4 July 2024: Wealth Product Ideas

India 2024 Economic Growth Dominates Emerging Markets

- India’s economy grew 7.8% YoY in Q4, expected to maintain high growth. India’s economy grew by 7.8% YoY in the January-March quarter, driven by strong manufacturing growth, exceeding economists’ forecast of 6.7%. This growth, though lower than the previous quarter’s revised 8.6%, is expected to maintain momentum supported by factors such as high tax growth, increased investments, and strong manufacturing and construction sectors. However, GDP growth is anticipated to decelerate to around 6.5% to 7.4% in FY25 due to a higher base effect and transient dampening factors. Despite these, India’s economy is expected to remain robust and show continued strong performance and stable inflation.

- Indian Prime Minister Narendra Modi to revamp the country. India’s president announced that the new government plans to introduce significant measures in its upcoming budget to drive the economy forward. The July budget will reflect Prime Minister Modi’s policy priorities and include major economic and social decisions. He aims to transform India into a developed country by 2047, requiring sustained high growth rates. The president also highlighted the government’s commitment to making India the world’s third-largest economy through ongoing reforms. Notably, Indian small-cap stocks have a higher exposure to industrial and materials sectors compared to large-caps, potentially benefitting more from the proposed reforms.

- In June, India’s manufacturing sector activity increased as indicated by the HSBC PMI rising to 58.3 from 57.5 in May, showing expansion. The growth was driven by record-high job creation, strong domestic demand, and increased export orders. Although cost pressures eased slightly from May, input prices for materials such as aluminium, plastic, and steel remained high, resulting in the fastest increase in selling prices since May 2022. Among the sectors, consumer goods led the growth, followed by intermediate and investment goods. India’s manufacturing PMI is expected to remain strong.

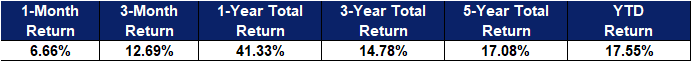

Fund Name (Ticker) | iShares MSCI India Small-Cap ETF (SMIN US) |

Description | The iShares MSCI India Small-Cap ETF seeks to track the investment results of an index composed of small-capitalization Indian equities. |

Asset Class | Equity |

30-Day Average Volume (as of 1 Jul) | 299,491 |

Net Assets of Fund (as of 2 Jul) | US$969,976,479 |

12-Month Trailing Yield (as of 31 May) | 0.00% |

P/E Ratio (as of 1 Jul) | 30.05 |

P/B Ratio (as of 1 Jul) | 3.80 |

Management Fees (Annual) | 0.79% |

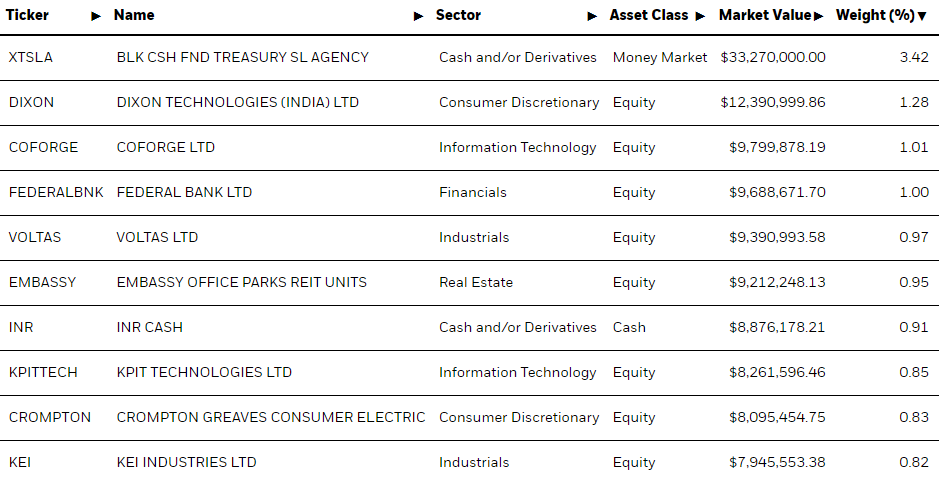

Top 10 Holdings

(as of 1 July 2024)

(Source: Bloomberg)

Reaping the benefit from the Digital India Program

- Digital India Program. India’s digital journey began nearly a decade ago with the launch of the Digital India Program in 2015. This initiative, built on three key pillars—developing a robust digital infrastructure, providing accessible government services, and empowering citizens through data—aims to connect citizens and the government via e-services. By focusing on increasing efficiencies, enhancing competitiveness, and bridging the rural economic divide, the program is likely setting the stage for another decade of growth. The country saw an increase in digital literacy over the years, alongside more digital infrastructure, which transformed the Indian economy. Over the years, India has seen tremendous progress in its universal payment infrastructure, currently reaching over 14 billion transactions.

- More opportunities within the digital economy. Reforms and incentives are driving a shift in foreign direct investment (FDI) intentions, which is poised to support long-term growth in India, particularly within the burgeoning digital economy. With over 123,000 startups and a record 114 unicorns, India currently boasts the world’s third-largest startup ecosystem. By 2030, India is projected to have the second-largest cohort of online shoppers, estimated at 500-600mn. These developments are set to further propel India’s digital economy. These rapid changes in the digital economy in India create a unique investment opportunity for active stock pickers, extending beyond the average Indian benchmark.

Fund Name (Ticker) | VanEck Digital India ETF (DGIN US) |

Description | VanEck Digital India ETF (DGIN) seeks to track as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Digital India Index (MVDINDTR), which is intended to track the overall performance of companies involved in supporting the digitization of the Indian economy. |

Asset Class | Equity |

30-Day Average Volume (as of 2 Jul) | 3855 |

Net Assets of Fund (as of 2 Jul) | US$41.6B |

12-Month Trailing Yield (as of 2 Jul) | 0.21% |

P/E Ratio (as of 30 Jun) | 39.74 |

P/B Ratio (as of 30 Jun) | 5.46 |

Management Fees (Annual) | 0.76% |

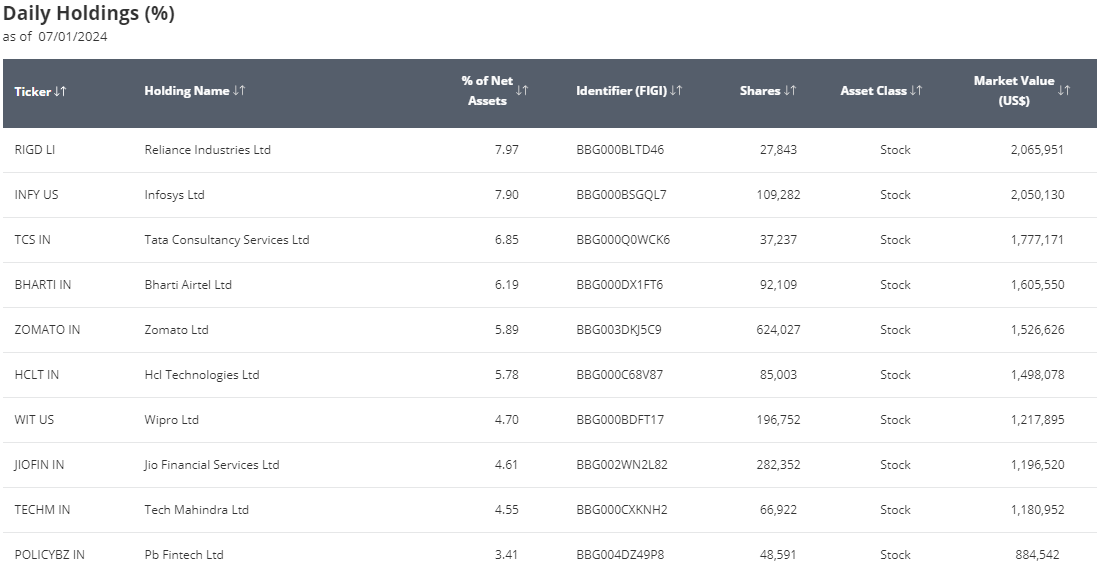

Top 10 Holdings

(as of 01 July 2024)

(Source: Bloomberg)