13 July 2023: Wealth Product Ideas

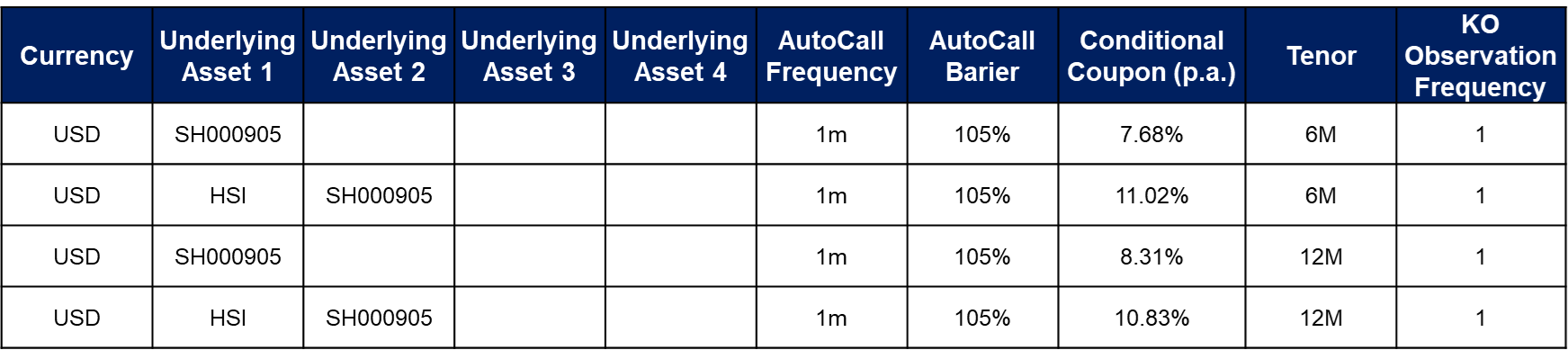

Snowball PPN (Structured Product) Key Points:

- Principal Protection: The principal invested is protected at maturity, providing a level of security. However, there is still exposure to counterparty/issuer risk.

- Monthly Observations: The underlying asset price is monitored monthly. If it reaches the preset Autocall price on any monthly observation date, investors can trigger early redemption and receive their principal and accumulated distribution.

- Accumulation of Distribution: If early redemption is not triggered, the distribution continues to accumulate. This gives investors the chance to potentially earn higher returns before maturity.

- Principal Redemption: At maturity, investors will receive 100% of their principal, regardless of the underlying asset’s performance.

- Suitable Investors: The product appeals to stable investors seeking regular income with the potential for modest returns.

Payout Scenarios:

- Early redemption: On any monthly observation date, if the price of the worst performing underlying asset is equal to or exceeds the Autocall price, investors will have the chance to trigger early redemption. In such cases, both the principal amount and accumulated interest will be paid to investors.

- Maturity with 100% principal: If the product reaches its maturity date, investors will receive 100% of their principal amount, regardless of the performance of the underlying assets.

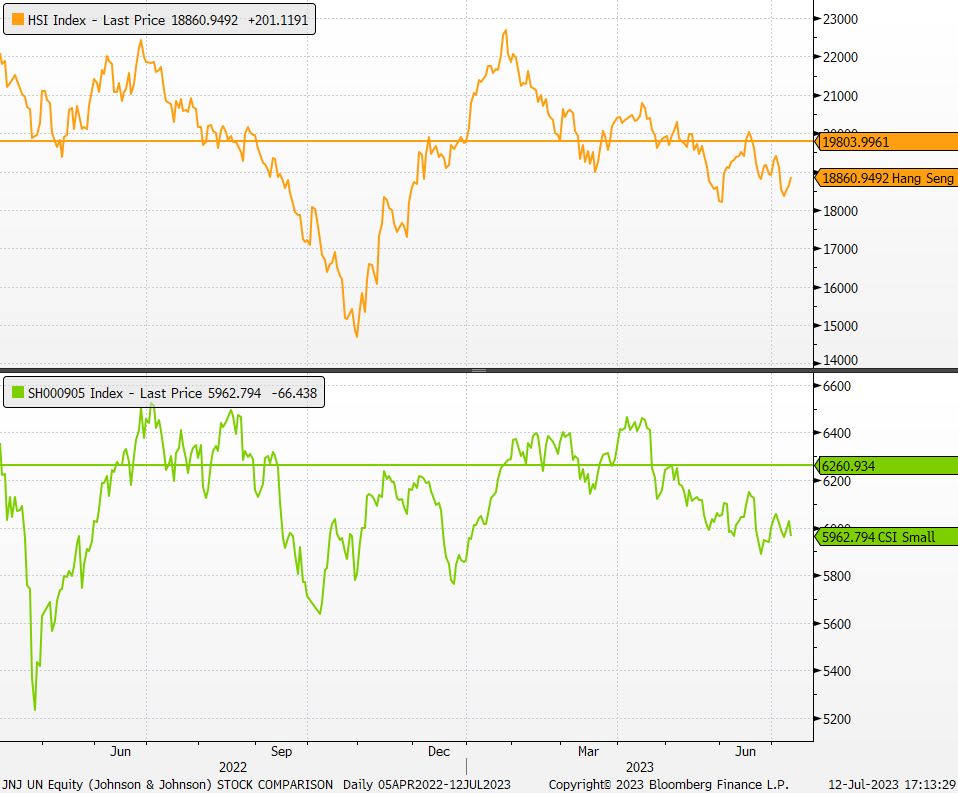

(Source: Bloomberg)