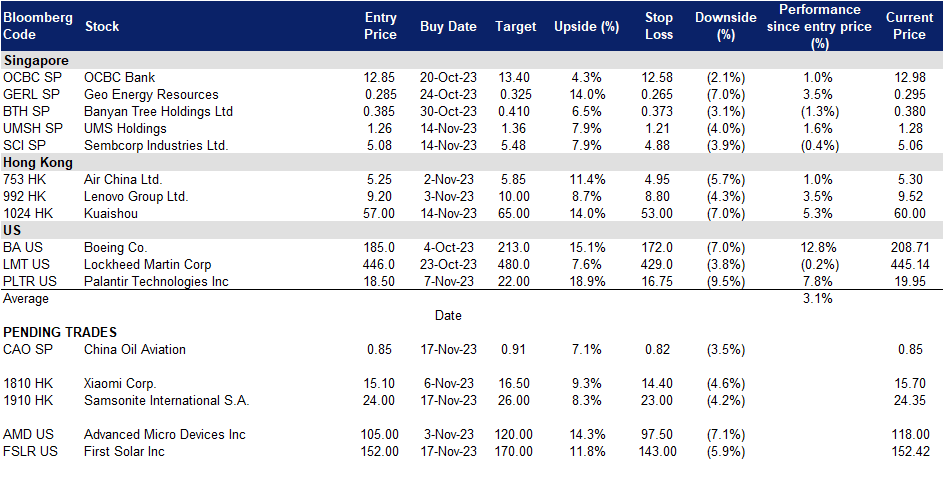

17 November 2023: China Aviation Oil Singapore Corp. Ltd. (CAO SP), Samsonite International S.A. (1910 HK), First Solar Inc (FSLR US)

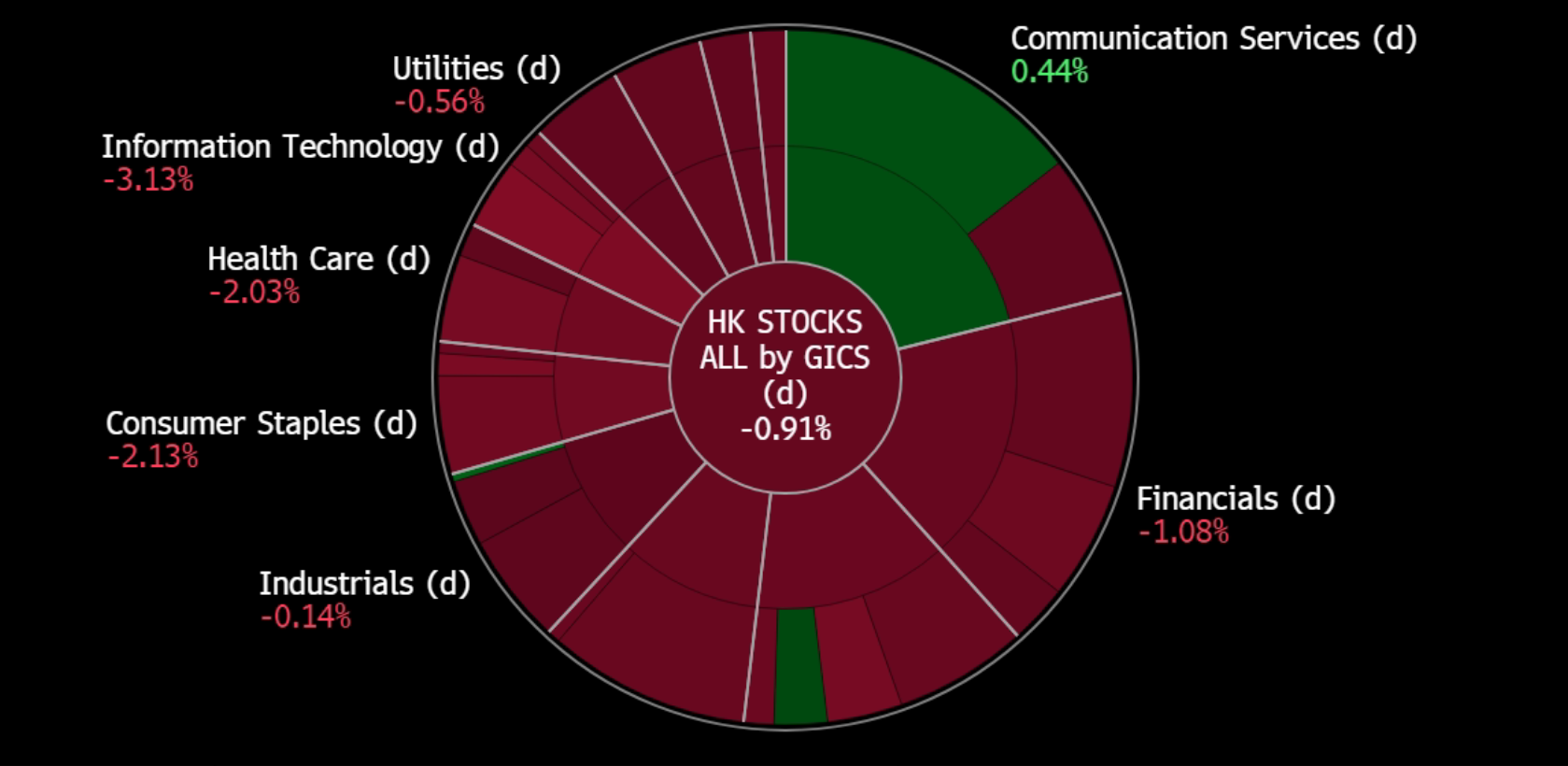

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

News Feed |

2. China’s Economy Is Likely to Continue Improving in Fourth Quarter After Positive October Data |

3. China housing gloom worsens as prices fall most in eight years |

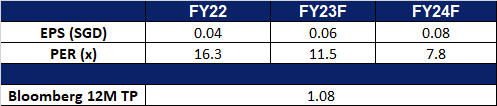

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Tailwinds from China-US summits

- BUY Entry 0.85 – Target – 0.91 Stop Loss – 0.82

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, and petrochemical products, including physical and paper swaps, and futures trading.

- Positives for air travel between China and the US. There were several achievements between China and the US after the two countries’ leaders met at the APEC forum. Among them, two items are favourable for the air transportation industry. Both countries agreed to further increase air travel in early 2024 and expand educational, student, youth, cultural, sports, and business exchanges. As the most open city in China, Shanghai shall see a further increase in direct flights to the US. Temporary moderation of China-US relations shall help recovery in foreign visits in Shanghai accordingly.

- Air traffic jumped in October. There were 41,559 takeoff and landing flights, an increase of 100.2% YoY in Shanghai Pudong Airport. The passenger traffic was 5.4 mn, an increase of 231.3% YoY. Freight turnover was 308,900 tonnes, an increase of 8.9% YoY.

Scheduled jet fuel demand at Pudong International Airport

- 1H23 results review. 1H23 revenue plunged by 32.4% to US$6.3bn. Gross profit plunged by 50.6% YoY to US$10.6mn. Total supply and trading volume decreased by 16.1% YoY to 9.5mn tonnes. Net profit decreased by 1.07% YoY to US$19.4mn.

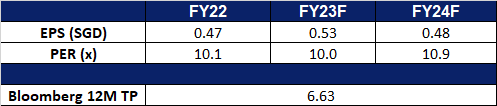

- Market consensus.

(Source: Bloomberg)

Sembcorp Industries Ltd. (SCI SP): The green transition

- RE-ITERATE BUY Entry 5.08 – Target – 5.48 Stop Loss – 4.88

- Sembcorp Industries Ltd provides utilities and integrated services for industrial sites such as power, gas, steam, water, wastewater treatment and other on-site services. Sembcorp Industries serves industrial parks, business, commercial, and residential spaces.

- Investing in renewables. Sembcorp Industries recently announced plans to invest about S$10.5bn in renewables as part of its 2023-2028 strategic plan. This substantial investment will account for 75% of the company’s total investments from 2024 to 2028. Sembcorp aims to grow its installed renewable capacity to 25 gigawatts (GW) by 2028, building upon its current 12 GW capacity, which represents 61% of its energy portfolio. The company also targets a 50% reduction in emission intensity and intends to focus on hydrogen assets, decarbonisation solutions, and integrated urban solutions for the remaining investment allocation. Sembcorp will continue to use gas as a transitional fuel to support its renewable growth and invest in low-carbon energy and hydrogen technologies. Its comprehensive 5-year plan will help to achieve its goal of halving its emission intensity by 2028.

- Retrofit Sakra cogen plant. Sembcorp Industries is collaborating with IHI Corporation and GE Vernova’s Gas Power business to retrofit its Sakra power plant in Singapore with ammonia-firing capabilities. This initiative aims to decarbonise the power plant operations and potentially generate low-carbon energy. This project builds upon a separate cooperation between IHI and GE Vernova to develop a retrofittable, 100% ammonia-capable combustion system, compatible with specific GE Vernova turbine models. This effort supports the transition to carbon-free combustion fuels like ammonia, aligning with the growing interest in sustainable alternatives in the energy sector, such as ammonia and hydrogen. It also facilitates the retrofitting of existing power generation facilities for reduced carbon emissions.

- 1H23 results review. Revenue fell 6% YoY to S$3.7bn. Net profit rose 56% YoY to S$608mn, due to contributions from a deferred payment note arising from the sale of its Indian unit and its Conventional Energy and Renewables segments. Its renewables segment’s revenue grew 71% YoY to S$379mn.

- Market Consensus.

(Source: Bloomberg)

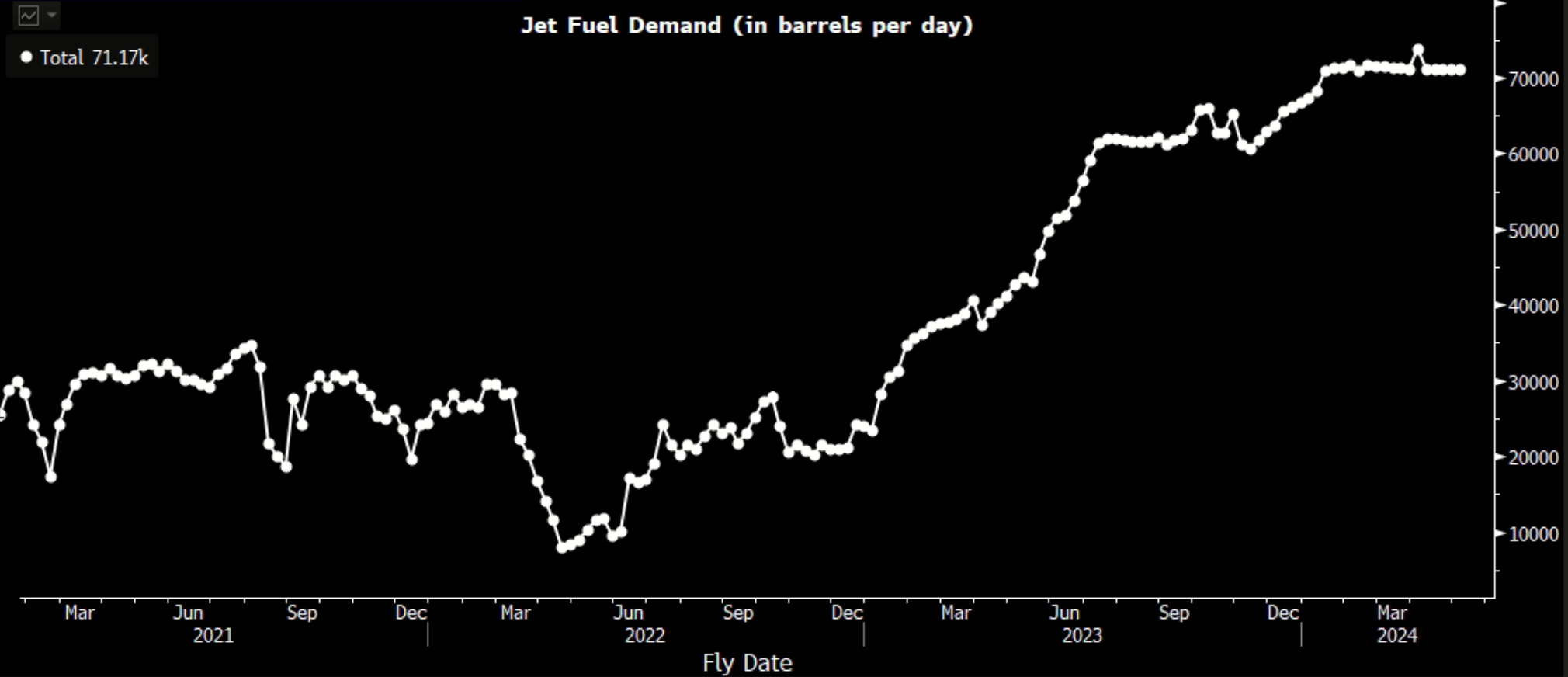

Samsonite International S.A. (1910 HK): Benefit from the year-end travelling season

- BUY Entry – 24.0 Target – 26.0 Stop Loss – 23.0

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Launch of Boss X Samsonite Collections. Samsonite recently launched a new collaboration with Hugo Boss on an exclusive aluminium capsule collection, which features cabin and check-in suitcases and a trunk, and introduces a new way to travel in style. This collection aims to showcase a shared passion for premium quality, innovation, and timeless design with a distinctive twist, and would appeal to those consumers who have a passion for travelling and exploration but refuse to compromise on style. The first launch of the collection of Hugo Boss and Samsonite stores has already been sold out, but consumers can expect more limited stocks soon. This partnership helps to promote Samsonite’s brand name indirectly, as well as showcasing the premium quality that Samsonite’s luggage is able to provide to its consumers.

- Upcoming winter travel season. The upcoming winter and festive seasons are expected to provide a boost to travel demand. The winter holidays spanning early November through January are usually one of the busiest travelling periods of the year. Consumers are likely to be clearing their work leaves, or finding time to escape the heat or cold in their countries. The upcoming winter holidays also mark the first winter season since China’s re-opening at the start of 2023. This increase in demand for travelling is likely to drive the sale of luggage for Samsonite.

- Increasing amount of flights showcasing strong travel demand. Several airlines globally have already announced plans to increase the number of flights globally across the incoming winter travel season. Chinese airlines have also seen a rise in scheduled flights for winter-spring, scheduling 96,651 domestic cargo and passenger flights each week for the upcoming winter-spring season, an increase of 33.95% from the same period in 2019-2020, according to the Civil Aviation Administration of China (CAAC). 516 new domestic routes will also be opened from Oct 29 to March 30 next year, providing 7,202 flights each week, according to the CAAC. In terms of international flights, 150 domestic and foreign airlines plan to arrange 16,680 flights per week, reaching 68 foreign countries. The US Department of Transportation announced that flights between China and the US will increase to 70 a week starting on 9 November, from the current 48 a week. The average flights between the two counties averaged 340 a week in the pre-COVID period.

- 3Q23 results. Net sales improved to US$957.7mn, up 21.1% YoY, compared to US$790.9mn in 3Q22. Net profit rose to US$123.2mn in 3Q23, up 88.3% YoY, compared to US$65.4mn in 3Q22. Adjusted Basic EPS was US$0.087 in 3Q23, compared to US$0.045 in 3Q22.

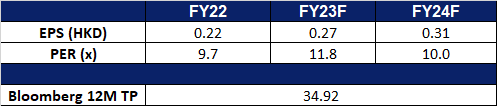

- Market Consensus.

(Source: Bloomberg)

Kuaishou (1024 HK): Upbeat business performance during Double 11

- RE-ITERATE BUY Entry – 57 Target – 65 Stop Loss – 53

- Kuaishou Technology is a China-based investment holding company mainly engaged in the operation of content communities and social platforms. The Company mainly provides live streaming services, online marketing services and other services. The online marketing solutions include advertising services, Kuaishou fans headline services and other marketing services. Other services include e-commerce, online games and other value-added services. The Company mainly conducts business within the domestic market.

- Double 11 is coming. This week will usher in the Double 11 shopping festival, and major Chinese e-commerce platforms began to offer discount sales as early as mid-October. As the domestic economic growth is weak this year, in the case of consumption downgrade, consumers are more inclined to low-price and discount goods. Live streaming platforms such as Kuaishou will leverage this shopping season to boost its gross merchandise value (GMV) which transfers into profits.

- Upbeat GMV figures. As of November 5th, Kuaishou’s GMV jumped by 85% YoY during the Double 11 season. The GMV of the pan-shelf area rallied 1.6 times, and the key product pool surged by 3 times. In addition, the overall GMV of branded merchants spiked 3 times, with the number of brands doubling from last year to more than 2,300. Previously, as the early bird who kick-started the promotion, Kuaishou announced RMB18bn traffic support and RMB2bn sales subsidies.

- 1H23 earnings. Revenue jumped by 23.9% YoY to RMB53.0bn. Gross profit surged by 38.2% YoY to RMB25.6bn. Net profit was RMB605mn compared to a net loss of RMB9.4bn in 1H22. Average DAUs and MAUs grew by 8.3% YoY and 12.1% to 375.1mn and 663.9mn respectively. Total GMV jumped by 33.8% YoY to RMB490.2bn.

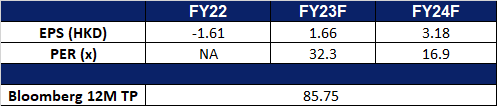

- Market Consensus.

First Solar Inc (FSLR US): Time to shine

- BUY Entry – 150 Target – 170 Stop Loss – 143

- First Solar, Inc. designs and manufactures solar modules. The Company uses a thin film semiconductor technology to manufacture electricity-producing solar modules.

- China and US agreement. The United States and China recently pledged to jointly tackle global warming by ramping up wind, solar and other renewable energy sources to displace fossil fuel, which holds significant implications for global climate change. As major contributors to greenhouse gas emissions, their joint efforts are pivotal in achieving worldwide emission reduction goals and curbing the increase in average global temperatures. The US-China climate agreement, known as the Sunnylands statement, underscores practical and feasible measures, acknowledging the current political context. China’s commitment to setting targets for all greenhouse gases, including methane, is a noteworthy aspect. With COP28 approaching, this agreement is timely and critical, though challenges persist, particularly in addressing issues like fossil fuel phase-out, requiring sustained political efforts.

- COP28. The United Nations COP28 climate summit will be held from 30 November to 12 December in Dubai, the United Arab Emirates, this year with representatives from nearly 200 countries. The European Union has announced its commitment to a “substantial” financial contribution to a groundbreaking international fund addressing climate change-related loss and damage. This fund, known as the climate “loss and damage” fund, is expected to launch during the COP28 climate summit. The EU’s move aims to facilitate progress on climate finance discussions at COP28, where issues such as phasing out fossil fuels and emission reduction steps will be considered. The EU also plans to provide funding at COP28 to support countries in meeting the goal of tripling global renewable energy capacity by 2030. The size of the EU’s financial contribution was not specified.

- Module growth. First Solar recently entered an agreement to supply 500GW of thin film modules to Swift Current Energy, a utility-scale renewables developer. The modules, part of First Solar’s CdTe Series 7, will be delivered between 2027 and 2028. Swift Current Energy, which has already ordered 2GW and 1.2GW in previous agreements, aims to enhance its value chain and support domestic manufacturing. First Solar reported a 14% increase in module production in Q3, reaching a record 3.2GW, and secured 6.8GW of net bookings, bringing the total for the year to 27.8GW.

- 3Q23 results. Revenue rose to US$801.09mn, up 27.4% YoY, missing expectations by US$91.25mn. GAAP EPS beat estimates by US$0.46 at US$2.50. Maintain full-year revenue guidance and raise the mid-point of EPS guidance to $7.60. Expect FY23 net sales of US$3.4B to US$3.6B vs US$3.5B consensus.

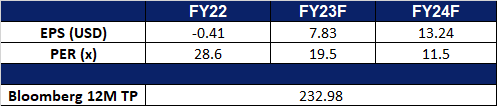

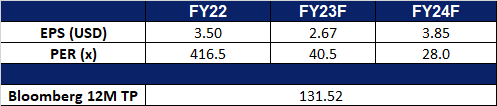

- Market consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): AI progression

- RE-ITERATE BUY Entry – 105.0 Target – 120.0 Stop Loss – 97.5

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- Further AI developments are to be announced. AMD will be holding an Advancing AI Event on December 6, featuring its products and partnerships related to AI development. The event will be live-streamed on their website.

- Increase in AI chip sales. AMD reported strong Q3 performance with revenue growth in the server CPU and Ryzen processor segments. The company is focusing on enhancing its AI capabilities and foresees robust growth in the Data Center and Client segments, projecting Q4 revenue of around $6.1 billion. In addition, AMD is targeting the AI market with the MI300X chip to compete with Nvidia and expects $2 billion in sales from it in 2024. However, these estimates could face challenges due to recent restrictions and potentially more stringent bans enforced by the US Department of Commerce, prohibiting the sale of advanced AI chips to China. While chip manufacturers have indicated that the impact will likely be minimal, this issue remains a source of concern for certain investors.

- Acquired AI software. AMD acquired Nod.ai, an artificial intelligence startup, as part of its strategy to strengthen its software capabilities and compete with Nvidia. Nvidia has established itself as a dominant force in the AI chip market through its software and developer ecosystem. AMD aims to invest in building unified software to support its range of chips. The Nod.ai acquisition aligns with the strategy, as its technology facilitates the deployment of AI models optimised for AMD’s chips. AMD has been growing its AI group with plans for further expansion and potential future acquisitions.

- ROCm vs CUDA. AMD is emphasising its commitment to evolving its software stack, ROCm, in the competitive AI chip market, recognising that software development is a journey. The company has made ROCm a top priority and created a new organisation to consolidate its software assets. This effort includes acquiring companies like Mipsology and expanding its talent pool. AMD has also established an internal AI models group to strengthen its software expertise. It uses open-source solutions like Triton to challenge Nvidia’s CUDA and offer alternatives for developers, emphasising the importance of open-source collaboration. AMD’s ROCm stack aims to allow the community to contribute and bridge the gap in software maturity. They have MI300 and MI300X AI chips with samples currently with customers and are focused on the success of ROCm in supporting these offerings.

- 3Q23 earnings review. Revenue rose by 4.1% YoY to US$5.8bn, beating estimates by US$110mn. Non-GAAP EPS was US$0.70, beating estimates by US$0.02. Revenue from the data centre segment remained flat, whereas the client segment saw an increase, followed by a decline in both the embedded and gaming segments.

- Market Consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Coinbase Global Inc (COIN US) at US$100. Stop loss on DBS Group Holdings Ltd (DBS SP) at SG$32.35.