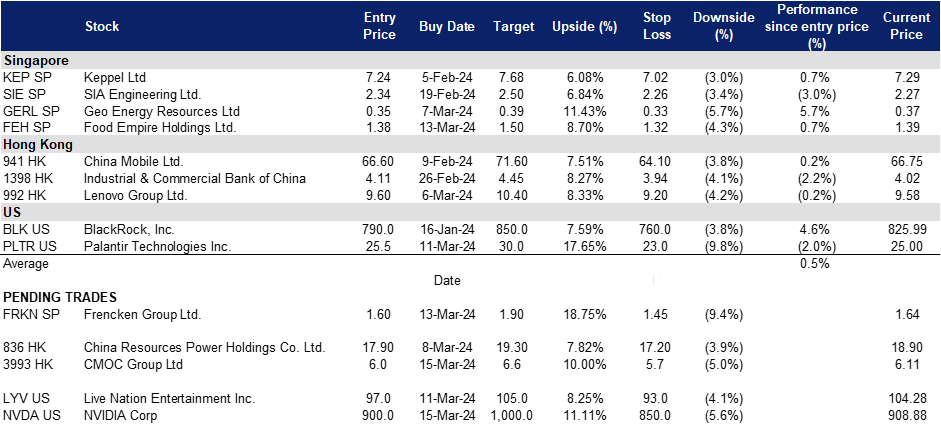

15 March 2024: Frencken Group Ltd. (FRKN SP), CMOC Group Ltd (3993 HK), NVIDIA Corp (NVDA US

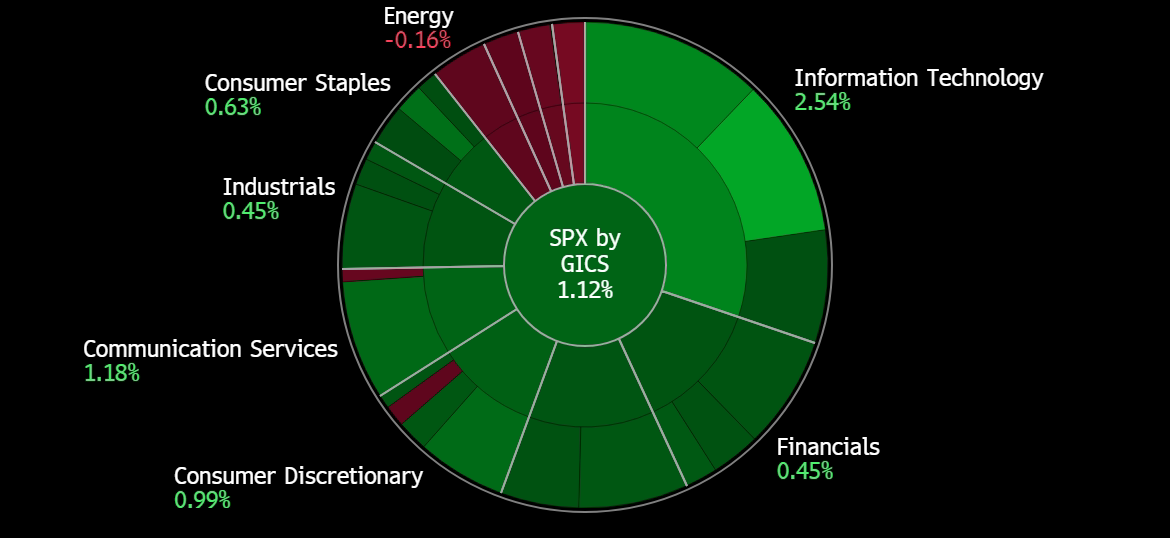

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Frencken Group Ltd. (FRKN SP): Following the semiconductor recovery

- RE-ITERATE Entry – 1.60 Target– 1.90 Stop Loss – 1.45

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial and semiconductor industries.

- Strong AI chip demand signal from the world’s largest semiconductor producer. Taiwan Semiconductor Manufacturing’s strong demand for high-end chips used in artificial intelligence (AI) has propelled the semiconductor index up, contributing to broader market gains. The positive outlook for AI demand in 2024 has driven optimism, with experts foreseeing substantial revenue growth for semiconductor companies, indicating the early stages of a technological revolution. Nvidia, a key player in AI computing, also experienced share gains, reaching a fresh record peak. We anticipate that this positive momentum will translate into revenue generated by Frencken’s semiconductor segment, which accounted for about 40% of its Q3 revenue.

- Continued demand for AI Chips. Applied Materials, Frencken’s main customer, announced an earnings beat for FY23 and expects continued outperformance as customers ramp up next-generation chip technologies critical to AI and the Internet of Things. Their key customer, Taiwan Semiconductor Manufacturing Co., also highlighted that revenue rose 9.4% in 2024’s first two months, riding a wave of global AI development. These strong demands for AI chips would translate to more revenue growth for Frencken.

- Anticipated decline in interest rates. Fed Chair Jerome Powell recently mentioned that inflation is “not far” from where it needs to be for the central bank to start cutting interest rates, but did not provide a specific timeline. The market expects a rate cut to occur in June’s FOMC meeting, with a market’s implied probability of 25bps in June at 56.7%. The expected rate decline throughout the year could contribute to increased valuations in the semiconductor sector.

- FY23 results review. FY23 revenue declined by 5.5% to $742.9mn, compared to $786.1mn in FY22. Net profit plunged 38.1% YoY to $32.0mn due to challenging business conditions for the technology sector, compared to $51.6mn in FY22. Gross profit margin contracted to 13.2% in FY23 from 15.1% in FY22, attributing it to lower revenue, inflationary cost pressures as well as increased depreciation expenses.

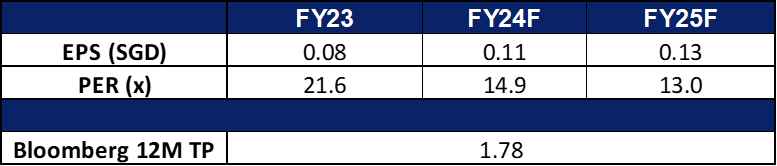

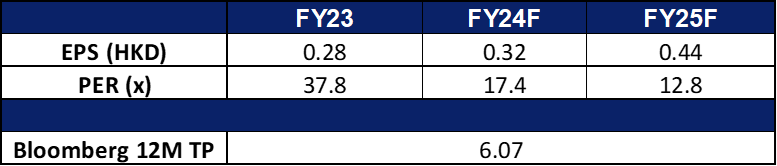

- Market Consensus

(Source: Bloomberg)

Food Empire Holdings Ltd. (FEH SP): Soaring to new heights

Food Empire Holdings Ltd. (FEH SP): Soaring to new heights

- RE-ITERATE Entry – 1.38 Target– 1.50 Stop Loss – 1.32

- Food Empire Holdings (Food Empire) is a multinational food and beverage manufacturing and distribution group headquartered in Singapore. Food Empire’s products are sold in over 60 countries, spanning North Asia, Eastern Europe, South-East Asia, Central Asia, the Middle East, and North America. The Group has 23 offices worldwide and operates 8 manufacturing facilities located in 5 countries.

- Strong consumer demand. Consumer demand stays resilient across Food Empire Holdings’ key markets despite ongoing geopolitical tensions worldwide, alongside a high-interest rate environment. Demand for coffee and tea remained strong across company’s all key markets, seeing volume growth YoY, as well as an increase in sales YoY in local currencies. The expectation that interest rates have peaked and potential rate cuts on the horizon due to cooling inflation will likely enhance consumer sentiment, fuelling the demand for consumer goods. We expect to see further growth in FY24.

- Optimising product mix. The company still remains focused on optimising its product mix and reducing costs in 4Q23. For the full year, the company’s gross profit margin (GPM) rose to 33.2% in FY23, compared to 29.8% in FY22.

- Malaysia’s NDC plant to commence operation soon. The group has finalized its non-dairy creamer expansion in Malaysia, anticipating the commencement of commercial production in the next few months, pending final approval from the Malaysian government. This expansion aims to boost non-dairy creamer sales to external parties in the region. Marketing efforts have already commenced to identify potential customers, and the group foresees the plant reaching 30% to 40% capacity by year-end.

- FY23 financial results. The company reported a record revenue of US$425.7mn for FY23, up 6.9% YoY, due mainly to higher volume and higher pricing from all the group’s core markets. The company saw a significant increase in revenue in Ukraine, Kazakhstan, and CIS, and South Asia, attributed to higher contributions from the group’s coffee manufacturing plants in these markets. Gross profit also rose by 19.0% to US$141.5mn YoY, compared to US$118.8 in FY22. Net profit increased 25.3% YoY to US$56.5mn in FY23 compared to US$45.1mn in FY22, excluding a one-off gain of US$15.0 million from the disposal of non-core assets in FY22.

- Special dividend. The company declares a final FY23 dividend of 5 Scents per share and a surprise special dividend of 5 Scents per share, indicating a forward yield of 7.14%.

- We have fundamental coverage with a BUY recommendation and a TP of S$1.65. Please read the full report here.

(Source: Bloomberg)

CMOC Group Ltd (3993 HK): Copper and gold hitting highs

- BUY Entry – 6.0 Target – 6.6 Stop Loss – 5.7

- CMOC Group Ltd, formerly China Molybdenum Co Ltd, is a China-based company mainly engaged in the mining, smelting, processing and trading of molybdenum, tungsten, copper and other metals. The Company operates through six segments. The Molybdenum and Tungsten Related Products segment is engaged in the mining of molybdenum and tungsten ore. The Copper and Gold Related Products segment is engaged in the mining of copper and gold. The Niobium and Phosphate Related Products segment is mainly engaged in the production of niobium and phosphate fertilizers. The Copper and Cobalt Related Products segment is engaged in the production of copper and cobalt. The Metals Trading segment is principally engaged in the sales of metals. The Other segment is mainly engaged in mining support business.

- Copper price rally. Copper prices jumped to near 11-month highs due to potential supply tightness. News of Chinese smelters discussing production cuts, along with ongoing disruptions in major copper producers Peru and Chile, fuelled the rally. China’s top copper smelters, facing a shortage of raw materials due to global mine disruptions, agreed for the first time in a while to jointly cut production at some loss-making plants. Each smelter will determine the extent of the cuts, but the move comes after a significant drop in copper concentrate fees, a key material for copper production. This shortage is despite China’s rapidly expanding smelter capacity in anticipation of rising copper demand for green energy. However, concerns linger about the long-term outlook.The spike in copper prices will benefit CMOC’s revenue.

China Shanghai copper spot price (RMB/tonne)

(Source: Bloomberg)

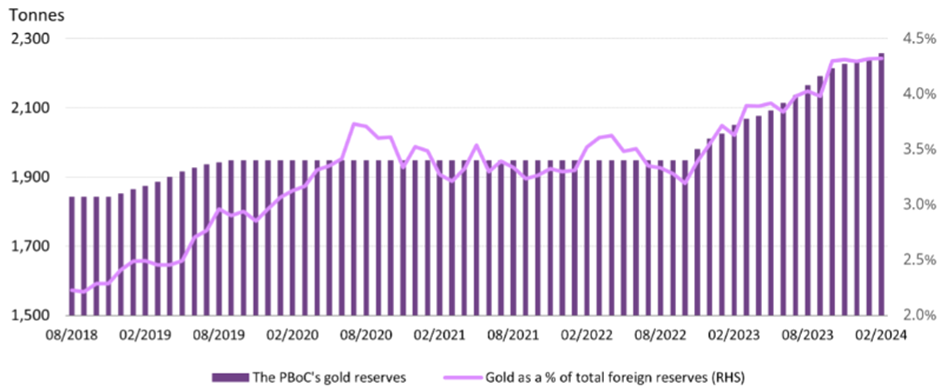

- China increasing its gold reserves. China recently extended its continuous gold purchase record after the central bank bought another 12 tonnes of precious metal in February. This brings China’s gold reserves now a total of 2,257 tonnes, according to the World Gold Council. These purchases increase the country’s already sizable holdings as part of a strategy to reduce its reliance on the US dollar. Gold now makes up 4.33% of China’s foreign exchange reserves in US dollars, the highest level ever recorded. The central bank’s gold buying spree, combined with weak performances of Chinese assets such as equities and properties, has sparked retail investors’ interest in gold. It also contributed to a surge in local gold investment demand during 2023 and could continue to support the sector’s growth.

PBOC Gold Reserves

(Source: PBoC, World Gold Council)

- Interest rate cuts in sight. The Federal Reserve is likely to hold interest rates steady until at least June due to higher-than-expected inflation. Recent inflation readings indicate the Fed’s previous interest rate hikes have yet to control inflation as much as they hoped. Economists now predict the Fed will raise its inflation forecasts and may only cut rates twice this year, instead of the previously expected three cuts. While a rate cut in June’s FOMC meeting is still on the table, some believe the Fed might wait until July. With interest rate cuts in sight, the price of gold may see more positives.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

- FY23 earnings. Total operating revenue rose 7.68% YoY to RMB186.269bn. Net profit attributable to shareholders increased 35.98% YoY to RMB8.25bn in FY23, mainly attributable to investment income from the disposal of Australian operations. Basic earnings per share was RMB0.38 in FY23, compared to RMB0.28 in FY22.

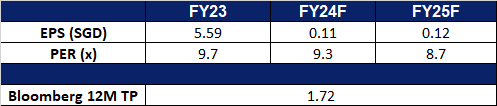

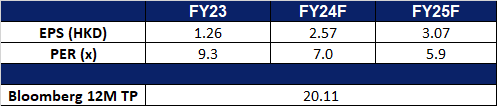

- Market consensus.

(Source: Bloomberg)

China Resources Power Holdings Co. Ltd. (836 HK): Increase coal use

- RE-ITERATE BUY Entry – 17.90 Target – 19.30 Stop Loss – 17.20

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Cold wave. China’s national observatory recently renewed an orange alert, the second-highest in the country’s four-tier weather warning system, for cold waves in various areas, forecasting plunging temperatures. The cold wave is set to bring a significant temperature decline to central and eastern China, progressing towards the east and south. In late February, northern China witnessed strong winds, widespread sandstorms, dramatic temperature drops, and rainy and snowy conditions. Temperatures in the north plummeted, with certain areas experiencing declines exceeding 20 degrees Celsius. Over the period, central and eastern China saw more widespread rainy, snowy, and freezing weather, coupled with noticeable temperature fluctuations. The cold wave is expected to drive increased electricity consumption as individuals opt to stay home, seeking warmth amid the freezing conditions across the period.

- Long-Term green power purchase agreement with Merck. China Resources Power has revealed its intention to engage in a long-term power purchase agreement with Merck. Under this agreement, Merck China will substantially enhance its utilization of green electricity in production and operations, aiming to achieve a 60% usage and reduce Scope 2 carbon emissions by 185,000 tonnes. This initiative aligns with Merck’s broader objective of raising its global procurement of electricity from renewable sources to 80% by 2030 and achieving climate neutrality by 2040. The ten-year power purchase agreement with Merck guarantees the life-cycle traceability of a total of 300 GWh of green power.

- Coal Prices. The decline in global coal prices is expected to have significant benefits for the company’s coal-fired power plants and gas-fired power plants. With prices at a 2-year low around of $130 per tonne, lower fuel costs for coal-fired power plants translate into improved profitability and a competitive advantage in the market. While China Resources Powers does have its own coal production plants, energy consumption during the current winter period typically skyrockets for China, this means that the company will be required to buy coal from other suppliers to further supplement its energy production and will therefore benefit from the lower prices. The declining prices also create opportunities for the company’s gas-fired power plants, as natural gas becomes a more cost-effective alternative. This diversification and cost advantage contribute to improved financial performance, market competitiveness, and the ability to offer competitive electricity prices to consumers. Overall, the decline in coal prices presents favourable conditions for the company’s power generation operations, enhancing profitability and sustainability.

Thermal Coal Price

(Source: Bloomberg)

- 1H23 earnings. Revenue rose 2.13% YoY to HK$51.5bn in 1H23, compared with HK$50.4bn in 1H22. Net profit rose 61.8% to HK$7,08bn in 1H23, compared to HK$4.37bn in 1H22. Basic earnings per share was HK$1.40 in 1H23, compared to HK$0.91 in 1H22.

- Market consensus.

(Source: Bloomberg)

NVIDIA Corp (NVDA US): Highly anticipated GTC event

- BUY Entry – 900 Target – 1,000 Stop Loss – 850

- NVIDIA Corporation designs, develops, and markets three dimensional (3D) graphics processors and related software. The Company offers products that provides interactive 3D graphics to the mainstream personal computer market.

- GTC 2024. NVIDIA’s annual GTC conference kicks off next week (17 March), with the highlight expected to be the unveiling of its new Blackwell architecture chips, codenamed B100, designed to advance AI capabilities. While updates on data centers, workstations, or consumer products are less likely, investors can expect software updates on NVIDIA’s AI platforms and news on its collaboration with Microsoft’s Azure cloud. Over 900 sessions on various AI applications and talks from industry leaders will fill the five-day event, alongside product demos and exhibitions showcasing the latest in generative AI. The upcoming GTC conference is expected to shed light on NVIDIA’s future plans, potentially boosting the stock.

Nvidia stock price performance during the GTC period

| Date | Returns |

| 20 – 23 March 2023 | 5.0% |

| 19 – 22 September 2022 | -6.1% |

| 21 – 24 March 2022 | 5.3% |

| 12 – 16 April 2021 | 4.6% |

| 5 – 9 October 2020 | 0.9% |

- 4Q24 earnings review. Revenue rose by 265.3% YoY to US$22.1bn, beating estimates by US$1.55bn. EPS was US$5.16, beating estimates by US$0.52. In FY25 revenue is expected to be US$24bn vs consensus of US$22.03bn, plus or minus 2%.

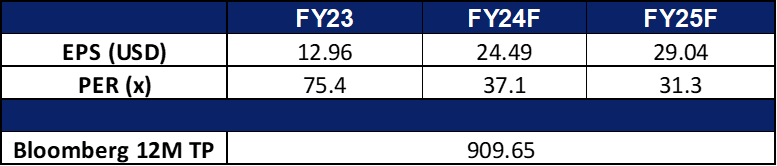

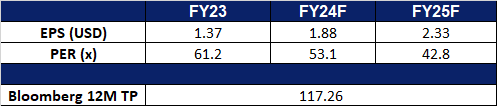

- Market consensus.

(Source: Bloomberg)

Live Nation Entertainment Inc (LYV US): Benefit from concert economics

- RE-ITERATE BUY Entry – 97 Target – 105 Stop Loss –93

- Live Nation Entertainment, Inc. produces live concerts and sells tickets to those events over the Internet. The Company offers ticketing services for leading arenas, stadiums, professional sports franchises and leagues, college sports teams, performing arts venues, museums and theaters. Live Nation Entertainment serves customers worldwide.

- 2023 biggest year for concerts. Live Nation had a remarkable year in 2023, surpassing previous records with revenue reaching US$22.7bn, a 36% YoY increase, driven by record attendance, ticket sales, and sponsorships. Concert attendance rose by 20.3% to 145.8mn, with significant gains in both North America and internationally. The company’s acquisition of Mexican promoter OCESA and the rise of K-pop and Latin music contributed to the international expansion of its concert business, with 50% more international acts featured in its top 50 tours compared to five years ago. Revenue from Live Nation’s owned and operated venues, Ticketmaster, and sponsorship and advertising divisions all saw substantial growth, reflecting the robustness of its business model. Looking ahead, Live Nation expects continued growth and profitability across its businesses, with strong ticket sales and sponsorship commitments already secured for 2024.

- Continued momentum through 2024. In 2023, Taylor Swift’s eras tour, promoted and organised by Live Nation, smashed records, grossing over US$1bn. This unprecedented success has fuelled a surge in concert attendance, with artists like LANY and Conan Grey following suit under Live Nation’s banner. This trend extends to established superstars as well, with Live Nation promoting tours for FY24 from Bad Bunny (Latin Trap, Reggaeton), Billie Eilish (Pop), Drake (Hip Hop), Harry Styles (Pop), and The Weeknd (Pop, R&B). Further solidifying the live music industry’s strength, JYP Entertainment, home to popular K-Pop groups like TWICE, Stray Kids, and ITZY, announced a multi-year strategic partnership with Live Nation. This collaboration aims to expand the global reach of these K-Pop acts by leveraging Live Nation’s extensive network and experience in promoting large-scale tours worldwide. This strong showing across genres indicates that the momentum for continued ticketed concerts and festivals has continued through to FY24, showing that consumers are willing to spend on such activities.

- Recent controversy. Live Nation has pushed back against accusations that its dominance in the live music industry, along with its Ticketmaster division, contributes to high ticket prices. In a blog post, Live Nation’s EVP Corporate and Regulatory Affairs, Dan Wall, argues that promoters and ticketing companies do not determine ticket prices; instead, artists and venues play a more significant role. Wall contends that service charges added to ticket prices cover costs for venues and ticketing companies and are not “junk fees.” He emphasizes that artists ultimately decide ticket prices, and venues determine service fees. Wall also suggests that economic factors, such as concerts becoming premier “experience goods” and artists’ increasing dependence on touring income due to declining recorded music sales, contribute to rising ticket prices. Despite Live Nation’s ownership of Ticketmaster, Wall asserts that secondary ticketing platforms, not Live Nation’s core business, are responsible for inflated resale prices. Overall, Live Nation aims to steer the political debate around ticketing toward issues that have minimal impact on its operations.

- 4Q23 earnings review. Revenue rose by 36.1% YoY to US$5.84bn, beating estimates by US$1.06bn. EPS was US$1.37, not comparable with estimates of -US$0.94. In FY24 growth is expected to be more weighted toward 2Q and 3Q compared to previous years, and capital expenditure is estimated to be US$540mn, in line with previous years as a percentage of revenue.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Cathay Pacific Airways (293 HK) at HK$8.8 and Zijin Mining Group Co. Ltd. (2899 HK) at HK$15.7. Add Food Empire Holdings Ltd (FEH SP) at S$1.38.