13 June 2024:Wealth Product Ideas

Wealth Product Ideas – 13 June

- No dividend tax: potential savings can be up to nearly 37% (~1.5% p.a.) over the past 20 years.

- Converting US-listed treasury ETF holding (i.e., TLT) into 3433 HK to save the 30% dividend tax each quarter.

- Asia hour trading: investors can position their UST view ahead of US macro news/policy move through real-time exchange-traded prices.

- Multiple currency choices: directly use HKD to trade 3433 on exchange to potentially save FX cost or create/redeem shares in USD in the primary market.

- Flexible execution: real-time execution to lock UST price in Asia hours or leave the order at the market on close US time.

Fund Name (Ticker) | CSOP FTSE US Treasury 20+ Years Index ETF (3433 HK) |

Description | The investment objective of the CSOP FTSE US Treasury 20+ Years Index ETF is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FTSE US Treasury 20+ Years Index. There is no assurance that the ETF will achieve its investment objective. |

Asset Class | Global Fixed Income |

30-Day Average Volume (as of 11 Jun) | 23,373 |

Net Assets of Fund (as of 11 Jun) | US$44,554,484 |

Average Yield to Maturity (as of 11 Jun) | 4.59% |

Weighted Average Maturity (as of 11 Jun) | 26.07 yrs |

Weighted Average Coupon (as of 11 Jun) | 2.95% |

Management Fees (Annual) | 0.20% |

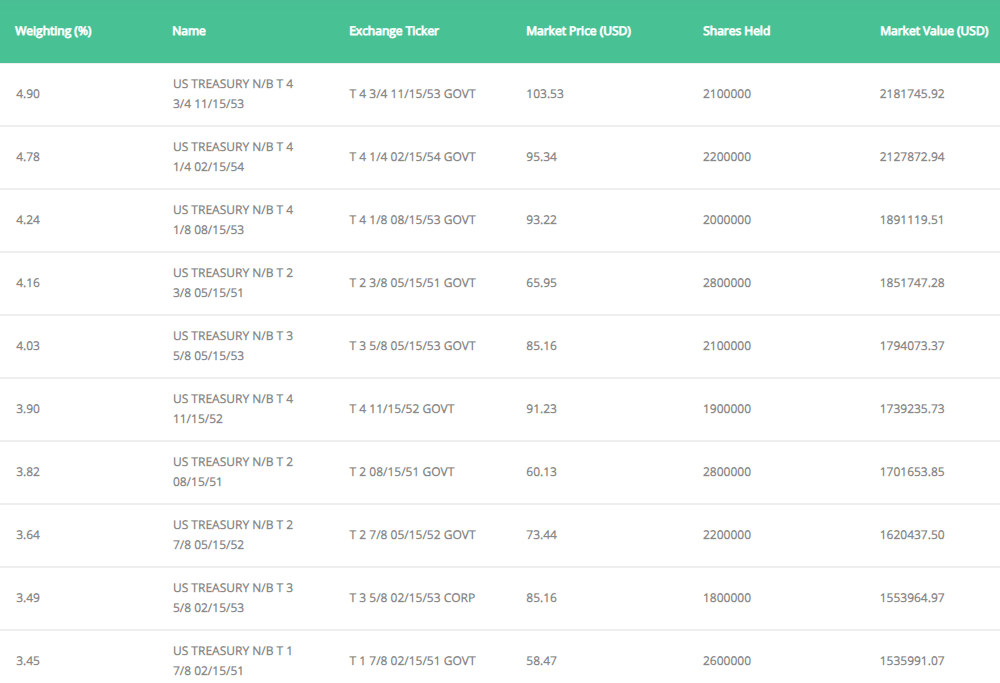

Top 10 Holdings

(as of 11 June 2024)

(Source: Bloomberg)

- Upside potential in rate-decreasing periods: The Fed turns to timing of rate cuts, and bond prices are expected to benefit from it. The higher a bond’s maturity/duration, the more its value will increase as interest rates fall.

- Customize your exposure to interest rate risk: target the duration you are looking for with iShares U.S. Treasury bond ETFs.

- Seek to target different segments of the yield curve: offers exposure to Treasury bonds that mature within specific maturity years or ranges, allowing you to target points on the yield curve.

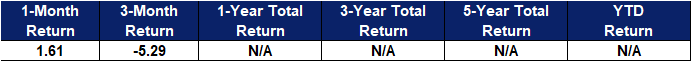

Fund Name (Ticker) | iShares 20+ Year Treasury Bond ETF (TLT) |

Description | The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. |

Asset Class | Fixed Income |

30-Day Average Volume (as of 10 Jun) | 34,379,492 |

Net Assets of Fund (as of 11 Jun) | US$49,476,787,268 |

12-Month Trailing Yield (as of 10 Jun) | 3.90% |

Weighted Average Maturity (as of 10 Jun) | 25.65 yrs |

Weighted Average Coupon (as of 10 Jun) | 2.64% |

Management Fees (Annual) | 0.15% |

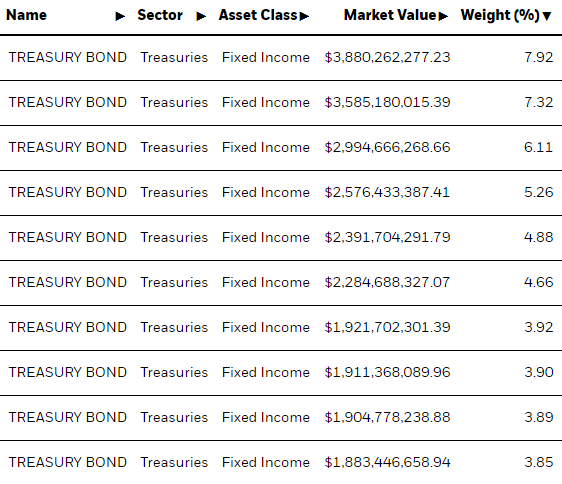

Top 10 Holdings

(as of 10 June 2024)

(Source: Bloomberg)