28 October 2024: Fortress Minerals Ltd (FMIL SP), Xinyi Solar Holdings Ltd (968 HK), Coinbase (COIN US)

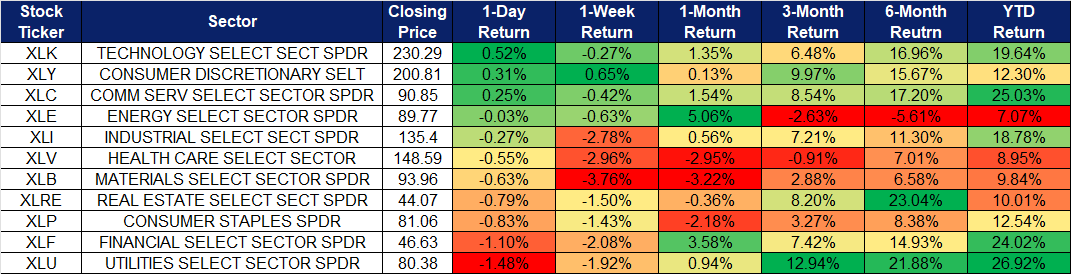

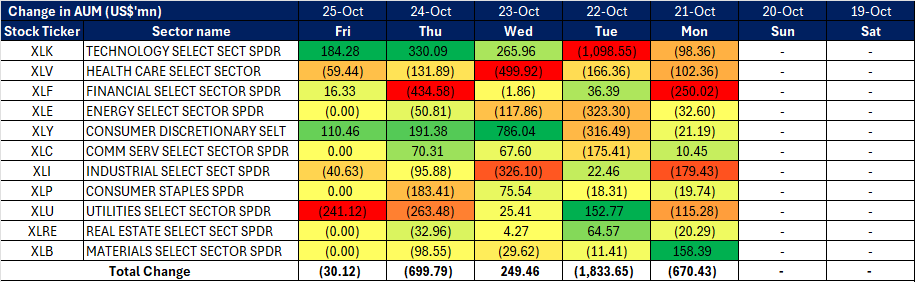

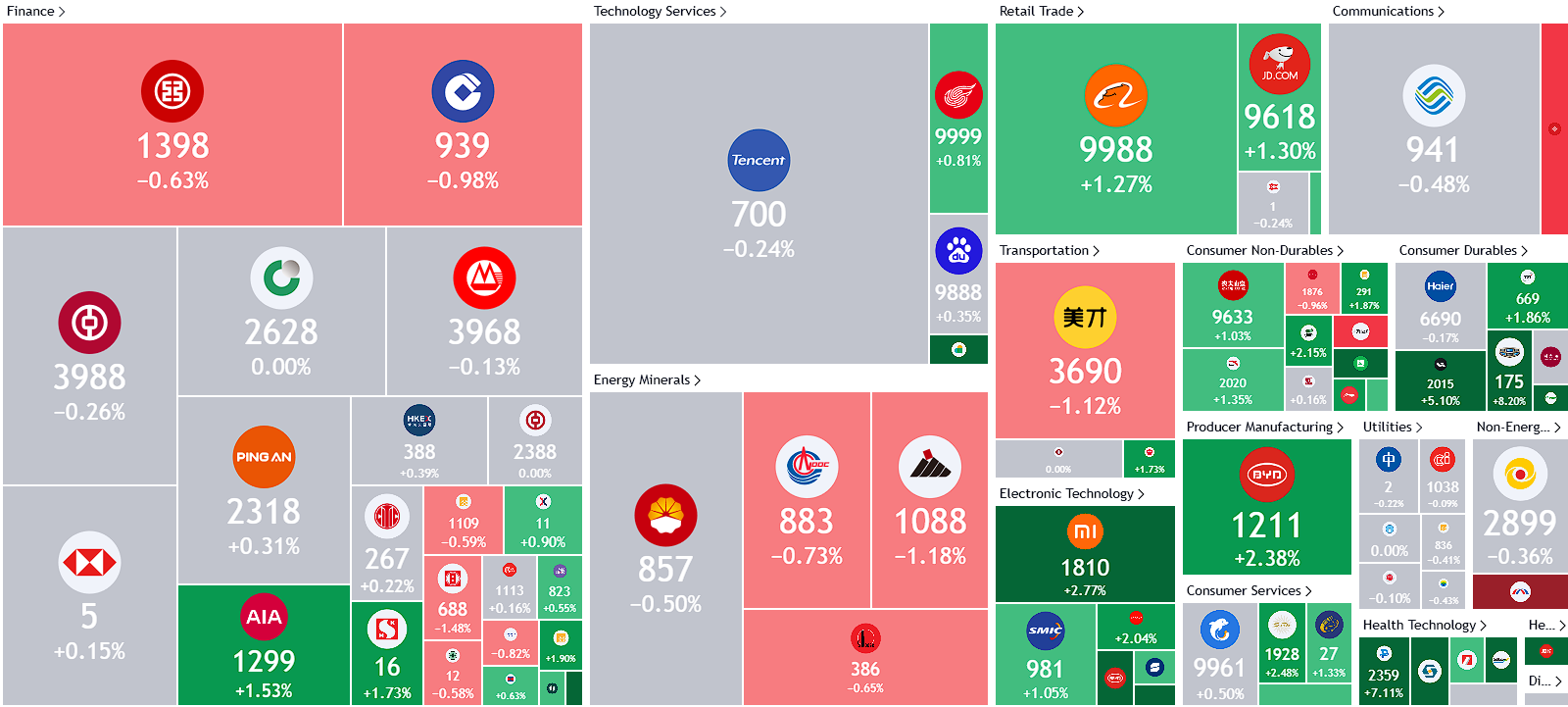

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

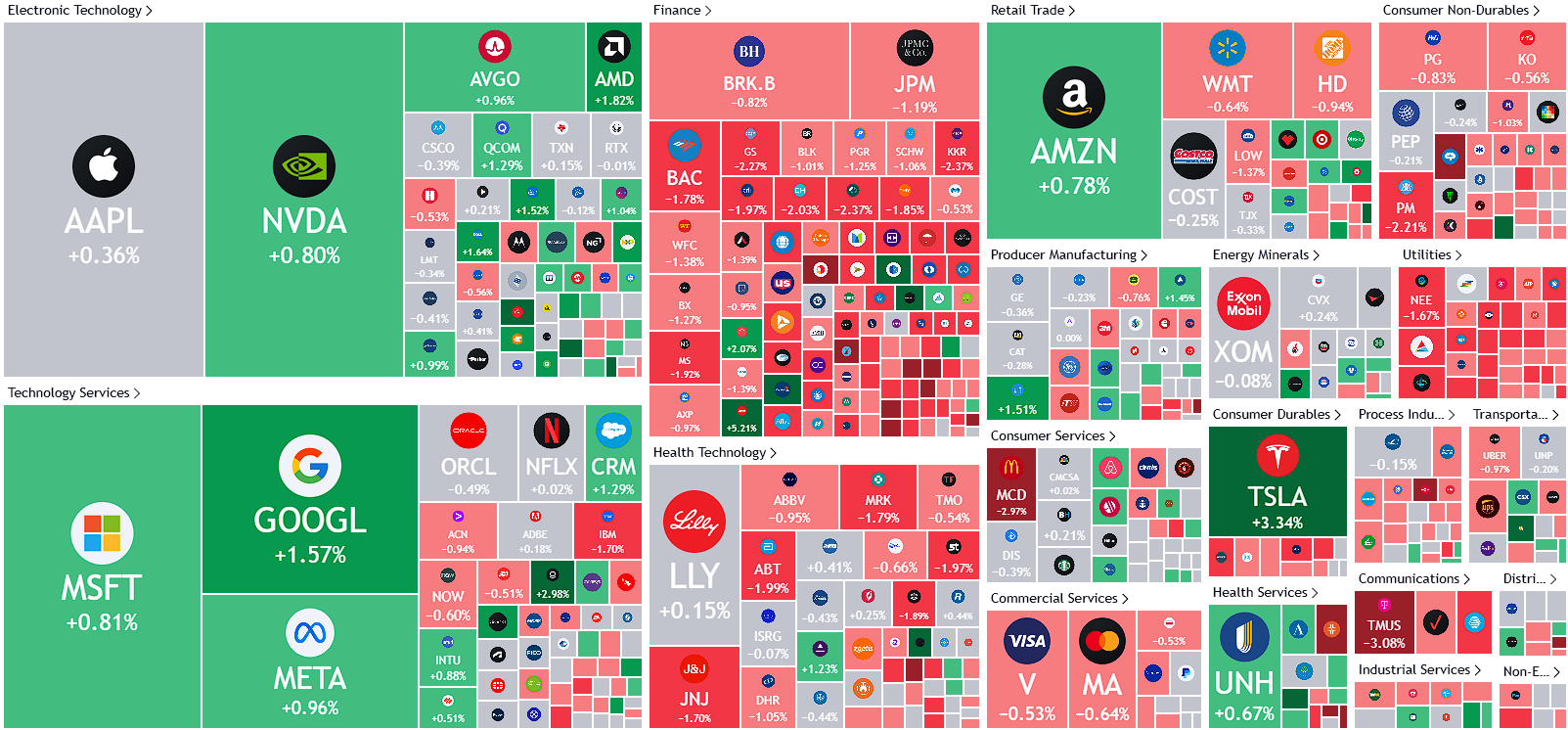

United States

Hong Kong

Fortress Minerals Ltd (FMIL SP): Expectations towards improvements in iron ore prices

- BUY Entry – 0.265 Target– 0.285 Stop Loss – 0.255

- Fortress Minerals Limited mines, processes, and distributes iron ore. The Company focuses on exploration, mining, production, and distribution of iron ore concentrates. Fortress Minerals serves customers in Singapore and Malaysia.

- Stable margins. Fortress Mineral reported a better gross profit margin of 68.8% in 1H25, despite a drop in revenue YoY. Net profit margin also improved to 27.1% in 1H25, compared to 23.2% in 1H24. The increase in margins showcased the company’s efforts to improve the operational efficiency of its business.

- China stimuli to support iron ore prices. Since mid-September, the Chinese government has been introducing a series of economic stimulus measures to boost the economy. These included rate cuts and new monetary facilities, with a focus on increasing investment and consumption. Additional measures to issue more debt and enhance liquidity are expected to ease the financial strains on property and construction companies. This could potentially revive the construction and real estate sectors, providing support for iron ore prices.

- New crushing plant to be commissioned in FY26. The company is expanding its production capacity at the Bukit Besi mine with the ongoing construction of a new, more advanced crushing plant. This facility will feature state-of-the-art equipment and technology, strategically designed to support scalable future operations. The plant will be larger and relocated to optimize operational efficiency, reduce costs, minimize manpower needs, and indirectly boost production. It is expected to be commissioned in FY2026.

- 1H25 results update. The company reported a revenue of US$25.3mn in 1H25, down 17.3% YoY, compared to US$30.6mn in 1H24. Gross profit margin improved to 61.7% as the company benefit from economies of scales on higher and better production capabilities, lowering its average unit cost. Net profit margin also improved to 27.1% in 1H25, compared to 23.2% in 1H24. Sales volume saw a 13.3% decrease to 271.2 thousand DMT in 1H25, compared to 312.9 thousand DWT in 1H24, as the company cut on sales volume and stockpile its processed iron ore at its mine amidst weaker iron pricings.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.40. Please read the full report here.

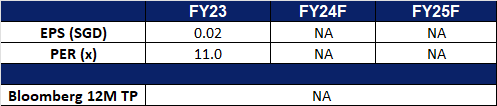

- Market Consensus.

(Source: Bloomberg)

Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP): Enhancing the world’s second-largest pharmaceutical market

- RE-ITERATE BUY Entry – 2.4 Target– 2.6 Stop Loss – 2.3

- Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited produces and sells traditional Chinese medicine, western medicine, health products, and healthcare instruments. The Company also manufactures gene-related biopharmaceutical products. Tianjin Pharmaceutical Da Ren Tang Group markets its products under the Great Wall, Cypress, and Health brand names.

- Policy support. China’s government is accelerating the development of its pharmaceutical market by implementing policies that emphasize innovation and R&D. The Government Work Report, passed in 2024, outlines measures to modernize the country’s industrial system, including financial incentives, subsidies, and the creation of high-tech science parks. These initiatives aim to boost the domestic biotech industry, enhance innovation, and support the development of new drugs. Additionally, China has introduced national reimbursement for innovative therapies and seen a rise in FDA-approved drugs and out-licensing deals, particularly in oncology, further demonstrating the government’s commitment to advancing the pharmaceutical sector. These will help to support Tianjin Pharmaceutical’s research and development of more products and instruments.

- New joint venture. Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited (formerly known as Tianjin Zhong Xin Pharmaceutical Group) is entering into an amended equity joint venture agreement regarding Tianjin TSKF Pharmaceutical Co., Ltd., alongside Haleon UK Services Limited and Haleon China Co., Ltd. This initiative includes extending the JV company’s operating period to 30 June 2025 and disposing of a 13% equity interest in the JV to Haleon China. Post-disposal, the equity structure will be adjusted, with Haleon UK holding 55%, Haleon China 33%, and Tianjin Da Ren Tang 12%.

- 1H24 results review. Revenue for 1H24 decreased by 3% YoY to RMB 3,965mn, a decrease of approximately RMB 124mn, driven mainly due to a YoY decrease in sale of goods. The profit attributable to equity holders in 1H24 was approximately RMB 658mn, a decrease of approximately RMB 65mn, or 9% from RMB 722mn of the corresponding period in 1H23. Earnings per share for 1H24 was RMB 0.85, lower than the RMB 0.94 in 1H23.

- Market Consensus.

(Source: Bloomberg)

Xinyi Solar Holdings Ltd (968 HK): Potential restrictions on Solar PV manufacturing

- BUY Entry – 4.0 Target 4.6 Stop Loss – 3.7

- Xinyi Solar Holdings Ltd is a company principally engaged in the production and sale of solar glass products and the development and operation of solar farms. The Company operates its businesses through three segments. Sales of Solar Glass segment is mainly engaged in the sales of solar glass. Solar Farm Business segment is mainly involved in solar farm development and solar power generation. Other segment is mainly involved in engineering, procurement and construction (EPC) services and sales of mining products. The Company’s products comprise ultra-clear patterned solar glass (raw and tempered), anti-reflective coating glass and back glass. The Company mainly conducts its businesses in the domestic market and overseas markets.

- Possible new restrictions on solar photovoltaic (PV) manufacturing. Recent social media rumors suggest that Beijing may soon introduce new regulations for solar PV manufacturing aimed at controlling oversupply and curbing the sector’s price wars. The Ministry of Industry and Information Technology (MIIT) is reportedly planning to implement energy consumption restrictions for PV production as early as next month. Additionally, other rumors indicate MIIT might enforce stricter requirements for production capacity utilization rates. If these reports hold true, it would likely signal positively for the solar PV industry by helping stabilize prices, which would benefit companies like Xinyi Solar Holdings.

- New Renewable Energy Consumption Benchmarks. China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) have jointly released updated requirements for the percentage of energy that provinces must source from renewable generators in 2024 and 2025. These requirements are part of China’s renewable energy consumption guarantee mechanism, mandating a significant increase in the share of renewable energy in several provinces. The document also outlines tentative renewable energy consumption targets for 2025. Current data reveals that six provinces experienced increases exceeding 6 percentage points in their renewable energy consumption mandate between 2023 and 2024. China remains on track to achieve its renewable energy goals, aiming for renewable energy, including hydropower, to account for 40 percent of total national energy consumption by 2030. This benchmarks are likely to spur on more investment into renewable energy as well.

- Rise in renewable energy in China. China’s renewable energy utilization has reached or surpassed advanced international standards, making rapid strides in its energy transition by expanding renewable capacity while relying on liquefied natural gas to meet rising electricity demands. The nation has shown strong momentum in renewable adoption, with a utilization rate of 97.6%, remaining above 95% for six consecutive years since 2018. Last year alone, new renewable energy installations reached 290 million kW—2.4 times the 2022 level—and accounted for 79% of the country’s total new power capacity, establishing renewable energy as the leading source of new power generation. This substantial capacity growth has spurred major investments in solar, wind, and hydropower projects across China. Projections indicate that by the end of 2024, China will reach 1,300 gigawatts (GW) of combined wind and solar capacity, surpassing its 1,200 GW target set for 2030. This trend aligns with China’s broader goals to reduce coal’s role in its energy mix and to fulfill its 2060 carbon neutrality commitment. Market expectations are that by 2028, approximately 50% of China’s electricity will be generated from renewable sources. Further underscoring its decarbonization progress, China’s National Energy Administration recently reported issuing 486 million Green Electricity Certificates (GECs) in the first half of 2024—a 13-fold increase from the same period last year. With this increased investment and focus on renewable energy, Xinyi Solar Holdings stands to benefit substantially.

- 1H24 earnings. The company’s revenue rose to HK$12.7bn in 1H24, +4.49% YoY, compared to HK$12.1bn in 1H23. The company’s net profit rose by 41.0% YoY to HK$1.96bn in 1H24, compared to HK$1.39bn in 1H23. Basic earnings per share rose to 22.03 HK cents in 1H24, compared to 15.63 HK cents in 1H23.

- Market consensus.

(Source: Bloomberg)

Pop Mart International Group Ltd. (9992 HK): Labubu Craze

- RE-ITERATE BUY Entry – 74.0 Target 90.0 Stop Loss – 65.0

- Pop Mart International Group Ltd is a China-based company mainly engaged in the provision of pop toy. intellectual property (IP) is at the core of its business. It has established an integrated platform covering the entire industry chain of pop toys, including artists development, IP operation, consumer access and pop toy culture promotion. The Company develops a broad array of pop toy products based on its IPs. Its Pop Mart brand products are primarily categorized into blind boxes, action figures, ball-jointed doll (BJDs) and accessories. The Company conducts its businesses within the China market and to overseas markets.

- In trendy series continue to rake in revenue. Pop Mart’s Labubu series recently went viral globally, thanks in part to a social media post by BLACKPINK’s Lisa. Combined with endorsements from several other celebrities, this surge in visibility has sparked overwhelming demand for Labubu toys, with products consistently selling out both in stores and online shortly after release. The Labubu series generated RMB 626.8 million in sales during the first half of 2024 and is on track to become Pop Mart’s top IP by revenue for the year. Other popular series, such as Molly and Skullpanda, have also performed exceptionally well, bringing in RMB 782.1 million and RMB 574.3 million in revenue, respectively, as of 1H24.

- Better than expected 3Q24 business updates. Pop Mart recently released its 3Q24 business update, projecting revenue to more than double YoY. The company expects overall revenue to grow by 120%-125% YoY. Revenue from operations in Mainland China increased by 55%-60% YoY, while revenue from Hong Kong, Macao, Taiwan, and overseas markets surged by 440%-445% YoY. This significant growth in overseas revenue highlights the success of Pop Mart’s expansion efforts and its strengthening market presence outside China. The company’s global growth strategy is clearly paying off, contributing substantially to its overall performance.

- Expanding presence locally and overseas. Pop Mart, the renowned high-end toy brand, has officially opened a store at Sun World Ba Na Hills in Da Nang, creating a highly artistic space. Situated in a prime location atop Ba Na Hills, the store features impressive interior architecture resembling a grand castle, inspired by the artistic and cultural charm of an old French village. This marks Pop Mart’s first store in a Southeast Asian theme park. Visitors can explore iconic characters like Molly, SkullPanda, Hirono, Dimoo, and The Monsters, making each visit a unique artistic experience. In addition, Pop Mart recently launched its first theme park in Beijing, transforming Chaoyang Park—the city’s largest park—into an immersive entertainment space filled with beloved characters like Molly, Labubu, and Dimoo. These expansions, coupled with the growing popularity of The Monsters and Molly series, are set to attract even more visitors and strengthen Pop Mart’s global presence.

- 1H24 earnings. The company’s revenue rose to RMB4.56bn in 1H24, +62.0% YoY, compared to RMB2.81bn in 1H23. The company’s net profit rose by 93.3% YoY to RMB964.1mn in 1H24, compared to RMB477.2mn in 1H23. Basic earnings per share rose to RMB69.49 in 1H24, compared to RMB35.46 in 1H23.

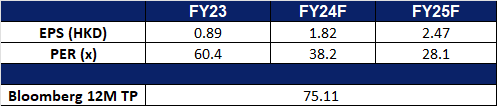

- Market consensus.

(Source: Bloomberg)

Coinbase (COIN US): Expect the rally to continue

- RE-ITERATE BUY Entry – 190 Target – 220 Stop Loss – 175

- Coinbase Global Inc provides financial infrastructure and technology for the crypto economy in the United States and internationally. The company offers consumers a primary financial account in the crypto economy; and a marketplace that provides institutional investors with a liquidity pool for trading crypto assets. It also provides technology and services that enable developers to build crypto products and securely accept crypto assets as payment.

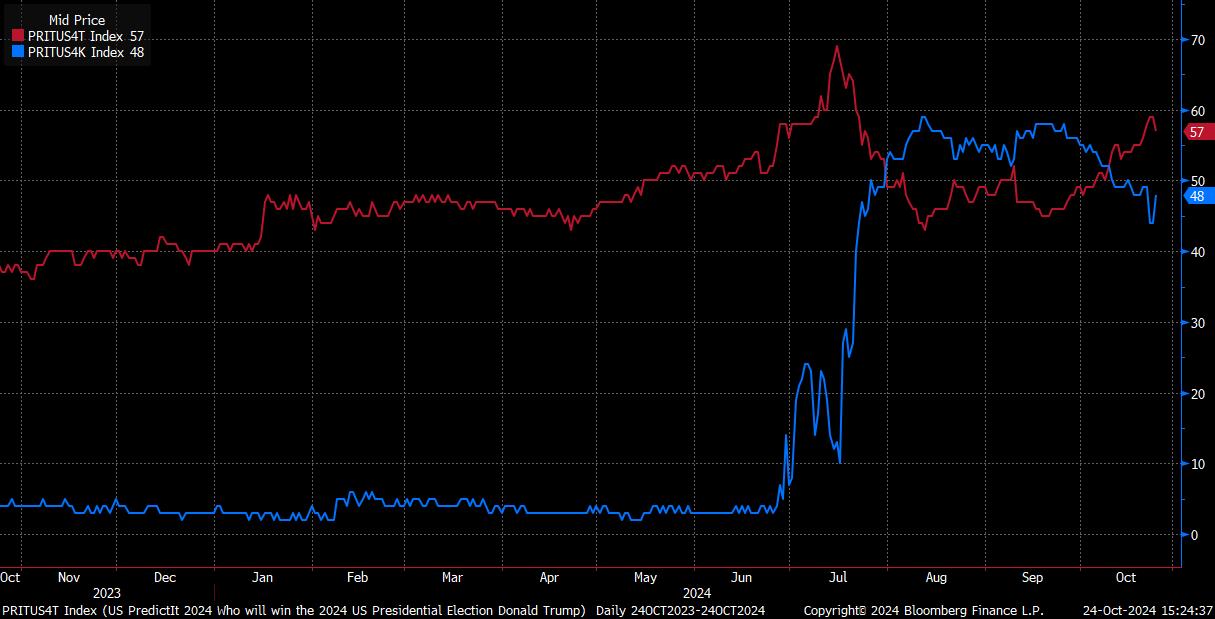

- Rising Trump-themed trades. The 2024 US election is less than two weeks. According to Bloomberg, Trump maintains the leading advantage against Harris by 9 pts. Funds have been betting on Trump-themed trade since early October. Cryptocurrencies are one of the asset classes that will benefit from Trump’s administration as he vowed to turn the US into the crypto capital of the planet and the Bitcoin superpower of the world. The recent upswing of Bitcoin reflects the strong expectations of Trump’s winning. However, the uncertainties of the Fed rate decision and the US election ahead still lead to a bumpy recovery of Bitcoin. We believe Bitcoin will retest the March all-time high and probably will create new highs after the election.

2024 US presidential election prediction

(Source: Bloomberg)

- Bitcoin ETF options approved. The Securities and Exchange Commission (SEC) has granted approval for the NYSE and CBOE to list options on spot Bitcoin ETFs. This will enhance capital inflows, and meanwhile, volatilities will enlarge. The trading volumes of Bitcoin ETFs and Bitcoin will increase accordingly.

- 4Q24 earnings review. Revenue increased 104.8% YoY to US$1.45bn, exceeding expectations by US$90mn. GAAP EPS was US$0.14, missing expectations by US$0.78.

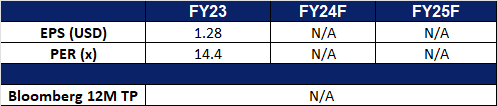

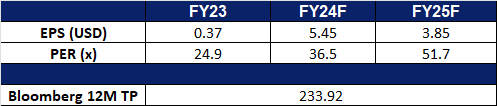

- Market consensus.

(Source: Bloomberg)

Deckers Outdoor Corp (DECK US): Upcoming shopping spree

Deckers Outdoor Corp (DECK US): Upcoming shopping spree

- RE-ITERATE BUY Entry – 156 Target – 180 Stop Loss – 146

- Deckers Outdoor Corporation designs and markets footwear and accessories. The Company offers footwear for men, women and children. Deckers sells its products including, accessories such as handbags, headwear, and outerwear. Deckers Outdoor serves customers in the United States.

- HOKA’s Growth Momentum. With the rise of professional outdoor sports in China, HOKA’s road running, trail running, and hiking shoes have gained significant traction in the market. The brand’s rapid expansion in China is driven by double-digit growth in the country’s trail running shoe segment. Deckers is capitalizing on this demand by increasing its store count and planning to open a flagship store in China. Over the past four years, HOKA has maintained an impressive annual revenue growth rate exceeding 50%, reaching US$1.41bn in FY24, with projections to hit US$2bn in FY25.

- UGG’s Resurgence. UGG snow boots have experienced a revival in the past two years, driven by the Y2K fashion trend, which draws inspiration from the late 1990s and early 2000s. This trend has contributed to a rapid rise in UGG’s sales, as the boots have become a popular choice once again among fashion-conscious consumers.

- Optimism for 4Q24. Deckers is well-positioned to benefit from the year-end shopping season in both China and Western markets. Key events such as China’s Double 11 Shopping Festival and Black Friday in Europe and the US provide strong opportunities for retail brands to boost their sales and meet annual targets. Historically, consumer discretionary stocks, especially those in the retail sector, perform well in November and December, and Deckers is likely to see a positive impact from better-than-expected holiday sales performance and strong Christmas season guidance in Western markets.

- 2Q25 earnings review. Revenue grew by 20.2% YoY to US$1.31bn, beating estimates by US$110mn. GAAP ESP was US$1.59, beating estimates by US$0.35. The company expects net sales to increase approximately 12% to $4.8bn gross margin to be in the range of 55% to 55.5%, and diluted EPS to be in the range of $5.15 to $5.25.

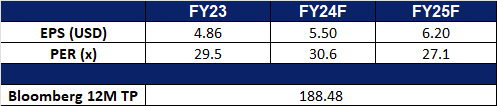

- Market consensus.

(Source: Bloomberg)

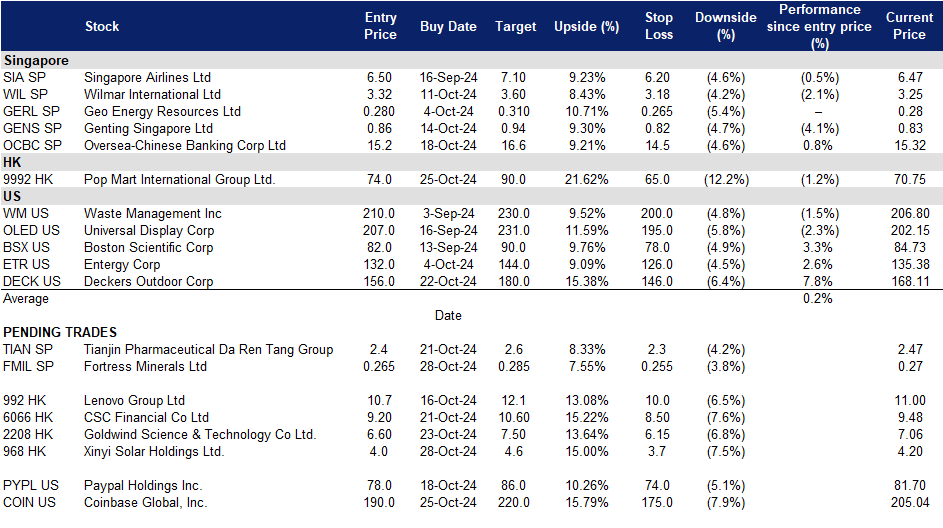

Trading Dashboard Update: Add Pop Mart International Group Ltd. (9992 HK) at HK$74.0. Cut loss on China State Construction International (3311 HK) at HK$11.6 and Affirm (AFRM US) at US$41.0.