27 June 2024: Wealth Product Ideas

Wealth Product Ideas – 27 June

Buying into Biotech

- Increased GLP-1 usage. The market for GLP-1 is rapidly growing, and digital health companies are taking advantage of the opportunities, with analysts predicting that it could reach US$100 billion by the end of the decade. Companies are using medications like Wegovy and Ozempic to introduce weight loss programs. Despite challenges such as medication shortages and insurance coverage issues, these firms are expanding their services and improving patient support to meet the increasing demand for effective obesity treatments.

- More HIV Prevention Alternatives. Gilead recently announced that its twice-yearly antiviral injection successfully prevented HIV in all participants in a trial involving thousands of women and girls in South Africa and Uganda. Previously, the company released an HIV preventive pill that must be taken daily. If approved, Gilead’s lenacapavir shot could be launched in 2025, potentially replacing the sales of its daily HIV preventive pills, Descovy and Truvada. Additionally, this new injection could expand the HIV PrEP market by making adherence easier and attracting patients who are reluctant to take a daily pill.

- Rate cut expectations. The US Federal Reserve decided to keep interest rates unchanged in June and anticipates a single rate cut in late 2024. However, the market expects a rate cut to occur as early as September due to cooling inflation and a slowdown in the labor market. If the sentiment regarding potential rate cuts continues to improve, it could prematurely boost consumer demand and spending in the upcoming months, enabling consumers to allocate more funds to discretionary items like weight loss drugs for self-fulfillment.

Fund Name (Ticker) | SPDR S&P Biotech ETF (XBI US) |

Description | The S&P Biotechnology Select Industry® represents the biotechnology segment of the S&P Total Market Index. The S&P TMI is designed to track the broad U.S. equity market. The biotechnology segment of the S&P TMI comprises the Biotechnology sub-industry. The Index is modified equally weighted. |

Asset Class | Equity |

30-Day Average Volume (as of 25 Jun) | 8,595,568 |

Net Assets of Fund (as of 25 Jun) | US$7,186,170,000 |

12-Month Trailing Yield (as of 24 Jun) | 0.14% |

P/E Ratio (as of 24 Jun) | 21.23 |

P/B Ratio (as of 24 Jun) | 4.07 |

Management Fees (Annual) | 0.35% |

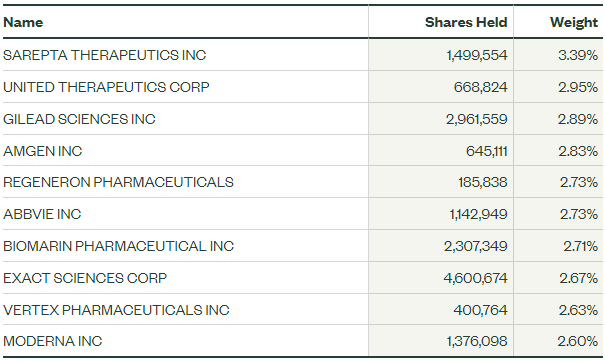

Top 10 Holdings

(as of 24 June 2024)

(Source: Bloomberg)

Fund Name (Ticker) | iShares Biotechnology ETF (IBB) |

Description | The iShares Biotechnology ETF seeks to track the investment results of an index composed of U.S.-listed equities in the biotechnology sector. |

Asset Class | Equity |

30-Day Average Volume (as of 25 Jun) | 1,325,982 |

Net Assets of Fund (as of 25 Jun) | US$7,556,366,706 |

12-Month Trailing Yield (as of 24 Jun) | 0.31% |

P/E Ratio (as of 24 Jun) | 23.53 |

P/B Ratio (as of 24 Jun) | 4.08 |

Management Fees (Annual) | 0.45% |

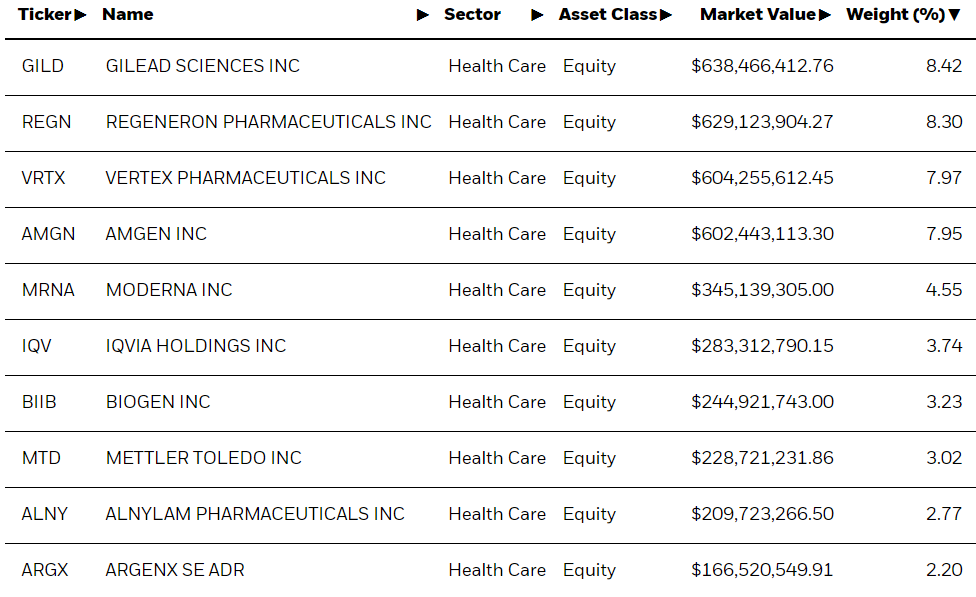

Top 10 Holdings

(as of 24 June 2024)

(Source: Bloomberg)