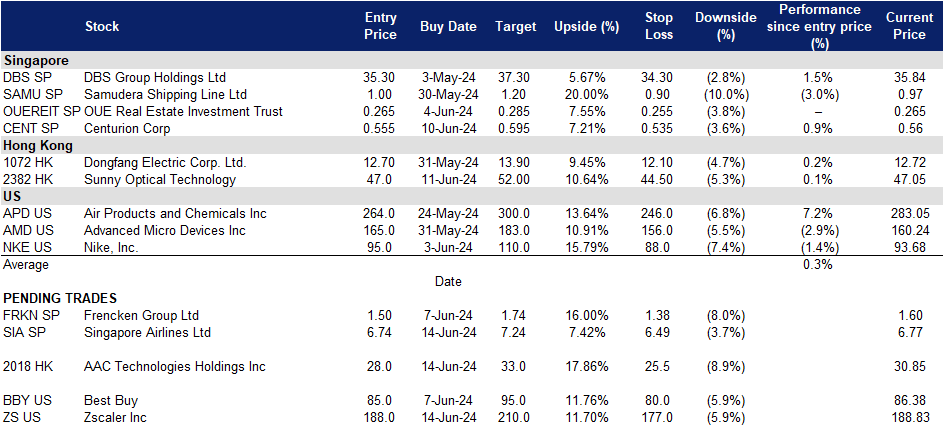

14 June 2024: Singapore Airlines Ltd (SIA SP), AAC Technologies Holdings Inc (2018 HK), Zscaler Inc (ZS US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

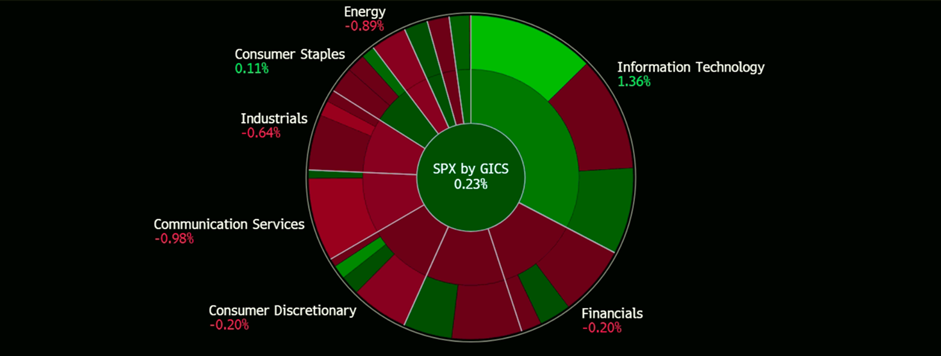

United States

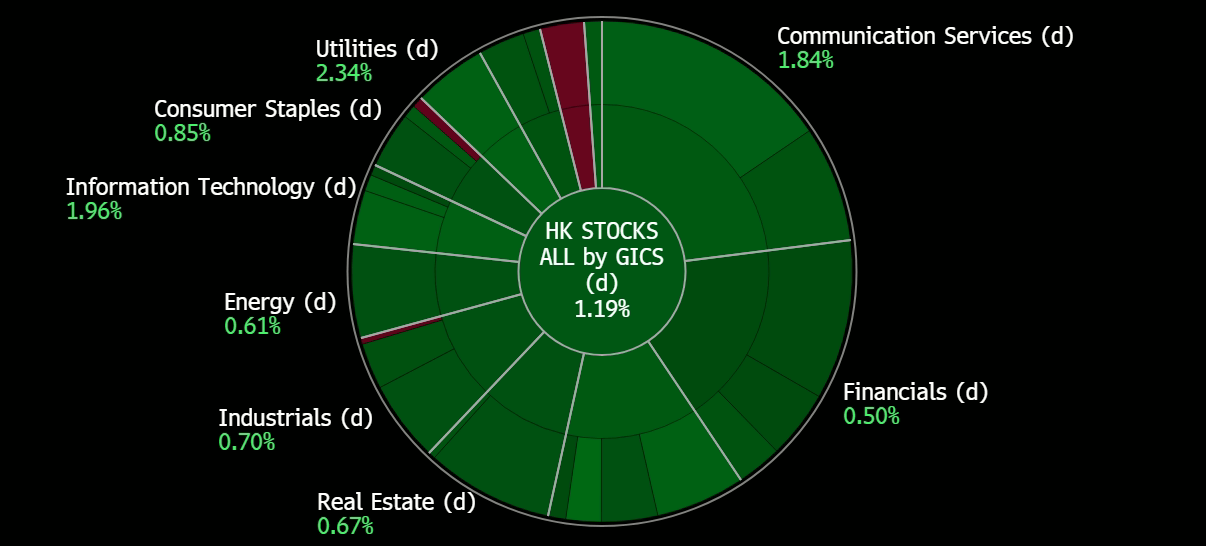

Hong Kong

Singapore Airlines Ltd (SIA SP): Seasonally peak coming

- BUY Entry – 6.74 Target– 7.24 Stop Loss – 6.49

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

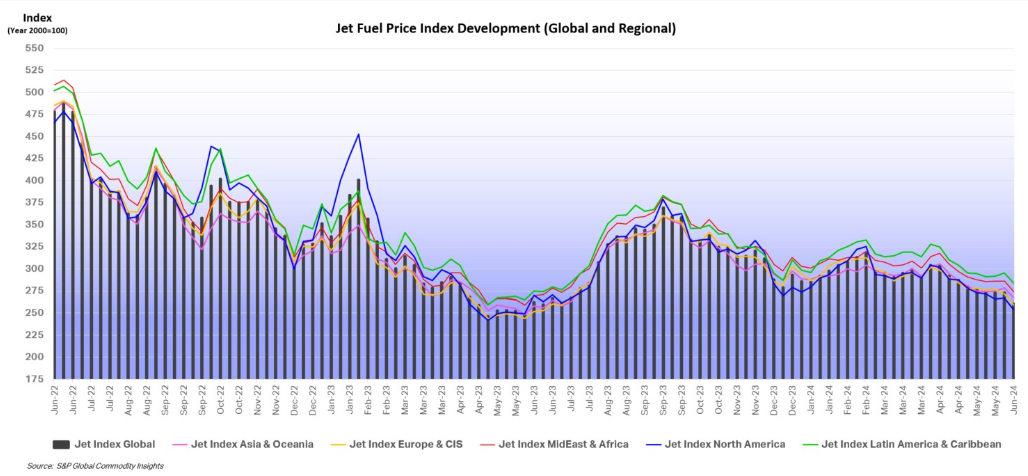

- Summer vacation demand. Despite the high-ticket prices, there has been a significant rise in travel demand due to the start of the summer holidays and the lifting of travel restrictions. This trend is evident in the large summer schedules and new destinations offered by airlines, as well as the increased capacity by some airlines to meet the growing demand. The decrease in jet fuel prices, coupled with higher ticket prices resulting from increased demand, is set to bolster Singapore Airlines’ profit margins.

Jet Fuel Price Trend

(Source: International Air Transport Association)

- Raised FY24 profit expectations. The International Air Transport Association (IATA) has raised its 2024 profit forecast for airlines to US$30.5bn, up from US$27.4bn in 2023. Revenue is projected to grow 9.7% to nearly US$1tn, with a record 4.96bn passengers expected to fly this year. However, supply chain issues and high fuel costs may impact profitability, with a forecasted profit margin of just 3.1% for the year. The Asia-Pacific region is expected to see the most significant profit increase.

- Striving towards sustainability goals. Cathay Pacific and Singapore Airlines have teamed up to promote the use of sustainable aviation fuel (SAF) in the region. They signed a memorandum of understanding to work on sustainability initiatives, including joint procurement of SAF, advocating for supportive policies, and creating a standard global accounting and reporting framework for emissions reductions. They also agreed to exchange best practices for reducing single-use plastic, minimizing waste, and improving energy efficiency. This collaboration aims to accelerate and support the development of the SAF supply chain in the region. The collaboration will assist the airlines in advancing their environmental initiatives, aligning with the decarbonisation theme in the aviation industry.

SIA seasonal performance

(Source: Bloomberg)

- Established a commercial partnership. On 4 June, it was announced that Singapore Airlines and Riyadh Air, a new airline set to start flying in 2025, inked a memorandum of understanding for a partnership. The partnership will explore interline connectivity, codeshare arrangements, and reciprocal benefits for frequent flyer programme members. This collaboration is expected to offer Riyadh Air’s guests access to SIA’s network in South-east Asia and the South-west Pacific and allow SIA’s customers greater access to the Middle East region through Riyadh Air’s network. This partnership aims to offer more options, better connectivity, and greater benefits to customers of both airlines, as well as to enhance customer experience and cargo services.

- FY23/24 results review. Total revenue for the year rose 7.0% YoY to S$19,013mn from the previous S$17,775mn in FY22/23. Net profit increased 24.0% to S$2,675mn from S$2,157. SIA and Scoot carried a combined 36.4mn passengers, up 37.6% YoY and passenger traffic grew 26.6%, outpacing the capacity expansion of 22.9%. This resulted in SIA and Scoot registering record passenger load factors of 87.1% and 91.2% respectively. It declared a final dividend of S$0.38 per share.

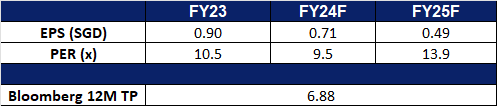

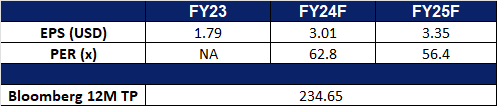

- Market Consensus.

(Source: Bloomberg)

Centurion Corp. Ltd. (CENT SP): Showcasing continued growth

- RE-ITERATE BUY Entry – 0.555 Target– 0.595 Stop Loss – 0.535

- Centurion Corporation Limited specialises in owning and operating worker and student accommodation assets. It ranks among Singapore’s largest owner-operators of high-quality worker accommodations in Singapore and Malaysia. Additionally, the company manages student accommodation properties across Singapore, Australia, the United Kingdom, and the United States.

- Foreign worker dormitories and student accommodations continue to contribute to revenue growth. Total revenue for 2H23 rose by 22% YoY from S$89.9mn to S$109.3mn. Despite revenue growth being partially offset by the cessation of management contracts of two onboard centres in Singapore, 2H23 revenue still managed to grow 22% YoY, showing strength in its rental rate revisions and occupancy rates across its PBWAs and PBSAs. As of FY23, the total asset under management was S$2.0bn with 67,377 operational beds in 34 properties in 15 cities globally.

- Prudent financial structure and debt management. The company’s balance sheet shows a healthy financial position with S$74.7m in cash and bank balances. This increase is mainly from operating activities. Current assets have increased due to assets held for sale, while current liabilities increased because of higher rental deposits and advance rentals received from new tenants. The company has enough cash and banking facilities to cover its current liabilities. Non-current liabilities increased due to additional loan drawdowns for asset development and acquisitions, partially offset by lease liability repayments. The average long-term bank debt maturity is 6 years, and the interest cover ratio is well within the threshold at 3.6 times.

- Continued organic growth of portfolio. Centurion is pursuing strategic, scalable growth through partnerships, investment funds, and fee-based management services. This includes selectively acquiring properties in existing and new markets, optimizing existing assets through renovations and reviews, and expanding revenue streams with specialized management services and ancillary income. This comprehensive strategy is expected to significantly increase its portfolio bed count by 4,310 in FY24.

- FY23 results review. FY23 revenue rose 15% YoY from S$180.5mn to S$207.2mn. The respective FY23 financial occupancy of PBWA and PBSA were 96% and 92%, up from 90% and 86% in FY22. The higher contributions from strong occupancies and improved rental rates across all the PBWAs and PBSAs, alongside an increase in the number of beds available for rent that came into operation helped boost Centurion’s revenue during the year. However, these positives were partially offset by the weaker British Pound, Malaysian Ringgit, and Australian Dollar against SGD which resulted in lower revenue reported in Singapore dollars. Despite these factors, the positives outweighed the negatives, leading to continued growth in both PBWA and PBSA segmental revenues. Higher rental rates across its properties in these four markets also contributed to the increase in revenue.

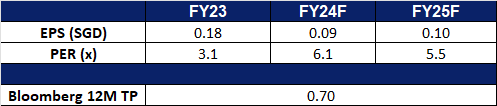

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$0.62. Please read the full report here.

(Source: Bloomberg)

AAC Technologies Holdings Inc (2018 HK): Riding the tailwinds of Apple’s new features

- BUY Entry – 28.0 Target 33.0 Stop Loss – 25.5

- AAC Technologies Holdings Inc. designs, develops and manufactures a broad range of miniaturized components that include speakers, receivers and microphones in the acoustic segment. The Company produces these components for mobile devices such as smartphones, tablets, wearables, ultrabooks, notebooks and electronic book-readers.

- Siri updates incoming. Apple plans to enhance Siri with generative AI, enabling it to control various apps more effectively. This upgrade aims to improve Siri’s understanding of user intentions and app functionalities, addressing previous challenges. A potential deal with OpenAI may integrate ChatGPT’s technology into iOS 18, making Siri more intuitive and context aware. The update is expected to boost iPhone sales, especially as Apple faces competition in China and slower growth in the US. Siri will support more natural language, follow-up questions, and text input, while also performing tasks based on on-screen content and drawing on personal context for more complex actions. On 10 June, Apple released an improved version of Siri and introduced AI features to a few applications. The enhancements announced by Apple will necessitate new components for the handset from AAC Technology, which in turn will benefit its acoustic business revenue.

- iPhone sales to improve. According to analysts, the anticipated demand for Apple’s new AI features, known as Apple Intelligence, is expected to result in a substantial increase in iPhone sales. This could potentially trigger what is known as an “iPhone supercycle.” These features will only be available on the iPhone 15 Pro or newer models, which may prompt many current iPhone users to upgrade. Apple Intelligence, currently in beta, will be available on the iPhone 15 Pro, iPhone 15 Pro Max, and devices with M1 chips or later. It will be integrated into iOS 18, iPadOS 18, and macOS Sequoia. This development may lead to a surge in sales of the iPhone 16 and might also give rise to a new AI App Store, which would significantly impact Apple’s market and boost iPhone sales. An increase in iPhone sales would also result in the need for more components from AAC Technology, benefiting its top lines.

- FY23 earnings. Revenue fell by 1.0% YoY to RMB20,419mn in FY23, compared to RMB20,625mn in FY22. Net profit fell 9.9% YoY to RMB740mn in FY23, compared to RMB821mn in FY22. Basic EPS fell 8.3% YoY to RMB0.63 in FY23, compared to RMB0.69 in FY22.

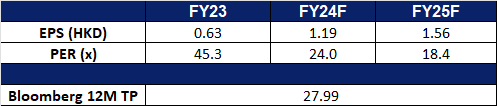

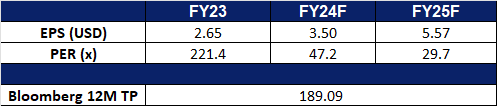

- Market consensus.

(Source: Bloomberg)

Sunny Optical Technology (Group) Co. Ltd. (2382 HK): To benefit from Apple’s WWDC

- RE-ITERATE BUY Entry – 47.0 Target 52.0 Stop Loss – 44.5

- Sunny Optical Technology (Group) Company Limited is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components, Optoelectronic Products and Optical Instruments. Through its subsidiaries, the Company is also engaged in the research and development of infrared technologies. The Company distributes its products in domestic market and to overseas market.

- Upcoming Apple’s WWDC. Apple is set to hold its Worldwide Developers Conference (WWDC) this week, where it will unveil new product offerings, technological advancements, and operating system upgrades, including developments in generative AI. These announcements could positively impact demand for Apple’s products. Consequently, Sunny Optical, one of Apple’s major suppliers of optical components, could see increased sales volumes as a result.

- Rebound in iPhone shipments in China. Apple’s iPhone saw a significant rebound in China last month, with shipments increasing by 52% amid extensive discounts from retail partners. According to the China Academy of Information and Communications Technology, smartphone shipments surged in the country, with about 3.5 million units coming from foreign brands, as Apple and its Chinese resellers have been cutting prices since early 2024, with these discounts continuing into the June 18th shopping festival. This surge in iPhone shipments highlights a rebound in Apple’s market share in China, leading to higher demand for Sunny Optical’s products.

- Continued Smartphone recovery in China. Local smartphone producers have also experienced a significant increase in sales, signaling a recovery in the Chinese smartphone market. Xiaomi’s sales grew at the fastest rate in two years, with a 27% year-over-year increase, and the company anticipates continued market recovery. Similarly, other Chinese smartphone makers, such as Huawei, have seen a surge in sales since the beginning of the year. Several manufacturers have launched new AI smartphones, tapping into the current AI trend and capturing Chinese consumer interest. The Chinese consumer electronics market is expected to continue its recovery, with the growing popularity of AI and foldable smartphones providing an additional boost to sales.

- FY23 earnings. Revenue fell by 4.6% YoY to RMB31.68bn in FY23, compared to RMB33.20bn in FY22. Net profit fell to RMB1.15bn in FY23, compared to RMB2.47bn in FY22. Basic EPS fell to RMB1.01 in FY23, compared to RMB2.20 in FY22.

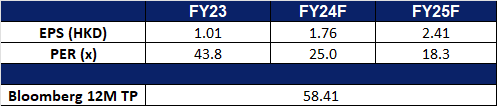

- Market consensus.

(Source: Bloomberg)

Zscaler Inc (ZS US): Partner with the AI-King

- BUY Entry – 188 Target –210 Stop Loss – 177

- Zscaler, Inc. operates as a security software company. The Company offers cloud-based platform that provides web and mobile security, threat protection, cloud application visibility, and networking solutions. Zscaler serves clients worldwide.

- Partnership with Nvidia. Zscaler has announced a collaboration with NVIDIA to enhance enterprise security and user experience using AI-powered copilot technologies. This partnership will enable Zscaler to leverage NVIDIA AI technologies to process over 400 billion transactions daily from its Zero Trust Exchange platform. The collaboration introduces new AI capabilities, including NVIDIA NeMo Guardrails and the NVIDIA Morpheus framework, to defend against cyber threats and simplify IT and network operations. The Zscaler ZDX Copilot, in collaboration with NVIDIA NeMo Guardrails, offers insights into network, device, and application performance, simplifying IT support and operations on a larger scale. Additionally, Zscaler will utilize Nvidia’s Morpheus framework and Nvidia NIM inference microservices to deploy predictive and generative AI solutions, including the Zscaler ZDX Copilot with NVIDIA Morpheus and the Zscaler ZDX Copilot with Nvidia NIM, which can help to accelerate threat detection and the deployment of generative AI models.

- Relationship between AI and cybersecurity. In the first half of 2024, there was a notable increase in funding for cybersecurity startups, particularly those that utilize generative AI. This bounce-back comes after a decrease in early-stage funding deals in 2023. Venture capital investment in cybersecurity is once again on the rise, with a specific focus on AI-driven solutions for threat management and access control. Both attackers and defenders are increasingly using AI in cybersecurity, indicating a shift in the industry. As AI continues to advance, its impact on cybersecurity becomes significant for both attackers and defenders. AI allows cyber threats to conduct more successful large-scale phishing campaigns and use deepfakes for deception. In cyber defence, AI-driven security systems offer a proactive approach to threat detection by analysing patterns and predicting potential vulnerabilities. The rapid advancement of AI introduces new complexities to cybersecurity, requiring more investments in AI cyber defence to counteract modern cyber risks.

- 3Q24 earnings review. Revenue grew by 32.1% YoY to US$553.2mn, beating estimates by US$17.11mn. Non-GAAP EPS was US$0.88, beating estimates by US$0.23. 4Q24 revenue is expected to be between US$565mn to US$567mn vs consensus of US$564.98mn. Non-GAAP EPS is expected to be US$0.69 to US$0.70 vs consensus of US$0.67. FY24 revenue to be approximately US$2.140bn to US$2.142bn vs consensus of US$2.21B and Non-GAAP EPS to be between US$2.99 to US$3.01 vs consensus of US$2.76.

- Market consensus.

(Source: Bloomberg)

Best Buy Co Inc (BBY US): Upward cycle of consumer electronics

- RE-ITERATE BUY Entry – 85 Target –95 Stop Loss – 80

- Best Buy Co., Inc. retails consumer electronics, home office products, entertainment software, appliances, and related services through its retail stores, as well as its web site. The Company also retails pre-recorded home entertainment products through retail stores. Best Buy operates in the United States and Canada.

- Consumer electronics bottoming out. The surge in demand for consumer electronics products such as smartphones, laptops, and tablets during the COVID period was driven by lockdown measures as working from home was compulsory, and it became a fab when economies just reopened. On average, the duration of these products is 4-5 years. Hence, the replacement cycle is about to begin since the outbreak of COVID-19 was more than 4 years from now. Moreover, the inception of artificial intelligence (AI) urges companies to embed this revolutionary function into the upcoming generation of products such as smartphones and PCs. Gadgets with AI functions will be pervasive, similar to a phone with cameras. Therefore, the great replacement of old gadgets will begin in 2H24.

- Main suppliers’ upbeat guidance. Apple will upgrade its AI feature, replacing Siri for the next generation of iPhones, iPads, and Macbooks. Sony expects 1% growth (excluding financial services) with a minimal slowdown in Gaming, Pictures, and Entertainment, Technology & Services. Samsung expects smartphone/tablet/wearable electronics/TV segments to grow. LG forecast demand for TVs and screens to recover in 2H24. HP/Dell/Lenovo will release AI PCs by the end of 2024.

- 1Q25 earnings review. Revenue dropped by 6.5% YoY to US$8.85bn, missing estimates by US$120mn. Non-GAAP EPS was US$1.20, beating estimates by US$0.13. FY25 revenue is expected to be from US$41.3bn to US$42.6bn. Comparable sales are expected to be from -3.0% to 0.0%. Non-GAAP diluted EPS is estimated to be from US$5.75 to US$6.20.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Cut loss on Anta Sports Product (2020 HK) at HK$83.