22 November 2024: Propnex Ltd (OYY SP), Pop Mart International Group Ltd. (9992 HK), AppLovin Corporation (APP US)

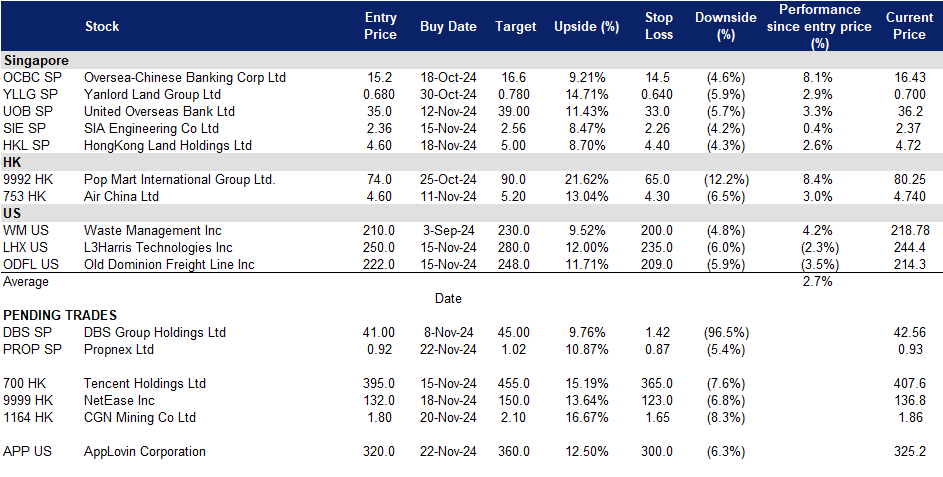

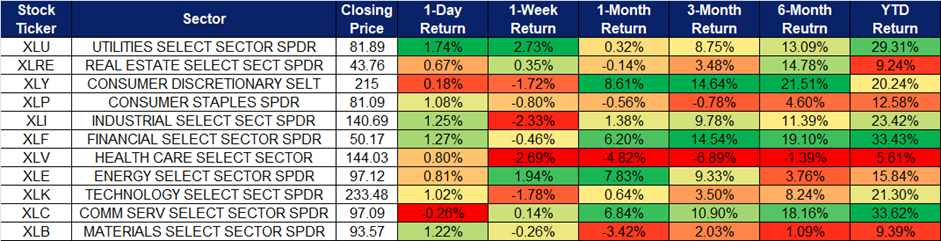

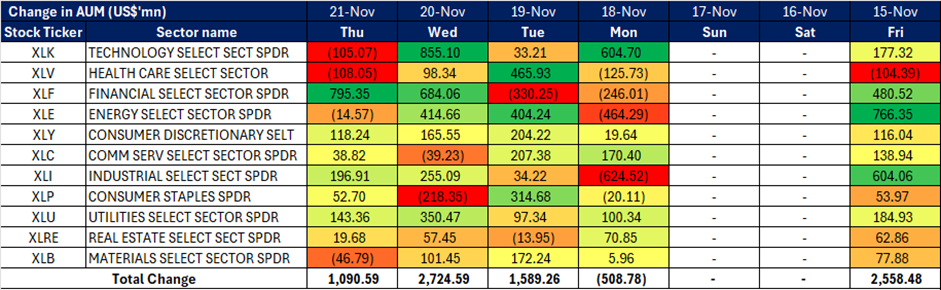

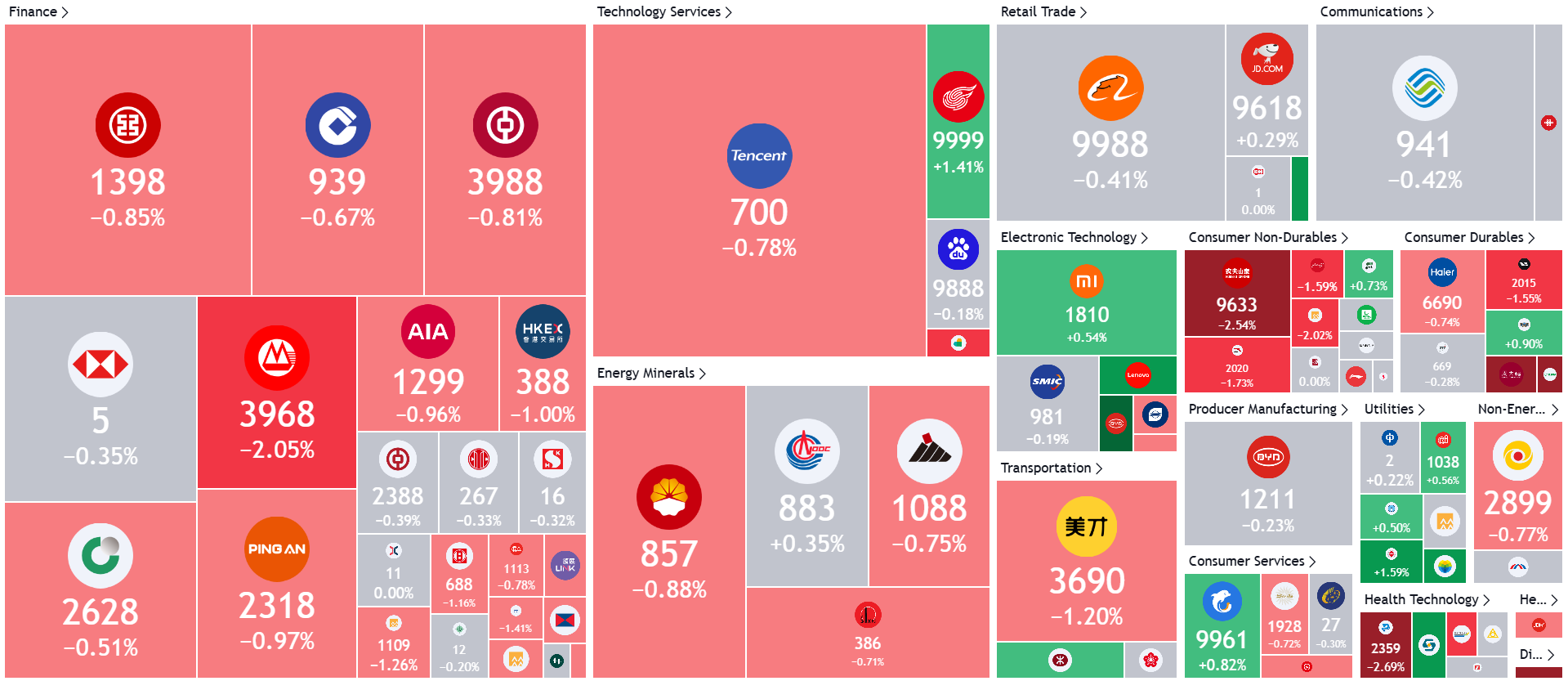

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

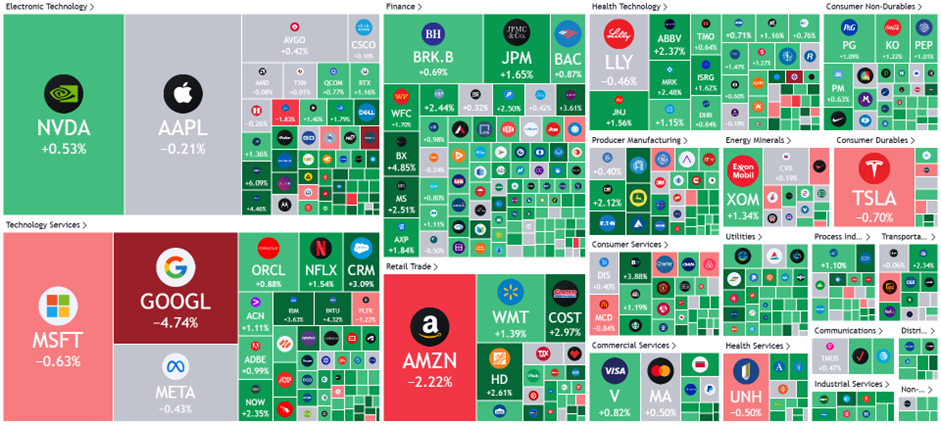

United States

Hong Kong

Propnex Ltd (OYY SP): Surge in home sales

- BUY Entry – 0.92 Target– 1.02 Stop Loss – 0.87

- Propnex Limited operates as a real estate agency. The Company offers business strategies, consultation, training, marketing support, and technological innovations for real estate sector, as buying, selling, and renting of properties. Propnex serves customers in Singapore, Indonesia, and Malaysia.

- Rebounding private home sales. New private home sales soared to an 11-month high in October, driven by increased launches from developers to meet growing buyer demand. This marks a continued recovery in market activity following a rebound in September, which reversed a 16-year low recorded in August. According to the Urban Redevelopment Authority, developers sold 738 private homes in October (excluding executive condominium units), an 84% increase from the 401 units sold in September and more than 3.5 times the 204 units sold in October 2023. The surge in sales is attributed to improving consumer confidence amid a strengthening economy and recent interest rate cuts, which have made mortgages more affordable. Momentum has carried into November, with over 2,000 units already sold, including the highly successful launch of Emerald of Katong, which achieved a near sell-out with a 99% take-up rate on its first booking day. PropNex is well-positioned to benefit from this strong resurgence in private home sales as market activity continues to gain pace.

- Private housing prices expected to continue rising. Private residential property prices declined by 0.7% in Q3 2024, reversing the 0.9% increase recorded in the previous quarter. Despite this short-term dip, the property price index for private residential properties remains on an upward trajectory, reaching 204.7—its highest level since the index began rising steadily in 2020. The decline in interest rates and improved consumer confidence have fueled a resurgence in demand for private properties, as evidenced by the strong home sales in October and November. Factors such as the inflation-hedging appeal of property, robust household balance sheets, more affordable mortgages, and demand from public homeowners upgrading to private apartments are expected to sustain this demand. Looking ahead, heightened interest in private properties is likely to exert upward pressure on sale prices. Analysts anticipate that property prices in major Asian markets, including Singapore, will rise in 2025, with Singapore forecasted to record modest growth of around 3%.

Singapore Property Price Index of private residential properties

(Source: Urban Redevelopment Authority)

- 1H24 results review. Propnex’s revenue decline to S$345.6mn in 1H24, -5.1% YoY, compared to S$364.3mn in 1H23. The decline in revenue was primarily attributed to a 19.6% YoY decrease in commission income from project marketing services, which fell to S$91.3mn in 1H2024 from S$113.5mn a year ago. This drop reflected the reduced number of private new home sales amidst fewer launches in the primary market. In contrast, the secondary market showed strength, with the Group’s commission income from real estate agency services increasing by 1.3% to S$251.9mn in 1H2024, up from S$248.7mn in 1H2023. The company’s net attributable profit fell by 13.8% YoY to S$19.mn in 1H24, compared to S$22.1mn in 1H23. Basic earnings per share fell to 2.57 Scents in 1H24, compared to 2.98 Scents in 1H23.

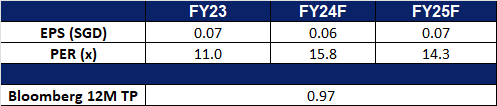

- Market Consensus.

(Source: Bloomberg)

HongKong Land (HKL SP): Reshaping its portfolio

- RE-ITERATE BUY Entry – 4.6 Target– 5.0 Stop Loss – 4.4

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Profit recovery. Hongkong Land reported higher underlying profit for 3Q24 compared to the same period last year, driven by increased build-to-sell completions in China. However, contributions from investment properties declined slightly, mainly due to lower performance from its Hong Kong central portfolio, though cost management measures partially offset this drop. In the investment property segment, the company’s central office portfolio saw a vacancy rate of 7.6%, better than the overall market rate of 12.2%. Physical vacancy stood at 9.0%, affected by planned tenant movements. Rental reversions remained negative despite a slight increase in office inquiries. In Singapore, Hongkong Land’s office portfolio remained fully occupied with positive rental reversions. Vacancy rates dropped to 1.5% from 2.6% in 1H, and leasing momentum stayed strong, driven by demand for premium office space. The group’s contracted sales in Singapore totaled US$60mn for the period. Looking ahead, Hongkong Land’s shift towards focusing on investment properties in key Asian cities, improved liquidity and a solid balance sheet, Hongkong Land is well-positioned to capitalize on ongoing demand for premium office space and drive further value creation through its capital recycling plans.

- Pivoting to fund management. Hongkong Land announced a shift in its strategy to focus solely on investment properties in key Asian cities, exiting its residential and build-to-sell division. The company plans to raise US$6bn through divestments to support this new direction, leveraging its flagship mixed-use projects in Hong Kong, Singapore, and Shanghai. This strategic change follows the change of its CEO in April 2024, who previously led Mapletree Investments’ operations in Europe and the US. Part of the new strategy includes setting a goal to double underlying profit before interest, tax, and dividends by 2035, while growing its assets under management to US$100bn, including significant third-party capital. The company also plans to selectively inject assets into real estate investment trusts (REITs) and limit any single city’s contribution to no more than 40% of its profits. Additionally, it aims to recycle up to US$10bn in capital by 2035 to drive growth. The implementation of this strategy will be phased over several years, with progress measured in three stages. With the potential for significant capital recycling and a robust plan for profitability, Hongkong Land’s new direction appears promising, making it an attractive prospect for investors looking for stable returns in an evolving market.

- 3Q24 results review. HongKong Land reported higher underlying profit in 3Q24 compared to the same period in 2023, mainly driven by increased build-to-sell completions in China. However, total contributions from Investment Properties were slightly lower, primarily due to weaker performance in the Hong Kong central portfolio. This was partially offset by cost management measures that helped strengthen the Group’s financial position. As of 30 September 2024, net debt decreased to US$5.3bn from US$5.4bn, with a gearing ratio of 17%. Committed liquidity improved to US$3.2bn from US$3.0bn in June, and 67% of the Group’s debt is at fixed interest rates. Full-year 2024 underlying profits are expected to be significantly lower than the previous year. This decline is mainly due to a US$295mn non-cash provision in the Group’s China build-to-sell business, which was recognized in the first half of the year.

- Market Consensus.

(Source: Bloomberg)

Pop Mart International Group Ltd. (9992 HK): Labubu Craze

- RE-ITERATE BUY Entry – 74.0 Target 90.0 Stop Loss – 65.0

- Pop Mart International Group Ltd is a China-based company mainly engaged in the provision of pop toy. intellectual property (IP) is at the core of its business. It has established an integrated platform covering the entire industry chain of pop toys, including artists development, IP operation, consumer access and pop toy culture promotion. The Company develops a broad array of pop toy products based on its IPs. Its Pop Mart brand products are primarily categorized into blind boxes, action figures, ball-jointed doll (BJDs) and accessories. The Company conducts its businesses within the China market and to overseas markets.

- In trendy series continue to rake in revenue. Pop Mart’s Labubu series recently went viral globally, thanks in part to a social media post by BLACKPINK’s Lisa. Combined with endorsements from several other celebrities, this surge in visibility has sparked overwhelming demand for Labubu toys, with products consistently selling out both in stores and online shortly after release. The Labubu series generated RMB 626.8 million in sales during the first half of 2024 and is on track to become Pop Mart’s top IP by revenue for the year. Other popular series, such as Molly and Skullpanda, have also performed exceptionally well, bringing in RMB 782.1 million and RMB 574.3 million in revenue, respectively, as of 1H24.

- Better than expected 3Q24 business updates. Pop Mart recently released its 3Q24 business update, projecting revenue to more than double YoY. The company expects overall revenue to grow by 120%-125% YoY. Revenue from operations in Mainland China increased by 55%-60% YoY, while revenue from Hong Kong, Macao, Taiwan, and overseas markets surged by 440%-445% YoY. This significant growth in overseas revenue highlights the success of Pop Mart’s expansion efforts and its strengthening market presence outside China. The company’s global growth strategy is clearly paying off, contributing substantially to its overall performance.

- Expanding presence locally and overseas. Pop Mart, the renowned high-end toy brand, has officially opened a store at Sun World Ba Na Hills in Da Nang, creating a highly artistic space. Situated in a prime location atop Ba Na Hills, the store features impressive interior architecture resembling a grand castle, inspired by the artistic and cultural charm of an old French village. This marks Pop Mart’s first store in a Southeast Asian theme park. Visitors can explore iconic characters like Molly, SkullPanda, Hirono, Dimoo, and The Monsters, making each visit a unique artistic experience. In addition, Pop Mart recently launched its first theme park in Beijing, transforming Chaoyang Park—the city’s largest park—into an immersive entertainment space filled with beloved characters like Molly, Labubu, and Dimoo. These expansions, coupled with the growing popularity of The Monsters and Molly series, are set to attract even more visitors and strengthen Pop Mart’s global presence.

- 1H24 earnings. The company’s revenue rose to RMB4.56bn in 1H24, +62.0% YoY, compared to RMB2.81bn in 1H23. The company’s net profit rose by 93.3% YoY to RMB964.1mn in 1H24, compared to RMB477.2mn in 1H23. Basic earnings per share rose to RMB69.49 in 1H24, compared to RMB35.46 in 1H23.

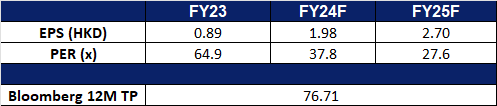

- Market consensus.

(Source: Bloomberg)

CGN Mining Co Ltd (1164 HK): Growing nuclear power demand

- RE-ITERATE BUY Entry – 1.80 Target 2.10 Stop Loss – 1.65

- CGN Mining Co Ltd is a company mainly engaged in the trading of natural uranium. The Company operates its business through three segments. The Natural Uranium Trading segment is engaged in the trading of natural uranium. The Property Investment segment is engaged in leasing business. The Other Investments segment is engaged in investment activities.

- Restricted uranium supply. Russia recently announced temporary restrictions on enriched uranium exports to the United States. As the world’s largest supplier of enriched uranium, this decision is viewed as a symbolic response to the U.S. ban on Russian uranium imports. However, companies approved by Russia’s export control authorities are still permitted to continue shipments to the U.S. under certain conditions. Russia has approximately 44% of the world’s uranium enrichment capacity and provides 5.5% of the global supply. It owns about 8% of the global reserves. In May, the US passed the Prohibiting Russia Uranium Imports Act. Countries with nuclear energy, especially the Western ones have been sourcing reliable supplies. Russia’s potential uranium export restriction will lead to tight supplies, and prices will rebound accordingly. Uranium prices saw a rebound following the restrictions, rising towards its current level at around $81 per pound in November, rebounding from a low at around US$76 per pound in early November.

Uranium futures prices

(Source: Bloomberg)

- Big Tech venture into nuclear power. Over the past few months, Microsoft reignited interest in nuclear energy stocks by signing a power purchase agreement with Constellation Energy (CEG), the largest clean energy supplier in the U.S. According to the agreement, Constellation will restart the Three Mile Island Nuclear Station in Pennsylvania to support Microsoft’s growing artificial intelligence (AI) needs. Google, a subsidiary of Alphabet, has also partnered with private firm Kairos Power to construct a series of SMRs with a total capacity of 500 megawatts. Recently, Amazon also announced plans to collaborate with Energy Northwest, Dominion Energy, and private firm X-energy to build several SMRs. These nuclear resources will support Amazon’s future AI services. These partnerships are bound to drive more interest towards the uranium market.

- China Stimulus to boost demand for uranium. China’s recent announcement of stimulus packages has boosted bullish momentum in uranium markets, driven by increasing energy demand from the world’s third-largest power producer. The stimulus package includes increased investment in infrastructure, including nuclear power plants. This would lead to a higher demand for uranium, the primary fuel for nuclear power generation. Furthermore, China’s push to expand its nuclear energy capacity has improved the investment outlook, fueling stronger interest in uranium. With 22 of the 58 global nuclear reactors currently under construction in China, the country is at the forefront of a global nuclear renaissance.

- 3Q24 operation update In 3Q24, the Group’s natural uranium deposits produced 692.6 tU of uranium, achieving 97.2% of the quarterly production target of 712.8 tU. Of this total, 228.9 tU were produced by Semizbay-U LLP, a 49%-owned joint venture in Kazakhstan, while 463.7 tU were produced by Mining Company Ortalyk LLP, a 49%-owned associate in Kazakhstan. For the first half of the year, the planned uranium extraction was 712.8 tU, with actual extraction reaching 692.6 tU, reflecting a completion rate of 97.2%. Specifically, the Semizbay Mine produced 95.0 tU, and the Irkol Mine contributed 133.9 tU to the overall output.

- 1H24 earnings. Revenue grew by 38.8% to HK$4.07bn. Gross loss was HK$56.4mn compared to HK$186.7mn profit in 1H23. Net profit attributable to the shareholders of the company declined by 37.0% to HK$113.1mn.

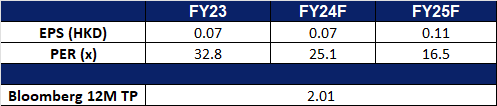

- Market consensus.

(Source: Bloomberg)

AppLovin Corporation (APP US): Excelling through AI

- BUY Entry – 320 Target – 360 Stop Loss – 300

- AppLovin Corporation develops technologies that help businesses of every size connect to their ideal customers. The company provides end-to-end software and AI solutions for businesses to reach, monetize, and grow their global audiences. AppLovin serves clients worldwide.

- Lower borrowing costs. AppLovin Corp has successfully transitioned from speculative-grade borrowing to the investment-grade bond market with a US$3.5 billion offering. The deal, divided into four parts, included a 30-year fixed note priced at 137.5 basis points over Treasuries, down from initial pricing of 175 basis points. This move to the high-grade market allows AppLovin to significantly reduce borrowing costs, saving tens of millions of dollars. Previously reliant on riskier loans, the company now holds a BBB- rating from S&P Global Ratings and Fitch Ratings, qualifying it as a “rising star” with access to a larger investor pool and lower pricing. The company’s strategic shift highlights its profitability, strong free cash flow, and potential for further credit rating upgrades, positioning it well for stock price appreciation.

- Exceptional Q3 performance. AppLovin recently joined the Nasdaq 100 index, highlighting its growing prominence. In Q3, the company reported exceptional results, with revenue increasing 39% YoY to US$1.2 billion, exceeding estimates of US$1.13 billion. Earnings per share of US$1.25 also outperformed expectations of US$0.92. AppLovin’s robust guidance for Q4, projecting revenue of US$1.24 to US$1.26 billion, above the US$1.18 billion consensus, reflects its confidence in continued growth. Furthermore, the company’s AI-powered advertising engine, AXON, has driven substantial growth, with software platform revenue rising 66% to US$835 million in Q3. AXON’s ability to enhance ad targeting has attracted advertisers, resulting in an impressive adjusted profit margin of 78% for the software platform. As it continues to expand its customer base, AXON will be able to deliver higher growth in revenue and profitability going forward.

- Emerging E-commerce opportunity. AppLovin’s pilot e-commerce project, which enables targeted ads within gaming environments, presents a promising growth avenue. Its CEO has emphasized its potential to drive financial impact beginning in 2025. As the project gains traction, it is expected to further boost the software segment, enhancing AppLovin’s revenue streams and market share in the broader digital advertising space. With the profitability and scalability of its software platform, AppLovin is poised for continued growth as it gains market share and expands its corporate client base. The combination of AI-driven ad solutions and emerging e-commerce capabilities positions the company as a future market leader in the AI advertising space.

- 3Q24 results. Revenue increased 38.8% YoY to US$1.20 billion, beating expectations by US$70 million. GAAP earnings per share were $1.25, beating estimates of $0.32. For the fourth quarter, Applovin projects US$1.24 billion to US$1.26 billion in revenue, above the US$1.17 billion analysts had expected. Its board also approved an additional US$2 billion in stock buybacks, as it had about US$300 million left in its previous buyback program after spending about US$437 million on buybacks in the third quarter.

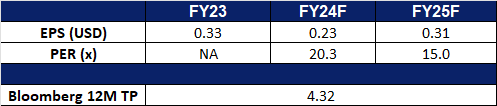

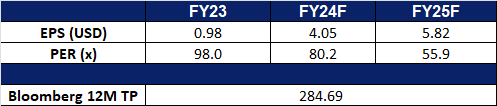

- Market consensus.

(Source: Bloomberg)

Old Dominion Freight Line Inc (ODFL US): Domestic logistics to benefit from Trump’s re-election

- RE-ITERATE BUY Entry – 222 Target – 248 Stop Loss – 209

- Old Dominion Freight Line, Inc. is an inter-regional and multi-regional motor carrier. The Company primarily transports less-than-truckload shipments of general commodities, such as consumer goods, textiles, and capital goods. Old Dominion Freight Line serves regional markets throughout the United States.

- Increased domestic trucking demand. President-elect Donald Trump’s proposed tariffs on imports, particularly from China, aim to encourage more domestic manufacturing and reduce reliance on foreign-made goods. In the short term, domestic manufacturers may frontload imports of commodities and components to avoid potential tariff hikes, likely causing temporary freight rates and domestic trucking rate increases due to demand spikes. Long term, once tariffs are enacted and US manufacturing scales up, demand for domestic logistics is expected to rise, benefiting carriers like Old Dominion Freight Line as they transport goods produced domestically across the US.

- Declining oil prices. Trump’s energy policies, focused on boosting US oil production and lowering gasoline costs, are anticipated to lead to a decline in oil prices. This drop would reduce operating costs for domestic trucking companies, benefiting their bottom lines. With the US as the world’s largest oil producer, increased production would further boost global oil supply, exerting downward pressure on prices. Additionally, Trump’s limited emphasis on climate change may delay a transition from diesel engines, potentially prolonging low fuel costs for companies like Old Dominion Freight Line, and supporting further improvements to its bottom lines.

- 3Q24 results. Revenue decreased by 3.3% YoY to US$1.47bn, missing expectations by US$20mn. GAAP earnings per share were US$1.43, beating expectations by US$0.01.

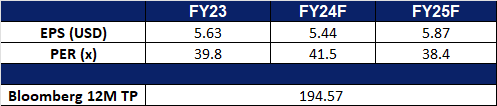

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Coinbase Global Inc (COIN US) at US$330.