27 June 2023: Wealth Product Ideas

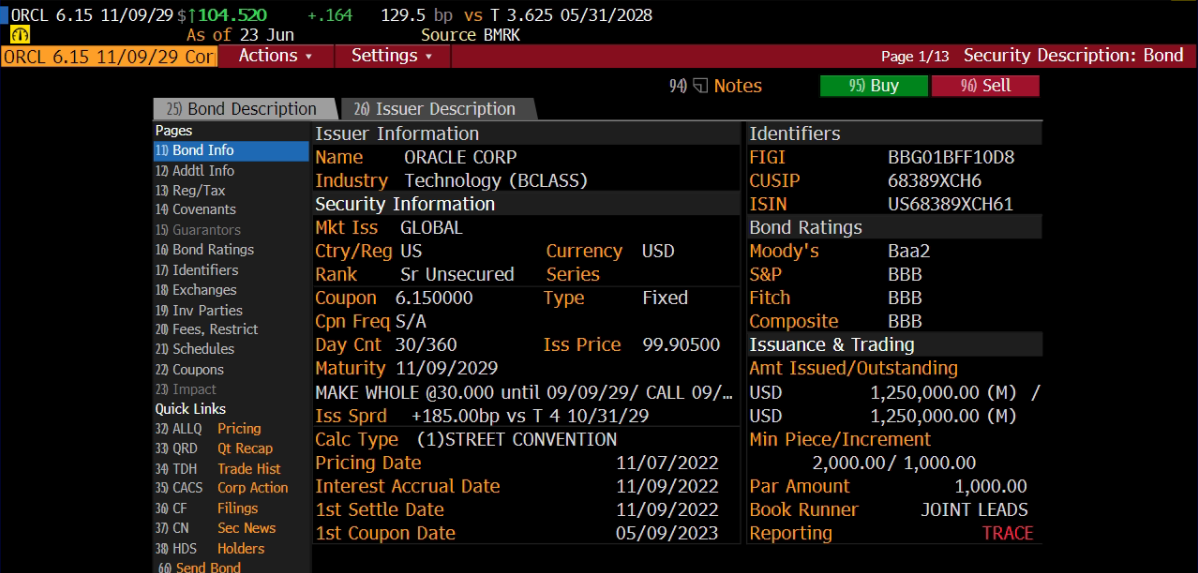

Ticker and ISIN | ORCL 6.15 11/09/29 Corp (US68389XCH61) |

Issuer | Oracle Corp. |

Country | United States |

Currency | USD |

Industry | Technology (BCLASS) |

Coupon rate | 6.15% |

Coupon frequency | Semi-annual |

Maturity | 11/09/2029 (MAKE WHOLE @30.000 until 09/09/29/ CALL 09/09/[email protected]) |

Ratings | Baa2 (Moody’s) / BBB (S&P) / BBB (Fitch) / BBB (Composite) |

YTM | 5.303% |

Amount issued | 1,250,000,000 |

Key Points

- Headquartered in the US, Oracle Corporation is a leading provider of computer software products specializing in enterprise information management, with USD 330.1 billion enterprise value.

- The company offers a wide range of solutions including databases, application development tools, decision support tools, and enterprise business applications, catering to various devices and computing environments.

- Investment-grade rating: Baa2 (Moody’s) and BBB (S&P).

- USD 50 billion revenue expected in FY2023, with cloud services growth forecasted for FY2024.

- Q4 performance exceeded expectations, with 24% net profit margin for four consecutive quarters.

- Significant operating cash flow improvement in FY2023, up nearly 80% to USD 17.17 billion.

- USD 9.76 billion in cash and cash equivalents, sufficient for short-term debt repayment.

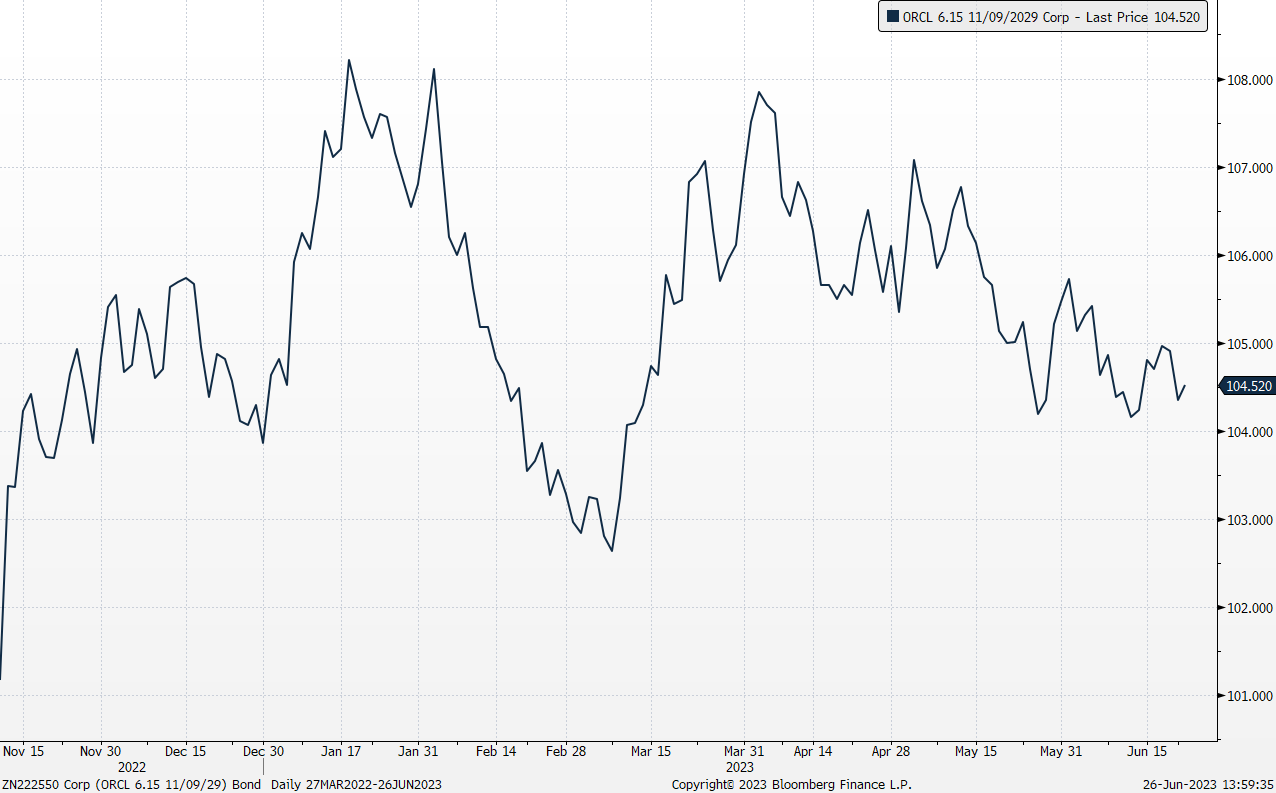

(Source: Bloomberg)

Range Accrual Note on SOFR

- Global interest rates at an important juncture

-

Key FOMC members appear to support:

- Maintaining steady interest rates in June, as demonstrated by the recent pause in rate hikes

- Limiting rate hikes through September

-

With rates unlikely to drop much soon:

- Range accrual notes may appeal to investors versus similar floating rate notes

- By avoiding lower limit costs, range accruals can benefit when rates are high

What is a Range Accrual Note?

- A Range Accrual Note is a structured product with the following characteristics:

- Linked to a reference rate: The note’s performance is tied to an underlying benchmark, such as an interest rate or an index.

- Conditional coupon payments: Coupon payments are made to investors only if the reference rate stays within a pre-defined range during a specific period.

- Variable income: The income generated from the note can be variable, as coupon payments depend on the reference rate remaining within the specified range.

- Higher potential returns: Range Accrual Notes may offer higher coupon rates compared to traditional fixed income products due to the uncertainty of coupon payments and the associated risks.

- Suitable for specific market views: Investors who expect the reference rate to remain within a certain range may find Range Accrual Notes appealing.

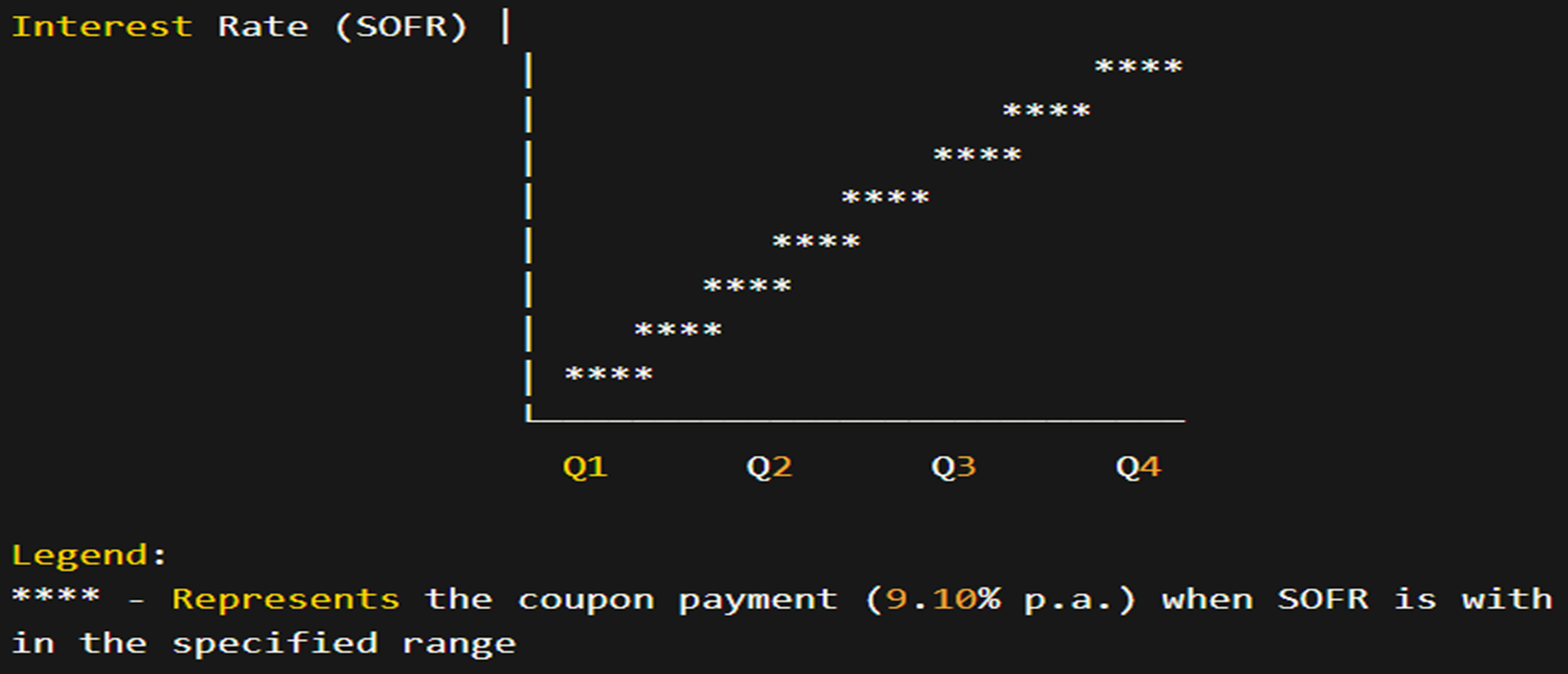

Range Accrual Note Pegged to SOFR

Payoff Structure:

A conditional quarterly coupon of 9.10% p.a.* n/N is paid when the following criteria are met:

- n: Number of business days in a quarter when the Underlying stays within the specified Range.

- N: Total number of business days in a quarter.

- Convention: 30/360

| Underlying Range | Coupon p.a. |

| Q1: 4.75% < SOFR < 5.50% | 9.10% |

| Q2: 4.50% < SOFR < 5.25% | 9.10% |

| Q3: 4.25% < SOFR < 5.25% | 9.10% |

| Q4: 4.00% < SOFR < 5.00% | 9.10% |

Payoff Diagram:

Maturity Redemption (excluding coupon):

- Upon maturity, the investor receives a redemption amount equal to the Protection Level.

- The product offers 100% protection of the principal amount, but this protection is only valid at maturity.

Risk Factors:

- Prior to maturity, the secondary market value of the certificate can be influenced by various factors (such as volatility and interest rates) and may fall below 100% of the principal amount.

- Investors are exposed to the credit risk of the issuer.

- The maximum return is capped at the coupon rate.