30 May 2024: Wealth Product Ideas

CSOP Nikkei 225 Leveraged and Inverse Products

- Nikkei 225 index exceeded the bubble-era high seen in December 1989, in March 2024, and market participants are holding mixed views on the outlook of Japanese equities.

- Amid the uncertainties, Nikkei 225 Leveraged and inverse products (L&Is) have been good trading tools to capture the ups and downs of the Nikkei 225 index.

Volatile Foreign Fund Flow

- The 2024 YTD foreign net fund inflow to Japanese stocks has surpassed the total inflow in 2023 (3008.8bn JPY) and reached a new high of 5543.7bn JPY since 2014. However, the foreign fund flows have become more volatile, which may indicate a game between long and short.

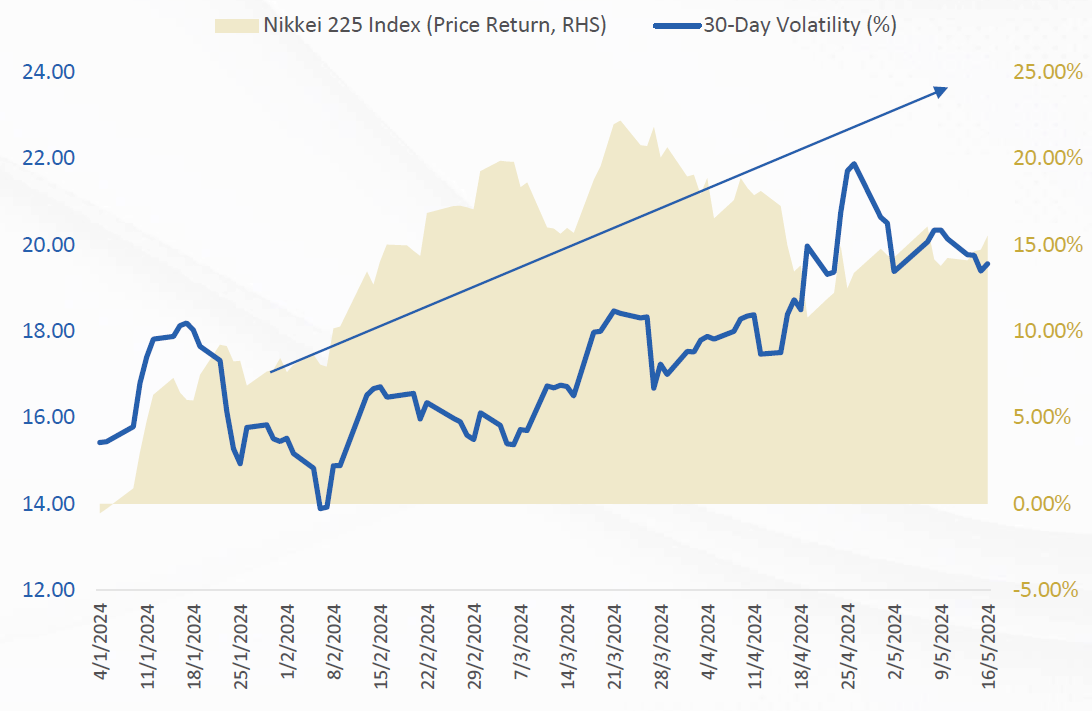

Increasing Volatility as Index Grows YTD

(Source: Bloomberg, CSOP Asset Management)

Nikkei 225 Index 10-year chart

(Source: Bloomberg)

(Source: Bloomberg)

Fund Name (Ticker) | CSOP Nikkei 225Daily (2x) Leveraged Product (7262 HK) |

Description | To provide investment results that, before fees and expenses, closely correspond to twice (2x) the Daily performance of the Index. The Product does not seek to achieve its stated investment objective over a period of time greater than one day. |

Asset Class | Equity |

Trading Currency | HKD |

Net Assets of Fund (as of 29 May) | JPY1,569,051,000 |

Management Fees (Annual) | 1.60% |

Fund Name (Ticker) | CSOP Nikkei 225 Daily (-2x) Inverse Product (7515 HK) |

Description | To provide investment results that, before fees and expenses, closely correspond to two times inverse (-2x) of the Daily performance of the Index. The Product does not seek to achieve its stated investment objective over a period of time greater than one day. |

Asset Class | Equity |

Trading Currency | HKD |

Net Assets of Fund (as of 29 May) | JPY1,570,665,000 |

Management Fees (Annual) | 1.60% |