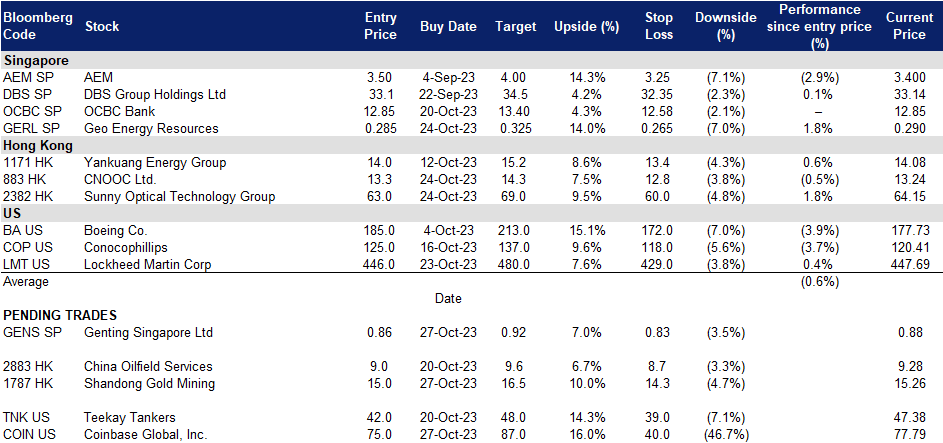

27 October 2023: Genting Singapore Ltd (GENS SP), Shandong Gold Mining (1787 HK), Lockheed Martin Corp (LMT US)

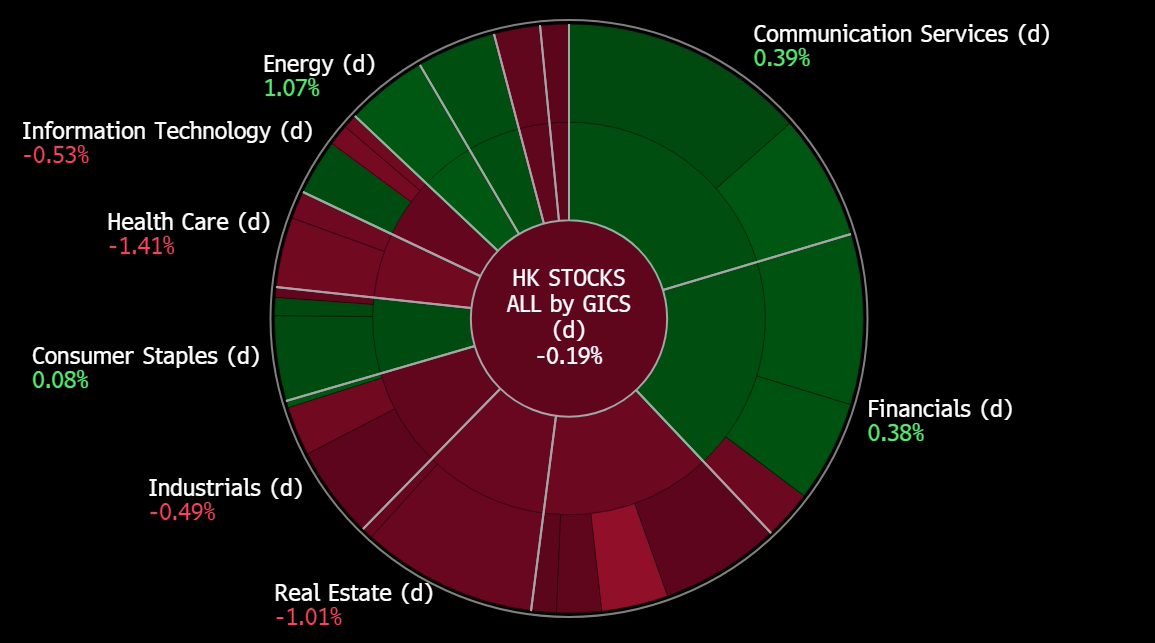

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

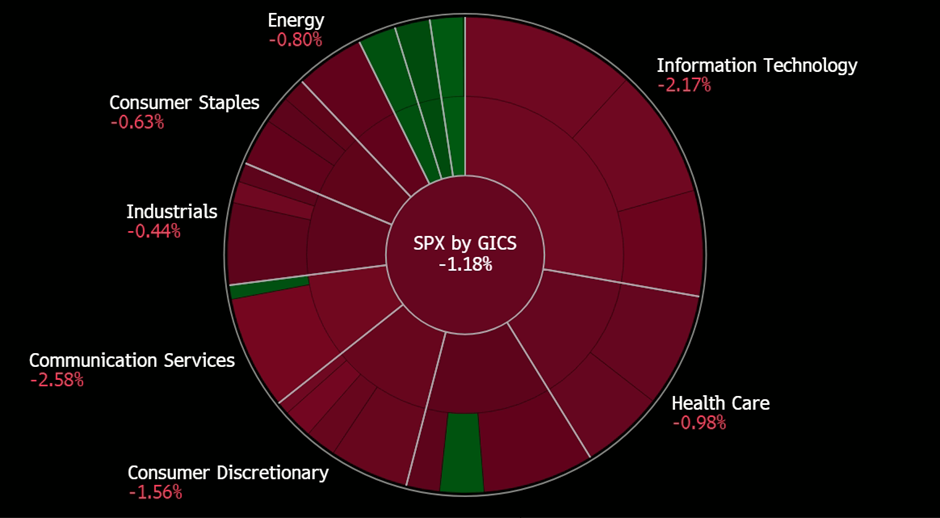

United States

Hong Kong

Genting Singapore Ltd (GENS SP): Bottoming out

- BUY Entry 0.86 – Target – 0.92 Stop Loss – 0.83

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

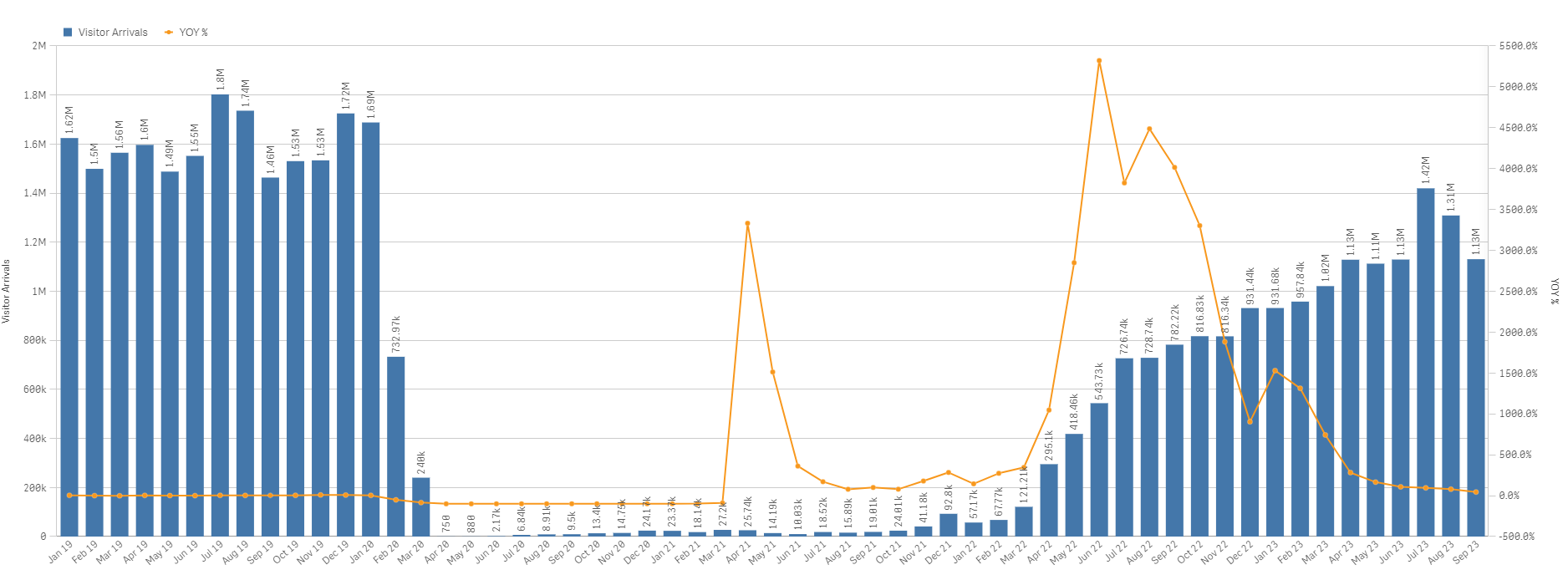

- Tourism expected to increase. Despite a slight decline from the peak of 1.42mn visitors in July, an increase in visitor numbers to Singapore is anticipated for the remainder of the year. Singapore is positioning itself as a global entertainment hub, attracting tourists with high-profile events like the F1 Grand Prix and upcoming concerts by Coldplay and Taylor Swift, which are expected to significantly boost the tourism sector and benefit airlines, airport services, and entertainment companies. Genting Singapore’s Resorts World Sentosa (RWS) could experience a boost in visitors. This increased footfall can translate into higher revenue for RWS, which could, in turn, lead to higher profits. Furthermore, the anticipation of more Chinese tourists visiting Singapore in 4Q23 aligns with Genting Singapore’s potential for revenue growth in FY24.

- Singapore Tourism Board partnership with Trip.com. Trip.com and the Singapore Tourism Board have extended their partnership for three more years. They will work together to promote inbound travel to Singapore, enhance the visitor experience, and highlight Singapore’s offerings for meetings, incentives, conferences, and exhibitions (MICE). The collaboration includes launching marketing campaigns in several countries and developing new products and custom itineraries. The partnership aims to capitalise on the increasing number of Chinese tourists visiting Singapore and strengthen the country’s position as a preferred travel destination.

Singapore monthly visitor arrivals trend (2019-2023)

(Source: Singapore Tourism Analytics Network)

- Correlation between tourists and revenue. Genting Singapore reported a significant increase in net profit and revenue for 1H23. The company attributed this improved performance to an increase in foreign visitor arrivals to Singapore, despite challenges such as limited air capacity from certain regional countries and higher airfares affecting leisure travel. Resorts World Sentosa (RWS) saw a 37% growth in adjusted earnings in 2Q23, mainly due to a rebound in the non-gaming business, a strong VIP win rate, and a recovery in regional gaming activities. Gross gaming revenue also rose 3% on a hold-normalised basis, reaching $547.9mn. We anticipate continued growth in Genting’s revenue from the increase in visitor arrivals in 2H23 alongside its strong VIP gaming segment and keys added to its newly refurbished Ora Hotel.

- Project timeline. Genting Singapore previously mentioned that it aims to begin construction in FY24 after government approvals on the new Waterfront building, the Equarius Hotel extension and the Health and Wellness Centre.

- 1H23 earnings. The company revenue rose to S$1,080.4mn, +63% YoY compared to 1H22. The company’s net profit for the period was S$276.7mn, more than 3 times the net profit in 1H22 of S$84.4mn. Basic earnings per share were S$2.29 cents compared to the previous S$0.70 cents in 1H22. It also paid out an interim dividend of S$1.5cents on 22 September 2023.

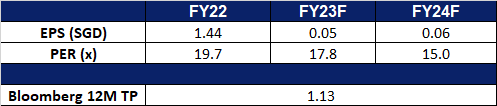

- Market Consensus.

(Source: Bloomberg)

Geo Energy Resources Limited (GERL SP): Seasonality tailwinds

- RE-ITERATE BUY Entry 0.285 – Target – 0.325 Stop Loss – 0.265

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third-party mine owners, and sells coal to coal traders and export companies.

- War chest secured. The company announced that it has secured US$200mn term loan facilities with an 8.5% p.a. Interest rate and tenor of up to 5 years from Bank Mandiri. The loan is used for potential acquisitions, working capital and other expenditures.

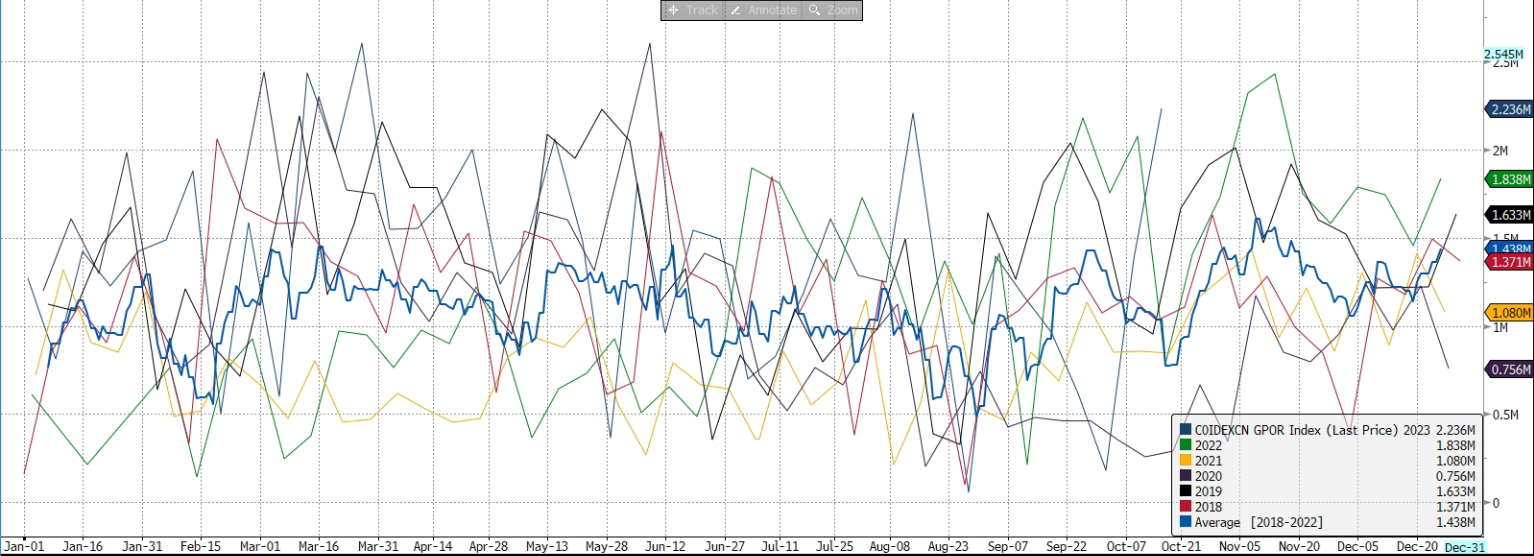

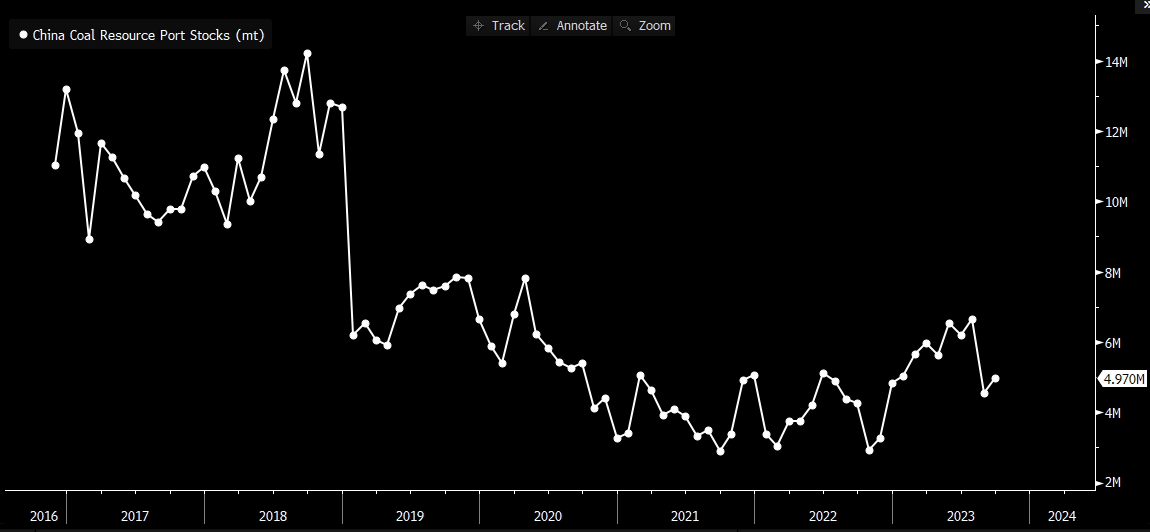

- Re-stocking season coming. China’s economic recovery has been lukewarm since its reopening in 4Q22. However, its coal demand remains resilient as higher electricity consumption is driven by the recovery in the service sectors. Meanwhile, the increasing penetration of electric vehicles also drives power demand higher. Seasonally, 4Q is the peak season of both electricity and coal demand, and hence, power companies start restocking their coal inventories for the coming winter. Accordingly, coal prices are expected to edge up higher.

Indonesia’s coal exports to China seasonality

(Source: Bloomberg)

China port coal stocks

(Source: Bloomberg)

Indonesia 4,200 GAR coal futures

(Source: Bloomberg)

- Attractive dividend yield. Geo Energy has been paying consistent quarterly dividends. The current trailing 12M dividend yield is 20.3%.

(Source: Bloomberg)

Shandong Gold Mining (1787 HK): Shinning gold

- BUY Entry – 15.0 Target – 16.5 Stop Loss – 14.3

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

- Rising global geopolitical tension. The ongoing Israle-Hamas conflict is likely to escalate regional tensions. This week, China’s 6 warships were stationed in the Middle East, and the authority proclaimed that these warships were on routine escort missions instead of being involved in the conflict. The US previously deployed two aircraft carriers to the eastern Mediterranean. Meanwhile, China and Russia strengthen their relationships to work on the Middle East solution. Rising global geopolitical tensions lead to the pursuit of safe haven assets such as gold.

- Defying strong USD. Generally, gold and USD perform an inverse correlation. However, recent movements of the two assets broke the general rule, as US Dollar index stayed firmly at around 106 but gold rebounded by nearly 10% over the past two weeks. Meanwhile, the 10-year US Treasuries yield climbed to a high of 5% since 2007. Right now the yields remain elevated. The abnormal gold’s performance under such as a backdrop is attributable to fear sentiment towards the unrest in the Mediterranean region.

- Positive profit alert. The company announced that it expected 9M23 net profit attributable to shareholders to be in the range between RMB1.2bn and RMB1.4bn, up 73.17% to 102.03% YoY. The adjusted 9M23 net profit attributable to shareholders is estimated to be in the range between RMB1.135bn and RMB1.335bn, up 50.01% to 76.45% YoY.

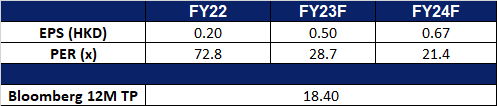

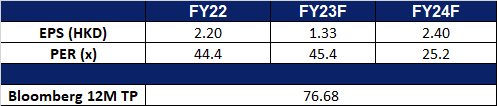

- Market Consensus.

(Source: Bloomberg)

Sunny Optical Technology Group (2382 HK): A smart recovery

- RE-ITERATE BUY Entry – 63.0 Target – 69.0 Stop Loss – 60.0

- Sunny Optical Technology (Group) Company Limited is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components, Optoelectronic Products and Optical Instruments. Through its subsidiaries, the Company is also engaged in the research and development of infrared technologies. The Company distributes its products in domestic market and to overseas market.

- Recovery of China’s smartphone market. China’s smartphone market, which has been declining since the beginning of the year, is showing signs of recovery, thanks to strong demand for Huawei’s new 5G phones and Apple’s recently launched iPhone 15 series. The recent “golden week” holiday saw a 15% YoY growth in smartphone sales in China. The global smartphone market also underwent a slight drop of 1% in 3Q23, signalling a slowdown in its decline, and also recorded double-digit sequential growth in 3Q23, ahead of the sales seasons, supported by regional recoveries and new product upgrade demand. Sunny Optical would be able to tap on the recovery of the smartphone market to drive sales to its customers.

- Huawei’s Mate 60 Pro handsets surging sales. Huawei Technologies reportedly sold 1.6mn of its Mate 60 Pro handsets in 6 weeks, despite a slowdown in the global smartphone market. Huawei also saw strong demand for its high-end smartphone renaissance over the same period in which Apple launched the iPhone 15 in mainland China, with its stocks being swiftly bought up as soon as it became available. With Huawei being one of Sunny Optical’s biggest customer for camera modules, Sunny Optical is bound to benefit from the strong demand for high-end Huawei’s products.

- 1H23 earnings. Revenue fell by 15.9% YoY to RMB14.28bn, compared to RMB16.97bn in 1H22. Net profit fell by 66.7% YoY to RMB459.4mn, compared to RMB1.38bn in 1H22. Basic EPS fell by 67.8% YoY to RMB39.99, compared to RMB124.13 in 1H22.

- Market Consensus.

(Source: Bloomberg)

Coinbase Global Inc (COIN US): Bull run kickstarted

- BUY Entry – 75 Target – 87 Stop Loss – 69

- Coinbase Global, Inc. provides financial solutions. The Company offers platform to buy and sell cryptocurrencies. Coinbase Global serves clients worldwide.

- Spot Bitcoin ETF. The prospect of the first US spot Bitcoin ETF gaining approval from the SEC has caused a surge in Bitcoin prices. This rally is fuelled by market expectations that the SEC will shift its long-standing policy of rejecting spot ETFs, given applications from industry giants like BlackRock and Franklin Templeton. If approved, this would cement Bitcoin’s status as a recognised asset class, offering a more secure and cost-effective method for people to invest in cryptocurrency. The SEC is expected to deliver its initial verdict on ETF filings early next year. Additionally, Coinbase Singapore has secured a Major Payment Institution licence from the Monetary Authority of Singapore, enabling the exchange to broaden its digital payment token services to both individuals and institutions within the nation.

- Bitcoin hit new high. Bitcoin recently hit a new high of US$35,000, since May 2022. After consolidating at around US$26,000, Bitcoin price surged due to investors’ optimism on the approval of the ETF. Bitcoin is halved every 4 years, and the next halving date is April 25 2024. Bitcoin halving leads to a slowdown in mining output. In other words, the supply of Bitcoin after the halving date will be less. Based on the previous two halvings, Bitcoin experienced bull cycles for 18 months (Previous two halving dates: July 9 2016 and May 11 2020). Historically, Bitcoin’s upward momentum started 6 months before the halving date. Therefore, the Bitcoin upcycle could have started currently.

Bitcoin Halving

(Source: Bloomberg)

- Priced in one more rate hike expectation. The current sell-off in growth/risky assets is attributable to prolonged high rate expectations. Given a robust labour market in the US and sticky inflation, the Fed is expected to hike another 25bps by the end of 2023. Meanwhile, the US 10-year government yield reanched near 4.9%, a high since 2007. However, the plunge in oil prices and the soft consumer spending mitigated the inflation pressure. Peak rate expectations remain, and risky assets are expected to rebound in the near term.

- 2Q23 results. Revenue rose to US$707.9mn, down 12.4% YoY, beating expectations by US$70.1mn. GAAP EPS beat estimates by US$0.36 at -US$0.42.

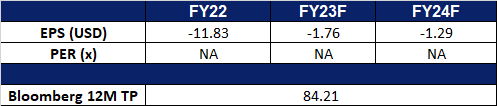

- Market consensus.

(Source: Bloomberg)

Lockheed Martin Corp (LMT US): Increasing safeguards due to worsening conflict

- RE-ITERATE BUY Entry – 446 Target – 480 Stop Loss – 429

- Lockheed Martin Corporation is a global security company that primarily researches, designs, develops, manufactures, and integrates advanced technology products and services. The Company’s operations span space, telecommunications, electronics, information and services, aeronautics, energy, and systems integration. Lockheed Martin operates worldwide.

- Israeli-Hamas conflict impact. The Israel-Hamas conflict, which has recently escalated and extended for more than a week, is causing significant regional uncertainty in the Middle East. This heightened conflict raises concerns about the defence industry. It can impact this industry by driving an increased demand for military equipment, potentially leading to higher weapon sales, fostering innovation and technological development in defense, creating export opportunities for nations supporting Israel, and influencing broader geopolitical dynamics that can affect global defense strategies and investments. Conflict situations often stimulate growth and innovation in the defence sector, with potential ripple effects across the industry. Israel’s close relationship with the U.S. may lead to additional support from American defence companies, potentially boosting defence contracts and sales. This regional instability could also create export opportunities for defence companies in supporting nations, further influencing global defence industry dynamics.

- US supplying arms to Israel. The Pentagon plans to send tens of thousands of 155mm artillery shells to Israel. Originally, these shells were intended for Ukraine but will now be diverted to Israel. The Israel Defense Forces and the Israeli Ministry of Defense expressed the urgent need for these artillery shells to prepare for potential conflicts in Gaza and along the Israel-Lebanon border. US officials believe that redirecting the shells to Israel will not immediately impact Ukraine’s capabilities in its conflict with Russia. While there’s concern about potential regional conflicts, the Pentagon is confident it can support both Ukraine and Israel in meeting their defence needs. This decision follows Israel’s increased use of artillery in response to recent hostilities. The ammunition was part of a US weapons stockpile in Israel, and the US agreed to send it back to Israel in response to the urgent request.

- Better expectations ahead. Lockheed Martin saw strong demand for its military equipment amid geopolitical tensions in Q3. The company reported weak sales in the F-35 fighter jet unit but the ongoing conflict in Ukraine has led to increased demand for weapons like shoulder-fired missiles and artillery, benefiting defense companies. Lockheed’s weapons, including the multiple launch rocket system and Javelin anti-tank missiles, have been crucial in Ukraine’s defense. However, pandemic-related labour and supply chain disruptions, particularly in the aeronautics business, have impacted the company’s performance. Sales in the aeronautics unit declined by 5.2% in the third quarter, while revenue from the Missiles and Fire Control unit increased by 3.8%. With the recent Israeli-Hamas conflict, it is anticipated that there will be an increase in sales demand.

- 3Q23 results. Revenue rose 1.8% year-over-year to US$16.88bn, beating estimates by US$160mn. Non-GAAP EPS of $6.77 beat expectations by $0.15. FY2023 outlook: Net sales of $66.25bn – $66.75bn vs. consensus of $66.64bn; Diluted EPS of $27 to $27.2 vs. consensus of $27.11. Increased share repurchase authority by $6.0bn to a total authorisation of $13.0bn.

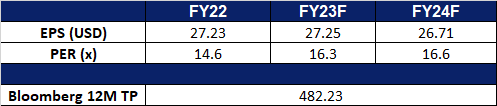

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Coinbase Global Inc (COIN US) at US$87.