Trading Ideas 21 February 2025 : DBS Group Holding Ltd (DBS SP), AAC Technologies Holdings Inc. (2018 HK), SoFi Technologies Inc (SOFI US)

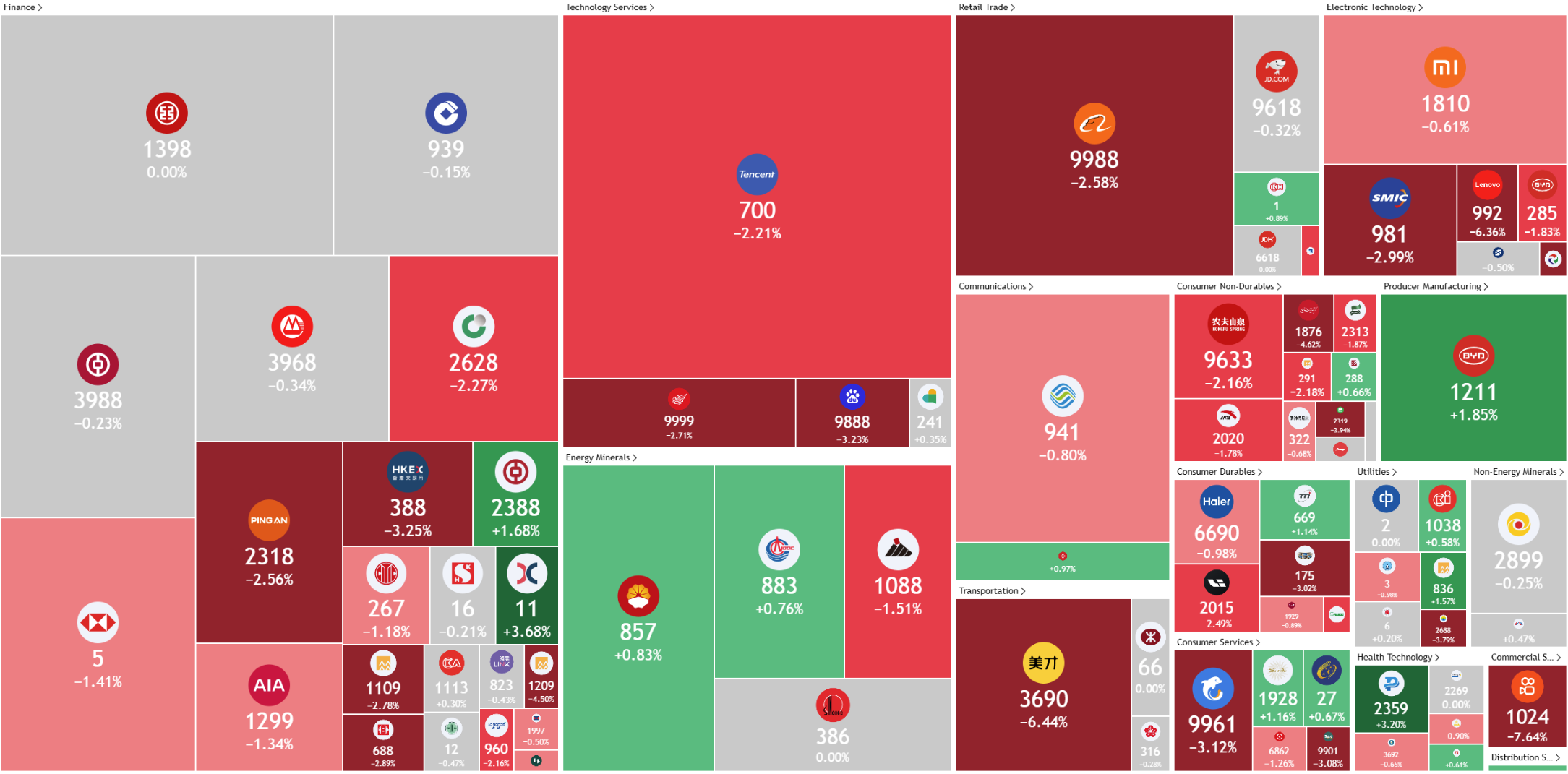

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

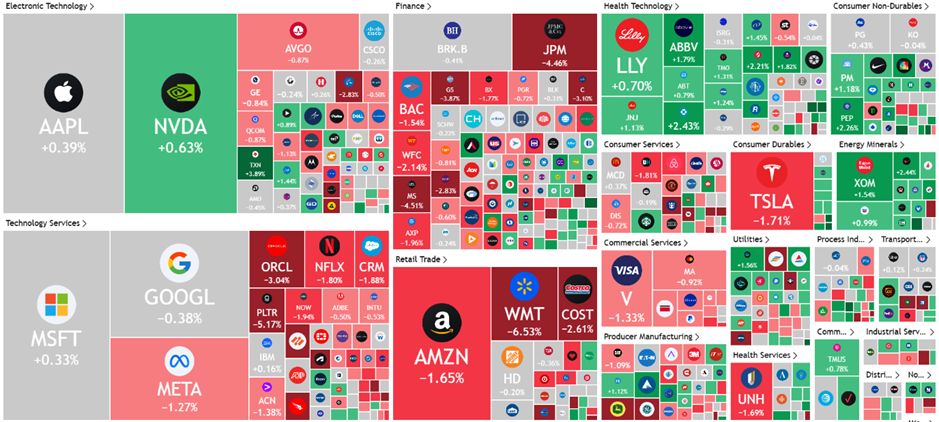

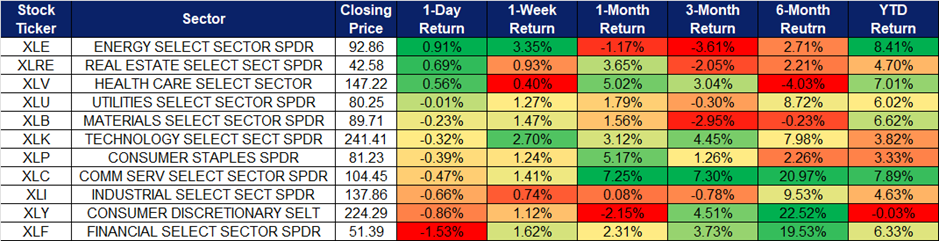

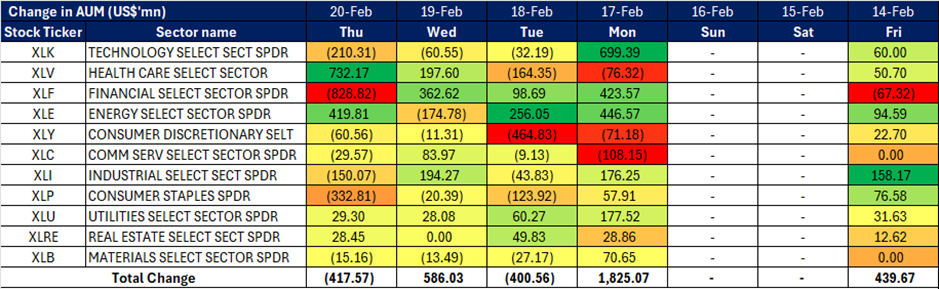

United States

Hong Kong

DBS Group Holdings Ltd (DBS SP): Budget’25 to boost economy

- RE-ITERATE BUY Entry – 44 Target– 48 Stop Loss – 42

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage. DBS Group also acts as the primary dealer in Singapore government securities.

- Potential benefits from budget. On 18 February, Prime Minister Lawrence Wong announced a bonanza of vouchers, credits, tax rebates and enhanced wage support for Singaporeans and corporations. Singapore’s budget 2025 introduced measures that could bolster local banks by stimulating economic activity and improving credit conditions. Infrastructure investments, including top-ups to key funds, are likely to drive higher loan demand. The 50% corporate tax rebate for SMEs may ease financial pressures, reducing asset quality risks for banks. Consumer-focused initiatives could support spending while mitigating inflationary risks, lowering non-performing loans. Additionally, incentives for SGX listings and fund management may enhance capital market activity, benefiting banks through increased trading volumes and demand for financial products. Overall, the budget measures are expected to create a favourable environment for Singapore banks, driving loan growth, improving asset quality, and supporting broader financial sector activity.

- Leadership changes ahead of CEO transition. DBS Bank has appointed Derrick Goh as its first Group Chief Operating Officer (COO), effective 1 April, overseeing operations and transformation. He will also join the bank’s executive committee. Koh Kar Siong will take over as head of audit and join the management committee. Additionally, Jimmy Ng, current head of operations, will retire on 1 July but continue as a senior adviser for AI until year-end. These changes come as Piyush Gupta prepares to step down as CEO on 28 March, with Tan Su Shan, deputy CEO since August 2024, set to succeed him. The leadership changes at DBS Bank signal a strategic transition aimed at sustaining growth and strengthening its operational and digital transformation efforts. DBS’ leadership changes reinforce its commitment to operational efficiency, and governance, ensuring continued growth amid evolving global banking trends. The bank is well-positioned for sustained profitability and market leadership under its new executive team.

- Special bonus and capital return amid record profits. DBS will distribute a one-time S$1,000 bonus to all staff except senior managers, totaling S$32 million, as a reward for their contribution to its record performance. This bonus will benefit 90-95% of employees. The bank also announced a capital return dividend of S$0.15 per share per quarter for FY25, with plans for similar distributions over the next two years. This is part of its strategy to reduce excess capital through dividends, special payouts, and share buybacks. For 4Q24, DBS reported a net profit of S$2.52 billion, 11% YoY increase, bringing its full-year net profit to a record S$11.29 billion, up 12% YoY. Despite macroeconomic uncertainty, interest rate trends and geopolitical risks, DBS managed to outperform expectations. We believe that the bank remains well-positioned for long-term growth, backed by record earnings, strong leadership succession, and continued investment in technology.

- 4Q24 results review. Total income for 4Q24 rose 11% to S$5.51bn and net profit rose 11% YoY to S$2.52bn, compared with S$2.27bn from the year-ago period. DBS’ full-year net profit was brought to a new record high of S$11.29bn, up 12% from the year-ago period. DBS declared Q4 dividend at S$0. 0.15 per share per quarter to be paid out over financial year 2025; it expects to pay out a similar amount of capital in the next two years.

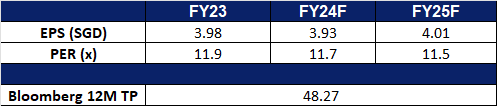

- Market Consensus.

(Source: Bloomberg)

IFast Corp Ltd. (IFast SP): Impressive results shows growth

- RE-ITERATE BUY Entry – 7.80 Target– 8.40 Stop Loss – 7.50

- iFast Corporation Ltd. operates a funds and investments distribution platform in the Asia Pacific region.

- Strong Growth in 4Q24 Results. iFast delivered robust 4Q24 results, with net profit surging 46.3% year-over-year to S$19.3 million, up from S$13.2 million in 4Q23. Revenue grew 16.4% to S$90 million, driven by strong performance in its core wealth management platform and a turnaround in iFast Global Bank (iGB). Notably, iGB became profitable for the first time, posting a S$0.3 million profit in 4Q24 compared to a S$2.57 million loss a year ago. Looking ahead to 2025, iFast expects continued growth across its business segments, with further expansion in assets under administration (AUA) for its wealth management platform and full-year profitability at iGB. iFast remains confident in achieving robust revenue and profitability growth in 2025, barring unforeseen circumstances.

- Expanding into China. In December 2024, iFAST Global Markets (iGM) Singapore launched a China Desk to enhance its ability to serve Chinese clients both within and outside Singapore. The unit aims to support investors looking to access the Chinese market, with initial operations in Singapore and Hong Kong. The China Desk is part of iFast’s broader strategy to expand its global business footprint, offering tailored advisory services to investors who prefer professional guidance over self-directed investing. Management sees this as a meaningful step toward deepening iFast’s engagement with Chinese investors and strengthening its international presence.

- Introducing Cross-Currency Transfers. iFAST Global Bank (iGB) launched EzRemit in September 2024, a service designed to streamline cross-currency transfers for its Digital Personal Banking (DPB) customers. With EzRemit, users can transfer money quickly and affordably to over 50 countries in more than 25 currencies. The EzWallet feature further enhances convenience by enabling transfers to international banks and over 50 e-wallets, including Malaysia’s TNG, the Philippines’ GCash, and Pakistan’s Easypaisa. By eliminating reliance on local financial players, iGB’s enhanced cross-border capabilities are expected to attract more customers and strengthen its competitive positioning in the digital banking space.

- 4Q24 results review. Revenue increased by 26.7% YoY to S$104.1mn in 4Q24 compared with S$82.2mn in 4Q23, driven by improvement in the group’s core wealth management platform business and turnaround of its banking business, iFast Global Bank (iGB). Net profit rose by 46.3% YoY to S$19.3mn in 4Q24 compared with S$13.2mn in 4Q23. Basis EPS rose to 6.47 Scents in 4Q24, compared to 4.46 Scents in 4Q23.

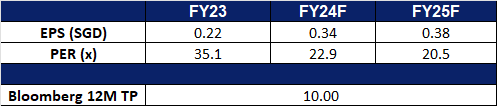

- Market Consensus.

(Source: Bloomberg)

AAC Technologies Holdings Inc. (2018 HK): New Iphone 16e

- BUY Entry – 48.0 Target – 54.0 Stop Loss – 45.0

- AAC Technologies Holdings Inc is a China-based investment holding company. The Company operates its businesses through four segments: Optics Business segment, Acoustics Business segment, Electromagnetic Drives/Precision Mechanics Business segment and Micro Electro-Mechanical Systems (MEMS) Business segment. The Company’s main products include acoustic products, electromagnetic drives and precision mechanics, optic products and MEMS components and other products.

- Apple’s Budget AI Phone. Apple has unveiled the iPhone 16e—a budget-friendly smartphone infused with AI capabilities—targeting mid-market consumers both domestically and in key growth regions such as China and India. Abandoning the previous SE naming, this model directly challenges popular Android devices at a time when competitors like Samsung and Huawei are rapidly integrating AI features. Priced to start at US$599—a US$170 increase over the former entry-level model—the iPhone 16e offers features nearing those of Apple’s flagships, including a high-performance chip that powers Apple Intelligence with ChatGPT-like access. This competitive pricing lowers the barrier for adopting Apple’s AI ecosystem, potentially boosting sales and benefiting suppliers like AAC Technologies.

- Positive Profit Alert. AAC Technologies recently issued a profit alert, citing a strong recovery in the global smartphone market, a shift toward higher-specification products that improved its product mix, and enhanced operational efficiency. The company now expects its net income to rise to between RMB1,700mn and RMB1,815mn —a YoY increase of roughly 130% to 145%. Furthermore, the successful completion of the first tranche acquisition of Acoustics Solutions International B.V. in February 2024 has added to the Group’s profit and bolstered its growth prospects in the automotive market. This strong financial position allows the company to continue driving growth in its business.

- CES 2025 Showcase. At CES 2025, the world’s largest consumer electronics and technology event, AAC Technologies demonstrated groundbreaking advances in sensory interaction across visual, audio, and haptic domains. The company presented its extensive portfolio, featuring innovations in smart automotive systems, acoustics, haptics, XR, optics, precision manufacturing, micro-motors, VCM, sensors, and semiconductors. With a broad range of self-developed products and solutions designed for diverse applications, AAC Technologies once again set new industry benchmarks—a move expected to attract heightened attention across multiple sectors and further strengthen its market position.

- 1H24 earnings. Revenue rose by 22.0% YoY to RMB11.2bn in 1H24, compared to RMB9.22bn in 1H23. Net profit rose significantly YoY to RMB537mn in 1H24, compared to RMB150mn in 1H23. Basic EPS rose to RMB0.46 in 1H24, compared to RMB0.13 in 1H23.

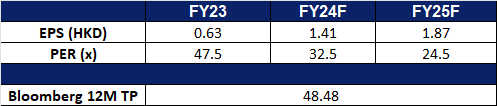

- Market consensus.

(Source: Bloomberg)

Yidu Tech Inc. (2158 HK): AI in Healthcare

- RE-ITERATE BUY Entry – 8.10 Target – 9.30 Stop Loss – 7.50

- Yidu Tech Inc is an investment holding company primarily engaged in providing healthcare solutions built on big data and artificial intelligence (AI) technologies. The Company mainly operates its business through three segments. The Big Data Platform and Solutions segment is engaged in providing data intelligence platform and data analytics-driven solutions. The Life Sciences Solutions segment is engaged in supporting the full life-cycle management of pharmaceuticals and medical devices, which covers all phases from clinical development to post-market commercialization. The Health Management Platform and Solutions segment is engaged in providing AI-enabled health management solutions. The Company conducts its business in the domestic and overseas markets.

- Integration of DeepSeek. Yidu Technology has integrated the DeepSeek AI model into its proprietary “AI Medical Brain,” YiduCore, further accelerating the large-scale application of AI in healthcare. This integration enhances YiduCore’s ability to extract deeper insights from medical data, improving disease analysis, diagnosis, and public health applications. By breaking down data silos and enhancing decision-making, the AI-driven platform aims to reduce healthcare costs, improve efficiency across the industry’s supply chain, and drive operational growth for Yidu Tech.

- Expanding Digital Health Market in China. China’s rapid advancements in AI, showcased by the recent launch of Qwen2.5-Max, Kimi k1.5, and DeepSeek-V3, underscore the country’s commitment to technological self-sufficiency. These AI models enable enhanced diagnostics, personalized treatment recommendations, and improved patient-provider communication, fueling the expansion of the digital health sector. According to GlobalData, China accounted for 20% of the Asia-Pacific digital health market in 2024, reflecting rising demand for AI-driven healthcare innovations. As a key player in China’s digital health space, Yidu Tech stands to benefit significantly from the country’s AI-driven growth.

- Strengthening Global Presence. Yidu Tech’s global reach continues to expand, as Founder and Chairwoman Ms. Gong Rujing represented China’s AI-powered healthcare sector at the World Economic Forum Annual Meeting 2025 in Switzerland. She highlighted the company’s impact, including 240+ scientific publications, a 40% increase in clinical trial efficiency, and health insurance solutions benefiting 34 million policyholders. Yidu Tech is actively expanding into Southeast Asia and the U.S., with plans to further establish its presence in Japan, Europe, and other key markets. This growing international footprint positions Yidu Tech as a leading force in AI-powered healthcare innovation.

- 1H24 earnings. Revenue fell by 7.6% YoY to RMB329.4mn in 1H24 compared with RMB356.5mn in 1H23. Net loss of RMB56.4mn in 1H24 compared with a net loss of RMB79.6mn in 1H23. Net loss per share was RMB0.04 in 1H24, compared to net loss per share of RMB0.07 in 1H23.

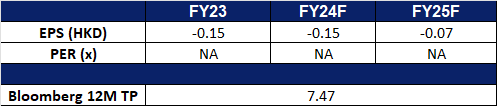

- Market consensus.

(Source: Bloomberg)

SoFi Technologies Inc (SOFI US): Unlock rewarding financial membership

- BUY Entry – 16 Target – 18 Stop Loss – 15

- SoFi Technologies, Inc. is an online personal finance company and online bank. The Company provides financial products including student and auto loan refinancing, mortgages, personal loans, credit card, investing, and banking through both mobile app and desktop interfaces. SoFi Technologies serves customers in the United States.

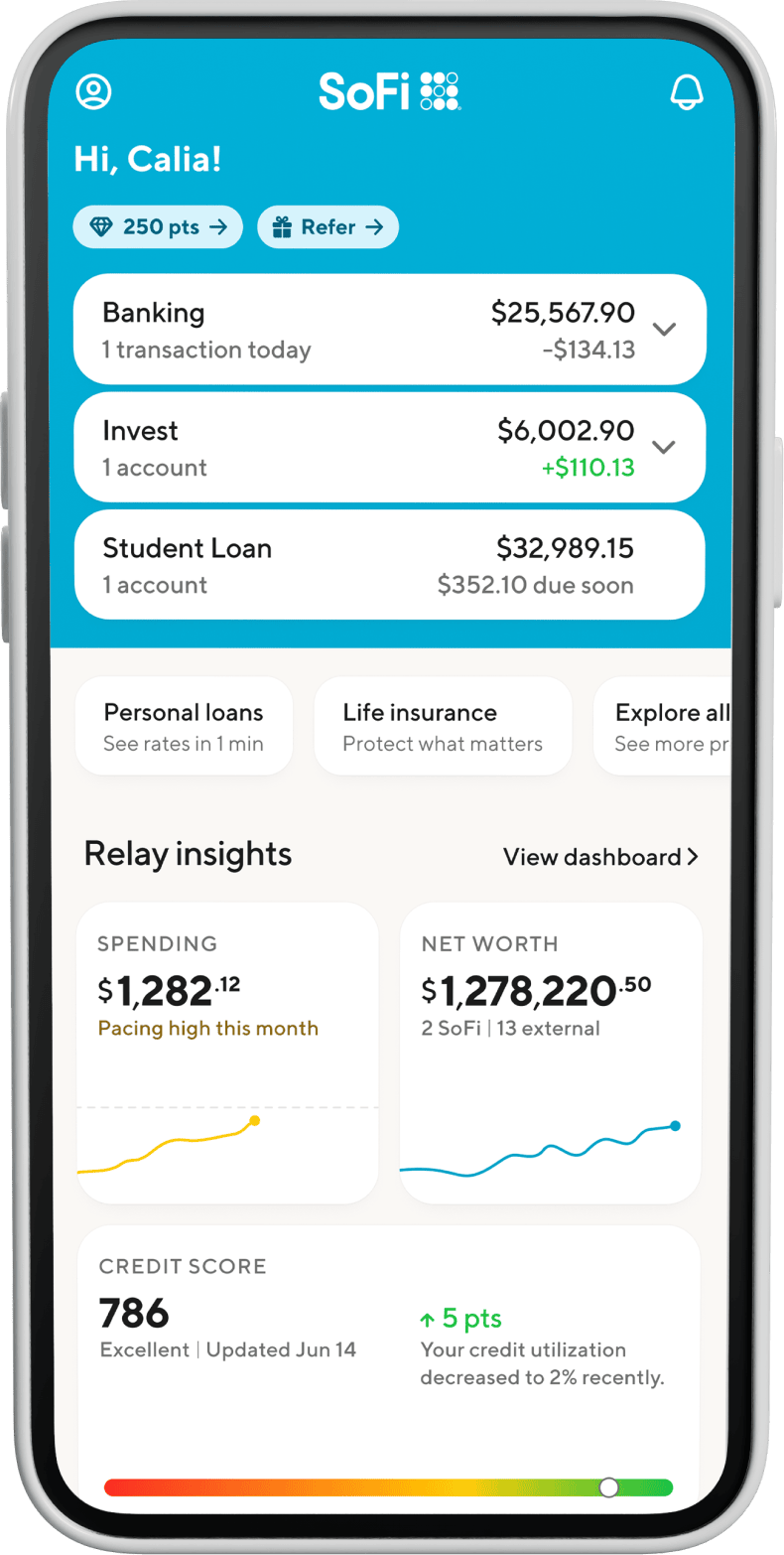

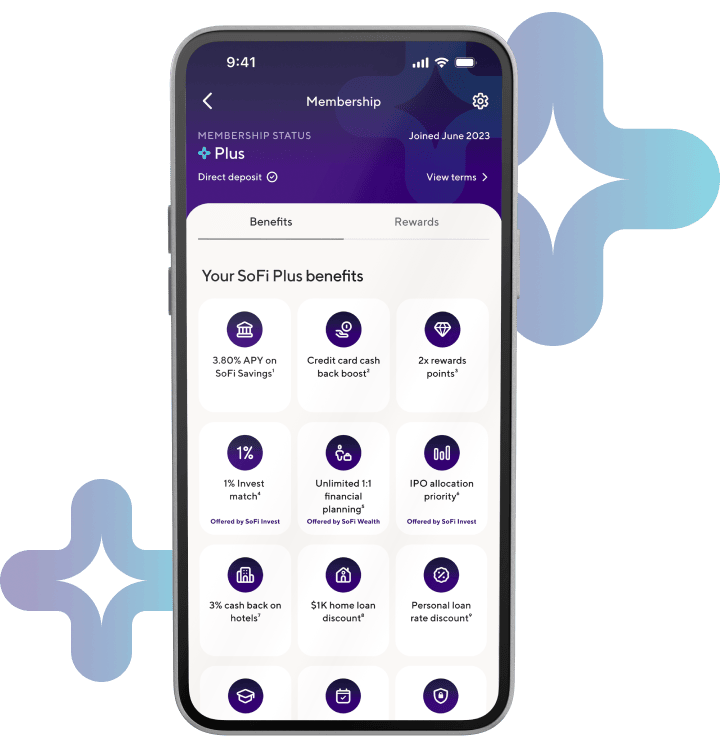

- Introduction of plus premium membership. SoFi Technologies introduced over eight new benefits to its premium financial membership, SoFi Plus, providing members with over US$1,000 in annual value. These benefits include preferred pricing on products and services, complimentary financial planning, rewards, and access to special events, Members can access SoFi Plus for US$10/month or for free with direct deposit. To mark the launch, SoFi introduced the ‘Power of Plus’ sweepstakes, giving six winners the opportunity to achieve major financial milestones, such as purchasing a home, paying off student debt, or funding a dream vacation. Existing perks, like preferred IPO allocations, a high APY on savings, and boosted cash back rewards on credit cards, remain available. The introduction of these enhanced benefits and the sweepstakes represents a strategic effort by SoFi to grow its customer base, increase Assets Under Management (AUM), and strengthen its competitive position in the digital financial services market. By offering tangible value and aligning with customers’ financial aspirations, SoFi aims to drive customer acquisition, retention, and engagement, while solidifying its edge over competitors. This initiative positions SoFi as a member-centric financial platform, well-equipped to expand its market share and reinforce its reputation in the industry.

SoFi Mobile Interface SoFi Plus

(Source: SoFi)

- Competitive edge. Despite providing weaker-than-expected quarterly and full-year guidance, SoFi’s “one-stop shop” approach and user-friendly digital platform differentiate it from traditional financial institutions, attracting a tech-savvy and potentially underserved customer base. It’s strategy of offering a wide range of financial products and services, such as lending, investing, banking, insurance, financial planning is paying off. Its financial services segment saw remarkable 84% revenue growth, indicating successful product expansion.

- Rapid growth. SoFi demonstrated impressive growth in 4Q24, with record new member additions of 785,000 and a total membership exceeding 10.1mn, up 34% YoY. FY24 GAAP revenue increased 26% to US$2.7bn, and adjusted net revenue also grew by 26% to US$2.6bn, driven by strong performance across multiple segments. Total deposits reached US$26bn, with a significant portion coming from direct deposit members, highlighting increasing customer engagement and stickiness. Management anticipates continued strong member growth in 2025, projecting at least 2.8 million new members, a 28% YoY increase.

- 4Q24 results. Revenue grew 19.3% YoY to US$734.13mn, beating expectations by US$51.93mn. Non-GAAP EPS of US$0.05, exceeding estimates by US$0.01. Total member and product adds in Q4 reached 785,000 and 1.1mn, respectively, setting new quarterly records. For 1Q25, it expects adjusted revenue of US$725mn to US$745mn and GAAP EPS of US$0.03. FY25 the company expects to deliver US$3.200bn to US$3.275bn in revenue and GAAP EPS of US$0.25 to US$0.27.

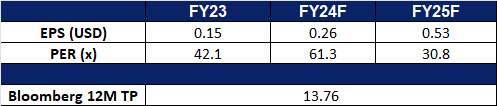

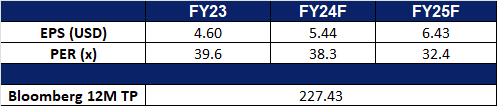

- Market consensus

(Source: Bloomberg)

General Electric Co (GE US): Driving innovation in aviation and defence

- RE-ITERATE BUY Entry – 205 Target – 225 Stop Loss – 195

- GE Electric Co (doing business as GE Aerospace) operates as an aircraft engine supplier company. The Company provides jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft. GE Aerospace serves customers worldwide.

- Expected steady growth in the global aviation industry. The global aviation market is projected to grow at an annual rate of 4%–5% from 2024 to 2030, driven primarily by demand for commercial aviation and air cargo. Increasing demand for new, more efficient, and lower-emission aircraft engines is expected to benefit GE Aerospace.

- Growth in military and defense business. Strong demand for military aerospace equipment from the U.S. and other countries, particularly in fighter jets, drones, and other defense applications, is driving growth. GE Aerospace’s F110 and F414 military engines are already in service across multiple armed forces, and as geopolitical uncertainties rise, demand for advanced defense technologies is expected to continue growing.

- 4Q24 results. Adjusted revenue grew 16% YoY to US$9.88bn, beating expectations by US$410mn. Non-GAAP EPS of US$1.32, exceeding estimates by US$0.28. Total orders increased 46% YoY to US$15.5bn. The company announced a 30% dividend increase and a US$7bn share repurchase program.

- Market consensus

(Source: Bloomberg)

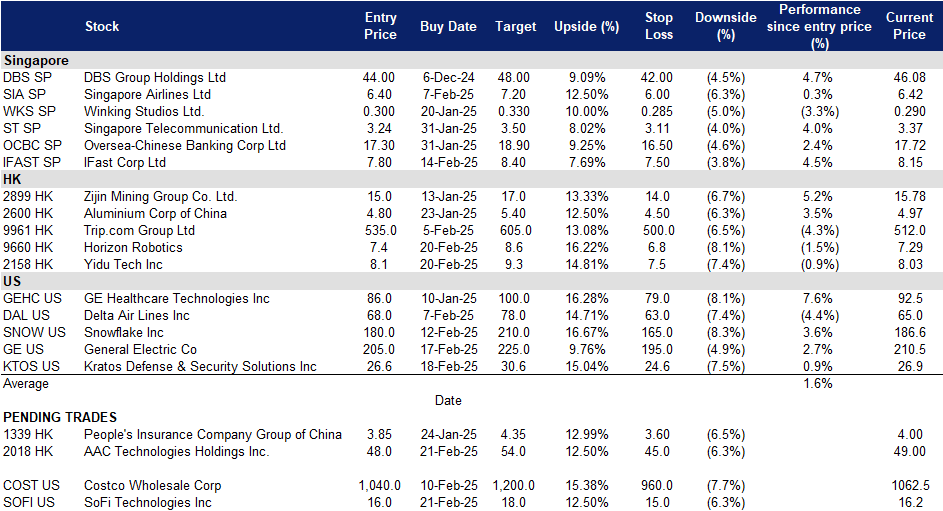

Trading Dashboard Update: Add Horizon Robotics (9660 HK) at HK$7.4, Yidu Tech Inc (2158 HK) at HK$8.1 and Kratos Defense & Security Solutions Inc (KTOS US) at US$26.6.