14 February 2023: Wealth Product Ideas

| Fund Name (Ticker) | AllianceBernstein (AB) Low Volatility Equity Portfolio (LU0965508806) |

| Description | The Portfolio’s investment objective is long-term capital growth. In seeking to achieve the Portfolio’s objective, the Investment Manager identifies equity securities that it believes have fundamentally lower volatility and less downside risks in the future. The Investment Manager uses its proprietary risk and return models as well as its judgement and experience in managing investment portfolios to construct a portfolio that seeks to minimize volatility while maximizing quality exposure. The Portfolio will predominantly invest in equity securities of companies in developed markets; however, the Portfolio is not restricted from purchasing equity securities in any country, including emerging markets. |

| Asset Class | Equity |

| Inception Date | 11/12/2012 |

| 30-Day Average Volume | N.A. |

| Net Assets of Fund (as of 10 Feb) | US$5,120,000,000 |

| 12-Month Trailing Yield (as of 31 Dec) | -11.50% |

| P/E Ratio | 17.598 |

| P/B Ratio | N.A. |

| Management Fees | 1.50% |

Top 10 Holdings

(as of 31 December 2022)

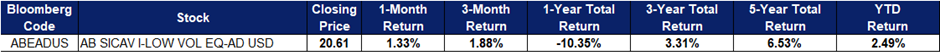

- BUY Entry –20.5 Target – 21.5 Stop Loss – 20

- Long-term growth amidst harsh economic environments. Ongoing inflation and the impact of interest rate hikes are potential catalysts for continued market volatility. However, that doesn’t necessarily mean that investors should avoid investing altogether, as statistically, investors who hold their investments over the long term tend to outperform the market compared to investors who try to time their holdings. One way to manage portfolio risk while generating returns over the long term is by investing in defensive stocks with the potential to weather market volatility across different market cycles.

- Stability and low volatility. The fund adopts a disciplined, low-volatility approach to buying high-quality, stable companies at the right price (QSP) and provides investors with multiple ways to mitigate risk while still participating in market gains. An investment portfolio based on a “90/70” model, it targets to capture 90% of the market gains when the market rises and 70% of the decline when the market falls in order to minimize losses and maximize profits. The Fund is expected to recover more quickly following a market downturn versus the broader market due to its focus on quality and stability.

Source: Bloomberg