15 November 2023: Sembcorp Industries Ltd. (SCI SP), Kuaishou (1024 HK), Coinbase Global Inc (COIN US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

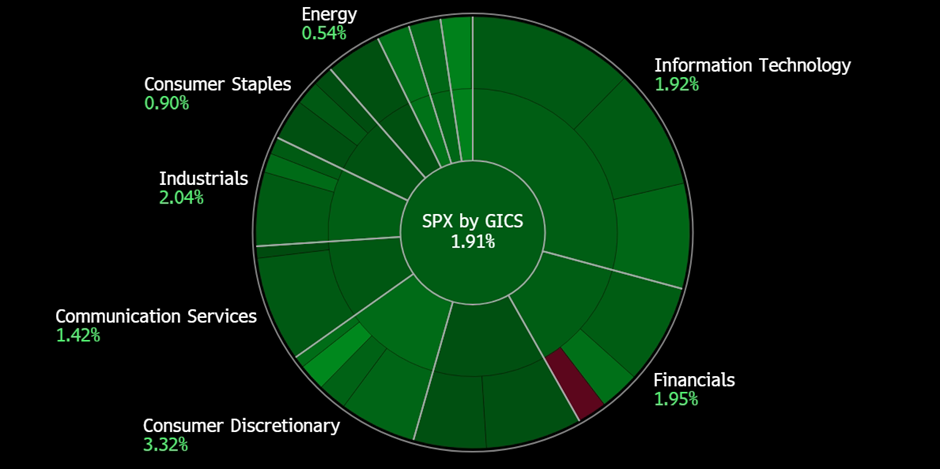

United States

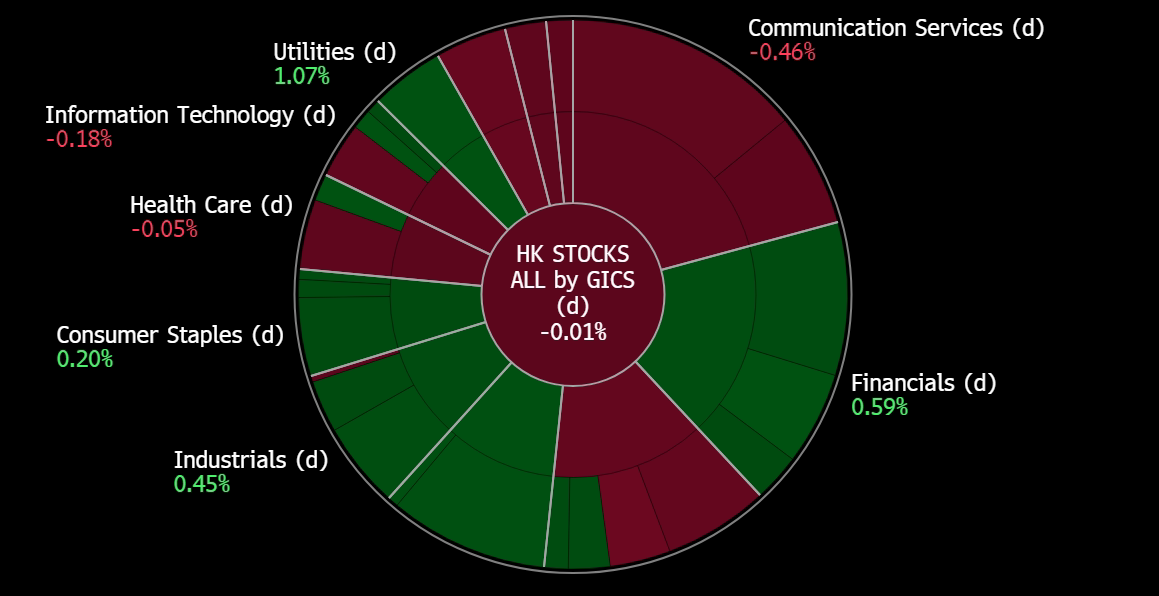

Hong Kong

Sembcorp Industries Ltd. (SCI SP): The green transition

- RE-ITERATE BUY Entry 5.08 – Target – 5.48 Stop Loss – 4.88

- Sembcorp Industries Ltd provides utilities and integrated services for industrial sites such as power, gas, steam, water, wastewater treatment and other on-site services. Sembcorp Industries serves industrial parks, business, commercial, and residential spaces.

- Investing in renewables. Sembcorp Industries recently announced plans to invest about S$10.5bn in renewables as part of its 2023-2028 strategic plan. This substantial investment will account for 75% of the company’s total investments from 2024 to 2028. Sembcorp aims to grow its installed renewable capacity to 25 gigawatts (GW) by 2028, building upon its current 12 GW capacity, which represents 61% of its energy portfolio. The company also targets a 50% reduction in emission intensity and intends to focus on hydrogen assets, decarbonisation solutions, and integrated urban solutions for the remaining investment allocation. Sembcorp will continue to use gas as a transitional fuel to support its renewable growth and invest in low-carbon energy and hydrogen technologies. Its comprehensive 5-year plan will help to achieve its goal of halving its emission intensity by 2028.

- Retrofit Sakra cogen plant. Sembcorp Industries is collaborating with IHI Corporation and GE Vernova’s Gas Power business to retrofit its Sakra power plant in Singapore with ammonia-firing capabilities. This initiative aims to decarbonise the power plant operations and potentially generate low-carbon energy. This project builds upon a separate cooperation between IHI and GE Vernova to develop a retrofittable, 100% ammonia-capable combustion system, compatible with specific GE Vernova turbine models. This effort supports the transition to carbon-free combustion fuels like ammonia, aligning with the growing interest in sustainable alternatives in the energy sector, such as ammonia and hydrogen. It also facilitates the retrofitting of existing power generation facilities for reduced carbon emissions.

- 1H23 results review. Revenue fell 6% YoY to S$3.7bn. Net profit rose 56% YoY to S$608mn, due to contributions from a deferred payment note arising from the sale of its Indian unit and its Conventional Energy and Renewables segments. Its renewables segment’s revenue grew 71% YoY to S$379mn.

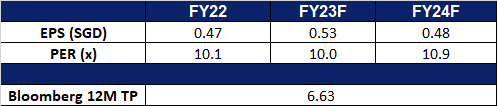

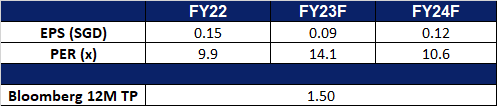

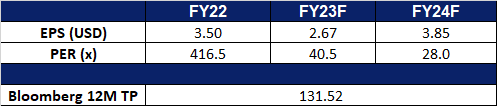

- Market Consensus.

(Source: Bloomberg)

UMS Holdings (UMSH SP): Expect better 3Q23 earnings

- RE-ITERATE BUY Entry 1.26 – Target – 1.36 Stop Loss –1.21

- UMS Holdings Limited provides equipment manufacturing and engineering services to Original Equipment Manufacturers (OEMs) of semiconductors and related products. The Company manufactures high precision components and complex electromechanical assembly and final testing services. UMS supports the electronic, machine tools and oil and gas industries.

- Semiconductor sector is bottoming out. The milestone development of artificial intelligence (AI) in 1H23 not only buffers the downcycle of the semiconductor sector but also kickstarts a new growth engine. The AI hype shadows the fall in demand for mobile/PC chips due to the normalisation of life and the drop in capex due to geopolitical factors. However, several market leaders projected that the sector will bottom out in 2H23 or 1H24 as both orders and capex will gradually recover. In the UMS’s 2Q23 press release, according to SEMI, global 300mm fab equipment spending for front-end facilities next year is expected to begin a growth streak to hit a US$119 billion record high in 2026 following a decline in 2023.

- Upbeat 2024 outlook from the upstream. Advanced Micro Devices’s 3Q23 results topped market estimates. Meanwhile, it predicted that the data center GPU revenue would exceed US$2bn in 2024. Samsung Electronics reported its 3Q23 as most profitable quarter in 2023, and it mentioned that smartphone and PC demand is poised to rebound amid the coming replacement cycle. AI theme will remain a key investment thesis in 2024, drivingrelated segments to grow.

- Applied Materials 3Q23 review. Applied Materials (AMAT US) is a key customer to UMS. Its 3Q23 revenue dropped 1.4% YoY to US$6.3bn, beating estimates by US$250mn. 3Q23 Non-GAAP EPS was US$1.9, beating estimates by US$0.15. It expects 4Q23 net sales to be approximately US$6.51bn, plus or minus US$400 mn, compared to a consensus of US$5.87bn. 4Q23 Non-GAAP adjusted diluted EPS is expected to be in the range of US$1.82 to US$2.18, compared to a consensus of US$1.60. AMAT will be releasing its 4Q23 earnings on 16 November.

- 3Q23 results review. Revenue fell 29% YoY to S$71.3mn. Gross material margin 21.6% from 43.8%. The new plant in Penang is expected to contribute at least US$30mn for FY24. The company maintains an interim dividend of 1.2 SG cents.

- Market Consensus.

(Source: Bloomberg)

Kuaishou (1024 HK): Upbeat business performance during Double 11

- RE-ITERATE BUY Entry – 57 Target – 65 Stop Loss – 53

- Kuaishou Technology is a China-based investment holding company mainly engaged in the operation of content communities and social platforms. The Company mainly provides live streaming services, online marketing services and other services. The online marketing solutions include advertising services, Kuaishou fans headline services and other marketing services. Other services include e-commerce, online games and other value-added services. The Company mainly conducts business within the domestic market.

- Double 11 is coming. This week will usher in the Double 11 shopping festival, and major Chinese e-commerce platforms began to offer discount sales as early as mid-October. As the domestic economic growth is weak this year, in the case of consumption downgrade, consumers are more inclined to low-price and discount goods. Live streaming platforms such as Kuaishou will leverage this shopping season to boost its gross merchandise value (GMV) which transfers into profits.

- Upbeat GMV figures. As of November 5th, Kuaishou’s GMV jumped by 85% YoY during the Double 11 season. The GMV of the pan-shelf area rallied 1.6 times, and the key product pool surged by 3 times. In addition, the overall GMV of branded merchants spiked 3 times, with the number of brands doubling from last year to more than 2,300. Previously, as the early bird who kick-started the promotion, Kuaishou announced RMB18bn traffic support and RMB2bn sales subsidies.

- 1H23 earnings. Revenue jumped by 23.9% YoY to RMB53.0bn. Gross profit surged by 38.2% YoY to RMB25.6bn. Net profit was RMB605mn compared to a net loss of RMB9.4bn in 1H22. Average DAUs and MAUs grew by 8.3% YoY and 12.1% to 375.1mn and 663.9mn respectively. Total GMV jumped by 33.8% YoY to RMB490.2bn.

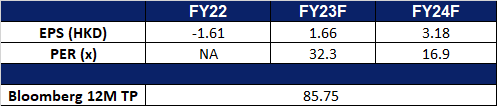

- Market Consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): Tap intp AI

- RE-ITERATE BUY Entry – 9.20 Target – 10.00 Stop Loss – 8.80

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- Partnership with Nvidia. Lenovo and NVIDIA have expanded their partnership to develop new hybrid AI solutions and collaborate on engineering. This partnership aims to bring the power of generative AI to every enterprise. Working closely with NVIDIA, Lenovo will deliver fully integrated systems that bring AI-powered computing to the edge and cloud, where data is created. This will make it easier for businesses to deploy tailored generative AI applications to drive innovation and transformation across all industries.

- New product on sales. Lenovo has just placed the ThinkPad X1 Fold 16” folding laptop on sales, more than a year after announcing the product. The ThinkPad X1 Fold 16” features an impressive 16.3-inch foldable Samsung OLED display, sporting a resolution of 2024 x 2560 pixels, and when folded, the device transforms into a 12-inch display, and it can be seamlessly paired with a Bluetooth keyboard, delivering a laptop-like experience. This product is bound to attract consumers to prefer a convenient yet big tablet that provides the same experience as using a laptop.

- Tapping into the India Market. Lenovo is amongst the 100 firms that are authorised by India to import electronic devices such as laptops, tablets, and personal computers under a new system aimed at monitoring shipments. Other companies include Apple, Dell, HP, Samsung etc. These companies must register the quantity and value of imports on a portal, with an authorisation valid until September 2024. This allows Lenovo to tap into the India market, possibly adding another source of revenue from India.

- 1Q24 earnings. Revenue fell 24.0% YoY to US$12.90bn in1Q24, compared with US$17.0bn in 1Q23. Net profit was US$191mn in 1Q23, dropping 66% YoY comparing to US$556mn in 1Q23. Basic earnings per share was US 1.48 cents in 1Q24, compared to US4.39 cents in 1Q23.

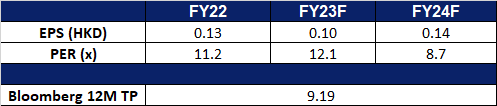

- Market Consensus.

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Bull run ongoing

- RE-ITERATE BUY Entry – 90 Target – 100 Stop Loss – 85

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies. Coinbase Global serves clients worldwide.

- BTC ETF surge. Bitcoin experienced a surge in prices, surpassing $36,000, driven by a short squeeze resulting in over $62mn in liquidated shorts within 24 hours. The short squeeze occurred during early Asian trading hours, with significant liquidations on exchanges like BitMEX, OKX, and Binance. Reports of the Securities and Exchange Commission (SEC) engaging in talks with Grayscale, particularly regarding the potential conversion of Grayscale Bitcoin Trust GBTC to a spot ETF, contributed to the market movement. Furthermore, analysts at Bloomberg Intelligence reinforced expectations of a spot Bitcoin ETF approval in the US, estimating a “90% chance” of a January launch. This potential milestone holds significance in potentially simplifying crypto investment for everyday investors and contributing to Bitcoin’s price upswing.

- Strengthening of global advisory council. Coinbase has strengthened its global advisory council with the addition of four national security experts, including former US defense secretary Mark Esper and former national security specialist Stephanie Murphy. The move comes amid increased regulatory scrutiny of the cryptocurrency industry following the collapse of FTX. The newly appointed members will assist the council in assessing the consequences of regulatory uncertainty in the United States, with a focus on long-term economic and national security impacts.

- Bitcoin halving. Bitcoin prices have recently witnessed a consistent uptrend, surging from around $27,000 to over $36,000, marking its highest value since May 2022. The periodic Bitcoin halving which leads to a slow-down in mining output is expected to be in April 2024. In other words, the supply of Bitcoin after the halving date will be less. Based on the previous two halvings, Bitcoin experienced bull cycles for 18 months (Previous two halving dates: 9 July 2016 and 11 May 2020). Notably, the upward momentum historically initiates 6 months before the halving date, suggesting that the current Bitcoin upcycle may have already commenced.

Bitcoin Halving

(Source: Bloomberg)

- Rate hike uncertainty. Federal Reserve officials have kept the benchmark borrowing rate steady at 5.25-5.5%, the highest in 22 years, in November. However, uncertainty looms over a potential rate hike in December. The Fed Chair’s post-FOMC meeting message indicates lingering uncertainty among officials regarding whether current rates are sufficient to curb inflation.

- 3Q23 results. Revenue rose to US$674.15mn, up 14.2% YoY, beating expectations by US$20.6mn. GAAP EPS beat estimates by US$0.52 at -US$0.01.

- Market consensus.

(Source: Bloomberg)

Advanced Micro Devices Inc (AMD US): AI progression

- RE-ITERATE BUY Entry – 105.0 Target – 120.0 Stop Loss – 97.5

- Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The Company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide.

- Further AI developments are to be announced. AMD will be holding an Advancing AI Event on December 6, featuring its products and partnerships related to AI development. The event will be live-streamed on their website.

- Increase in AI chip sales. AMD reported strong Q3 performance with revenue growth in the server CPU and Ryzen processor segments. The company is focusing on enhancing its AI capabilities and foresees robust growth in the Data Center and Client segments, projecting Q4 revenue of around $6.1 billion. In addition, AMD is targeting the AI market with the MI300X chip to compete with Nvidia and expects $2 billion in sales from it in 2024. However, these estimates could face challenges due to recent restrictions and potentially more stringent bans enforced by the US Department of Commerce, prohibiting the sale of advanced AI chips to China. While chip manufacturers have indicated that the impact will likely be minimal, this issue remains a source of concern for certain investors.

- Acquired AI software. AMD acquired Nod.ai, an artificial intelligence startup, as part of its strategy to strengthen its software capabilities and compete with Nvidia. Nvidia has established itself as a dominant force in the AI chip market through its software and developer ecosystem. AMD aims to invest in building unified software to support its range of chips. The Nod.ai acquisition aligns with the strategy, as its technology facilitates the deployment of AI models optimised for AMD’s chips. AMD has been growing its AI group with plans for further expansion and potential future acquisitions.

- ROCm vs CUDA. AMD is emphasising its commitment to evolving its software stack, ROCm, in the competitive AI chip market, recognising that software development is a journey. The company has made ROCm a top priority and created a new organisation to consolidate its software assets. This effort includes acquiring companies like Mipsology and expanding its talent pool. AMD has also established an internal AI models group to strengthen its software expertise. It uses open-source solutions like Triton to challenge Nvidia’s CUDA and offer alternatives for developers, emphasising the importance of open-source collaboration. AMD’s ROCm stack aims to allow the community to contribute and bridge the gap in software maturity. They have MI300 and MI300X AI chips with samples currently with customers and are focused on the success of ROCm in supporting these offerings.

- 3Q23 earnings review. Revenue rose by 4.1% YoY to US$5.8bn, beating estimates by US$110mn. Non-GAAP EPS was US$0.70, beating estimates by US$0.02. Revenue from the data centre segment remained flat, whereas the client segment saw an increase, followed by a decline in both the embedded and gaming segments.

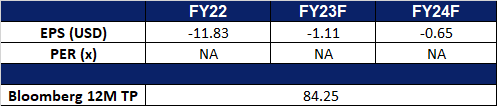

- Market Consensus.

(Source: Bloomberg)

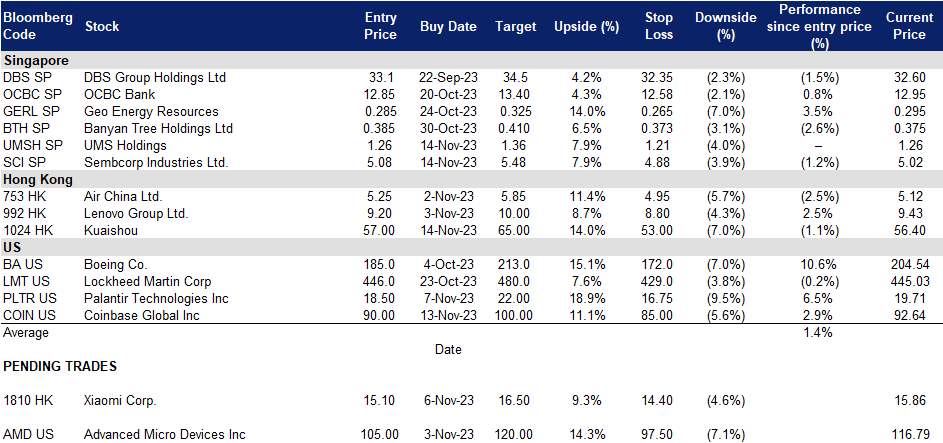

Trading Dashboard Update: Take profit on Genting Singapore Ltd (GENS SP) at S$0.92. Add UMS Holding (UMSH SP) at S$1.26, Sembcorp Industries Ltd (SCI SP) at S$5.08, Kuaishou (1024 HK) at HK$57 and Coinbase Global Inc (COIN US) at US$90. Stop loss on AEM (AEM SP) at S$3.25.