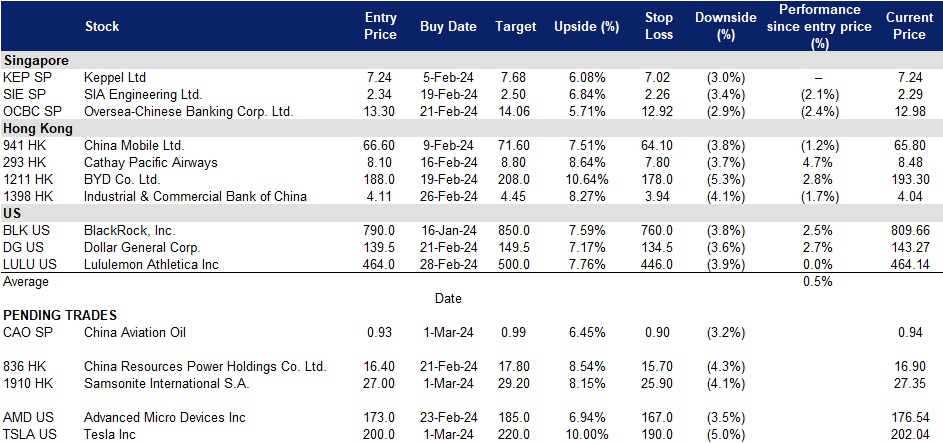

1 March 2024: China Aviation Oil Corp. Ltd. (CAO SP), Samsonite International S.A. (1910 HK), Tesla Inc (TSLA US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

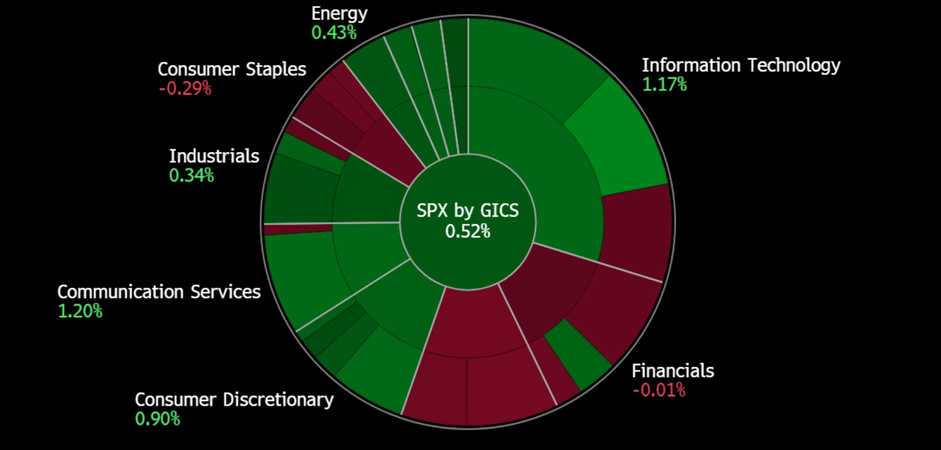

United States

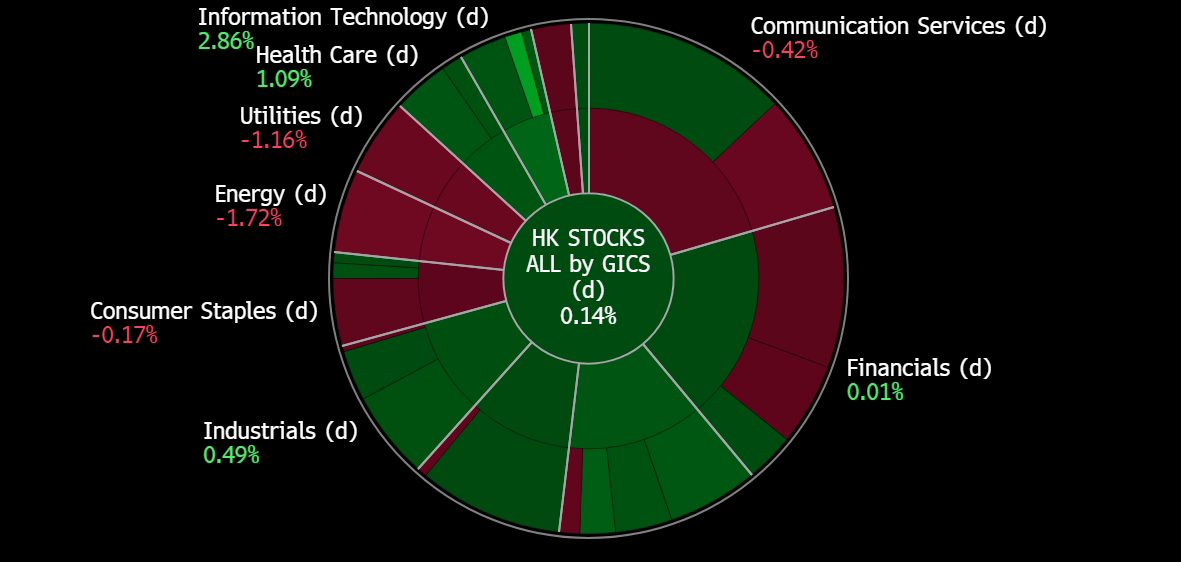

Hong Kong

China Aviation Oil Corp. Ltd. (CAO SP): Increasing Flights

- Entry – 0.93 Target– 0.99 Stop Loss – 0.90

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, petrochemical products, including physical and paper swaps, and futures trading.

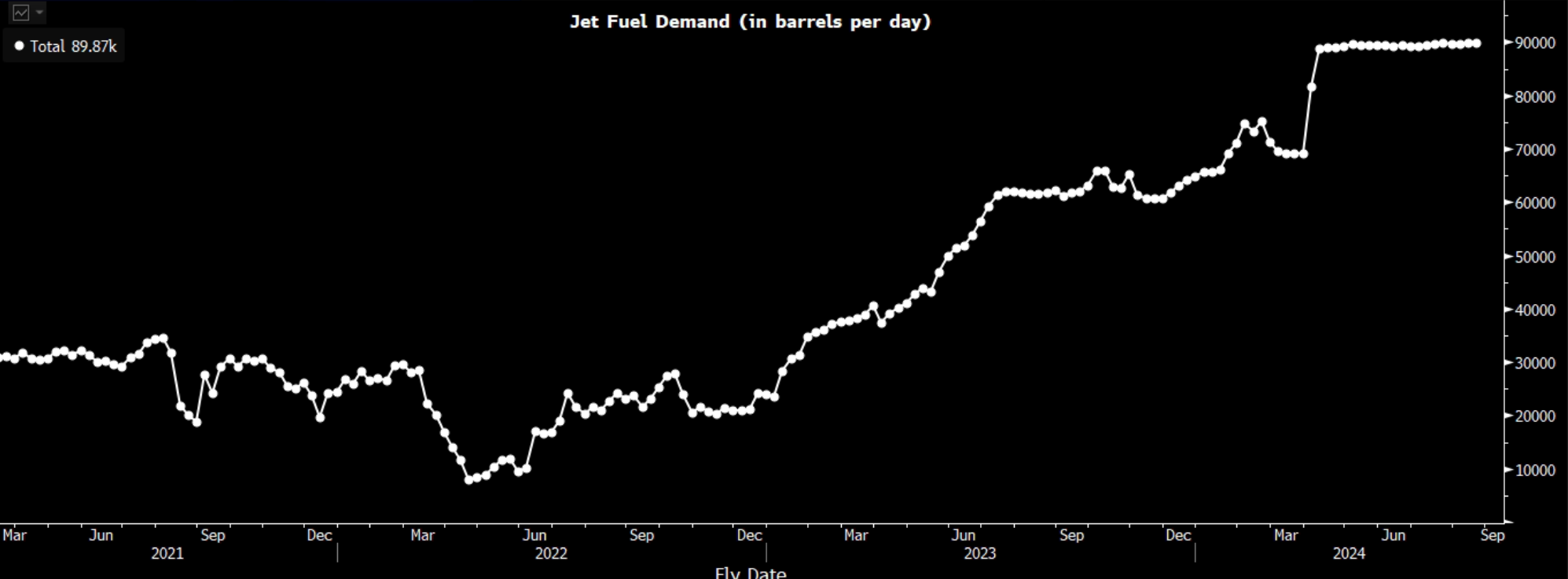

- More flights between China and the US. The U.S. Department of Transportation has announced that Chinese passenger airlines will be permitted to increase their weekly round-trip U.S. flights to 50, effective March 31, up from the existing limit of 35. This approval is a significant stride toward further normalizing the U.S.-China market, especially in anticipation of the Summer 2024 traffic season, as stated by the US Department of Transportation. Last month, China simplified visa applications for U.S. tourists, reducing the required documents, likely leading to increased travel demand between China and the U.S. This expected rise in flight activities is anticipated to benefit China Aviation Oil.

- Record Travel Demand. Official data reveals that China experienced more than 7.2 billion inter-regional trips from January 26 to February 27, spanning the initial 33 days of the Spring Festival travel rush. This period, recognized as the world’s largest annual migration, drew massive crowds to tourist attractions nationwide. Minister of Transport Li Xiaopeng reported record-breaking Civil Aviation Passenger traffic, road traffic, and railway passenger traffic. The air travel sector alone saw over 18 million passenger trips during the holiday, reaching a daily average of 2.25 million, marking a new record. Additionally, domestic tourism spending surged by 47.3% to 632.7 billion yuan ($87.96 billion) compared to the same holiday period in 2023.

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- Improved air travel. China’s international air travel market is poised for further recovery, as the Civil Aviation Administration of China (CAAC) foresees weekly flights reaching 80% of pre-COVID levels by the close of 2024. The regulator envisions an increase in weekly international passenger flights from over 4,600 to 6,000 by year-end, a substantial rise from the less than 500 recorded at the start of 2023. Emphasizing a commitment to enhance international connectivity and the global standing of major airports, the CAAC aims to transform Beijing, Shanghai, and Guangzhou into world-class aviation hubs by 2050. Deputy Administrator of CAAC, Han Jun, states a focus on boosting intercontinental connectivity and global influence. The CAAC projects a robust recovery, forecasting 690 million passenger trips in 2024, an 11% increase from 2023. Additionally, the regulatory body plans to expand traffic rights with Belt and Road nations and deepen cooperation with regions such as Central Asia, the Middle East, and Africa.

- FY23 results review. FY23 revenue fell by 12.36% to US$14.43bn, compared to US$16.46bn in FY22. Net profit rose by 75.90% YoY to US$58.37mn, compared to US$33.19mn in FY23. Basic EPS rose by 75.48% to US6.84 cents in FY23, compared to US3.90 cents in FY22.

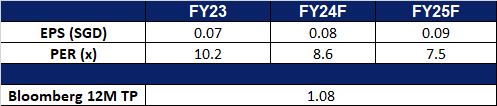

- Market Consensus.

(Source: Bloomberg)

Oversea-Chinese Banking Corp Ltd (OCBC SP): Seizing growth opportunities

Oversea-Chinese Banking Corp Ltd (OCBC SP): Seizing growth opportunities

- RE-ITEREATE Entry – 13.30 Target– 14.06 Stop Loss – 12.92

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Targeting regional growth. OCBC Bank plans to capitalise on China’s uncertain economic recovery by expanding its transaction banking business, particularly in Southeast Asia. The bank aims to increase its focus on Greater China and Asean markets, with Hong Kong and mainland China showing significant growth potential. To achieve this, OCBC plans to invest over S$50mn in its transaction banking capabilities in Greater China. Additionally, the bank aims to engage Chinese companies in Singapore and Hong Kong, facilitating their expansion into markets like Malaysia, Indonesia, Thailand, and Vietnam. OCBC also emphasized digital transformation, focusing on instant cross-border payments and exploring the use of digital currencies for payments and trade. The bank sees digitalization as crucial for capturing more business, as shown by the increasing adoption of digital solutions by trade finance customers and the growth of its OneCollect platform for QR code payments. OCBC has also been piloting the use of digital currencies, such as China’s central bank digital currency, and expanding its instant cross-border payment initiatives.

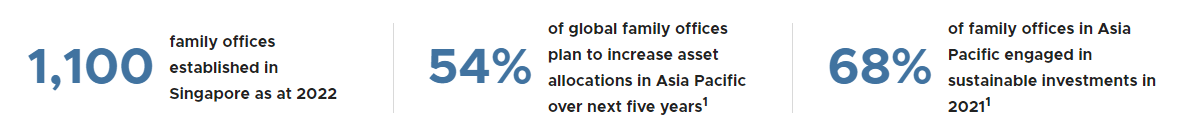

Singapore family office statistics

(Source: Singapore Economic Development Board)

- Attractive to multi-generational wealth. The Henley & Partners global ranking positions Singapore as the third most attractive destination for families seeking opportunities for the next generation, trailing only Switzerland and the United States. Singapore’s strong showing can be attributed to its robust economy, top-tier employment opportunities, and impressive economic mobility. The study emphasizes Singapore’s commitment to cutting-edge development across diverse sectors and its “skills-first” approach in the competitive job market, offering a significant advantage to recent graduates. While Switzerland takes the top spot due to its exceptional earning potential, career advancement opportunities, and low unemployment rate, the United States shines in terms of top-tier employment prospects and earning potential. Drawn by these advantages, affluent families have increasingly chosen Singapore as their new home, entrusting their wealth to established wealth management firms or setting up their own family offices here. This trend shows no signs of slowing down, and Singapore is well-positioned to continue attracting more affluent families seeking stability and growth for their futures. With more positive inflows of net new money in the country, OCBC will benefit from the continued influx of new clients under the group’s wealth management business unit.

- Doubled SME sustainable funding. OCBC Bank significantly increased its sustainable financing for small and medium-sized enterprises (SMEs) in 2023, doubling the amount from the previous year to over S$7bn provided to more than 1,200 companies across Southeast Asia. The bank’s SME Sustainable Finance Framework, initiated in 2020, aims to simplify and reduce the cost for SMEs to access sustainable financing. Over 80% of the SMEs that utilised the bank’s sustainable financing in 2023 were from sectors like built environment, clean transportation, energy efficiency, and renewable energy. OCBC also assisted larger and mid-sized corporates in manufacturing, logistics, and technology to become pioneers in sustainable transformation, hoping to inspire others. The motivation for SMEs to adopt sustainable financing is driven by the desire to future-proof their businesses and meet the increasing demand for sustainability from customers and stakeholders, rather than financial incentives. In 2024, OCBC aims to empower even more companies to become sustainability pioneers, offering them access to financing solutions while creating a positive impact on the environment. This approach benefits both borrowers through growth opportunities and the bank through sustainable practices and potential interest income.

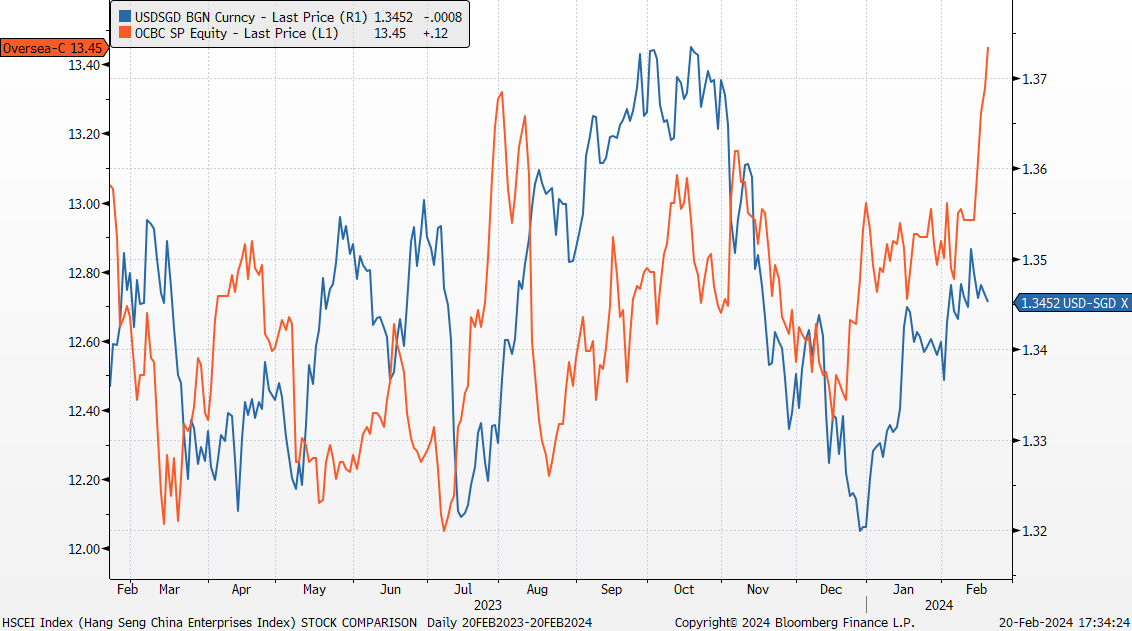

OCBC share price and USD/SGD comparison

(Source: Bloomberg)

- Benefit from rates staying higher for longer. Singapore banks are poised to benefit from the extended period of higher interest rates. The recent rise in Singapore’s T-bill yield to 3.66%, reflecting strong global economic signals, indicates a potential delay in Federal Reserve rate cuts. While demand for T-bills dipped slightly, it remained substantial, suggesting sustained upward pressure on rates. Although future rate cuts are expected, the current high yields suggest a longer period of elevated rates. This could lead to wider interest margins and potentially boost profitability for OCBC.

- 3Q23 earnings. The company’s total income for the period was S$3.43bn rising 13% YoY driven by higher net interest income and growth in non-interest income. The company’s net profit rose to S$1.81bn, +21% YoY compared to S$1.49bn in 3Q22. EPS rose to S$1.58 on an annualised basis. The group’s wealth management income grew 16% YoY to S$1.12bn, making up 33% of the Group’s income in 3Q23. Its wealth management assets under management increased 8% YoY to S$270bn, driven by positive inflows of net new money.

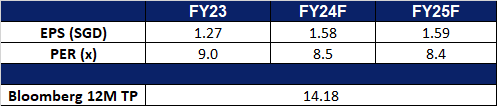

- Market Consensus.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): Potential Privatisation

- BUY Entry – 27.0 Target – 29.2 Stop Loss – 25.9

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Takeover Interest. Samsonite is currently weighing options including going private after holding talks with a group of suitors, according to a report, which added that some private equity firms are considering acquiring the company and relisting it in another market at a higher valuation. Shares in Samsonite surged as much as 14% on Feb 27, the most since August 2022. Its market value surged to a current level of around HK$38 billion. The company is currently trading at 10.75x p/e ratio, compared to an industry p/e ratio of 12.04x, making Samsonite undervalued compared to its peers.

- Demand for travelling stays strong. The global demand for travel remains robust as 2023 concludes, evident in strong results from numerous hospitality and travel companies, underscoring the ongoing resilience of the travel industry. Although expectations suggest a moderation in travel demand, it is anticipated to persist at a strong level, projecting that flight activities will surpass pre-COVID levels by the close of 2024. In Asia, travel activities exhibit signs of a robust recovery, with China achieving a record number of trips during the Lunar New Year festivities, whereas the recovery of travel activities in the U.S. is progressing at a slower pace. The upcoming Sakura season is also poised to further stimulate global travel demand.

- Strong Brand Partnership. Samsonite recently announced a partnership with USA Gymnastics in preparation for the 2024 Summer Olympics. This collaboration involves supplying USAG athletes with the sleek and secure Proxis suitcases as they travel within the United States for training camps and internationally for competitions this year. The Proxis suitcase collection features a stylish design, secure siding, and TSA-approved locks, with a Roxkin outer shell – Samsonite’s proprietary shock-absorbent and damage-resistant material, ensuring lightweight durability. Additionally, the suitcases are equipped with a built-in USB port for convenient phone charging, enhancing connectivity during trips. Beyond supporting USA Gymnastics, this partnership indirectly promotes Samsonite’s brand name and underscores the premium quality of its luggage offerings.

- 3Q23 results. Net sales improved to US$957.7mn, up 21.1% YoY, compared to US$790.9mn in 3Q22. Net profit rose to US$123.2mn in 3Q23, up 88.3% YoY, compared to US$65.4mn in 3Q22. Adjusted Basic EPS was US$0.087 in 3Q23, compared to US$0.045 in 3Q22.

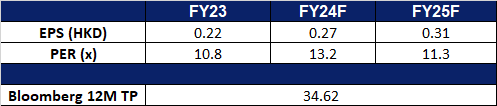

- Market consensus.

(Source: Bloomberg)

Industrial & Commercial Bank of China (1398 HK): Increasing business confidence

- RE-ITERATE BUY Entry – 4.11 Target – 4.45 Stop Loss – 3.94

- Industrial and Commercial Bank of China Ltd is a China-based company principally engaged in the provision of banking and related financial services. The Bank mainly operates three segments, including Corporate Banking segment, Personal Banking segment and Treasury segment. The Corporate Banking segment provides loan, trade financing, deposit, corporate finance, custody and other related financial products and services to enterprises, government agencies and financial institutions. The Personal Banking segment provides loan, deposit, bank card, personal finance and other related financial products and services to individual customers. Treasury segment includes money markets business, securities investment business, self and valet foreign exchange trading and derivative financial instruments business. The Company conducts its businesses within domestic and overseas markets.

- Lowering loan prime rate. In an effort to stimulate economic growth in a sluggish consumption environment, the People’s Bank of China (PBoC) decreased China’s five-year loan prime rate (LPR) by 25 basis points, from 4.2% to 3.95%. This comes with the aim of reducing financial costs to shore up credit and property market. This move not only aims to improve the banks’ profitability but also paves the way for the People’s Bank of China to decrease other interest rates. As a result, China’s banks can stabilize their Net Interest Margins and sustain their lending capacity, thereby providing crucial support to the economy.

- Encouraging spending to stimulate growth. Reducing interest rates provides businesses with a stronger incentive to pursue loans, while a decline in deposit rates raises the expense for individuals holding savings in banks. This interplay fosters increased spending, consequently fueling economic growth. This ripple effect positively affects banks by generating more lending opportunities and broadening their customer base. A surge in loan demand could potentially elevate the volume of loans issued by banks, contributing to an overall income boost. Moreover, the enhanced consumption across China facilitates further economic recovery, particularly after a sluggish performance in the first half of 2023.

- Laws boosting business confidence. China has recently announced the initiation of drafting a law aimed at fostering the development of the private sector economy, with the goal of revitalizing confidence and promoting innovation. This legislation will address key issues concerning private companies, such as safeguarding property rights, ensuring entrepreneurs’ interests, and handling missed payments for small- and medium-sized enterprises. The primary objectives of the law include maintaining stable and consistent policy implementation, encouraging business innovation, and enforcing equitable treatment of state-owned and private companies. This initiative is poised to enhance the business confidence of private enterprises, potentially leading to an increased demand for loans as these companies seek to expand and grow their operations.

- 3Q23 earnings. Operating income fell 6.61% YoY to RMB194.6bn in 3Q23, compared with RMB208.4bn in 3Q22. Net profit rose 0.03% to RMB94.93bn in 3Q23, compared to RMB94.90bn in 3Q22. Basic earnings per share was RMB0.24 in 3Q23, same compared to in 3Q22.

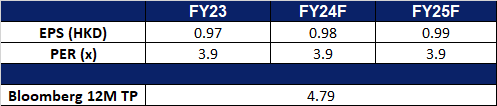

- Market consensus.

(Source: Bloomberg)

Tesla Inc (TSLA US): Excitement for roadster

- BUY Entry – 200 Target – 220 Stop Loss – 190

- Tesla Inc. operates as a multinational automotive and clean energy company. The Company designs and manufactures electric vehicles, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla owns its sales and service network and sells electric power train components to other automobile manufacturers.

- Unveiling the Roadster. Tesla CEO Elon Musk announced plans to ship the Roadster electric sports car next, promising it to be unparalleled in its design and performance. He hinted at revolutionary features, including reaching 60 miles per hour in less than a second. Despite Musk’s grandiose promises, Tesla has yet to deliver on the Roadster, with its production design set to be completed and unveiled by the end of this year. Originally announced in 2017 and delayed due to supply chain issues, the Roadster aims to debut after multiple postponements, including one in 2021 and another in 2023. If Tesla follows through on its announcement to release the Roadster for purchase, it will position the company to compete directly with its Chinese EV rival, BYD. BYD recently unveiled its latest electric supercar, the U6, slated for customer delivery this summer. The Roadster’s highly anticipated release is expected to significantly boost Tesla’s sales revenue.

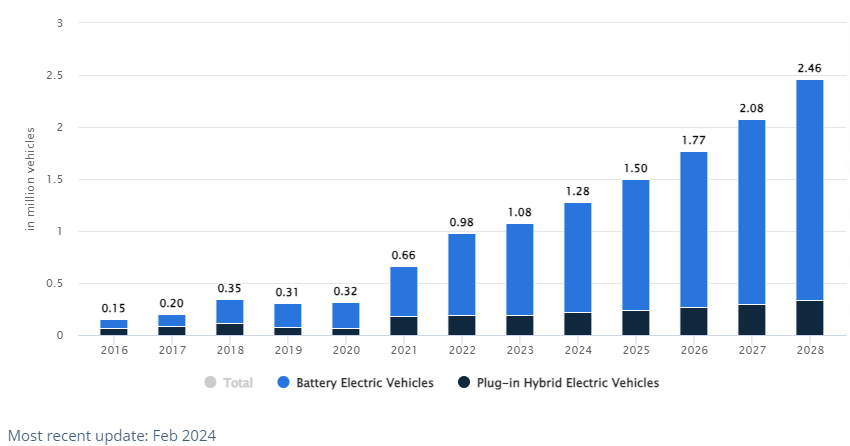

Projected electric vehicle unit sales in the United States 2024 to 2028

(Source: Statista Market Insights)

- Ongoing US EV transition plan. The Biden administration plans to ease proposed yearly requirements through 2030 to cut tailpipe emissions and increase electric vehicle (EV) sales. The Environmental Protection Agency (EPA) proposed a 56% reduction in new vehicle emissions by 2032, with automakers aiming for EVs to constitute 60% of new vehicle production by 2030. However, under the revised regulation, the pace of emissions requirements will slow, resulting in EVs accounting for less than 60% of total vehicles produced by 2030. Automakers and the United Auto Workers (UAW) had urged for a more gradual increase in stringency, citing concerns about EV technology costs and charging infrastructure development. The Alliance for Automotive Innovation (AAI) also called for more achievable requirements, suggesting 40 to 50% electric, plug-in electric, and fuel vehicles by 2030. The EPA’s proposal is still under review, with discussions ongoing between the government, automakers, and stakeholders.

- 4Q23 earnings review. Revenue rose by 3.5% YoY to US$25.17bn, missing estimates by US$590mn. Non-GAAP EPS was US$0.71 miss estimates by $0.03. In FY24, Tesla expects vehicle volume growth to be notably lower than in FY23 as the company is working toward launching its new next-generation vehicle in Texas.

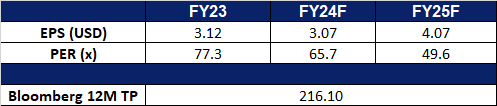

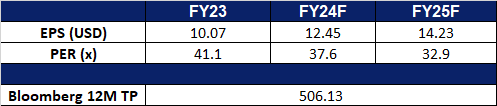

- Market consensus.

(Source: Bloomberg)

Lululemon Athletica Inc (LULU US): Working towards its sustainable targets

- RE-ITEREATE BUY Entry – 464 Target – 500 Stop Loss – 446

- Lululemon Athletica Inc. designs and retails athletic clothing products. The Company produces fitness pants, shorts, tops and jackets for yoga, dance, running, and general fitness. Lululemon Athletica serves customers worldwide.

- Breakthrough in recycling. On 21 February, Lululemon and Samsara Eco, an Australian enviro-tech startup, introduced the world’s first enzymatically recycled nylon 6,6 product, showcasing a breakthrough in textile waste recycling. The samples, including Lululemon’s Swiftly Tech long-sleeve top, signify a milestone in creating a circular ecosystem in the fashion industry. Nylon 6,6, notoriously difficult to recycle, is now being extracted from end-of-life textiles, offering the potential for infinite clothing lifespans. Samsara Eco’s technology reduces emissions compared to virgin nylon production and has the potential to save millions of tonnes of CO2 annually. Over 90% of nylon in the samples is produced through Samsara’s recycling process, maintaining Lululemon’s quality standards. This collaboration aligns with Lululemon’s goal to make products with preferred materials and end-of-use solutions by 2030. Such partnerships not only drive Lululemon’s sustainability agenda forward through innovative practices but also mark a broader transition towards circular models across various industries.

- Footwear offerings expansion. Lululemon recently launched its inaugural men’s footwear line, including a casual sneaker named “cityverse” and will launch its new running shoe models, beyondfeel and beyondfeel trail in March and May respectively. This move aligns with the company’s strategy to double its men’s business and achieve US$12.5bn in revenue by 2026. While the footwear expansion marks a pivotal growth pillar, Lululemon remains primarily focused on its core apparel business. The launch comes amid a slower growth rate and heightened competition from established players like Nike and emerging brands like On Running. This will allow Lululemon to leverage innovation and its strong brand identity to differentiate itself in the increasingly competitive athletic apparel market.

- 3Q23 earnings review. Revenue rose by 18.3% YoY to US$2.2bn, beating estimates by US$10mn. Non-GAAP EPS was US$2.53 beat estimates by $0.25. For 4Q23, the company expects net revenue to be in the range of US$3.135bn to US$3.170bn. For FY23, it expects net revenue to be in the range of US$9.549bn to US$9.584bn.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Lululemon Athletica Inc. (LULU US) at US$464.