6 September 2024: First Resources (FR SP), Trip.com Group Ltd (9961 HK), Dell Technologies Inc (DELL US)

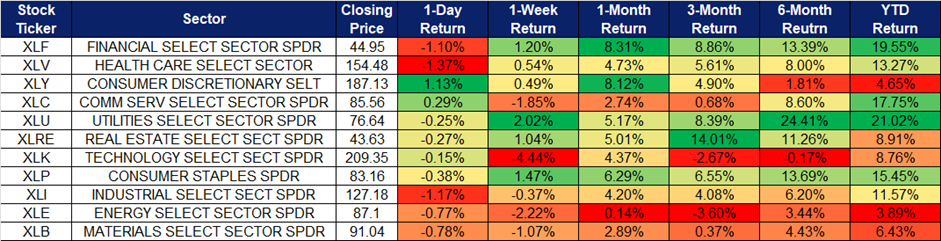

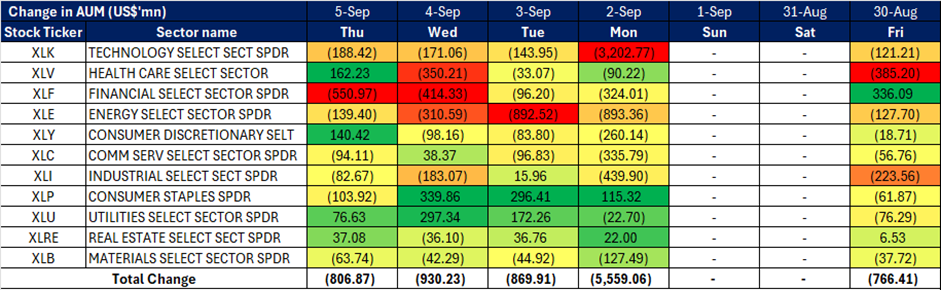

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

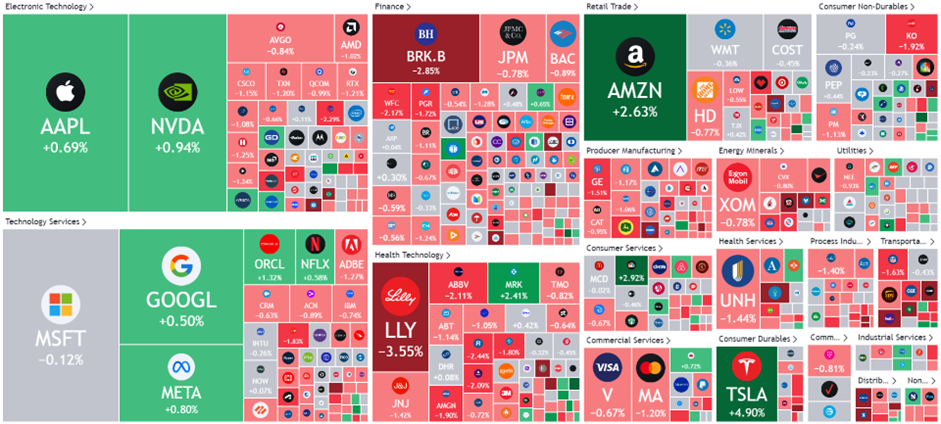

United States

Hong Kong

First Resources (FR SP): Palm oil prices to rise

- BUY Entry – 1.46 Target– 1.60 Stop Loss – 1.39

- First Resources Limited produces crude palm oil. The Company is an upstream operator with primary business activities in the cultivation and harvesting of oil palms, and the processing of fresh fruit bunches into crude palm oil for local and export sales.

- Palm oil production to decline. Indonesia’s palm oil production outlook has worsened due to dry weather and aging trees, which could tighten global supply and keep prices high. Production is expected to be flat or decrease by up to 5% in 2024 compared to 2023. Earlier predictions of increased output have been revised downward by industry groups. Factors contributing to the decline include reduced rainfall in key regions and the aging of many plantations, particularly those managed by smallholders. The situation is exacerbated by similar issues in Malaysia, the world’s second-largest palm oil producer, leading to the lowest global palm oil reserves in three years. This combination of lower production and declining reserves is driving up palm oil prices. Malaysian palm oil futures surged over 1% on 30 August, reaching near MYR 4,000 per tonne, marking the second consecutive day of gains. This price increase benefits palm oil producers.

- Acquisition to drive inorganic growth. First Resources’ subsidiary, PT Karya Tama Bakti Mulia, won a S$162.9mn bid to acquire 17,600 hectares of plantation assets in Indonesia’s Riau Province. The assets, which include mills, plantations, and unplanted land, were purchased from PT Tri Bakti Sarimas through a public auction. The acquisition aligns with First Resources’ expansion strategy and aims to enhance its operational footprint, with expected operational synergies boosting overall performance. The purchase was funded internally and is not expected to significantly impact the company’s financials.

- 1H24 results review. Total revenue for 1H24 increased by 1.9% YoY to US$457.2mn from US$448.8mn, primarily due to the higher production volumes as compared to the same period last year, partially offset by a reduction in purchases of palm oil products from third parties for processing and sale. Net profit was US$103.9mn in 1H24, an increase of 45.4% YoY and profit from operations rose by 48.9% YoY to US$143.5mn, driven by higher production volumes and improved processing margins. Basic EPS rose in 1H24 to 6.67 UScents from 4.56 UScents in 1H23.

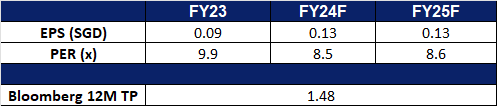

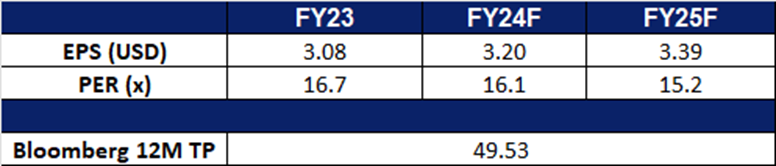

- Market Consensus.

(Source: Bloomberg)

Winking Studios Ltd (WKS SP): Growth through acquisition

- RE-ITERATE BUY Entry – 0.290 Target– 0.320 Stop Loss – 0.275

- Winking Studios Limited operates as a game art outsourcing studio. The Company provides complete end-to-end art outsourcing and game development services across various platforms for the video games industry. Winking Studios serves customers worldwide.

- The resounding success of Black Myth: Wukong is poised to catalyse a shift in the Chinese gaming industry to invest in AAA game development. As the game’s global acclaim coupled with its impressive sales figures (as of 23 August, over 10 million copies sold and a peak online player count of 3 million), demonstrates the potential for high-quality, home-grown AAA titles, more studios are likely to invest in ambitious projects, seeking to capitalize on the growing demand for immersive, high-budget games. This trend will drive demand for art outsourcing services, positioning Winking Studios as a key partner for studios seeking visually stunning and technically sophisticated games. As more studios pursue ambitious AAA projects, the demand for skilled artists and designers will rise, creating more opportunities for Winking Studios to collaborate with gaming companies and secure new projects, ultimately boosting growth and profitability.

- Continued M&A strategy to drive inorganic growth. Since its IPO, Winking Studios has strategically expanded its presence in Asia through the acquisition of two art outsourcing studios in Taiwan and Malaysia. This aligns with the company’s broader strategy of utilizing mergers and acquisitions to strengthen its position as a market leader in the art outsourcing industry. Its successful placement of new shares further supports its ongoing efforts to grow its market position through strategic acquisitions.

- Organic growth in the Japanese market. 1H24 revenue grew 7.1% YoY to US15.2mn from US$14.2mn in 1H23, driven by a surge in orders from both its Art Outsourcing and Game Development segments. Notably, the company’s business development efforts in Japan have yielded significant results, with revenue from this region increasing nearly threefold to US$1.5mn in the Art Outsourcing segment. This growth has contributed to a more balanced geographical revenue mix, strengthening the company’s resilience against potential economic fluctuations.

- Strategic dual-listing on the London Stock Exchange (LSE). Winking Studios is currently pursuing a dual-listing on LSE, which would provide several advantages. Fungible share transfers between the Singapore Exchange (SGX) and LSE would offer greater flexibility for shareholders in both markets. This could potentially increase trading volume and enhance market liquidity.

- 1H24 results review. Total revenue for 1H24 increased by 7.1% YoY to US$15.23mn driven by strong growth in the Art Outsourcing Segment and Game Development segment, which saw a 6.6% and 8.1% rise respectively.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.35. Please read the full report here.

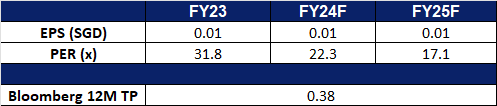

- Market Consensus.

(Source: Bloomberg)

Trip.com Group Ltd (9961 HK): Favourable seasonality

- BUY Entry – 365 Target 405 Stop Loss – 345

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Favourable Seasonality ahead. Upcoming holidays in China is expected to provided a boost to both domestic and international travel in China. China will enjoy 2 upcoming holidays, the Mid Autumn festival which runs 3 days between 15 September, 2024 and 17 September, 2024, as well as the China National Day Holiday which runs 7 days between 1 October 2024 to 7 October 2024. Last year, the Mid-Autumn Festival and China National Day holidays saw13.78 million international tourists visiting the country over the period. This upcoming holiday season is bound to see an increase in travel demand in China.

- New Asia Live Streaming Centre. Trip.com Group recently launched its new Asia Live Streaming Centre at its Bangkok office, marking a significant expansion of the company’s content marketing strategies. This hub is set to transform how partners and consumers engage by producing daily live content that highlights Thailand’s tourism offerings, providing travel inspiration and exclusive deals directly to eager travelers. The Asia Live Streaming Centre will also function as the group’s regional hub, collaborating with hotels, local attractions, and businesses in Thailand to feature a variety of travel products and promotions. The content will emphasize high-quality offerings, including those showcased on Trip.Best, Trip.com’s ranking list that helps global travelers choose the best experiences a destination has to offer.

- Extending partnership. Trip.com Group recently announced a partnership with Ryanair, enabling Trip.com to include Ryanair’s low-fare flights in its dynamic product offerings. This collaboration is a significant advantage for Trip.com customers, providing access to Ryanair’s budget-friendly fares, a vast selection of over 235 destinations, and excellent service. Travelers will soon be able to book Ryanair flights directly through Trip.com in the coming weeks.

- 1H24 earnings. Revenue rose by 20.6% YoY to RMB24.7bn in 1H24, compared to RMB20.5bn in 1H23. Net profit rose by 10.0% YoY to RMB8.151bn in 1H24, compared to RMB4.01bn in 1H23. Basic EPS increased to RMB12.46 in 1H24, compared to RMB6.14 in 1H23.

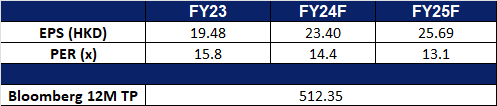

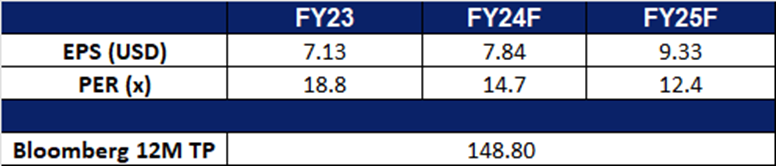

- Market consensus.

(Source: Bloomberg)

Sunny Optical Technology Group Co Ltd (2382 HK): Upcoming Apple event

- RE-ITERATE BUY Entry – 47.0 Target 52.0 Stop Loss – 44.5

- Sunny Optical Technology Group Co Ltd is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components segment, Optoelectronic Products segment and Optical Instruments segment. The Company’s main products include mobile phone lenses, automotive lenses, high-pixel lens lights, camera modules and others. The Company’s products are sold in China and overseas markets.

- Upcoming Apple event. Apple has announced its next major event, titled “It’s Glowtime,” scheduled for September 9, 2024. The company is widely expected to unveil the iPhone 16 lineup during this event. One of the most notable changes in the iPhone 16 and 16 Plus models is the anticipated switch to a vertically aligned camera system on the back. Additionally, all four iPhone 16 models are expected to feature an Action Button and possibly a new button dedicated to capturing photos and videos. The new lineup is also rumored to include several AI-powered enhancements, such as an upgraded Siri, AI-driven writing tools, and integration with ChatGPT. These improvements could drive strong demand for the iPhone 16 models, potentially benefiting suppliers like Sunny Optical.

- Higher sales expectations. Apple has reportedly asked suppliers to prepare parts for the production of around 88mn-90mn new iPhones, marking an increase of at least 10% from last year’s initial order of approximately 80mn units. This anticipated surge in demand for the new iPhone models is expected to drive higher demand for Sunny Optical’s handset lenses, boosting their sales. Sunny Optical’s recent earnings report highlighted that a higher average selling price could further enhance revenue and net profit due to an improved product mix. The company has also raised its growth guidance for FY24 to 5-10% and expects its gross margin to improve to 20-25% in the second half of the fiscal year.

- More smartphone shipments expected. International Data Corp. (IDC) recently raised its forecast for full-year global smartphone shipments, citing strong growth in the first half of the year as consumer electronics demand rebounds and AI features draw buyers. IDC now expects shipments to increase by 5.8% to 1.23bn units in 2024, up from its previous projection of 4% growth to 1.21bn units. The market anticipates that new AI features will boost demand, particularly in key markets like the U.S. and China, which is recovering from a prolonged slump.

- 1H24 earnings. Revenue rose by 32.1% YoY to RMB18.9bn in 1H24, compared to RMB14.3bn in 1H23. Net profit rose by 142.0% YoY to RMB1.11bn in 1H24, compared to RMB0.459bn in 1H23. Basic EPS increased to RMB0.9904 in 1H24, compared to RMB0.3999 in 1H23.

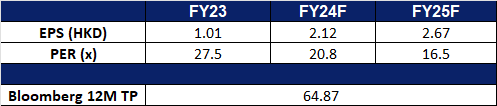

- Market consensus.

(Source: Bloomberg)

Campbell Soup Co (CPB US): Quick meal fix

- BUY Entry – 50.0 Target – 55.0 Stop Loss – 47.5

- Campbell Soup Company, with its subsidiaries, manufactures and markets branded convenience food products. The Company’s core divisions include soups and sauces, biscuits and confectionery, and foodservice. Campbell’s distributes its products worldwide.

- Exhibits consumption defensive attributes. Its business has steadily operated and expanded over the past few years, showing resilience across economic cycles. This stability is bolstered by robust sales growth as more budget-conscious consumers seek value. Despite inflation easing for four consecutive months, rising 2.9% 2.9% in July, consumers continue to feel the effects of higher prices. According to the US Bureau of Labor Statistics, the “food away from home” index increased by 0.2% in July, following 0.4% gains in the prior two months, with dining out costs rising 4.1% YoY. Grocery prices rose 0.1% for the month and 1.1% YoY. While rate cuts are expected, inflation pressures have led many consumers to shift towards preparing meals at home, benefiting Campbell’s meals and beverages segment this quarter. As consumer sentiment strengthens, the company will be well-positioned for significant future growth.

- Expected improvement in profit margins. In FY25, a projected decline in raw material prices is anticipated to contribute to a rise in Campbell’s gross margin. Additionally, the easing labour market, with job openings falling to 7.673 million and the unemployment rate rising to 4.3%, could lead to reduced wage pressures. This may result in lower operating costs and further improve operating margins.

- Strategic branding plan. Campbell Soup Company completed the acquisition of Sovos Brands on 12 March 2024, adding a premium brand to its meals and beverages segment. Net sales in the fourth quarter increased by 11% to US$2.3bn, driven by the benefit from the Sovos Brands acquisition. The integration has progressed faster than expected, with the deal expected to boost earnings per share by the second year, excluding one-time costs. On 26 August 2024, Campbell sold its Pop Secret popcorn business, which generated US$120mn in fiscal 2024 sales. This sale is expected to reduce its fiscal 2025 earnings slightly. The company aims to accelerate growth in its Snacks division and other leading brands, forecasting net sales to rise 9% to 11% in fiscal 2025, driven by steady demand for its soups and ready-to-eat products.

- 4Q24 earnings review. Net sales grew by 11.1% YoY to US$2.3bn, missing estimates by US$10M. Non-GAAP EPS was US$0.63, beating estimates by US$0.01. It delivered an annual dividend yield of 2.87%. For FY25, Campbell expects net sales growth of 9% to 11% vs estimated growth of 8.96%, reflecting contributions from Sovos Brands and the loss of net sales from the divesture of Pop Secret.

Market consensus.

(Source: Bloomberg)

Dell Technologies Inc (DELL US): Tailwinds from PC upgrade cycle & AI wave

Dell Technologies Inc (DELL US): Tailwinds from PC upgrade cycle & AI wave

- BUY STOP Entry – 105 Target – 130 Stop Loss – 93

- Dell Technologies Inc. provides computer products. The Company offers laptops, desktops, tablets, workstations, servers, monitors, printers, gateways, software, storage, and networking products. Dell Technologies serves customers worldwide.

- Strong demand for AI servers. Dell Technologies raised its annual revenue and profit forecasts, driven by strong demand for its AI-optimized servers powered by Nvidia chips. In the second quarter, revenue from Dell’s infrastructure solutions group surged 38% to a record US$11.65bn. Dell’s servers, designed to handle the intense computational needs of AI systems, are seeing increased adoption, with a backlog of US$3.8bn in orders. Dell now expects annual revenue between US$95.5bn and US$98.5bn and has raised its profit forecast. However, while AI server demand is strong, Dell’s PC business remained soft, with a 4% drop in revenue. The company also took a US$328mn charge for workforce reductions and is exploring the sale of its cybersecurity firm, SecureWorks. Despite losing some market share in the storage and PC business, Dell is expected to attract more customers seeking to upgrade their servers with AI capabilities. Additionally, the reduction in manpower costs is likely to contribute to future profitability.

- Global PC recovery to continue in the second half of the year. An IDC report indicates that the traditional PC market experienced its second quarter of growth following eight consecutive quarters of decline. In Q2, worldwide shipments reached 64.9 million units, reflecting a 3.0% YoY growth. When excluding China, worldwide shipments grew by more than 5% YoY. AI PCs are predicted to drive demand from the commercial market in the short term. As we reach the four-year mark since the COVID-19 pandemic began in 2020, it’s expected that the PC commercial refresh cycle will start. Additionally, with inventory levels returning to normal, average selling prices are anticipated to increase due to more advanced configurations and reduced discounting. Therefore, the report expects that the PC recovery will persist.

- Partnership to run the new platform. Dell Technologies and Nutanix have expanded their long-term partnership to offer a competitive alternative to VMware, particularly targeting customers unhappy with changes under Broadcom’s ownership. This collaboration integrates Nutanix’s software with Dell’s PowerEdge servers and PowerFlex storage, aiming to capture market share from discontented VMware users. The new Dell XC Plus appliance, a turnkey hyperconverged infrastructure (HCI) solution, is central to this strategy, offering simplified management and scalability for hybrid cloud environments. The partnership, which is set to expand further, could intensify competition in the HCI market and allow Dell to gain a competitive advantage in the computing space.

- Lowering costs. Dell Technologies is cutting jobs as part of a reorganization focused on streamlining its sales teams and prioritizing investments in AI products and services. The company is creating a new AI-focused group and adjusting its approach to data center sales. Despite growing investor interest in Dell’s AI capabilities, there is concern over the long-term payoff of such investments. The company, which had already cut 13,000 jobs earlier in 2023, aims to become leaner through the cutting of jobs. Dell remains optimistic about future growth, particularly with AI-optimized PCs, despite challenges in its traditional PC market.

- 2Q24 earnings review. Revenue grew by 9.2% YoY to US$25.03B, beating estimates by US$910M. Non-GAAP EPS was US$1.89, beating estimates by US$0.18. It achieved record revenue of US$11.6bn in infrastructure solutions and US$7.7bn in servers and networking, marking a 38% and 80% YoY growth respectively. The company revised its annual revenue outlook to be between US$95.5bn and US$98.5bn, up from the previously forecasted US$93.5bn to US$97.5bn. It also raised its annual profit per share guidance to US$7.80, plus or minus 25 cents.

Market consensus.

(Source: Bloomberg)

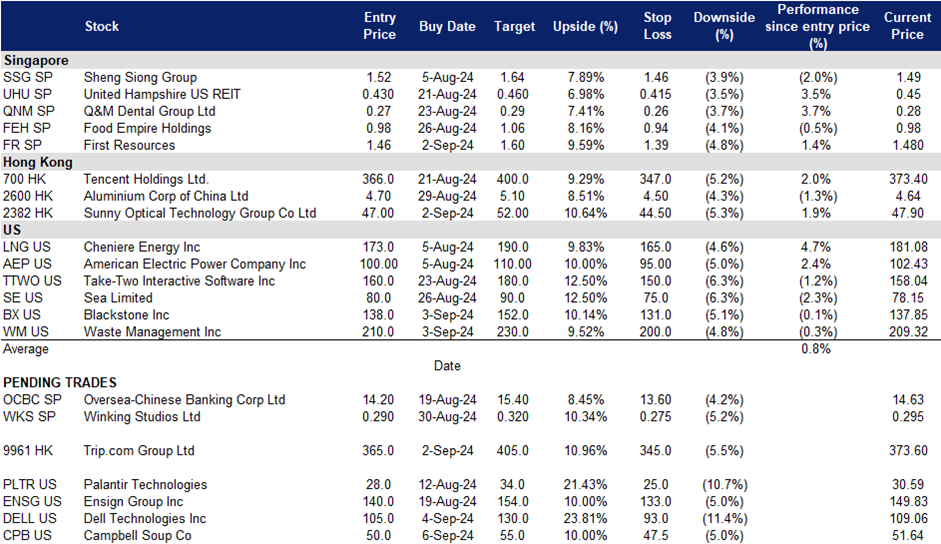

Trading Dashboard Update: Take profit on Home Depot (HD US) at US$364.67. Add First Resources (FR SP) at S$1.46.