25 October 2024: Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP), Pop Mart International Group Ltd. (9992 HK), Coinbase (COIN US)

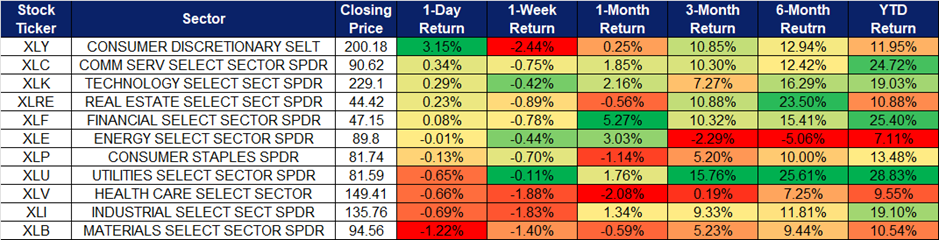

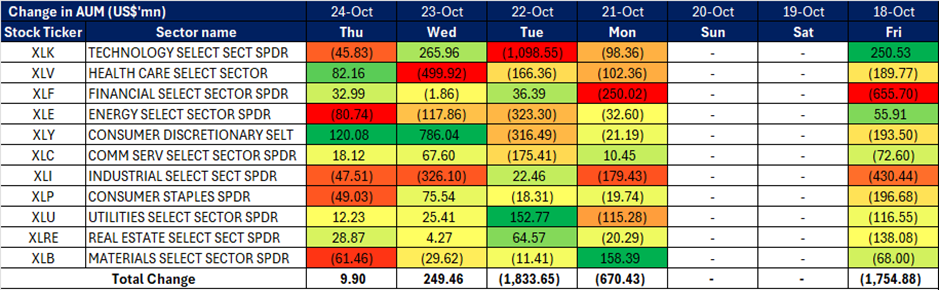

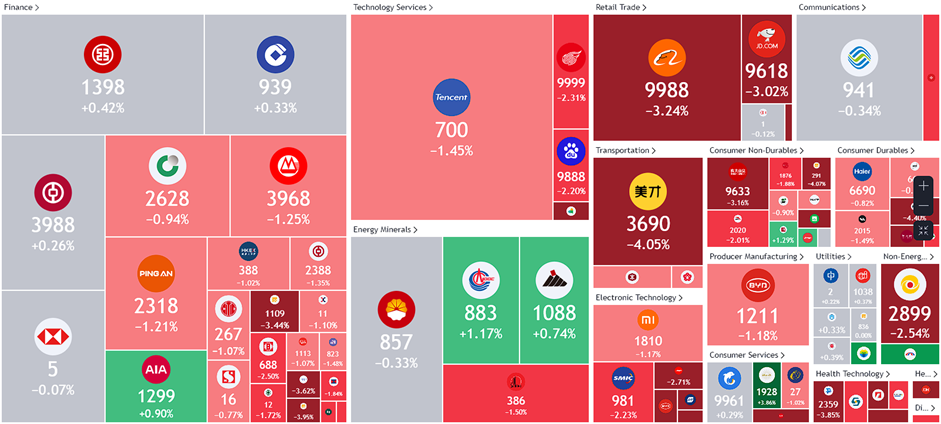

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

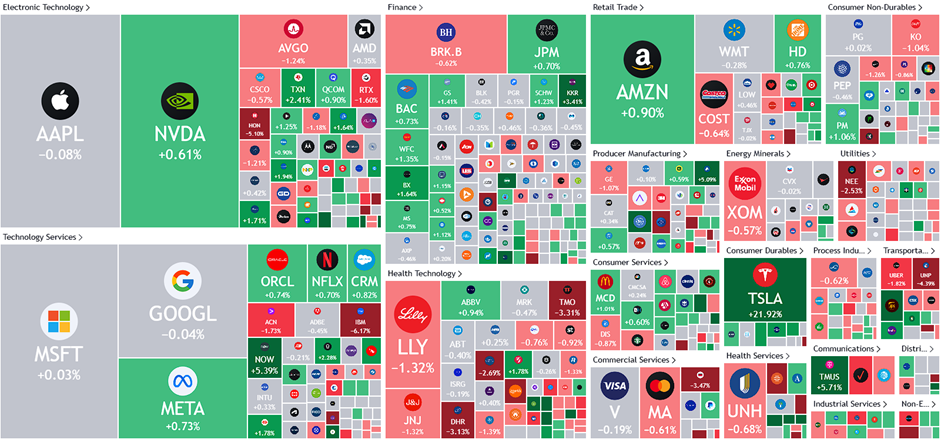

United States

Hong Kong

Tianjin Pharmaceutical Da Re Tang Group Corp Ltd (TIAN SP): Enhancing the world’s second-largest pharmaceutical market

- RE-ITERATE BUY Entry – 2.4 Target– 2.6 Stop Loss – 2.3

- Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited produces and sells traditional Chinese medicine, western medicine, health products, and healthcare instruments. The Company also manufactures gene-related biopharmaceutical products. Tianjin Pharmaceutical Da Ren Tang Group markets its products under the Great Wall, Cypress, and Health brand names.

- Policy support. China’s government is accelerating the development of its pharmaceutical market by implementing policies that emphasize innovation and R&D. The Government Work Report, passed in 2024, outlines measures to modernize the country’s industrial system, including financial incentives, subsidies, and the creation of high-tech science parks. These initiatives aim to boost the domestic biotech industry, enhance innovation, and support the development of new drugs. Additionally, China has introduced national reimbursement for innovative therapies and seen a rise in FDA-approved drugs and out-licensing deals, particularly in oncology, further demonstrating the government’s commitment to advancing the pharmaceutical sector. These will help to support Tianjin Pharmaceutical’s research and development of more products and instruments.

- New joint venture. Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited (formerly known as Tianjin Zhong Xin Pharmaceutical Group) is entering into an amended equity joint venture agreement regarding Tianjin TSKF Pharmaceutical Co., Ltd., alongside Haleon UK Services Limited and Haleon China Co., Ltd. This initiative includes extending the JV company’s operating period to 30 June 2025 and disposing of a 13% equity interest in the JV to Haleon China. Post-disposal, the equity structure will be adjusted, with Haleon UK holding 55%, Haleon China 33%, and Tianjin Da Ren Tang 12%.

- 1H24 results review. Revenue for 1H24 decreased by 3% YoY to RMB 3,965mn, a decrease of approximately RMB 124mn, driven mainly due to a YoY decrease in sale of goods. The profit attributable to equity holders in 1H24 was approximately RMB 658mn, a decrease of approximately RMB 65mn, or 9% from RMB 722mn of the corresponding period in 1H23. Earnings per share for 1H24 was RMB 0.85, lower than the RMB 0.94 in 1H23.

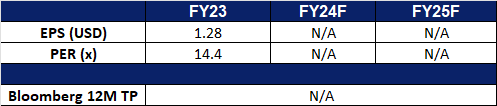

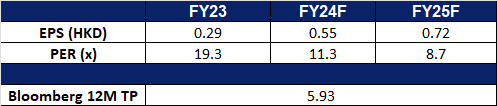

- Market Consensus.

(Source: Bloomberg)

Oversea-Chinese Banking Corp Ltd (OCBC SP): Increased banking activity

- RE-ITERATE BUY Entry – 15.2 Target– 16.6 Stop Loss – 14.5

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Positive sentiment from the US banks. Despite declining interest rates impacting net interest income, US banks delivered strong third-quarter results, fuelled by increased deal-making and corporate debt issuance. There is growing optimism that the upcoming interest rate cuts will continue to boost deal activity as borrowing costs decline. Furthermore, with the strong stock market and expectations of a soft economic landing in the US are also boosting dealmakers’ confidence. This positive sentiment in the US banking sector has also extended to the banking market in Singapore.

- Collaboration with Disney. OCBC and Disney have announced a five-year strategic partnership across Singapore, Malaysia, and Indonesia, aimed at significantly increasing OCBC’s new customer base in Southeast Asia by 2029. The collaboration includes the launch of the OCBC MyOwn Account for children aged 7-15, allowing them to manage their own accounts under parental supervision via the OCBC app. The partnership will also feature Disney-themed bank cards, financial literacy materials with Disney characters, and related merchandise by mid-2025. OCBC highlighted that the partnership will help attract new customers by offering unique, non-price-based products and services.

- Increase in SME transactions. The OCBC SME Index saw gains for the second consecutive quarter, reaching 50.8 in 3Q24, up from 50.2 in 2Q24. This improvement reflects a slight increase in collections and payments by SMEs, supported by cooling inflation and stronger external demand. In a survey of 1,100 SMEs, 40% reported better business performance, up from 35% in the previous quarter. Looking ahead, 48% of SME owners expect further improvement over the next six months, while 40% foresee stable conditions. Singapore’s GDP growth for 3Q24 is estimated at over 3.5%, surpassing earlier forecasts. Despite, potential risks from geopolitical tensions and economic uncertainties, OCBC anticipates continued expansion in the fourth quarter and relative stability in the year ahead.

- 1H24 results review. Total income for 1H24 increased by 7% YoY to S$7.26bn, net interest income and non-interest income rose 3% and 15% YoY respectively. Net profit increase by 9% YoY to S$3.93bn in 1H24, compared to S$3.59bn in 1H23, mainly due to record total income and lower allowances. The Board declared an interim dividend of S$0.44, up 10% or S$0.04 from a year ago, representing a payout ratio of 50% of the Group’s 1H24 net profit.

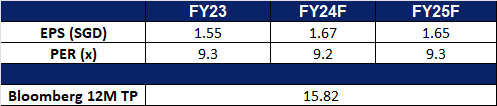

- Market Consensus.

(Source: Bloomberg)

Pop Mart International Group Ltd. (9992 HK): Labubu Craze

- BUY Entry – 74.0 Target 90.0 Stop Loss – 65.0

- Pop Mart International Group Ltd is a China-based company mainly engaged in the provision of pop toy. intellectual property (IP) is at the core of its business. It has established an integrated platform covering the entire industry chain of pop toys, including artists development, IP operation, consumer access and pop toy culture promotion. The Company develops a broad array of pop toy products based on its IPs. Its Pop Mart brand products are primarily categorized into blind boxes, action figures, ball-jointed doll (BJDs) and accessories. The Company conducts its businesses within the China market and to overseas markets.

- In trendy series continue to rake in revenue. Pop Mart’s Labubu series recently went viral globally, thanks in part to a social media post by BLACKPINK’s Lisa. Combined with endorsements from several other celebrities, this surge in visibility has sparked overwhelming demand for Labubu toys, with products consistently selling out both in stores and online shortly after release. The Labubu series generated RMB 626.8 million in sales during the first half of 2024 and is on track to become Pop Mart’s top IP by revenue for the year. Other popular series, such as Molly and Skullpanda, have also performed exceptionally well, bringing in RMB 782.1 million and RMB 574.3 million in revenue, respectively, as of 1H24.

- Better than expected 3Q24 business updates. Pop Mart recently released its 3Q24 business update, projecting revenue to more than double YoY. The company expects overall revenue to grow by 120%-125% YoY. Revenue from operations in Mainland China increased by 55%-60% YoY, while revenue from Hong Kong, Macao, Taiwan, and overseas markets surged by 440%-445% YoY. This significant growth in overseas revenue highlights the success of Pop Mart’s expansion efforts and its strengthening market presence outside China. The company’s global growth strategy is clearly paying off, contributing substantially to its overall performance.

- Expanding presence locally and overseas. Pop Mart, the renowned high-end toy brand, has officially opened a store at Sun World Ba Na Hills in Da Nang, creating a highly artistic space. Situated in a prime location atop Ba Na Hills, the store features impressive interior architecture resembling a grand castle, inspired by the artistic and cultural charm of an old French village. This marks Pop Mart’s first store in a Southeast Asian theme park. Visitors can explore iconic characters like Molly, SkullPanda, Hirono, Dimoo, and The Monsters, making each visit a unique artistic experience. In addition, Pop Mart recently launched its first theme park in Beijing, transforming Chaoyang Park—the city’s largest park—into an immersive entertainment space filled with beloved characters like Molly, Labubu, and Dimoo. These expansions, coupled with the growing popularity of The Monsters and Molly series, are set to attract even more visitors and strengthen Pop Mart’s global presence.

- 1H24 earnings. The company’s revenue rose to RMB4.56bn in 1H24, +62.0% YoY, compared to RMB2.81bn in 1H23. The company’s net profit rose by 93.3% YoY to RMB964.1mn in 1H24, compared to RMB477.2mn in 1H23. Basic earnings per share rose to RMB69.49 in 1H24, compared to RMB35.46 in 1H23.

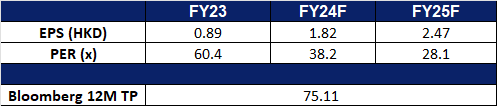

- Market consensus.

(Source: Bloomberg)

Goldwind Science & Technology Co Ltd. (2208 HK): Spurring investments into renewable energy

- RE-ITERATE BUY Entry – 6.60 Target 7.50 Stop Loss – 6.15

- Goldwind Science & Technology Co Ltd, formerly Xinjiang Goldwind Science & Technology Co Ltd, is a China-based company that provides overall solutions for wind turbines, wind power services and wind farm development. The Company operates its businesses through four segments. The Wind Turbine Manufacturing and Sales segment is mainly engaged in the research and development, manufacturing and sales of wind turbines and their parts. The Wind Power Service segment mainly provides wind power-related consultants, wind farm construction and maintenance and transportation services. The Wind Farm Development segment is mainly engaged in the development and operation of wind farms. Other segment is mainly engaged in financial leasing and water treatment development and operation business. The Company conducts its businesses both in the domestic market and overseas markets.

- New Renewable Energy Consumption Benchmarks. China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) have jointly released updated requirements for the percentage of energy that provinces must source from renewable generators in 2024 and 2025. These requirements are part of China’s renewable energy consumption guarantee mechanism, mandating a significant increase in the share of renewable energy in several provinces. The document also outlines tentative renewable energy consumption targets for 2025. Current data reveals that six provinces experienced increases exceeding 6 percentage points in their renewable energy consumption mandate between 2023 and 2024. China remains on track to achieve its renewable energy goals, aiming for renewable energy, including hydropower, to account for 40 percent of total national energy consumption by 2030. This benchmarks are likely to spur on more investment into renewable energy as well.

- Increasing use of renewable energy in China. China’s renewable energy utilization has reached or exceeded advanced international levels, demonstrating rapid progress in sustainable energy. The country has maintained strong momentum in renewable energy adoption, with a utilization rate of 97.6%, surpassing 95% for six consecutive years since 2018. Last year, newly installed renewable energy capacity rose to 290 million kW, 2.4 times that of 2022, accounting for 79% of the total new power generation capacity nationwide, making it the primary source of new power generation. This surge in capacity has spurred significant investments in solar, wind, and hydropower projects across the country. These efforts are part of China’s broader strategy to peak carbon emissions before 2030 and achieve carbon neutrality before 2060. Furthermore, China’s National Energy Administration also recently reported that 486 million Green Electricity Certificates (GECs) were issued during the first half of 2024– a 13-fold increase compared to the same period last year, further signalling progress towards the decarbonisation and reform of the power sector. Goldwind is likely to benefit from the increased investment and spending in renewable energy.

- Expanding presence. Goldwind Science & Technology has officially opened its first overseas wind turbine manufacturing plant in Brazil. The facility has begun production with a capacity to produce up to 150 turbines annually. Valued at approximately $18.2 million, this investment aims to strengthen local supply chains and leverage the region’s rich wind resources. While the plant will primarily serve the Brazilian market, it is also positioned to export equipment across South America via the port of Bahia. With this new facility, Goldwind is expected to secure a 24% to 30% share of the Brazilian wind turbine market.

- 1H24 earnings. The company’s revenue rose to RMB20.1bn in 1H24, +6.53% YoY, compared to RMB18.9bn in 1H23. The company’s net profit rose by 6.74% YoY to RMB1.44bn in 1H24, compared to RMB1.35bn in 1H23. Basic earnings per share rose to RMB0.32 in 1H24, compared to RMB0.28 in 1H23.

- Market consensus.

(Source: Bloomberg)

Coinbase (COIN US): Expect the rally to continue

- BUY Entry – 190 Target – 220 Stop Loss – 175

- Coinbase Global Inc provides financial infrastructure and technology for the crypto economy in the United States and internationally. The company offers consumers a primary financial account in the crypto economy; and a marketplace that provides institutional investors with a liquidity pool for trading crypto assets. It also provides technology and services that enable developers to build crypto products and securely accept crypto assets as payment.

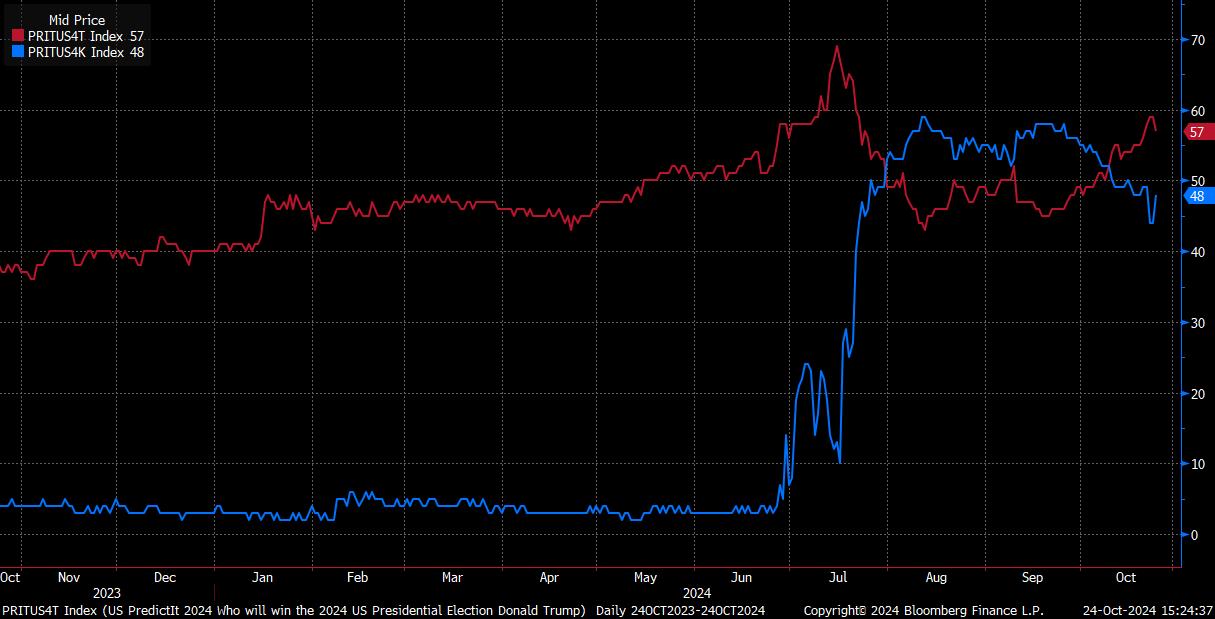

- Rising Trump-themed trades. The 2024 US election is less than two weeks. According to Bloomberg, Trump maintains the leading advantage against Harris by 9 pts. Funds have been betting on Trump-themed trade since early October. Cryptocurrencies are one of the asset classes that will benefit from Trump’s administration as he vowed to turn the US into the crypto capital of the planet and the Bitcoin superpower of the world. The recent upswing of Bitcoin reflects the strong expectations of Trump’s winning. However, the uncertainties of the Fed rate decision and the US election ahead still lead to a bumpy recovery of Bitcoin. We believe Bitcoin will retest the March all-time high and probably will create new highs after the election.

2024 US presidential election prediction

(Source: Bloomberg)

- Bitcoin ETF options approved. The Securities and Exchange Commission (SEC) has granted approval for the NYSE and CBOE to list options on spot Bitcoin ETFs. This will enhance capital inflows, and meanwhile, volatilities will enlarge. The trading volumes of Bitcoin ETFs and Bitcoin will increase accordingly.

- 4Q24 earnings review. Revenue increased 104.8% YoY to US$1.45bn, exceeding expectations by US$90mn. GAAP EPS was US$0.14, missing expectations by US$0.78.

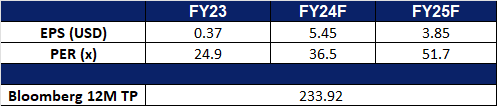

- Market consensus.

(Source: Bloomberg)

PayPal Holdings Inc (PYPL US): Spending to rise

PayPal Holdings Inc (PYPL US): Spending to rise

- RE-ITERATE BUY Entry – 78 Target – 86 Stop Loss – 74

- PayPal Holdings, Inc. operates as a holding company. The Company, through its subsidiaries, provides technology platform that enables digital and mobile payments on behalf of consumers and merchants. The Company offers online payment solutions. PayPal Holdings serves customers worldwide.

- Declining interest rates. Despite consumer sentiment declining to 68.9 in October from 70.1 in September, below forecasts of 70.8, inflationary pressures continue to affect consumers with persistently high prices. However, with 50bps rate cuts in September and another 50bps expected by year-end, the economic environment is starting to shift. The effects of these rate cuts have already begun to materialize, as seen in increased mergers and acquisitions among corporations, signalling more activity in the business sector. Inflationary pressures on consumption are expected to gradually ease, though consumers may still feel the pinch in the short term. During this period, more people may turn to PayPal’s “Buy Now, Pay Later” (BNPL) options, such as its “Pay in 4” checkout method, which allows users to make purchases in bi-weekly installments. This could incentivize higher spending as consumers look for ways to manage their cash flow while still making necessary purchases. For higher-value items, consumers may opt for monthly installment payments, where PayPal stands to benefit not only from increased transaction volumes and fees but also from the Annual Percentage Rate charged to consumers using the “Pay Monthly” option. With lowering interest rates and the upcoming holiday season, consumer spending is expected to rise, even among those who may not have the immediate funds to purchase items outright. The BNPL function will enable these consumers to buy now and pay later, boosting overall consumer spending and driving higher revenue for PayPal.

- Launch a platform in China. PayPal has launched its Complete Payments platform in China, aimed at streamlining payments and receivables for businesses of all sizes, supporting cross-border transactions. The platform offers Chinese businesses various payment options, quick fund settlements, and risk management and fraud detection tools. It connects merchants to PayPal’s global network, enabling transactions in over 100 currencies and 200 regions, reaching over 400 million active users. The platform is integrated with WooCommerce and aims to help small- to medium-sized businesses grow by offering customized checkout experiences and advanced solutions. This geographical expansion to China will help PayPal to expand its global footprint.

- Expansion of its cryptocurrency offerings. PayPal now allows US merchants to buy, hold, and sell cryptocurrency through their business accounts, expanding on its crypto services for consumers, which started in 2020. This follows the launch of its stablecoin, PayPal USD, in 2023. PayPal’s merchants had expressed interest in the same cryptocurrency features available to consumers. Businesses would be able to transfer digital currency to third-party wallets and conduct blockchain transactions, though the service would not initially be available in New York. By integrating cryptocurrencies into its US platform, PayPal gains a competitive edge in the market, offering a broader range of payment solutions compared to other platforms.

- 4Q24 earnings review. Revenue increased 8.2% YoY to US$7.9bn, exceeding expectations by US$80mn. Non-GAAP earnings per share were US$1.19, beating expectations by US$0.20. The company guided for 3Q24 revenue growth of mid-single digit and GAAP EPS of US$0.96 to US$0.98. For FY24, PayPal expects GAAP EPS of US$3.88 to US$3.98 and non-GAAP EPS growth of low to mid-teens.

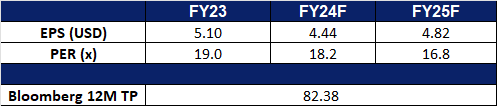

- Market consensus.

(Source: Bloomberg)

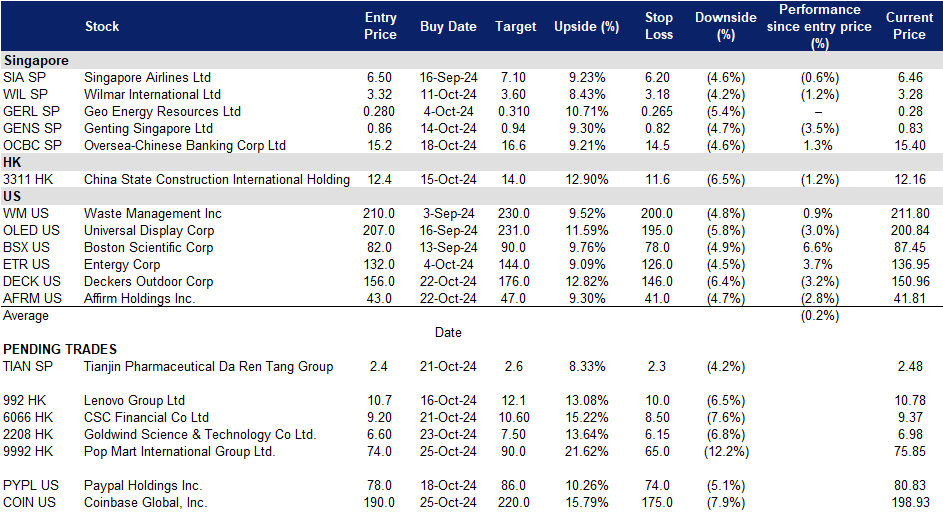

Trading Dashboard Update: Add Deckers Outdoor Corp. (DECK US) at US$156.0 and Affirm Holdings Inc. (AFRM US) at US$43.0. Cut loss on CapitaLand Investment Ltd (CLI SP) at S$2.90 and On Holdings AG (ONON US) at US$47.0.