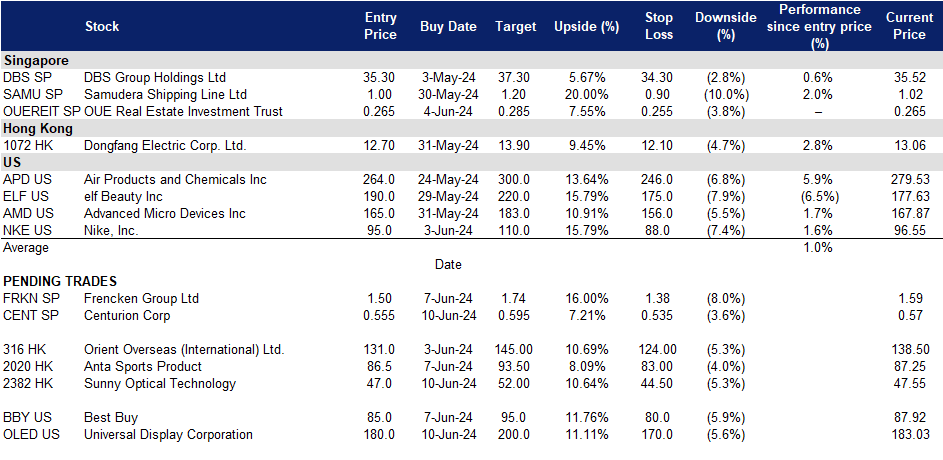

10 June 2024: Centurion Corp. Ltd. (CENT SP), Anta Sports Products Ltd. (2020 HK), Best Buy Co Inc (BBY US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

The KGI Daily Trading Ideas – 10 June

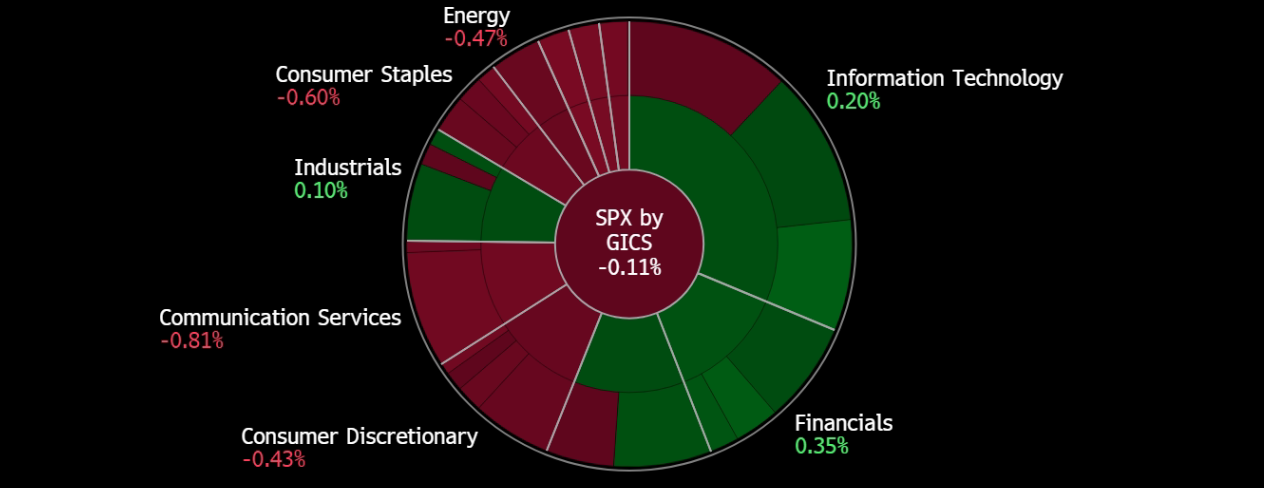

United States

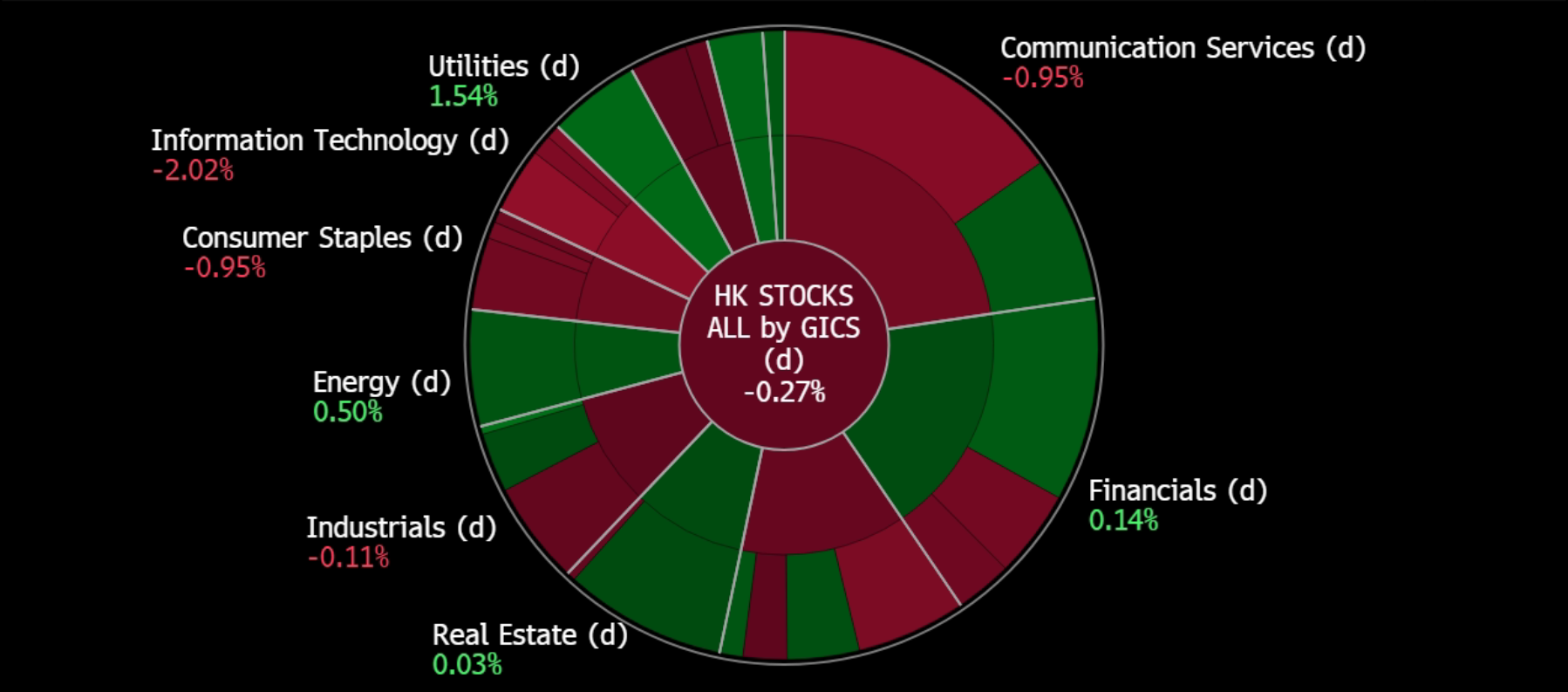

Hong Kong

Centurion Corp. Ltd. (CENT SP): Showcasing continued growth

- BUY Entry – 0.555 Target– 0.595 Stop Loss – 0.535

- Centurion Corporation Limited specialises in owning and operating worker and student accommodation assets. It ranks among Singapore’s largest owner-operators of high-quality worker accommodations in Singapore and Malaysia. Additionally, the company manages student accommodation properties across Singapore, Australia, the United Kingdom, and the United States.

- Foreign worker dormitories and student accommodations continue to contribute to revenue growth. Total revenue for 2H23 rose by 22% YoY from S$89.9mn to S$109.3mn. Despite revenue growth being partially offset by the cessation of management contracts of two onboard centres in Singapore, 2H23 revenue still managed to grow 22% YoY, showing strength in its rental rate revisions and occupancy rates across its PBWAs and PBSAs. As of FY23, the total asset under management was S$2.0bn with 67,377 operational beds in 34 properties in 15 cities globally.

- Prudent financial structure and debt management. The company’s balance sheet shows a healthy financial position with S$74.7m in cash and bank balances. This increase is mainly from operating activities. Current assets have increased due to assets held for sale, while current liabilities increased because of higher rental deposits and advance rentals received from new tenants. The company has enough cash and banking facilities to cover its current liabilities. Non-current liabilities increased due to additional loan drawdowns for asset development and acquisitions, partially offset by lease liability repayments. The average long-term bank debt maturity is 6 years, and the interest cover ratio is well within the threshold at 3.6 times.

- Continued organic growth of portfolio. Centurion is pursuing strategic, scalable growth through partnerships, investment funds, and fee-based management services. This includes selectively acquiring properties in existing and new markets, optimizing existing assets through renovations and reviews, and expanding revenue streams with specialized management services and ancillary income. This comprehensive strategy is expected to significantly increase its portfolio bed count by 4,310 in FY24.

- FY23 results review. FY23 revenue rose 15% YoY from S$180.5mn to S$207.2mn. The respective FY23 financial occupancy of PBWA and PBSA were 96% and 92%, up from 90% and 86% in FY22. The higher contributions from strong occupancies and improved rental rates across all the PBWAs and PBSAs, alongside an increase in the number of beds available for rent that came into operation helped boost Centurion’s revenue during the year. However, these positives were partially offset by the weaker British Pound, Malaysian Ringgit, and Australian Dollar against SGD which resulted in lower revenue reported in Singapore dollars. Despite these factors, the positives outweighed the negatives, leading to continued growth in both PBWA and PBSA segmental revenues. Higher rental rates across its properties in these four markets also contributed to the increase in revenue.

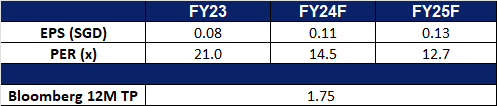

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$0.62. Please read the full report here.

(Source: Bloomberg)

Frencken Group Ltd. (FRKN SP): Semicon recovery on-track

- RE-ITERATE BUY Entry – 1.50 Target– 1.74 Stop Loss – 1.38

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment, and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial, and semiconductor industries.

- Nvidia delivering better than anticipated results again. Nvidia recently reported Q1 results which surpassed estimates, its revenue tripled YoY to US$26bn and it delivered profits that significantly exceeded expectations. The company projected higher-than-expected Q2 revenue of about US$28bn, surpassing analysts’ predictions of US$26.8bn. This positive outlook is driven by the strong demand for AI chips. Its CEO heralded this as the start of a new industrial revolution. Nvidia is currently bolstered by AI accelerators used by major tech firms like Amazon and Google. Despite high demand outpacing supply, Nvidia aims to diversify its market beyond hyperscalers to sectors like healthcare and automotive. This positive demand is expected to extend to Frencken’s semiconductor segment, which represents approximately 41% of its FY revenue.

- Good performance. Frencken Group’s revenue rose 12.2%YoY to S$193.6mn, with the mechatronics division seeing a 14.4% increase to S$170.1mn, primarily from the semiconductor, medical, and analytical life sciences segments. It reported a net profit of S$9mn for 1Q23, up 73% from S$5.2mn the previous year, driven by higher gross profit margins and revenue growth. The IMS division’s revenue remained stable at S$22.8mn, with a decline in the automotive segment offset by a significant increase in the consumer and industrial electronics segment. Gross profit margin improved to 13.7%. The company remains cautious due to global economic uncertainties and expects 1H24 revenue to be comparable to 2H23, with growth in semiconductor, medical, and analytical life sciences segments but softer automotive and industrial automation revenues. Frencken is anticipated to recover alongside the rest of the Semiconductor industry.

- 1Q24 results review. 1Q24 revenue rose by 12.2% to S$193.6mn, compared to S$172.5mn in 1Q23. Net profit increased 73% YoY to S$9mn from S$5.2mn in the previous year due to higher revenue growth and gross profit margins. Gross profit margin improved to 13.7% in 1Q24 from 12.3% in 1Q23, attributing it to better operating leverage. In 1H24, Frencken expects to deliver revenue comparable to 2H23 revenue. The semiconductor, medical, and analytical life sciences segments are expected to improve, while the industrial automation and automotive segments are expected to soften.

- Market Consensus

(Source: Bloomberg)

Sunny Optical Technology (Group) Co. Ltd. (2382 HK): To benefit from Apple’s WWDC

- BUY Entry – 47.0 Target 52.0 Stop Loss – 44.5

- Sunny Optical Technology (Group) Company Limited is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components, Optoelectronic Products and Optical Instruments. Through its subsidiaries, the Company is also engaged in the research and development of infrared technologies. The Company distributes its products in domestic market and to overseas market.

- Upcoming Apple’s WWDC. Apple is set to hold its Worldwide Developers Conference (WWDC) this week, where it will unveil new product offerings, technological advancements, and operating system upgrades, including developments in generative AI. These announcements could positively impact demand for Apple’s products. Consequently, Sunny Optical, one of Apple’s major suppliers of optical components, could see increased sales volumes as a result.

- Rebound in iPhone shipments in China. Apple’s iPhone saw a significant rebound in China last month, with shipments increasing by 52% amid extensive discounts from retail partners. According to the China Academy of Information and Communications Technology, smartphone shipments surged in the country, with about 3.5 million units coming from foreign brands, as Apple and its Chinese resellers have been cutting prices since early 2024, with these discounts continuing into the June 18th shopping festival. This surge in iPhone shipments highlights a rebound in Apple’s market share in China, leading to higher demand for Sunny Optical’s products.

- Continued Smartphone recovery in China. Local smartphone producers have also experienced a significant increase in sales, signaling a recovery in the Chinese smartphone market. Xiaomi’s sales grew at the fastest rate in two years, with a 27% year-over-year increase, and the company anticipates continued market recovery. Similarly, other Chinese smartphone makers, such as Huawei, have seen a surge in sales since the beginning of the year. Several manufacturers have launched new AI smartphones, tapping into the current AI trend and capturing Chinese consumer interest. The Chinese consumer electronics market is expected to continue its recovery, with the growing popularity of AI and foldable smartphones providing an additional boost to sales.

- FY23 earnings. Revenue fell by 4.6% YoY to RMB31.68bn in FY23, compared to RMB33.20bn in FY22. Net profit fell to RMB1.15bn in FY23, compared to RMB2.47bn in FY22. Basic EPS fell to RMB1.01 in FY23, compared to RMB2.20 in FY22.

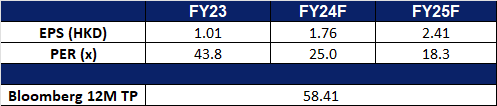

- Market consensus.

(Source: Bloomberg)

Anta Sports Products Ltd. (2020 HK): Preparations for Olympic games

- RE-ITERATE BUY Entry – 86.5 Target 93.5 Stop Loss – 83.0

- ANTA Sports Products Ltd is a China-based company principally engaged in the production and sale of sporting goods. The Company’s main businesses are brand marketing, production, design, procurement, supply chain management, wholesale and retail of branded sporting goods, including footwear, apparel and accessories. The Company explores the potential of the sporting goods market through diversified brands, including ANTA, FILA, DESCENTE and KOLON SPORT. The Company’s products are sold to domestic and international markets.

- Upcoming sporting events. The Paris Olympics, starting on July 26, 2024, is expected to drive a surge in sporting goods consumption. As the Olympics inspire national sporting spirit, fitness enthusiasts will likely seek to upgrade or purchase new equipment to train like their favorite athletes. This increased interest may also boost sports participation. Moreover, extensive media coverage of the Olympics will showcase the latest sporting gear and apparel, further fueling consumer desire for these performance-enhancing and trendy items. Consequently, sporting goods retailers and manufacturers in China, including Anta, are poised to see significant revenue growth.

- 618 shopping festival. The 618 shopping festival in China has begun, with major e-commerce platforms offering significant discounts and promotions. Approximately 185 brands, including Apple, Xiaomi, and Huawei, have each surpassed $13.8mn in gross merchandise value on Taobao and Tmall. Additionally, about 37,000 other brands have doubled their YoY sales on these platforms during the initial promotional period, according to preliminary sales data. This surge in consumer spending over the sales period is expected to benefit Anta Sports Products as well.

- New partnership. Kyrie Irving recently signed his father, Drederick, to a professional shoe deal with ANTA Sports, which will include a signature shoe set to release in Foot Locker stores in September. ANTA Sports had already partnered with Kyrie Irving for a signature shoe line under his name and recently released the latest signature sneaker recently as well, the Anta Kai 1 “Chief Hélà. This new collaboration with Irving and his father marks a significant step in ANTA’s international expansion efforts. By launching exclusive product lines and leveraging Irving’s influence, ANTA is strategically positioning itself to grow its global market presence.

- FY23 earnings. Revenue increased by 16.2% YoY to RMB62.36bn in FY23, compared to RMB53.65bn in FY22. Group’s operational profit margin increased by 3.7pp to 24.6%. Net profit increased by 34.9% to RMB10.24bn in FY23, compared to RMB7.59bn in FY22. Basic EPS rose by 30.9% to RMB3.69 in FY23, compared to RMB2.82 in FY22.

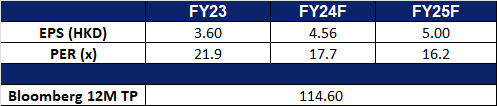

- Market consensus.

(Source: Bloomberg)

Best Buy Co Inc (BBY US): Upward cycle of consumer electronics

- RE-ITERATE BUY Entry – 85 Target –95 Stop Loss – 80

- Best Buy Co., Inc. retails consumer electronics, home office products, entertainment software, appliances, and related services through its retail stores, as well as its web site. The Company also retails pre-recorded home entertainment products through retail stores. Best Buy operates in the United States and Canada.

- Consumer electronics bottoming out. The surge in demand for consumer electronics products such as smartphones, laptops, and tablets during the COVID period was driven by lockdown measures as working from home was compulsory, and it became a fab when economies just reopened. On average, the duration of these products is 4-5 years. Hence, the replacement cycle is about to begin since the outbreak of COVID-19 was more than 4 years from now. Moreover, the inception of artificial intelligence (AI) urges companies to embed this revolutionary function into the upcoming generation of products such as smartphones and PCs. Gadgets with AI functions will be pervasive, similar to a phone with cameras. Therefore, the great replacement of old gadgets will begin in 2H24.

- Main suppliers’ upbeat guidance. Apple will upgrade its AI feature, replacing Siri for the next generation of iPhones, iPads, and Macbooks. Sony expects 1% growth (excluding financial services) with a minimal slowdown in Gaming, Pictures, and Entertainment, Technology & Services. Samsung expects smartphone/tablet/wearable electronics/TV segments to grow. LG forecast demand for TVs and screens to recover in 2H24. HP/Dell/Lenovo will release AI PCs by the end of 2024.

- 1Q25 earnings review. Revenue dropped by 6.5% YoY to US$8.85bn, missing estimates by US$120mn. Non-GAAP EPS was US$1.20, beating estimates by US$0.13. FY25 revenue is expected to be from US$41.3bn to US$42.6bn. Comparable sales are expected to be from -3.0% to 0.0%. Non-GAAP diluted EPS is estimated to be from US$5.75 to US$6.20.

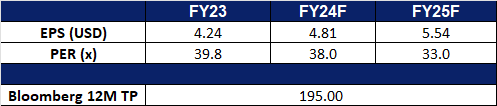

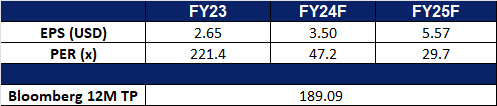

- Market consensus.

(Source: Bloomberg)

Universal Display Corporation (OLED US): The hidden gem behind the great IT replacement cycle

- BUY Entry – 180 Target – 200 Stop Loss – 170

- Universal Display Corporation is a member of the United States Display Consortium. The Consortium is a cooperative industry and government effort aimed at developing an infrastructure to support a North American flat panel display infrastructure. The Company and its partners are developing high-resolution, full color, light weight Organic Light Emitting Diode (OLED) technology.

- Consumer electronics bottoming out. The surge in demand for consumer electronics products such as smartphones, laptops, and tablets during the COVID period was driven by lockdown measures as working from home was compulsory, and it became a fab when economies just reopened. On average, the duration of these products is 4-5 years. Hence, the replacement cycle is about to begin since the outbreak of COVID-19 was more than 4 years from now. Moreover, the inception of artificial intelligence (AI) urges companies to embed this revolutionary function into the upcoming generation of products such as smartphones and PCs. Gadgets with AI functions will be pervasive, similar to a phone with cameras. Therefore, the great replacement of old gadgets will begin in 2H24.

- OLED IT products to grow in 2024. According to Omdia market research, OLED tablets are expected to increase by more than 300% YoY, growing from 3.7 million units in 2023, to 12.1 million units in 2024. OLED notebook users will grow 50% YoY, from 3.4 million units in 2023 to 5.1 million units in 2024. Total mobile OLED PC units growing from 7.1 million units in 2023 to 17.2 million units in 2024, and is expected to reach 72.3 million units by 2028, which represents just 14% of the total mobile PC display market. OLED TV shipments will increase by more than 30% YoY, from 5.3 million units in 2023 to 7.2 million units in 2024. DSCC market research expects OLED smartphone units to increase by 11% YoY in 2024, with flexible OLED increasing 9% YoY, and rigid OLEDs increasing 17% YoY.

- Robust cash position. As of 1Q24, the company accumulated US$539.3mn cash and equivalents while its total debt was only US$25.5mn. The 1Q24 free cash flow increased to US$64.95mn, near the historical peak of US$66.38mn in 2021.

- 1Q24 earnings review. Revenue rose by 26.7% YoY to US$165.26mn, exceeding estimates by US$14.88mn. GAAP EPS was US$1.19, beating estimates by US$0.17. 2024 revenue guidance will be in the range of US$635mn to US$675mn and the consensus is US$655.99mn.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on COSCO Shippinga Holdings (1919 HK) at HK$15.0.