore interline connectivity, codeshare arrangements, and reciprocal benefits for frequent flyer programme members. This collaboration is expected to offer Riyadh Air’s guests access to SIA’s network in South-east Asia and the South-west Pacific and allow SIA’s customers greater access to the Middle East region through Riyadh Air’s network. This partnership aims to offer more options, better connectivity, and greater benefits to customers of both airlines, as well as to enhance customer experience and cargo services.

- FY23/24 results review. Total revenue for the year rose 7.0% YoY to S$19,013mn from the previous S$17,775mn in FY22/23. Net profit increased 24.0% to S$2,675mn from S$2,157. SIA and Scoot carried a combined 36.4mn passengers, up 37.6% YoY and passenger traffic grew 26.6%, outpacing the capacity expansion of 22.9%. This resulted in SIA and Scoot registering record passenger load factors of 87.1% and 91.2% respectively. It declared a final dividend of S$0.38 per share.

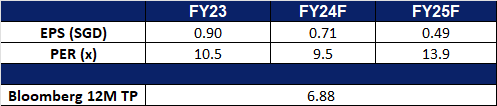

- Market Consensus.

(Source: Bloomberg)

COSCO Shipping Holdings Co. Ltd. (1919 HK): Freight rates reach a new high YTD

- BUY Entry – 14.4 Target 16.0 Stop Loss – 13.6

- COSCO SHIPPING Holdings Co., Ltd., formerly China COSCO Holdings Company Limited, is an investment holding company principally engaged in container shipping and related businesses. The Company is engaged in container shipping, dry bulk shipping, the management and operation of container terminals, container leasing and the provision of logistics services. The Company operates its business through two segments. The Container Shipping segment is engaged in the transportation of goods across the Pacific, Asia and Europe, and other international routes. The Terminal Operation and Investment segment is engaged in the operation and management of ports. The Company is also involved in the management and leasing of containers.

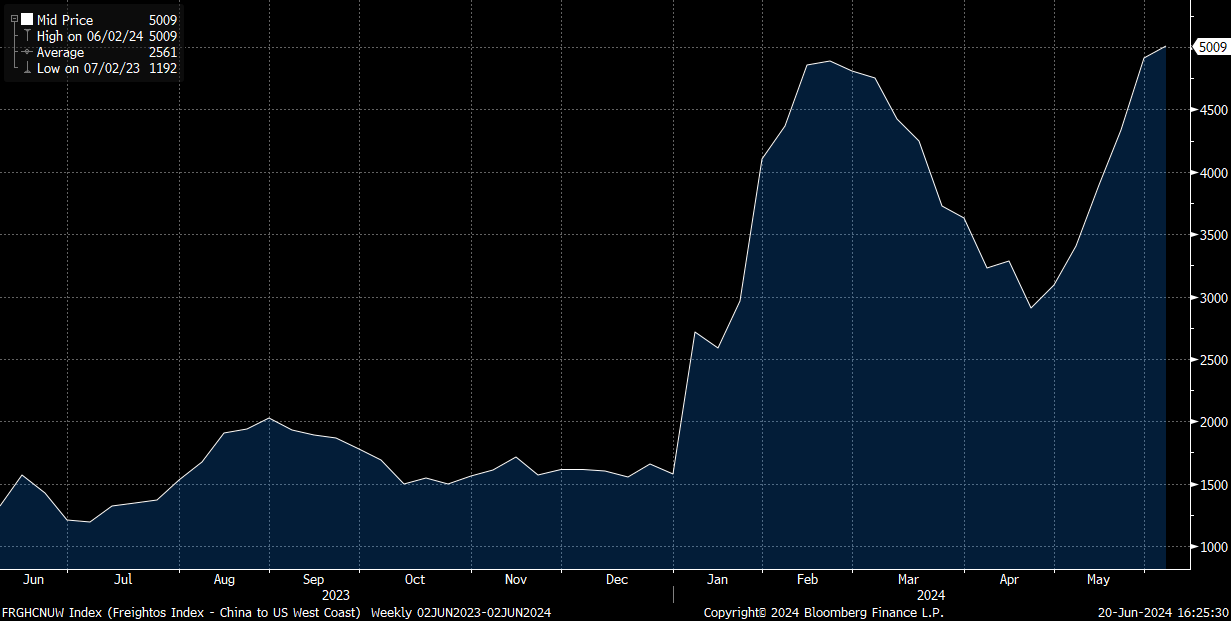

- Rebounding freight rates. The Freightos Baltic Index has rebounded even further since the end of April 2024, reaching its highest point since September 2022. This reflects a broader trend in the container shipping industry, marked by robust demand coupled with supply chain disruptions. The increased demand for sea freight is primarily due to shifting consumer behaviors and a growing reliance on e-commerce platforms. Additionally, ocean carriers are being forced to divert routes away from the Red Sea, opting instead to navigate around Africa’s Cape of Good Hope due to ongoing vessel attacks, further straining the supply chain by extending shipping times. This rebound in freight rates is expected to positively impact COSCO Shipping.

Freightos Baltic Index

(Source: Bloomberg)

- New strategic cooperation. Cosco Shipping recently entered into a strategic cooperation agreement with China Marine Bunker and CGN New Energy Holdings to develop green methanol production and sales integration project at Bairin Left Banner, Chifeng city, Inner Mongolia, which will be able to produce 200,000 tonnes methanol per year. Cosco Shipping will be in charge of the transportation and warehousing of green energy, while CGN New Energy Holding will be engaged in methanol production and China Marine Bunker will in charge of sales for ocean-going vessel fuel supply. Being able to cut carbon emission by up to 95%, this strategic agreement to produce green methanol comes in line with the global transition towards greener shipping initiatives.

- More shipping routes. Cosco Shipping recently launched a new container service connecting Tianjin Port in China to the East Coast of South America. The service began operations last week, facilitating trade between China and countries in the region by reducing sailing time from 54 to 40 days and increasing reefer shipping capacity. The company will deploy 12 vessels, each with a capacity of 14,000 TEU, offering weekly sailings. Given that China has been Brazil’s largest trading partner for 15 consecutive years, this additional container service is poised to drive long-term revenue growth for the company.

- 1Q24 results review. Revenue increased 1.94% YoY to RMB48.3bn in 1Q24, compared with RMB47.4bn in 1Q23. Net profit fell 5.23% to RMB6.76bn in 1Q24, compared to RMB7.13bn in 1Q23. Basic earnings per share was RMB0.42 in 1Q24, compared to RMB0.44 in 1Q23.

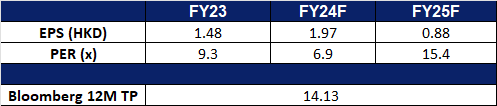

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

Uni-President China Holdings Ltd. (220 HK): Increasing ramen prices

- RE-ITERATE BUY Entry – 7.30 Target 7.90 Stop Loss – 7.00

- Uni-President China Holdings Ltd. is a Hong Kong-based investment holding company principally engaged in the manufacture and sales of beverages and instant noodles. It operates through three segments, including Beverages segment, Instant Noodles segment and Others segment. The Company’s beverage products include juice drinks, ready-to-drink tea, milk tea, coffee and bottled water, among others. Its instant noodles products include bowl noodles, packet noodles and snack noodles. The Company is also involved in the wholesales of forage and fertilizer, as well as the provision of catering services through its subsidiaries.

- To benefit from rising food prices. As food prices rise amidst China’s uncertain economy, people are increasingly turning to low-cost options like instant ramen. However, even instant ramen prices are climbing, as major manufacturers raise their retail prices, according to several media reports. Other food categories, including beverages, street food, fruits, and vegetables, have also seen price hikes due to rising costs of raw ingredients. This overall increase in food prices is driving consumers to choose cheaper alternatives instead of dining at more expensive places like restaurants. Uni-President China is bound to benefit from the increase in food prices as well as higher sales volume of instant products.

- Expanding presence. Earlier this year, Uni-President’s board authorized a share purchase to acquire full ownership of South Korea’s Woongjin Foods, increasing its stake from 79.32%. This acquisition aligns with Uni-President’s strategy to establish a large distribution platform in Asia and underscores its commitment to expanding into Northeast Asia.

- FY23 earnings. Revenue rose by 1.2% YoY to RMB28.6bn in FY23, compared to RMB28.3bn in FY22. Net profit rose 36.4% YoY to RMB1.67bn in FY23, compared to RMB1.22bn in FY22. Basic EPS rose 36.4% YoY to 38.6 RMB cents in FY23, compared to 28.3 RMB cents in FY22.

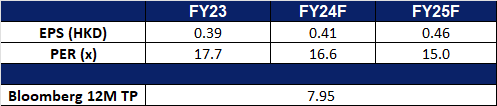

- Market consensus.

(Source: Bloomberg)

Broadcom Inc (AVGO US): Next to join the trillion-dollar club

- BUY STOP Entry – 1,850 Target –2,150 Stop Loss – 1,625

- Broadcom Inc. designs, develops, and supplies semiconductor and infrastructure software solutions. The Company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the most complex hybrid environments. Broadcom serves customers worldwide.

- Expecting AI spending boom. Market analysts recently predicted an increase in capital expenditure, on AI capabilities for mega-cap tech firms this year. They project Alphabet, Meta and Amazon to boost spending by 43% to US$91bn on servers and equipment. With plans to enhance their AI prowess and possibly introduce new products, the estimated expenditures across these firms are expected to rise 35% YoY to US$145bn. This upswing in spending is expected to benefit chipmakers over the next few years. Additionally, according to Bain & Company’s survey of 200 US companies with at least US$5mn in revenue, corporations from other industries are also looking to adopt AI in the coming years, with language generation and software coding being the most common AI applications to prioritise. These companies have reported spending an average of US$5mn a year on generative AI. Therefore, Broadcom’s strong position in the AI semiconductor market presents an attractive opportunity for investors amidst soaring demand for AI semiconductors.

- Good results, better guidance. Broadcom recently released its second-quarter earnings and revenue results beating estimates. It raised its annual revenue forecast for AI-related chips by 10% to US$11bn for FY24. The company benefiting from increased investment in AI applications like OpenAI’s ChatGPT, recorded US$3.1bn in AI product revenue in Q2. The company also announced a 10-for-1 stock split to make shares more accessible to retail investors, effective 15 July. Broadcom’s semiconductor solutions segment revenue grew by 6% YoY to US$7.20bn, and its infrastructure software revenue more than doubled, partly due to acquiring VMware. Broadcom’s full-year revenue forecast increased by US$1bn to US$51bn, alongside higher profit projections. Looking ahead, with continued global AI integration in corporations, the demand for its products and services will also increase, benefitting Broadcom’s sales.

- 2Q24 earnings review. Revenue grew by 43.1% YoY to US$12.49bn, beating estimates by US$480mn. Non-GAAP EPS was US$10.96, beating estimates by US$0.12. FY24 revenue guidance of approximately US$51.0bn and adjusted EBITDA of 61% of projected revenue.

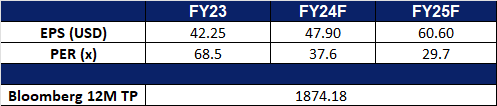

- Market consensus.

(Source: Bloomberg)

Zscaler Inc (ZS US): Partner with the AI-King

- RE-ITERATE BUY STOP Entry – 188 Target –210 Stop Loss – 177

- Zscaler, Inc. operates as a security software company. The Company offers cloud-based platform that provides web and mobile security, threat protection, cloud application visibility, and networking solutions. Zscaler serves clients worldwide.

- Partnership with Nvidia. Zscaler has announced a collaboration with NVIDIA to enhance enterprise security and user experience using AI-powered copilot technologies. This partnership will enable Zscaler to leverage NVIDIA AI technologies to process over 400 billion transactions daily from its Zero Trust Exchange platform. The collaboration introduces new AI capabilities, including NVIDIA NeMo Guardrails and the NVIDIA Morpheus framework, to defend against cyber threats and simplify IT and network operations. The Zscaler ZDX Copilot, in collaboration with NVIDIA NeMo Guardrails, offers insights into network, device, and application performance, simplifying IT support and operations on a larger scale. Additionally, Zscaler will utilize Nvidia’s Morpheus framework and Nvidia NIM inference microservices to deploy predictive and generative AI solutions, including the Zscaler ZDX Copilot with NVIDIA Morpheus and the Zscaler ZDX Copilot with Nvidia NIM, which can help to accelerate threat detection and the deployment of generative AI models.

- Relationship between AI and cybersecurity. In the first half of 2024, there was a notable increase in funding for cybersecurity startups, particularly those that utilize generative AI. This bounce-back comes after a decrease in early-stage funding deals in 2023. Venture capital investment in cybersecurity is once again on the rise, with a specific focus on AI-driven solutions for threat management and access control. Both attackers and defenders are increasingly using AI in cybersecurity, indicating a shift in the industry. As AI continues to advance, its impact on cybersecurity becomes significant for both attackers and defenders. AI allows cyber threats to conduct more successful large-scale phishing campaigns and use deepfakes for deception. In cyber defence, AI-driven security systems offer a proactive approach to threat detection by analysing patterns and predicting potential vulnerabilities. The rapid advancement of AI introduces new complexities to cybersecurity, requiring more investments in AI cyber defence to counteract modern cyber risks.

- 3Q24 earnings review. Revenue grew by 32.1% YoY to US$553.2mn, beating estimates by US$17.11mn. Non-GAAP EPS was US$0.88, beating estimates by US$0.23. 4Q24 revenue is expected to be between US$565mn to US$567mn vs consensus of US$564.98mn. Non-GAAP EPS is expected to be US$0.69 to US$0.70 vs consensus of US$0.67. FY24 revenue to be approximately US$2.140bn to US$2.142bn vs consensus of US$2.21B and Non-GAAP EPS to be between US$2.99 to US$3.01 vs consensus of US$2.76.

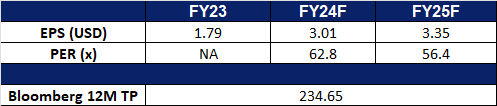

- Market consensus.

(Source: Bloomberg)

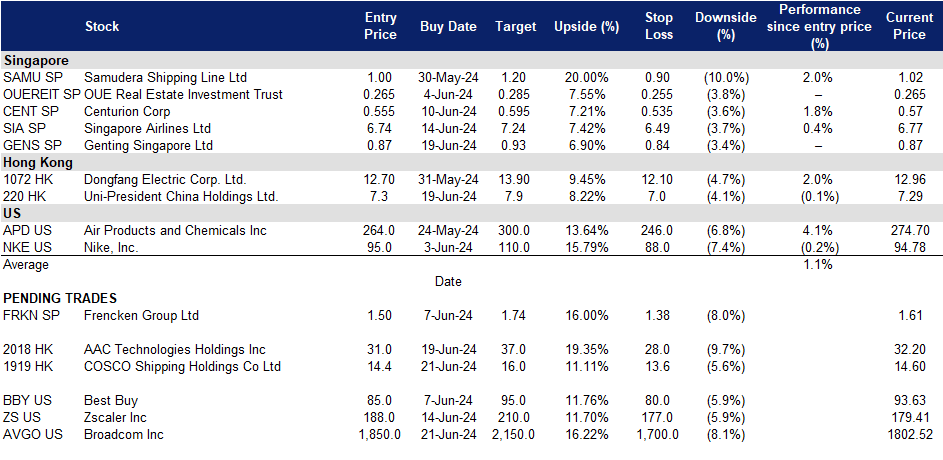

Trading Dashboard Update: Take profit on DBS Group Holdings Ltd (DBS SP) at S$35.5. Add Genting Singapore Ltd (GENS SP) at S$0.87 and Uni-President China Holdings Ltd. (220 HK) at HK$7.3.