19 December 2024: Wealth Product Ideas

Five AI trends in 2025:

1. Increased monetization of enterprises’ AI investments, including the development of proprietary large language models (LLMs), is creating opportunities for a wide array of companies in the AI ecosystem, such as data centers, consultants, ad platforms, cloud computing companies, and cybersecurity firms.

2. Infrastructure development and buildout will be essential to meet demand

3. Proprietary models are underway in unlocking enterprise AI applications

4. As AI moves to the edge, smartphones and other connected devices could be positioned for a strong upgrade cycle, potentially benefitting a wide range of component suppliers and vendors.

5. Deal activity and mergers and acquisitions M&A are likely to pick up in 2025, as companies across the tech sector look to capitalize on the rapidly evolving AI landscape.

Artificial intelligence (AI) is beginning to drive substantial top-line growth for technology companies beyond the semiconductor sector, creating potential investment opportunities across an expanding AI ecosystem. So far, key beneficiaries have included cloud computing, digital advertising, technology consulting, and data center infrastructure providers.

The scale of this expansion is evident in recent market developments: For example, in less than two years since launch, Microsoft expects its AI business to scale to $10 billion in annual revenues. Google’s Cloud unit witnessed growth acceleration due to AI adoption. In ads, Meta credits recent AI investments for enhanced targeting.

This momentum suggests that the secondary effects of the AI revolution are already materializing and are poised to benefit a broad range of industry participants. As evidence of monetization mounts, more enterprises are expected to ramp up capital expenditures and commitments towards AI infrastructure, adding fuel to the ongoing AI arms race. As the monetization and investment flywheel strengthens, the theme could continue to be viewed favorably by investors in 2025.

Fund Name (Ticker) | Artificial Intelligence & Technology ETF (AIQ US) |

Description | The Global X Artificial Intelligence & Technology ETF (AIQ) seeks to invest in companies that potentially stand to benefit from the further development and utilization of artificial intelligence (AI) technology in their products and services, as well as in companies that provide hardware facilitating the use of AI for the analysis of big data. |

Asset Class | Equity |

30-Day Average Volume (as of 17 Dec) | 429,469 |

Net Assets of Fund (as of 17 Dec) | $2.67bn |

12-Month Yield | 0.153% |

P/E Ratio (as of 16 Dec) | 28.87 |

P/B Ratio (as of 16 Dec) | 4.30 |

Expense Ratio (Annual) | 0.68% |

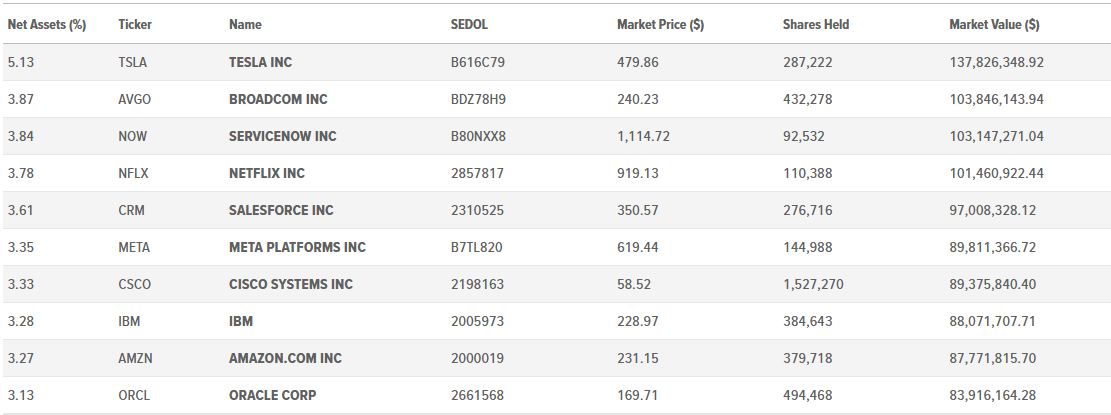

Top Holdings

(as of 17 December 2024)

(Source: Bloomberg)

Fund Name (Ticker) | Data Center & Digital Infrastructure ETF (DTCR US) |

Description | The Global X Data Center & Digital Infrastructure ETF (DTCR) seeks to invest in companies that operate data centers and other digital infrastructure supporting the growth of communication networks. |

Asset Class | Equity |

30-Day Average Volume (as of 17 Dec) | 133,884 |

Net Assets of Fund (as of 17 Dec) | $152.74mn |

12-Month Yield | 1.20% |

P/E Ratio (as of 16 Dec) | 19.93 |

P/B Ratio (as of 16 Dec) | 3.03 |

Expense Ratio (Annual) | 0.50% |

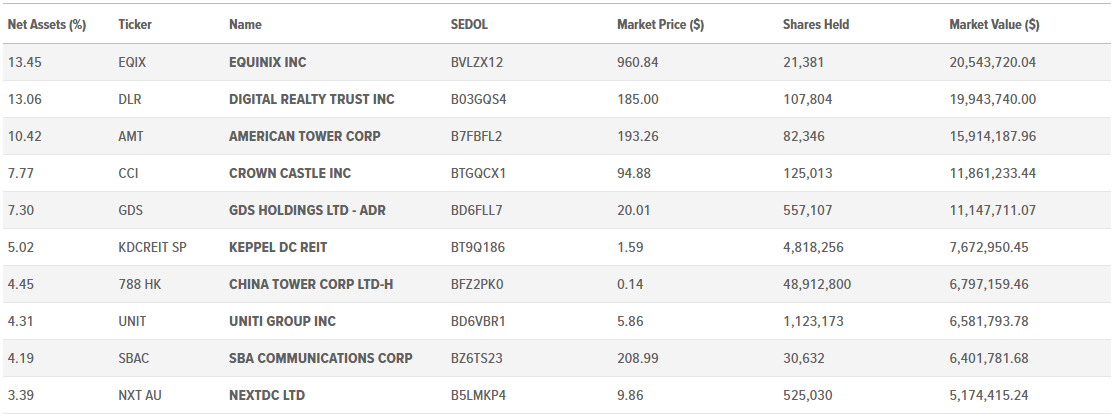

Top 10 Holdings

(as of 17 December 2024)

(Source: Bloomberg)