16 February 2023: Wealth Product Ideas

| Fund Name (Ticker) | Consumer Discretionary Select Sector SPDR Fund (XLY US) |

| Description | The Consumer Discretionary Select Sector SPDR® Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Consumer Discretionary Select Sector Index. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 14 Feb) | 4,686,524.4 |

| Net Assets of Fund (as of 14 Feb) | US$14,878,620,000 |

| 12-Month Trailing Yield | N.A. |

| P/E Ratio | 23.41 |

| P/B Ratio | 6.17 |

| Management Fees (Annual) | 0.03% |

Top 10 Holdings

- BUY Entry –150 Target – 160 Stop Loss – 145

- The recent February University of Michigan consumer sentiment for the US jumped to a thirteen-month high of 66.4 from 64.9 in January, beating forecasts of 65.0. The gauge for current economic conditions also improved to 72.6 from 68.4 in the previous month.

- After three consecutive monthly increases, sentiment rose 6.0% YoY but 14.0% below two years ago, pre-inflationary period.

- Inflation expectations for the coming year grew from 3.9% to 4.2%, with the five-year outlook remaining at 2.9%.

- Despite the high inflationary backdrop, consumer sentiment has improved, showing that consumers have growing confidence in their financial situations and future expenditures.

Source: Bloomberg

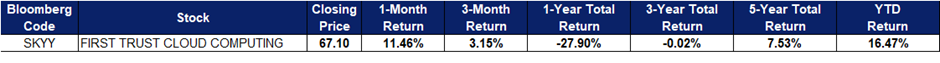

| Fund Name (Ticker) | First Trust Cloud Computing ETF (SKYY US) |

| Description | The First Trust Cloud Computing ETF is an exchange-traded fund. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before the Fund’s fees and expenses, of an equity index called the ISE CTA Cloud Computing Index™. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 15 Feb) | 462930 |

| Net Assets of Fund (as of 14 Feb) | US$2,807,007,055 |

| 12-Month Trailing Yield (as of 15 Feb) | -25.83% |

| P/E Ratio | N.A. |

| P/B Ratio (as of 30 Dec) | 3.43 |

| Management Fees | 0.60% |

Top 10 Holdings

(as of 13 Feb 2023)

- BUY Entry – 65.0 Target – 72.0 Stop Loss – 61.0

- Rise of Artificial Intelligence. One of the most significant impacts of AI is increased efficiency and productivity. Automation, through AI systems and robots, can perform repetitive, boring, and dangerous tasks easily, freeing humans to focus on more innovative and strategic work.

- This advancement in AI capabilities helps firms become more efficient, strategic, and insight-driven in the business cloud computing environment. Businesses gain flexibility, agility, and cost savings when they host data and apps in the cloud.

- With ChatGPT’s viral success and Microsoft working to integrate the bot into its search engine, many big tech companies such as Google, Meta and Baidu, are already in plans to release or invest in other AI bots, such as Google’s Bard and Baidu’s Earnie Bots.

- Integration of AI in Cloud Computing. Microsoft recently rolls out its Azure OpenAI service, allowing businesses to integrate tools like DALL-E into their own cloud apps, which has been testing this Azure service for just over a year, and it will soon include access to ChatGPT.

Source: Bloomberg