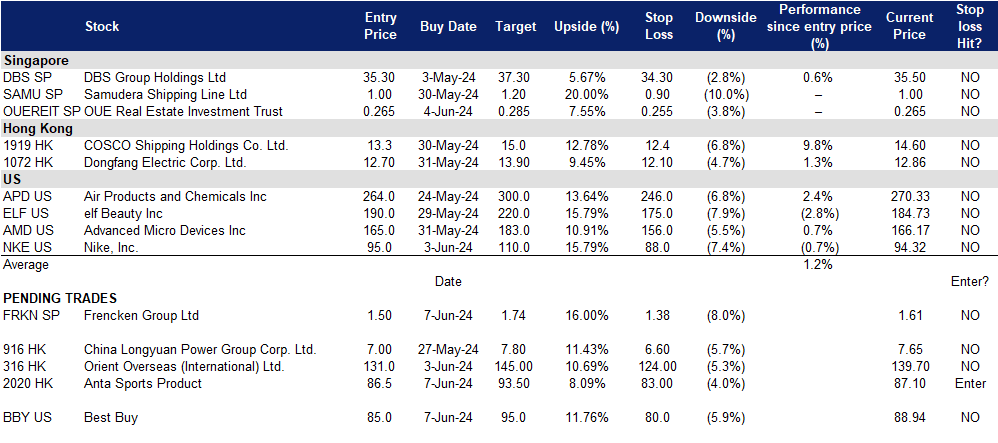

7 June 2024: OUE Real Estate Investment Trust (OUEREIT SP), Orient Overseas (International) Ltd. (316 HK), Advanced Micro Devices Inc (AMD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

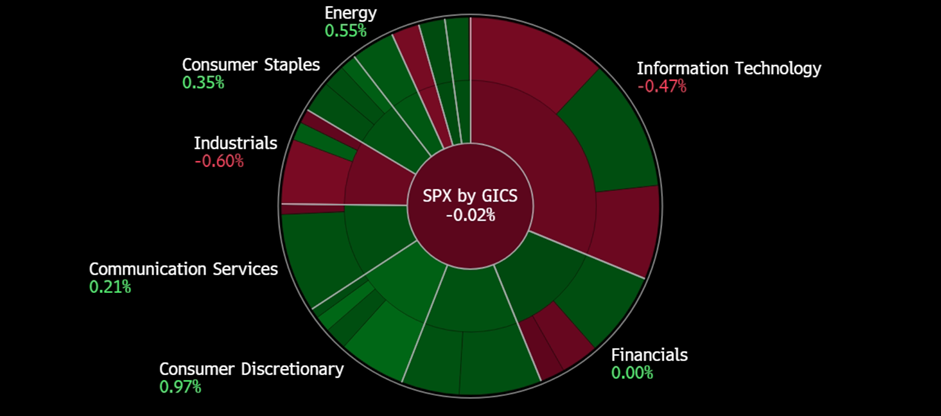

United States

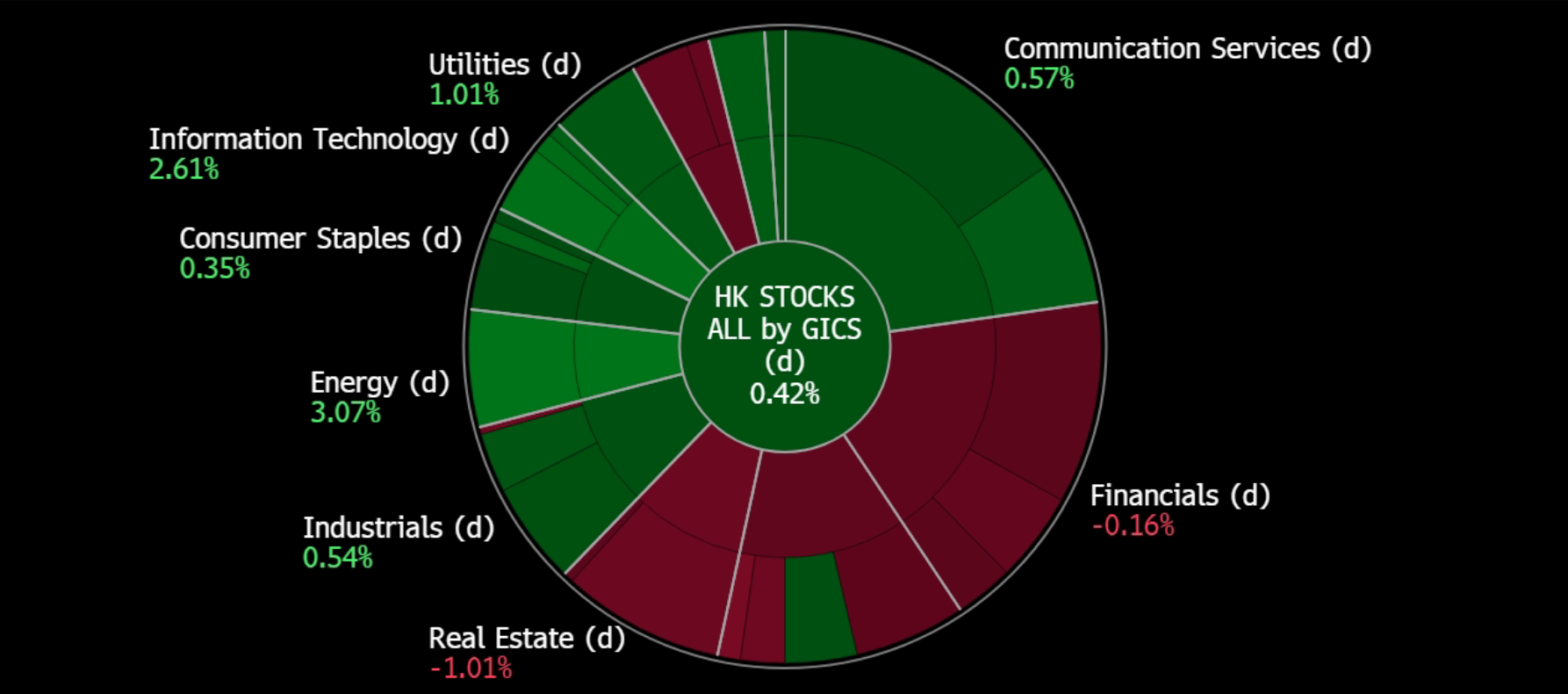

Hong Kong

Frencken Group Ltd. (FRKN SP): Semicon recovery on-track

- BUY Entry – 1.50 Target– 1.74 Stop Loss – 1.38

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment, and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial, and semiconductor industries.

- Nvidia delivering better than anticipated results again. Nvidia recently reported Q1 results which surpassed estimates, its revenue tripled YoY to US$26bn and it delivered profits that significantly exceeded expectations. The company projected higher-than-expected Q2 revenue of about US$28bn, surpassing analysts’ predictions of US$26.8bn. This positive outlook is driven by the strong demand for AI chips. Its CEO heralded this as the start of a new industrial revolution. Nvidia is currently bolstered by AI accelerators used by major tech firms like Amazon and Google. Despite high demand outpacing supply, Nvidia aims to diversify its market beyond hyperscalers to sectors like healthcare and automotive. This positive demand is expected to extend to Frencken’s semiconductor segment, which represents approximately 41% of its FY revenue.

- Good performance. Frencken Group’s revenue rose 12.2%YoY to S$193.6mn, with the mechatronics division seeing a 14.4% increase to S$170.1mn, primarily from the semiconductor, medical, and analytical life sciences segments. It reported a net profit of S$9mn for 1Q23, up 73% from S$5.2mn the previous year, driven by higher gross profit margins and revenue growth. The IMS division’s revenue remained stable at S$22.8mn, with a decline in the automotive segment offset by a significant increase in the consumer and industrial electronics segment. Gross profit margin improved to 13.7%. The company remains cautious due to global economic uncertainties and expects 1H24 revenue to be comparable to 2H23, with growth in semiconductor, medical, and analytical life sciences segments but softer automotive and industrial automation revenues. Frencken is anticipated to recover alongside the rest of the Semiconductor industry.

- 1Q24 results review. 1Q24 revenue rose by 12.2% to S$193.6mn, compared to S$172.5mn in 1Q23. Net profit increased 73% YoY to S$9mn from S$5.2mn in the previous year due to higher revenue growth and gross profit margins. Gross profit margin improved to 13.7% in 1Q24 from 12.3% in 1Q23, attributing it to better operating leverage. In 1H24, Frencken expects to deliver revenue comparable to 2H23 revenue. The semiconductor, medical, and analytical life sciences segments are expected to improve, while the industrial automation and automotive segments are expected to soften.

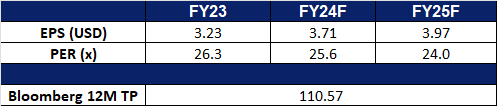

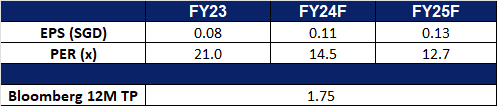

- Market Consensus

(Source: Bloomberg)

Samudera Shipping Line Ltd (SAMU SP): Freight rates going back upwards

- RE-ITERATE BUY Entry – 1.00 Target– 1.20 Stop Loss – 0.90

- Samudera Shipping Line Limited owns and operates ocean-going ships and provides containerized feeder shipping services. Through its subsidiaries, the Company also owns and charters vessels, provides sea and air freight forwarding, and operates shipping agency and container freight station services.

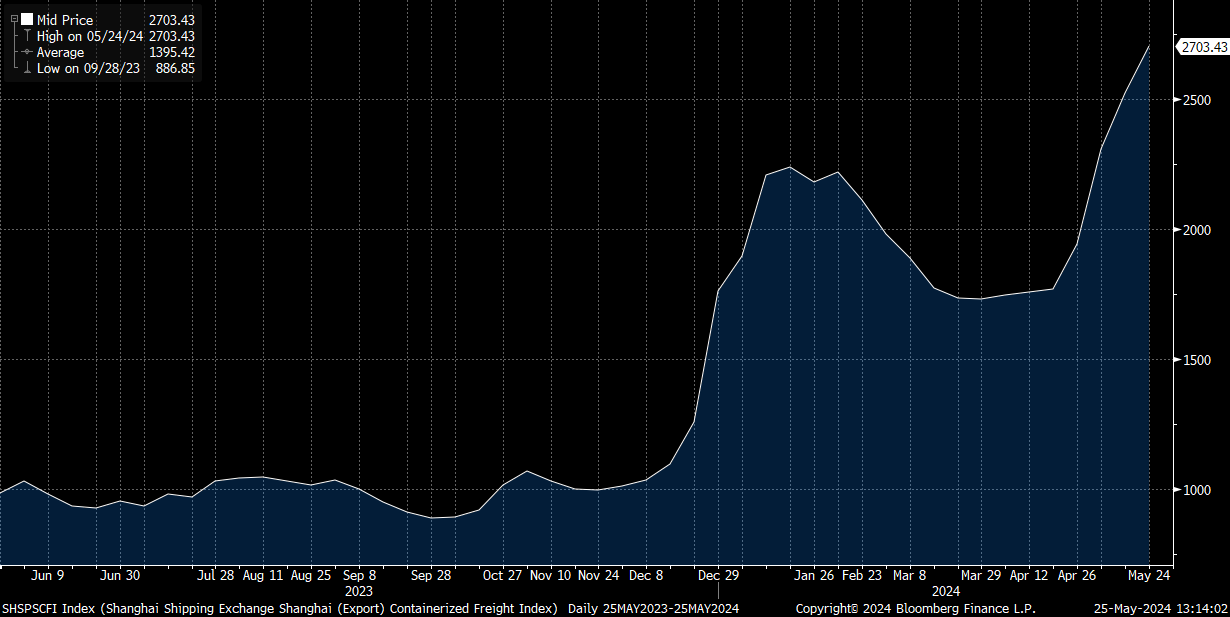

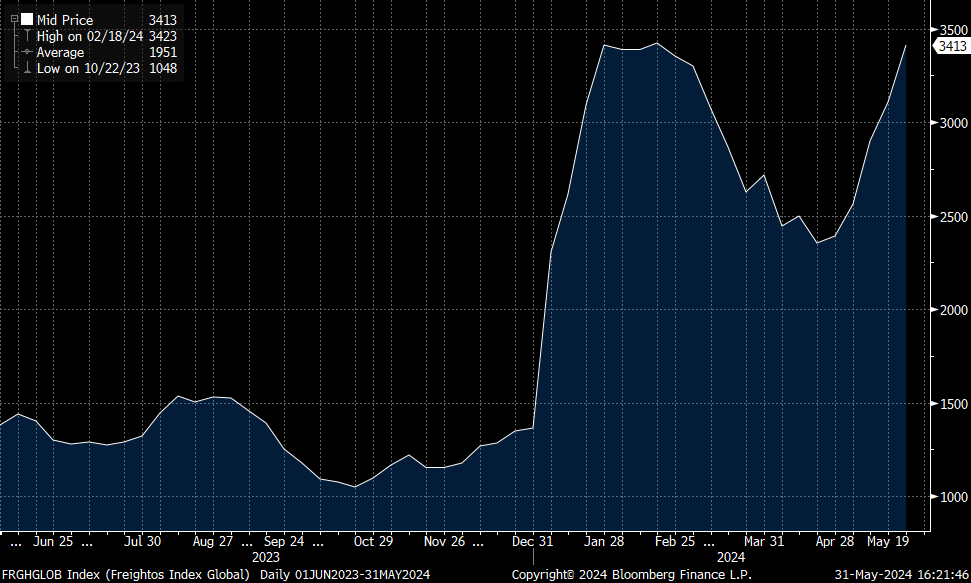

- Intra-Asia freight rates at 30-month high. Port congestion in Asia, diversions in the Red Sea, and increasing exports from Southeast Asia are driving intra-Asia freight rates to 30-month highs on some routes from China. Carriers and forwarders report rising intra-Asia volumes as long-haul ocean carriers redeploy vessels and skip regional trades to support mainline east-west services. High charter rates and a shortage of feeder vessels are preventing carriers from leasing additional ships to address the capacity shortfall.

Shanghai Shipping Exchange (Export) Containerized Freight Index

(Source: Bloomberg)

- Global shipping rates surge. A sudden container capacity crunch is causing global ocean freight rates to soar, with rates increasing by about 30% recently and expected to rise further, impacting consumer prices. This surge is driven by the peak shipping season, longer transit routes to avoid the Red Sea, and bad weather in Asia, leading carriers to skip ports and reduce time at ports, exacerbating supply chain issues. Spot rates have spiked by as much as US$1,500 on US routes, with container shortages severe due to high demand and delayed returns of empty containers. This situation is reminiscent of the Covid-19 pandemic, with logistics experts now facing shortages in trade lanes from Asia to Latin America, Europe, and the US West Coast. The ongoing congestion and higher rates are expected to persist, especially with an early start to the peak shipping season to avoid potential labour disruptions at East Coast and Gulf ports in the fall. Shipping companies are increasing rates and adding surcharges, with MSC announcing rates of US$8,000 to US$10,000 for 40-foot containers to the US West Coast. The higher rates are expected to benefit Samudera, enabling it to boost its revenue in response to the increased demand despite the higher prices.

- Reaping the benefits of its new additions. On 27 December, Samudera Shipping announced that it signed a memorandum of understanding to acquire two ethylene gas vessels for US$12.6mn, to be renamed Sinar Ternate and Sinar Tidore. Built in 2009 and 2010 and flagged in the Bahamas, the acquisition will be funded through bank borrowings and internal resources. This purchase aims to expand Samudera’s fleet and secure more charter contracts, capitalizing on the growing ethylene market in Indonesia, where ethylene is extensively used as a feedstock in petrochemical plants. It announced that the second vessel, Sinar Tidore was delivered on 24 April 2024. This will enable it to take on more charter contracts contributing to an increase in its revenue.

- FY23 results review. FY23 revenue fell by 41.2% to US$582.9mn and net profit decreased 68.6% YoY to USS$101.2mn. The decline was attributed to lower freight rates in the container shipping segment, despite a slight increase in container volume. In 1Q24, its container volume remained relatively stable, whereas freight rates declined to US$244 from US$371 per TEU. Its fleet size increased to 7 vessels. Additionally, both storage capacity and volume handled rose YoY, attributed to securing more management contracts and higher demand for storage capacity.

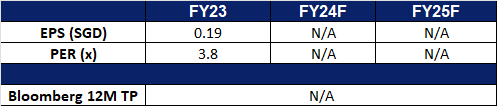

- Market Consensus

(Source: Bloomberg)

Anta Sports Products Ltd. (2020 HK): Preparations for Olympic games

- BUY Entry – 86.5 Target 93.5 Stop Loss – 83.0

- ANTA Sports Products Ltd is a China-based company principally engaged in the production and sale of sporting goods. The Company’s main businesses are brand marketing, production, design, procurement, supply chain management, wholesale and retail of branded sporting goods, including footwear, apparel and accessories. The Company explores the potential of the sporting goods market through diversified brands, including ANTA, FILA, DESCENTE and KOLON SPORT. The Company’s products are sold to domestic and international markets.

- Upcoming sporting events. The Paris Olympics, starting on July 26, 2024, is expected to drive a surge in sporting goods consumption. As the Olympics inspire national sporting spirit, fitness enthusiasts will likely seek to upgrade or purchase new equipment to train like their favorite athletes. This increased interest may also boost sports participation. Moreover, extensive media coverage of the Olympics will showcase the latest sporting gear and apparel, further fueling consumer desire for these performance-enhancing and trendy items. Consequently, sporting goods retailers and manufacturers in China, including Anta, are poised to see significant revenue growth.

- 618 shopping festival. The 618 shopping festival in China has begun, with major e-commerce platforms offering significant discounts and promotions. Approximately 185 brands, including Apple, Xiaomi, and Huawei, have each surpassed $13.8mn in gross merchandise value on Taobao and Tmall. Additionally, about 37,000 other brands have doubled their YoY sales on these platforms during the initial promotional period, according to preliminary sales data. This surge in consumer spending over the sales period is expected to benefit Anta Sports Products as well.

- New partnership. Kyrie Irving recently signed his father, Drederick, to a professional shoe deal with ANTA Sports, which will include a signature shoe set to release in Foot Locker stores in September. ANTA Sports had already partnered with Kyrie Irving for a signature shoe line under his name and recently released the latest signature sneaker recently as well, the Anta Kai 1 “Chief Hélà. This new collaboration with Irving and his father marks a significant step in ANTA’s international expansion efforts. By launching exclusive product lines and leveraging Irving’s influence, ANTA is strategically positioning itself to grow its global market presence.

- FY23 earnings. Revenue increased by 16.2% YoY to RMB62.36bn in FY23, compared to RMB53.65bn in FY22. Group’s operational profit margin increased by 3.7pp to 24.6%. Net profit increased by 34.9% to RMB10.24bn in FY23, compared to RMB7.59bn in FY22. Basic EPS rose by 30.9% to RMB3.69 in FY23, compared to RMB2.82 in FY22.

- Market consensus.

(Source: Bloomberg)

Orient Overseas (International) Ltd. (316 HK): Surging freight rates

- RE-ITERATE BUY Entry – 131 Target 145 Stop Loss – 124

- Orient Overseas (International) Limited is an investment holding company principally engaged in container transport and logistics businesses. Along with subsidiaries, the Company operates its business through two segments: the Container Transport and Logistics segment, as well as the Others segment. The Container Transport and Logistics segment is engaged in the provision of global containerised shipping services in major trade lanes, covering Trans-Pacific, Trans-Atlantic, Asia/Europe, Asia/Australia and Intra-Asia trades. In addition, it also provides integrated services over the management and control of effective storage and flow of goods. The Others segment is involved in the commercial properties.

- Surge in ocean container freight rate. Global freight spot rates have surged over 30% in the past month, reaching levels expected to surpass those seen during the Red Sea crisis earlier this year. This increase is driven by peak shipping season, longer transit routes to avoid the Red Sea, and adverse weather in Asia, causing carriers to skip ports and reduce port times, worsening supply chain issues. On US routes, spot rates have spiked by up to $1,500, with severe container shortages due to high demand and delayed returns of empty containers. Orient Overseas International is bound to benefit from the increase in freight rates.

Global Freightos Index

(Source: Bloomberg)

- Continued Supply chain headwinds. Ongoing attacks on ships in the Red Sea are straining shipping routes, forcing vessels to reroute around the Cape of Good Hope and thereby increasing transit times from Asia to the Middle East. Additionally, U.S. tariffs on Chinese goods are prompting Chinese exporters to accelerate shipments, further driving up demand for containers amidst tight supply. The combination of increased global exports and longer sailing periods has led to congestion at several key ports worldwide. This surge in shipping demand at the onset of the peak season is expected to continue driving freight rates higher in the near term.

- Increasing sea routes. Orient Overseas Container Line (OOCL), a subsidiary of Orient Overseas International, has announced the expansion of its Asia-Latin America network with a new service connecting China, Japan, and Korea to Mexican ports. This route will provide direct links between China, South Korea, and Mexico, featuring sailing times of 15 days from Qingdao to Ensenada and 20 days to Manzanillo. The service will employ eight ships with capacities ranging from 4,000 to 6,000 twenty-foot equivalent units. Additionally, OOCL has launched a new maritime service between Saudi Arabia and Jubail Commercial Port, enhancing connectivity between the Kingdom’s ports and those in the UAE, Kuwait, and other Gulf countries. These new shipping routes are expected to boost Orient Overseas International’s revenue.

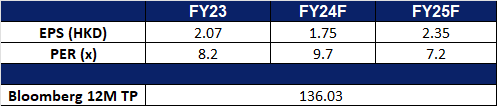

- FY23 earnings. Revenue fell to US$8.34bn in FY23, compared to US$19.8bn in FY22. Net profit fell to US$1.37bn in FY23, compared to US$9.97bn in FY22. Basic EPS fell to US$2.07 in FY23, compared to US$15.09 in FY22.

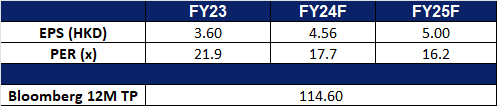

- Market consensus.

(Source: Bloomberg)

Best Buy Co Inc (BBY US): Upward cycle of consumer electronics

- BUY Entry – 85 Target –95 Stop Loss – 80

- Best Buy Co., Inc. retails consumer electronics, home office products, entertainment software, appliances, and related services through its retail stores, as well as its web site. The Company also retails pre-recorded home entertainment products through retail stores. Best Buy operates in the United States and Canada.

- Consumer electronics bottoming out. The surge in demand for consumer electronics products such as smartphones, laptops, and tablets during the COVID period was driven by lockdown measures as working from home was compulsory, and it became a fab when economies just reopened. On average, the duration of these products is 4-5 years. Hence, the replacement cycle is about to begin since the outbreak of COVID-19 was more than 4 years from now. Moreover, the inception of artificial intelligence (AI) urges companies to embed this revolutionary function into the upcoming generation of products such as smartphones and PCs. Gadgets with AI functions will be pervasive, similar to a phone with cameras. Therefore, the great replacement of old gadgets will begin in 2H24.

- Main suppliers’ upbeat guidance. Apple will upgrade its AI feature, replacing Siri for the next generation of iPhones, iPads, and Macbooks. Sony expects 1% growth (excluding financial services) with a minimal slowdown in Gaming, Pictures, and Entertainment, Technology & Services. Samsung expects smartphone/tablet/wearable electronics/TV segments to grow. LG forecast demand for TVs and screens to recover in 2H24. HP/Dell/Lenovo will release AI PCs by the end of 2024.

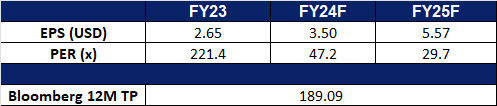

- 1Q25 earnings review. Revenue dropped by 6.5% YoY to US$8.85bn, missing estimates by US$120mn. Non-GAAP EPS was US$1.20, beating estimates by US$0.13. FY25 revenue is expected to be from US$41.3bn to US$42.6bn. Comparable sales are expected to be from -3.0% to 0.0%. Non-GAAP diluted EPS is estimated to be from US$5.75 to US$6.20.

- Market consensus.

(Source: Bloomberg)

NIKE, Inc. (NKE US): To shine in the Olympics

- RE-ITERATE BUY Entry – 95 Target – 110 Stop Loss – 88

- NIKE, Inc. designs, develops, and markets athletic footwear, apparel, equipment, and accessory products for men, women, and children. The Company sells its products to retail stores, through its own stores, subsidiaries, and distributors. NIKE serves customers worldwide.

- Potential turnaround in the upcoming Olympics. In April, Nike unveiled the Olympic products for athletes in the Paris Olympic kits unveiling event. The market fightback plan is via a reinvention of the Nike Air sneaker. The new design includes an AI-generated interpretation of Air tech which is also co-created with athletes. Amidst rising global geopolitical tensions, the Olympics attracts more than ever spectators as contentions among athletes are considered as a form of competition of national power. Fan support will spur the consumption of related sports kits.

- Cyclical upswing. During the COVID period, working from home stimulated the consumption of sports gear. However, the surge in demand resulted in the ensuing high inventory as sales normalised soon after the reopening. Nike suffered from high inventories over the past two years, and it announced a US$2bn cost optimisation plan last year. Nike’s days in inventory turnover maintain at 105 days currently after 2 years of de-stocking. Recent guidance from the Dicks Sporting Goods showed that the sales of sports gear have bottomed out and are embracing an upswing cyclical growth.

- 3Q24 earnings review. Revenue rose slightly by 0.3% YoY to US$12.43bn, exceeding estimates by US$130mn. Non-GAAP EPS was US$0.98, beating estimates by US$0.23.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: No change to the trading dashboard.