9 December 2024: Bumitama Agri Ltd (BAL SP), Yidu Tech Inc (2158 HK), Sprouts Farmers Market Inc (SFM US)

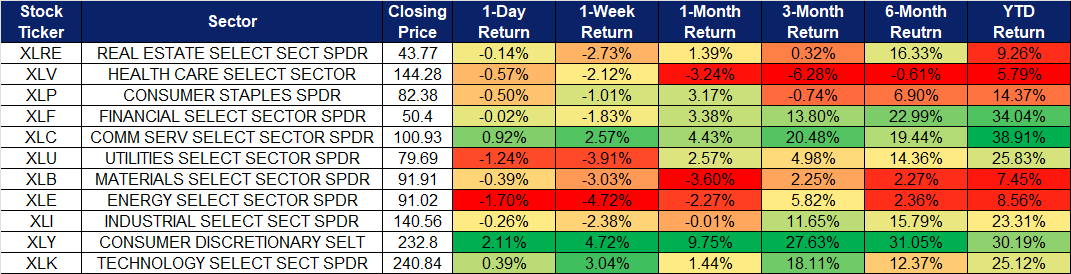

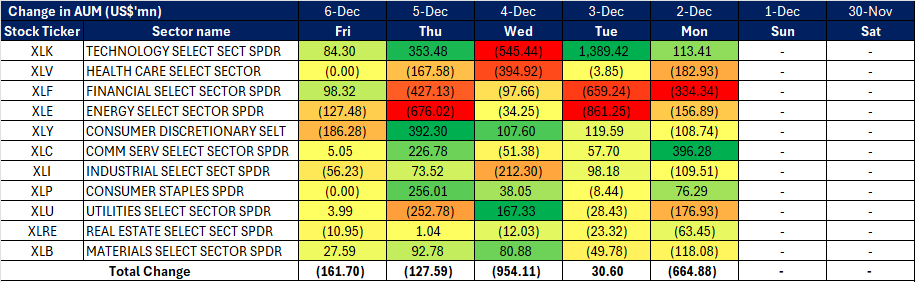

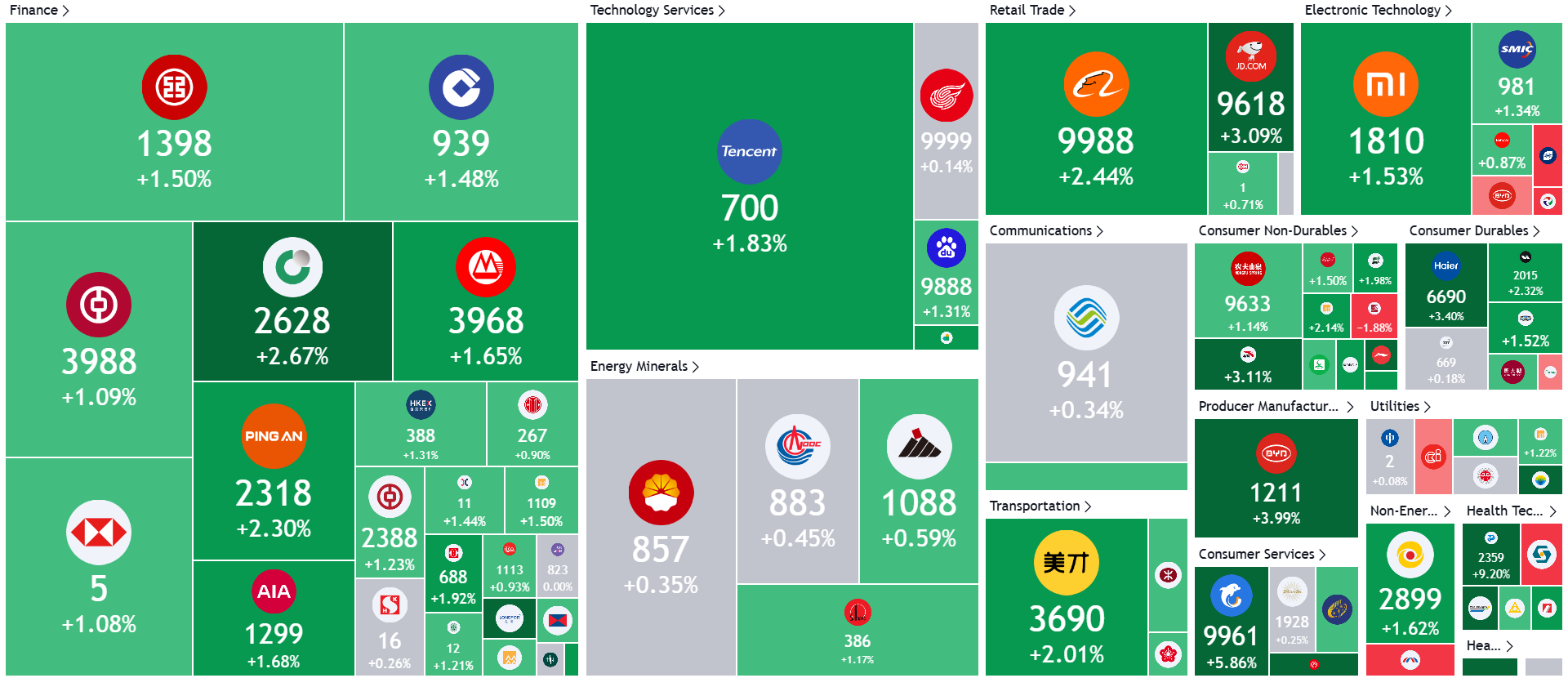

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

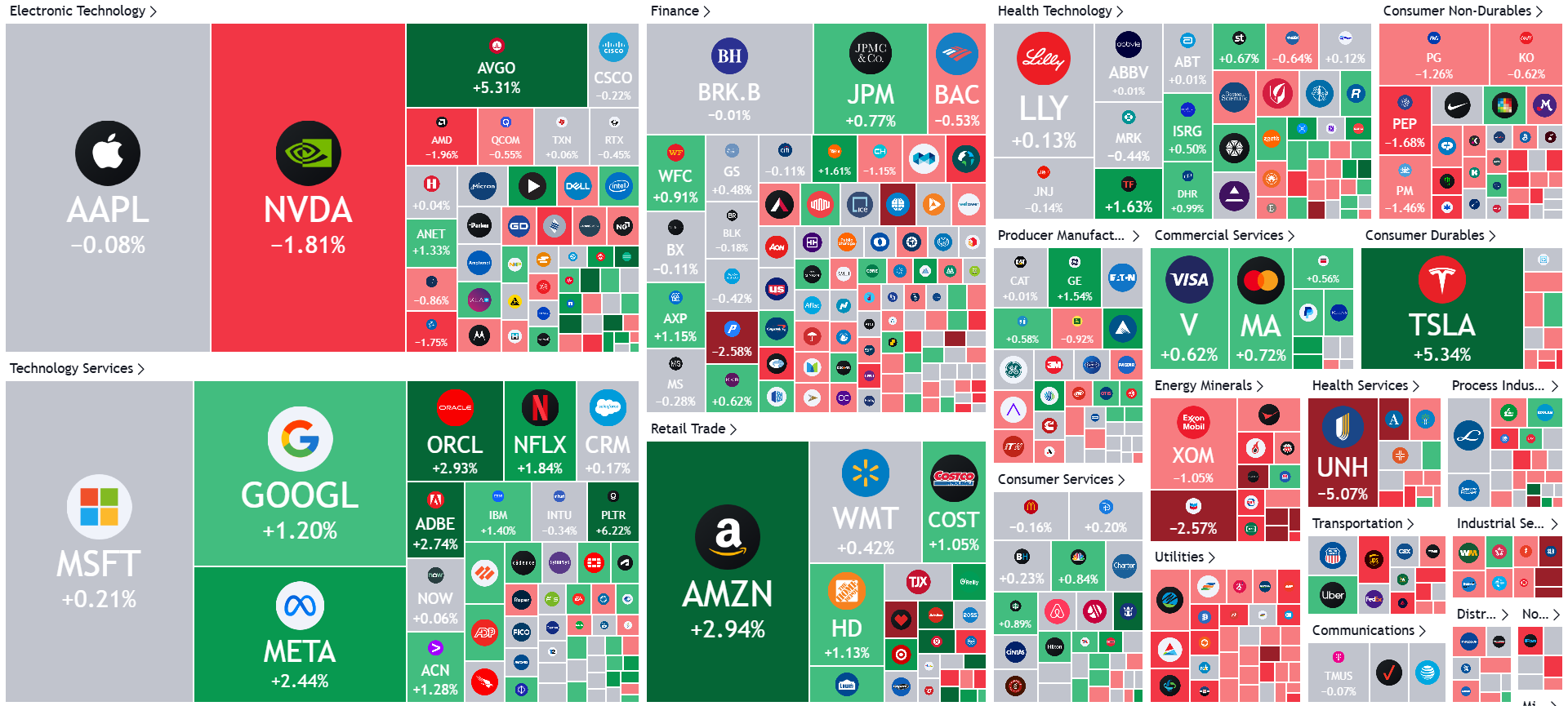

United States

Hong Kong

Bumitama Agri Ltd (BAL SP): Palm oil demand to maintain

- BUY Entry – 0.89 Target– 0.97 Stop Loss – 0.85

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK and selling CPO and PK in Indonesia.

- Continued palm oil rally. The Council of Palm Oil Producing Countries (CPOPC) forecasts palm oil prices to range between RM4,000 and RM5,000 per tonne in 2025 due to stagnating production in key markets like Indonesia and Malaysia. Current prices around RM5,000 per tonne are seen as temporary, influenced by Malaysia’s floods and bullish market sentiment. Stagnation in production is attributed to ageing plantations, unpredictable weather, and limited expansion into new plantation areas, potentially leading to a global supply shortage and driving prices higher.

- High expectations. Bumitama Agri has demonstrated resilience over the past decade, navigating fluctuating palm oil prices driven by changing demand, adverse weather, and geopolitical tensions. The company has consistently delivered strong financial performance and shareholder returns, including a record 14% dividend yield in FY22 and 10% in FY23, supported by robust cash flow and a healthy balance sheet. Despite weather-related challenges and cost pressures in 1H24, Bumitama achieved significant QoQ growth in Q2, with gross profit, net profit, and EBITDA showing marked improvement. Core profit rose 43%, fueled by higher palm oil prices and easing cost pressures. Key growth drivers include Indonesia’s biodiesel mandate, set to increase blending requirements to 40% by 2025, boosting domestic consumption and reducing export volumes, thereby sustaining elevated global palm oil prices. Surging palm kernel prices further contribute to growth opportunities. Looking ahead, Bumitama is well-positioned for continued financial growth, supported by stable costs, strong demand, and favorable pricing for palm oil and palm kernel products.

- 1H24 results review. Revenue rose by 1.4% YoY to IDR7.6tn in 1H24, compared to IDR7.50tn in 1H23. Net profit fell by 29.5% to IDR1.00tn in 1H24, compared to IDR1.42tn in 1H23. Basic and Diluted EPS per share is DR494 in 1H24, compared to IDR686 in 1H23.

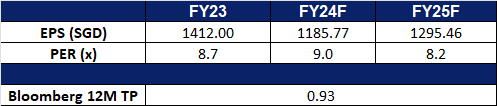

- Market Consensus.

(Source: Bloomberg)

DBS Group Holdings Ltd (DBS SP): Visionary move

- RE-ITERATE BUY Entry – 44 Target– 48 Stop Loss – 42

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage. DBS Group also acts as the primary dealer in Singapore government securities.

- Reaping benefits from wealthy Russians. DBS Group Holdings has expanded its wealth management team to serve affluent Russian clients, navigating global sanctions-related complexities while ensuring strict compliance. Recent hires include two Russian-speaking private bankers, bringing the total to at least nine in Singapore. Over the past two years, DBS has recruited talent from Credit Suisse and Julius Baer, attracting over US$1 billion in client assets after Credit Suisse exited its Singapore-based Russian wealth operations. While Russian assets represent a small fraction of DBS’s US$401 billion under management, this segment has shown significant growth. To ensure compliance, Russian clients must hold at least US$20 million in assets and undergo rigorous screening to verify wealth sources and confirm they are not under sanctions. As global competitors like UBS, HSBC, and OCBC exit Russian transactions due to regulatory challenges, DBS benefits from reduced competition, gaining access to a larger client pool. With plans to double wealth management fees by 2027, this team expansion better positions DBS’s wealth management division to achieve its goal, boosting its assets under management and solidifying its presence in Asia’s expanding wealth market.

- IMDA partnership. DBS and the Infocomm Media Development Authority (IMDA) have launched the Spark GenAI program to encourage Singapore’s SMEs to adopt generative AI (gen AI) solutions. With only 4.2% of SMEs currently using AI, the program aims to engage 50,000 businesses over two years, guiding on integrating gen AI into operations such as customer engagement and marketing. Spark GenAI will offer online resources, quarterly workshops, tailored solution recommendations, and access to grants from IMDA and EnterpriseSG. It will also enhance digital resilience through cyber insurance and a cyber wellness course. As Southeast Asia’s digital economy is projected to reach S$352 billion by 2024, DBS emphasizes the importance of innovation for SMEs to remain competitive. Through these advanced technology solutions, DBS will help to drive SME growth and cement its relationship with this key client segment.

- 3Q24 results review. Total income for 3Q24 rose 11% to S$5.75bn and net profit rose 15% YoY to surpass S$3bn for the first time. DBS announced a new S$3bn share buyback programme and declared Q3 dividend at S$0.54 per share.

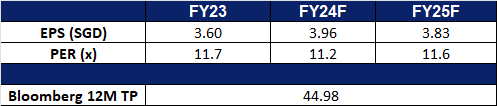

- Market Consensus.

(Source: Bloomberg)

Yidu Tech Inc (2158 HK): AI in healthcare

- RE-ITERATE BUY STOP Entry – 5.40 Target 6.40 Stop Loss – 4.90

- Yidu Tech Inc is a China-based investment holding company that mainly provides medical big data solutions. The Company operates through three segments. The Big Data Platform and Solutions segment is mainly composed of big data platform offerings and other solutions to customers. The Life Science Solutions segment is responsible for providing analysis-driven clinical development, real-world evidence (RWE)-based research, and digital commercialization solutions to pharmaceutical, biotech and medical device companies and other companies. The Health Management Platform and Solutions segment mainly operates research-driven personal health management platforms and provides insurance technology and disease management solutions to insurance companies and agencies. The Company’s main data intelligence infrastructure is YiduCore.

- Rotation to AI application. The AI investment theme is entering another segment, application, following the infrastructure (chips, data centre, and power). The software as a service (SaaS) segment has started seeing some improvement in business development, operations, and profitability owing to the adoption of AI technology, especially in using large language models in data analytics. In 2025, SaaS will be one of the key themes with a promising outlook.

- AI + Healthcare. As of September 2024, the company provided solutions to 105 top-tier hospitals in China and 40 regulators and policy makers, covering over 2,800 hospitals. The company launched the “Big Data + Large Language Model” dual middleware solution for scientific and clinical research. Approximately 50% of the R&D expenditures are allocated to the AI large model, focusing on the training of 70B parameter models.

- 1H24 earnings. Yidu Tech’s revenue decreased by 7.6% YoY from RMB356.5 million for 1H23 to RMB329.4 million in 1H24, this was primarily attributable to the decline in revenue from Life Science Solutions segment and Health Management Platform and Solutions segment. Overall, the company’s loss for the period decreased by 29.2% YoY from RMB79.6 million for 1H23 to RMB56.4 million for 1H24, due to the decline in cost of sales and other expenses. Basic loss per share rose to a loss of RMB0.04 in 1H24, compared to its loss of RMB0.07 in 1H23.

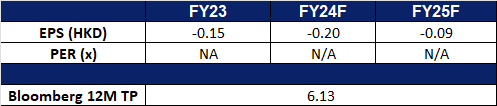

- Market consensus.

(Source: Bloomberg)

Goldwind Science & Technology Co Ltd. (2208 HK): Spurring investments into renewable energy

- BUY Entry – 7.0 Target 8.0 Stop Loss – 6.5

- Goldwind Science & Technology Co Ltd, formerly Xinjiang Goldwind Science & Technology Co Ltd, is a China-based company that provides overall solutions for wind turbines, wind power services and wind farm development. The Company operates its businesses through four segments. The Wind Turbine Manufacturing and Sales segment is mainly engaged in the research and development, manufacturing and sales of wind turbines and their parts. The Wind Power Service segment mainly provides wind power-related consultants, wind farm construction and maintenance and transportation services. The Wind Farm Development segment is mainly engaged in the development and operation of wind farms. Other segment is mainly engaged in financial leasing and water treatment development and operation business. The Company conducts its businesses both in the domestic market and overseas markets.

- New Renewable Energy Consumption Benchmarks. China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) have jointly released updated requirements for the percentage of energy that provinces must source from renewable generators in 2024 and 2025. These requirements are part of China’s renewable energy consumption guarantee mechanism, mandating a significant increase in the share of renewable energy in several provinces. The document also outlines tentative renewable energy consumption targets for 2025. Current data reveals that six provinces experienced increases exceeding 6 percentage points in their renewable energy consumption mandate between 2023 and 2024. China remains on track to achieve its renewable energy goals, aiming for renewable energy, including hydropower, to account for 40 percent of total national energy consumption by 2030. This benchmarks are likely to spur on more investment into renewable energy as well.

- Increasing use of renewable energy in China. China’s renewable energy utilization has reached or exceeded advanced international levels, demonstrating rapid progress in sustainable energy. The country has maintained strong momentum in renewable energy adoption, with a utilization rate of 97.6%, surpassing 95% for six consecutive years since 2018. Last year, newly installed renewable energy capacity rose to 290 million kW, 2.4 times that of 2022, accounting for 79% of the total new power generation capacity nationwide, making it the primary source of new power generation. This surge in capacity has spurred significant investments in solar, wind, and hydropower projects across the country. These efforts are part of China’s broader strategy to peak carbon emissions before 2030 and achieve carbon neutrality before 2060. Furthermore, China’s National Energy Administration also recently reported that 486 million Green Electricity Certificates (GECs) were issued during the first half of 2024– a 13-fold increase compared to the same period last year, further signalling progress towards the decarbonisation and reform of the power sector. Goldwind is likely to benefit from the increased investment and spending in renewable energy.

- Expanding presence. Goldwind Science & Technology has officially opened its first overseas wind turbine manufacturing plant in Brazil. The facility has begun production with a capacity to produce up to 150 turbines annually. Valued at approximately $18.2 million, this investment aims to strengthen local supply chains and leverage the region’s rich wind resources. While the plant will primarily serve the Brazilian market, it is also positioned to export equipment across South America via the port of Bahia. With this new facility, Goldwind is expected to secure a 24% to 30% share of the Brazilian wind turbine market.

- 1H24 earnings. The company’s revenue rose to RMB20.1bn in 1H24, +6.53% YoY, compared to RMB18.9bn in 1H23. The company’s net profit rose by 6.74% YoY to RMB1.44bn in 1H24, compared to RMB1.35bn in 1H23. Basic earnings per share rose to RMB0.32 in 1H24, compared to RMB0.28 in 1H23.

- Market consensus.

(Source: Bloomberg)

Sprouts Farmers Market Inc (SFM US): Appeal to health-conscious consumers

- BUY Entry – 150 Target – 170 Stop Loss – 140

- Sprouts Farmers Market, Inc. operates a chain of retail grocery stores. The Company offers meats, cheese, dairy products, bakery, beer and wine, bulk foods, vitamins, and supplements. Sprouts Farmers Market serves customers throughout the United States.

- Resilient demand from mid- to high-end consumers. Despite high inflation and rising interest rates, mid- to high-end consumers in the United States have maintained their overall spending levels, though their consumption habits have shifted. The COVID-19 pandemic heightened awareness of food safety and quality, driving steady growth in demand for organic products. Additionally, the wealth effect from stock market gains has supported increased spending on premium organic food among affluent consumer groups.

- Strong growth and performance. As of 3Q24, Sprouts Farmers Market operates 428 stores and plans to expand its footprint with an annual growth rate of 10% in new store openings. Comparable store sales rose 8.4% YoY, while gross profit margin reached a record high of 38.1% during the quarter. Online sales also grew by 36% YoY, accounting for 14.5% of total sales, reflecting the company’s ability to adapt to evolving consumer preferences and capitalize on digital growth opportunities.

- 3Q24 results. Revenue reached US$1.9 billion, a YoY increase of 11.8%, exceeding market expectations by US$20 million. Non-GAAP earnings per share were US$0.91, beating expectations by US$0.14. The company’s fourth-quarter guidance is that net sales will increase by approximately 12% YoY; comparable store sales will increase by 8% to 10% YoY; adjusted diluted earnings per share will be in the range of US$0.67 to US$0.71, and market expectations are US$0.58.

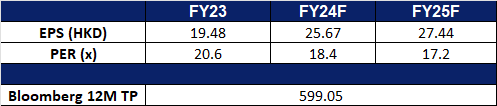

- Market consensus.

(Source: Bloomberg)

Tapestry Inc (TPR US): Deals and steals

- RE-ITERATE BUY Entry – 60 Target – 68 Stop Loss – 56

- Tapestry, Inc. designs and markets clothes and accessories. The Company offers handbags, leather goods, footwear, fragrance, jewelry, outer wear, ready-to-wear, scarves, sunwear, travel accessories, and watches. Tapestry serves customers worldwide.

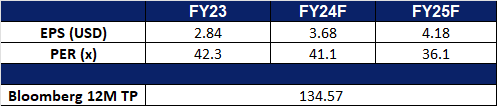

- Shopping for discounts. According to the National Retail Federation (NRF) the Thanksgiving holiday shopping weekend saw robust consumer activity, with 197 million people shopping from Thanksgiving to Cyber Monday, slightly fewer than the 2023 record of 200 million but surpassing the NRF’s expectations of 183 million. Shoppers spent more overall, with online spending up nearly 15% on Black Friday and total sales rising 3.4%, driven by discounts and deals. In-store traffic grew modestly by 0.7%. The NRF reported that consumers spent an average of US$235, up US$8 from last year, primarily on clothing and accessories. Retailers noted that shoppers were selective due to inflation, focusing on value and early sales promotions. Black Friday remained the peak shopping day for both in-store and online activity. The NRF expects holiday sales to grow up to 3.5% this year, slower than recent years but consistent with pre-pandemic trends. Retail executives described consumers as becoming more resourceful, with early holiday deals and budget-conscious behaviour shaping spending patterns. Tapestry Inc is well-positioned to benefit from the increased consumer demand for discounts during the holiday season. As shoppers prioritize value, the company’s promotions and competitive pricing will likely drive strong sales, capitalizing on consumers’ desire for good deals.

Thanksgiving weekend shopping trends (five-day holiday weekend from Thanksgiving through Cyber Monday)

(Source: National Retail Federation)

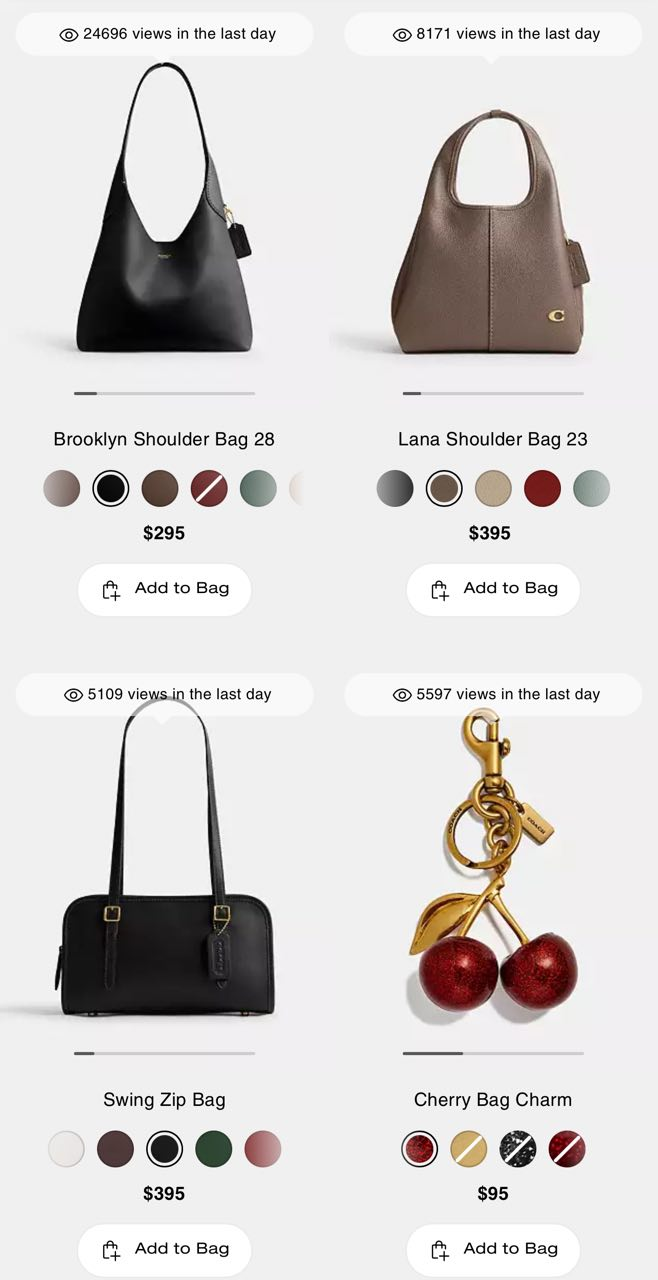

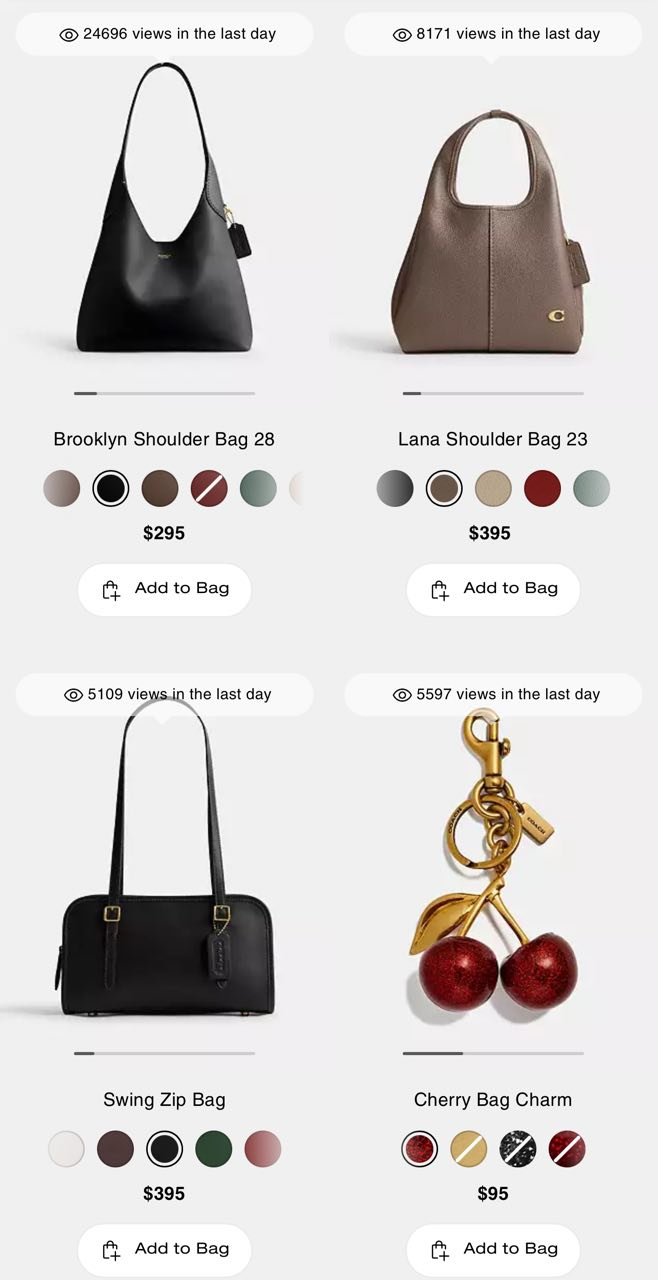

- Banking on Coach’s popularity. Coach has experienced a resurgence in popularity, fuelled by social media and the revival of Y2K nostalgia. As a more affordable luxury brand, Coach’s quality and stylish designs have resonated with Gen-Z and millennial consumers. This growth is evident in Tapestry Inc.’s first-quarter results, with Coach driving handbag revenue and AUR gains. The brand’s success was driven by strong demand for its Coach Tabby bags, which boosted full-price sales in 4Q24. Other designs, like the Brooklyn bag, have also gained traction on social media, selling out quickly. Celebrity endorsements, such as Bella Hadid carrying Coach bags, have further enhanced its appeal to Gen-Z. With its targeted social media marketing and vintage-inspired designs, Coach is poised to maintain strong revenue and profitability growth during this holiday season, which would benefit Tapestry’s top lines.

Bestsellers on Coach US website (prices listed in US$)

(Source: Coach)

- 1Q25 results. Revenue was US$1.51 billion, flat YoY, exceeding market expectations by US$40 million. Non-GAAP EPS was US$1.02, beating expectations by US$0.07. The company raised FY25 revenue expectations to over US$6.75 billion an increase of approximately 1% to 2% YoY, from the previous forecast of about 1% YoY growth, slightly above analysts’ consensus of US$6.706 billion. On an adjusted basis, Tapestry now expects earnings of US$4.50 to US$4.55 a share, compared to its prior guidance of US$4.45 to US$4.50 a share, above analysts’ estimates of $4.49. For Q1, it declared a quarterly dividend of US$0.35 per share, in line with the previous. Tapestry also announced plans for a US$2 billion accelerated share repurchase program.

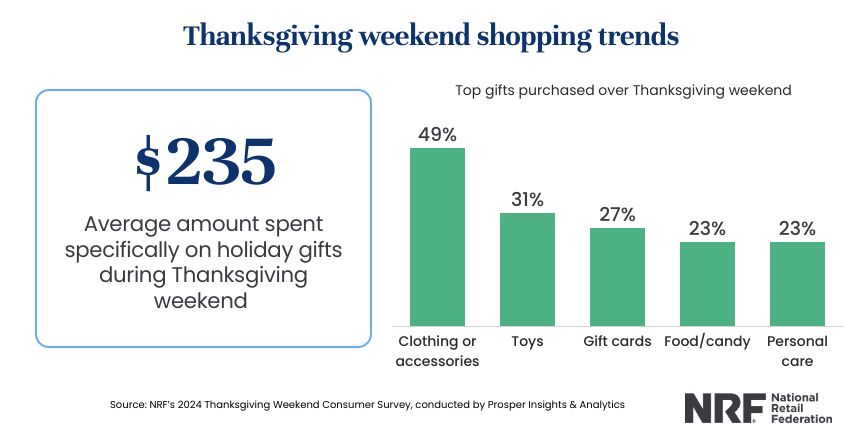

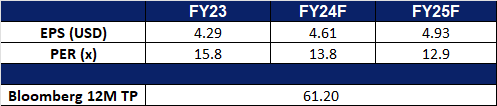

- Market consensus.

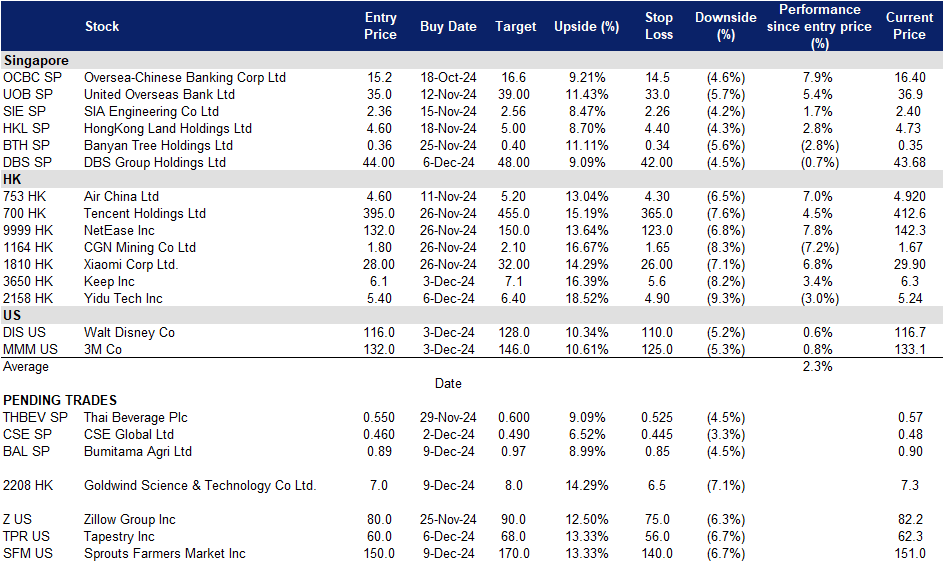

Trading Dashboard Update: Add DBS Group Holdings Ltd (DBS SP) at S$44 and Yidu Tech Inc (2158 HK) at HK$5.40. Cut loss on L3Harris Technologies Inc (LHX US) at US$235.