16 May 2024: Wealth Product Ideas

Power Sector

- The U.S. may see a shortage in power as the demand for power increases alongside the demand for AI. Power infrastructure is expected to expand even further to cater to this heightened demand. I.E. More data centers are required to cater to the demand of AI; Large language models are also very energy-intensive because they require a lot of computational power.

Fund Name (Ticker) | First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID US) |

Description | The First Trust NASDAQ® Clean Edge® Smart Grid Infrastructure Index Fund is an exchange-traded fund. The Fund seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an equity index called the Nasdaq Clean Edge Smart Grid Infrastructure™ Index. |

Asset Class | Equity |

30-Day Average Volume (as of 13 May) | 112,787 |

Net Assets of Fund (as of 13 May) | USD1,230,073,008 |

12-Month Yield (as of 30 Apr) | 1.88% |

P/E Ratio (as of 30 Apr) | 21.24 |

P/B Ratio (as of 30 Apr) | 3.11 |

Management Fees (Annual) | 0.57% |

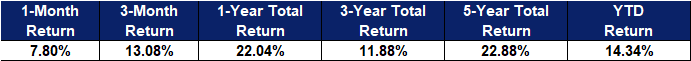

Top 10 Holdings

(as of 13 May 2024)

(Source: Bloomberg)

- Record copper prices. Copper prices hit a record, breaking $5 per pound for the first time as strong demand and tight supply continued to raise concerns of shortages. China continued to import high levels of copper ore inputs amidst the surge in copper price, reflecting strong demand from manufacturers and raising hopes for industrial growth following Beijing’s plan to issue long-maturity bonds. China imported 438 thousand mt of unwrought copper and products in April, and 474 thousand mt in March. On the other hand, limited material availability has also squeezed margins for Chinese smelters, who produce over half of the global supply, thereby constraining their output.

- Increasing global demand for copper. Despite global supply challenges, the demand for copper remains strong, driven by the energy transition and advancements in technologies such as artificial intelligence (AI). Copper’s essential role in electrification—from electric vehicle charging to grid-scale energy storage and automation infrastructure—underpins long-term forecasts for its utility. This sustained demand suggests a bullish outlook for copper over the next three years. As data centers evolve to support AI servers, the need for copper is expected to stay robust. Additionally, the global shift toward electric vehicles (EVs) further boosts demand, as EVs require four times more copper than traditional combustion-engine vehicles.

Fund Name (Ticker) | Global X Copper Miners ETF (COPX US) |

Description | The Global X Copper Miners ETF (COPX) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Copper Miners Total Return Index. |

Asset Class | Equity |

30-Day Average Volume (as of 14 May) | 1,406,181 |

Net Assets of Fund (as of 14 May) | US$2.48bn |

12-Month Trailing Yield (as of 14 May) | 12.25% |

P/E Ratio (as of 13 May) | 15.64 |

P/B Ratio (as of 13 May) | 1.50 |

Management Fees (Annual) | 0.65% |

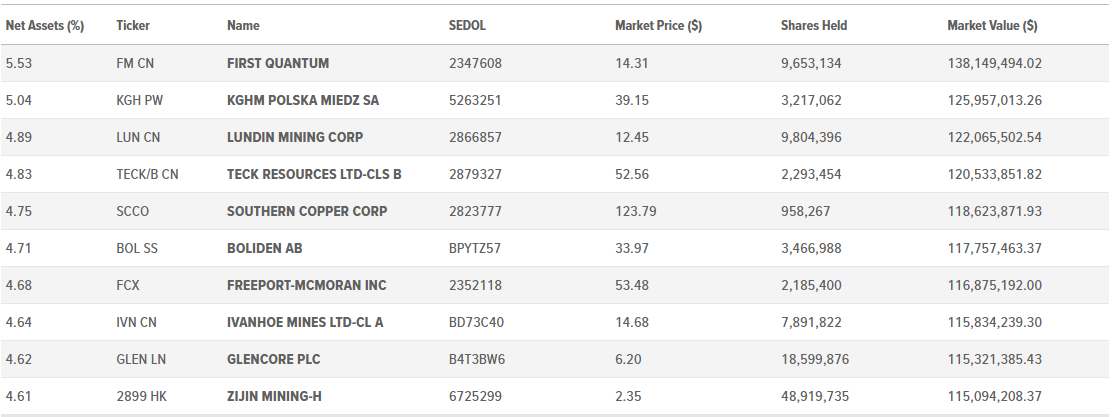

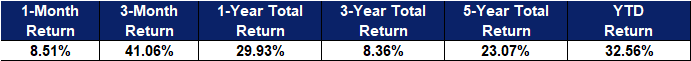

Top Holding

(as of 6 May 2024)

(Source: Bloomberg)